In 2021, El Salvador became the world's first country to adopt Bitcoin as legal tender, causing a great sensation globally and setting an innovative example for Latin America. This decision not only changed the country's financial system but also sparked interest in cryptocurrency throughout Latin America, demonstrating the region's openness to new technologies.

Aiying summarized and analyzed the "LATAM Market Report" released by Kaiko, providing insights into the current status, major trends, and future prospects of the cryptocurrency market in Latin America in 2024. The report covers market conditions in various countries, popular trading currencies, and the development of local exchanges. Through this content, you will discover the unique position and development potential of Latin America in the global cryptocurrency market. Whether due to political environment, economic pressure, or technological innovation, Latin America is driving the widespread use of cryptocurrency in its own way.

I. Overview of the Latin American Market

1. Market Background

In Latin America, issues such as political instability, inflation, and a large population without bank accounts have long plagued many countries. It is because of these reasons that an increasing number of people are paying attention to and adopting cryptocurrencies.

Firstly, political instability has been a long-standing issue in Latin America. From frequent changes in government to various policy changes, the financial systems of many countries lack stability. For example, countries like Argentina and Venezuela have experienced severe economic problems due to political turmoil, leading to the devaluation of traditional currencies. For ordinary people, cryptocurrencies have become a hedge, allowing them to protect their assets from the devaluation of their national currency by holding cryptocurrencies such as Bitcoin.

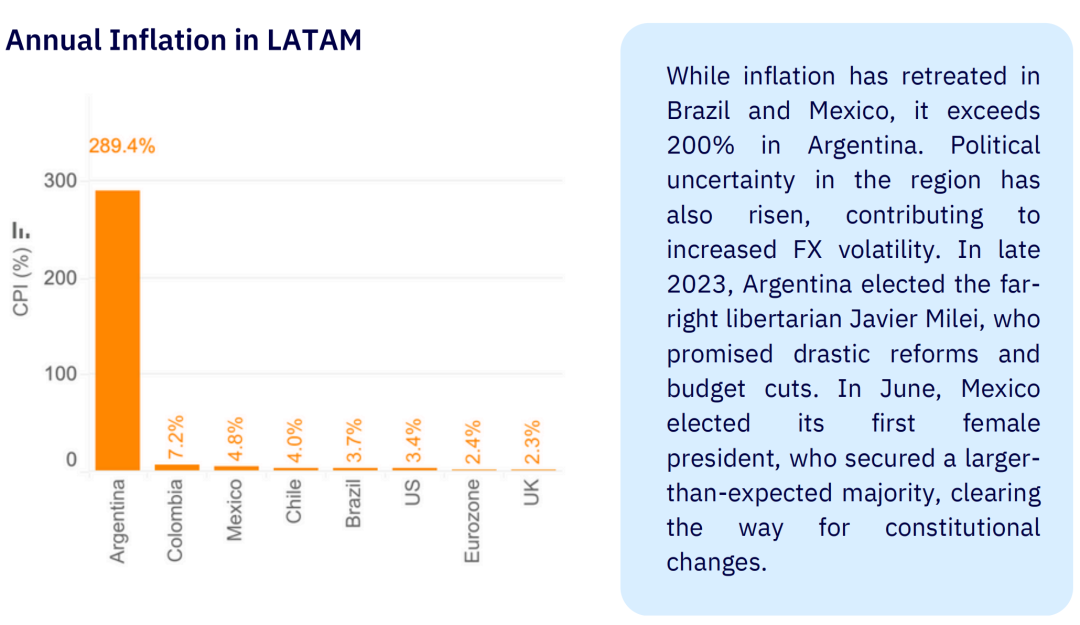

Secondly, some Latin American countries suffer from severe inflation. For example, Argentina's inflation rate exceeded 200% in 2024. Such high inflation forces people to seek new ways to preserve wealth. Cryptocurrencies, with their decentralized and anti-inflation characteristics, have become a viable option. Many people convert part of their assets into Bitcoin or stablecoins to counter the rapid devaluation of their national currency.

Finally, the large population without bank accounts is also an important reason for the popularity of cryptocurrencies in Latin America. Many people are unable to use traditional banking services for various reasons, but as long as they have a smartphone, they can conduct transactions and savings through cryptocurrencies. This not only facilitates the circulation of funds but also provides more economic participation opportunities for these people.

2. Market Growth Expectations in 2024

Looking ahead to 2024, the cryptocurrency market in Latin America is expected to experience significant growth. This is mainly due to several factors:

Policy support and regulatory improvement:

Governments of various countries have begun to realize the potential of cryptocurrencies and have successively introduced supportive policies. For example, Brazil introduced a central bank digital currency (CBDC) in 2021 and gradually improved related regulations, making the market environment more friendly and regulated.

Other countries are also actively following suit. For example, Argentina established a registration system for cryptocurrency exchanges in 2023, providing legal protection for the development of the cryptocurrency market.

Technological innovation and infrastructure development:

Technology companies and financial institutions in Latin America continue to introduce new cryptocurrency products and services, attracting a large number of users. For example, Itau Unibanco in Brazil launched trading and custody services for Bitcoin and Ethereum, further promoting market penetration.

Major exchanges are also continuously optimizing technology, improving trading efficiency and security, enhancing user trust.

Economic environment driving force:

The issues of high inflation and currency devaluation remain severe, leading to a continuous increase in demand for cryptocurrencies. Especially in countries like Argentina and Venezuela, an increasing number of people view cryptocurrencies as effective tools to combat inflation and protect their assets.

At the same time, with the digital transformation of the economy, the use cases for cryptocurrencies are expanding, from cross-border payments to daily consumption, gradually integrating into people's lives.

Market education and user awareness improvement:

Over time, an increasing number of people are beginning to understand and recognize the value of cryptocurrencies. The increase in various educational and promotional activities has led to a continuous increase in the acceptance and usage of cryptocurrencies by the general public.

Overall, Latin America has favorable conditions for the rapid growth of the cryptocurrency market. Policy support, technological progress, economic demand, and improved user awareness are all important factors driving market development. It is expected that in 2024, the cryptocurrency market in Latin America will experience a new round of rapid development, demonstrating tremendous potential.

II. Highlights of the Latin American Market

1. Legalization of Bitcoin in El Salvador

In 2021, El Salvador made history by becoming the first country in the world to adopt Bitcoin as legal tender. This bold move not only attracted global media attention but also sparked widespread discussions in the international financial community.

The legalization of Bitcoin in El Salvador began with a proposal from President Nayib Bukele, aimed at promoting economic development and financial inclusion. Bukele believes that Bitcoin can help a large number of Salvadorans without bank accounts to enter the financial system, while also attracting investment and tourism from the global Bitcoin community.

To support this policy, the Salvadoran government introduced a series of supporting measures:

Establishment of the national digital wallet Chivo:

The government developed a digital wallet called "Chivo," provided to all citizens, and gave each new user $30 worth of Bitcoin to encourage usage and adoption.

Construction of Bitcoin infrastructure:

El Salvador installed Bitcoin ATMs nationwide, making it convenient for people to deposit, withdraw, and trade Bitcoin.

Promotion of education and training:

The government collaborated with non-profit organizations to conduct cryptocurrency-related education and training programs, helping citizens understand the use of Bitcoin and potential risks.

These measures have positioned El Salvador uniquely in the global cryptocurrency market, becoming a model for other countries to learn from and emulate. Although this policy also faces some challenges in implementation, such as technical issues and resistance from some citizens, the legalization of Bitcoin in El Salvador undoubtedly explores new possibilities for the application of cryptocurrencies.

2. Leading Position of Brazil

As the largest economy in Latin America, Brazil is also at the forefront of the cryptocurrency field. Brazil has not only made active attempts in policy and regulation but also achieved significant progress in technological and market innovation.

Launch of CBDC:

The Central Bank of Brazil announced the launch of a central bank digital currency (CBDC) development project in 2021. Through CBDC, Brazil hopes to improve the efficiency of the financial system, reduce transaction costs, and promote financial inclusion. Currently, Brazil's CBDC project has entered the testing phase and is expected to be fully implemented in the coming years.

Launch of cryptocurrency ETFs:

In 2021, Brazil introduced the first Bitcoin ETF and Ethereum ETF in Latin America. These ETFs are listed and traded on the Brazilian stock exchange (B3), providing a convenient investment channel for cryptocurrency investors. The introduction of ETFs has not only attracted the attention of a large number of local investors but also attracted international capital inflows.

Improvement of market regulation and legal framework:

In 2021, Brazil passed the "Cryptoassets Act," providing a clear legal basis and regulatory framework for the cryptocurrency market. This legal framework covers aspects such as cryptocurrency trading, custody, and issuance, aiming to protect investor interests and combat money laundering and other illegal activities.

Participation of local financial institutions:

Large financial institutions in Brazil, such as Itau Unibanco and Banco Bradesco, actively participate in the cryptocurrency market. Itau Unibanco launched trading and custody services for Bitcoin and Ethereum in 2024, further promoting market penetration and development.

Through these measures, Brazil has established a leading position in the cryptocurrency market in Latin America, attracting not only a large number of local users but also global investors' attention. Brazil's experience demonstrates that policy support, market innovation, and technological progress are key factors driving the development of the cryptocurrency market.

III. Trading Activities and Market Trends

1. Trading Volume and Market Share

In Latin America, cryptocurrency trading volume shows a significant growth trend, with different market performances in various countries, but overall demonstrating strong momentum. The following is an analysis of the trading volume and market share of each country, with a focus on Brazil's dominant position.

- Dominant Position of Brazil:

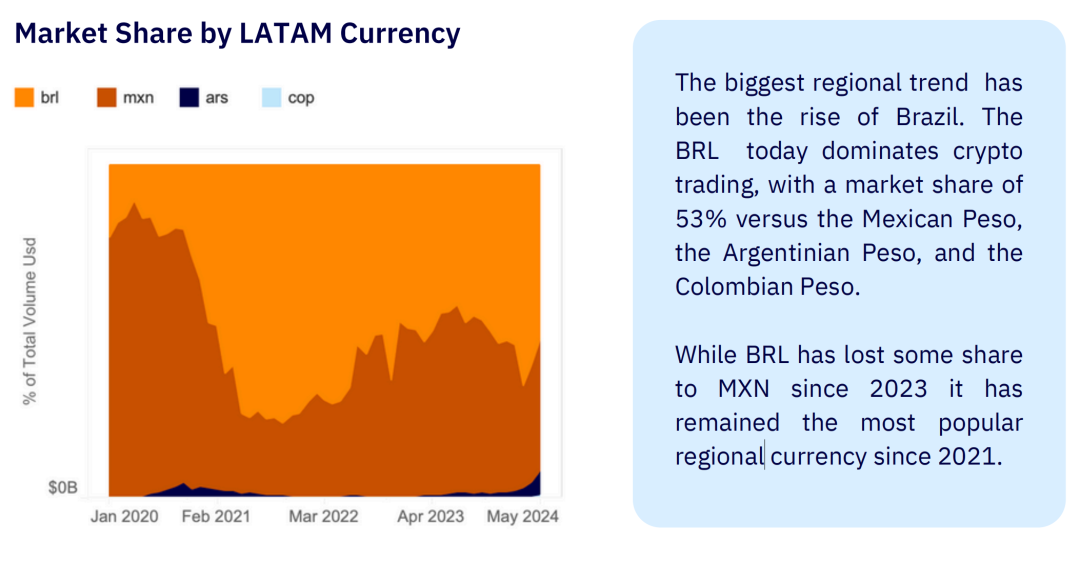

- Brazil dominates the cryptocurrency market in Latin America, with its trading volume experiencing significant growth in 2024. According to statistics, Brazil's cryptocurrency trading volume reached $6.9 billion from January to May 2024, accounting for 53% of the Latin American market. This growth is attributed to Brazil's cryptocurrency-friendly policy environment and strong domestic demand for mainstream cryptocurrencies such as Bitcoin and Ethereum.

- Brazil's market share far exceeds that of other countries. While the trading volume in countries like Mexico and Argentina is increasing, their market share is relatively small. Brazil's dominance is not only reflected in trading volume but also in the activity level of exchanges and the number of users.

- Market Share in Mexico:

- Mexico is the second-largest cryptocurrency market in Latin America, with its trading volume mainly concentrated on the local exchange Bitso. Bitso holds a 99.5% market share in Mexico, while international exchanges such as Binance and Bitfinex have relatively smaller market shares. Despite the increase in trading volume, Mexico's overall market share is still lower than that of Brazil.

- Market Share in Argentina:

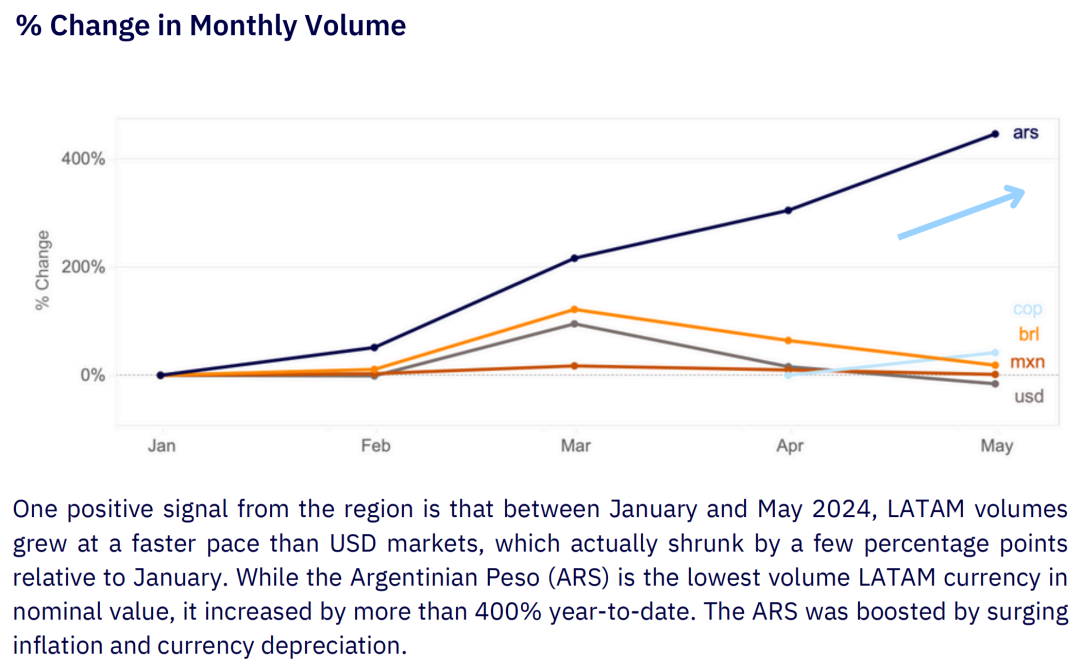

- The cryptocurrency market in Argentina also showed significant growth in 2024, especially driven by high inflation and currency devaluation. The trading volume in Argentina increased by over 400% from January to May 2024. However, due to the relatively small overall market size, its market share is still lower than that of Brazil and Mexico.

2. Inflation and Currency Devaluation

Inflation and currency devaluation are important factors driving the increase in cryptocurrency trading volume in Latin America, particularly evident in countries like Argentina.

- High Inflation in Argentina:

- Argentina's inflation rate exceeded 200% in 2024, leading to continuous currency devaluation and a surge in local demand for cryptocurrencies. Bitcoin and stablecoins such as USDT have become the primary tools for Argentinians to hedge against inflation and protect their assets. Against this backdrop, Bitcoin trading volume in Argentina increased several times within a short period, especially on local exchange Bitso and international exchange Binance.

- Role of Stablecoins:

- Due to the dual pressure of inflation and currency devaluation, Argentinians are increasingly inclined to convert part of their assets into cryptocurrencies to preserve their value. This trend became particularly pronounced in 2024, leading to a significant increase in trading volume.

- Situation in Other Countries:

- Venezuela faces a similar situation, where high inflation and economic crises have made Bitcoin and other cryptocurrencies important hedging tools. Despite the relatively smaller market size, Venezuela's cryptocurrency trading volume has also shown significant growth. Countries like Colombia and Peru have been similarly affected, with lower inflation rates but economic uncertainty and political turmoil prompting more people to turn to cryptocurrencies.

- Role of Stablecoins:

- Stablecoins have played an important role in combating inflation and currency devaluation. Tether (USDT) and other stablecoins, pegged to stable currencies like the US dollar, provide users with a stable store of value. In Latin America, the use of stablecoins in trading has significantly increased, becoming the primary tool for transactions with local currencies.

Overall, countries in Latin America exhibit different characteristics in terms of cryptocurrency trading volume and market share. Brazil's dominant position is attributed to its friendly policy environment and strong market demand, while Argentina and other countries have driven widespread adoption of cryptocurrencies due to the pressures of high inflation and currency devaluation. In the future, with further changes in the economic and policy environment, the cryptocurrency market in Latin America is expected to continue growing, presenting a more diverse development trend.

IV. Trading Preferences and Major Exchanges

1. Popularity of Stablecoins

In Latin America, stablecoins are widely embraced by many investors and ordinary users due to their relatively stable value and ease of exchange.

Dominance of Stablecoins:

Stable value: Unlike highly volatile cryptocurrencies like Bitcoin and Ethereum, stablecoins are typically pegged to stable currencies such as the US dollar, providing a relatively stable store of value. For Latin American residents facing high inflation and currency devaluation pressures, stablecoins are a reliable choice.

Convenient for transactions: Stablecoins can be easily used for daily transactions and cross-border payments. Many Latin American users use stablecoins like USDT for savings, transfers, and payments, greatly enhancing the convenience and efficiency of financial transactions.

Usage Scenarios:

Daily consumption and savings: In countries with severe inflation, such as Argentina and Venezuela, residents are increasingly using stablecoins for daily consumption and savings to hedge against the devaluation of their national currencies.

Cross-border remittances: As stablecoins can be transferred quickly and at low cost globally, many Latin American immigrants working abroad choose to remit money back home through stablecoins, avoiding the high fees and exchange rate losses associated with traditional remittance methods.

Market Data:

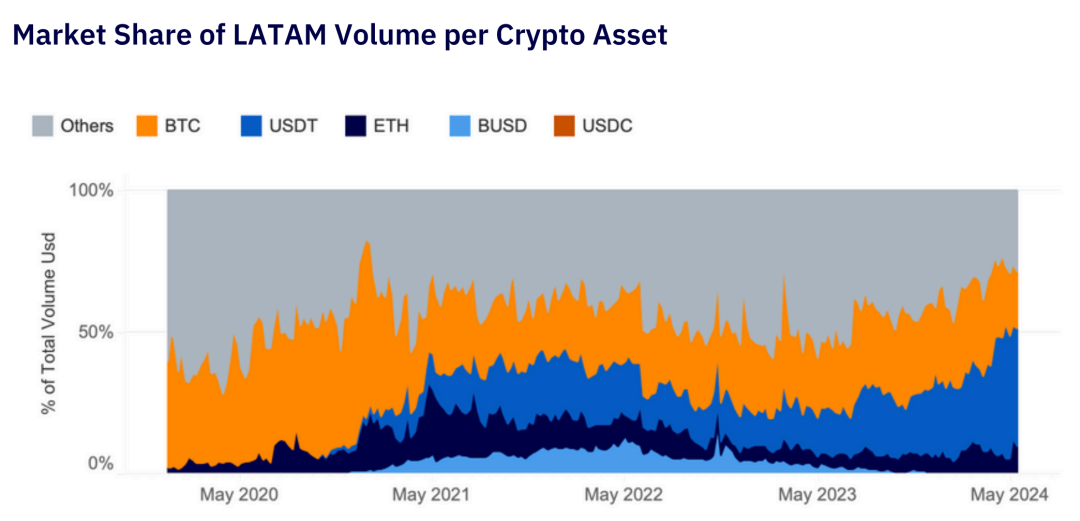

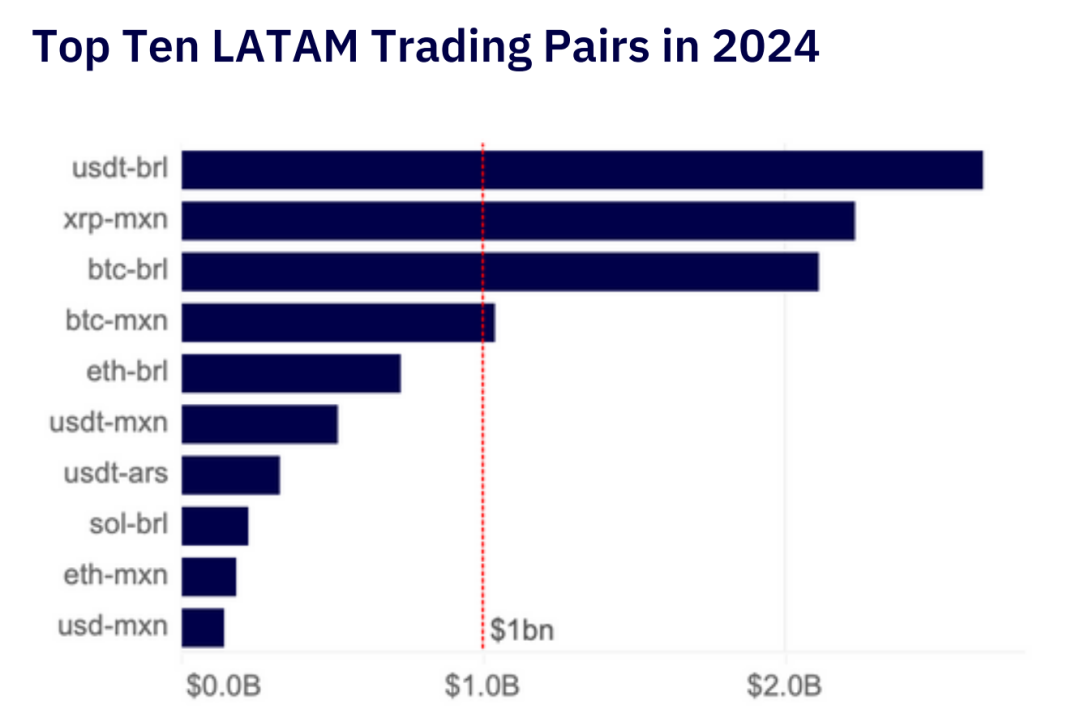

Stablecoin trading volume accounts for a significant proportion in Latin American cryptocurrency exchanges. In Brazil, for example, nearly half of the BRL (Brazilian Real) trading pairs in 2024 involve stablecoins. Overall, over 40% of cryptocurrency trades in Latin America are related to USDT, indicating the significant role of stablecoins in the market.

2. Rise of Local Exchanges

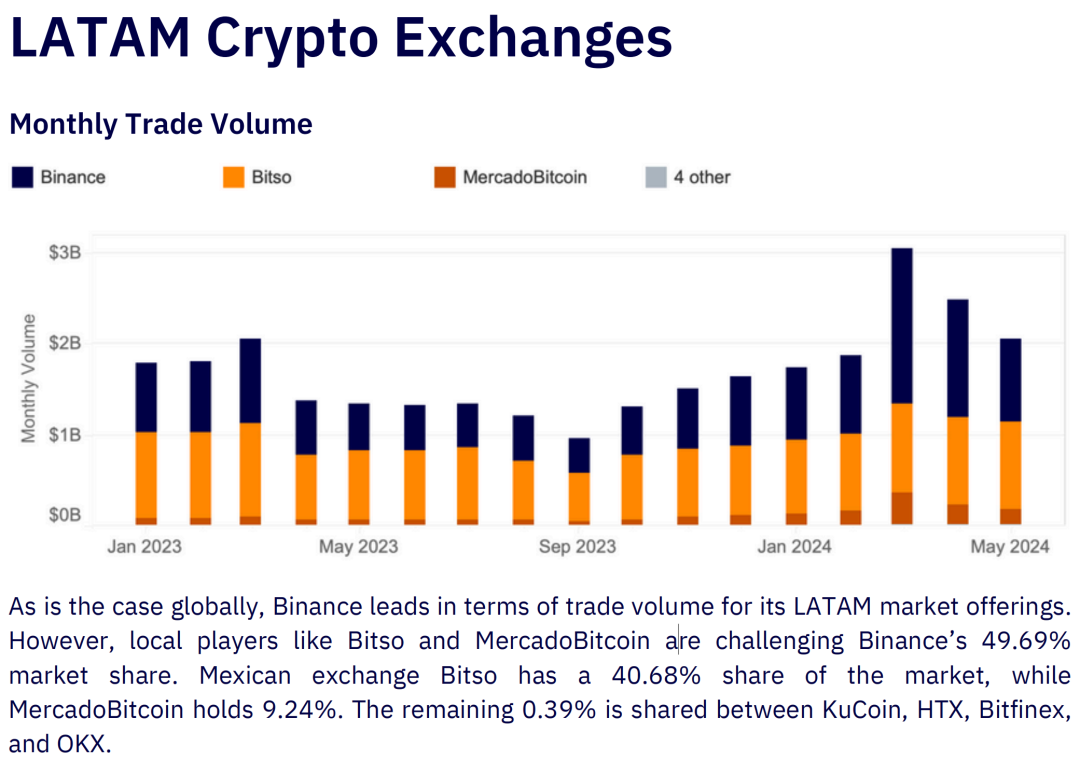

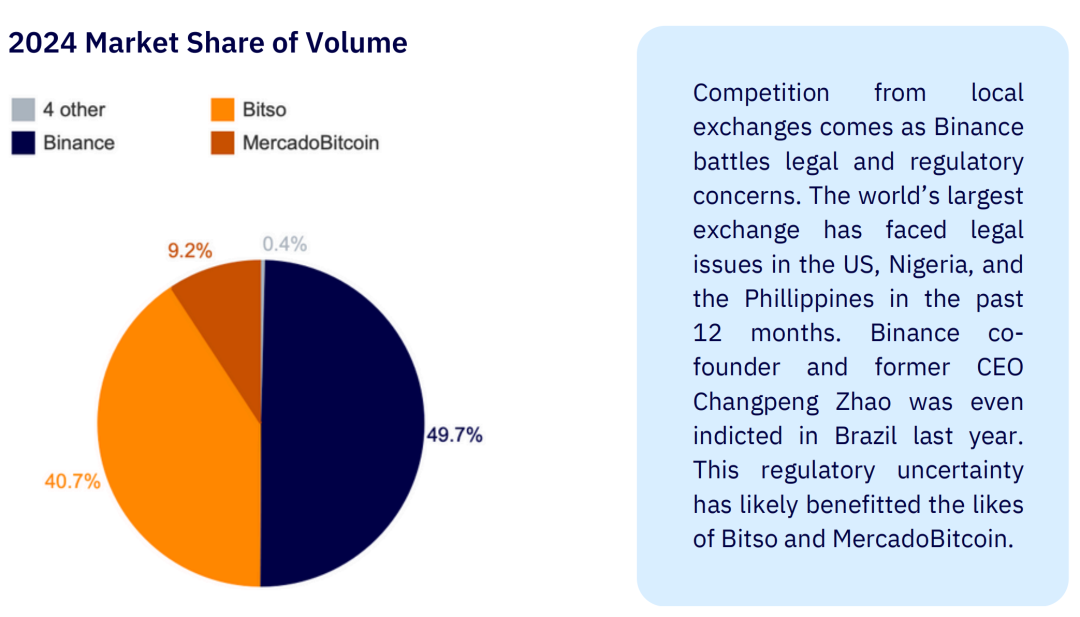

While Binance is the largest cryptocurrency exchange globally, local exchanges such as Bitso and MercadoBitcoin are gradually rising in Latin America, challenging Binance's market share.

Challenges Faced by Binance:

- Legal and regulatory issues: Binance faces legal and regulatory challenges in multiple countries globally, including the United States, Nigeria, and the Philippines. In Latin America, Binance also faces legal issues due to alleged violations of local regulations. In 2023, a Brazilian congressional committee recommended prosecuting Binance's founder, Changpeng Zhao, and three Brazilian executives, impacting Binance's market position in Brazil.

Insufficient Localization Services:

- Despite Binance providing extensive cryptocurrency trading services globally, there are still shortcomings in localization services, especially in meeting the needs of Latin American users. Local exchanges can provide services and support closer to user needs, attracting a large number of users.

Rise of Local Exchanges:

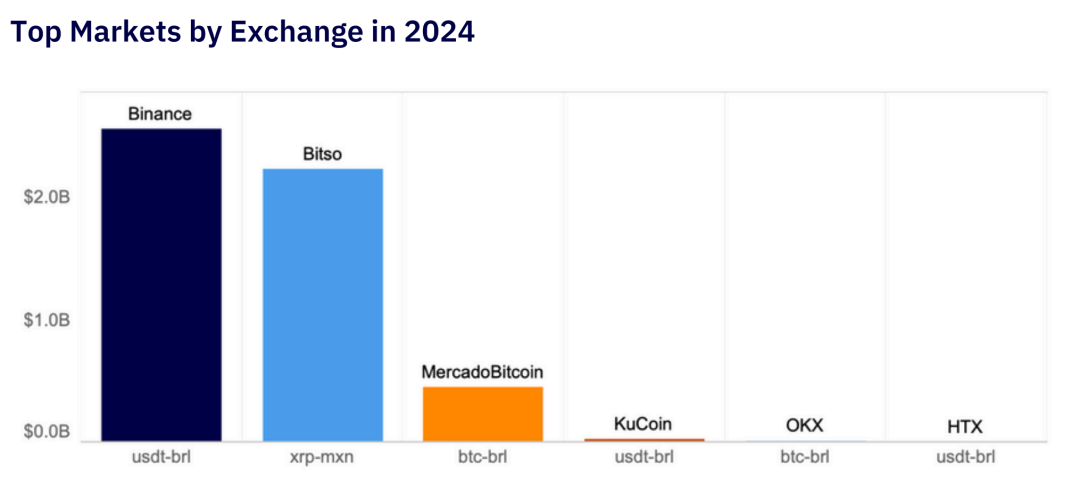

- Bitso: As the largest cryptocurrency exchange in Mexico, Bitso holds a significant position in the Latin American market. In 2024, Bitso's market share in Mexico reached 99.5%, almost monopolizing local cryptocurrency trading. By offering localized payment solutions and low transaction fees, Bitso has attracted a large user base.

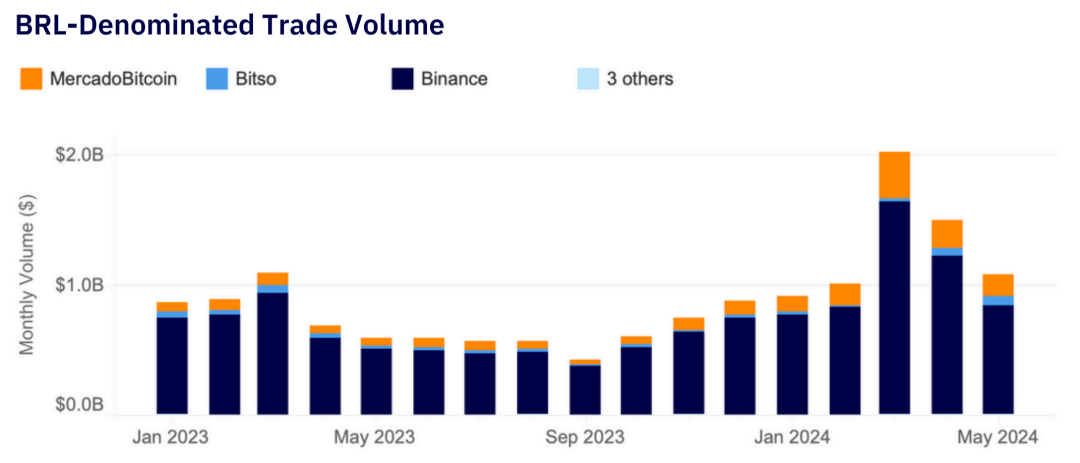

- MercadoBitcoin: MercadoBitcoin in Brazil also experienced significant growth in 2024, doubling its trading volume within a year. This growth is attributed to obtaining a payment institution license from the Central Bank of Brazil, enhancing regulatory compliance and user trust. Additionally, MercadoBitcoin continues to expand its cryptocurrency product line, attracting more investors and traders.

Trading Pair Analysis:

- Binance, HTX, and KuCoin: Stablecoins are the most traded cryptocurrency assets on these international exchanges. This indicates that while these platforms offer a variety of cryptocurrency trading, users prefer to trade using stablecoins, primarily due to their stable value characteristics.

- Bitso: XRP has the highest trading volume on Bitso exchange in Mexico. This trend is mainly due to Bitso's close partnership with Ripple, the issuer of XRP, attracting a large volume of XRP trades.

MercadoBitcoin:

- As the only local exchange with the highest Bitcoin trading volume in Latin America, MercadoBitcoin aligns with global trading trends. Bitcoin, being the most well-known cryptocurrency globally, its trading volume on MercadoBitcoin indicates high acceptance and demand for Bitcoin among Brazilian users.

Market Share and Competitive Landscape:

- Market Share: While Binance holds a significant market share globally, its market share in Latin America has been gradually eroded by local exchanges. In 2024, Binance's market share in Latin America decreased to 49.69%, while Bitso and MercadoBitcoin held 40.68% and 9.24% market shares, respectively.

- Competitive Advantage:

- Local exchanges have gained user preference by providing services that better align with local needs, low transaction fees, and improved customer support. Additionally, seizing the opportunity presented by Binance's regulatory challenges, local exchanges have further expanded their market share.

In summary, stablecoins dominate the Latin American market, serving as important tools to combat inflation and currency devaluation. Meanwhile, local exchanges such as Bitso and MercadoBitcoin, leveraging their localization advantages and flexible service models, are challenging Binance's market dominance. In the future, with intensified market competition and evolving user demands, the cryptocurrency market in Latin America is expected to exhibit a more diverse and dynamic development trend.

V. In-depth Analysis of Markets in Various Countries

1. Brazilian Market:

Market Growth:

- Brazil's cryptocurrency trading volume experienced significant growth in 2024, reaching $6.9 billion from January to May, nearly doubling from the same period in 2023. This growth was primarily driven by increased trading volumes of mainstream cryptocurrencies such as Bitcoin and Ethereum.

- Brazil's cryptocurrency market not only performed well in terms of trading volume but also led in the number of users and market activity. More and more Brazilians are accepting and using cryptocurrencies for investment and payments.

Rise of Local Platforms:

- MercadoBitcoin: As the largest local cryptocurrency exchange in Brazil, MercadoBitcoin significantly increased its market share in 2024. MercadoBitcoin offers a variety of cryptocurrency trading pairs and continuously improves user experience and security. In 2024, MercadoBitcoin's trading volume doubled, mainly due to obtaining a payment institution license from the Central Bank of Brazil and its continuous expansion of cryptocurrency product lines.

- Localization Advantage: Local exchanges have gained the trust and support of a large user base by providing services that better align with the needs of Brazilian users, such as local payment methods, low transaction fees, and round-the-clock customer support.

Policy and Regulatory Environment:

- The Brazilian government maintains an open attitude towards cryptocurrencies and actively promotes related legal and regulatory frameworks. The "Cryptocurrency Legal Framework" passed in 2021 provides a clear legal basis for the cryptocurrency market, promoting its healthy development.

- The Central Bank of Brazil is also actively exploring and promoting Central Bank Digital Currency (CBDC) to improve the efficiency and inclusiveness of the financial system.

Participation of Traditional Financial Institutions:

- Major financial institutions in Brazil, such as Itau Unibanco and Banco Bradesco, are actively involved in the cryptocurrency market, offering Bitcoin and Ethereum trading and custody services. The participation of these traditional financial institutions not only increases the depth and breadth of the market but also enhances user trust in cryptocurrencies.

Markets in Mexico and Argentina:

2. Mexican Market:

- Dominance of Exchanges: The cryptocurrency market in Mexico is primarily dominated by the local exchange Bitso. Bitso holds a 99.5% market share in Mexico, making it the most popular cryptocurrency trading platform in the country. By offering localized payment solutions and low transaction fees, Bitso has attracted a large user base.

- Market Growth: Mexico's cryptocurrency trading volume steadily increased in 2024 but remained lower than Brazil's trading volume. Mexican users primarily focus on trading mainstream cryptocurrencies such as USDT and Bitcoin.

- Policy and Regulation: The Mexican government's regulation of cryptocurrencies has gradually improved, with the passing of a law in 2023 requiring all cryptocurrency exchanges to register. This measure helps standardize the market and protect investor interests.

3. Argentine Market:

- Driven by High Inflation: The growth of Argentina's cryptocurrency market is primarily driven by high inflation and currency devaluation. In 2024, Argentina's inflation rate exceeded 200%, leading to a significant conversion of assets into cryptocurrencies by residents to hedge against the devaluation of the national currency.

- Trading Volume and Market Share: Argentina's cryptocurrency trading volume experienced significant growth in 2024, increasing by over 400% from January to May. Argentine users primarily focus on trading Bitcoin and stablecoins such as USDT.

- Role of Local Exchanges: While Binance and other international exchanges have a presence in the Argentine market, the local exchange Bitso is gradually expanding its influence, especially in Bitcoin and stablecoin trading in Argentina.

Overall, Brazil, Mexico, and Argentina each have their own characteristics in the Latin American cryptocurrency market. Brazil is in a leading position due to its strong market growth and the rise of local platforms; Mexico is steadily developing through the dominance of the local exchange Bitso; and Argentina is experiencing rapid expansion in the cryptocurrency market driven by high inflation and currency devaluation. In the future, with further improvement in policies and market environments in these countries, these markets are expected to continue growing, demonstrating greater development potential.

VI. Future Outlook

Based on the above analysis, AICoin believes that the Latin American cryptocurrency market will experience significant development in the coming years:

Market Size Will Continue to Expand:

- With policy support and technological advancements, it is expected that the Latin American cryptocurrency market will continue to expand in the coming years. Countries such as Brazil, Mexico, and Argentina will continue to play important roles in driving market growth across the region.

Dominance of Stablecoins and Bitcoin Will Persist:

- Stablecoins will continue to hold significant positions in trading, especially in high inflation countries. Meanwhile, Bitcoin's position as a store of value and investment tool will become more solid, attracting more users and investors.

Enhanced Competitive Advantage of Local Exchanges:

- Local exchanges such as Bitso and MercadoBitcoin will further consolidate their market positions, continuing to attract and retain users with localized services and flexible operational strategies. At the same time, international exchanges like Binance will need to pay more attention to local market demands to cope with competitive pressure.

Improved Financial Inclusion:

- The widespread adoption of cryptocurrencies will significantly improve financial inclusion in Latin America, especially for those without bank accounts. Through cryptocurrencies, these individuals will be able to participate more conveniently in economic activities, improving their financial situations.

Overall, the Latin American cryptocurrency market is expected to demonstrate strong growth momentum and broad development prospects in the coming years. Whether through improved policy environments or technological innovation, Latin America is poised to become an important part of the global cryptocurrency market, showcasing tremendous potential and vitality. AICoin will continue to monitor these developments.

References:

"LATAM Market Report," Kaiko, June 2024.

Kaiko Official Website, research.kaiko.com

Central Bank of Brazil Official Website, www.bcb.gov.br

Government of El Salvador Official Website, www.presidencia.gob.sv

Bitso Exchange Official Website, www.bitso.com

MercadoBitcoin Exchange Official Website, www.mercadobitcoin.com.br

Binance Exchange Official Website, www.binance.com

"El Salvador adopts Bitcoin as legal tender," BBC News, www.bbc.com

"Brazil’s Crypto Regulation: A Legal Framework for the Future," CoinDesk, www.coindesk.com

"Argentina's Inflation Crisis and Cryptocurrency Adoption," Forbes, www.forbes.com

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。