Original Title: Polymarket and the Decentralization Dilemma of Prediction Markets|CryptoSnap

Original Author: dt

Original Translator: Lisa

Recently, with the expected warming up of the $ETH ETF, market attention has gradually returned to the EVM ecosystem. As the current largest on-chain prediction market, Polymarket is attracting attention due to the anticipation of the successful passage of the $ETH ETF. As the saying goes, "a tall tree catches the wind." Despite Polymarket's enormous liquidity, its settlement method has been questioned by participants. Let's follow Dr. DODO to explore the ins and outs of this controversial event.

Polymarket

First, let's introduce the Polymarket protocol. Polymarket is a prediction market based on the Polygon public chain. Due to its early release and long operation time, it is currently the largest on-chain prediction market. The platform allows traders to use $USDC or $ETH to place bets on today's hottest and most controversial topics, ranging from national presidential elections to whether the price of $ETH will exceed $4000 the next day. Polymarket attracts liquidity providers through a liquidity reward program, providing traders with excellent trading depth.

Polymarket has undergone two rounds of public financing. The first was a seed round, raising four million US dollars; the second was led by Founder Fund, raising forty-five million US dollars on May 14, 2024. For a DApp, this scale of financing is quite considerable.

Source: polymarket.com

UMA

When mentioning Polymarket, it is necessary to mention its service provider, UMA. Polymarket uses UMA's Optimistic Oracle (OO) deployed on Polygon to ensure the fairness of prediction results.

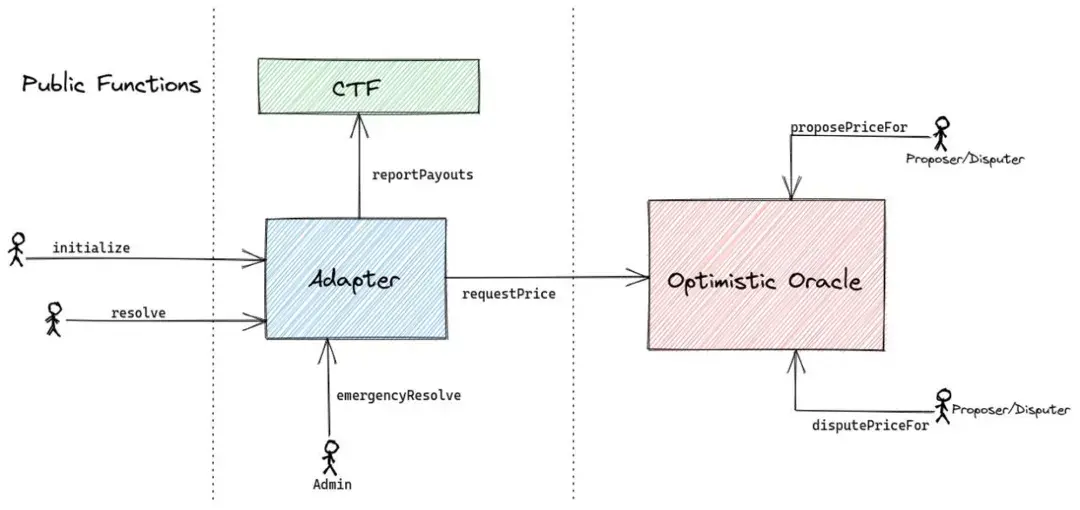

Polymarket's UMA integration includes three parts: market contracts, CTF adapter contracts, and OO. Each market created will include a condition generated by the CTF adapter when it is created, which is the question that OO needs to answer, such as "Will the price of $ETH exceed $10,000 in the third quarter of 2024?"

When the market is initialized, the CTF adapter will automatically send a request to OO. Proposers in the UMA system can respond to this request. If there is no dispute, this response will be considered correct and submitted to the CTF adapter after a two-hour challenge period. If the answer is incorrect, or if other participants in UMA have objections to the answer, other participants can act as challengers to debate the response.

Upon the first objection, the CTF adapter will ignore the objection and send the same parameter request to OO again. If the second request is challenged again, the request will be sent to UMA's DVM system (OO's arbitrator), which is composed of UMA token holders who will vote to determine the dispute result.

Source: https://github.com/Polymarket/uma-ctf-adapter?tab=readme-ov-file

Controversy over the Approval of ETF

Points of Contention:

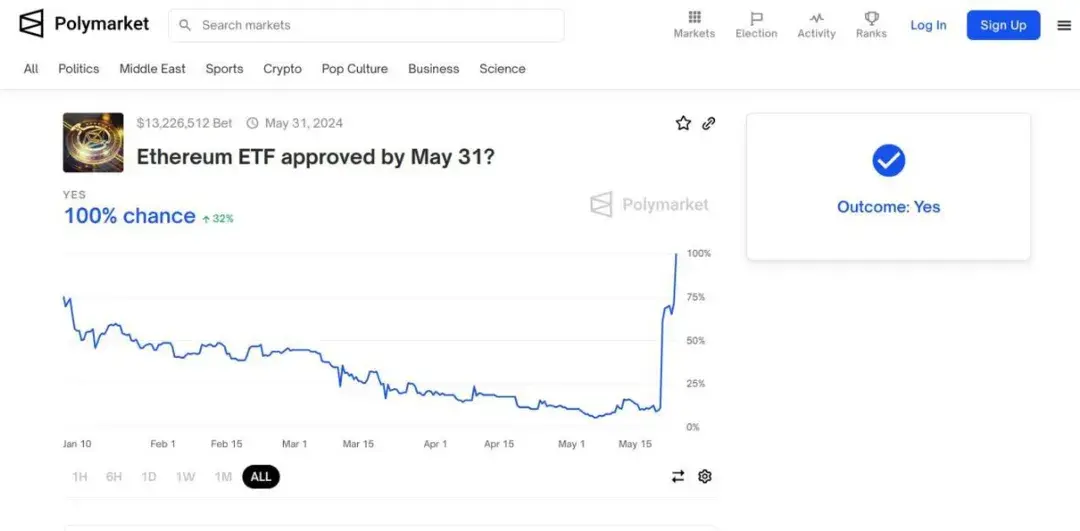

Some traders believe that the $ETH ETF did not truly pass before May 31, and everything was just speculation by UMA decision-makers. Because the approval of the US ETF requires approval of the 19b-4 application and the S-1 application to officially trade on the exchange, and currently the S-1 application has not been approved, which means there is still uncertainty about whether the $ETH ETF can truly trade.

Timeline:

After the U.S. Securities and Exchange Commission approved the 19b-4 application for multiple Ethereum ETFs, UMA proposers provided the result of the ETF's approval.

Possibly due to the short challenge period or the overly centralized voting power of UMA, there were no objections from voters during the immediate two-hour challenge period, so the response was adopted as the final result.

Subsequently, objectors raised objections to the result and requested the adapter to resend the request to OO, but the YES result once again overwhelmingly passed with as much as 99% of the vote.

In response, Polymarket did not issue an official response to this event.

Source: https://polymarket.com/event/ethereum-etf-approved-by-may-31

Early and Future Prediction Markets

The concept of prediction markets emerged at a time when major L1 public chains had not yet risen.

Augur

For example, in 2018, the first deployment of Augur, early versions v1 and v2 were ultimately optimized into Augur Turbo, officially released in 2022, due to the overly complex architecture. Unlike Polymarket, the prediction results of Augur are determined by ChainLink's oracle, TheRundown data provider. Compared to Polymarket's UMA mechanism, the degree of centralization in result adjudication is higher, which may be why it did not continue to operate later, as centralized prediction markets do not have significant advantages compared to decentralized ones, especially since centralized prediction markets are also very willing to support cryptocurrency deposits.

Azuro

Azuro, which has been rumored to be launching a coin, is taking a different approach. Unlike traditional prediction market DApps, Azuro is moving towards a more foundational level. As an emerging provider of prediction market infrastructure, it aims to facilitate the rapid integration of prediction functionality for other projects through a structure similar to Uniswap, rather than focusing on operating a market itself. However, inevitably, as long as the prediction is about real-world events, the final determination of the prediction result still comes from insufficiently decentralized data. Defillama data shows that Azuro's TVL (total value locked) is steadily increasing, and its revenue is not low among small and medium-sized DApps. It has also raised a total of eleven million US dollars in financing. Infrastructure providers are bound to have the advantage of wide coverage and a large user base, and we look forward to Azuro's future development.

Source: https://azuro.org/#intro

The new generation of prediction markets represented by Polymarket is often built on layer one or layer two blockchains with lower gas fees, which gives them a natural advantage over earlier projects: no longer excluding small traders due to high gas fees. However, prediction markets like Polymarket still have a long way to go to achieve their project vision. In the current situation of incomplete blockchain infrastructure, projects have to make trade-offs between decentralization and efficiency. Nevertheless, the optimistic outlook of investment institutions on the future of prediction markets or speculative expectations can be glimpsed from the financing situation. Technology often requires capital to drive it, so we still look forward to the future development of this track.

Author's Opinion

We do not comment on whether Polymarket's decision in this event was correct, but it can be seen from this event that in the intersection of decentralization and centralization, decentralized products have not fully realized their vision of decentralization. When faced with off-chain events, centralized oracles are still needed for adjudication, thus posing a certain centralization risk. At present, the project can only strive to make a relatively fair assessment, and perhaps extending the market settlement time is a better way to handle it. This also indirectly reflects that Polymarket has relatively few actual users, so the official response to this dispute is to handle it in a cold manner.

Until the reliability of the source of prediction results is resolved, the future of the on-chain prediction market track remains uncertain. We have long been aware of the "impossible triangle" problem in blockchain, which also exists in prediction markets. For the project to further develop, it must address the decentralization of prediction results, which may require significant changes in the underlying blockchain and even in society, or technological innovation.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。