Author: Alex Liu, Foresight News

The Aptos public chain was built by some members of Facebook's former blockchain team Diem after they became independent, raising a whopping $350 million. After giving out a large airdrop on the testnet, the Aptos mainnet has been online for over a year and a half, and the ecosystem projects are becoming increasingly mature, but most have not yet issued coins. How to layout in order to maximize the benefits of interacting with the Aptos ecosystem? This article takes stock of the main potential projects in the ecosystem and provides detailed interaction paths.

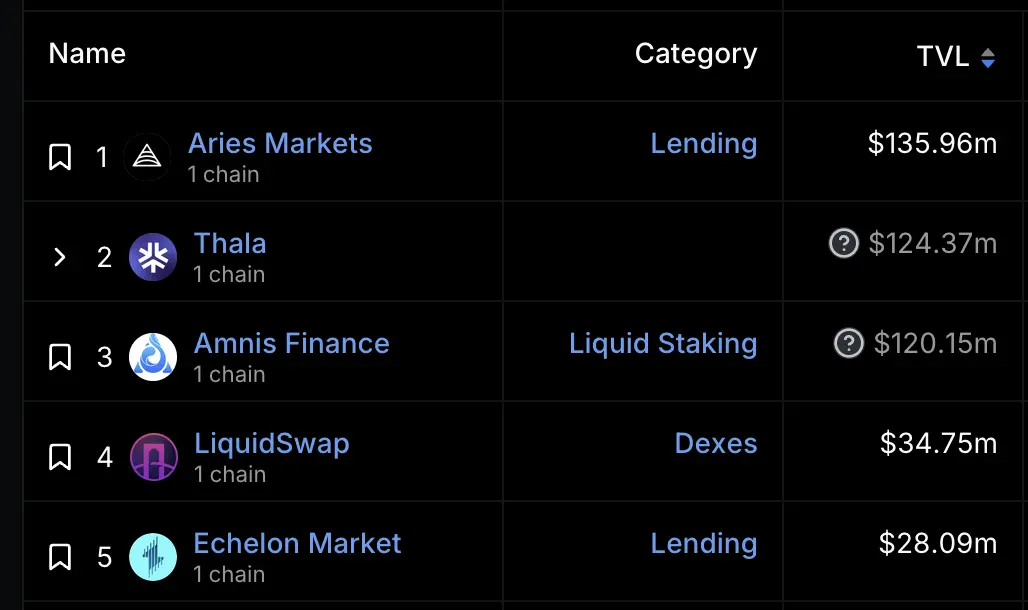

The top 5 protocols in the Aptos ecosystem TVL ranking on DefiLlama, only Thala has issued coins

Potential Projects

Aries Markets

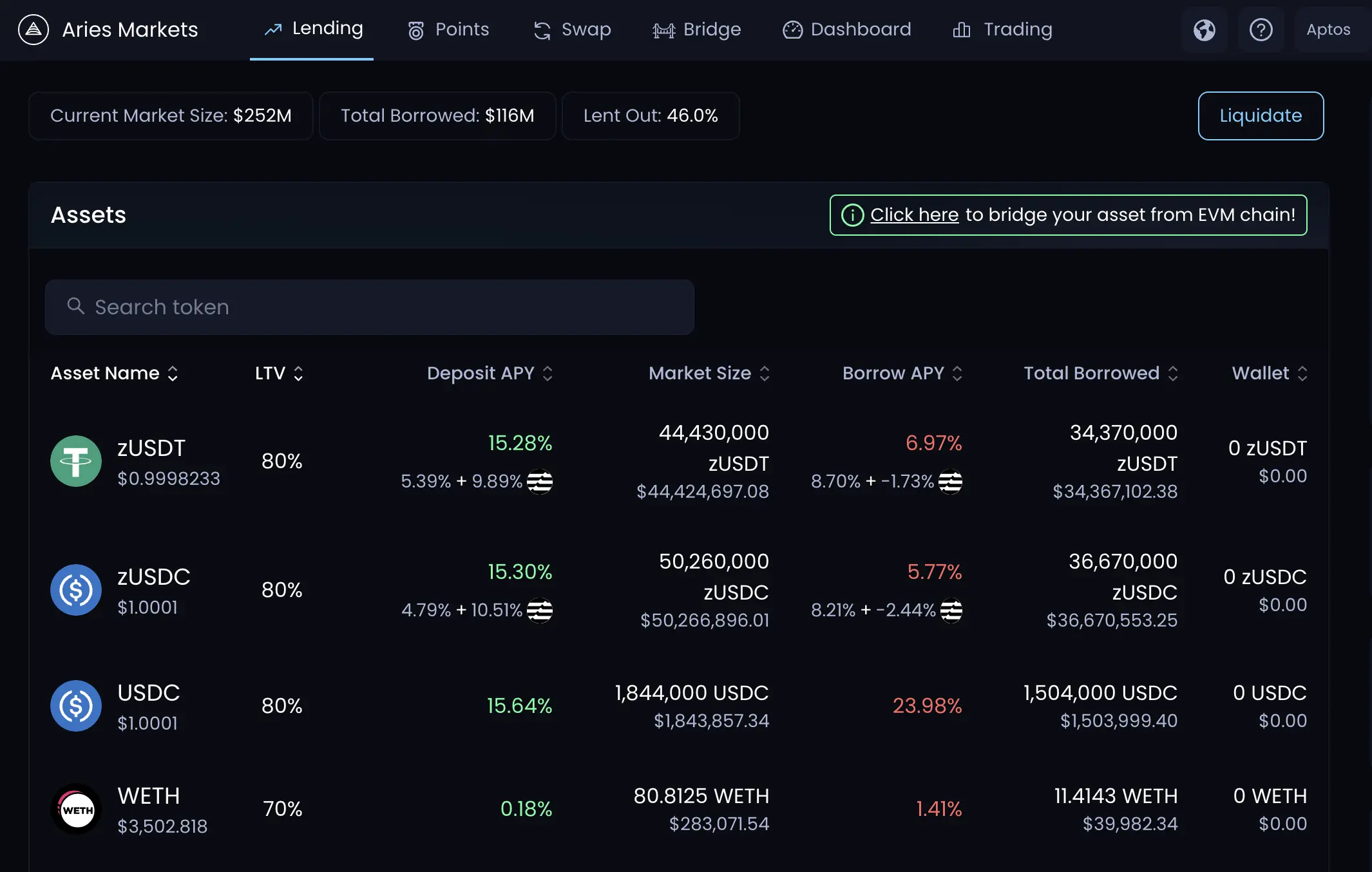

Aries Markets is the largest lending protocol on Aptos in terms of TVL, and also the largest protocol in all categories. It has qualified for incentives from the Aptos Foundation. Currently, storing and borrowing zUSDT and zUSDC (USDT and USDC bridged by LayerZero) in the protocol can earn APT token subsidies, and the interest rates are considerable. In addition to receiving airdrops, it is also a good place for daily deposits and loans.

Aries Markets has launched a points system, where depositing one dollar of assets can earn 1 point per day, and lending one dollar of assets can earn 3 points per day. The participation method is simple and clear: to receive Aries airdrops, you need to first go to the points page to register and link your X (Twitter) account, and then participate in the protocol's storage and borrowing.

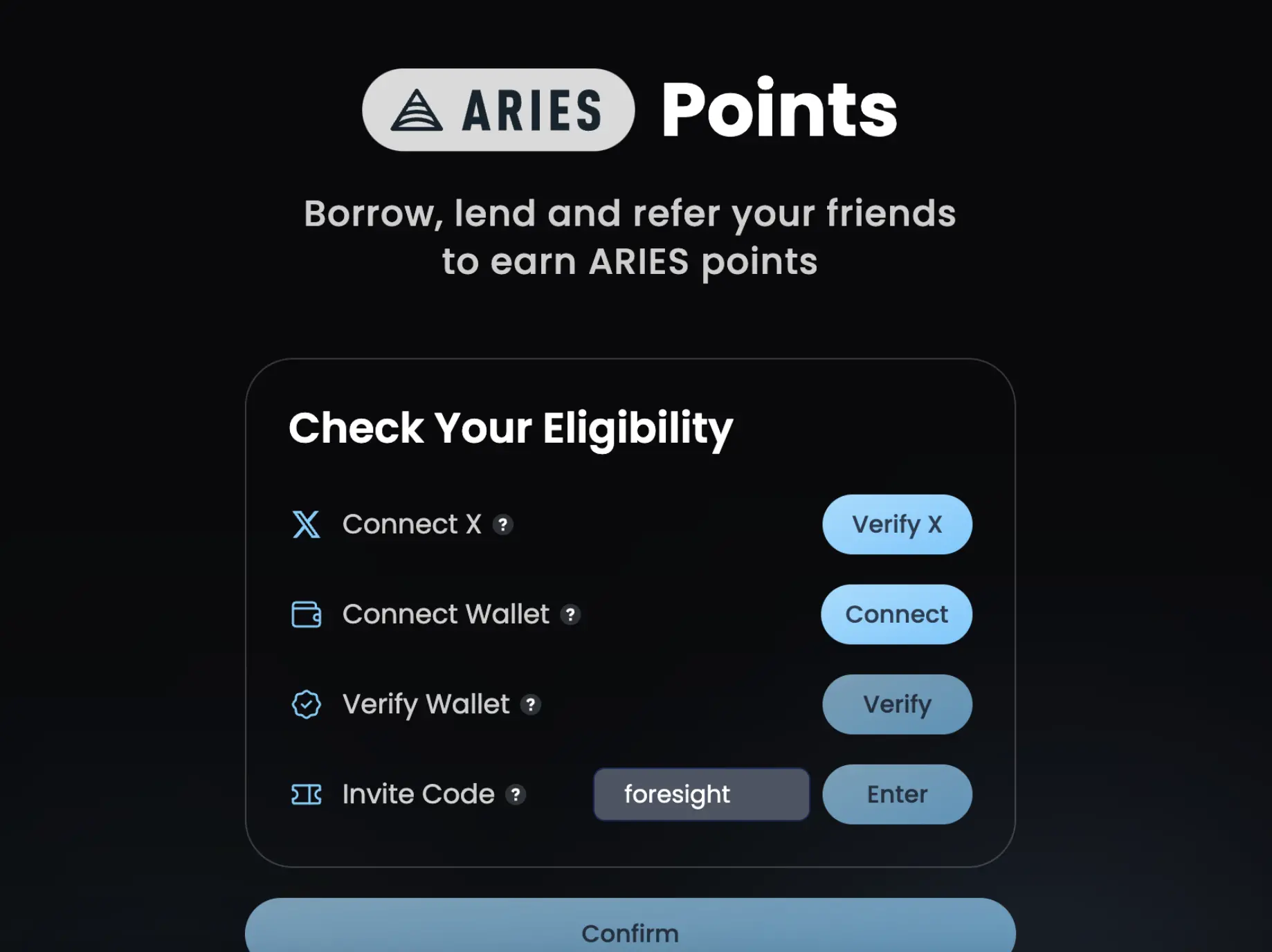

Points

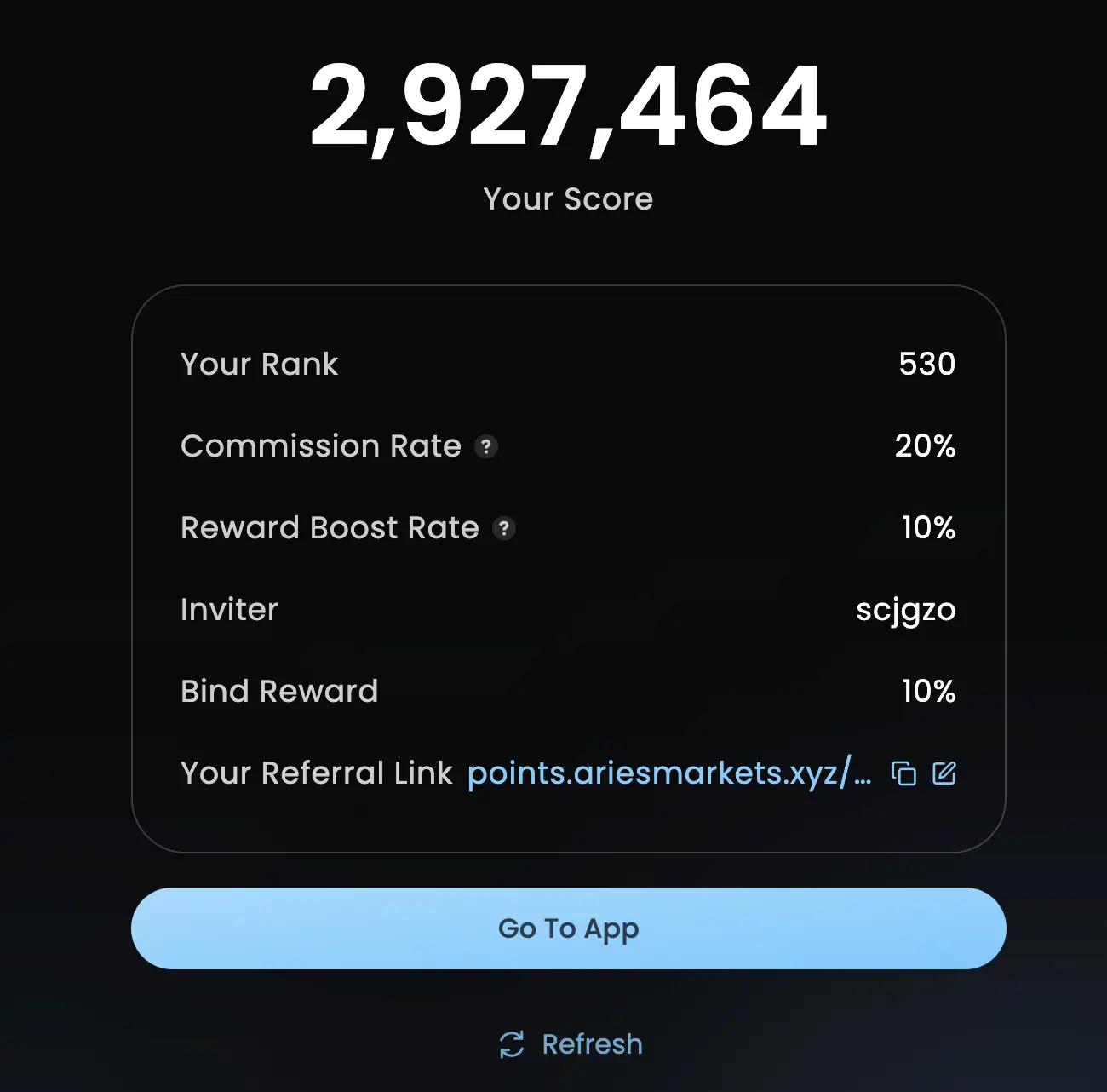

Registering with an invitation code gives a 10% bonus in points. After linking the account and setting it correctly, the page looks like this:

Since the airdrop is based on a points system and activating the points system requires linking an X account to filter out bots, it is suggested that only a moderate number of points be obtained, as it seems to be of little significance to obtain a large number of points.

Amnis Finance

Amnis Finance is a liquidity staking protocol on APT, where users can exchange APT 1:1 for amAPT, which can be redeemed for an equivalent amount after 1 month, or exchanged for approximately 1% discount directly on DEX, and further staking to earn stAPT, which accumulates staking rewards similar to wstETH.

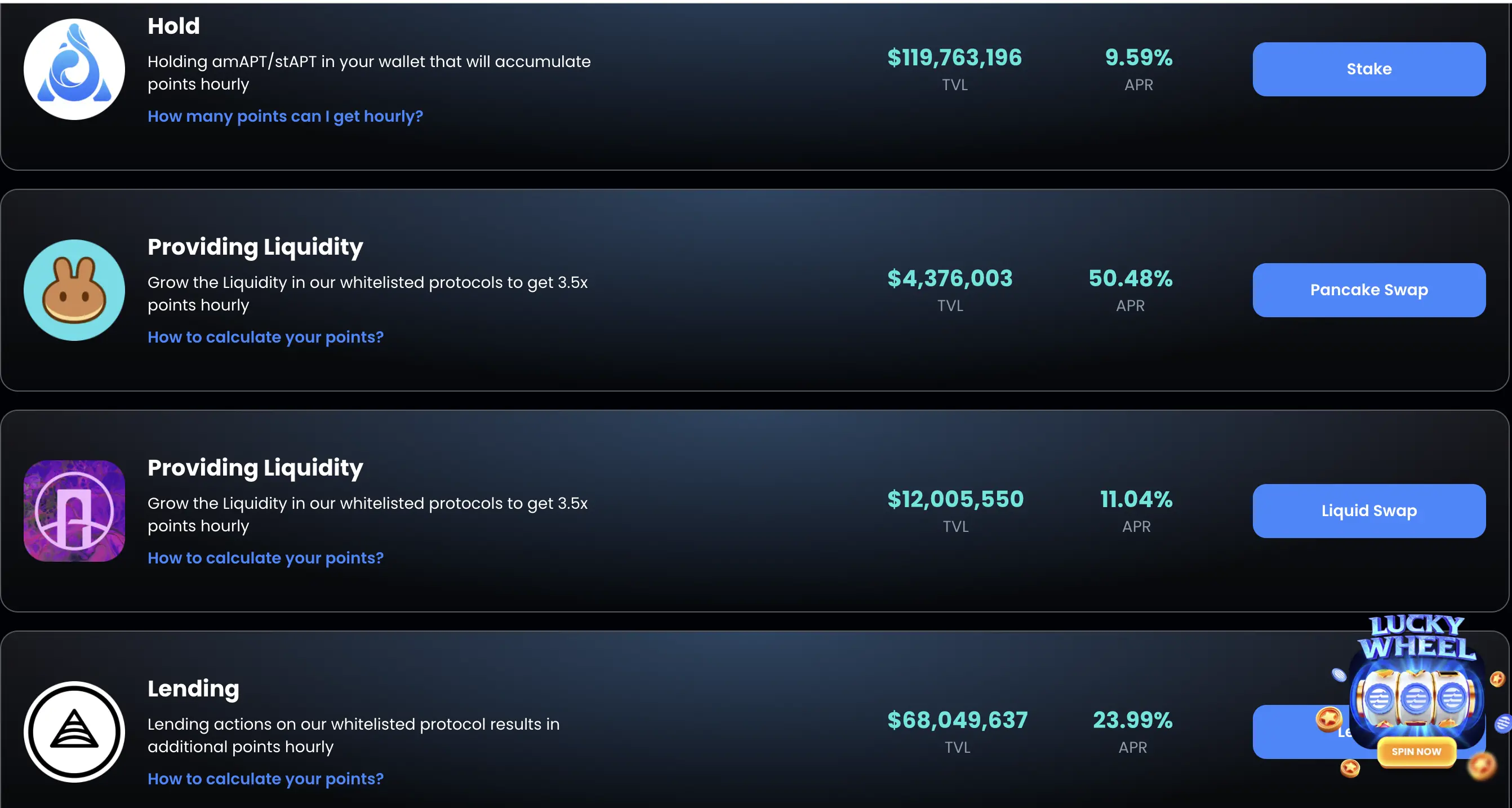

The retroactive airdrop activity of Amnis Finance is currently ongoing, with participation methods including:

- Minting amAPT, staking stAPT, accumulating 1 point for each APT

- Holding amAPT and stAPT in the wallet, generating points hourly, with a total of 1 point per APT per month

- Providing liquidity for amAPT-APT pairs on Pancake Swap or Liquid Swap, with a 3.5x multiplier for amAPT in the LP compared to holding it simply in the wallet. (Liquid Swap is recommended, not yet issued coins, tutorial to follow)

- Lending stAPT to lending protocols such as Aries Markets, with a 1.2x multiplier for points. (Aries also provides a bonus for stAPT)

Multiple ways to participate in Amnis Finance

LiquidSwap

LiquidSwap is the first DEX on Aptos. Its project party, Pontem Lumio, has raised $10.5 million from well-known capital sources such as Mechanism, Lightspeed, Faction, and Aptos Foundation. At the same time, it is also the developer of the Ethereum L2 Lumio and the Aptos ecosystem wallet Pontem that supports the Move language. In other words, interacting with LiquidSwap airdrops may also receive airdrops from potential projects such as Lumio.

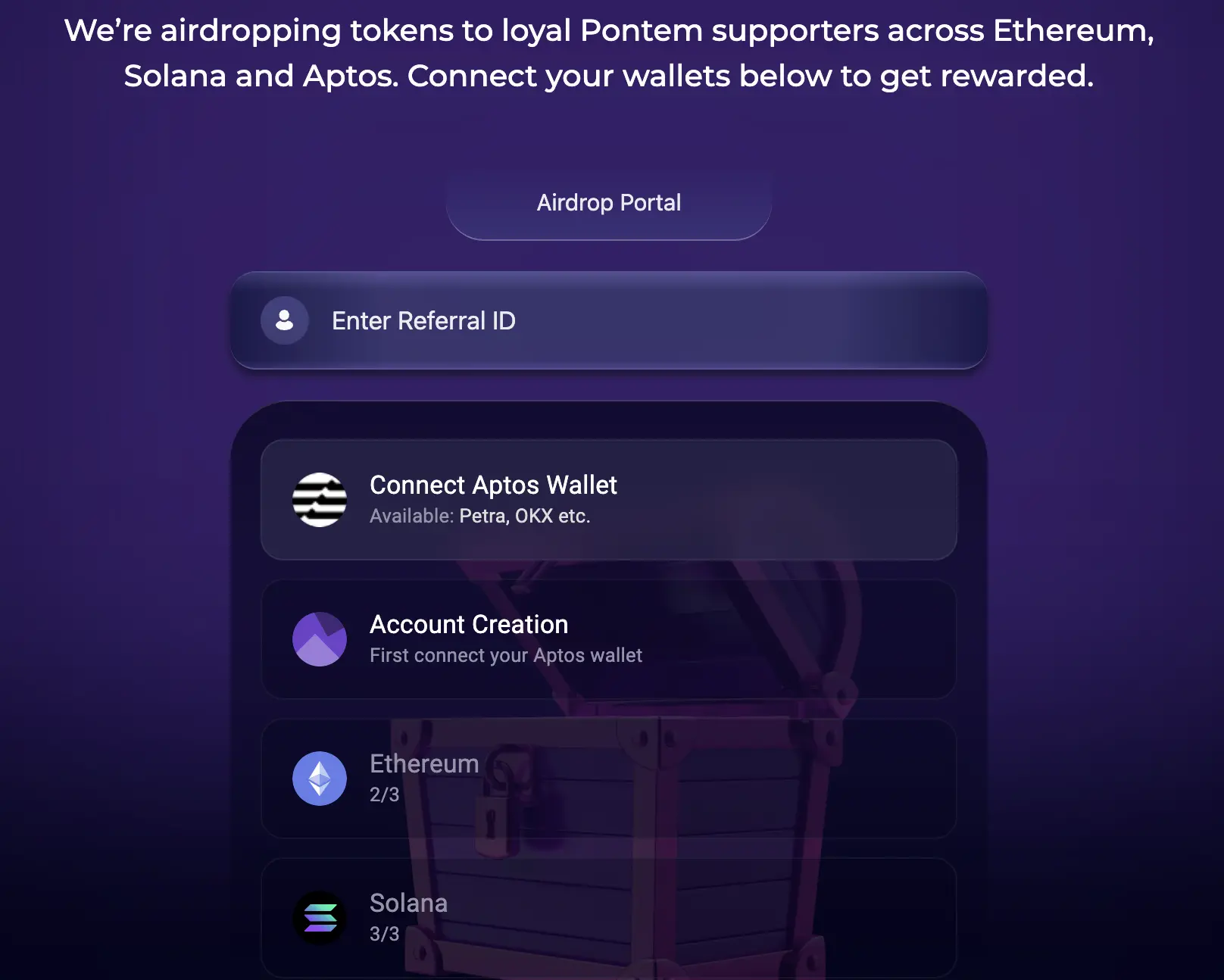

LiquidSwap has also launched an airdrop activity registration page, which requires registration before participating in the airdrop activity. In addition to the Aptos address, EVM addresses and Solana addresses can also be linked.

Its airdrop page emphasizes that trading activities on LiquidSwap will affect the specifications of the airdrop received.

The official has set the following trading volume thresholds:

- 1-20$ - coke

- 20-50$ - socks

- 50-300$ - ledger

- 300 - 3000$ - Ticket to NBA

- 3000 - 6000$ - Vision pro

- 6000 - 30000$ - Vacation in the Bahamas

- 30000 - 100000$ - Cybertruck

- 100000 - 10000000$ - House

You can check your trading volume and tier level on the Dashboard page. At the same time, the page also provides dimensions such as the amount of liquidity provided, total number of transactions, whether you are an official NFT holder (expensive, not recommended to purchase for the purpose of airdrops), and the amount of MEME held.

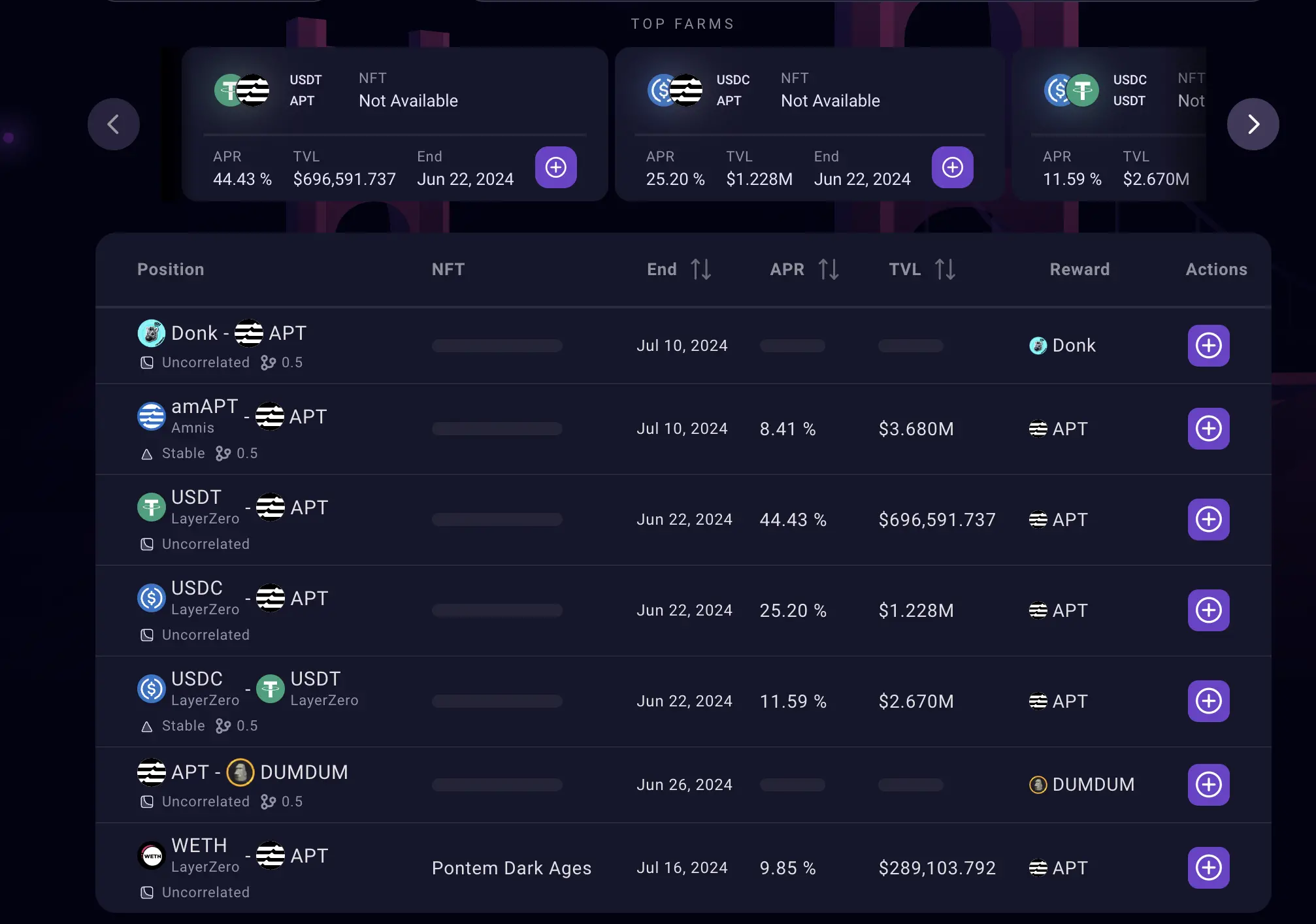

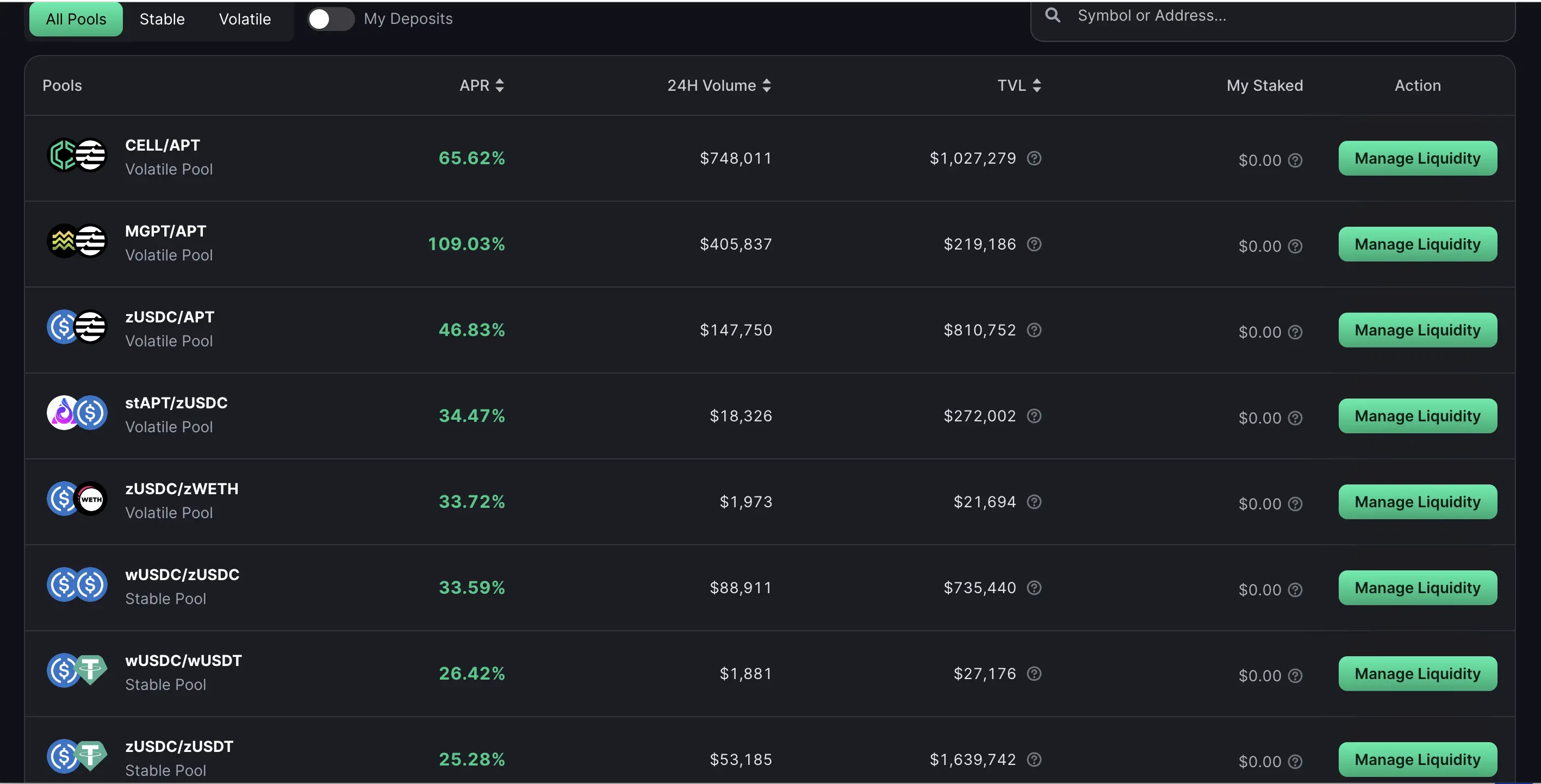

After providing liquidity in the Pool on LiquidSwap, you can further stake in the Farm to earn incentives in APT and other tokens, with equally good returns.

LiquidSwap's Farm page

Cellana

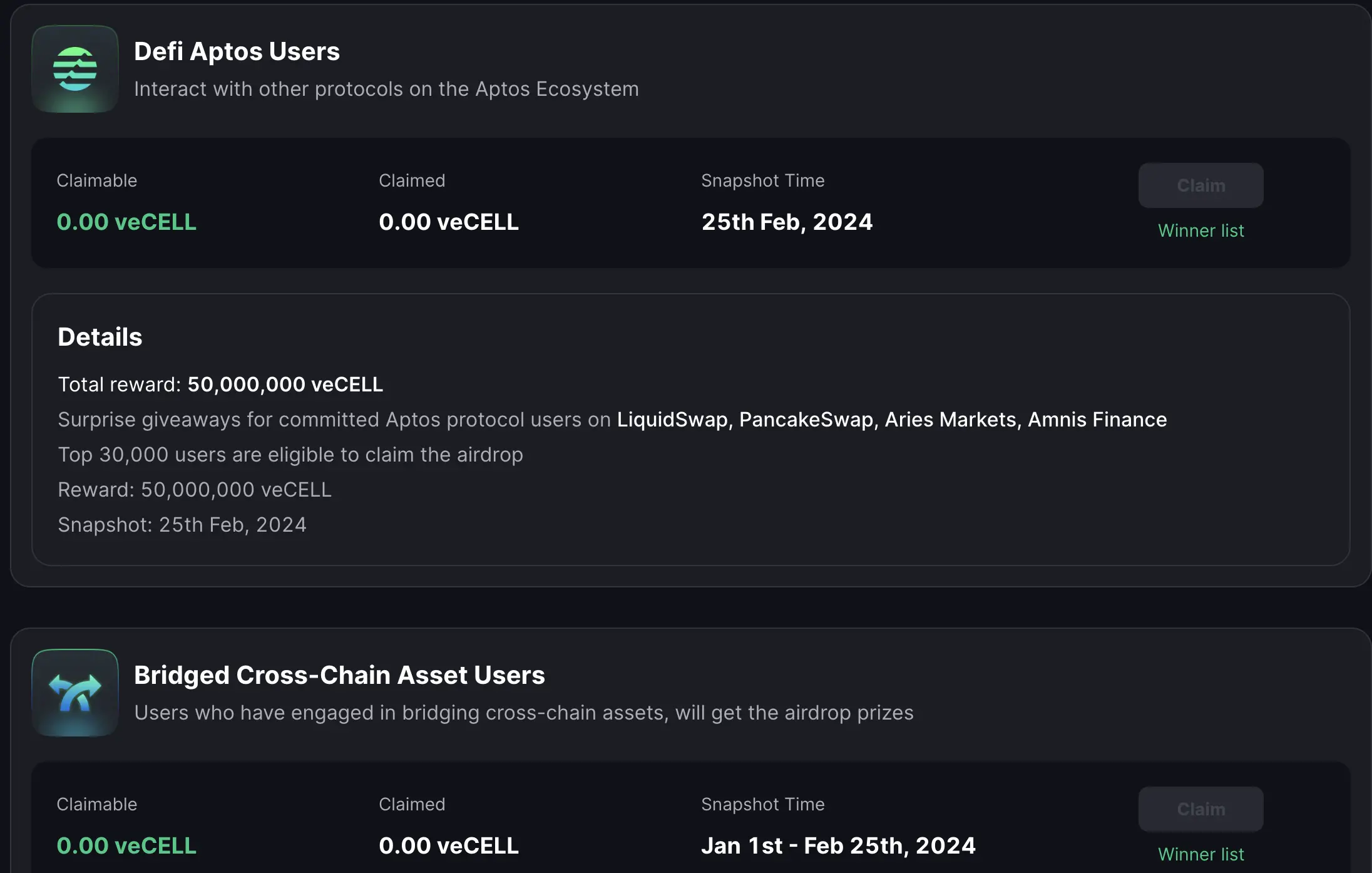

Cellana is the largest Ve(3,3) model DEX on Aptos, and has already conducted token airdrops, with further airdrop expectations.

If you have participated in DeFi in the Aptos ecosystem before February 25th this year, or bridged to Aptos through LayerZero between January 1st and February 25th, visit this page to check if you are eligible to claim the airdrop.

The airdrop from Cellana is distributed in the form of veCELL NFT, which cannot be sold immediately and requires a two-year full unlock. However, it can be traded on the NFT secondary market, and you can also receive a 40% annualized voting reward weekly.

Cellana previously conducted the first round of the second phase of the airdrop, which was distributed to liquidity providers. The returns from LP on Cellana itself are also very high, making it worth a try.

Multi-path Strategy 1

Mint stAPT and deposit it into Aries Markets, borrow APT. Convert approximately half of the APT into amAPT on LiquidSwap, and provide liquidity for the amAPT-APT pair on LiquidSwap.

Multi-path Strategy 2

Deposit zUSDT/zUSDC in Aries Markets, borrow zUSDC/zUSDT, and convert half of the borrowed stablecoins into another stablecoin on LiquidSwap, then provide liquidity for the stablecoin pair in Cellana.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。