作者:WOO X Research

对于加密货币用户而言,川普当选后最令人期待能够落实的政见绝对是美国采用比特币作为战略储备,但选后超过三个月的时间,中央政府迟迟未见行动,难道比特币战略储备的希望梦碎?那到不然,其实在最近短短一周内,美国已有两州正式将比特币写进州库,另有五州处于箭在弦上的立法阶段。拆解各州采取的资金来源、配置上限与托管模式其实差异巨大,映照出地方政府对「高波动、去中心化资产」的不同容忍度。本文以怀疑眼光拆解,谁在真布局、谁在政治作秀、潜在黑天鹅躲在哪里?并推演这股「官方 HODL」浪潮对市场流动性与叙事溢价的下一步影响。

新罕布夏与亚利桑那怎么玩?

在短短 48 小时内,新罕布夏与亚利桑那先后完成立法并由州长签署,开启州库持币元年。两州采取的路径与风控机制几乎南辕北辙,充分暴露出不同政治经济目标下的取舍。

新罕布夏 HB 302|主动拨款、单押 BTC、设天花板

新罕布夏的作法最像「财政部级资产多元化」。条文授权州财长把 一般基金与雨天基金中最多 5 %,直接换成市值连续一年高于 5,000 亿美元的数位资产,实际上只有比特币符合资格。

立法者强调这个 5 % 上限就是安全阀门:如果财政池子膨胀或缩水,持币额度会随之调整,避免一次性重仓。惟条文对「基金规模缩小时是否被迫比例卖出」语焉不详,留下会计处理灰区。

在托管上,HB 302 提供三条路:

-

州库自管多重签名冷钱包;

-

交由持牌「特殊目的存款机构(SPDI)」或其他受监管银行代管;

-

透过 SEC 或 NFA 核准的比特币 ETF 持有

若选冷钱包,自管必须符合七项技术标准,包含地理分散、硬体隔离与年度渗透测试,尽可能堵死私钥外泄风险。但若选 ETF,州库其实只拿到受托凭证──透明度回到传统金融帐本,和链上「看得到、追得到」的优势相矛盾。

资讯披露方面,州财长需逐季在财政报告里列出持仓、成本与未实现盈亏;支持法案的议员并口头承诺「会公布链上地址」以强化透明度,但这并未写进强制条款。条文还全面禁用杠杆、借贷或抵押,意图将信用风险归零,代价是放弃所有孳息强化手段。

新罕布夏走的是「财政部级资产多元化」路线,小比例、单资产、极度保守,但也把纳税人直接绑上 BTC 价格过山车。

亚利桑那 HB 2749|被动收编、零税负、允许 Staking

亚利桑那则把「不动用一毛税金」视为核心卖点。新法允许州政府在三年寻人期届满后,把无主加密资产(含私钥残缺但可识别者)转进新设的「比特币暨数位资产准备基金」

亚利桑那州立法机构。自此该基金还能依法收下所有衍生的空投与 staking 奖励,形成复利循环,完全不用向议会追加预算。

更大胆的是标的范围,条文没有任何市值或流动性门槛,只要落到州府手里,就能进库。理论上,从比特币到日成交量只有数万美元的迷因币都可能被收编;州府靠持仓多元分散风险,但也把自己暴露在小币价格操纵的高爆雷区。

托管必须交给在亚利桑那持牌的合规机构;期间允许资产参与整链 staking 以挣取收益。这让州库首次成为链上活跃玩家,若验证人罚没(slashing)或智能合约出错,损失同样落到公部门帐上。

在流动性调度上,HB 2749 仅允许州财长把最多 10 % 的非比特币持仓 换成现金,补贴一般基金支出;BTC 部分被立法锁仓,除非另行立法,不得动用。资讯披露则采「年报+议会拨款才能支用」双重把关,但没有强制公开链上地址,透明度低于去中心化标准。

亚利桑那把 BTC 当作「捡到的钱滚利息」,透过 Staking 与空投来放大闲置价值,聪明避开纳税人质疑,但也把州库置于链上运营风险前线。

身为投资者的我们该注意什么?

-

买盘规模:NH 即便满仓也仅 3–4 亿美元,对 BTC 流动性影响有限;AZ 初期更是杯水车薪。

-

叙事加分:官方背书+「零税负」故事,足以推升短线情绪,但现金流并不会马上涌入。

-

风控对比:NH 用「上限+冷钱包」换低收益;AZ 用「无本 Staking」换高技术/合约风险,两种模式皆非万灵药。

-

黑天鹅:若当 BTC 出现单日 > 20 % 跌幅,NH 可能因会计评价被迫减值;AZ 则需面对 Staking Slashing 或托管事故,都足以让反对派在州议会翻案

核心差异

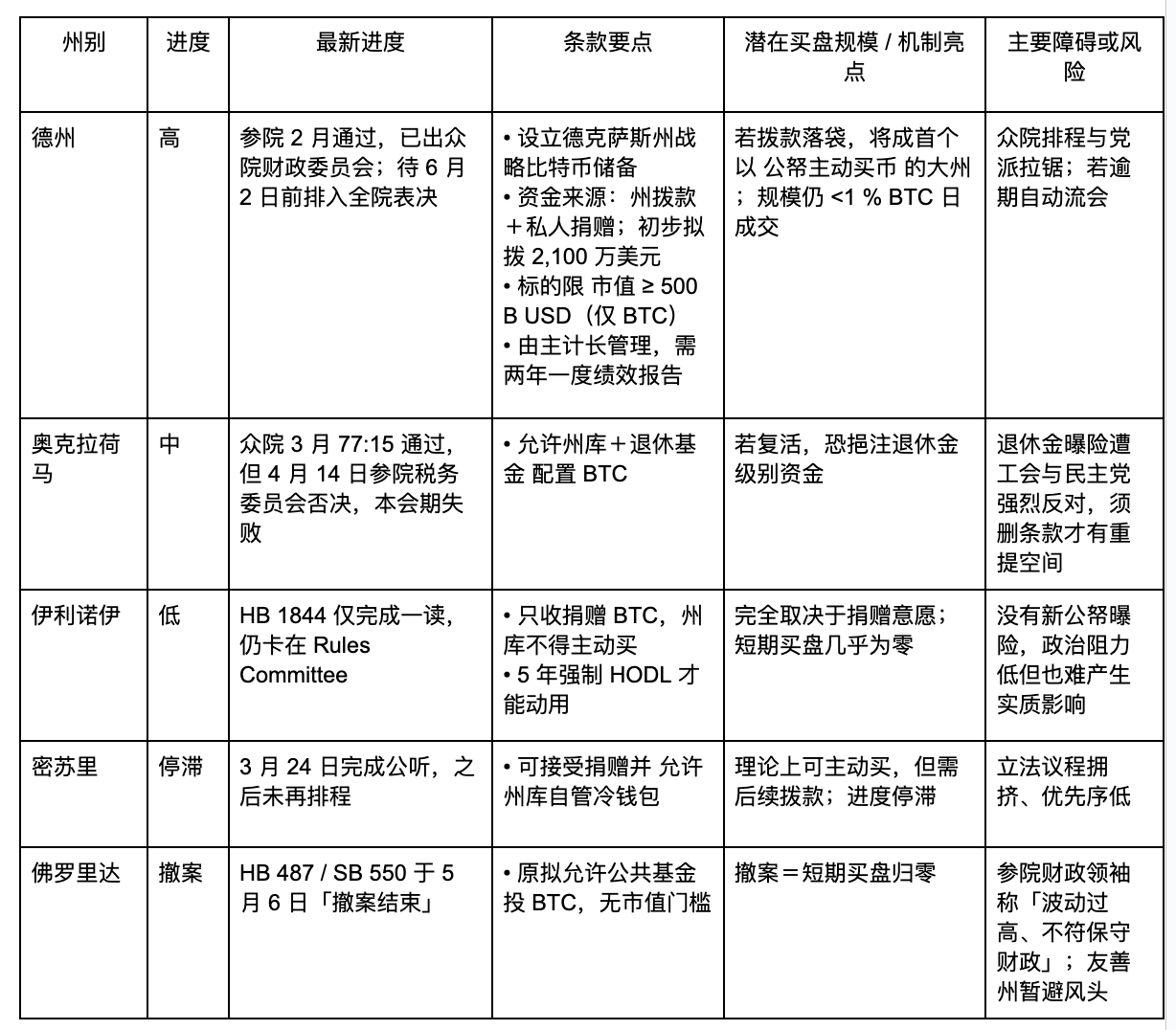

其他州状况如何?

-

关键在德州:若 6 月 2 日前成功排案并拨款,将标志首个「大规模公帑买币」案例,叙事将被放大。反之,连德州都卡关,后续州更难动员。

-

买盘≠立法:即便法案过、预算拨款仍要另行议决;投资者应持续追踪拨款法案与链上钱包地址公开。

-

条款差异极大:从德州的「主动拨款+单押 BTC」到伊利诺伊的「纯捐赠+五年锁仓」,风险/收益曲线各不相同,后续州可能择优混搭。

结语:买盘规模带来实质效应?情绪先炒作

新罕布夏允许州库把一般/雨天基金最多 5 % 转成比特币,州财政年度预算不到 70 亿美元,即便满仓粗估也仅 3–4 亿美元;亚利桑那更是把三年以上无主加密资产「被动收编」,短期连亿级都难碰到。相比之下,比特币 24 小时现货成交量长期维持 600–700 亿美元,州府买盘即使一次性入场,也只占市场日流动性的 0.1 %,立法的声量大于实际资金量;价格反应更多是情绪交易,而非现货供需失衡。

两州法案分别于 5 月 6 日(NH)与 5 月 8 日(AZ)签署;比特币在 48 小时内由 96 K 升至逼近 100 K,单周涨幅约 3 %。而 Axios 统计显示,同期与「Bitcoin Reserve」关键字相关的社交媒体讨论量周增逾 240 %。但交易量并未同步放大,指向「headline rally」而非大量现货吸收。

此外 Glassnode 指出 30 日实际年化波动已回落至 45–50 %,创 2021 年以来低区间,但长期历史区间动辄 60 % 以上,仍非传统资产可比。若 Black-Swan 日内跌幅 > 20 %,新罕布夏 5 % 持仓将立刻面临减值压力,而亚利桑那还需承担 Staking slashing 或托管合约失误的额外风险。

官方 HODL 叙事已被市场「先炒半成」,真正决定行情的是立法落地速度与财政拨款实际金额。只有在立法+拨款+链上地址三件事同时成立,才能说比特币价格推升的主因可以归咎于州战略储备金。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。