This article will introduce the upcoming updates and TGE details of Bluefin, and tell the development history and grand vision of Bluefin.

Author: Deep Tide TechFlow

Preface

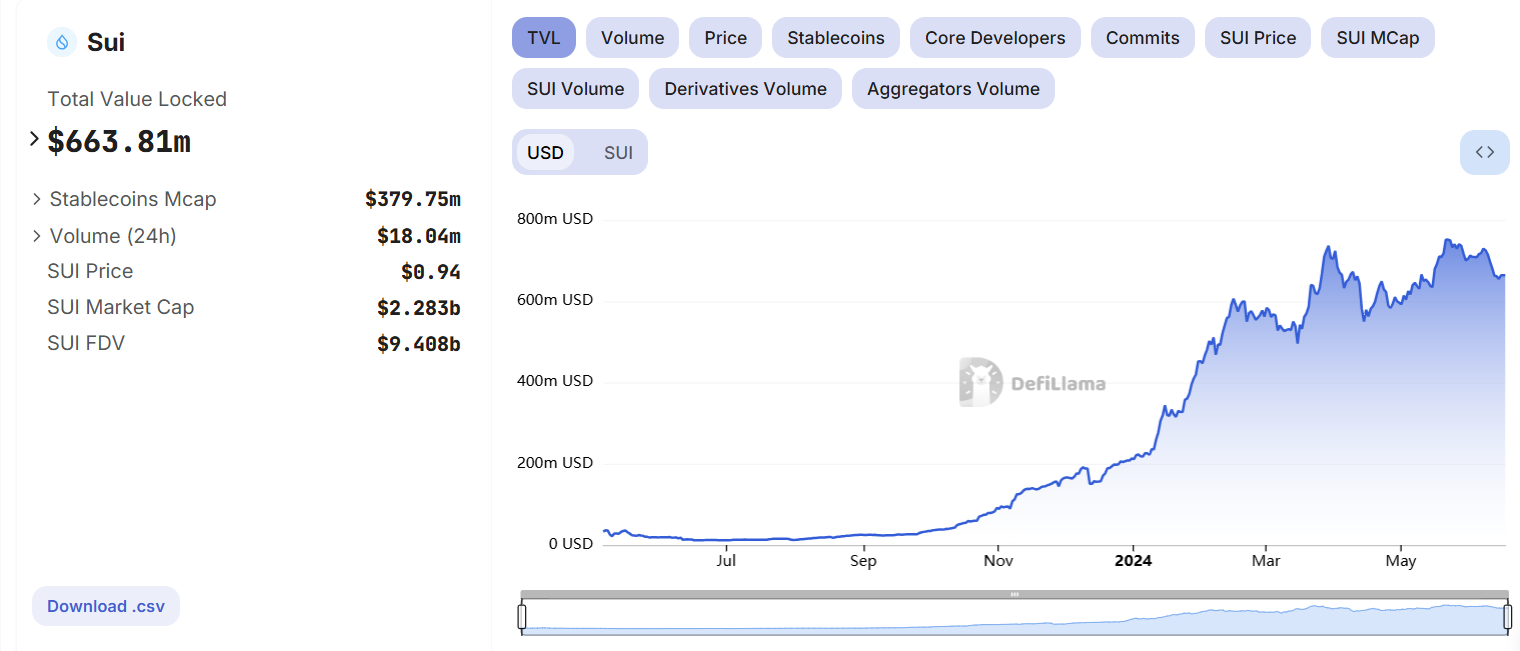

With the arrival of the bull market, the star public chain Sui, which was highly anticipated in the bear market, has changed its low-key image. Not only has the coin price performed strongly, but the ecosystem TVL has continued to grow to over 600 million US dollars, showing a strong upward trend.

The continuous influx of funds has attracted a lot of attention from the market. The technical features of Sui, such as high throughput, low latency, and strong scalability, have been recognized by more people. The developer community has become more active, and various protocols in the ecosystem have begun to flourish.

As the top trading platform in the Sui ecosystem, Bluefin provides users with a derivative + spot multi-variety trading experience with efficient transaction processing speed, transparent on-chain security mechanisms, and user-friendly operation interface.

More than just a trading platform, the vision of Bluefin is to build ecological infrastructure on the Sui network and create a decentralized financial ecosystem.

In the volatile market environment, it is a good time to explore the potential of the public chain ecosystem. Bluefin is about to conduct a TGE in the near future and will also welcome the launch of the spot asset aggregator and the official release of Bluefin Pro in the second half of the year.

This article will introduce the upcoming updates and TGE details of Bluefin, and tell the development history and grand vision of Bluefin.

Bluefin's Positioning in the Sui Ecosystem

Market demand and efficiency supply are not aligned

Although Sui is known for its high performance and user-friendly features, these advantages have not been fully utilized in many applications, leading to the high performance and low latency characteristics of Sui not being fully demonstrated to users. Many applications are still relatively complex in design and not intuitive enough, failing to make good use of Sui's user-friendliness, and ordinary users still face a high learning cost when using them. These issues have limited the further promotion and application of the Sui ecosystem.

Derivative trading is also gradually becoming a focus of attention for DeFi users. However, many existing platforms still have shortcomings in performance and user experience, unable to meet the demand for efficient and low-latency trading from users. In addition, high trading fees are also a common problem, especially when the trading volume is large and the market fluctuates dramatically, users need to pay high fees. This poses a certain obstacle to the further development of the DeFi track.

Sui ecosystem needs to break the "ignition point" barrier

It is not difficult to see from the steadily increasing TVL that Sui is gradually moving towards the direction of a major public chain as planned. However, despite the increasingly perfect infrastructure, most projects in the Sui ecosystem are still in the early stages, lacking innovative applications to attract ordinary users, and have not yet formed a strong user base and community influence. In order to shine in this round of "non-intercepting bull market" like Solana and Base, the Sui ecosystem still lacks an "ignition point" that can attract the attention of mainstream users.

In this context, Bluefin, as a unique protocol, has emerged. Bluefin sees the urgent need for Sui to utilize its high-performance potential, challenges the current market limitations, finds its ecological positioning, and breaks through with strength.

Accelerating with Sui, Bluefin Leverages the Sui Ecosystem

As an early explorer of DEX, the mature and excellent Bluefin is the result of the team's continuous technological iterations.

Initially, the Bluefin v1 test version was launched on Arbitrum in 2023. However, the Bluefin team quickly realized the limitations of the platform on Arbitrum in terms of scalability and cost-effectiveness, and shifted its focus to the Sui public chain. Attracted by the unique architecture and advantages of the Sui blockchain, the Bluefin team began to adjust the codebase and build a Bluefin adapted to the Sui network. It was finally deployed on the Sui mainnet as Bluefin v2 at the end of 2023, with a trading volume of over 3.2 billion US dollars in December 2023 alone.

As expected by the team, after transitioning to Sui, Bluefin found a solution that matched its high-performance and user experience goals.

From the initial Bluefin Classic to Bluefin v2, and now the upcoming launch of Bluefin Pro, it has gone through multiple versions of evolution. Each version has significantly improved in terms of performance and user experience. Bluefin, step by step, has gradually established itself as an excellent trading platform. In the future, Bluefin aims to expand towards finance and infrastructure, building on-chain infrastructure for Sui and creating an ecological financial network.

Sui, providing a high-speed channel for trading

In the Sui network, Single-Owner Objects have extremely high efficiency and parallel processing capabilities. This includes token transfers and smart contract deployment, which are processed by Sui without reaching consensus, achieving large-scale parallel processing and only locking relevant data.

At the same time, Sui processes each transaction separately, avoiding block batching issues, resulting in shorter delay times for each transaction. Then, the arbitration driver assembles these transactions into certificates, completes the transaction after successful verification. Additionally, Sui uses causal ordering for transactions containing self-owned objects, enabling large-scale parallelization and sharding through multiple machines, greatly improving the scalability of the Sui network.

Sui's high performance, low cost, and strong scalability enable Bluefin to achieve sub-second settlement speed and ultra-low transaction costs comparable to centralized exchanges.

Reducing wallet presence, maximizing user experience

Bluefin achieves user invisibility in the on-chain interaction process through account abstraction, allowing users to trade easily without the need for a wallet.

Bluefin has integrated with zkLogin, simplifying the user registration process. Users only need a Google account to directly log in and connect to Bluefin for trading without the need for a wallet. At the same time, zero-knowledge proofs also ensure the privacy of sensitive user data.

To provide a user experience equivalent to centralized exchanges, the project team has simplified the process of depositing assets as much as possible.

Bluefin has integrated Wormhole, providing users with a smooth cross-chain solution within the Bluefin platform, supporting DeFi users to make one-click deposits from any chain. For newcomers to Web3 or users of centralized exchanges such as Binance, Bluefin will support direct fiat deposits and direct deposits from CEX.

Bluefin aims to completely eliminate the need for Web3 wallets. Users can bypass wallet installation, obtain a faster, more user-friendly, and secure trading experience, without compromising technical integrity.

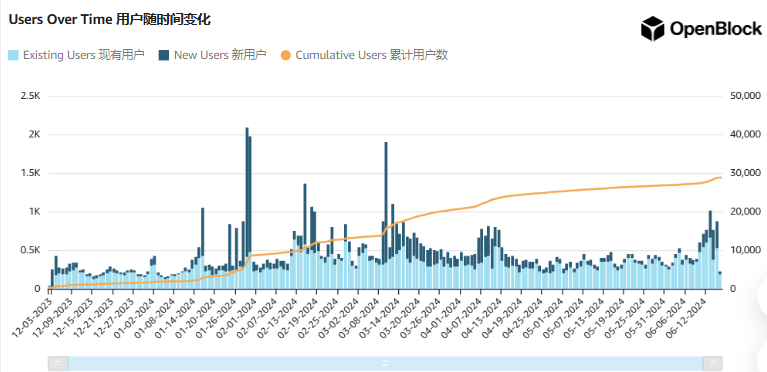

The team's dedication to user experience has naturally received the most authentic feedback. Since the launch of v2, Bluefin's user base has continued to grow.

Team background and ecosystem

The leadership team of Bluefin comes from well-known companies such as Meta, Goldman Sachs, Amazon, and NYSE. Founder Rabeel Jawaid is a research scientist at the Singh Center for Nanotechnology at the University of Pennsylvania and has also served as an investment analyst at Optimus Capital Management.

According to available information, apart from the undisclosed Pre-Seed round, Bluefin has raised $29.2 million, led by Polychain, Three Arrows Capital, and DeFiance Capital, with participation from numerous star institutions and individuals.

Currently, Bluefin has partnered with leading market makers and companies such as Wintermute, Amber, Keyrock, Meta, Goldman Sachs, and Amazon.

Currently, Bluefin has interconnected with several on-chain financial protocols such as CetusProtocol, Turbos Finance, KriyaDEX, AVEO, and has also collaborated with well-known NFT communities such as Pudgy Penguins, MadLabs, and Azuki. During the TGE, Bluefin will distribute $BLUE tokens to the community members of the collaborating projects. In the future, Bluefin will collaborate with more high-quality projects to create a thriving on-chain financial network.

The Future is Here: Technical Highlights of Bluefin Pro

While Bluefin v2 continues to evolve, the Bluefin team will launch Bluefin Pro in the second half of this year, representing a highly optimized version of the product. Its main features include reduced fees, reduced trade execution latency, and full-margin trading accounts.

Utilizing Owned Object Transactions

Full-margin support: Bluefin Pro will introduce full-margin trading accounts, a key feature of the trading platform.

30-millisecond confirmed transactions: Bluefin Pro ensures fast confirmation for users, regardless of on-chain processing time. It achieves confirmation of off-chain transactions in approximately 30 milliseconds at a speed of around 30,000 TPS.

400-millisecond on-chain finality: Fast on-chain finality will ensure that Bluefin Pro remains efficient and responsive even in high-traffic situations.

Gas costs: Bluefin transactions typically consume 1,000 to 2,000 gas units, with an average gas cost of about $0.01, ensuring low costs and predictability. The Bluefin Foundation covers these gas fees.

Illustrative example of single-owner objects and owned object transactions:

In the technical architecture of Bluefin Pro, "single-owner objects" and "owned object transactions" are two closely related but independent concepts: single-owner objects provide the foundation for owned object transactions, which utilize this foundation to achieve efficient transaction processing.

Using the example of borrowing books from a library, Sui is the management system of the entire library, responsible for recording the status of each book and borrower, ensuring that each book has a unique label (ownership). Bluefin is the librarian in the library, using Sui's system to quickly process book borrowing and returning operations.

Each book has a unique label indicating who has borrowed it. This is similar to "single-owner objects," where each book (object) has a clear borrower (owner).

When you want to borrow or return a book, the library only needs to check the label of the book, without needing to check the status of all books. This is similar to "owned object transactions," where only the relevant books and owners need to be checked, without the need for a global check of the entire system.

TGE Approaching: How to Participate in Bluefin

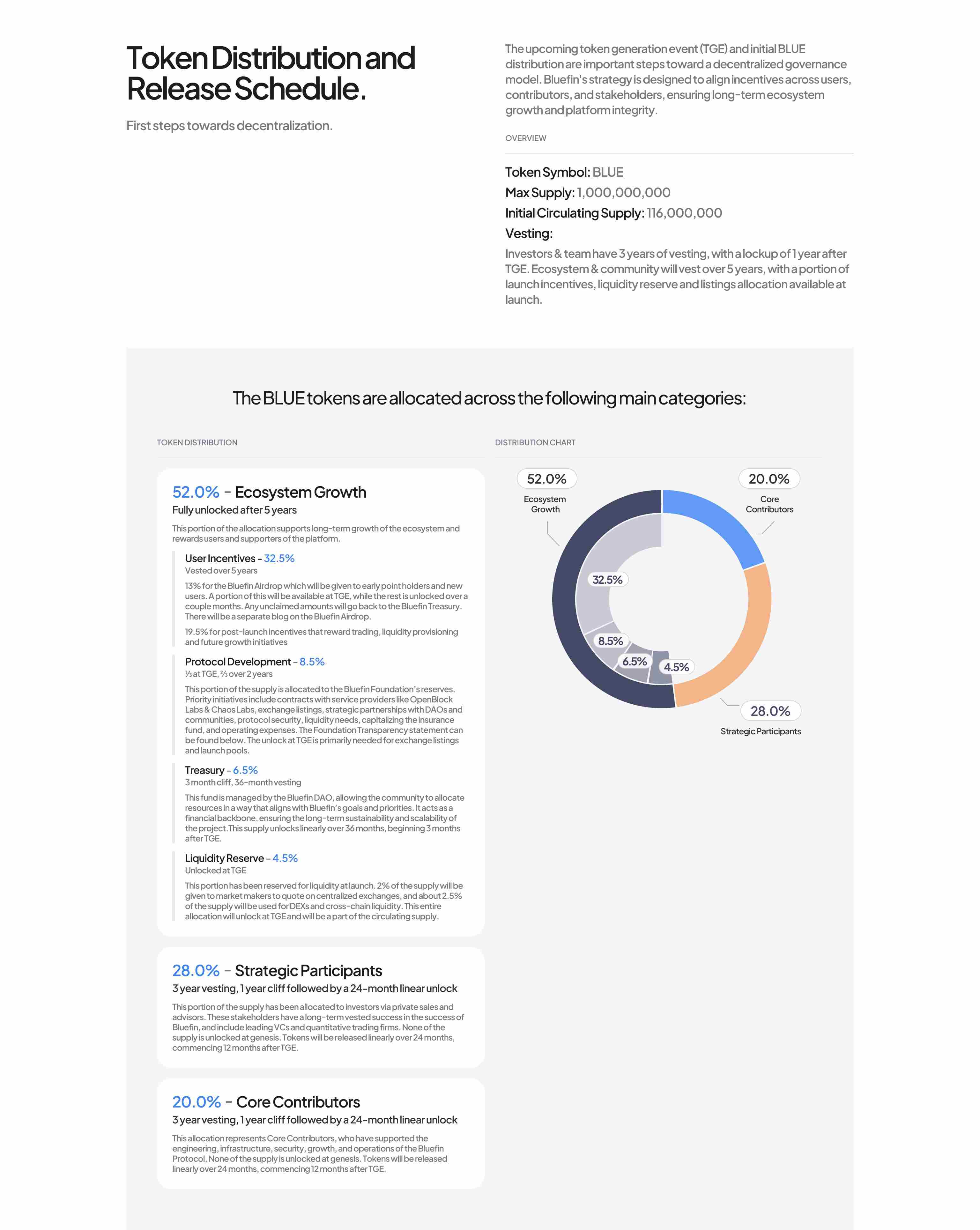

In the future, the distribution focus of Bluefin's project token $BLUE will be on incentivizing ecosystem growth (52%), with 13% allocated for Bluefin airdrops, 19.5% for trading rewards, liquidity provision, and future growth plans, and 4.5% for liquidity addition at launch, all unlocked at TGE.

The remaining 48% is allocated to investors and core project contributors, with linear release starting 12 months after TGE.

For users, there are four ways to participate:

- Trading Mining

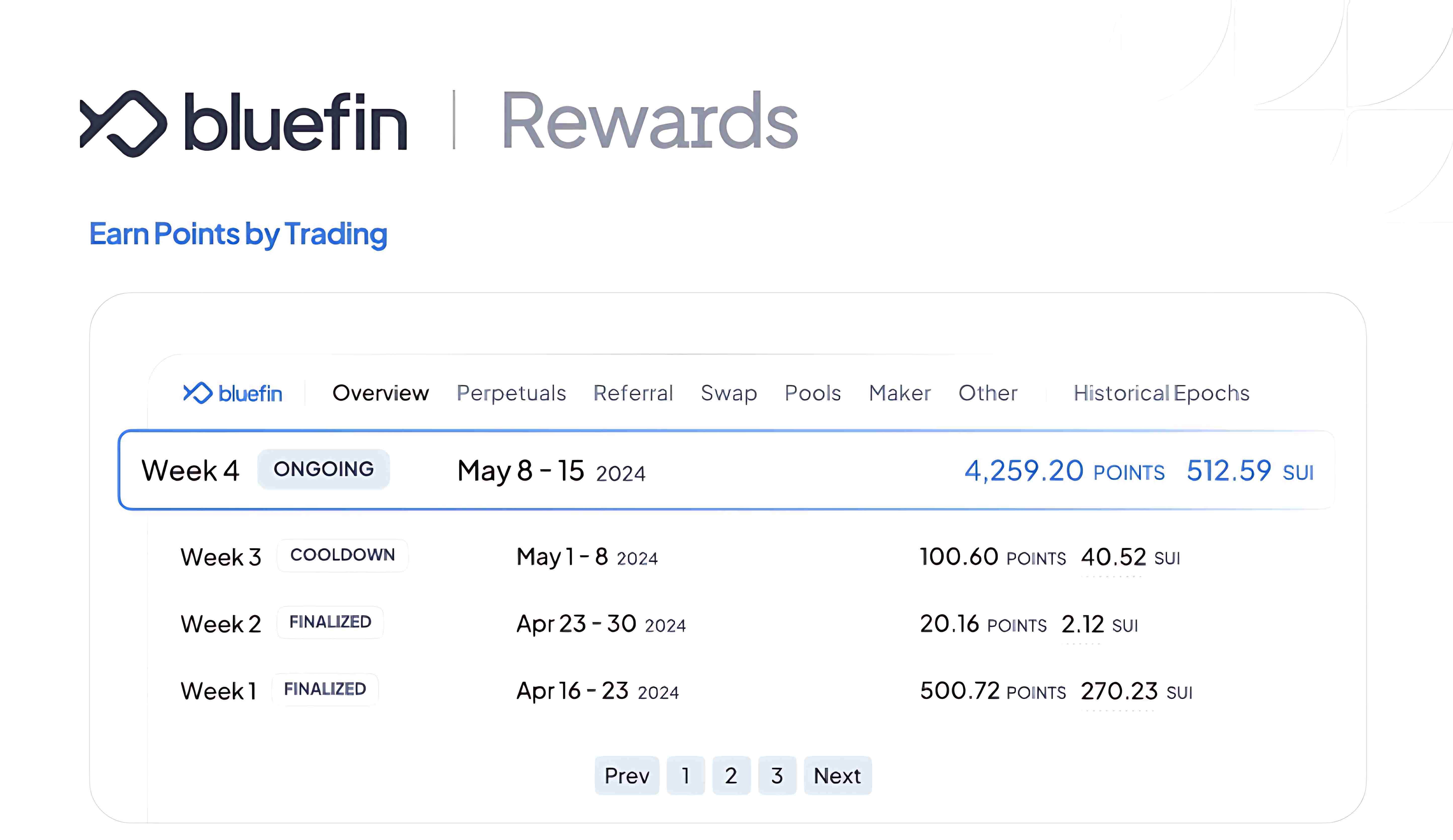

Currently, users can earn points by trading on the Bluefin platform. The Bluefin trading rewards program distributes Blue points and Sui rewards to traders weekly, based on the fees paid by users within a week. Click the "Rewards Pool" button on the Bluefin Rewards Dashboard to view the weekly rewards pool.

- Trading Level League

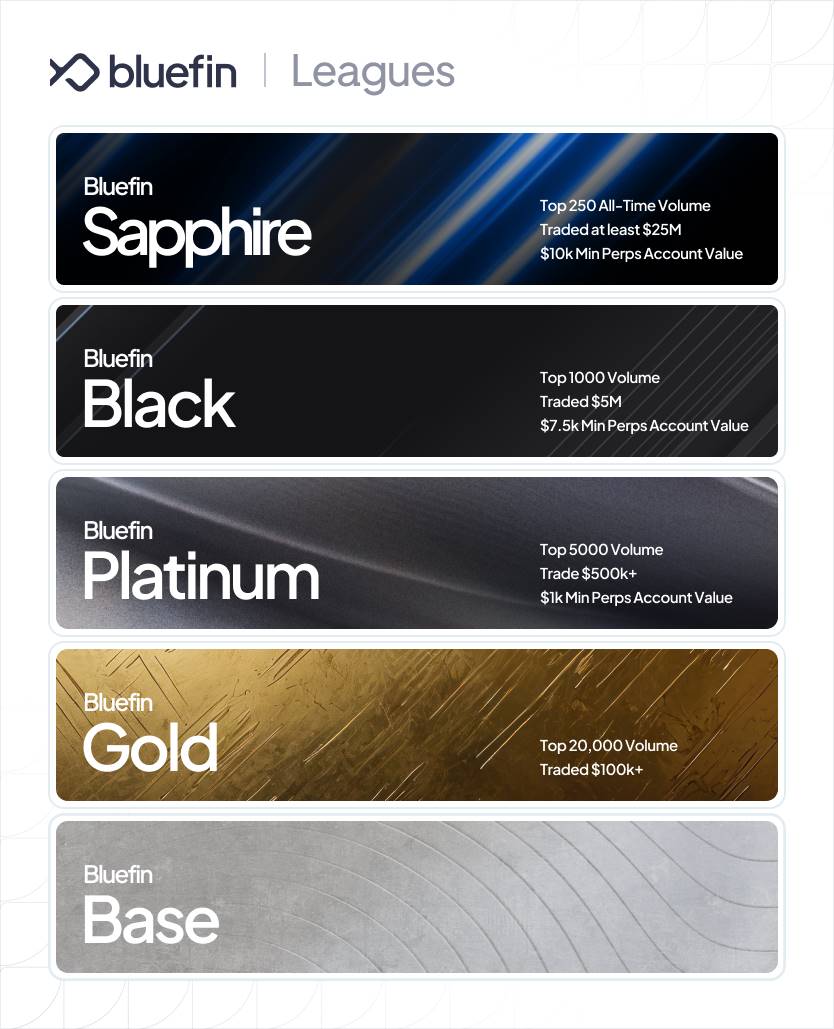

The level league activity is coordinated with trading mining. Users participating in Bluefin trading earn different levels of NFT based on their trading data, with higher levels receiving richer airdrop rewards.

Under the level mechanism, users can freely devise participation strategies, whether it's aiming for a higher level or maintaining a lower level for corresponding expected returns.

- Bluefin Stable Pools

Users can support order book liquidity through Bluefin Stable Pools to earn stable returns and minimize downside risk.

- Open Referral

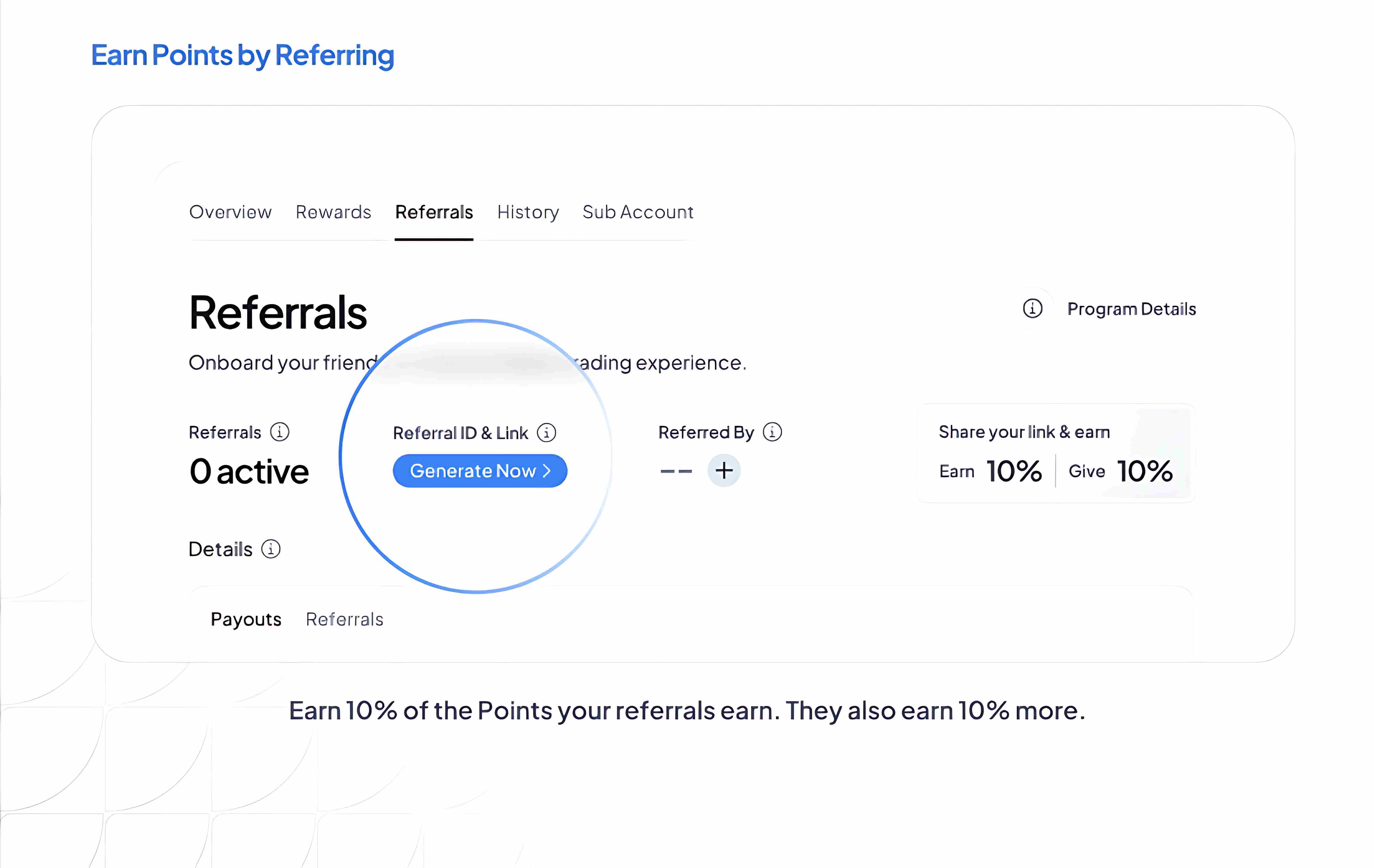

Through the Open Referral program, users can create their own referral links and enjoy a 10% bonus with the invitee.

Conclusion

The emergence of Bluefin effectively fills the current market gap. As a high-performance on-chain trading platform, Bluefin sees the enormous potential behind Sui's excellent technical architecture. Through its innovative application layer design, it fully demonstrates Sui's technical advantages. Not only does it have significant advantages in transaction speed and cost, but Bluefin also puts a lot of effort into user experience, making it easy for even novice users to get started. Through Bluefin, users can intuitively experience the powerful performance of Sui, enhancing user trading experience and further promoting the popularization and application of the Sui ecosystem.

Not only does Bluefin deeply integrate with Sui in terms of technical performance, but it also greatly increases user participation and community loyalty through unique user reward mechanisms and community activities, bringing new vitality and sustained attention to the Sui ecosystem. In the future, Bluefin will further develop the financial network, improve the spot market, and build ecological infrastructure.

With the imminent release of the $BLUE token, well-prepared Bluefin may become the "ignition point" leading the Sui ecosystem to break through, guiding the Sui ecosystem towards a more mature financial world.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。