Author: Weird Thoughts, BlockBeats

The first data DAO, the first user-owned data network

Reddit revealed in its IPO prospectus in February this year: By signing data authorization agreements with AI companies, it has generated a total of $203 million in revenue. The reason why AI companies are willing to spend a lot of money is that data, like computing power, is an essential key resource for developing AI models.

Sadly, none of this revenue flows to Reddit's users, even though they are the actual creators of over 1 billion posts and over 16 billion comments on the platform.

In the face of such great injustice, the first data DAO "r/datadao" was born on April 4th. It encourages users to export their data on the Reddit platform and upload it to the community database, and collectively vote to rent the data to AI companies to share the profits. Users can also receive governance tokens RDAT based on their data contributions.

Subsequently, it was revealed by the media that the mastermind behind r/datadao is a startup company Vana, which raised $20 million from VC giants such as Paradigm and Polychain Capital. Encouraged by this news, RDAT surged 50 times from the opening price of $0.011 to a high of $0.67 within 5 days. However, it later adopted a mode of unlimited issuance at any time, causing the price of RDAT to plummet back to its initial level without a resurgence.

Generally speaking, the story ends here. In the world of cryptocurrency projects, this basically means Game Over.

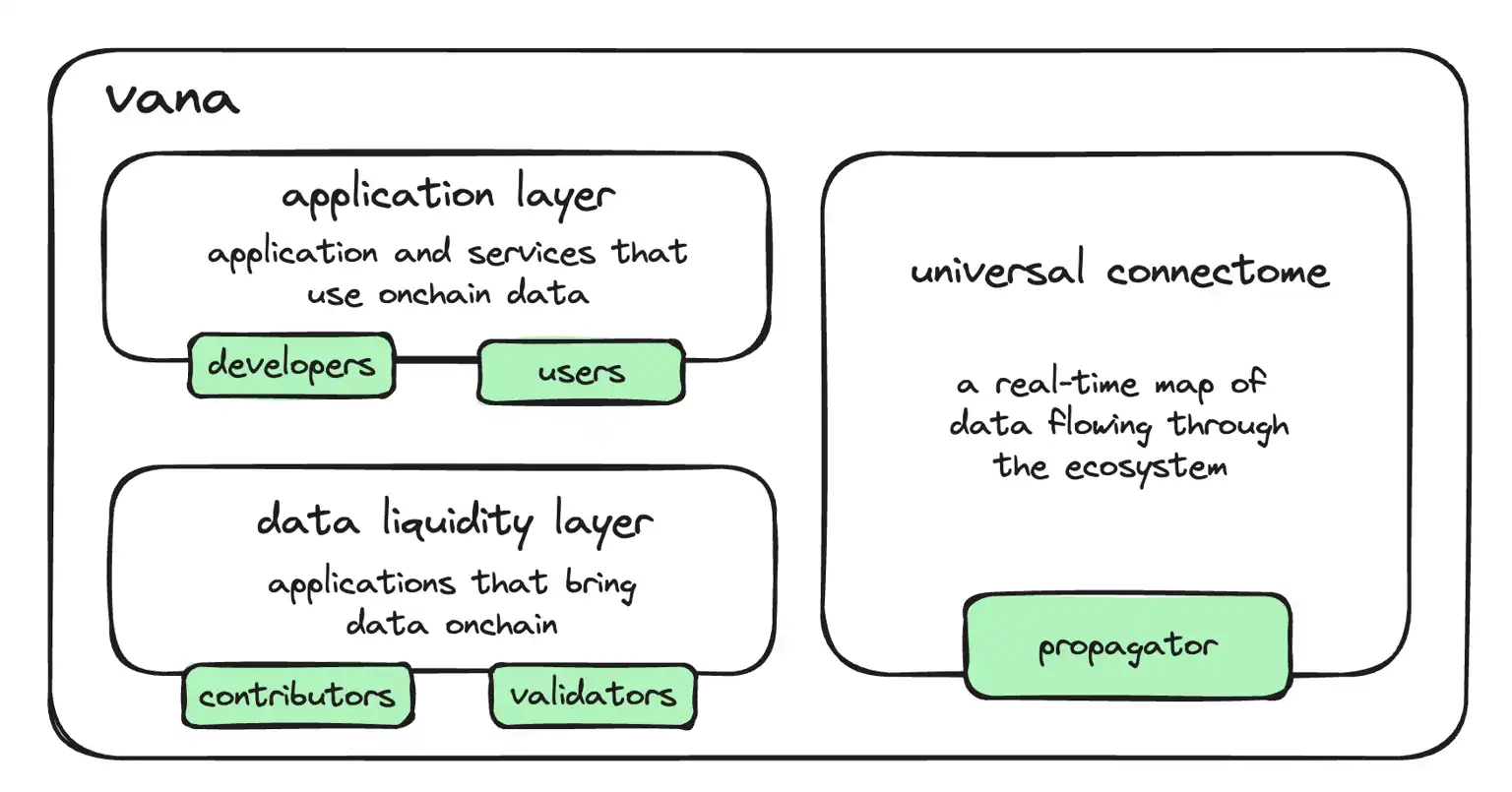

While our attention has been focused on r/datadao, we have overlooked what the behemoth Vana really wants to do. r/datadao is just a trial for Vana to reclaim user data rights from the giants. What it really wants to do is to establish the first user-owned data blockchain network. In this open internet, users own and manage their data, as well as the intelligent products created from this data. Users obtain ownership of AI models by contributing data, and the value flows to users and independent model developers, rather than centralized platforms.

Yes, Vana wants to create a completely new public chain. On June 11th, this public chain welcomed its first testnet, "Satori Testnet". It turns out that the drama of challenging the giants has just begun.

A completely new public chain is actually a small Bittensor?

In fact, Vana's public chain is not entirely new. In many ways, it is very similar to Bittensor.

What Bittensor is most famous for is its market mechanism that "multiple subnets compete with each other to improve the quality of digital goods production for AI development".

It can be said that Vana has imitated Bittensor's entire mechanism to serve its own need to "establish an efficient data liquidity network".

Therefore, Vana has proposed the concept of DLP, which is like a subnet to Bittensor. To understand Bittensor, it is most important to understand "subnets". Similarly, to understand Vana, one must understand "DLP".

DLP

DLP stands for "Data Liquidity Pool".

At the blockchain level, Vana is an EVM-compatible chain based on proof of stake consensus, and DLP is actually a smart contract on the Vana network.

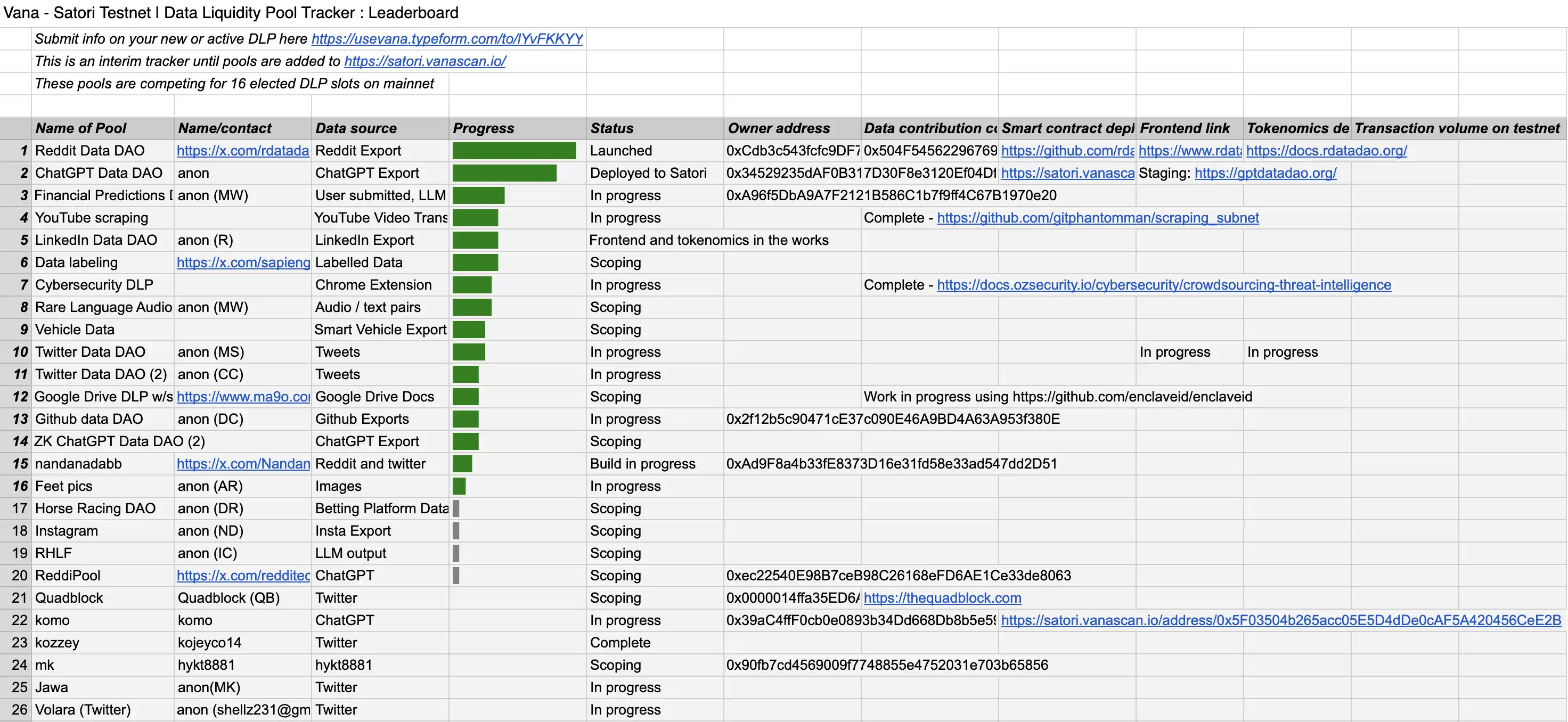

Data DAOs like r/datadao are specific manifestations of DLP. Builders on the Satori testnet are currently developing various data DAOs such as ChatGPT Data DAO, LinkedIn Data DAO, Twitter Data DAO, and Github Data DAO.

In the future, the Vana mainnet will launch 16 DLP slots, and native Gas token DAT holders of the Vana network will vote to select from all the DLPs on the testnet based on total transaction volume, transaction fees, verified data upload volume, and interaction frequency with independent wallets.

Just like subnets can receive TAO emission rewards from Bittensor, DLPs can also receive DAT emission rewards from Vana. Of course, DLPs that are not selected can still receive emission rewards, but not as much as the top 16 DLPs. New DLPs must also operate without emission rewards for a period of time to prove themselves.

Users who submit data to DLPs are called "data contributors" and receive specific token rewards from DLPs based on the quality of their data contributions, similar to miners on Bittensor subnets who receive TAO token rewards for completing various tasks. Each DLP will implement its own contribution proof function based on its specific dataset. For example, r/datadao measures the value of data contributions by users' "Karma" and requires users to post code in their Reddit profiles to confirm ownership.

There is an ordinary but significant detail here, I wonder if the readers have noticed? That is, the rewards given to users by DLPs are not Vana network's native Gas token DAT, but their own specific governance tokens! This means that Vana allows each DLP to create its own dataset-specific tokens, allowing DLPs to fully control the token economy of their pools. r/datadao gives users its own governance token RDAT and can fully control its token supply. This is currently the most different aspect between Vana and Bittensor, and it is also a question that I will focus on at the end of the article.

Nagoya Consensus

The data submitted by users first needs to be scored by validation nodes, which will evaluate the quality of the submitted data based on the standards set by the DLP creator. In this process, Vana adopts a fuzzy consensus mechanism similar to Bittensor's Yuma consensus, called the Nagoya consensus, where a group of validation nodes collectively assess the quality of the data submitted by users and determine the final score using a weighted average.

In addition, validation nodes will also score the rating behavior of other validation nodes. If a validation node gives a high score to a very poor quality file, other validation nodes will give a low score to that node.

Every 1800 blocks (approximately 3 hours) form a cycle (epoch). At the end of each cycle, the DLP contract will allocate emission rewards to validation nodes based on the final score. This mechanism not only suppresses behaviors that deviate from the majority consensus, but also incentivizes validation nodes to honestly evaluate data contributions.

All transactions will be verified for validity by propagation nodes and added to blocks in the Vana network for confirmation. Propagation nodes can earn transaction fees and emission rewards in the same way as other EVM-compatible chains based on proof of stake consensus.

User Self-Hosting Data

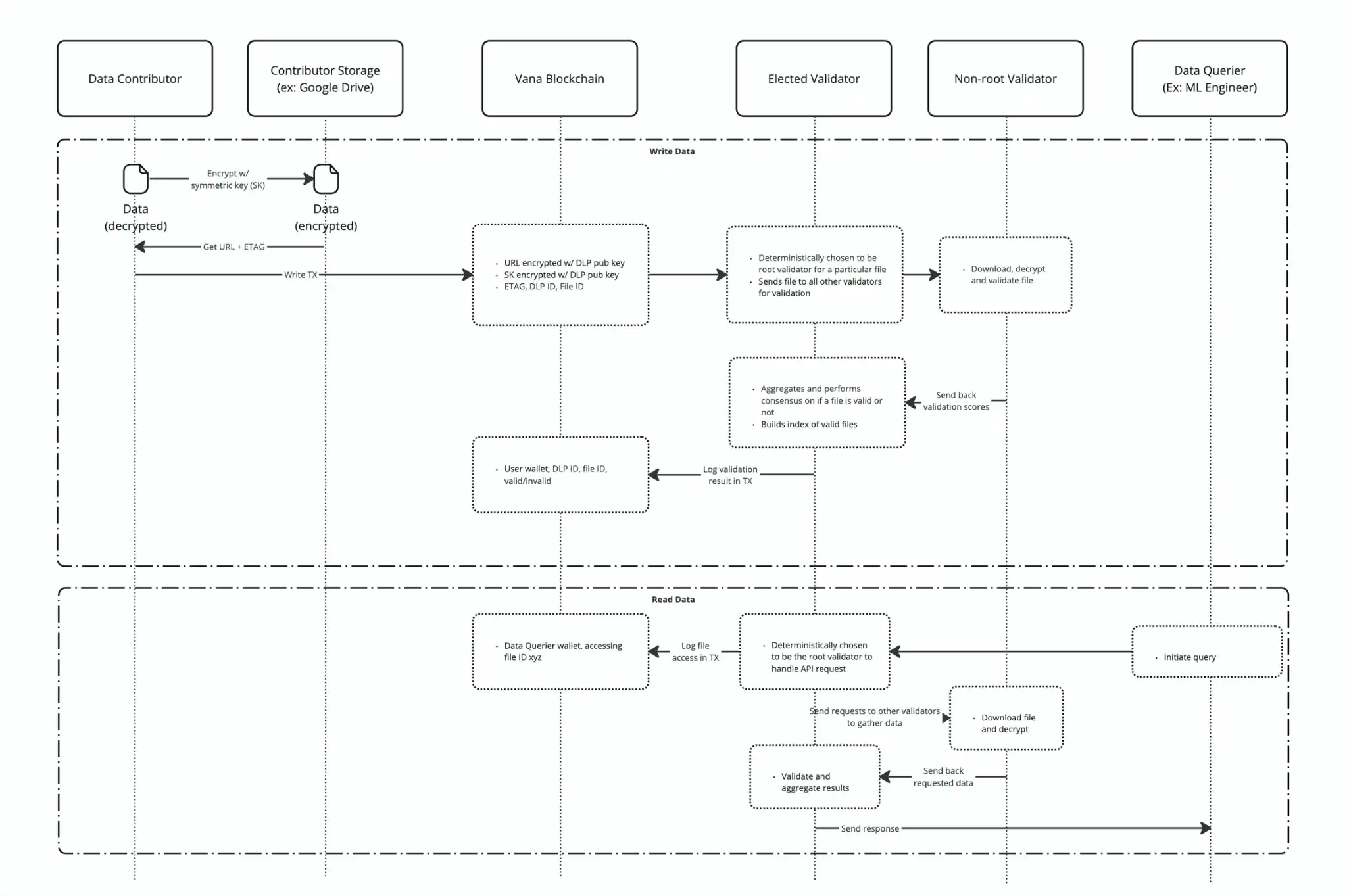

It is worth noting that although users submit personal data to data DAOs, this data is not actually stored on the chain.

Data, unlike tokens, is non-exclusive, and once it is publicly stored on the chain, it can be freely copied. To make data liquid, it is necessary to first ensure that users have control over their private data, ensuring that data will not be used multiple times without the owner's consent, which means the "double spending problem" of data must be solved.

In this regard, Vana, through its ingenious and rigorous design, has made the process of data circulation for users akin to a carefully choreographed dance.

First, data contributors encrypt the data using symmetric keys and store the encrypted data in personal cloud storage accounts such as Google Drive. After obtaining the URL and unique identifier (ETAG) of the data, this information, along with the encryption key, is recorded on the Vana blockchain. Then, selected validation nodes act as root validation nodes, responsible for coordinating other validation nodes to download, decrypt, and verify the data files. Through a fuzzy consensus mechanism, the validation nodes confirm the validity of the data and record the results on the blockchain, creating an index of valid files.

When a data query is initiated, the root validation node once again organizes the validation nodes to download, decrypt, and aggregate the data, and finally delivers the securely verified data to the query initiator. Throughout the process, only legitimate validation nodes can decrypt and access the data through blockchain permission control, preventing unauthorized downloads and decryption operations.

Building on a solid foundation of data liquidity and blockchain, Vana has created an open application layer for collaboration between data contributors and developers. Developers can use the data liquidity accumulated by DLPs to build applications, while the contributor community can create real economic value from their data.

A Step Ahead in Implementing the dTAO Mechanism?

As mentioned earlier, the biggest difference between Vana and Bittensor is that Vana allows DLPs to have their own token economy.

I believe that most people initially had the same doubts as I did: Why should each DLP create its own token? What if they mess up (like the governance token RDAT of r/datadao experiencing a rollercoaster ride)? I didn't see any necessity in doing this.

It wasn't until consulting with the Vana team that I realized that Vana not only wants to simply adopt Bittensor's mechanism, but also wants to take a more proactive approach to the challenges currently faced by Bittensor. Allowing each DLP to have its own token economy is the core of Bittensor's slow-moving Dynamic TAO (BIT001) network upgrade.

Bittensor's Dynamic TAO upgrade aims to decentralize the allocation of TAO emissions, which was originally decided by a few validation nodes in the root network, to all TAO holders through a market-based dynamic pricing mechanism. For this mechanism to work, each subnet needs to issue its own token (dTAO token) and establish a liquidity pool of subnet tokens and TAO. TAO holders can choose to stake TAO in the liquidity pool corresponding to different subnets to receive the specific dTAO token of that subnet.

Each subnet's dTAO token has its own independent supply, and subnet validation nodes use dTAO to participate in consensus and receive rewards. The price of each pool is determined by the ratio of TAO and dTAO reserves, reflecting the market demand for that subnet. Bittensor will inject newly issued TAO into each pool according to the ratio of dTAO pool prices.

This changes the original TAO allocation based on root network voting to allocation based on the price ratio of dynamic TAO pools, allowing all TAO holders to "vote with their feet" through staking behavior to determine which subnets should receive more TAO rewards.

Although Vana's official documentation still indicates that the "root network" module is responsible for managing DLPs and token reward distribution, it is clear that Vana wants to move away from this centralized governance mechanism before the mainnet goes live, taking a bolder step forward compared to Bittensor.

Why do I say "taking a bolder step forward compared to Bittensor"? That's because the original method of TAO allocation based on root network validation node voting, although relatively centralized, provides validation nodes with the motivation to maintain their reputation and be relatively cautious. Allowing all token holders to participate may attract speculators and affect ecosystem stability. Since the price of dTAO pools is entirely determined by market supply and demand, sudden large staking or unstaking by major holders may cause significant price fluctuations, leading to substantial fluctuations in TAO allocation based on their price ratio and systemic risk.

If Vana does indeed intend to adopt a similar approach to Bittensor's dTAO mechanism after the mainnet goes live, it must be prepared to address the above issues in advance. Its former teacher, Bittensor, is still moving forward, with no one paving the way or testing for it.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。