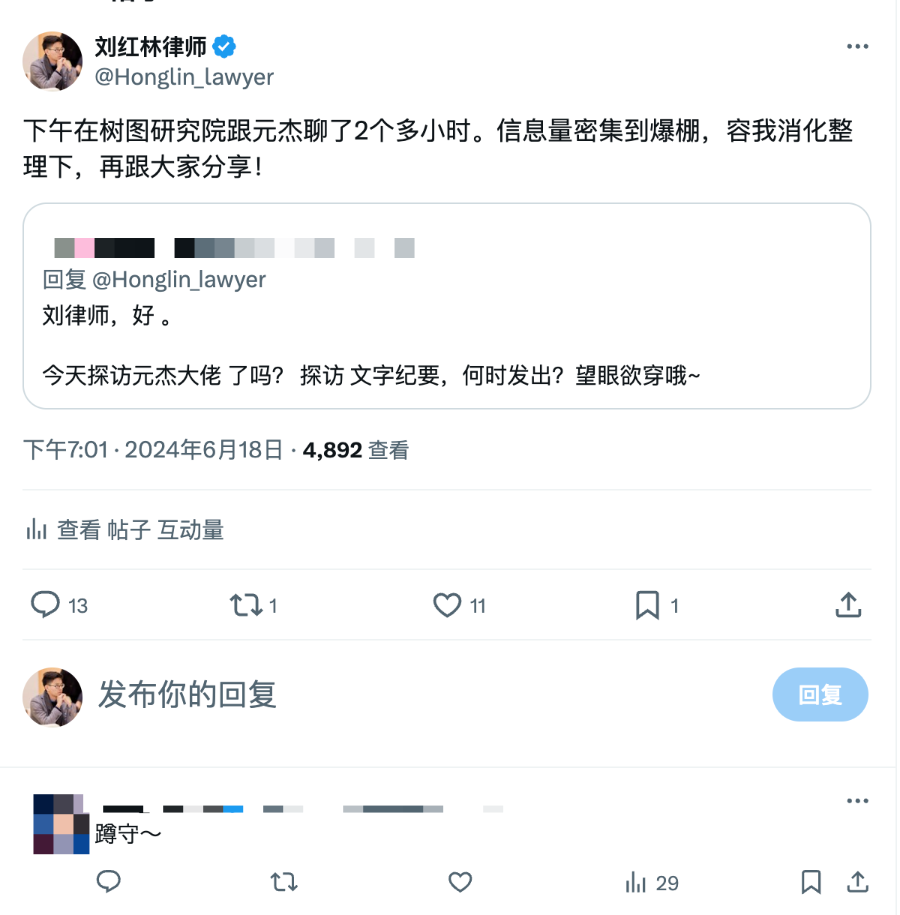

Last week, Professor Yao Qizhi, Chief Scientist of Conflux and a key figure at the Shu Tu Research Institute, received a reply that sparked widespread attention from Conflux enthusiasts. On the day this news became a hot topic in the crypto circle, lawyer Liu Honglin from the Mankun Law Firm posted a tweet on X platform, announcing that he would lead a team to visit the Shu Tu Research Institute in Shanghai next week to meet with Yuan Jie and solicit questions of interest from everyone. The tweet received an enthusiastic response from netizens.

Purely based on personal preference for Chinese Web3.0 entrepreneurial projects, Lawyer Liu Honglin has been paying attention to and researching this well-established Chinese public chain. He has previously written several articles analyzing information about Conflux from the perspectives of legal compliance and Web3.0 entrepreneurs. Interested friends can take a look.

Subsequently, after nearly a year, Lawyer Honglin, accompanied by the attention and questions from numerous netizens about Conflux Shu Tu, visited Conflux and engaged in a conversation with co-founder Yuan Jie for over two hours. This visit revolved around the relationship between the Conflux ecosystem and the Shu Tu Research Institute, hot topics about Conflux on the internet, the market situations in mainland China and Hong Kong, and changes in regulatory policies, among other aspects, and was a high-density exchange of dialogue with no dull moments. The visiting team gained a lot from the experience.

Of course, "the more, the merrier" (promises made to netizens must be kept, as online urging is more pressing). Lawyer Honglin has compiled the content of the conversation and is sharing it here.

It is necessary to solemnly declare that: at the end of the conversation, I voluntarily told Yuan Jie that I would organize the content of the conversation into a written piece to share, and I would show it to him before publishing it. If there were any parts he did not want to disclose or felt were not expressed properly, they could be deleted. He said it was unnecessary. I asked, "What if I disclose your trade secrets?" He said I could choose not to admit it.

This is quite acceptable.

Therefore… this sharing represents only Lawyer Honglin's personal recollection of the two-plus-hour conversation, and the information is organized based on memory, without guaranteeing 100% accuracy. Any misunderstandings or incorrect information are my responsibility, not Yuan Jie's. The related content is for discussion and exchange among friends interested in Conflux or Chinese Web3.0 entrepreneurs, and does not constitute any official opinions or investment advice from Conflux.

About the Shu Tu Research Institute and Conflux

Yuan Jie once again provided a detailed introduction to the relationship between the Shu Tu Research Institute in Shanghai and the Conflux Foundation. Currently, the vast majority of public chain projects on the market operate independently as foundations and development companies. The relationship mechanism between the foundation and the operating company may be either close or loose. Taking Ethereum as an example, its governance structure revolves around Vitalik Buterin ("V God") as the core, with loose internal relationships with foundation members. In contrast, some foundations and projects operate as "one team, two brands," which may be more practical and efficient in the early stages of Web3 project entrepreneurship.

The relationship between the Shu Tu Research Institute and Conflux is as follows: Conflux is a non-profit organization registered overseas, while the Shu Tu Research Institute is a non-profit organization supported by the Shanghai municipal government. From a legal perspective, there is no direct subordination or affiliation between the two.

However, within the Conflux ecosystem, the Shu Tu Research Institute acts as a core contributor to open-source code and undertakes related technical development work. In this relationship, the Shu Tu Research Institute and the Conflux Foundation are somewhat like Party A and Party B: the domestic research institute is responsible for development work, while the overseas foundation provides compensation through donations or funding.

Additionally, as a research institution supported by the Shanghai municipal government, the Shu Tu Research Institute not only supports Conflux-related work but also explores new application scenarios and projects in the Web3 field, including projects led by the Ministry of Industry and Information Technology and distributed storage 0G (ZeroGravity). Government-related research projects provide the institute with a stable source of income, which can cover daily expenses and operating costs.

In summary, the relationship between the Shu Tu Research Institute in Shanghai and the Conflux Foundation reflects the typical model of independent operation between a foundation and a development company. The Shu Tu Research Institute is not only a core technical contributor to the Conflux ecosystem but also obtains stable income by participating in government projects.

Yuan Jie also candidly shared that the co-founders of the Conflux Foundation and the Shu Tu Research Institute are continuously exploring better governance mechanisms for the foundation to find the most effective way to promote the stable development of the Conflux project.

About the Roles of Conflux Co-Founders

Because the Shu Tu Research Institute and the Conflux Foundation are relatively independent, the division of responsibilities among the co-founders is also clear. During this exchange, Mr. Yuan Jie shared the current specific division of responsibilities:

Yuan Jie himself mainly focuses on business and operational affairs, closely monitoring hot tracks and cutting-edge business opportunities in the Web3 market, seizing opportunities for commercialization, and driving the project's development.

Long Fan is mainly responsible for domestic government relations and related work, including communication and coordination with government agencies and relevant departments to ensure the smooth progress of the project in China and obtain necessary policy support and cooperation opportunities.

Wu Ming mainly focuses on exploring cutting-edge technical challenges and the development of related technologies. He is dedicated to technical research and development, committed to solving complex technical problems, and promoting innovation and progress in the project's technical field.

About the Stalled BTC L2

The BTC L2 project was actively pursued by the team when Mingwen was in the limelight at the end of last year. The Shu Tu team also actively promoted related attempts, but according to market feedback, the enthusiasm for this track has gradually waned, and the performance of existing projects is not ideal. Therefore, the team has chosen to temporarily suspend this investment. In Yuan Jie's view, this is a tactical exploration and choice, and he will continue to pay attention to and explore emerging tracks and opportunities in the industry.

About Institutional Investment and Market Makers

In the discussion about investment institutions and market coin prices for the Conflux project, Yuan Jie mentioned that the investment institutions of the Conflux Foundation will complete all unlocking in the first half of next year. Recently, the Conflux Foundation has also received strategic investments from other partners (but has not publicly disclosed this information). This new financial support has made the foundation's financial reserves relatively abundant, ensuring that the team can continue to focus on the development and promotion of the project. In short: Conflux is currently not short of money.

Regarding the performance of Conflux assets in the secondary market, Yuan Jie explained that this is a natural market behavior. The foundation had previously collaborated with market makers such as DWF. However, they found that their styles did not match, leading to the termination of the partnership. Currently, the Conflux Foundation is seeking to collaborate with more mainstream market makers, especially in different countries and regions' exchanges. These new partners will provide Conflux with longer-term and more closely integrated market-making services, not only offering market services but also participating in on-chain node work. This deep involvement will help build a healthy Conflux ecosystem and improve the performance of assets in the secondary market. Whether this ideal state will be achieved cannot be guaranteed by anyone, so as adults, everyone should take responsibility for their own judgment.

About the Positioning of the Conflux Public Chain Ecosystem

For the core team of the Shu Tu Research Institute and Conflux, entrepreneurship has entered its sixth year. During this time, the team's mindset has undergone significant changes.

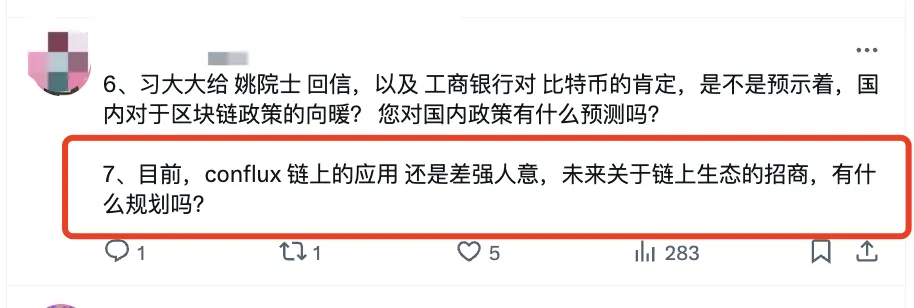

Initially, the Conflux team believed that a public chain should host hackathons in different countries and regions globally, attracting entrepreneurial teams to develop and be active on the public chain, similar to a business district's investment promotion. This strategy has been successful for other projects such as the Ethereum Foundation and Solana, as these projects have ample financial and traffic support (such as TON).

However, the team later found that this path might not be suitable for Conflux. Many ecosystem projects developed on Conflux gradually moved to other public chains as market and capital flowed, and Conflux did not have its own moat advantage. This cannot be blamed on developers, as everyone needs to make a living.

Conflux's positioning in the Web3.0 public chain race is a long-term strategic path. For Conflux, the Chinese-speaking region is where it can gain a more differentiated competitive advantage and build its moat in key segmented markets. Therefore, in addition to providing excellent performance, low cost, and outstanding user experience for its public chain services, Conflux also combines with Chinese regulatory policies to ensure the compliance of its network ecosystem. This provides a natural ideal platform for many entrepreneurs of Chinese background who wish to enter the Web3.0 field.

Although Conflux cannot always wave the flag of patriotism, China and the entire Chinese-speaking region do need their own public chain projects. Currently, there are few public chain projects led by Chinese people, and Conflux is in a good state in terms of compliance, technical capabilities, development pace, future plans, and sources of income. It can be expected that in the next 4 to 5 years, Conflux will be able to maintain its position in the global market value rankings and maintain patience to await the right timing.

About Conflux Ecosystem Projects Being Hacked

Regarding the concern about Conflux ecosystem projects being hacked, leading to asset losses, Yuan Jie also provided a detailed response and explanation.

Since the incident occurred, he has been actively pushing related work, including assisting users in reporting to the authorities in China and frequently communicating with the management of two major exchanges. For the small amount of less than 20,000 USDT stolen in this incident, the Conflux Foundation has already compensated the losses, but for users with larger assets, cooperation with the relevant exchanges is still required.

About the Conflux BSIM Card

Yuan Jie provided an introduction and sharing about the research work on the Conflux BSIM card project. Currently, the research work on the BSIM card has been completed, and pilot tests have been conducted in two cities in China, with very cost-effective package plans (Lawyer Mankun was also invited to participate in product testing).

Regarding the large-scale market launch of the BSIM card, this will depend more on the pace of progress of telecom partners, as they are state-owned entities, and their internal progress and market development are more stable. There is no way to rush it, and Yuan Jie's optimistic estimate is that substantial progress can be made before the end of the year. If it cannot be achieved, everyone can just consider it as boasting.

About Regulatory Policies, Hong Kong Market, and Hong Kong Dollar Stablecoin

Regarding whether regulatory policies in mainland China have relaxed and the market situation in Hong Kong, Yuan Jie's viewpoint includes the following:

First, it is highly probable that regulatory policies in mainland China regarding virtual currencies will not relax in the short term. This is mainly because it is directly related to the current economic situation and performance of the capital market in China. Relaxing restrictions on virtual currencies in the short term would not have a particularly positive impact on the domestic economic environment, as uncontrolled capital outflows do not align with current policies.

As part of China and with the support of mainland China, Hong Kong's exploration of Web3.0 and virtual currency finance is actually a good opportunity. However, currently, the majority of mainstream financial institutions in Hong Kong are still in a wait-and-see state regarding these new attempts. For example, the trading volume of virtual currency exchanges and the trading situation of Bitcoin ETFs launched in Hong Kong are not optimistic. This is mainly because most of those actively involved in these new initiatives are still capital or financial institutions from the mainland, such as China Asset Management and Southern Fund, while in Hong Kong's financial market, foreign capital or Western financial institutions are the main players in terms of funds and resources. This indicates that Western capital markets and financial institutions have not shown a positive attitude towards Hong Kong's current policies and matters regarding virtual currencies.

Secondly, regarding the Hong Kong dollar stablecoin. Yuan Jie's view is that the main sources of income for stablecoins are twofold: friction costs in the inflow and outflow process, for example, Tether's friction cost is approximately one-thousandth; and the returns on underlying assets. Tether's current total issuance of stablecoins is over a hundred billion, and the passive interest income is around four to five billion US dollars annually. The Tether stablecoin project team consists of no more than 80 people, and the revenue output brought by these 80 people is very impressive. From these two perspectives, if the Hong Kong dollar stablecoin is to be launched, it needs to solve not only the settlement problem between traditional funds or financial institutions but more importantly, whether it can become a native application tool in the virtual currency market, such as one of the trading pairs on virtual currency exchanges, or whether it can become a payment settlement tool for a large number of small and medium-sized merchants. Currently, some domestic companies are already attempting overseas stablecoin businesses, including JD Finance's user settlement business overseas.

Regarding the Hong Kong dollar stablecoin, Conflux's partners in Hong Kong are already preparing for related compliant Hong Kong stablecoin matters and are expected to be on the first batch, but the government's pace in promoting this project is slightly lower than expected. Based on the Hong Kong dollar stablecoin, Conflux hopes to conduct more financial technology experiments on-chain, rather than just being a settlement tool for traditional financial institutions.

About the Web3.0 Industry Snobbery Chain

Yuan Jie admitted that currently, Chinese projects are not always welcomed in the Web3.0 investment circle. Projects with European and American faces have an advantage in fundraising and obtaining higher valuations, while Chinese projects are relatively disadvantaged, which is a bias existing in the industry. In previous years, some domestic investment institutions continued to pay attention to and invest heavily in emerging opportunities in the Web3.0 field. However, in the past two years, traditional domestic funds have significantly reduced their attention and investment in Web3.0 projects. This does not mean that Chinese projects are weaker in terms of development capabilities or technical research and development. Those behind the projects are still Chinese, relying on their strength for research and development.

In this market environment, combined with the current regulatory policies in mainland China, for the vast majority of Chinese Web3.0 entrepreneurs, engaging in native Web3.0 technology development or blockchain projects will face significant limitations. A better approach is to find some cross-disciplinary businesses, meaning using blockchain as an auxiliary technology, applied in interdisciplinary or entrepreneurial fields. For example, the combination of AI and blockchain, using some blockchain technology or elements as a differentiated highlight in one's entrepreneurial project, is a better choice at the current stage, both in terms of recognition in the capital market and the risk of the project itself.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。