Translation:

bocaibocai.eth

Since the Bank for International Settlements (BIS) and the Monetary Authority of Singapore (MAS) respectively launched "Financial Internet (Finternet)" and the central bank-led infrastructure Global Layer 1, the traditional financial sector has been experiencing a significant trend of transformation: the financial and monetary systems are transitioning towards tokenization. Global policymakers, financial institutions, and startups have shown unprecedented interest and research in tokenization, making it a core topic at many important industry conferences.

In addition to the technological process and infrastructure of tokenization, decentralized finance (DeFi) as one of the core innovations in the blockchain industry has also become a hot topic in the traditional financial sector. Therefore, a new concept, "institutional DeFi," has emerged. Recently, Deutsche Bank published a research report on institutional DeFi, which the author has translated.

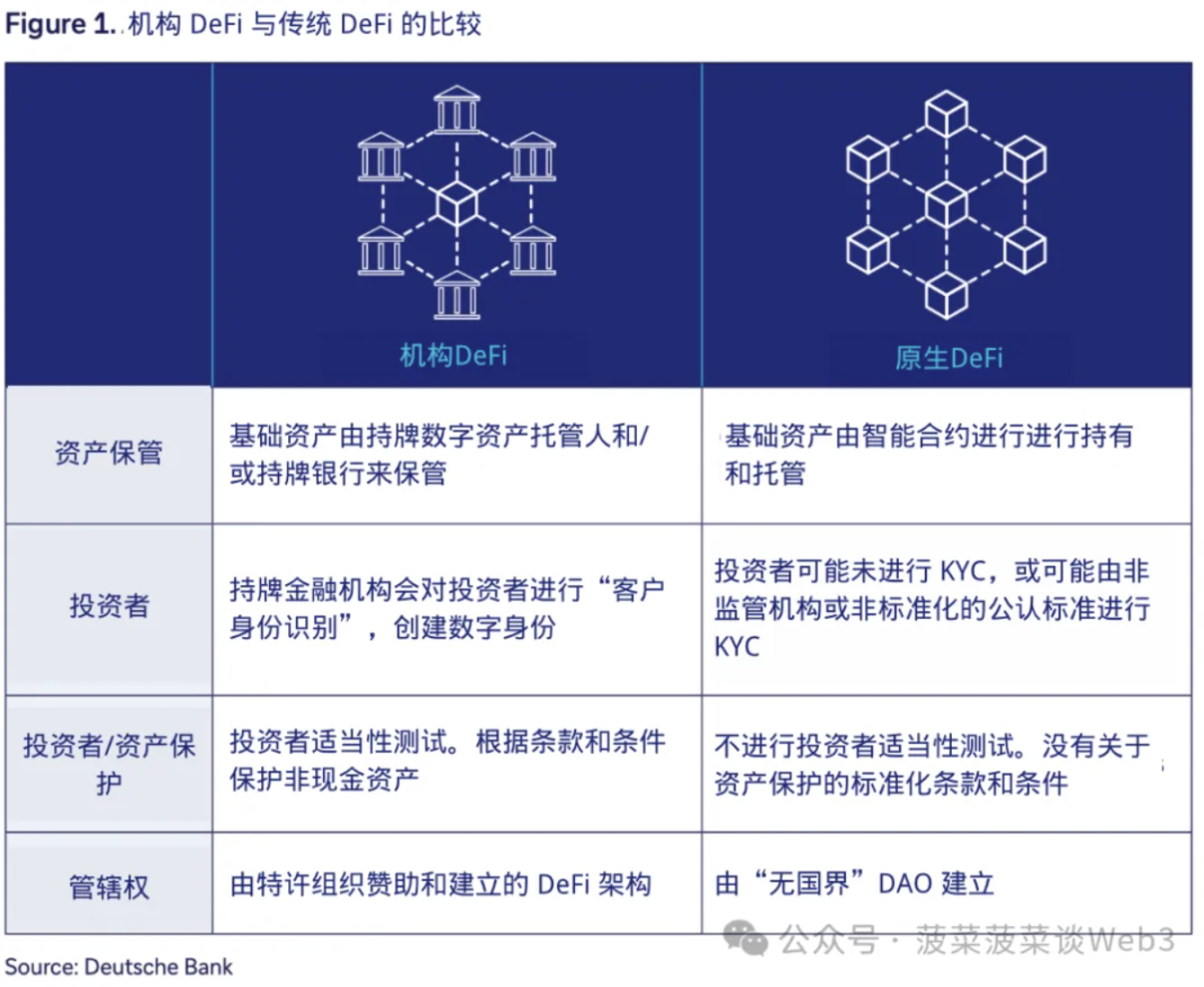

Different from the characteristics of native DeFi, which include no access barriers, asset custody by smart contracts, and governance by DAO organizations, institutional DeFi emphasizes asset custody by regulated financial institutions, KYC/AML in digital identity form, and governance by specialized organizations and professionals. Traditional financial institutions view this regulated DeFi as a new growth tool that can reduce costs, increase efficiency, and enhance regulatory transparency.

The article also criticizes the "decentralization illusion" phenomenon in the native DeFi field, where governance is carried out in the name of DAO under the banner of "decentralization," but in reality, it is extremely centralized, with a few individuals holding the power and governance tokens. This phenomenon has long been noticed by the author, and most people in the industry have turned a blind eye to it, becoming the "elephant in the room," which is something worth reflecting on.

Some may think that it is seemingly ridiculous for the "decentralized" DeFi to be used by "removed intermediaries" to conduct financial business. However, upon careful consideration, in the case of DeFi lending, for example, in native DeFi, lending is carried out by a group of people providing underlying asset liquidity to earn interest on the lent assets, while another group provides collateral assets and lends out the underlying assets in smart contracts and pays interest. In this process, intermediaries are simply replaced by smart contracts, and the role has changed, but the intermediaries have not disappeared. It is not unrealistic for financial institutions to operate DeFi protocols, and it actually reduces many labor costs and processes.

In fact, no "credit currency" is created out of thin air in this process. The ability of traditional commercial banks to derive credit currency through credit is something that native DeFi can achieve technically but is difficult to achieve at the commercial level. This involves credit assessment of borrowers and a series of social institutional constraints, which are governance issues. It is almost impossible to conduct unsecured credit lending in permissionless DeFi, lacking a system of accountability and legal constraints on users.

Institutional DeFi is the path to solving this problem. Financial institutions can significantly lower the barriers for enterprises and individuals to participate in finance through regulated DeFi protocols, achieving broader financial inclusion, reducing costs, and increasing efficiency. From the perspective of central banks and policymakers, this is a positive development for the entire national economy and society. This will also be a major trend in the future transformation of tokenization in the traditional financial sector.

To achieve this goal, technology is not the core obstacle; governance and legal regulations are the key. Today, we can see more and more central banks and financial institutions initiating pilot projects and formulating regulatory frameworks for tokenization, and we believe that large-scale application and implementation are only a matter of time.

-——————– Main Text ————————

The institutional application of decentralized finance (DeFi) has the potential to create a new financial paradigm based on principles of collaboration, composability, and open-source code, and is built on an open and transparent network. In this white paper, we delve into the history of DeFi and its potential future developments, with a focus on how this will impact institutional financial services.

Preface

The evolution of decentralized finance (DeFi) and its potential application in institutional use cases has sparked great interest among industry observers. Supporters believe that there are strong reasons for the rise of a new financial paradigm, which is based on principles of collaboration, composability, open-source code, and is built on an open and transparent network. As an area under the spotlight, the path to conducting regulated financial activities using DeFi is under construction.

The constantly changing macroeconomic and global regulatory environment has hindered widespread meaningful progress, with developments mainly occurring in the retail sector or through incubation sandboxes. However, in the next one to three years, institutional DeFi is expected to take off and be combined with the widespread adoption of digital assets and tokenization, for which financial institutions have been preparing for years.

This path is driven by the advancement of blockchain infrastructure, which accommodates organizations operating under regulatory compliance requirements in the form of Global Layer 1 or Interlinking Networks. Solutions to key uncertainties are also emerging, including compliance and balance sheet requirements, as well as the anonymity of blockchain wallets and how to meet Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements on public blockchains. As these discussions deepen, it is becoming increasingly clear that centralized finance (CeFi) and decentralized finance (DeFi) are not binary opposites; and comprehensive adoption on the institutional side of the financial sector may only be feasible for organizations with a hybrid governance model that is centralized in the ecosystem.

In institutional circles, exploring this area is often positioned as a discovery journey into an attractive potential field, where innovative investment products can be developed to reach new consumers and liquidity pools that were previously untapped, and new digital operational models and more cost-effective market structures can be adopted. Only time (and innovation) will prove whether DeFi will exist in its purest form, or whether we will see a compromise that allows a certain degree of decentralization to bridge the financial world.

In this white paper, we reflect on the recent history of DeFi, attempt to unveil the mystery behind some commonly used terms, and then carefully examine some key drivers in the DeFi landscape. Finally, we will consider what the institutional financial services community will face on the path to institutional DeFi.

DeFi Landscape Analysis

1.1 What is DeFi?

The core of DeFi is to provide financial services on-chain, such as lending or investment, without relying on traditional centralized financial intermediaries. In this rapidly developing field, there is no official and universally accepted definition. Typical DeFi services and solutions can be identified by the following elements:

- Self-custody wallets that allow investors to act as their own custodians.

- Smart contract custody for managing digital asset custody using code.

- Staking contracts that calculate and allocate rewards based on deposit value and/or variables.

- Asset exchange protocols that allow one asset to be exchanged for another and used in lending or decentralized exchanges (DEX), such as Uniswap, an early participant in the DeFi ecosystem, which executes transactions using smart contracts.

- Structuring of different assets through securitization and re-collateralization of underlying "wrapped" assets, where the issued assets may have secondary market value.

1.2 What is Institutional DeFi?

Institutional DeFi - the focus of this paper - refers to the institutional adoption and adaptation of DeFi structures, as well as institutional participation in decentralized applications (dApps) or solutions. By discussing this topic within the regulatory framework of the financial industry, the advantages of DeFi can be transferred to traditional financial markets, opening up possibilities for creating new cost efficiencies and effects, while also paving the way for new growth paths. These new paths include the tokenization of physical assets and securities, integrating programmability into asset categories, and introducing new operational models.

The difference between institutional DeFi and traditional DeFi is shown in Figure 1.

1.3 DeFi - History

In an open environment, DeFi-related projects sparked the crypto market in the summer of 2020, ushering in a new era. Due to its high liquidity, expensive assets, and high mining returns, DeFi rapidly rose during the Federal Reserve's (Fed) large-scale quantitative easing (QE) in response to the COVID-19 pandemic, with the total value locked (TVL) in DeFi services rising from $1 billion at the beginning of the year to over $15 billion by the end of the year.

[Original text has been translated and formatted]

During this period, new DeFi projects received a large amount of funding support, and the number of projects and related tokens became relatively saturated, attempting to capitalize on the momentum. By the end of 2021, the total number of DeFi users surged, with over 7.5 million unique users conducting transactions in the DeFi ecosystem, a 2550% increase from a year ago. The Total Value Locked (TVL) reached its peak in November 2021 at $169 billion (based on DeFiLlama data). New terms and names such as Uniswap and Yield Farming were introduced into daily financial life.

During this year, due to multiple interest rate hikes and significant inflation, coupled with some illicit activities in the ecosystem, DeFi experienced quite a few issues, including some well-known collapse events. This meant that the entire market was forced to take a step back and enter a cautious and rational phase in the second half of 2022.

This trend became more apparent in early 2023, as the cost of financing increased, and private financing in the financial technology DeFi sector dried up, reflected in a 69% year-on-year decrease in trading activity from the beginning of the year to the first quarter of 2023 (Fintech Global Research). This led to a decrease in TVL in the DeFi system to less than $50 billion in April 2023, and a low point of $37 billion by the end of October 2023.

Despite significant declines and the concurrent "crypto winter" (i.e., a decrease in the value of crypto assets), the fundamentals of the DeFi community remain resilient, with a steady increase in the number of users, and many DeFi projects persistently focusing on product and capability development.

By the end of 2023, with the first approval of a spot crypto ETF product in the United States, widely seen as a significant milestone for the further integration of digital assets into traditional financial products, the market experienced growth. More importantly, this opened the door for institutional participants to more deeply engage in these emerging ecosystems, providing much-needed liquidity to the field.

1.4 Fulfilling the Early Promise of DeFi

In the native crypto asset space, the DeFi movement led to a coded structure, demonstrating how DeFi works without the involvement of certain intermediary institutions, typically involving smart contracts and/or peer-to-peer (P2P) foundations. Due to low access costs, DeFi services were rapidly adopted in their early stages and quickly proved their value in providing efficient asset pools and reducing intermediary fees, applying economic behavioral finance technology to manage demand, supply, and prices.

These new advantages were realized as DeFi reprogrammed or replaced existing intermediary activities through smart contract coding, achieving greater efficiency, thereby changing workflows and shifting roles and responsibilities. In the "last mile" with investors and users, DeFi applications (i.e., DApps) are the tools that provide these new financial services. Therefore, existing market structures can change.

Pioneering Institutional DeFi Activities

Many institutional use cases can be extracted from the DeFi space, utilizing the tokenization of real assets and securities.

Here are some examples that attempt to summarize the connections between financial service products, technology, and regulations to create new value, illustrating why institutional DeFi is attractive.

Case 1: Interoperability - In 2023, by using DeFi constructs in the institutional domain, self-custody wallets can achieve a distributed asset custody model while providing comprehensive and independent digital accounts (addresses) for trading liquidity, settlement, and reporting. An important use case is a smart contract bridge that connects different blockchains to achieve interoperability and avoid fragmentation.

Applicability: Serving as connection points between public, public permissioned, and private networks to minimize fragmentation while allowing high access and participation.

Example: Interlinking Networks Technical Paper

Case 2: Refinancing with Stablecoins - In 2023, the DeFi system can also be used for financing in traditional industries, although it has not yet been widely applied. For example, security tokens representing certain real-world financial instruments can be placed as collateral in a smart contract "vault" to obtain stablecoins, which can then be converted into fiat currency.

Reference: Refinancing with DAI Stablecoin in DeFi - MakerDAO

Case 3: Tokenized Funds in Asset Management - In 2023, tokenized fund units or tokens can be distributed via blockchain, directly open to qualified investors, and maintain investor records on-chain, while smart contract facilities allow for rapid or near-instant subscription and redemption using regulated stablecoins. Furthermore, tokenized fund units representing high-quality liquidity traditional financial instruments can be used as collateral.

Example: BlackRock Launches First Tokenized Fund

Evolution of DeFi Institutional Market Structure

The market concept driven by DeFi has proposed an intriguing market structure that is inherently dynamic and open, challenging the norms of traditional financial markets. This has led to various discussions on how DeFi can integrate or cooperate with the broader financial industry ecosystem, and the forms that new market structures might take.

2.1 Governance, Trust, and Centralization

In the institutional domain, there is a greater emphasis on governance and trust, requiring ownership and accountability in the roles and functions played. While this may seem contradictory to the decentralized nature of DeFi, many believe that this is a necessary step to ensure regulatory compliance and provide clarity for institutional participants to adapt to and adopt these new services. This trend has given rise to the concept of the "decentralization illusion," as the need for governance inevitably leads to a certain degree of centralization and concentration of power within the system.

Even with a certain degree of centralization, new market structures may be more streamlined than our current market structures, as intermediary activities are significantly reduced. The result is that orderly interactions will become more parallel and concurrent. This, in turn, helps reduce the number of interactions between entities, thereby improving operational efficiency and reducing costs. In this structure, management activities, including Anti-Money Laundering (AML) checks, will also become more effective, as the reduction of intermediary institutions can increase transparency.

2.2 Potential for New Roles and Activities

The pioneering use cases listed in Section 1.4 of the institutional DeFi space highlight how today's market structures may evolve with the next wave of DeFi innovations.

As such, public blockchains can become the de facto industry utility platform, much like how the internet became the delivery infrastructure for online banking. There have been some precedents for launching institutional blockchain products on public blockchains, especially in the money market fund space. The industry should expect further progress, such as in the tokenization field, virtual funds, asset categories, and intermediary services; and/or with permissioned layers.

Participating in the DeFi Market on Public, Private, or Permissioned Blockchain Networks

For institutions, the nature of DeFi itself is both daunting and convincing.

Participating, operating, and trading in the open ecosystem offered by DeFi products may conflict with the closed or private environment of traditional finance. In the traditional financial environment, clients, counterparties, and partners are well-known, and risks are accepted based on appropriate disclosure and due diligence levels. This is one of the reasons why many advances in the institutional digital asset space have occurred in private or permissioned blockchain networks. In this domain, trusted administrators act as "network operators," and owners are responsible for approving participants' entry into the network.

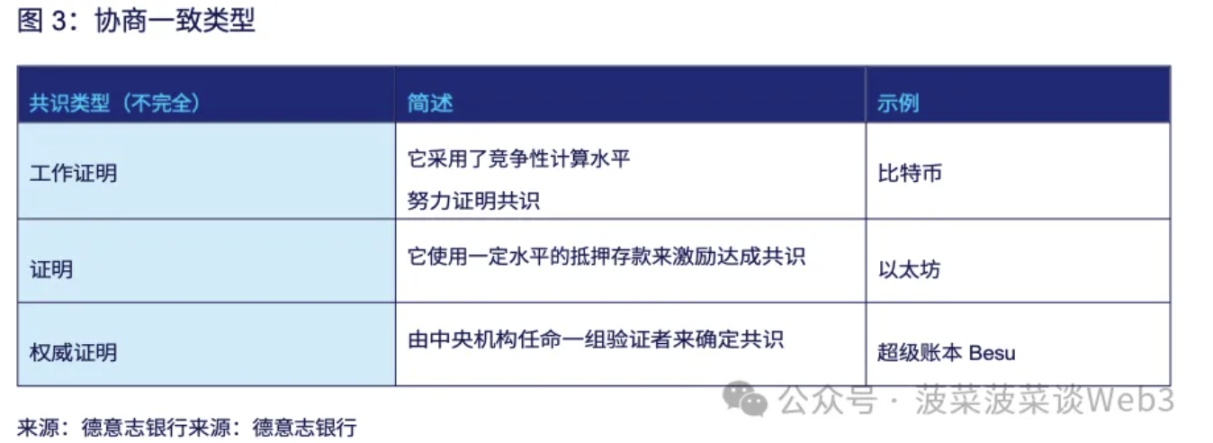

In contrast, public chain networks have the potential for open scale, low entry barriers, and ready-made innovation opportunities. These environments are inherently decentralized, built on the principle of no single point of failure, and incentivize the user community to "do good." Consensus protocols for maintaining blockchain security and consistency (Proof of Stake (POS), Proof of Work (POW) are primary examples) may vary across different chains. This is a way for participants - as validators - to contribute and be rewarded in what we consider the "blockchain economy."

3.1 Participation Checklist Outline

When evaluating participation in any digital asset and blockchain ecosystem, the main factors to consider should include the maturity of the blockchain and its corresponding roadmap, achievable final settlement consensus, liquidity, interoperability with other on-chain assets, regulatory perspectives and adoption. It is also necessary to assess network technology risks, network security, continuity plans, and the core community and developer participation in the network. The degree of technical standardization and a common understanding of classification can also pave the way for application development.

Based on this, private chains appear to be lower risk and more attractive. However, the lower risk level of private chains compared to public chains should also be measured through factors such as availability of expertise, vendor dependency, accessibility, liquidity scale, and the cost of creating, maintaining, and operating a private chain, which may determine the success or failure of a project. Imagine if every bank had to run its own private internet to support its internet banking applications, cost would be a key factor, especially during the transition period when blockchain will operate in parallel with existing technology stacks, this needs to be considered.

Ultimately, enterprises must adapt to the level of transparency and new ways of working they can accept and manage, while maintaining a high level of focus on data and asset protection for themselves and their respective clients' interests. Regardless of which side of DeFi you stand on, asset custody and security are crucial. The key is to understand novel approaches - such as extending custody to assets held by smart contracts - and substantively address the gray areas in these areas, which helps to reduce risks and regulatory issues.

Another example is the importance of identity. In the process of institutionalizing DeFi, deploying verifiable credentials is one of the fundamental elements. These credentials will facilitate governance and provide assurance for institutions participating in these open blockchain ecosystems. Verifiable credentials allow anyone to use cryptographic proof to prove their identity without directly sharing personal identifiable information (PII), while storing such PII material off-chain or in encrypted decentralized ways to increase protection.

Therefore, in such digital identities at the "DApps" layer, centralized governance in areas such as investor entry and exit from institutional DeFi structures can achieve reliable customer due diligence (KYC), sanction checks, and anti-money laundering prevention. In addition, market abuse detection and other market integrity measures (such as investor suitability) will become new protective measures that can be implemented. Digital identity helps identify risk patterns while maintaining transaction confidentiality and banking privacy.

In this way, the core advantages of DeFi in cost-effectiveness and innovation value are preserved and integrated by concentrating certain key attributes, in order to successfully achieve regulatory balance.

In recent years, early development and evaluation of blockchain in the institutional sector have been advocated. It is worth noting that in June 2022, the multi-stage industry-level "Guardian Project" was initiated by the following institutions. The Monetary Authority of Singapore (MAS) seeks to make progress on the path to institutional DeFi. Developing "open and interoperable" networks, exploring the potential of interconnected markets.

This aligns with the broader industry innovation vision, which is to achieve scalability, liquidity, and new market connections using blockchain-based technology, without compromising the financial stability and integrity of the ecosystem. How to achieve this goal while considering regulation? This is the trillion-dollar question facing DeFi institutions.

Regulatory Barriers

4.1 Framework without Intermediaries

There is no doubt that the road ahead is long, full of innovation, exploration, and review/reflection. The DeFi system requires regulators, standard setters, and policymakers to reconsider their traditional supervisory frameworks, which are centered around intermediaries. Given that decentralized systems may lack access points for regulation and supervision, DeFi is undoubtedly driving a paradigm shift.

4.2 Market Integrity and Investor Protection

Since the end of 2023, momentum and cross-jurisdictional progress in this field have been growing: in December, the International Organization of Securities Commissions (IOSCO) issued a "Policy Recommendations for DeFi," outlining nine key policy recommendations for core risks related to market integrity and investor protection. Prior to this, IOSCO had released "Crypto Asset Policy Recommendations" in November 2023, which complemented the policy recommendations involving DeFi. With these two interoperable global policy recommendations, an activity will be subject to one regulation if it is not subject to another. Therefore, the regulatory landscape is now clearer, and as IOSCO's recommendations are implemented by its members globally, the regulatory landscape will become even clearer.

This clarity is also due to the push for global regulatory principles, namely the same activities, the same risks, the same regulations, and technological neutrality. This means that a tokenized traditional financial instrument should be regulated based on its nature as a financial instrument, rather than being treated differently just because it has been tokenized. As tokenization is a technical process, existing technology risk provisions will apply. Financial institutions are increasingly affected by how to understand and calculate the risk interpretations triggered by the unique characteristics of asset-liability management under new technology.

4.3 Prudent Treatment

The impact of participating in the digital asset field on the balance sheet is another challenge in regulatory evolution. The Basel Committee on Banking Supervision (BCBS) published the final standards for the prudential treatment of bank crypto assets in December 2023 for consultation. It focuses on recognizing the market's composition, which is concentrated in recognizing the inherent market, credit, and liquidity risks in activities related to crypto assets (essentially including DeFi), and defining the required disclosures and safeguards. The BCBS standards also address the need to categorize asset types into Group 1 and Group 2 based on classification criteria, reflecting the potential risks that need to be managed. Another round of negotiations on disclosure requirements under the Basel Accord ended on January 31, 2024. Recently, on May 16, 2024, the Basel Committee announced a one-year delay in the implementation date to January 1, 2026. In these circumstances, how to classify institutional DeFi still needs substantial examination.

These are important milestones in the industry's exploration journey. They are the result of years of joint efforts by the public sector and the industry to understand, discuss, calibrate, and reach a common understanding, with the aim of paving the way for further progress as the market and technology develop in sync. Establishing and unifying understandings of how to consider the new digital domain, including the related risks of participating in these domains, will be an important foundation and barrier for innovation, while increasing regulatory clarity.

Many use cases demonstrate that innovative technology combined with appropriate regulations will be a very powerful force for change, reshaping and reordering business models and markets.

5. DeFi: What's Next?

The light bulb did not come from continuous improvements to the candle, but from the continuous improvement of alternative technologies to address the shortcomings of candle making.

If we consider the above question and believe in the potential power of widely regulated or institutional DeFi, we must acknowledge that it requires a set of core beliefs, standards, and prerequisite capabilities to build the structure of the ecosystem. In fact, only in this way will institutional participants see it as a new growth tool and move forward with sufficient safeguards and regulatory certainty.

2024 is a turbulent period for all forms of DeFi, and after this, 2024 will be a decisive moment. The implementation of regulations is a driving force that will continue to determine the interest and adoption speed of institutions in the digital domain. It can be said that DeFi has expanded the challenges in risk management, anti-money laundering, and information privacy. However, it is difficult to ignore its potential benefits for new products, new services, and new operating models in the future digital-first financial industry, when considering the opportunities brought by institutional DeFi, including financial inclusion.

The technology itself is becoming increasingly mature, and people's understanding of the technology is deepening. Regulations are becoming clearer, and it is now easier to obtain the necessary expertise as lessons are learned from pilot projects. For example, the increase in regulations and expertise in control functions such as compliance and auditing is helping to introduce DeFi technology into the financial industry.

The industry is currently in the "post-concept validation" phase and needs to upgrade visible and successful "live" products to scalable commercial products. This transition will help achieve cost-effectiveness or new growth and further drive the path of institutional development. We look forward to seeing how the factors discussed in this article will impact or inhibit the development trajectory of regulated DeFi for institutional participation.

In key areas such as cross-chain interoperability, Oracles, digital or decentralized ID solutions, and trust anchors, the continuous maturation of technology, innovation, and regulation will only fuel the momentum needed to reach critical mass. While the path to institutional DeFi may not take us to the "moon," it will certainly be an exciting journey, leading us to a new and captivating destination.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。