Whether it's EVM, non-EVM, or Cosmos, it involves a wide range of DeFi fields.

Author: ROUTE 2 FI

Translation: Deep Tide TechFlow

Hello everyone!

If you are looking for airdrops, yields, or incentive programs, here are some potentially promising DeFi protocols for us to explore together.

Here are some DeFi protocols with untapped potential, including opportunities for yields, airdrops, and more that you can explore today. They cover potential projects on different networks, whether it's EVM, non-EVM, or Cosmos, involving a wide range of DeFi fields such as derivatives, yields, decentralized exchanges (Dex), and more. These projects are highlighted for their significant support and earning opportunities, but this article does not constitute financial advice. Be sure to do your own research before engaging.

Let's get started:

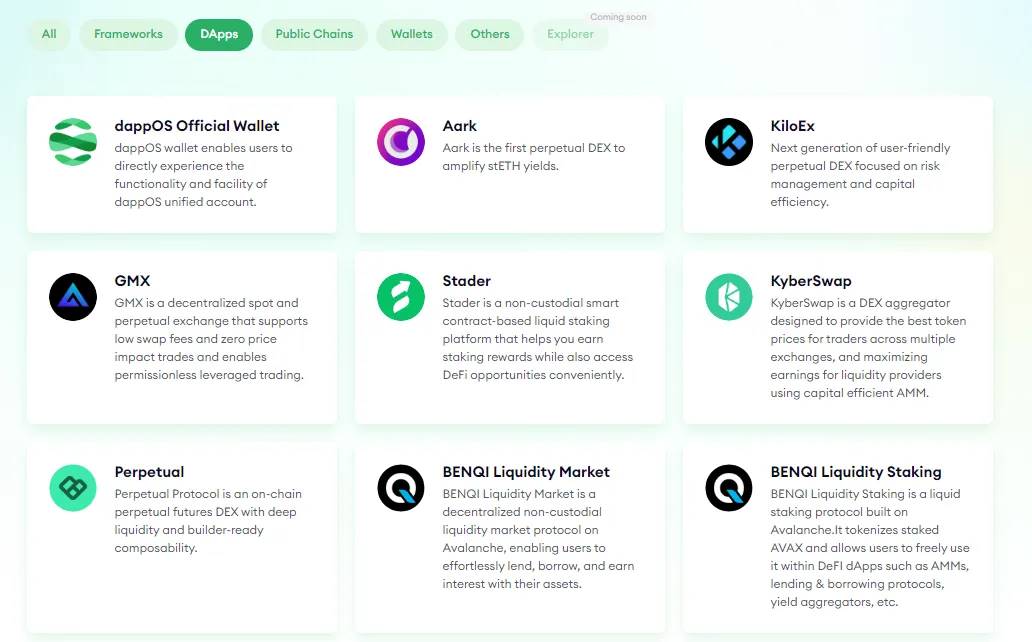

1. dAppOS

dAppOS is an intent execution platform that makes blockchain and dApps intent-centric by creating a bilateral market. What sets dAppOS apart is that it makes interactions with dApps seamless, user-friendly, and time-saving. Imagine needing to trade GMX on Arbitrum with 100 USDC, but your funds are distributed across different chains: 50 USDC on Arbitrum, 30 USDC on the BNB chain, and 20 USDC on Ethereum. You would need to bridge these funds, spending time and gas fees to transfer the funds to Arbitrum for trading. This is where dAppOS comes in – with just a click, all funds will be available on Arbitrum within minutes. You don't need to worry about allocation or specific tokens for gas fees; all of this is done through its interface, potentially protecting users from smart contract risks. dAppOS also has a lineup of well-known investors such as Polychain, Binance Lab, and Hashkey Capital, with a funding round of $15.3 million and a valuation of $300 million. dAppOS V2 has already been integrated into perpetual contract exchanges (perp Dex) such as GMX and KiloEX, where you can explore more dApps in their ecosystem.

It is rumored that dAppOS V3 will be launched with a token generation event (TGE), but there isn't much discussion about dAppOS at the moment. The last post I found about it dates back to last year, with less than 100,000 views.

I have interacted with some dApps in the ecosystem, and one tip is to keep an eye on the new dApps launched in the ecosystem, as they almost always have prize activities for each new integration. A good example is the recent 50,000 Arbitrum trading competition that ended after the integration with Aark.

2. Symbiotic

Following the success of Eigenlayer, a leader in the re-staking field with a total locked value (TVL) of over $18 billion, competitors like Karak have quickly risen to over $1 billion TVL in a short time. Symbiotic, a newcomer in this field, has adopted a different approach and technology in an attempt to stand out. Symbiotic is permissionless and modular, allowing any protocol to launch native staking for its tokens to increase network security. Symbiotic's core contracts are non-upgradable (similar to Uniswap), reducing governance power so that the protocol can continue to operate even if the team leaves. More importantly, it supports multi-assets from any chain, making it more diverse than Eigenlayer, which only supports ETH and its derivatives. Symbiotic has completed a $5.8 million funding round led by Paradigm and Cyberfund (a company founded by Lido founder Konstantin Lomashuk), so the rumors that Paradigm and Lido are funding Eigenlayer's competitors are true!

According to an interview of Symbiotic CEO Misha Putiatin by Blockwork, he stated that "the mainnet will launch some networks around the end of summer." We can speculate that it will be launched with a token generation event (TGE), which means the Symbiotic Token will be launched before $Eigen becomes tradable, potentially taking away the narrative of re-staking from existing Eigenlayer. What's more interesting is that Symbiotic is running an incentive program, but the deposit limit has been reached. The solution is to introduce another project, Mellow – a liquidity re-staking protocol (LRT) built on top of Symbiotic, similar to Renzo and Etherfi for Eigenlayer. You can earn Mellow and Symbiotic points at the same time. Pendleintern has a great post on how to maximize returns by depositing on Pendle:

The second method is to deposit $mETH into Symbiotic when the limit is lifted, which gives a 5x reward daily in the Methamorphosis event for the upcoming Mantle liquidity re-staking token ($cMETH) governance token $Cook, while earning Symbiotic points.

3. Elixir

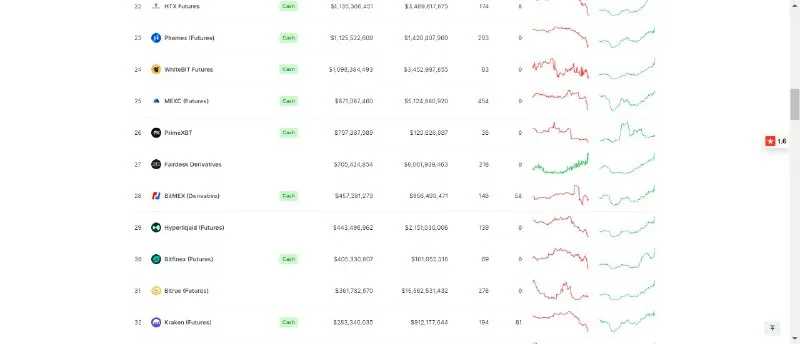

One of the reasons decentralized order book exchanges lag behind centralized exchanges (CEX) is liquidity. Even the largest derivatives exchange by trading volume, Hyperliquid, ranks 29th with an open interest (OI) of $440 million. In comparison, at the time of writing, Binance's OI is $15 billion.

- The common unhealthy practice of attracting liquidity for projects is through airdrop programs, which only attract short-term funds. Airdrop hunters will move their capital to another protocol after profiting, or rely on a group of KOLs to promote their exchange, etc. This is where Elixir comes in – Elixir is essentially a modular DPos network designed to provide liquidity support for order book exchanges. The network serves as critical infrastructure, enabling exchanges and protocols to easily bootstrap liquidity for their order books. Elixir benefits both liquidity providers (LPs) and traders, with LPs earning rewards through order book exchange incentive programs, and traders benefiting from tighter bid-ask spreads that the exchange can offer. This is not another Uniswap fork; as of the last report in May, they provided 40% of the total liquidity for DeFi order book exchanges and established partnerships with industry leaders such as Hyperliquid and Dydx.

They also raised a total of $17.6 million from Hack VC, Arthur Hayes (who also funded another successful airdrop project and PMF–Ethena this year), with a valuation of $800 million.

The mainnet is expected to launch in August, and for this, they are conducting an event called Apothecary. Users can earn "potions" by providing liquidity in a wide range of available pools. There are three strategies to earn rewards: first, locking ETH on the mainnet until the network goes live in August, which will give a 50% bonus; second, depositing through the Orderly Quantum plan to earn "contracts" supported by Elixir; and finally, staying active on discord.

4. Mitosis

With the increasing number of chains and protocols, ordinary liquidity providers (LPs) face significant bottlenecks. They need to constantly monitor news to find the best returns, and suffer losses when transferring assets from one chain to another. Most LPs are trapped in a vague scoring system and cannot accurately calculate rewards. Mitosis solves this problem by introducing a novel liquidity model – Ecosystem-Owned Liquidity (EOL). EOL allows LPs and protocols to adapt to a multi-chain environment and earn multi-chain rewards without manually allocating funds, while providing a clear reward system that allows LPs to choose the best available options. Mitosis completed a $7 million funding round led by Amber Group and Foresight Venture.

Their ongoing event – Expedition – supports the Etherfi liquidity re-staking protocol (LRT) weETH. After depositing, you can earn staking annual percentage yield (APR) + re-staking APR + Eigenlayer points + Etherfi points + Mitosis points. Additionally, depositing on tokenless Layer 2 networks such as Scroll, Linea, and Blast (Season 2) also prepares for future airdrops.

The event has attracted over 45,000 depositors, with the majority being small depositors with deposits ranging from 0-1 weETH. Deposits exceeding 1 weETH will place you in the top 3000.

5. Infinex

Some of the issues hindering the mainstream adoption of cryptocurrencies are poor user experience (UX) and the learning curve faced by newcomers. They need to learn about wallets, bridging, security, and more. Infinex accelerates mainstream adoption by unifying decentralized ecosystems and applications in a user experience similar to centralized exchanges (CEX), designed for Web2 audiences while remaining fully decentralized. Imagine a scenario where newcomers can conduct on-chain transactions without needing to understand crypto terms such as trading, gas fees, etc., just like on a CEX, but it's 100% decentralized – this is what Infinex is building. Developed by the team behind the Ethereum OG project Synthetic, Synthetic is a continuously top 10 derivatives protocol. Although no funding has been announced, according to an interview of Synthetic founder Kain by Blockwork, he has invested $25 million in building Infinex, indicating his commitment and confidence in the project.

They have an ongoing project called Craterun, where users can earn "crates," but this is not your typical deposit and earn points activity; it has a unique twist. Kain explained the reason for this approach:

Craterun is a 5-week final event (ending on July 30th) that has raised over $100 million in the first 10 days of the initial event. There are 5 million crates up for grabs, each with a 50/50 chance to win 1000 Patron NFTs, 5000 Patron passes, a $5 million prize pool, and more rewards. So, you're not just earning crates, but competing for actual rewards. You can deposit assets such as USDe, stETH, wstETH, and ezETH, while earning two types of rewards.

6. Hyperlane

Hyperlane is the first universal interoperability layer built for modular blockchain stacks. Unlike other interoperability protocols (such as Wormhole and Layerzero), which only support EVM and non-EVM (such as Solana), Hyperlane supports EVM, non-EVM, and Cosmos blockchains (such as Tia, Inj, etc.). More importantly, Hyperlane allows anyone to deploy permissionlessly in any blockchain environment, enabling these chains to seamlessly communicate on other chains deployed by Hyperlane. Hyperlane has received support from well-known investors including Circle and Kraken Venture, with funding exceeding $18 million, but the valuation has not been disclosed.

Interoperability and bridging protocols have performed well in the DeFi space because they have product-market fit (PMF) and are profitable. A recent example is Wormhole, which is widely distributed and remains a good choice for airdrop hunters even when Layerzero faces opposition. Inspired by these successes, I believe Hyperlane will also develop along a similar trajectory. To maximize returns, you need to adopt a strategy opposite to that of most people: while most people focus on EVM to EVM transactions, they overlook chains like Tia in the Cosmos network. As we saw in Wormhole, users interacting with non-EVM chains received a boost in the final allocation, and this situation may be replicated in Hyperlane. You can use their official bridge Nexus to transfer non-EVM assets (such as Tia) between chains, or integrate with their partner projects (such as Renzo, nautilus, forma) and complete the ongoing Layer3 tasks.

7. Shogun

Berachain is one of the most anticipated projects in 2024, considered to be a memecoin-centric project like Solana. Currently in the testnet phase, I believe the mainnet will experience a surge in token deployment due to this widespread perception. A critical tool in decentralized trading is Telegram bots, as they make quick exchanges and operations easy, compared to the relatively slow and inefficient user experience (UX) of regular decentralized exchanges (Dex). Shogun is building an intent-based platform that can broadcast orders to any blockchain for processing, starting with Berachain. This platform is an aggregation layer across chains, eliminating the need for multiple exchange user interfaces through its intuitive Telegram bot. Shogun has received undisclosed funding rounds from Binance and a $6.9 million funding led by top investor Polychain.

They are waiting to start operations after the launch of the Berachain mainnet, and you can join their Telegram beta in addition to participating in potential roles on their Discord.

8. Infinity Pool

According to a report from Binance Lab last year, traders lost as much as $892 million in exchanges related to oracles due to exploitable vulnerabilities. Attackers inflated the price of low-liquidity tokens on the target dApp and then exchanged the inflated tokens for other tokens to profit.

Imagine a decentralized exchange that offers infinite leverage for any asset, with no liquidation, no counterparty risk, and no reliance on oracles – this is the breakthrough that Infinity Pools is building. It is built on Uniswap V3, with centralized liquidity, and the repayment of assets can be done using any LP asset by leveraging the positions of liquidity providers (LP) as a source of credit. They have received support from notable investors such as Dragonfly, Coinbase Venture, and Wintermute. Infinity Pools is also the winner of the Blast Bang Bang competition. Although the mainnet has not yet launched, you can turn on notifications for future updates on Twitter and Discord.

That's all for today, I hope you enjoy this article.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。