Crackdown on Transnational Human Trafficking Criminal Entities in Southeast Asia

The fight against transnational human trafficking criminal entities in Southeast Asia relies not only on the law enforcement activities of various countries and regions but also requires the voluntary cooperation of operators in the cryptocurrency industry infrastructure—Cex, OTC, Crypto Payment, etc.

Cryptocurrency trading guarantee platforms primarily provide transaction guarantee services for the black and gray markets in Southeast Asia. Their clientele includes entities involved in illegal activities such as money laundering, payments, document verification, smuggling, and gambling, and they have become a powerful tool for cybercrime groups.

In addition to these conventional crime types, some trading guarantee platforms engage in human trafficking activities under the guise of "overseas labor." This article aims to disclose the development trends of this inhumane crime industry and analyze its business scale and financial pollution based on cryptocurrency.

Southeast Asia's Electric Fraud and Slave Labor Trade

Southeast Asian electric fraud groups need to recruit employees of corresponding nationalities based on their fraud target groups. For example, in the case of the "Pig Butchering Scam" targeting the Chinese community, a large number of young Chinese individuals cross the border through legal or illegal channels each year to work in electric fraud parks.

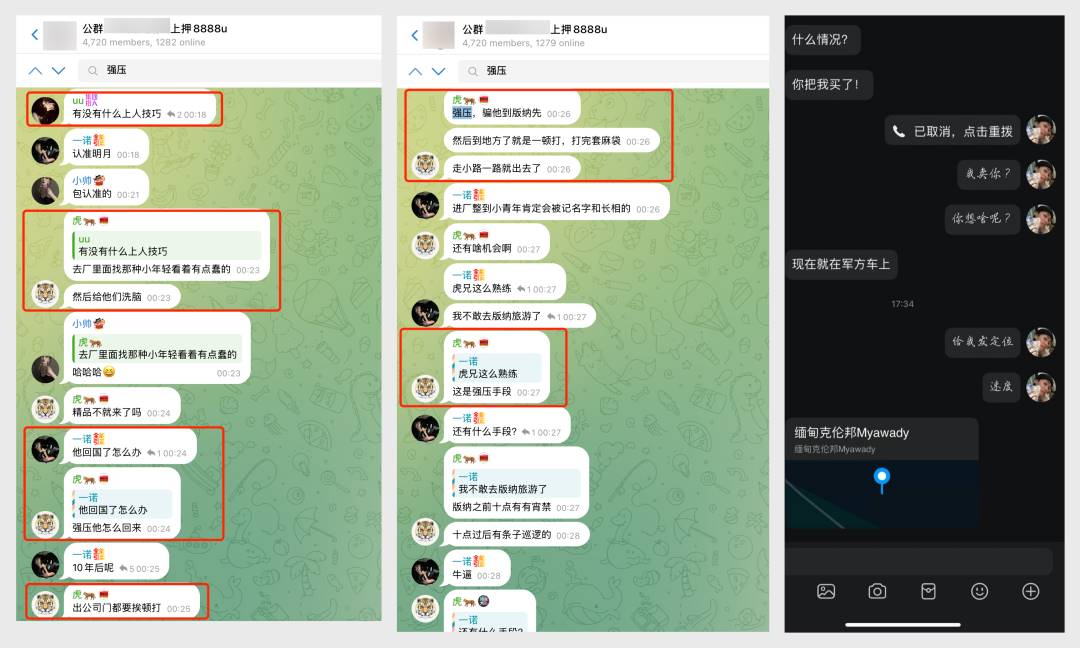

A merchant in a public group is sharing how to deceive/kidnap young Chinese men.

These young individuals are often deceived or forced into Southeast Asia, and by the time they realize they have been sold into the electric fraud industry as slave labor, it is often too late to escape.

Population prices by age group (in USDT)

Typically, young males aged 20-30 are the most popular "goods," fetching higher prices, while those under 20 or over 35 are considered "scrap," either priced lower or requiring stricter assessments. Females are almost never included in the trading range.

The kidnapping case of actor Wang Xing, which previously caused a huge public outcry in mainland China, involved Wang Xing being sold to an electric fraud park through this channel.

Forced Transaction Guarantee Services

In terms of conventional black and gray market material transactions, the business logic of trading guarantee platforms is similar to that of e-commerce platforms like Amazon and Taobao. Merchants must first pay a deposit to the platform before conducting business, and the total amount of business conducted at the same time cannot exceed the deposit limit. If a merchant cannot provide effective services or goods for any reason, the buyer has the right to apply for platform arbitration and even receive compensation from the deposit. Through this model, trading guarantee platforms establish trust between illegal trading parties.

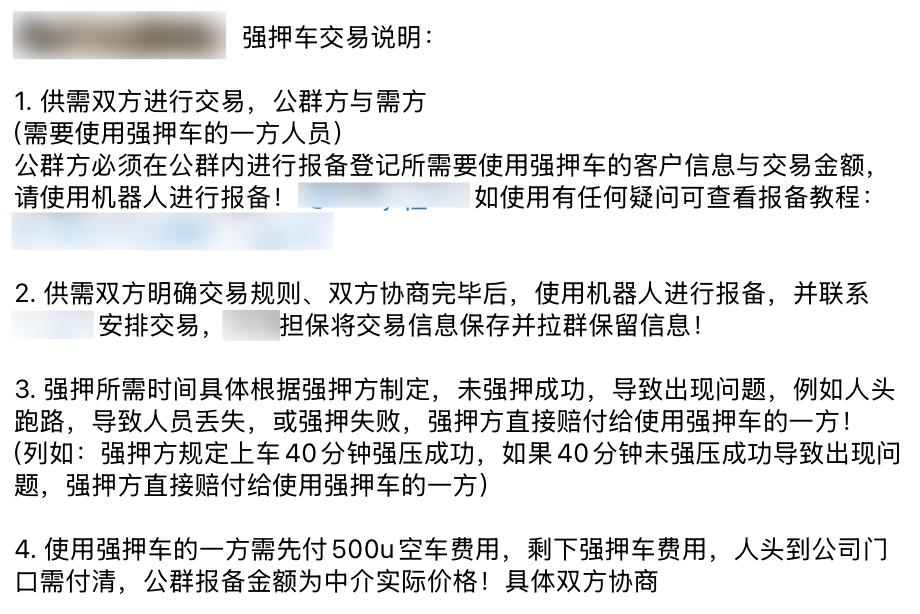

Rules for forced transaction guarantees in the leading guarantee group.

In the case of human trafficking, the basic model is also consistent. When trading human beings, these merchants are referred to as "labor transaction guarantee merchants." However, since involuntary victims may jump out of the vehicle (literally), report to the police, or refuse to cooperate at any time, some merchants may resort to intimidation, coercion, or beating during transportation. Those providing such additional services are referred to as "forced transaction guarantee merchants."

"Forced" is industry jargon that refers to kidnapping.

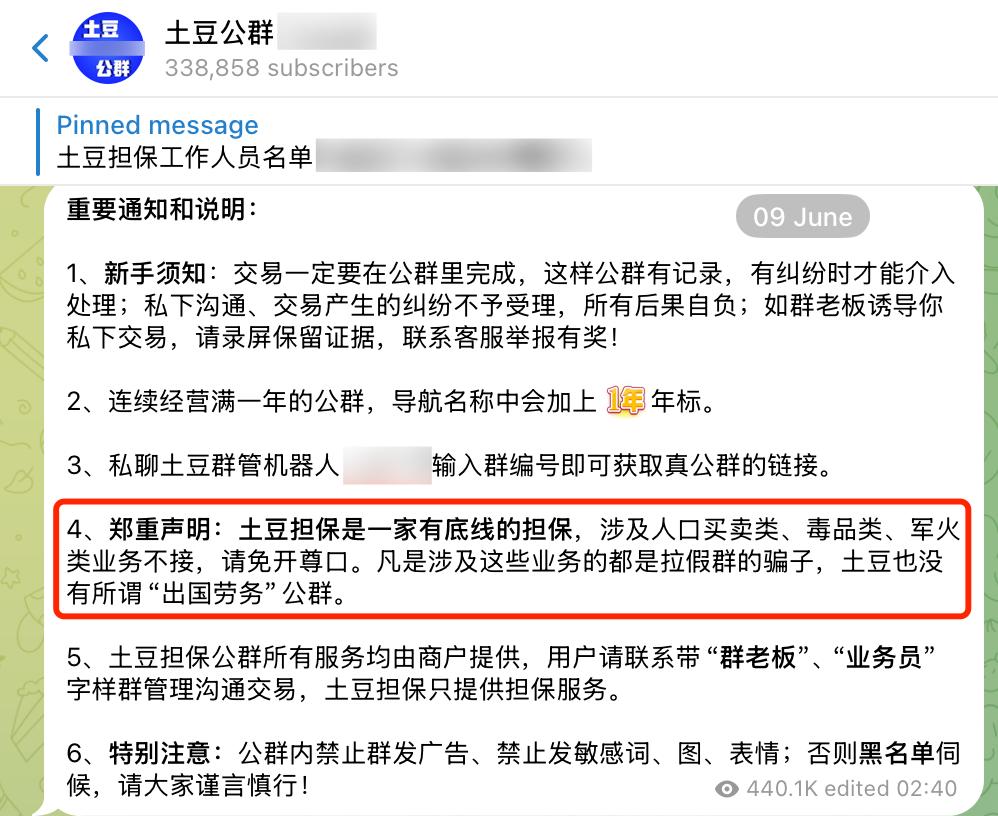

Tudou Guarantee, a subsidiary of Huiwang Group, emphasizes "bottom line."

Due to the global law enforcement crackdown on transnational human trafficking criminal activities, the vast majority of guarantee trading platforms refuse to provide transaction guarantee services for human trafficking-related illegal transactions. Even Tudou Guarantee, a leading guarantee trading platform under Cambodia's Huiwang Group, emphasizes the "human bottom line" and claims it will not participate, highlighting the severity of such business.

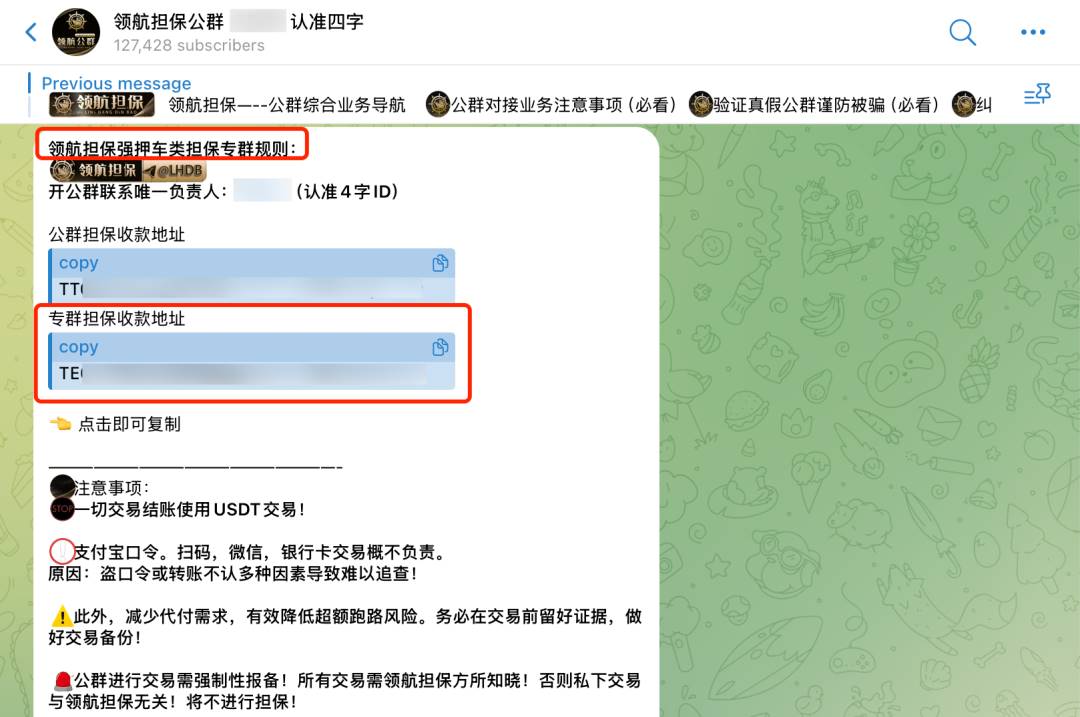

Analysis of Deposit Addresses in the Leading Guarantee Group

Linghang Guarantee is the only one among the top ten trading guarantee platforms in Southeast Asia that operates "overseas labor" public and private group businesses and explicitly states that it provides guarantee services for "forced transactions."

Official announcement from the Linghang Guarantee channel.

The pinned announcement in its official Telegram channel mentions that "forced transaction guarantee merchants" under Linghang Guarantee must submit deposits through designated addresses in private groups, indicating that the counterparties of the publicized addresses are all related entities in the transnational human trafficking industry in Southeast Asia.

Thanks to this, Bitrace investigators can conduct blockchain analysis.

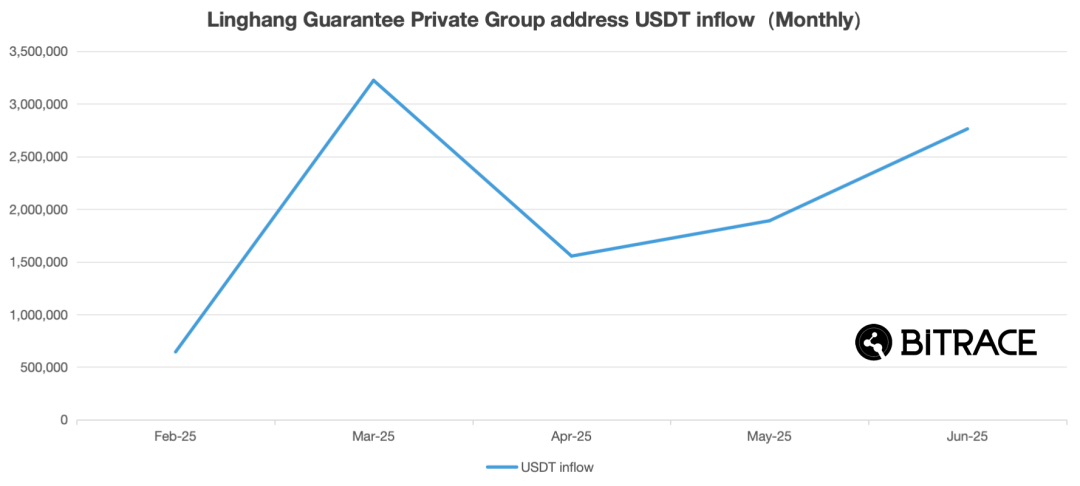

Data from Bitrace Pro investigation tool.

The latest deposit address in the Linghang Guarantee private group was activated on February 23, 2025, and in less than five months, a total of 100,748,05.56 USDT, worth over 100 million dollars, flowed in.

It is noteworthy that this batch of funds is merely the deposits submitted by merchants operating only "forced transaction guarantees" to the private group address. Within the deposit range, merchants can repeatedly conduct business, and the actual amount of funds related to transnational human trafficking in Southeast Asia far exceeds this figure.

Analysis of Financial Pollution from Slave Labor Trade

By analyzing the funds of counterparties to the Linghang Guarantee private group address, Bitrace investigators attempt to assess the situation of centralized trading platforms being exploited.

Entity Name

USDT Deposit to Linghang

Entity Name

USDT Withdraw From Linghang

OKX

71,050

OKX

1,449,300

HTX

1,362

HTX

156,513

-

-

Binance

66,819

-

-

Gate io

17,098

Data from Bitrace Pro investigation tool.

In terms of fund inflow direction, two exchanges transferred a total of 72,418 USDT in 18 transactions to the audited entity. This indicates that Linghang Guarantee merchants directly used exchange addresses to pay deposits to Linghang Guarantee, which were used to secure their human trafficking business.

In terms of fund withdrawal direction, 262 user addresses from four exchanges received a total of 1,689,730 USDT in 414 transactions from the audited entity. This indicates that after stopping business, Linghang Guarantee merchants directly transferred the deposits returned by the platform into exchange accounts.

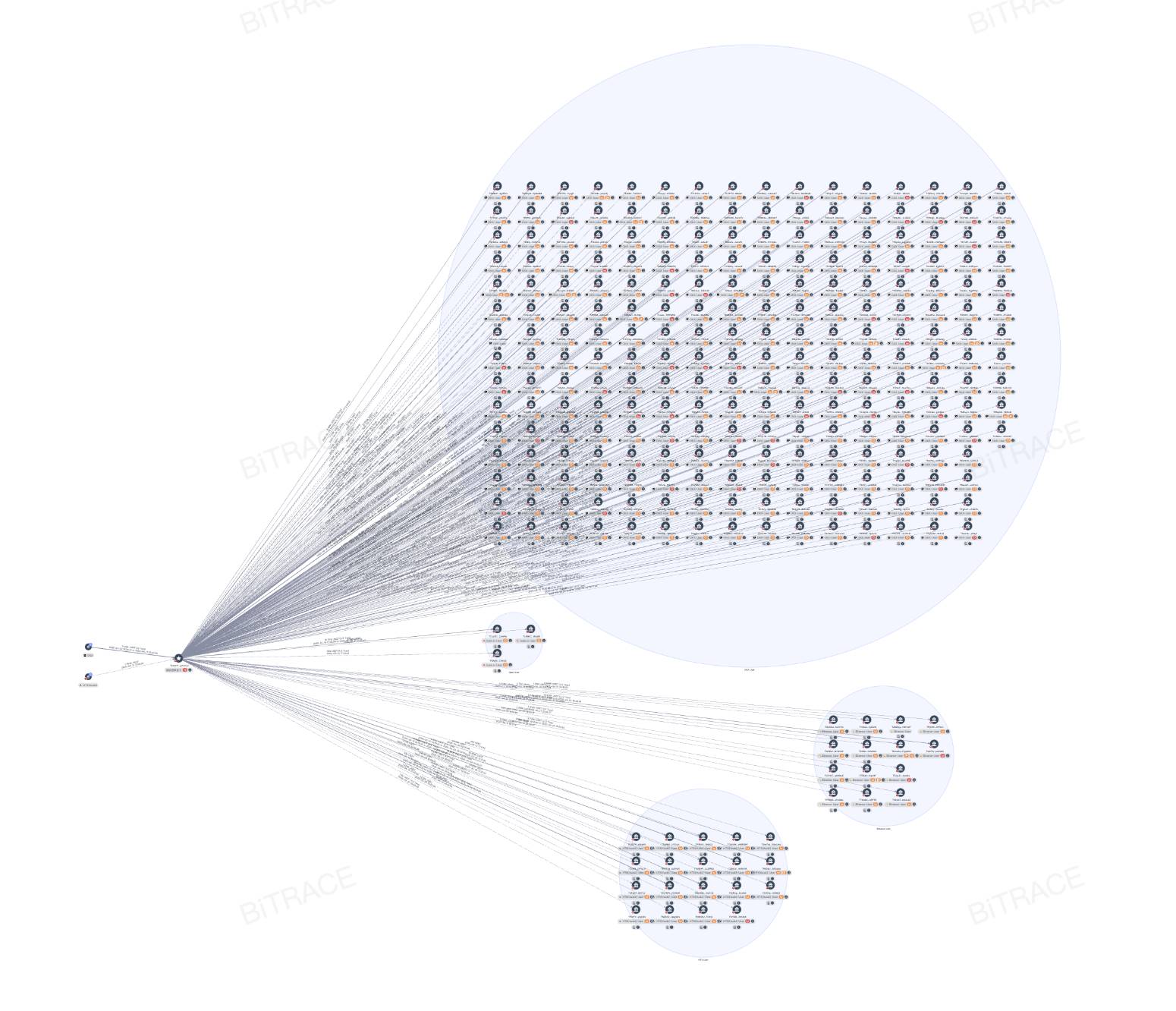

Image captured from Bitrace Pro investigation tool.

All four exchanges have Chinese backgrounds, and their main user base consists of Chinese-speaking users, which aligns with the business of Linghang Guarantee merchants primarily selling Chinese individuals to electric fraud parks in Southeast Asia.

Among them, OKX, as one of the leading centralized cryptocurrency exchanges globally, has been heavily utilized in this process for deposit payments and criminal fund storage, with 17.3% of the withdrawal activities from the Linghang Guarantee deposit address pointing to 236 OKX user addresses.

Threat of Guarantee Funds

Illegal transaction guarantee platforms are often combined with anonymous social software and on-chain money laundering, posing a continuous and covert financial threat to cryptocurrency institutions.

Taking the most commonly used social software, Telegram, as an example, although many public group merchants openly share their business content and addresses in their channels, the truly dangerous illegal transactions are often hidden in non-public private groups or VIP groups, making them difficult to detect.

Frequent changes in business addresses also pose challenges for ongoing monitoring. Aside from leading trading guarantee platforms that maintain relatively stable address rotations, other small and medium-sized guarantee platforms exhibit a large number of mixed-use business addresses, irregular changes, and overlapping business functions, requiring rapid awareness from risk control personnel.

Therefore, not only illegal transaction guarantee platforms in cryptocurrency but also funds related to organized crimes such as online gambling, money laundering, and fraud pose financial threats to centralized entities like exchanges.

In Conclusion

The crackdown on transnational human trafficking criminal entities in Southeast Asia relies not only on the law enforcement activities of various countries and regions but also requires the voluntary cooperation of operators in the cryptocurrency industry infrastructure—Cex, OTC, Crypto Payment, etc.

Bitrace has long maintained close cooperation with law enforcement agencies and regulatory bodies in various parts of Asia, deeply participating in the tracking and analysis of over a thousand virtual asset-related cases, accumulating rich practical experience and high-value risk data in the process. Based on this, Bitrace has built a high-quality risk address database covering over 20 mainstream and emerging public chains, continuously optimizing risk labeling, fund path identification, and address clustering capabilities by combining self-developed AI models and large language model technologies, enabling rapid awareness and intelligent analysis of complex on-chain money laundering and criminal activities.

Through Bitrace Pro, Bitrace Blacklist, and Bitrace AML tools, Bitrace can effectively meet the different needs of financial institutions, providing compliance experiences for operators and risk control personnel.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。