Source: Coin World

Author: Web3 Observation

According to the market data from Coin World, as of 12:00 on July 5th, Bitcoin has dropped below $54,000, currently trading at $53,984, with a daily decline of 7.1%. Ethereum has dropped below $2,850, with a daily decline of 11%. Other altcoins have also experienced widespread declines, with ORDI, PEOPLE, ZK, AEVO, BAKE, and YGG all dropping by more than 20%, and ARB hitting a new historical low. Meanwhile, the US Dollar Index (DXY) has dropped below 105 for the first time since June 13th.

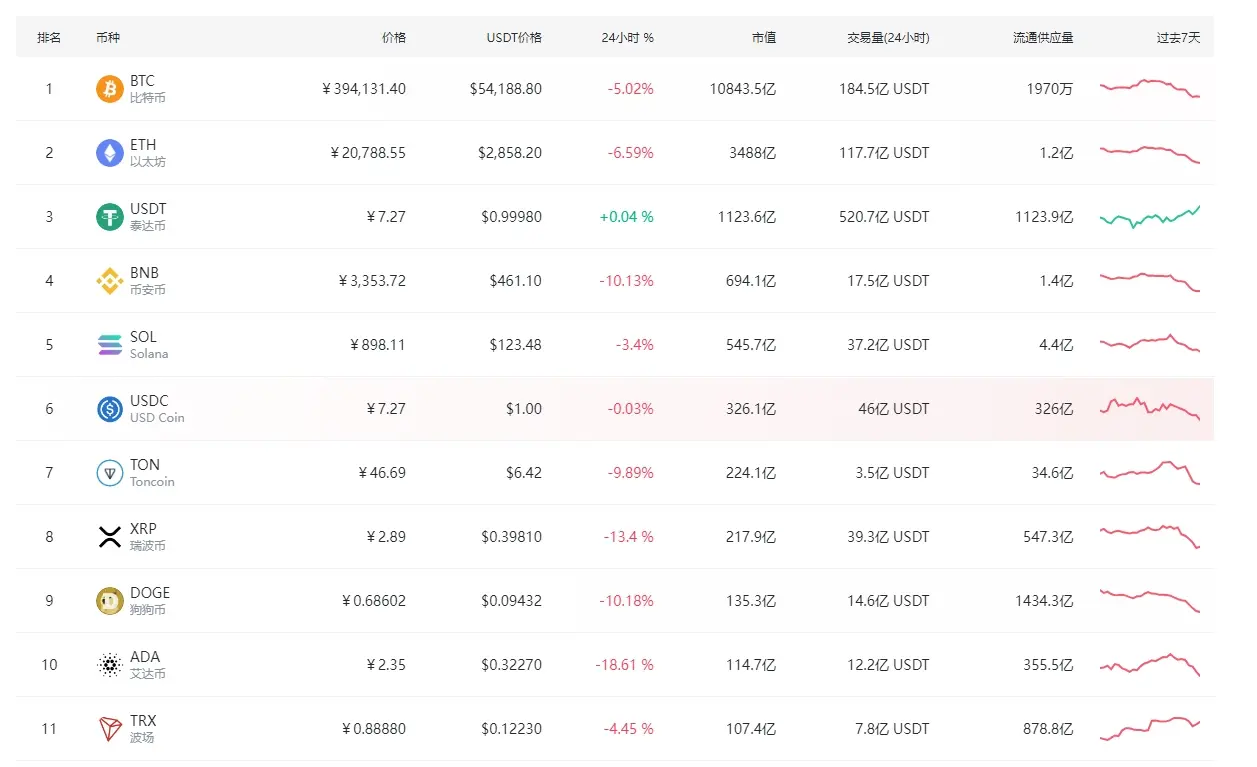

(Coin World cryptocurrency market data)

With Bitcoin's price dropping below $54,000, it is expected that the major cryptocurrency exchanges' (CEX) futures markets will see the liquidation of $620 million in long positions, leading to further increases in the number of forced liquidations and the amount involved.

The catastrophic downturn in the cryptocurrency market this time is influenced by multiple bearish news, including the continuous selling of BTC by the German government, the repayment of debts by Mt. Gox, and the net outflow indicator of Bitcoin ETF, which may have contributed to the sharp decline in Bitcoin prices.

Mt. Gox Begins Repayment of Debts, Triggering Concerns of Large-scale Sell-offs

Recently, Mt. Gox wallets have been frequently transferring funds, initiating the repayment of compensations, which has raised concerns in the market about potential selling pressure.

According to Arkham's monitoring, approximately one hour ago on July 5th, an address starting with 1L7Xbx transferred 2,702 bitcoins to Mt. Gox's cold wallet, and then these 2,702 bitcoins were transferred to Bitbank (Bitbank is one of the trading platforms supporting Mt. Gox's repayments). In addition, Mt. Gox also transferred 47,228 bitcoins (approximately $2.71 billion) from cold storage to a new wallet.

Furthermore, on-chain monitoring data shows that Mt. Gox-related address 1L7Xbx…6onk has transferred 47,228 bitcoins (approximately $2.7 billion) to two addresses:

- Address 16ArP3…VqdF: received 44,500 bitcoins, worth approximately $2.55 billion

- Internal address 1JbezD…APs6: received 2,700 bitcoins, worth approximately $154.8 million

German and US Governments Successively "Dumping" Bitcoin

First, it was the selling behavior of the German government. In early June, a wallet labeled as "German government" began transferring 50,000 bitcoins seized from the operator of the pirated movie website Movie2k, and sold approximately 4,736 bitcoins in batches that month. In the past week, the German government has sold over two thousand bitcoins. Shortly after the market fell this morning, the German government was observed to have transferred 13,475 bitcoins and has already sold 13,000. As of now, the German government still holds over 40,000 bitcoins.

In addition, a US government BTC holding wallet that had not moved for a year sent 4,000 BTC to Coinbase on June 27th, suspected to have initiated a selling mode. Yesterday, the "US government" wallet address (starting with 349c6) was observed to have transferred 237 BTC to an address starting with bc1qvc.

Coupled with the net outflow of the US spot Bitcoin ETF, it has accelerated market panic. Data shows that a total of 9 Bitcoin ETFs have collectively reduced holdings by 609 bitcoins, worth approximately $35 million. On July 3rd, the net outflow of the US spot Bitcoin ETF was $20.5 million.

Bitcoin Spot ETF Experiences Net Outflow for Two Consecutive Days

On the other hand, the Bitcoin spot ETF is an important reference for judging market trends. Data shows that the Bitcoin ETF has experienced net outflows for two consecutive days, with a total outflow of $34.2 million over the two days.

From the net flow of the Bitcoin ETF, Markus Thielen, the founder of 10x Research, stated in his latest report that the average entry price of Bitcoin ETF buyers is estimated to be between $60,000 and $61,000. Therefore, when Bitcoin fell below $60,000 yesterday, it may have triggered a wave of ETF liquidation, further lowering the price of Bitcoin.

In addition, the lack of new funds entering the market is also an important reason why the market is struggling to meet expectations. Since the middle of last year, the total market value of stablecoins in the cryptocurrency market has steadily increased, corresponding to the market's continuous rise at that time, indicating a clear shift from bear to bull. However, since early May, there has been no new money entering the cryptocurrency market, and the total market value of stablecoins has been hovering around $160 billion for over two months. The lack of liquidity in the market has led to insufficient buying power to drive the market up.

Bitcoin Breaks Below the 200-day Moving Average, Questioning the Bull Market Cycle

Bitcoin's price has broken below the 200-day moving average (DMA), which is currently at $58,373. This is the first time since August 2023 that Bitcoin has broken below this key technical indicator. Since the beginning of 2024, Bitcoin's price has been rising steadily, reaching a peak of over $70,000 in March. However, the recent break below the 200 DMA indicates that the market may be entering a corrective phase.

According to Glassnode's data, the interaction between Bitcoin and the 200 DMA has always been a reliable indicator for judging bull or bear market trends. In general, a price breakthrough of the 200 DMA indicates a significant upward trend, while a break below it indicates a long-term bear market phase.

BTC 200-day moving average, from Glassnode

The current price trend needs to be treated with caution, as it may signal the end of the recent bull market cycle. This dynamic indicates that the Bitcoin market is under significant pressure during the adjustment process after the halving. Investors need to closely monitor the future price trend to judge the next market trend.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。