Ignoring the negative news, we should pay more attention to the long-term development trend.

After experiencing two months of painful decline, the market welcomed a comprehensive cooling of the US CPI data yesterday, and Bitcoin successfully rebounded and broke through $59,000. However, the continued selling of Bitcoin by the German government resulted in the sale of approximately 10,627 Bitcoins worth $616 million in just 16 hours yesterday, causing Bitcoin to directly recover all the gains brought by the CPI expectations.

TL;DR

• The cycle of cryptocurrencies is influenced by four important factors: macroeconomics, whether there are innovative breakthroughs in the technical infrastructure, whether the regulatory system is friendly, and the halving cycle of BTC. We are currently in an important period of global interest rate cuts, BTC halving, gradually clear regulations, and cryptocurrencies entering the public eye.

• Since last year, the strong performance of large AI companies has to some extent overshadowed the brilliance of the cryptocurrency market, and investors have transferred a large amount of funds to AI-related stocks. "Perhaps the market's peak is not because cryptocurrencies are not good, but because AI is more attractive."

• The negative factors still present in the market include: the possible economic recession after the US interest rate cut, the selling pressure from the German and American governments, and the expected landing of Ethereum spot ETF. How much selling pressure remains from these factors?

• The once-every-four-years European Cup once again coincides with the Bitcoin halving, and the speculative trading community in the football betting circle highly overlaps with the cryptocurrency market. Do these investors who chase quick profits frequently transfer funds between these two areas, also drain some of the liquidity from the cryptocurrency market?

• Ignoring the negative news, we should pay more attention to the long-term development trend. The market still has a lot of potential for upward movement: Trump's presidency in the United States will bring about friendly cryptocurrency regulatory policies, stable coin supply steadily increasing market liquidity, institutions continue to buy Bitcoin, active venture capital investment, and the continuously increasing user base on the chain, etc. We should focus on these positive factors in the long run, rather than being overly obsessed with short-term price fluctuations.

How much selling pressure will the market continue to bear?

Roughly calculated, as of July 12th, the German government still holds only 9,094 Bitcoins to be sold, and they will continue to sell coins in the coming week. At the current rate of sales, they will probably complete all sales within this week, which may lead to a rapid short-term decline in BTC in extreme cases. However, the market is strong enough to withstand such a scale of selling pressure.

The 10-30 billion US dollars worth of Bitcoins from Mt. Gox and the US government have not yet taken any action, and combined with the 23.6 billion US dollars worth of Bitcoins already sold by the German government, this will put a total selling pressure of about 4-7 billion US dollars on the cryptocurrency market, which is also the reason why the market has been unable to rise. But this does not mean that the bull market has ended. According to Bitwise's report for the second quarter, it mentioned some positive factors supporting the long-term rise of cryptocurrencies, such as the continuous inflow of Bitcoin ETFs, which set a new record of over 2.4 billion US dollars in the previous quarter. The number of active wallets for Bitcoin and Ethereum also increased by 26% and 34% respectively last month, and the number of users holding more than 1 Bitcoin surpassed 1 million for the first time. The average open interest of regulated Bitcoin futures contracts also hit a new high of 9.8 billion US dollars (an increase of nearly 400% year-on-year), indicating that institutional investors' interest remains strong, and the asset management scale and trading volume of stable coins have been steadily increasing. VCs also invested 3.194 billion US dollars in the previous quarter, a 28% increase from the previous quarter. The launch of Ethereum spot ETF will also boost market confidence, as well as the US presidential election in the second half of the year. These data and events prove that there is still potential for further development of the cryptocurrency bull market. There is also an important event that the market has forgotten. If FTX is approved to repay $16 billion to creditors, this will be a strong boost for the cryptocurrency market to rise. Specifically:

Key time points include the customer voting deadline on August 16th and the judge's final decision on October 7th. If approved, this huge amount will gradually flow back from the fourth quarter of 2024 to the first quarter of 2025. This coincides with other positive factors such as interest rate cuts and the timing of the US election. And since most FTX customers are cryptocurrency enthusiasts, this $16 billion may directly enter the cryptocurrency market, becoming the biggest driving force for price increases.

Cooling of US economic data, interest rate cuts imminent

As the market's optimistic expectations for the decline in inflation are consistent, the US June non-seasonally adjusted CPI year-on-year recorded 3.0%, lower than the market's expected 3.1%, falling to the lowest level since June last year; the core CPI year-on-year recorded 3.3%, lower than the market's expected 3.4%, falling to the lowest level since April 2021. Both CPI and core CPI are lower than the previous values, and Bitcoin also rebounded to the position of $59,000, perhaps because traders had already bet on the favorable data being lower than expected. The rebound yesterday was limited, and the German government continued to sell BTC. Earlier today, BTC had recovered all the gains from yesterday. Let's take a look at the detailed CPI data:

The food inflation rate has steadily declined from a high of 11% in 2020 to around 2% now, and is currently at a low level.

In terms of energy, gasoline prices fell by 3.8% month-on-month. This index fell by 3.6% in May. The continued decline in gasoline prices has made an important contribution to the lower-than-expected inflation data. The energy index, including natural gas, electricity, natural gas, and heating oil prices, fell by 2% in June.

Excluding volatile energy and food, the core CPI data has dropped to a 4-year low.

Goods inflation has slowed down, and data for new and used cars continues to decline.

Service inflation data is at its best level in several years: in June, housing prices rose by 0.2% month-on-month, and rents rose by 0.3% that month. Owner's equivalent rent index also rose by 0.3%, all showing the smallest increase since August 2021. Entertainment services and educational services have also slowed significantly, showing lower growth rates.

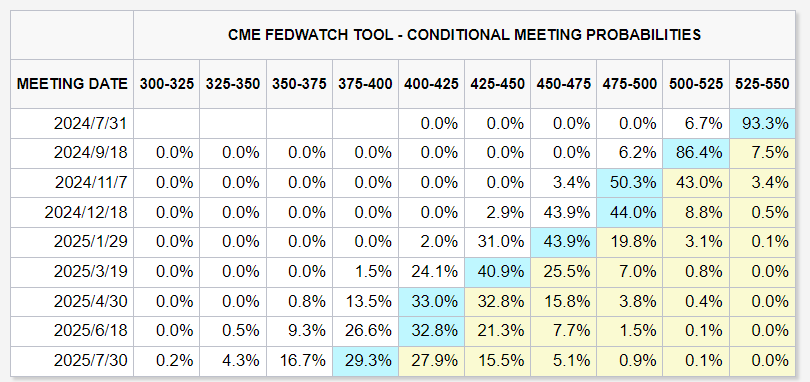

The first interest rate cut in the United States in September is a foregone conclusion, and Powell also stated the day before that the Fed does not need the inflation rate to be below 2% before cutting interest rates. According to the CME observation tool, after the latest inflation data was released, the probability of the Fed maintaining interest rates in August was 93.3%, and the probability of a 25 basis point rate cut in September rose to 86.4%. Traders expect two interest rate cuts in 2024, with a 25% chance of a third 25 basis point rate cut within the year.

CME FedWatch Tool

Interest rate cuts will increase market liquidity, which is conducive to the rise of risk assets, but also comes with the risk of a US economic recession. The interest rate level, changes in monetary policy, and changes in the overall economic situation are all crucial for market liquidity.

Latest progress on Ethereum ETF

The launch of an ETF is divided into two processes. The first part requires the issuer to submit Form 19b-4 before May. Several companies have already submitted applications for Ethereum ETFs, and the SEC has approved 8 spot Ethereum ETF 19b-4 forms (BlackRock, Fidelity, Grayscale, Bitwise, VanEck, Ark, Galaxy Digital, and Franklin Templeton) in May through a comprehensive order. The second part is the S-1 form, which is not subject to any specific deadline, and several issuing institutions have already submitted S-1 registration applications for Ethereum spot ETFs and are waiting for SEC approval. The issuers have revised and resubmitted the previously rejected S-1 forms to the SEC before July 8th, and it is estimated that at least one more round of declaration is needed before the ETF can start trading. The listing date of the Ethereum spot ETF will depend on the efficiency of SEC approval. Once approved by the SEC, the Ethereum spot ETF will officially start trading.

Regarding the listing date:

• Nate Geraci, President of The ETF Store, stated on July 8th that the revised S-1 application submission deadline was on the 8th, and it is not yet clear how quickly the SEC will process it, but he is optimistic that the Ethereum spot ETF is expected to be launched in the next week or two.

Bloomberg analyst Eric Balchunas commented: "No one really knows why the SEC is taking so long to process these forms. Considering the lack of comments, the listing should happen quickly, but it could be that some 'issue' with the issuer has slowed down the process, or it's just summer laziness/people on vacation, uncertain."

Bloomberg analyst James Seyffart previously predicted that the Ethereum spot ETF may be listed later this week or the week of July 15th. There have been many examples in history where this process took 3 months, but it is also possible that it could be approved in as little as one day.

The approval progress of these S-1 forms is an important focus for investors to follow the dynamics of the Ethereum ETF. Once these S-1 applications are approved by the SEC, related Ethereum ETF products are expected to be officially listed in a short period of time, and various signs indicate that the listing will happen this month. However, the SEC has always been cautious in approving cryptocurrency ETFs, so there is still some uncertainty about the final outcome of these applications.

If the Ethereum spot ETF is ultimately approved and listed, it will have a significant impact on the entire cryptocurrency market, providing investors with a new channel for direct investment in Ethereum, as follows:

- Increased institutional participation

ETFs are a favored investment tool for institutional investors, more conducive to risk management for large funds. ETFs reduce the risk exposure of individual assets through diversified investments, are more convenient in trading, have good liquidity, and usually have lower management fees than actively managed funds, providing cost advantages for institutional investors. The approval of the Ethereum ETF will open the door for institutional investors, attracting more funds into Ethereum and the entire crypto market.

- Improvement in market depth

ETFs, as a standardized investment tool, are recognized at the regulatory level and operate relatively standardized, providing more peace of mind for investors. The introduction of ETFs will help increase the trading volume and counterparties in the cryptocurrency spot market, thereby improving overall liquidity.

- Driving the derivatives market

As more institutional investors are attracted to the crypto market, these institutional investors usually also participate in derivative trading such as futures and options. At the same time, the Ethereum ETF provides investors with a direct channel for investing in Ethereum, which will increase the demand for hedging and hedging, and directly stimulate exchanges and derivative providers to accelerate product innovation and launch more derivative tools, making the market more diverse.

- Driving the prosperity of the related ecosystem

As the second largest cryptocurrency, the launch of the Ethereum spot ETF will not only drive the demand for related derivatives but also promote the development of the entire Ethereum ecosystem, including the increased activity of on-chain DeFi, NFT, and other applications. Even though the Ethereum ecosystem users have lost the motivation to continue using these Rollups after the airdrop of some top L2 projects, it is believed that the stagnant growth of the ecosystem will gain new momentum with the increase in demand for derivatives.

The industry is currently waiting for the SEC to make a decision on the Ethereum ETF application. Once the S-1 forms are approved, the Ethereum ETF will be officially allowed to be listed and traded on US stock exchanges, and a large amount of passive investment funds will flow into Ethereum. Gemini estimates that there could be up to $5 billion in net inflows in the first 6 months. The influx of passive funds often leads to a rapid rise in asset prices. Matthew Sigel, Head of Digital Asset Research at VanEck, also optimistically stated that over $6 trillion in assets may flow into cryptocurrencies in the next 20 years.

Currently, the ETH/BTC ratio is close to the low point of the past few years, and Ethereum has a greater potential for upward movement compared to Bitcoin, also reserving a greater momentum for future price increases.

If the ETH/BTC ratio can return to the median level of the past 3 years, Ethereum's price is expected to rise by nearly 20%; if the ETH/BTC ratio can re-approach the high point of around 0.087 in the past 3 years, Ethereum's price will increase by about 55%, potentially reaching a new high. In any case, the value of Ethereum relative to Bitcoin is currently significantly underestimated, and the launch of the Ethereum spot ETF will benefit the entire cryptocurrency market, attracting more funds and driving the overall market.

New Turn in the US Presidential Election, Obama's Comeback?

The 2024 US presidential election has suddenly become a hot topic, with some division within the Democratic Party over whether Biden should run for re-election. On one hand, the strong candidate Trump has gained increasing competitiveness, and more and more young voters are less interested in traditional parties and more inclined to express their political views on social media, posing a challenge to traditional politicians' campaign methods. Trump prefers to express his opinions on social media and is active in internet politics. Compared to Biden's worrying physical condition, Trump is more popular and has maintained high support, showing a strong momentum.

On the other hand, the Democratic Party has also failed to cultivate a strong candidate to compete against Trump. However, interestingly, it seems that the Democratic Party has a backup plan. They have been closely monitoring Biden's physical condition, fearing that he may not last until the end of the election. If something were to happen, they already have a backup plan, which is to have former President Obama step in to take over.

According to the US Constitution, Obama must avoid candidacy, but can participate in Biden's team, win the election as Vice President, and then ensure in various ways that Obama can take over the presidency if Biden's health prevents him from completing his term. In fact, Obama has long been prepared for this, and Biden has maintained close contact with Obama. He regularly reports campaign progress or discusses family matters with Obama, and Obama also provides advice to the White House and Biden's campaign team. In addition to behind-the-scenes support, Obama will also appear and participate in campaign activities.

Earlier this year, Biden co-hosted a rare dialogue event with Obama and another former president, Clinton, in Manhattan. These are all efforts by the Democratic Party leadership to consolidate internal cohesion and ensure that Biden can be re-elected smoothly.

The current presidential election campaign is in full swing. On the other hand, in its official party platform for the 2024 US presidential election, the Republican Party expressed support for multiple cryptocurrency policy measures favorable to digital asset companies and holders.

According to the official document released by the Trump campaign team, the Republican "Make America Great Again" platform vows to end "illegal and un-American attacks" on the US cryptocurrency industry. The platform also promises to "defend Bitcoin mining rights" and allow cryptocurrency holders to self-custody their tokens, and also opposes the creation of central bank digital currencies (CBDC). The document states: "We will defend the right to trade without government surveillance and control."

Trump himself has repeatedly voiced support for discussing Bitcoin as a corporate asset, and he has officially confirmed his attendance at the upcoming Bitcoin summit on July 25-27, where he will deliver a speech. This should be the first time a former US president has spoken at such a large-scale crypto conference. Trump's crypto-friendly stance has also brought him a lot of traffic and votes. According to opinion polls, about 13% of voters who do not intend to vote for the Republican Party have a more positive view of Trump because of this.

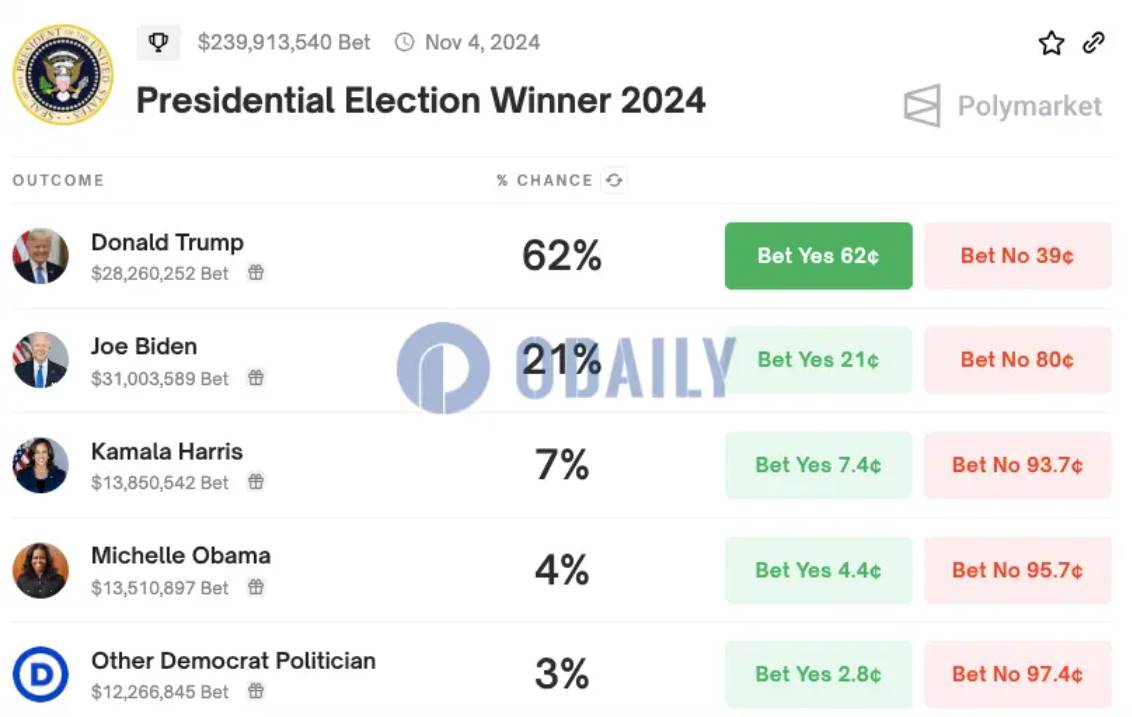

Currently, the cryptocurrency prediction market Polymarket data shows a 21% probability of Biden's election and a 62% probability of Trump's election. In the most watched opinion poll in US politics - a poll by The New York Times and Siena College, Trump's support rate is 49%, while Biden's is 43%, with Trump leading Biden by 6 percentage points among potential voters. Biden's current situation is not optimistic. Time magazine reports that his support rate has been consistently low, far below that of other former presidents seeking re-election. Surveys show that concerns about Biden's age are the main reason for the reversal in the election.

Polymarket prediction results

How much liquidity will flow back to the cryptocurrency market after being drawn away by the European Cup?

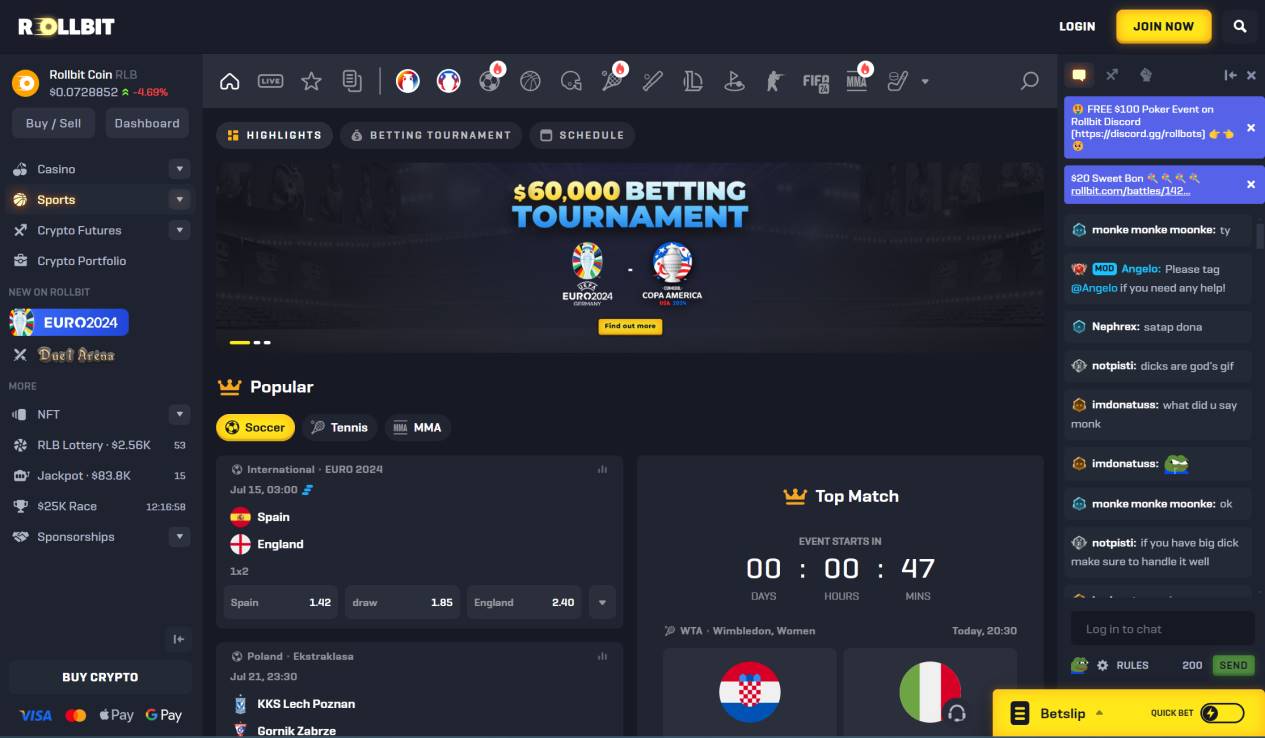

The European Cup and the cryptocurrency industry have always had an inexplicable connection, and the once-every-four-years Bitcoin halving event always coincides with this quadrennial football event. The demographic of speculative traders in the cryptocurrency market overlaps significantly with the football betting community related to the European Cup. An analysis of the website traffic of the on-chain crypto gambling site Rollbit shows a significant increase in visitor traffic in regions such as Brazil, Australia, and Mexico since the start of the European Cup in June. The top two websites with the most visits from Rollbit's target audience are Dexscreener and Stake.com, further proving that a portion of the funds in the crypto market may have flowed out and into the football betting sector, potentially contributing to the downward movement of cryptocurrency prices.

Another crypto gambling and sports betting platform, Stake.com, saw an astonishing 1.24 billion visits during the June European Cup, representing a 31.38% increase from the previous month, indicating an increasing participation in gambling after the start of the football competition. The regions that sent the most traffic to Stake.com were India, Canada, and Argentina.

According to data from the Asian Racing Federation, the number of gambling websites accepting bets on the top 5 cryptocurrencies by global market value - BTC, ETH, Tether, BNB, and Solana - increased from 648 in 2020 to 811 in 2024, a 25% increase. Additionally, out of the top 20 illegal gambling websites in Hong Kong, 12 accept cryptocurrency bets.

European Cup betting interface on the Rollbit gambling website

The 2024 European Cup will end on July 12th, and although there is currently no direct data to prove how much capital from the cryptocurrency market has been drawn away by the European Cup betting, it is predicted that after the conclusion of this major sports event, the traders and speculators who were originally attracted to football events will refocus on the cryptocurrency market, and the withdrawn funds will once again be used to repurchase cryptocurrencies.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。