作者:David & Liam,深潮 TechFlow

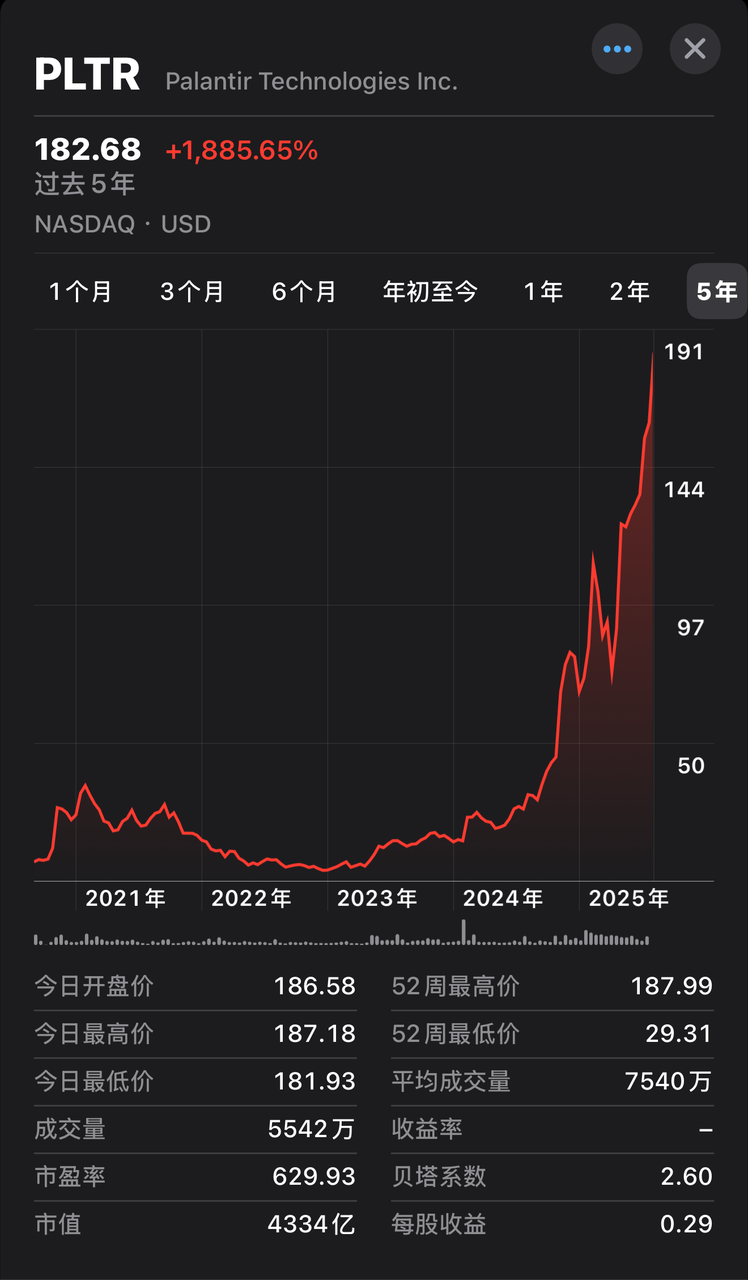

2025 年 8 月 8 日,Palantir Technologies(PLTR)股价触及 187.99 美元,市值突破 4430 亿美元——比洛克希德·马丁、雷神和诺斯罗普·格鲁曼三大军工巨头的总和还高。

从 2020 年 9 月以 10 美元直接上市至今,PLTR 从最低 5.92 美元反弹,累计涨幅达 31 倍;即便以上市价算,也有近 19 倍的回报。

2025 年初至今,PLTR 又涨了 145%。

这家 AI 数据公司不造芯片,不训练大模型,不做消费级产品。

客户名单却像电影《碟中谍》里的常客:CIA、FBI、NSA、五角大楼、以色列国防军、英国 MI5。

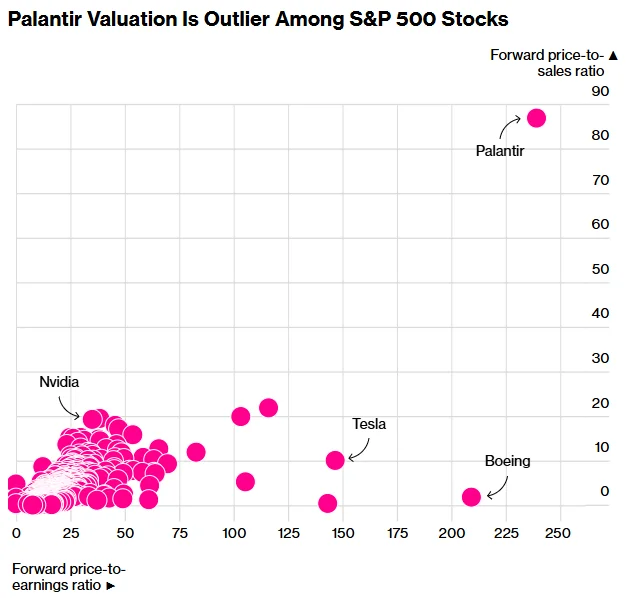

更诡异的是估值。PLTR 的前瞻市盈率高达 245 倍,而行业平均只有 24 倍;作为对比,被一些人称为“AI 泡沫”的英伟达,市盈率只有 35 倍。

信仰来自于何方?

这家由 PayPal 黑帮教父 Peter Thiel 创立、曾拿过王思聪投资的数据公司,一度被硅谷唾弃为“邪恶公司”。如今摇身一变,成了 AI 时代最炙手可热的明星,美国国运的代言股。

大人,时代变了。

911、CIA 与水晶球

2001 年 9 月 11 日,世贸双塔倒塌,美国的安全观被永久改变。

在硅谷,刚从 PayPal 套现 10 亿美元的年轻富豪 Peter Thiel 思考着另一个问题:

PayPal 用来打击交易欺诈的方法能不能扩展到其他领域,比如打击恐怖主义?

彼时他们建立了世界上最先进的商业反欺诈系统,通过分析交易模式来识别异常行为。如果把同样的逻辑应用到国家安全领域呢?

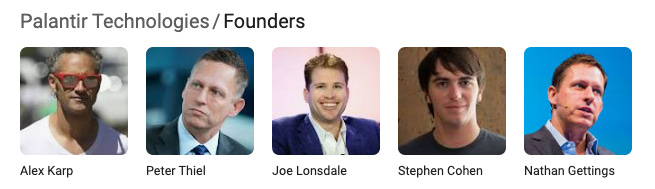

但 Thiel 需要一个特别的人来领导这家公司并实现这个想法。他想到了斯坦福法学院的老同学 Alex Karp。

Karp 是硅谷最不像 CEO 的 CEO。他在哈弗福德学院学哲学,在斯坦福拿了法学博士,然后跑到德国法兰克福大学攻读新古典社会理论的博士学位,博士论文研究的是"生活世界中的攻击性"。

2004 年,Thiel 正式聘请 Karp 担任 CEO。

同年,他们召集了一个奇特的创始团队:24 岁的斯坦福天才 Joe Lonsdale,Thiel 的斯坦福室友 Stephen Cohen,以及 PayPal 的工程师 Nathan Gettings,正是他开发了 PayPal 的反欺诈系统原型。

公司取名“Palantir”,源自托尔金《指环王》中的“真知晶球”(seeing stone),一种能够看穿时空、洞察一切的魔法石。在小说中,谁掌握了 Palantír,谁就掌握了信息优势。

有趣的是,公司甚至把办公室都用中土大陆的地名命名:帕洛阿尔托叫“夏尔”(The Shire),弗吉尼亚州麦克莱恩叫“瑞文戴尔”(Rivendell),华盛顿特区叫“米那斯提力斯”(Minas Tirith)。

公司的启动资金同样不寻常:200 万美元来自 CIA 的风险投资部门 In-Q-Tel,3000 万美元来自 Thiel 自己和他的风投基金 Founders Fund。

在此后的十多年里,Palantir 累计融资超过 30 亿美元,投资方既包括美国的顶级风投机构,也包括一些颇具争议的个人,比如 2014 年,中国知名富二代王思聪通过普思资本向 Palantir 投资了 400 万美元,估值区间约为 90 亿美元左右。

他们的使命,在 911 后的美国格外清晰。

正如 CEO Karp 后来所说,Palantir 做的是“寻找隐藏的东西”(the finding of hidden things):下一场可能的恐怖袭击。

追踪本拉登

从 2003 到 2006 年,Palantir 几乎从公众视野中消失。

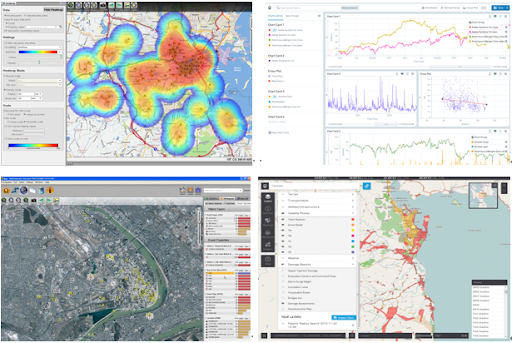

没有产品发布,没有媒体报道,甚至没有正式的办公室标识。工程师们在一栋不起眼的建筑里,为美国情报机构开发一款代号为"Gotham"(哥谭)的软件。

没错,就是蝙蝠侠守护的那座城市。

2010 年的阿富汗,美军面临着一个看不见的敌人。仅这一年,200 多名美军士兵死于路边炸弹(IED),比前三年的总和还多。

此时 Gotham 展现了它的价值,它能将看似无关的信息碎片拼接成完整的图景:

一个当地人戴着紫色帽子, 系统立即标记异常,因为紫色在当地文化中极其罕见。通过追踪这个特征,结合手机信号、行动轨迹、社交网络,最终确认此人正是埋设地雷的敌对分子。

而另一个广为人知的成绩,则是 2011 年本·拉登被击毙。

虽然官方未公开证实,但多个消息源暗示 Palantir 在这次行动中扮演了关键角色。在马克·鲍登那本描述抓捕本拉登始末的《终结》一书中,他将 Palantir 描述为“名副其实的杀手级应用”。

Gotham 系统通过分析数年来积累的海量数据,电话记录、金融交易、人员流动、社交网络,最终将线索指向了那座看似普通的院落。

这家从 CIA 地下室走出来的公司,成为了美国政府强大的数据武器。

硅谷异类

政府订单是一把双刃剑。

对 Palantir 而言,依赖政府合同的确带来了早期的收入来源,但也在它的额头烙下了难以抹去的标签,“政府公司”。这个隐形枷锁,几乎伴随了它商业化的全部过程。

2009 年,Palantir 第一次尝试走出情报界,摩根大通成为了商业化落地的第一个大客户。

他们用 Palantir 的技术做内部风控——监控交易员的邮件、GPS定位、打印和下载行为,甚至分析电话录音转写,寻找潜在的不当交易。

2011 年,公司推出面向企业的 Foundry 平台,将销售、库存、财务、运营等数据整合到一个分析中心,跨部门调用更高效。然而,这个系统部署周期长达数月,每个项目几乎都是定制开发,价格高昂,难以规模化。

许多客户对技术赞不绝口,却被成本和实施周期劝退。相比之下,Snowflake、Databricks 等“轻量化”平台更受青睐。

商业化不顺的同时,Palantir 频频卷入政治争议:协助中情局打击维基解密、参与“棱镜”监听计划、用视觉识别技术追踪非法移民与街头抗议者。

在左派文化占主流的硅谷,这些都让它被视为“助纣为虐”的邪恶公司。抗议者多次在 Palantir 总部和创始人 Thiel、Karp 的住所示威。

2020 年,上市前夕,Palantir 选择搬离硅谷,迁至丹佛,与硅谷彻底决裂。

公司 CEO Karp 在公开信中表达不满与委屈,“我们为美国国防和情报机构提供软件服务,是为了维护国家安全,却不断遭受非议,而那些出售消费者数据来获取广告利润的互联网公司,却对此习以为常。”

同年 9 月,Palantir 上市。

媒体给它贴满了负面标签:

创立 17 年,从未盈利:2019 年亏损 5.8 亿美元,Palantir 甚至在招股书中预计,未来可能永远无法实现或者保持盈利。

过度依赖政府合同:2020 年上半年,政府客户贡献的收入占公司总收入的 53.5%,去年占比 45%。

管理机构异常激进:Palantir 曾在递交美国 SEC 的文件中表示,允许创始人单方面调整投票权。

上市首日开盘价 10 美元,2 年后,股价一度跌至 5.92 美元。

在外界看来,这样一家严重依赖政府合同,商业化屡屡受挫,创立十余年依然看不到盈利希望,在硅谷人人喊打的公司,谈不上任何投资价值。

然而,仅仅几年后,它的市值却冲上了 4000 亿美元,跻身全球最具价值的科技公司之列。

Palantir 究竟是如何完成这场反转的?

华丽转身

2022 年 11 月 30 日,ChatGPT 横空出世,整个世界都在谈论 AI 革命。

但对大多数企业来说,兴奋过后是现实的困惑:ChatGPT 能写诗、能聊天,却不懂我的业务数据,不知道我的运营流程,更无法接入我的核心系统。

这个困惑,恰恰成了 Palantir 的机会,Karp 看到了别人没看到的东西。

就在 ChatGPT 发布不到 5 个月后,Palantir 推出了 AIP(Artificial Intelligence Platform)。

AIP 本质上是一个 AI Agent 平台,让大语言模型能够理解并操作企业的真实数据,学习你的业务流程、理解你的数据结构、熟悉你的运营逻辑,最终成为一个真正懂你公司的 AI 员工。

它能够分析 ERP 系统、CRM 数据库、财务报表等各种企业内部数据,还能执行操作。

当你问“哪条生产线应该优先维护”时,它不会像 GPT 一样给你设备管理的相关理论,而是基于实时的设备状态、维护历史、生产计划,直接给出具体的建议,甚至可以自动下达维护工单。

这正是 Palantir 多年来积累的核心能力:数据整合和自动化决策。

过去 20 年,它为 CIA、FBI 处理情报数据,为五角大楼分析战场信息,本质上都是在解决一个问题,如何让复杂的数据变成可执行的行动。

AI 让这一切自动化变成了可能。ChatGPT 让每个人都能与 AI 对话,AIP 让每家企业都能用 AI 为自己工作。

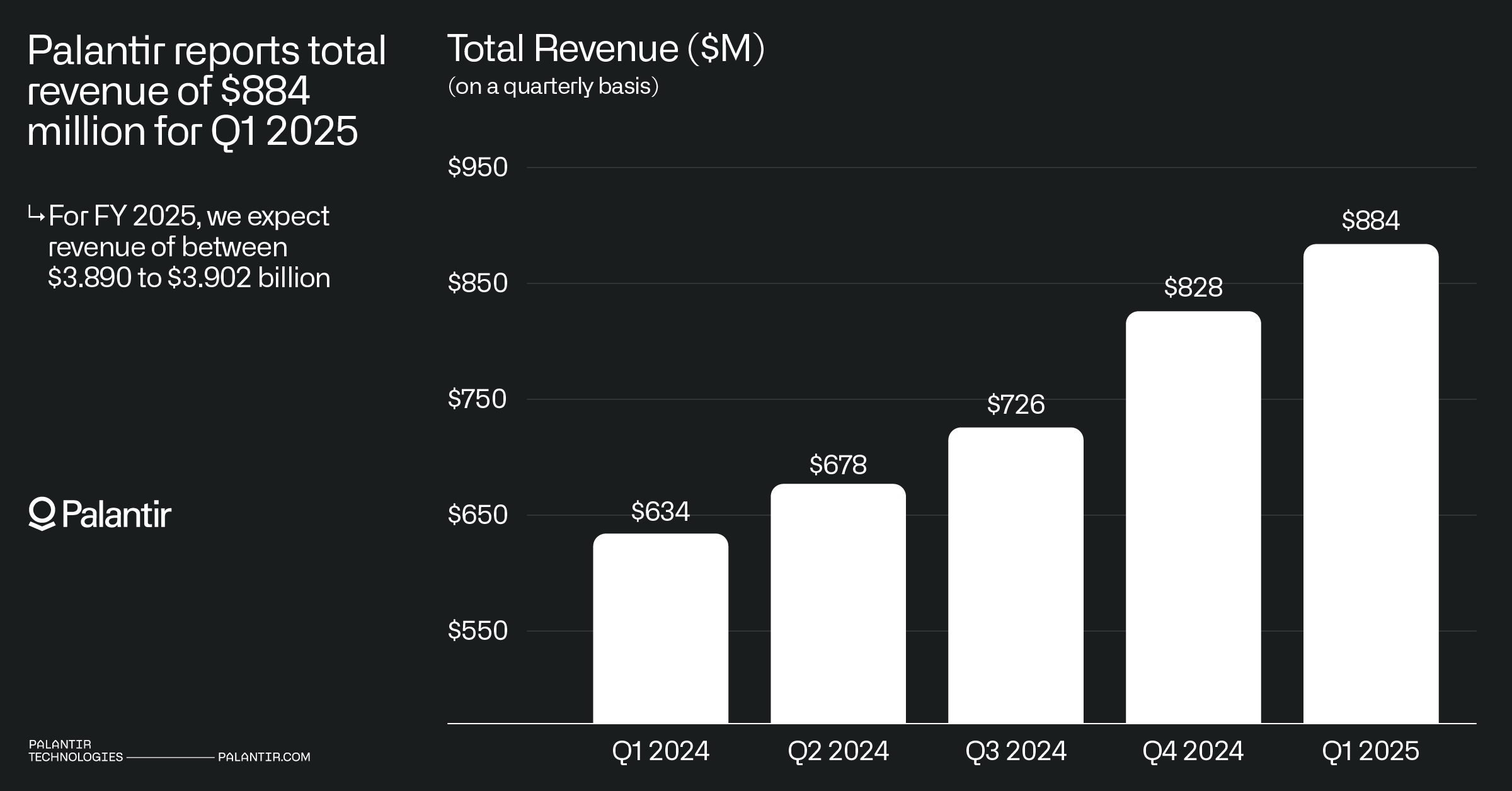

财报数字立刻反映了这种转变的威力。AIP 推出前的 2023 年第一季度,Palantir 的营收增长率跌至历史最低的 13%。但 AIP 上线后,增长率开始强劲回升,2024 年全年营收增长 23%。

2025 年彻底迎来爆发式增长,Q1 营收 8.84 亿美元,同比增长 39%;Q2 营收 10.1 亿美元,同比增长 48%。

更重要的是客户结构的变化。2023 年第四季度,美国商业客户数量同比增长 55%;2024 年第四季度,总客户数量达到 711 个,同比增长 43%,商业收入同比增长 64%,超过政府收入 45%的增长。

过去被诟病的"政府依赖症"正在被治愈,从雪佛龙到 Airbus,从桑坦德银行到 Wenzel Spine,各行各业的企业都在排队部署 AIP。

从政府外包商,硅谷的弃儿,到 AI 时代的宠儿,Palantir 用 AIP 完成了一次华丽的转身。

AI 军火商

AI 革命既可以发生在聊天窗口里,也可以发生在真正的战场上。

在军工领域,Palantir 已经成为西方世界的“AI 军火商”。

2022 年,Palantir CEO Karp 穿着战术靴子,现身基辅,与乌克兰政府达成一系列合作协议。

很快,Gotham 系统进入战场:指挥官输入目标坐标,算法自动计算开火参数,并将任务分配给“性价比最高”的武器。Palantir 直接成为了这一场现代战争的关键参与者。

Palantir 已然融入美国乃至整个西方的军工体系。

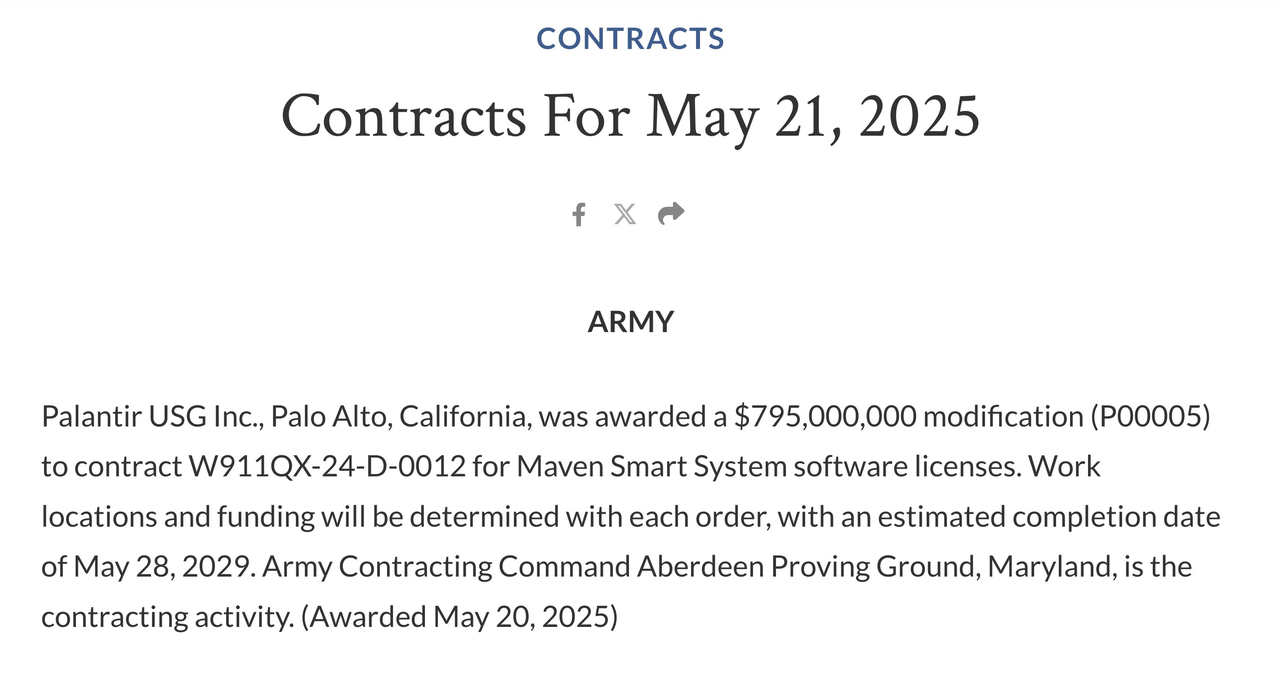

2019 年谷歌退出 Maven 项目后,Palantir 毫不犹豫地接手了这个五角大楼的核心 AI 合同。随后的几年里,合同接踵而至:2024 年第三季度,Palantir 获得了 Space Force 的 2.18 亿美元合同,用于构建空天一体作战系统;2025 年 8 月,美国陆军与 Palantir 签下 10 年期、价值 100 亿美元的大合同。

2025 年 4 月,一个更具象征意义的里程碑到来:北约正式采购 Palantir 的 Maven Smart System,部署在盟军作战司令部,用于提升多国协同作战能力。这一举动几乎奠定了 Palantir 技术在西方军事联盟中的"事实标准"地位。

Palantir CEO Karp 曾在接受《华盛顿邮报》采访时表示:“先进算法战争系统的威力如此强大,相当于拥有战术核武器对抗只有常规武器的对手”。

2024 年底,Palantir 在社交媒体发布广告短片,标题为“战斗未始,胜负已分。” 这不仅是营销,更像是一种宣言。

Palantir 的背后力量远不止 Peter Thiel 一人。同为 PayPal 黑帮成员的埃隆·马斯克,正与 Peter Thiel 构建着一个前所未有的 AI 军工生态:Palantir 提供战场数据分析,SpaceX 的星链网络负责通讯支援,X(推特)主导信息战和舆论战。

这个新兴的军工复合体正在重新定义 21 世纪的战争形态。

信仰股的诞生

AIP 的爆发和连连中标军工大单,将 Palantir 的股价推上了狂飙之路:

2023 年 5 月 20 美元,2024 年 11 月加入 S&P 500 时 60 美元,2025 年 8 月触及 187.99 美元的历史新高,两年多涨近 10 倍。

在 SaaS 行业,有个著名的“40 法则”用以评估公司健康状况:年度收入增长率与利润率相加,超过 40%即被认为优秀。

而在 25 年的第一季度,Palantir 的这一数字是 83%。

然后,散户军团登场了。

Reddit 上的 r/PLTR 板块聚集了 10.8 万名“信徒”,分析每份财报,解读 CEO 发言,甚至为公司起昵称。在他们眼中,Palantir 不只是软件公司,更是美国国运的延伸。

对这些散户来说,买入 PLTR 不是押注一家公司,而是在押注一种世界秩序。只要美国维持全球军事霸权,Palantir 就会继续繁荣。

CEO Alex Karp 从不掩饰政治立场。他曾公开表示:“我们始终持有亲西方观点,认为西方有更优越的生活方式和组织方式。”

在 2024 年股东信中,他引用历史学家塞缪尔·亨廷顿的话:“西方的崛起,不是因为思想、价值观的优越性,而是因为在运用有组织的暴力方面的优越性。”

2025 年初,Karp 出版了一本书:《技术共和国》(The Technological Republic)。

书中,他对硅谷的科技公司提出质问:

“为什么硅谷的公司只关心外卖和社交媒体,而不是国家安全?”

在他看来,科技公司的责任不只是赚钱,而是主动塑造世界的政治秩序。

这种赤裸裸的技术民族主义在硅谷极为罕见。当谷歌因员工抗议退出 Maven 项目时,Palantir 毫不犹豫地接手,明确表态要在 AI 军备竞赛中充当美国的“数字军火商”。

2025 年 8 月,Palantir 市值达到 4435.5 亿美元,成为全球第 21 大最有价值公司。这个数字意味着什么?

它超越了洛克希德·马丁、雷神和诺斯罗普·格鲁曼的市值总和,三大传统军工巨头加起来都不如这家不到 4000 名员工的软件公司值钱。

高达 245 倍的市盈率,触及了信仰股的本质:它不关乎现金流和估值模型,而是关乎一种朴素的信念,在这个愈发危险的世界里,美国需要 Palantir。

股价还会涨吗?没人知道答案。但可以确定的是,在地缘政治重新洗牌的时代,押注“美国国运”成了大洋彼岸最朴素的投资逻辑,Palantir 恰好成为了美国国运的最佳股票载体。

或许它是史上最昂贵的“国运股”,但对信仰者来说,这正是它的价值所在。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。