Undoubtedly, the current BTC futures market is no longer controlled by traditional cryptocurrency exchanges and retail investors, but has fallen into the hands of professional traders in the United States.

Author: Crypto_Painter

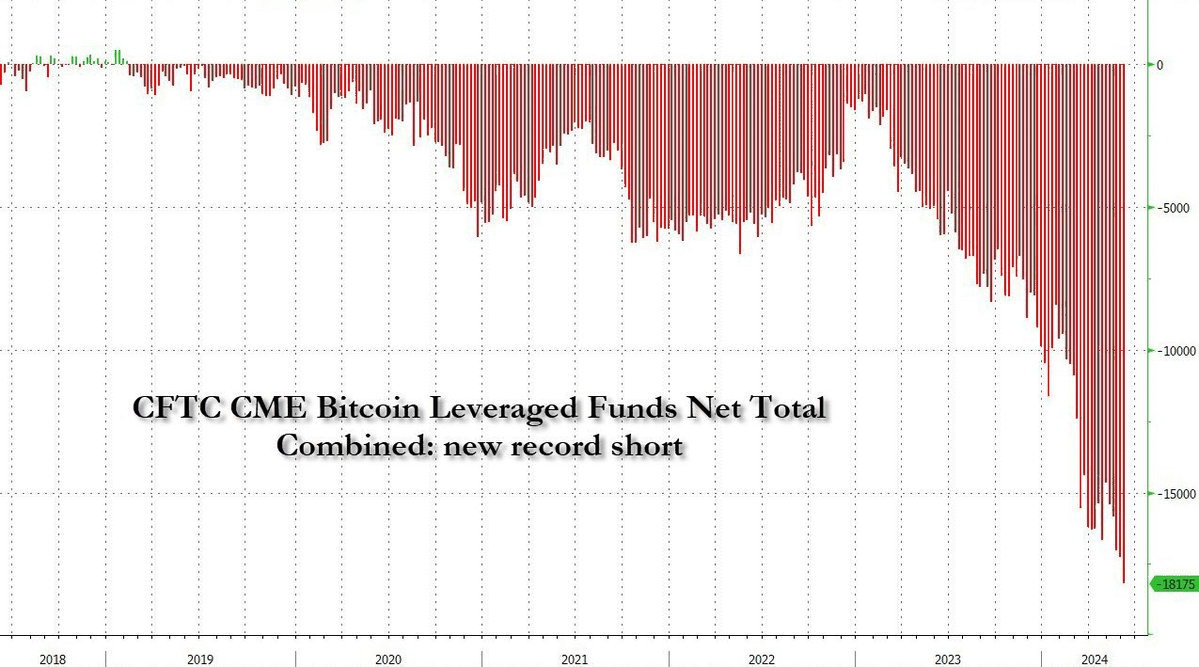

Recently, the entire market has shown a hint of panic, largely due to the massive short positions held by CME. As a veteran in the cryptocurrency circle, I still remember that when CME officially launched BTC futures trading, it coincided with the end of the epic bull market in 2017!

Therefore, studying these massive short positions at CME is of extraordinary significance!

First, let me introduce the background:

CME refers to the Chicago Mercantile Exchange, which launched BTC futures trading at the end of 2017, with the commodity code: [BTC1!]. Subsequently, a large amount of Wall Street institutional capital and professional traders entered the BTC market, dealing a heavy blow to the ongoing bull market, leading BTC into a bear market that lasted for 4 years.

With more and more traditional funds entering the BTC market, the institutional traders (hedge funds) and professional traders served by CME began to participate more in BTC futures trading.

During this period, CME's futures open interest continued to grow, and last year it successfully surpassed Binance, becoming the leader in the BTC futures market, with a total open interest of 150,800 BTC, equivalent to approximately $10 billion, accounting for 28.75% of the entire BTC futures market.

Therefore, it is no exaggeration to say that the current BTC futures market is no longer controlled by traditional cryptocurrency exchanges and retail investors, but has already fallen into the hands of American professional institutional traders.

As more and more people have recently discovered, not only have CME's short positions increased significantly, but they have also recently reached a historical high and continue to rise. As of the time I am writing this article, CME's short position has reached $5.8 billion, and there is no sign of a significant slowdown.

Does this indicate that the elite capital on Wall Street is heavily shorting BTC and has no confidence in the future performance of this bull market?

Purely based on the data, it does seem so. Moreover, BTC has never maintained a period of consolidation for more than 3 months after breaking historical highs in a bull market. All signs indicate that these large funds may be betting that this round of BTC bull market will not perform as expected.

Is reality really like this?

Next, I will explain where these massive short positions at CME come from, whether we should feel fearful, and what impact this has on the bull market.

First, if you frequently check the prices at CME, you will notice an interesting feature: the price of the BTC1! futures trading pair is almost always several hundred dollars higher than the Coinbase spot price. This is easily understood because CME's BTC futures are settled monthly, similar to the monthly forward contracts in traditional cryptocurrency exchanges.

Therefore, when the market sentiment is bullish, we can often see varying degrees of premium on the forward contracts, such as a very high premium on the quarterly contracts during a bull market.

If we subtract the price of CME's BTC futures from Coinbase's spot price (both are USD trading pairs), we get the following chart:

The orange line represents the price of BTC at the 4-hour level, while the gray line represents the premium of CME futures prices relative to CB spot prices.

It is clear that the premium of CME futures fluctuates in a regular pattern as each monthly contract is rolled over (automatically moved to the next month's contract). This is similar to the premium on forward contracts in traditional cryptocurrency exchanges, which tend to have a high premium when the contracts are generated and gradually flatten out as the contracts approach expiration.

It is because of this pattern that we are able to engage in a certain degree of arbitrage between futures and spot prices. For example, when the quarterly contracts on a CEX exchange are generated after a period of a bull market, if the premium has already reached 2-3%, we can invest $2 million, buying $1 million in spot and opening a $1 million short position on the quarterly contract.

During this period, regardless of price fluctuations, the short position is unlikely to be liquidated. As long as the premium is gradually flattened out before the quarterly contract expires, we can achieve a risk-free stable return of 2% on $1 million, which is $20,000.

Do not underestimate this return. For large funds, this is almost risk-free high returns!

If we do a simple calculation, CME generates a new contract on average every month. Starting from 2023, the average premium is 1.2%. Considering the transaction fees for this operation, let's assume it's 1%. This means that over the course of a year, there is a fixed 1% risk-free arbitrage opportunity every month.

Assuming 12 times a year, this is roughly a risk-free annualized return of 12.7%, which already surpasses the returns of most money market funds in the United States, not to mention the interest earned by depositing this money in a bank.

Therefore, at present, CME's futures contracts are a natural arbitrage venue. However, there is still a question: where can one buy spot from if futures can be traded at CME?

CME serves professional institutions or large funds, and these clients cannot trade like us by simply opening an account on a CEX exchange. Most of their money is also from LP, so they must find a compliant and legal channel to purchase BTC spot.

Ta-da! How coincidental that the BTC spot ETF has come through!

With this, the loop is complete. Hedge funds or institutions buy a large amount on the US stock ETF, while simultaneously opening an equivalent short position at CME, conducting a risk-free fixed arbitrage every month, achieving a stable return of at least 12.7% annually.

This argument sounds very natural and reasonable, but we cannot rely solely on words; we need to verify it with data. Have American institutional investors really been arbitraging through ETF and CME?

As shown in the following figure:

I have marked on the chart the periods when CME's futures premium was extremely low since the ETF was launched, and the sub-chart below shows the bar chart of net inflows of my own BTC spot ETF.

You can clearly see that whenever the premium of CME futures starts to significantly shrink, to less than $200, the net inflow of the ETF also decreases, and when CME generates a new monthly contract, there is a large net inflow of the ETF on the first Monday of trading for the new contract.

To a certain extent, this can indicate that a considerable portion of the net inflow funds in the ETF are not purely purchasing BTC, but are being used to hedge the high premium short positions to be opened at CME.

At this point, you can go back and take another look at the data chart of CME's futures short positions. You will find that the time when CME's short positions truly began to surge by 50% is just after January 2024.

And the BTC spot ETF began trading officially just after January 2024!

Therefore, based on the somewhat incomplete data analysis above, we can draw the following research conclusions:

The massive short positions at CME likely include a significant portion of shorts used to hedge the spot ETF, so the actual net short position should be far less than the current $5.8 billion, and we do not need to panic because of this data.

The net inflow of the ETF, totaling $15.1 billion as of now, likely includes a considerable portion of funds in a hedging state. This explains why the historical second-highest net inflow of the ETF in early June ($886 million) and the entire week's net inflow did not lead to a significant breakthrough in BTC's price.

Although there is a lot of speculation in CME's short positions, there was already a significant increase before the ETF was approved. Moreover, during the subsequent bull market, from $40,000 to $70,000, there were no major liquidations, indicating that there is likely still a significant amount of capital among American institutional investors that firmly believes in the bearish outlook for BTC, so we should not take this lightly.

There needs to be a new understanding of the daily net inflow data for ETFs. The impact of net inflow funds on market prices may not necessarily be positively correlated, and there may also be a negative correlation (large ETF purchases leading to a decrease in BTC price).

Consider a special scenario: when the future premium at CME is completely eliminated by these arbitrage systems one day, and there is no potential arbitrage space, we will see a significant reduction in CME's short position, corresponding to a large net outflow from the ETF. If this situation occurs, there is no need to panic; it simply indicates a withdrawal of liquidity from the BTC market in search of new arbitrage opportunities.

Finally, some thoughts: where does the premium in the futures market come from? Is the wool really on the sheep? I may conduct new research on this in the future.

Well, that's the summary of this research. This issue leans towards market research and does not provide clear directional guidance for trading. However, it is very helpful for understanding market logic. After all, when I see the massive short positions at CME, I feel a bit scared, and it even brings back memories of the prolonged bear market from 2017 to 2018…

That bear market was much more nauseating than today's volatile market. But fortunately, at present, BTC is indeed favored by traditional capital. To put it bluntly, the fact that hedge funds are willing to arbitrage in this market is essentially a form of recognition, even though the money comes from us retail investors, haha.

Finally, if you have doubts about the uniqueness of this bull market, you can also read the discussion in the article "Is this bull market more complex than previous ones?" mentioned in this article for a better understanding when combined with this one!

Thank you for reading!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。