Author: 10x Research

Translation: Felix, PANews

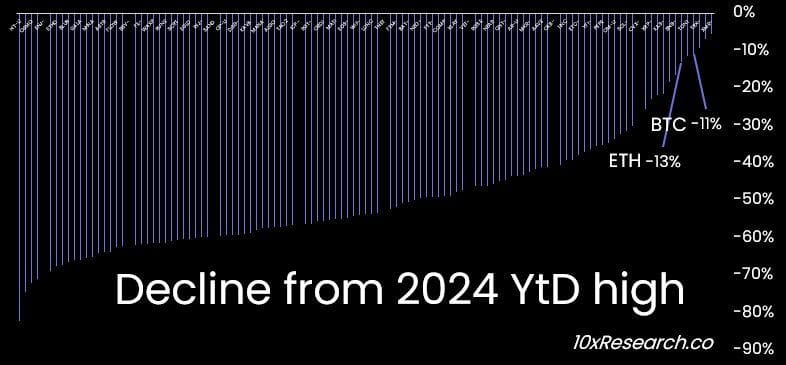

Today's headline resonates with everyone who traded altcoins in 2017 or 2021. 10x Research analyzed 115 tokens, and the average price has dropped 50% from the peak in 2024. As explained below, the decline will be more severe unless the liquidity of cryptocurrencies improves. Bitcoin (-11%) and Ethereum (-13%) have performed well, and as smarter traders shift from altcoins to these two tokens, both may benefit from it (as has happened in the past two cycles).

Tokens ranked in the top 115 by market capitalization: Down from the 2024 peak (Bitcoin only down 11%)

One of the key factors for surviving the bear market of altcoins is effective risk management. Token unlocks and unfavorable liquidity indicators are the main causes of the current collapse of altcoins.

Last week was a crucial moment in the crypto space, and one of the most critical weeks of 2024. Cryptocurrencies, especially altcoins, experienced a significant decline. The market struggled to absorb a large amount of token unlocks, totaling $483 million, including Aptos at $97 million, IMX at $51 million, STRK at $75 million, SEI at $62 million, ARB at $90 million, APE at $18 million, and UNI at $90 million. Early investors and venture capitalists seem to be facing pressure to cash out. These fund flows are dragging down Bitcoin.

In addition, Bitcoin miners have started selling their Bitcoin inventory, and the ETH balance on exchanges has increased by $2.5 billion, which was related to potential selling pressure. Despite improving inflation data, there has been a significant net outflow from Bitcoin ETFs (approximately $660 million outflow in 5 days). The overall net flow across various segments (stablecoins, futures leverage, ETFs, etc.) is -$2.4 billion, marking the third consecutive week of net outflows since the launch of ETFs in January 2024.

On May 8th, 10x Research issued a warning, "Beware of token unlocks. Do venture capital foundations shorten the altcoin cycle? Nearly $2 billion worth of tokens will be rapidly unlocked in the next ten weeks, which may lower the price of the altcoin market." A core argument is that venture capital funds invested $13 billion in the first quarter of 2022, and the market quickly entered a bear market. With artificial intelligence becoming a more popular field, these funds are now facing pressure from investors to return capital.

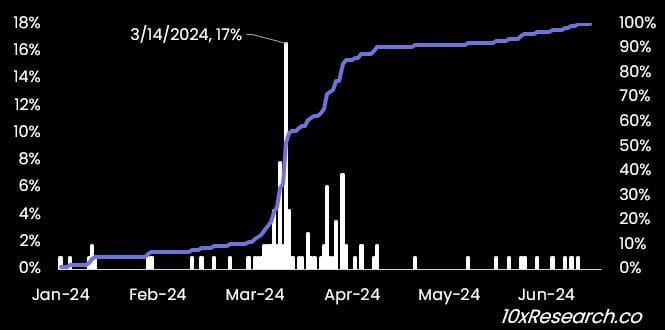

Today, altcoins are in a brutal bear market. In 2024, 73% of these 115 tokens reached their peak in March. But in early March, the situation changed. Among the tokens ranked in the top 115 by market capitalization, 17% (on the left) reached their peak on March 14th (all have now experienced a decline).

In early March 2024, Bitcoin reached a potential year-end target of $70,000. Last year, 10x Research predicted a year-end target of $45,000 for 2023. In October 2022, it was predicted that Bitcoin would rise to $63,000 when halving in 2024. Higher targets ($125,000) can be derived through quantitative analysis, but the shrinking liquidity in the crypto market is hindering its development.

Related reading: Opinion: "618" Discount, Where Will the Crypto Market Go?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。