Preface:

The cryptocurrency market has never lacked opportunities to make money. Seizing one or two opportunities can result in hundredfold returns, which can solve all the troubles in life.

However, on the contrary, many people's stories have always been: coming in with nothing, leaving with heavy debts, and only contributing fuel to the market.

But if we enter in a different way, will it be a different scenario? For example: you come in with nothing, start with heavy debts, and in the end, unwilling to accept the situation, you start researching the deep logic of the cryptocurrency market, never forgetting to look for opportunities for a new narrative in the ups and downs of the environment…

Two different attitudes lead to vastly different results.

So when something appears in front of you, do you treat it as a piece of garbage and curse, or do you embrace it with a learning attitude, then dig into the underlying logic, and finally decide whether to get involved or discard it?

I. Seizing the underlying trend of the coin circle, making tens or hundreds of times the profit

One underlying logic in the coin circle is that the cryptocurrency market never lacks new concepts and follows the principles of "faster, more innovative, and more monopolistic."

Even if most new concepts are iterations of previous gameplay, they can still bring new waves and speculation to the market, such as:

- In the early days of ICO, an "air coin" had returns of tens to hundreds of times;

- After ICO, IEO came into play, with exchanges issuing coins to you, yielding an annualized return of 3-40%;

- After the IEO returns decreased, INO emerged, with returns of hundreds or thousands of times in 2021;

- While INO was ongoing, IDO also emerged, with returns of 10-50 times on platforms like Coinlist;

- IDO also evolved into an LBP, with smaller waves, but still able to make money;

From the above, we can see that since 2017, every change in the way assets are issued in the market has been able to ignite a large number of new projects, allowing every early holder to gain new returns.

Have we ever considered that in 2023-2024, there were several projects in Web3 AI that made tens of times the profit, but no IXO platform emerged?

In 2023, 189 billion was invested in traditional AI companies, but 99% of them were unable to monetize.

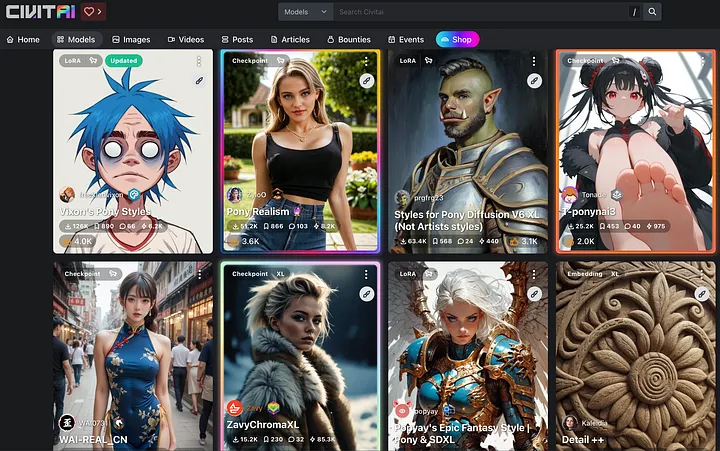

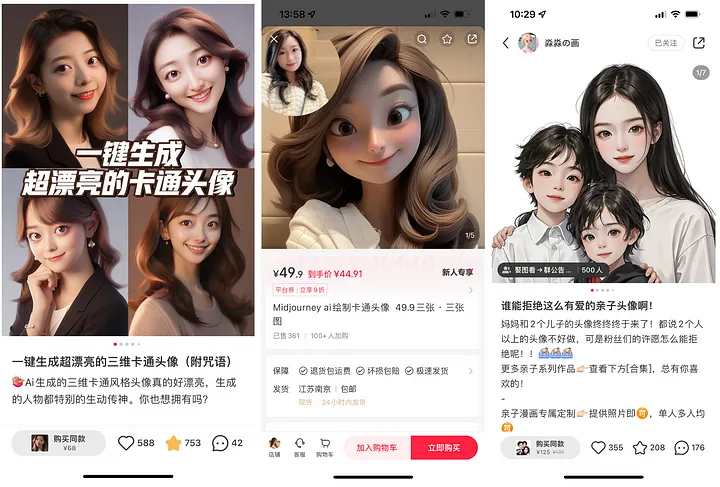

AI has many community platforms on Web2, especially in graphic and image platforms, such as C Station and Bilibili;

These large model platforms based on stable diffusion release a massive number of personally trained models every day, but have you ever thought about how to monetize them?

If someone downloads and uses the model you trained to create an image that sells for tens of thousands on Xiaohongshu, while you are still worrying about whether to upgrade to a 4090 graphics card, what would you think at that moment?

It's the same in Web3. With so many AI projects, as a project party: how do you attract users, how do you quickly issue coins, and how do you obtain a continuous stream of user interactions? How do you monetize your large models? How do your users monetize?

At this point, a comprehensive large model market that combines Web2 and Web3 is needed, after all, Web2 has not figured out how to monetize in this regard. If there is a platform that can meet the needs of project parties, model training teams, users, and platforms, wouldn't this be a space for tens or hundreds of times the profit?

And in March of this year, a project called Ora Protocol, an AI project, first proposed the concept of IMO (Initial Model Offering), and the first AI token $OLM issued on it rose 60 times within a week.

Isn't it amazing? Let's take a look at the deep logic of Ora Protocol and how early users can get airdrops, and then decide whether to continue to follow.

The following sections are divided into:

- Core Mechanism of Ora Protocol

- Business Value of Ora Protocol

- How to Get Ora Protocol Airdrops

- How to Participate in New Offerings on Ora Protocol

II. Core Mechanism of Ora Protocol

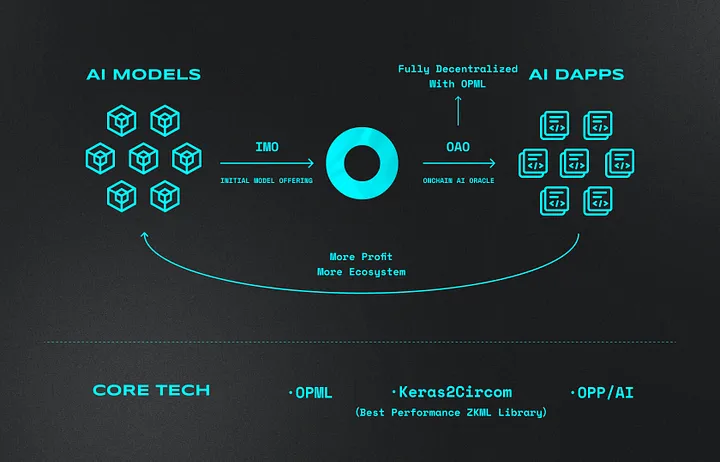

Ora Protocol is an AI model tokenization platform (IMO), where any AI team can issue its own token for its AI large model on the Ora Protocol platform.

If you are a WEB3 AI developer, in addition to various development and training tasks, you also have to do your own marketing and operations, and figure out how users can generate income…

With Ora Protocol, you don't need to do much. You just need to focus on backend technical support, and leave the frontend issuance of coins and market matters to Ora Protocol.

How is this achieved? You only need to understand a few core issues:

- Ora Protocol ensures that a certain AI model is genuine and can correspond to the token you hold through Onchain AI Oracle (OAO) and opML (Optimistic Machine Learning).

- Ora Protocol connects the AI model and the economic value it generates with the token holders through the ERC-7641 token standard; it ensures that AI works cannot be altered or forged and enjoys the subsequent use of the AI model and the sharing of profits from creating works through ERC-7007, known as "Verifiable AI-Generated Content Token."

So the overall logic of IMO is very clear: AI model developers need to raise funds, bind the model to a certain token for IMO; buyers purchase tokens and, according to the rules of the token smart contract, enjoy the subsequent use of the AI model and the sharing of profits from creating works.

III. Business Value of Ora Protocol

In 2023, 189 billion was invested in traditional AI companies, but 99% of them were unable to go public, and the traditional world cannot solve problems such as tracking and sharing the value of their open-source models.

It is reported that after Ora Protocol announced its intention to create an IMO platform, more than 20 traditional AI companies found ORA to conduct public offerings through IMO, showing how thirsty traditional AI companies are for monetization solutions.

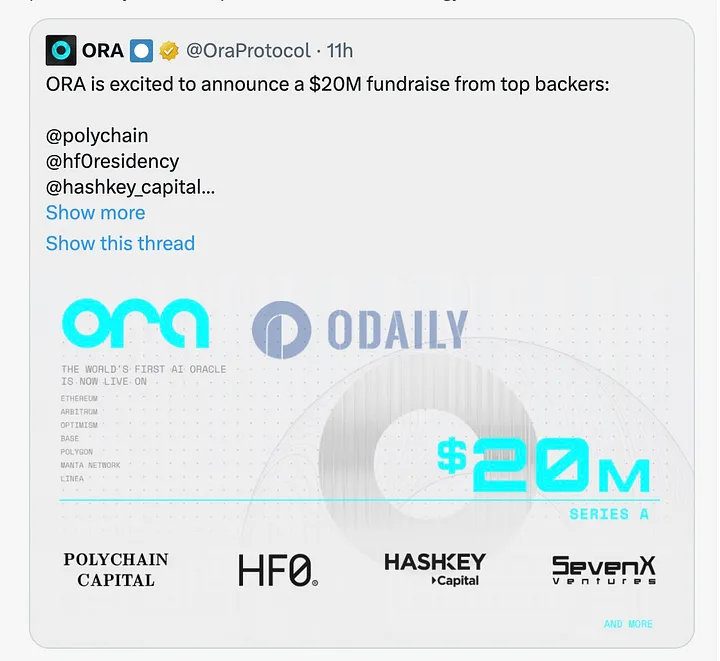

As a result, VCs have recognized its commercial potential. After the launch of Ora Protocol, it has successively raised two rounds of financing, raising a total of $23 million. Investors include:

Top investment giants Holychain, HF0 (a top-tier AI company incubator in the United States), Hashkey, DAO5, and Sequoia China.

As all AI models can be sold on-chain through Ora, it can be imagined that in the future, more and more AI projects will issue coins on Ora Protocol, creating a sustainable business worth billions, completely unleashing the imagination of the crypto AI market.

IV. How to Participate in Ora Protocol Airdrop (Prepare in Advance from July 1st)

Ora Protocol is preparing to launch an airdrop campaign: there will be a 10,000 ETH Cap, and airdrop points will correspond to future tokens, which can be used with STONE/OLM/ETH.

- Core of Airdrop Interaction: Use AI large models to brush gas, and each use can earn 3-6 points. The interaction method is as follows:

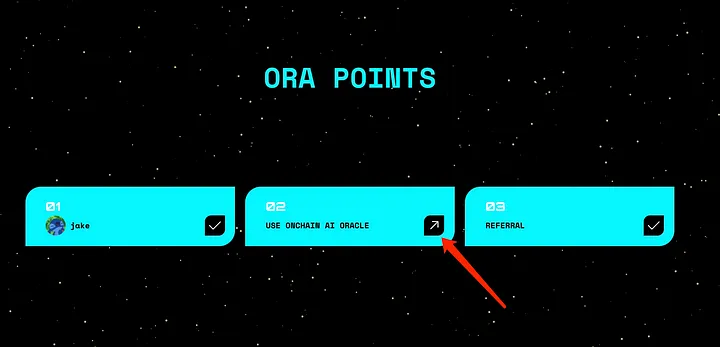

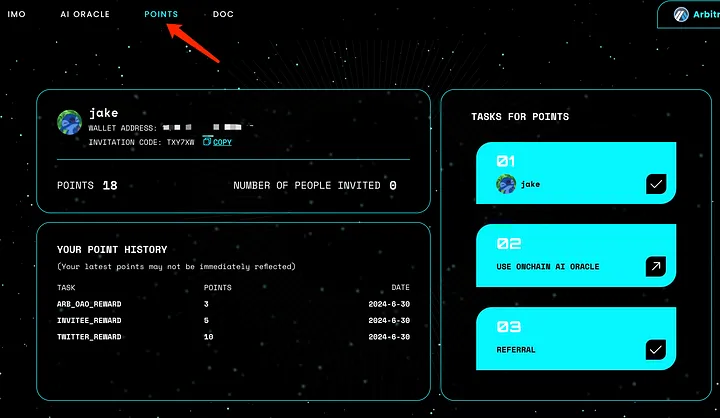

Step 1: Enter Ora Protocol and Bind Twitter

- Relevant task link: https://www.ora.io/app/tasks

- Link Twitter (10 points)

- Enter code: TXY7XW (5 points)

- Link wallet

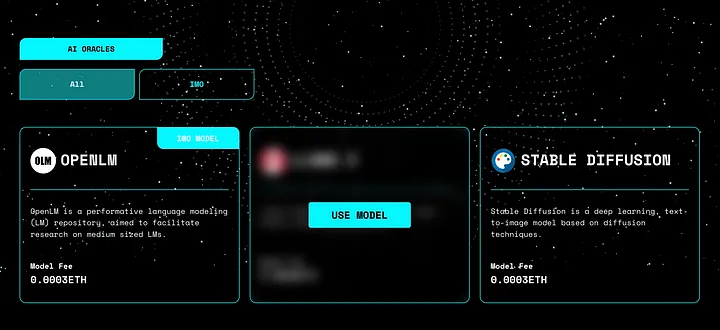

Step 2: Enter ORA Onchain AI Oracle and Make Transactions

- Click on ORA Onchain AI Oracle

- Choose any model

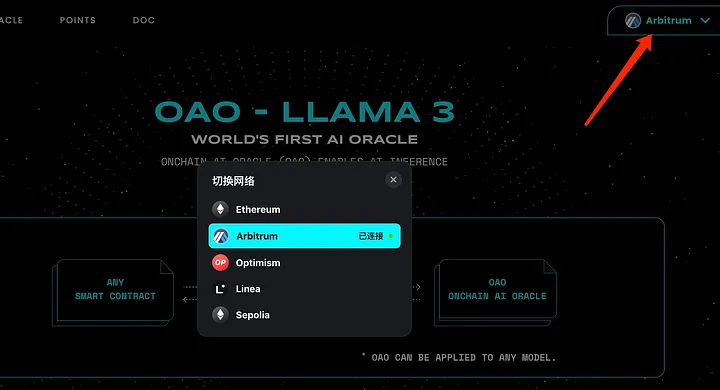

- If you are concerned about transaction fees, you can switch to other chains

If you want to benefit more, use $STONE token transactions or use the Linea chain.

- Enter the prompt word or click "Surprise me"

- Wallet confirmation

Each transaction will incur a fee of 0.0003 ETH + Gas, and each use can earn 3-6 points.

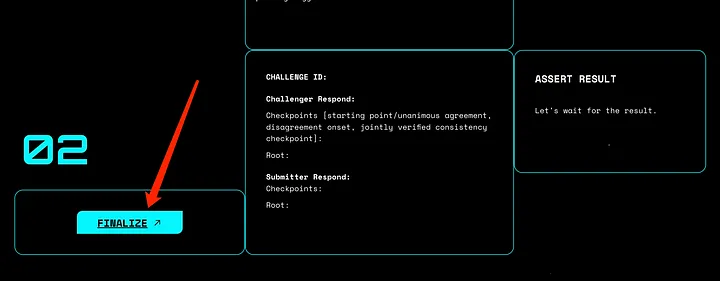

- Scroll down the page and click "Finalize"

Then you can see the transaction points on the POINTS page:

There is no limit to the number of transactions, and this is a transaction-based airdrop, so the more transactions, the better.

The airdrop tutorial ends here, and the acceleration reward will begin on July 2nd.

Ora Protocol does not have its own platform token yet. The points we earn will be exchanged for platform token airdrops in the future. The token economics have not been released yet, so the value of the points cannot be calculated at the moment. However, on the trading page, seeing that each ETH can earn 10,000 points, the value of a point can be calculated to be between 0.3 and 0.4.

Although there is a difference between the cost and value of the points, if we brush hard, we may not earn much. Therefore, it is essential to brush under official activity bonuses, such as the first phase with a 10,000 ETH Cap starting on July 2nd.

Points acceleration activity:

- Time: 7/2 13:00 SGT

- Phase cap: 10,000 ETH/STONE + 300 million OLM: https://www.ora.io/app/stake

Rules: ORA points calculation method:

- Accumulate points over time

- ETH, stETH, STONE earn 8 points per 1 ETH every 24 hours

- 10,000 OLM earns 24 points every 24 hours

- Multiple assets can be pledged

- Process: Stake STONE/OLM/ETH at https://www.ora.io/app/stake, and points are settled and distributed daily.

V. How to Participate in New Offerings on Ora Protocol

Ora Protocol is an AI model token issuance platform (IMO), and many AI projects will issue coins on the platform. The first coin issued on the platform is $OLM, which rose 60 times in a week.

It is reported that around July 7th, the platform will launch the second Fair Launch, which can be participated in using STONE. Prepare some STONE in advance.

References:

https://foresightnews.pro/article/detail/54971

https://www.chaincatcher.com/article/2115451

https://www.binance.com/en/square/post/6801873537834

https://x.com/arya_web3/status/1805491367646576923?s=46&t=ImVlGABBYv-FTaT73CStFw

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。