Author: Fu Ruhe; Editor: Hao Fangzhou

Produced by | Odaily Planet Daily

2024 is already halfway through, and the cryptocurrency industry has taken an epic step, from the approval of the Bitcoin ETF spot in the United States at the beginning of the year, to the approval of Bitcoin and Ethereum ETF spot in Hong Kong, and the imminent breakthrough of the Ethereum and Solana ETF spot in the United States, marking the formal integration of crypto assets into the mainstream financial world.

In the native crypto market, the Bitcoin market continues to break historical highs; the meme sector has also swept away the signs of the previous bear market, becoming a gathering place for the wealth effect in the first half of the year; the Bitcoin ecosystem also saw further development last year, with a continuous emergence of second-layer projects around the Bitcoin mainnet; the emergence of the new original language DePIN has brought about a new round of enthusiasm in the infrastructure sector.

Which projects in the primary market attracted high attention in the first half of this year? AI + blockchain has undoubtedly become the first, whether it is AI-driven underlying networks or AI-related tools, they are sought after by capital. Perhaps when depicting the future of Web3, AI has long been one of its most representative features.

While significant breakthroughs are occurring in overall development, what sparks will be ignited in the primary market?

In this article, Odaily Planet Daily will focus on the layout of institutional primary markets, providing a detailed overview of the investment situation of major representative institutions in the first half of 2024 (for a more complete analysis of numerical amounts, please stay tuned for the upcoming Q2 review). We also had the privilege of interviewing representatives from institutional investors OKX Ventures, ArkStream Capital, and Foresight Ventures, discussing the current market stage, each institution's investment preferences, and the underlying logic.

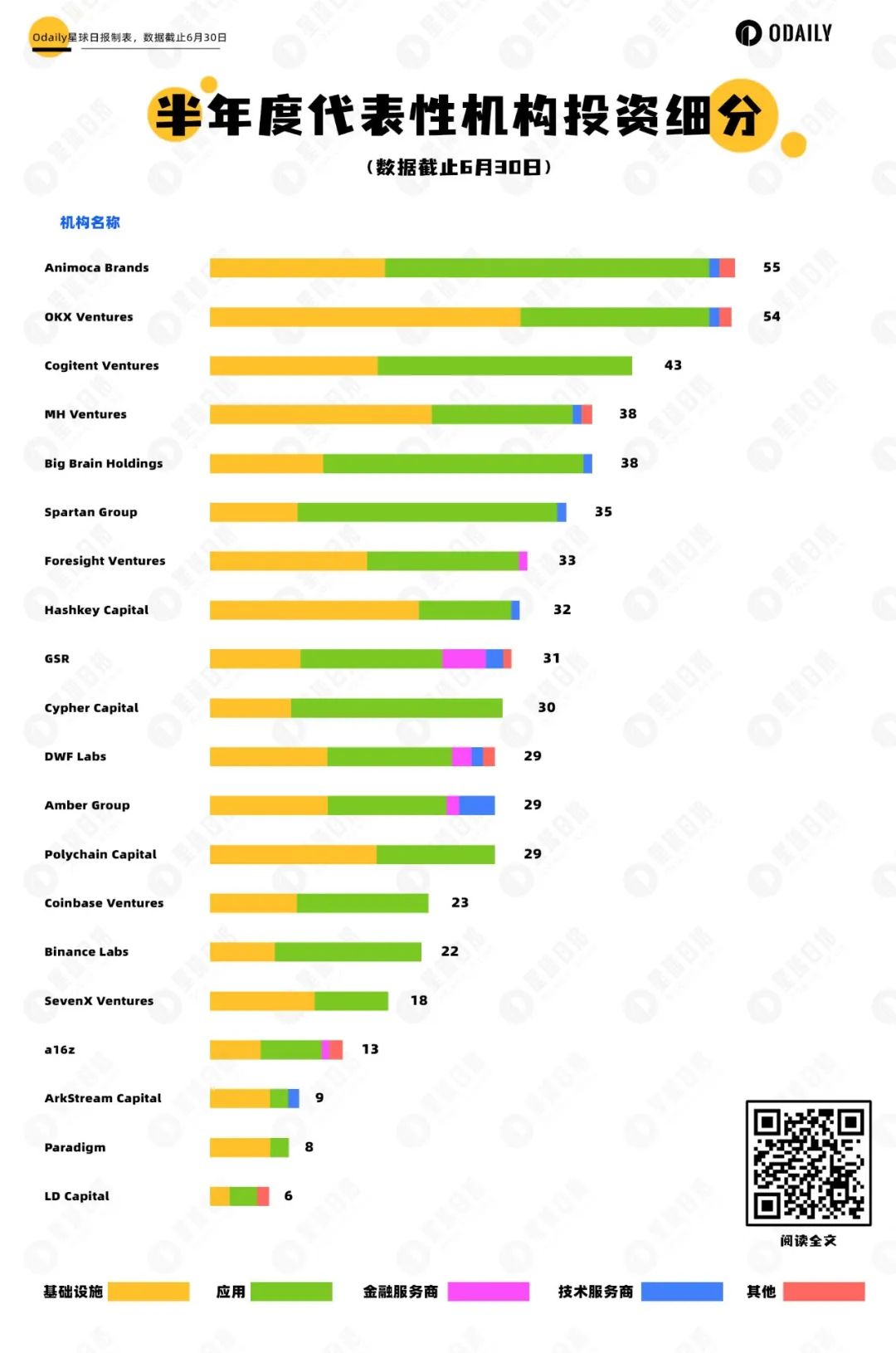

Classification of Projects Invested by Institutions

The following figure selects representative Web3 investment institutions based on the number of investments in the first half of the year. Odaily Planet Daily further categorizes them into 5 major tracks based on the business type, target audience, business model, and other dimensions of the invested projects: infrastructure, applications, technology service providers, financial service providers, and others.

Animoca Brands

Infrastructure: Futureverse, E Money Network, ARPA, Humanity Protocol, Lava Network, Shiba Inu, Berachain, Monad, XION, peag, Myshell, 0G, PolyHedra, Beoble, io.net, KIP Protocol, Root Protocol, Nubit;

Applications: Redacted, Saltwater, Zeek Network, The Sandbox, GoPlus Security, Stashh, Cookie3, TRALA, CARV, Kuroro Beasts, OpenSocial, IVX, Pencils Protocol, Aria, Param Labs, Cross The Ages, Baby Shark Universe, Blade Games, Puffverse, Iskra, DARKTIMES, Wild Forest, Puffer Finance, Sharpe Al, Planet Mojo, llluviu, Rollie Finance, eesee, Imaginary Ones, Matr1x, Ultiverse, WELL3, Pixelmon, AOFverse;

Technology Service Providers: Sapien;

Others: Bondex*2, Co-Museum;

OKX Ventures

Infrastructure: Merlin Chain, B2 Network, Zeus Network, 0G, Sonic, codatta, GoPlus Security, Cysic, Monad, Arch Network, ZKM, Carv, Movement, Lumoz, UTXO stack, Privasea, Camp Network, Sophon, FLock.io, Bitlayer, MyShell, Nubit, Meson Network, DLC.Link, Eclipse, io.net, Taiko, BounceBit, Ether.Fi, Delphinus Lab, Ethena, PolyHedra;

Applications: Zeek Network, UniSat, DEXTools, OpenSocial, Pencils Protocol, BlockBooster, Blade of God X, Bedrock, L3E7, Wild Forest, Thruster, Tomo, Cellula, StakeStone, UXLINK, AltLayer, NAVI Protocol, Portal Network, Renzo Protocol;

Technology Service Providers: 0xScope;

Others: DeBoX, BeWater;

Cogitent Ventures

Infrastructure: TNA, Chakra, NatixNetwork, Tevaera, Zeko, BonusBlock, peag, Bitlayer, Nubit, BEVM, Tanssi Network, Flash Protocol, Ten, Cosmology, Humanity Protocol, Beoble, Entangle;

Applications: XProtocol, Stage, Elys Network, IVX, RunesFi, Zaros, RunesTerminal, xSwap, Crestal, Mitosis, SHADOW WAR, Creator.Bid, MerlinStarter, Master Protocol, Moongate, Satoshi Protocol, GAM3S.GG, BitRealms, Metalcore, Silencio, Exverse, Truflation, Lends, Velar, SkyArk Chronicles;

MH Ventures

Infrastructure: Entangle, Particle Network, AgentLayer, Play Al, Parasail, Blockless, Crestal, TNA, Aizel Network, XION, Nubit, BEVM, AlLayer, Morph, io.net, Privasea, Humanity Protocol, Lava Network, Merlin Chain, Analog, OMEGA, Bitlight Labs, Hivello;

Applications: Param Labs, XSwap, Creator.Bid, Avalon, Gull Network, SatoshiSync, Gomble Games, Satoshi Protocol, Openstamp, Blockus, ChronoForge, Imaginary Ones, Velar;

Technology Service Providers: Lightlink;

Others: Synnax;

Big Brain Holdings

Infrastructure: Entangle, Exabits, Sphere, Initia, Ten, Zeus Network, MegaETH, Sonic, Nubit, Natix Network, Shiba Inu, Mayan, Monad;

Applications

- BitFlow

- Synonym Finance

- Overworld

- Watches.io

- GLIF

- Utila

- BitRealms

- Planet Mojo

- Gomble Games

- Parallel

- ZKasino

- Decent.land

- kima Network

- Pixelverse

- XOCIETY

- IVX

- Aria

- Arch Network

- EYWA

- Mitosis

- L3E7

- Plena Wallet

- Inference Labs

- TODAY

Technology Service Providers: Safary

The Spartan Group

Infrastructure: Morph, XION, Zeus Network, Berachain, Merlin Chain, Particle Network, Nubit, Zentry, API3

Applications: The Bornless, Pallet Exchange, MetaCene, Metalcore, Karma3 Labs, Overworld, Pixelmon, Forgotten Playland, Saros Finance, illuvium, Sophon, Parallel, peaq, Alex, Gomble Games, Planet Mojo, Redacted, XOCIETY, Supervillain Labs, Aria, L3E7, Puffverse, Wild Forest, UnchartedCentrifuge, Avalon

Technology Service Providers: Cookie3

Foresight Ventures

Infrastructure: Merlin Chain, Ether.Fi, DePHY, io.net, Humanity Protocol, Morph, XLink, MyShell, Shiba inu, Glacier Network, Avail, Parasail, TheoriqAl, Movement, Avalon, Cellula

Applications: SoulLand, Pixelmon, PublicAl, Overworid, Oyl, KiloEx, Alex, Gomble Games, Blade Games, L3E7, Decent.land, Rango, Pixelverse, Focus Tree, Mitosis, Puffverse

Financial Service Providers: Agora

HashKey Capital

Infrastructure: ORA, Particle Network, GoPlus Security, Avail, Babylon, Cysic, Tevaera, Othentic, Berachain, B2 Network, Lava Network, Lumoz, Mystiko.Network, PolyHedra, Cosmology, Karma3 Labs, Humanity Protocol, Delphinus Lab, HackQuest, Beoble, AltLayer, FuzzLand

Applications: Halo, UXLINK, Bladerite, Puffverse, Aark Digital, Overworld, Lightcycle, bitsCrunch, Fetcch

Technology Service Providers: 0xScope

GSR

Infrastructure: Lava Network, Ethena, Taiko, Inco Network, Analog, Fhenix, Owito Finance, Monad, Myshell

Applications: Altitude, The MysterySociety, Kiln, Arcade ARC, Kelp DAO, UXUY, Mitosis, Usual, Puffer Finance, LILLIUS, TODAY, Arrow Markets, Midas, EarlyFanS, Elixir

Technology Service Providers: 0xScope, SoSo Value

Financial Service Providers: Cube.Exchange, M^0, D2X, ClearToken

Others: Ink Finance

DWF Labs

Infrastructure: Analog, Beoble, DeMR, Lumia, Zentry, API3, Tevaera, Klaytn, peaq, GraphLing Chain, Flash Protocol, Ten

Applications: Ultiverse, TokenFi, Prom, Artfi, Yuliverse, Milady, Parasail, Kelp DAO, Shogun, Scallop, Alex, Nebula Revelation, Juice Finance

Technology Service Providers: NuLink

Financial Service Providers: Double, LazyBear

Others: DeBox

Amber Group

Infrastructure: Ethena, io.net, Merlin Chain, Berachain, Babylon, Layer3, Taiko, Fhenix, ZKM, Monad, Reya Network, AlLayer

Applications: Ether.Fi, Pixelmon, Kodiak, DappOS, Backpack, Metalcore, Mitosis, Bedrock, Anichess, MerlinStarter, Merkle Trade, Parallel

Technology Service Providers: 0xScope, Carbcoin, Tensorplex Labs, Elixir

Financial Service Providers: Woo Network

Cypher Capital

Infrastructure: Humanity Protocol, Hivello, Beoble, Arch Network, Shiba lnu, Berachain, Flash Protocol, XLink

Applications: Imaginary Ones, Shuffle, ZeroLend, Pixelmon, Velar, bitsCrunch, Kasu, BracketX, Kelp DAO, CARV, Gomble Games, BlockGames, CAM3S.GG, Aark Digital, Raiinmaker, Ooga Booga, Juice Finance, Madworld, Pallet Exchange, UXLINK, NFTG, Scallop

Polychain Capital

Infrastructure: Bitfinity Network, AltLayer, Berachain, Nubit, Babylon, Cysic, Clique, Eclipse, Sahara, Talus, ORA, Botanix, Milky'way, Movement, Ritual, Gasp, PolyHedra

Applications: Superform, Squid, Drift Protocol, Canza finance, Particle, DappOS, Monkey Tilt, Pac Finance, Shogun, Tomo, Stream Finance, Sofamon

Coinbase Ventures

Infrastructure: Polymer, WITNESS, Mountain Protocol, Arcium, Turnkey, Othentic, Avalon, Monad, Umoja

Applications: LogX, Portal Network, Conduit, Farworld, Squads, Neynar, El Dorado, Paragraph, Agora, Puffer Finance, Midas, BOB, Reya Network, Stack

Binance Labs

Infrastructure: Zircuit, Movement, BounceBit, Privasea, Babylon, Ethena

Applications: Memeland, BracketX, infrared, Rango, AeVO, Zest Protocol, UXUY, Milkyway, StakeStone, Cellula, Deriwio, QnA3 GPT, NFPrompt, Shogun, Puffer Finance, Renzo Protocol

SevenXVentures

Infrastructure: ORA, AltLayer, io.net, Particle Network, Avail*2, REVOX, Azuro, Monad, Karma3 Labs, Delphinus Lab, Adot

Applications: ArenaX Labs, L3E7, UXLINK, Cellula, Sophon, MetaCene, Renzo*2

Technology Service Provider: Safary

Others: eesee

a16z Crypto

Infrastructure: NEBRA, Espresso Systems, Optimism, EigenLayer, Nodekit

Applications: Neynar, Farcaster, Kiosk, MyPrize, Madworid

Financial Service Provider: OpenTrade

Others: KIki World, Friends with Benefits

ArkStream Capital

Infrastructure: ARPA, Nubit, BEVM, io.net, Merlin chain, Nibiru

Applications: Kelp DAO, MerlinStarter

Technology Service Provider: Blockus

Paradigm

Infrastructure: Conduit, Symbiotic, Babylon, Monad, Succinct, Axiom

Applications: Farcaster, Phoenix

LD Capital

Infrastructure: Babylon, DeMR

Applications: Decent.land, Fetcch, Bored Slot

Others: Gamic

Institutional Investment Logic Self-narrative

In addition to event and data compilation, Odaily Planet Daily also interviewed some representatives of the institutions covered in the previous article, discussing the current market conditions, investment preferences of various institutions, and the underlying logic.

Odaily Planet Daily: What stage is the current Web3 market in?

OKX Ventures: When looking at the industry cycle, we need to consider it from the following three perspectives:

The industry is beginning to enter the mainstream: The market size of Crypto is maintaining a $2 trillion scale, and the inclusion of Bitcoin and Ethereum ETFs in the global mainstream financial market trading range represents the acceleration of Crypto industry integration with the traditional world.

Improvement in the entrepreneurial environment: VC fund inflows are increasing, with total investment and financing amount exceeding $3 billion in Q2 2024, a 28% increase from the previous quarter, indicating increased activity among investment institutions. At the same time, there is a continuous influx of outstanding entrepreneurs with top industry backgrounds and top-tier educational backgrounds, contributing fresh blood to the industry.

Large-scale user entry: In the past few years, blockchain infrastructure has improved, and Ethereum, Layer 2, and high-performance public chains have provided a friendly development environment and abundant block space. User-side applications such as games, social media, and Telegram ecosystems are allowing more users to enter the Crypto world without awareness. AI applications, intent, and account abstraction are lowering the learning threshold for users. We are on the eve of a large-scale application explosion, and we maintain a long-term optimistic attitude towards this.

ArkStream Capital: We believe that we are currently in the early stage of a bull market, and there is still a larger upward trend, relying on the easing in the United States.

Foresight Ventures: I believe that the current crypto market has not yet started the main bull market. After the approval of the Bitcoin spot ETF, Bitcoin has moved away from the crypto market and has become a US stock asset. It is difficult for the funds from the Bitcoin spot ETF to overflow into the crypto market. But I believe that with the arrival of interest rate cuts and the increase in industry penetration, the market will start to receive funds again in the second half of the year.

Odaily Planet Daily: What is the volume of primary investments and which track or sector are you particularly optimistic about recently, and why?

OKX Ventures: The entire team comes into contact with 100-200 projects every week. OKX Ventures makes investments across all tracks, covering AI, GameFi, DeFi, Web3, NFT and Metaverse, blockchain underlying infrastructure, and many other tracks, with a total of over 300 projects. The investment distribution is as follows: infrastructure (40%), DeFi (20%), gaming (15%), Web3 (15%), NFT and Metaverse (10%). In this cycle, we are focusing on three directions:

More efficient infrastructure construction: Faster, more efficient, and cheaper infrastructure is still a focus, such as the parallel direction represented by MegaETH and Monad. At the same time, more differentiated infrastructure, such as public chains designed for AI, solutions for privacy issues such as FHE, and more ZK-based infrastructure.

Innovative DeFi products: DeFi products have mature business models and user bases. In the future, DeFi will tend towards multi-chain, decentralization, the introduction of more RWA assets, the introduction of more derivatives, and greater efficiency.

Introducing Web2 users: The overall user base of Web3 is still growing rapidly. Compared to Web2 industries such as AI, gaming, social media, and streaming media, the Crypto industry still has a lot of room for growth. A typical example is AI and Telegram. ChatGPT has captured nearly 200 million users, and there is a natural coupling between AI and the Crypto industry. Telegram has 900 million active users, is one of the top 20 apps with the highest daily activity globally, and has brought 700 million TVL to TON. Ton.app currently has 874 projects. We believe that these applications will bring more Web2 users into the blockchain industry.

ArkStream Capital: Our investments and research in the first half of the year focused on three sectors: the BTC ecosystem, Ethereum expansion and re-staking track, AI + DePIN track, and we also made layouts in subfields such as FHE, data storage, and chain abstraction.

Foresight Ventures: It is difficult for us to count how many projects we look at each week, but it is definitely on the order of dozens. We are currently particularly interested in AI Crypto, Consumer App, TG ecosystem, and institutional platform sectors.

Odaily Planet Daily: What are the most important aspects of the team and product at the moment?

OKX Ventures:

Team's innovation and technical capabilities: OKX Ventures emphasizes the evaluation of the team's technical depth and innovation capabilities, looking for teams that can drive technology and application frontiers in fields such as finance, gaming, AI, FHE, ZK, and cryptography. The team needs to have a solid technical foundation and innovative thinking.

Market potential and uniqueness of the product: The product needs to have a clear market demand and potential user base, and be able to demonstrate its uniqueness and innovation in a highly competitive market. In the current market environment, where competition is intense, products not only need to meet user needs but also lead the market narrative.

Team's execution and business growth capabilities: In addition to innovation, the team must be able to translate innovative ideas into actual products and successfully bring them to market. OKX Ventures focuses on whether the team can quickly respond to market changes, effectively promote products, and achieve rapid business growth, achieving effective Go-To-Market.

Commitment to long-term industry development and compliance: Project teams need to continuously pay attention to industry standards and compliance, which is crucial for maintaining the sustainability of business in the constantly changing global regulatory environment. OKX Ventures values projects and teams that contribute to the healthy and compliant development of the entire blockchain industry.

In summary, OKX Ventures' investment strategy places great emphasis on the team's innovative spirit, professional skills, execution, as well as the market potential and differentiation of the product, while also highly valuing the long-term development potential of the project. These factors together form OKX Ventures' judgment of teams and products.

ArkStream Capital: We first conduct a detailed mapping within the tracks we are optimistic about, covering all projects in this track. We select products with disruptive innovation and top-level narratives, considering various aspects of the team's capabilities, including product implementation capabilities, iteration speed, data growth rate, team configuration, marketing, and community. After conducting thorough competitive analysis and due diligence, we make investments.

Foresight Ventures: The founding team needs to have the ability to understand and organize the team, and the product needs to have innovative uniqueness.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。