Although the currency may change, the temptation of getting rich will never disappear.

Author: Crypto, Distilled

Translation: Deep Tide TechFlow

Meme is the fastest Ponzi scheme in the world. Whether you like Dogecoin or Catcoin (or neither), this is hard to deny.

However, after experiencing several big winners like $WIF and $PEPE, you might wonder:

Is this frenzy about to end, or has it just begun?

What is a Meme?

The word "Meme" was proposed by Richard Dawkins in his book "The Selfish Gene" in 1976.

It comes from the Greek word "mimema," meaning "imitation."

Memes are ideas, behaviors, or styles that spread through imitation in culture.

In a certain culture, ideas, behaviors, styles, or usages spread from one person to another.

Viral Spread of Memes:

From politics and sports to entertainment and finance, memes are spreading virally.

Due to the speculative nature of meme coins, they have a strong synergistic effect with cryptocurrencies.

The Core of Memes:

Memes have always been an indispensable part of cryptocurrency enthusiasts' blood.

They shape the culture of the entire cryptocurrency space.

From "WAGMI" and "Wen Lambo" to "Choose Rich" and "In it for the tech"…

Memes are at the core of Crypto Twitter (CT).

Acceleration Point:

Despite its deep historical roots, 2021 is a turning point.

The perfect storm of the COVID-19 pandemic, $GME, and massive money printing has created a meme frenzy.

From Joke to Giant:

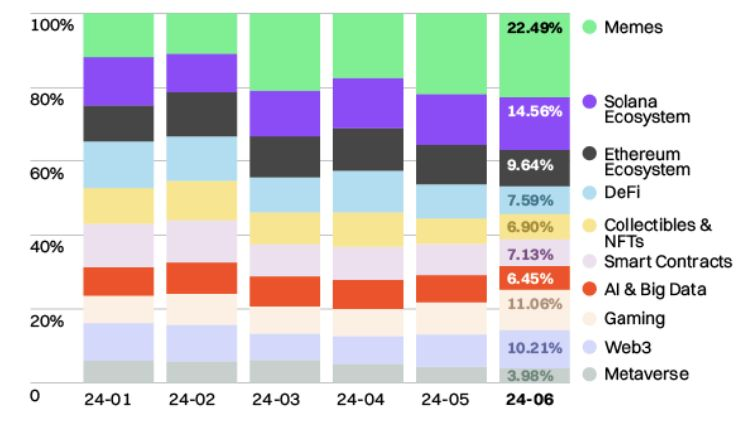

Fast forward to 2024, meme coins continue to explode.

For the first time, meme coins have become the most popular category in cryptocurrency.

Memes accounted for about 23% of the page views on @CoinMarketCap, exceeding 25 million times in June alone.

The Fastest Ponzi Scheme:

Ironically, in a period when the market is expected to mature, memes are thriving.

We have $BTC ETFs and new technologies, but investors still choose the dark side.

As GCR said, "Long-term bullish on human despair, greed, and decadence."

@GCRClassic: "For the average person, flying to Macau or Las Vegas is often too expensive. In situations with a lot of idle money and high macro risks, decentralized casinos and decentralized Ponzi schemes are always the fastest choice. I am long-term bullish on human performance in despair, greed, decadence, loneliness, and being trapped in the metaverse."

From Joke to Wealth:

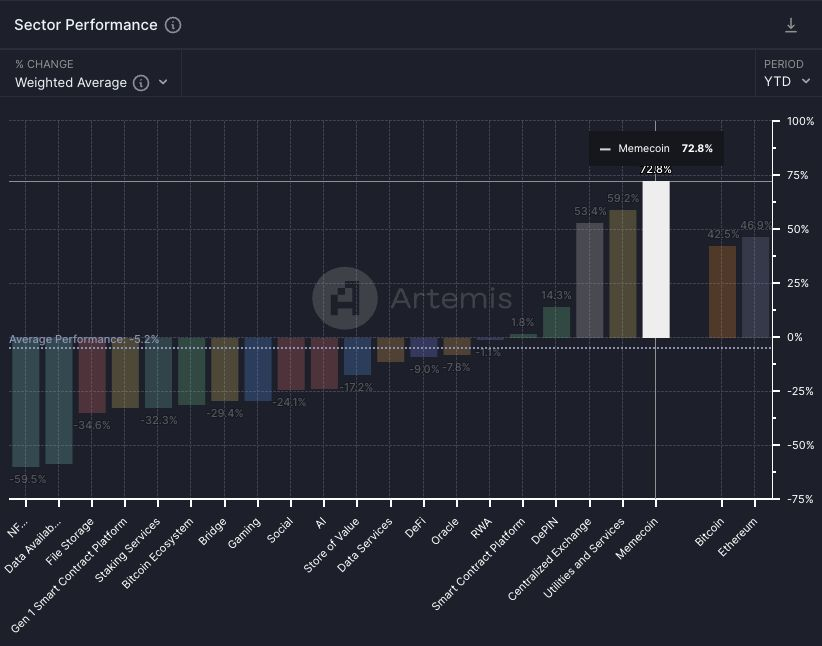

Top memes not only dominate attention but also dominate returns.

Meme coins are the highest-earning sector, rising 72% year-to-date (weighted average by sector).

(Thanks to @artemis__xyz)

Dominating Ecosystem:

Most leading meme coins are on $SOL or $ETH.

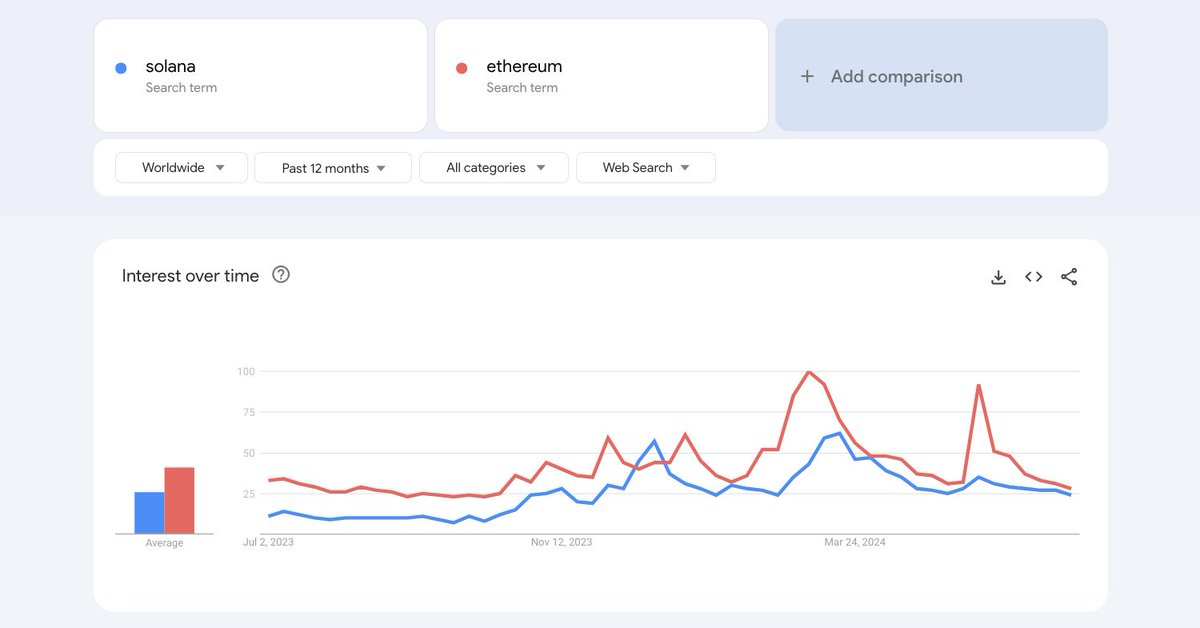

However, in this cycle, the $SOL ecosystem has received more attention than $ETH.

Mind Dominance:

Since October 2023, $SOL and its meme coin ecosystem have gained momentum.

Although $SOL has not yet surpassed $ETH in market value, it has kept pace with $ETH in Google search interest.

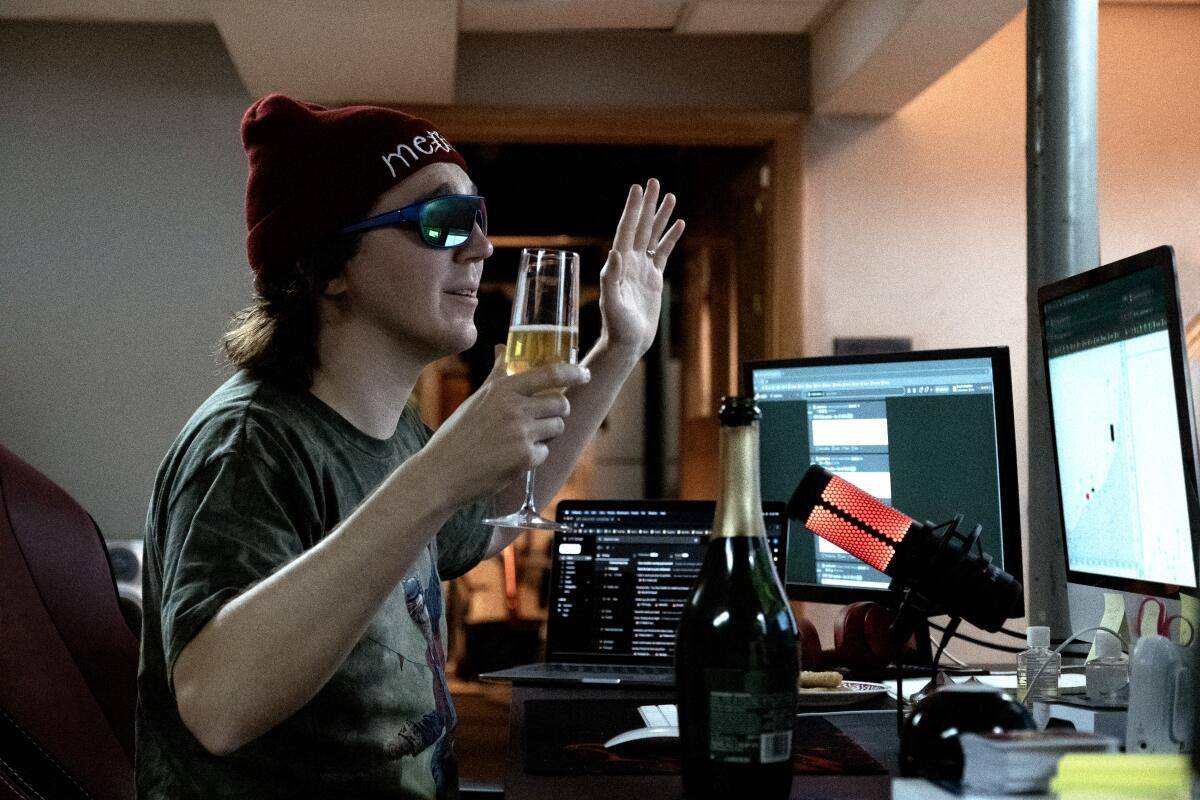

"Casino" Chain:

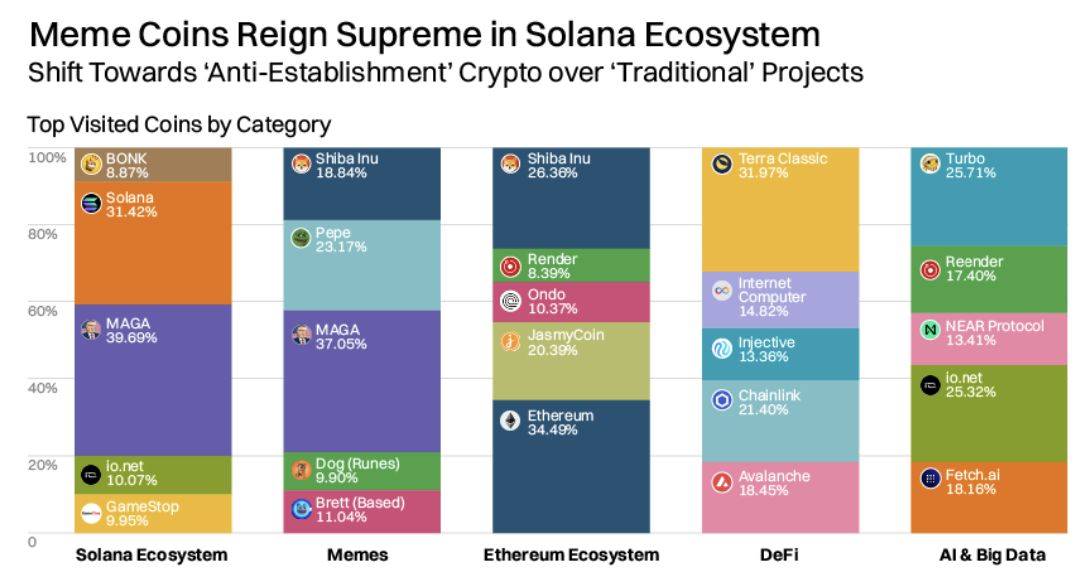

In the $SOL ecosystem, meme coins symbolize the frenzy for speculative assets.

The influx of liquidity has made $SOL feel like a casino.

Participants seem to prefer high-risk assets over traditional, slower-developing projects. (Thanks to @CoinMarketCap)

What Drives the Meme Craze?

Retail investors value quick returns over venture-backed high fully diluted valuations (FDV) projects.

Due to high project saturation (many projects have high FDVs), market participants are feeling fatigued.

Low mainstream adoption and a lack of breakthrough consumer applications exacerbate this phenomenon.

Meme Coin Black Hole:

According to CoinMarketCap's data, new meme coins are gathering momentum faster than ever before.

Even in the AI category, many popular projects are "memefied" AI tokens.

Meme is like a black hole, devouring all those "in it for the tech."

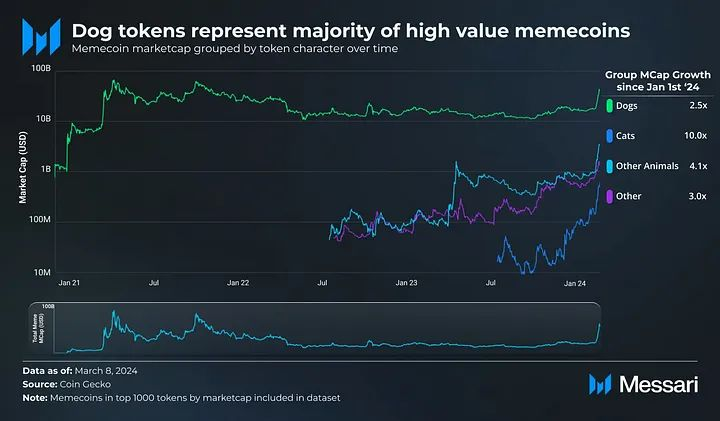

Battle of Dogs and Cats:

An interesting phenomenon in meme coins is the competition between Dogecoin and Catcoin.

Catcoin has performed well this year, but Dogecoin still has a higher market value.

Yes, that's the current state of cryptocurrency.

(Thanks to @MessariCrypto)

Profiting from Memes:

While many people think of memes as just a lottery, the reality is more complex.

Those who are good at spotting cultural trends early may succeed.

However, without strong trading skills or a solid social network, your chances are not great.

Potential Risks:

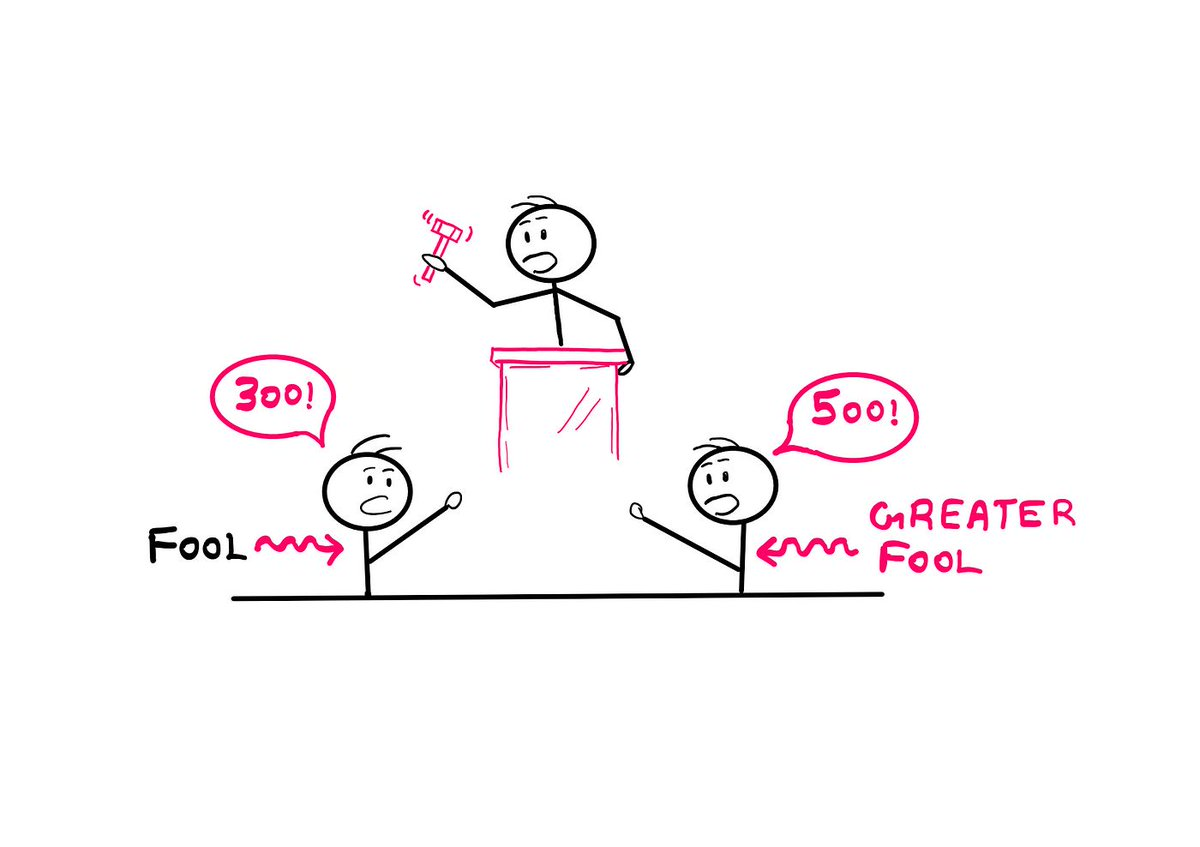

Profiting from meme coins relies on the extremely risky "greater fool theory."

Investment enthusiasm can come and go quickly.

For example, the "trillionaire" phenomenon.

Final Thoughts:

Although the currency may change, the temptation of getting rich will never disappear.

Whether you choose to participate in gambling or not, the casino will continue to operate.

Even if you don't like memes, understanding why they are successful can be beneficial.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。