Article: Wenser, Odaily Planet Daily

On June 24th, Berachain's ecological liquidity staking protocol, Infrared Finance, announced the completion of a new round of financing with participation from Binance Labs, with the specific amount yet to be disclosed. According to Raito Bear, the co-founder and CEO of Infrared, this round of financing is a strategic round in which Binance Labs participated as the sole investor.

In May, Jack Melnick, former head of Polygon Labs DeFi, joined Berachain to oversee the development of the DeFi ecosystem. In April, Berachain announced that the size of its Series B financing had increased to $100 million, with Brevan Howard Digital's Abu Dhabi branch and Framework Ventures leading the investment, and participation from Polychain Capital, Hack VC, and Tribe Capital, among other institutions. Its valuation has now exceeded $1 billion.

After the conclusion of numerous L1 and L2 network dramas, based on the recently proposed Proof Of Liquidity (POL) mechanism, Berachain may become a key player in "reviving the glory of L1 public chains." Odaily Planet Daily will provide a brief analysis in this article for readers' reference.

Current Market Situation: "The World is Weary of the Points System"

In a previous article written by Odaily Planet Daily's senior author, Nan Zhi, titled "The World is Weary of the Points System, a Review of the Rise and Decline of the Points Model," we can see that the emergence of the points system is influenced by specific market conditions.

Firstly, in terms of timing, Blur was born during a bear market when the market was cold, and the points system was an effective means of extending the project's lifecycle. At the very least, it could delay the expected issuance of coins and alleviate the urgency of issuing coins.

Secondly, in terms of project differences, projects involving trading, order placement, liquidity locking, and other aspects are more inclined to adopt the points system. On one hand, it clearly delineates users' behavioral trajectories and input costs, while on the other hand, it provides users with relatively clear and intuitive "numerical incentives." Many people have experienced the visual stimulation brought about by the continuous growth of points, even though it is not a change in balance, it is indeed more advantageous than the static interface in the past.

Furthermore, in terms of user expansion, the points system can achieve a wider range of social expansion through invitation links. Moreover, the creation of rankings can bring about more significant conversion effects for the project's marketing and operations. Often, large whales will invest a large amount of funds for the title of "top player" due to the psychological effect and marketing advantage similar to that of Web2 live streaming platforms.

Lastly, in terms of off-exchange trading, the points system also provides price guidance for token listings. Both off-exchange trading platforms like Aevo and Whales Market, as well as off-exchange OTC trading groups using a double pledge model, can leverage the points system to attract a certain level of liquidity. Moreover, insiders also know that due to the impact of time differences and anonymity, off-exchange trading sometimes exhibits a certain premium effect, making it easier to drive up the price of project points.

In addition, Robinson Burkey, co-founder of the Wormhole Foundation, recently expressed his views on the points system in light of the progress made since the launch of the W token airdrop nearly 3 months ago. "I believe the best airdrops are those that are unexpected by users. However, I think we can no longer return to that simple era and have to enter the era of points activities and witch wars. Points activities are like an unspoken agreement between protocols and 'new users,' that is, airdrop farming is acceptable. The question then becomes whether the protocol can provide a good environment for farmers to farm. I personally support points programs because they can reduce the workload of protocol teams (i.e., reduce the time spent on anti-witch work)."

However, after being inundated with project points activities, the current points system has caused aesthetic fatigue and even a sense of resistance, mainly due to:

- The restrictions of the points system on liquidity locking. Blast's fund locking restrictions have become a glaring example that is deeply abhorred.

- The unfriendliness of the points system towards retail investors in the market. While large whales can obtain substantial returns through large capital, retail investors receive meager rewards.

- The long-term damage to the ecological network caused by the points system. Often, the points system creates false prosperity for projects, as seen after the end of the LayerZero airdrop, where the daily trading volume plummeted by over 95% compared to its peak. After the end of the points system activities, the project was left with nothing but a mess.

Therefore, the market is calling for a renewal of the points system, and Berachain's Proof Of Liquidity (POL) has emerged in response.

Proof Of Liquidity: Rewarding Liquidity Provision to Benefit the Ecosystem

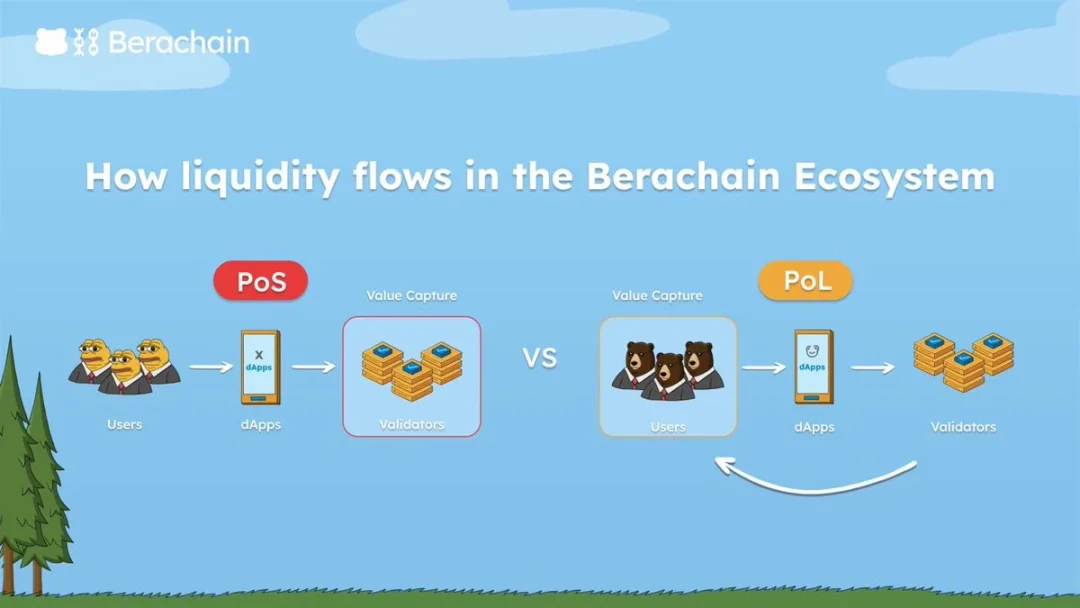

Previously, Smokey, co-founder of Berachain, stated in a post, "Berachain is the first chain to vertically integrate liquidity into the base layer. Block rewards from validators flow to applications on the chain, ultimately reaching their users, bringing liquidity to DApps in the Bera ecosystem. Berachain is an application layer aggregator."

POL mechanism diagram

POL mechanism diagram

So, what is the POL mechanism, and what are its characteristics and advantages? The following provides a detailed introduction.

What is the POL Mechanism?

According to the latest explanation released by Berachain, in simple terms, the POL mechanism is an accelerator at the application layer of Berachain—expanding the liquidity and security of the ecosystem through the collective efforts of users, protocols, and validators.

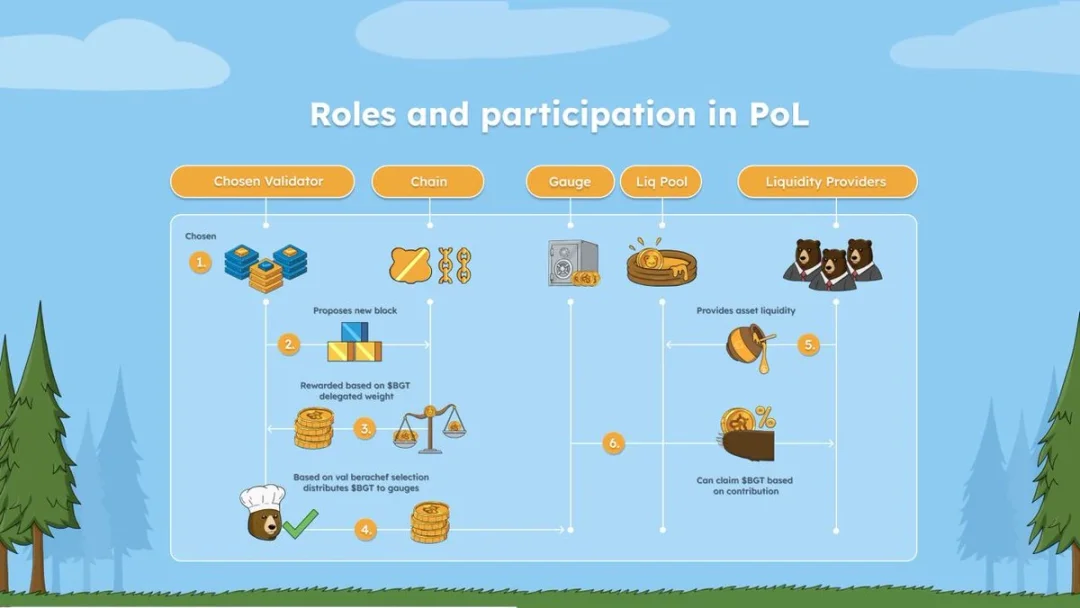

In this process, each party plays a different role, as follows:

Users: Provide liquidity and stake LP, accumulate BGT rewards and LP fees (the BGT rewards in the liquidity pool are calculated based on the global weighted average of the validator's liquidity pool).

The user's BGT (Berachain's ecological governance token) income is based on two factors: 1. The total assets included in the stake; 2. The amount of BGT sent to the dashboard.

Validators: Sequentially build blocks and receive block rewards based on the amount of BGT delegated to them.

Validators direct a portion of the BGT obtained from block construction to the project's liquidity pool through their "berachef."

berachef interface: https://bartio.station.berachain.com/validators/0x40495A781095932e2FC8dccA69F5e358711Fdd41

Application Projects: Create proposals to establish new liquidity pools, making the reward pool eligible to receive the BGT input from validators.

Since the liquidity pool is just a smart contract that accepts single-asset staking, it can exist in the form of DEX pools or any other asset pool in the Berachain ecosystem.

Roles and participation in the POL mechanism diagram

Roles and participation in the POL mechanism diagram

How are the Advantages of the POL Mechanism Manifested?

If the above version sounds somewhat complex, in plain language, Berachain's POL mechanism matches BGT liquidity with rewards for different application tokens by introducing "validators" as an intermediary role:

- Users stake assets in the dashboard built by validators.

- Validators mobilize BGT assets to support different applications and receive corresponding application rewards.

- Application projects need to attract support from validators through proposals and reward them, for distribution to validators and users.

At the same time, in this process, users and validators can flexibly enter and exit assets. Additionally, the users, validators, and application projects form a "community of interests," which can achieve a positive flywheel effect through the accelerated circulation of liquidity, thereby driving the overall development of the Berachain ecosystem. Specifically:

- Users: Maximize the benefits of staking assets by providing liquidity to application projects and delegating BGT to a unified validator to receive rewards.

- Validators: Obtain rewards through more BGT delegation and service protocol liquidity rewards, effectively collaborating with application projects to create greater profits.

- Application projects: Increase the efficiency of liquidity funds circulation by guiding liquidity through cooperation with validators and directly incentivizing users through BGT token issuance, as compared to conventional liquidity mining.

In this process, BGT becomes the main circulating asset within the ecosystem, and application projects can issue their own assets to form exchanges and circulation with BGT assets, ultimately achieving a win-win situation for all parties. In addition, the POL mechanism also decentralizes the generation and distribution of incentives, allowing users, validators, and application projects to determine the flow of BGT. A more efficient liquidity circulation and a win-win solution for all parties involved is undoubtedly the best choice.

Conclusion: A Community of Interests Can Drive the Ecosystem, Not the Other Way Around

Unlike the points system, the POL mechanism allows different roles within the Berachain ecosystem to find their own "ecological niche," thereby forming a relatively complete "community of interests," rather than forcing the three parties to participate due to point rewards.

Compared to Blast's ecosystem, which treats points and golden points as "carrots dangling in front of users" and arrogantly dilutes the early liquidity input and rewards through various mechanisms, Berachain's POL mechanism is undoubtedly more transparent and fair, and is expected to attract more users, validators, and application projects to join.

As a meme-worthy L1 public chain known as the "playground for infinite economic games," Berachain may grow into another uniquely distinctive blockchain network.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。