Author: VanEck

Translation: Felix, PANews

VanEck expects the approval of a spot Ethereum ETF to be traded on a U.S. stock exchange. This approval will enable financial advisors and institutional investors to hold Ethereum under the protection of compliant custodians and benefit from the pricing and liquidity advantages of the ETF. In response, VanEck updated its financial model and re-evaluated ETH. VanEck also conducted a series of quantitative analyses on how ETH interacts with BTC in a traditional 60/40 investment portfolio, focusing on the trade-off between risk and return.

**(PANews note: VanEck holds ETH and BTC; a 60/40 investment portfolio consists of 60% S&P 500 stocks and 40% 10-year U.S. Treasury bonds)

The main points of this article are as follows:

- Driven by strong value propositions for entrepreneurs, the Ethereum network may continue to rapidly expand its market share from traditional financial market participants and an increasing number of large tech companies. If Ethereum maintains its dominant position in the smart contract platform while doing so, VanEck believes that by 2030, ETH will rise to $22,000.

- Adding a moderate amount of cryptocurrencies (up to 6%) to a traditional 60/40 investment portfolio can significantly increase the portfolio's Sharpe ratio with relatively minimal impact on drawdowns. For a pure crypto investment portfolio, a close to 70/30 allocation between Bitcoin and Ether provides the best risk-adjusted return.

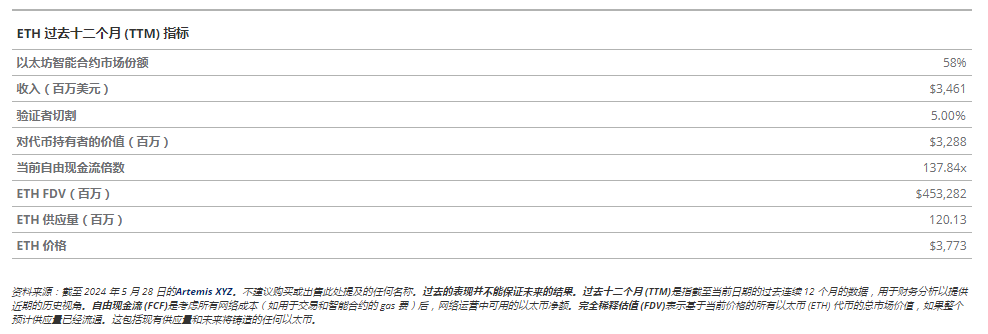

Ethereum Investment Evaluation

Ethereum's native token Ether (ETH) is a new type of asset that provides investors with a high-growth, internet-native business system that has the potential to disrupt existing financial businesses and large tech platforms such as Google and Apple. Ethereum is a successful digital economy with approximately 20 million monthly active users, settling approximately $4 trillion in the past year and facilitating $5.5 trillion in stablecoin transfers. Ethereum has over $91.2 billion in stablecoins, $6.7 billion in tokenized off-chain assets, and $308 billion in digital assets. The core asset of the Ethereum system is the token ETH, which VanEck believes will reach $22,000 by 2030, resulting in a total return of 487% compared to today's ETH price, with a compound annual growth rate (CAGR) of 37.8%.

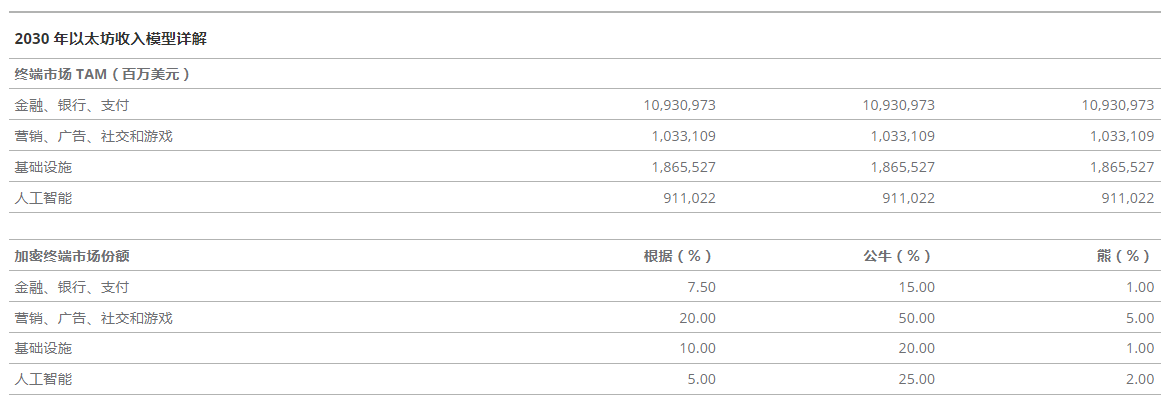

VanEck forecasts the valuation of 2030 ETH based on the $660 billion in free cash flow generated by Ethereum. VanEck estimates a multiple of 33 times for these cash flows. As Ethereum is an application platform, VanEck values it by estimating the market size of the business areas that blockchain applications will disrupt. Based on the annual revenue of the following vertical industries, the estimated total addressable market (TAM) is $15 trillion:

- Finance, Banking, and Payments (FBP): $10.9 trillion

- Marketing, Advertising, Social, and Gaming (MASG): $1.1 trillion

- Infrastructure (I): $1.8 trillion

- Artificial Intelligence (AI): $1.4 trillion

Using TAM data, VanEck estimates the market share of Ethereum and other blockchains for these revenues. The penetration rates for FBP, MASG, I, and AI are 7.5%, 20%, 10%, and 5% respectively (Figure 6). Subsequently, the share of encrypted applications built on Ethereum is estimated to be 70%. VanEck then estimates the fees Ethereum will charge to application users, calculating this ratio to be 5-10%. VanEck recently updated its ETH model from spring 2023 to reflect Ethereum's huge potential in the AI terminal market. Other impactful adjustments to the previous model include increased ETH burn, a larger share of the terminal market, and a higher potential adoption rate of economic activities. Based on fundamentals, recent innovations, and changes in U.S. politics, VanEck believes these adjustments are reasonable.

Figure 1:

Figure 2:

VanEck believes that ETH is a revolutionary asset with almost no comparability in the non-crypto financial field. ETH can be considered "digital oil" as it is consumed through activities on Ethereum. ETH can also be seen as "programmable currency" because the financialization of ETH and other Ethereum assets can occur automatically on the Ethereum blockchain without any intermediaries or reviews. Additionally, VanEck considers ETH to be a "yield commodity" as it can be staked in a non-custodial manner to earn returns for validators. Finally, ETH can be seen as an "internet reserve currency" as it is the underlying asset for the $1 trillion Ethereum ecosystem, all activities in over 50 connected blockchains, and most digital asset pricing.

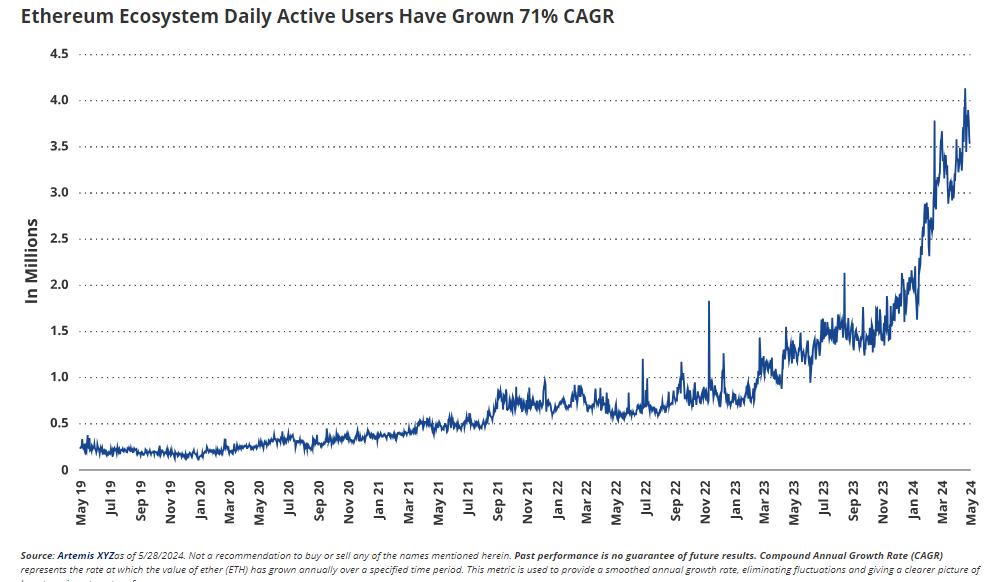

Figure 3: Ethereum's ecosystem has a compound annual growth rate of 71% for daily active users

Regardless of the classification, ETH benefits from the growing usage of the Ethereum blockchain. Ethereum is a vibrant economic platform that can be seen as a "digital mall," with its user base growing by approximately 1500% and revenue soaring at a compound annual growth rate of 161% since 2019. In the past year, Ethereum has generated $34 billion in revenue, all of which directly benefits ETH holders. As ETH must be purchased to use Ethereum, all ETH holders benefit from demand-driven capital inflows. Additionally, about 80% of ETH revenue is used for buybacks and "burning" of circulating ETH. This is similar to irreversible stock buybacks.

In the past six months, 541,000 ETH worth $1.58 billion, accounting for 0.4% of the total supply, has been burned. Therefore, due to user-driven ETH purchases and the destruction of the supply, ETH holders benefit from double gains from Ethereum activity. ETH users can also earn a yield on ETH, averaging about 3.5% per year in ETH terms. This is achieved by staking ETH to validators, providing collateral for running the Ethereum network.

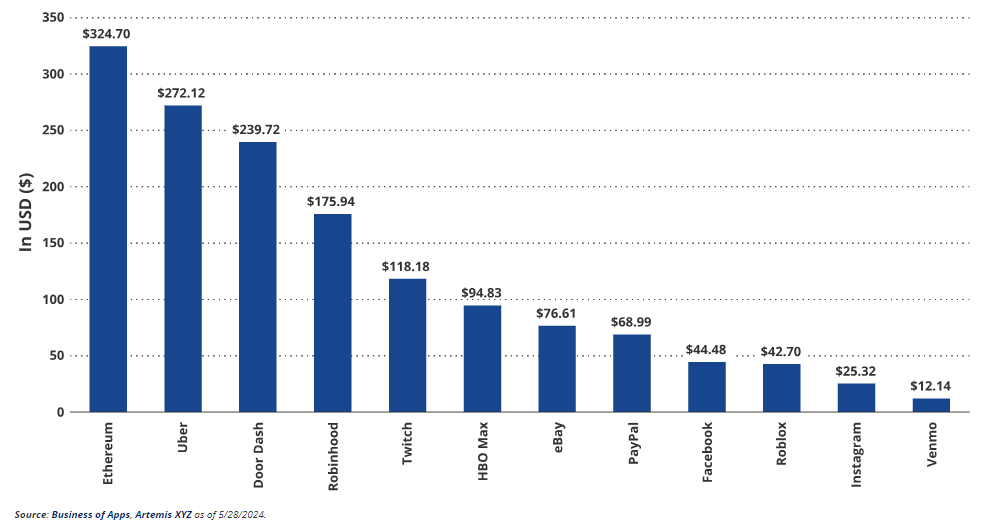

Figure 4: Ethereum's average user income exceeds that of most Web2 companies

Compared to Web2 applications, Ethereum's revenue of $3.4 billion exceeds that of Etsy ($2.7 billion), Twitch ($2.6 billion), and Roblox ($2.7 billion). Ethereum's 20 million monthly active users surpass those of Instacart (14 million), Robinhood (10.6 million), and Vrbo (17.5 million). Additionally, Ethereum's average monthly active user annual income is $172, exceeding that of Apple Music ($100), Netflix ($142), and Instagram ($25). Although Ethereum is classified as a platform business similar to the Apple App Store or Google Play, Ethereum has a huge advantage over Web2 platforms as it reduces costs for users and applications.

The most attractive aspect of Ethereum is the potential cost savings for businesses and users. Apple and Google take around 30% of the hosted app revenue, while Ethereum currently takes about 24% (14% for non-DeFi applications). Additionally, as activity shifts to the lower-cost Ethereum Layer2, Ethereum's fees are expected to decrease to 5-10% in the next 18 months. From a payment perspective, credit card processors and other payment apps (such as PayPal) extract 1.94% from all payments (2.9% for commercial transactions), while Visa charges 1.79-2.43% or more. In comparison, on Ethereum, users only pay about 0.001% for simple transfers, which is less than one-thousandth of the fees charged by leading payment apps.

Compared to data-centric social networking platforms like Facebook, Ethereum can provide entrepreneurs with more powerful and profitable applications. Ethereum allows applications to use permissionless deployment environments and open-source data for interconnection and innovation. Anyone can create applications and access important data, including all user activities on the chain, similar to how Visa provides customer payment data for free. For example, the social media app Farcaster currently generates a monthly user income of $75.5, while Facebook's income is about $44. Notably, the average daily user engagement on Farcaster is 31 minutes, compared to 350 minutes for Facebook users.

The attributes of Ethereum lead to a transfer of part of the profits earned by big finance, big tech, and big data to consumers. As more data becomes public and more business activities move away from expensive closed financial channels, traditional business moats will be "eroded," forming potential businesses around open-source low-profit economies. Consumers and app builders will migrate to Ethereum because it is cheaper and offers higher value than current mainstream platforms. It is believed that in the next 5-10 years, 7%-20% of Web2/big finance business revenue (trillions of dollars) can be absorbed by systems like Ethereum, and most of the revenue will be returned to users and app builders. Additionally, Ethereum's unique ownership attributes allow for censorship-resistant social media and gaming applications. These features will become increasingly valuable if government censorship of information continues to strengthen.

Furthermore, there is ample reason to believe that blockchains like Ethereum will become important backend infrastructure for artificial intelligence applications. The surge in AI agents and the AI agent economy will require unrestricted value transfers and clear data/model sources. These unique attributes are available on the blockchain, bypassing existing technical infrastructure. It is estimated that by 2030, the potential total revenue of cryptocurrencies and artificial intelligence could reach $911 billion, with $455 billion in revenue from open-source AI applications and infrastructure, of which $12 billion in revenue may flow directly to ETH holders.

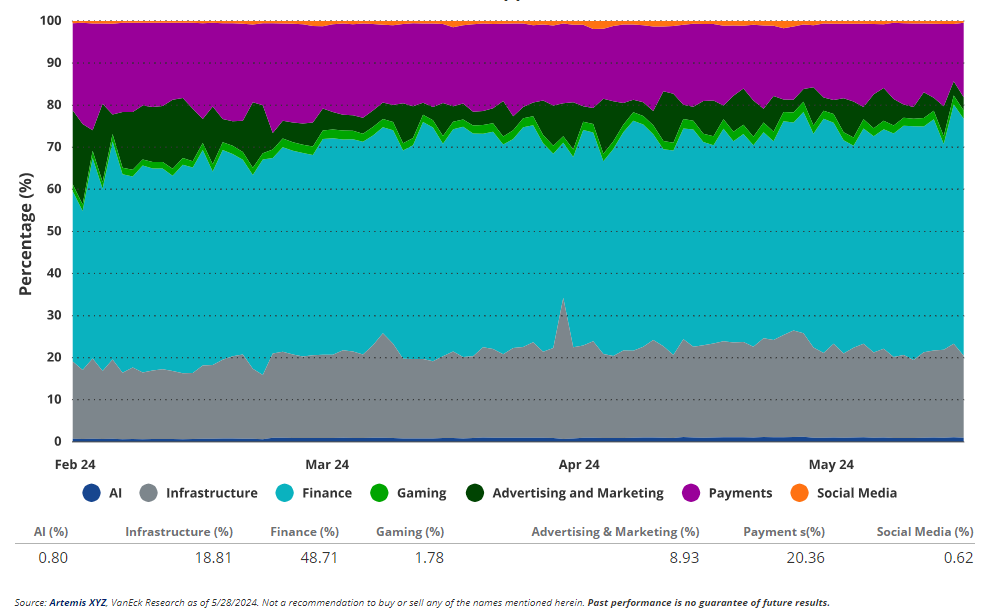

Currently, most activity on Ethereum is financial in nature. Decentralized exchanges and "banking" protocols account for 49% of Ethereum's revenue, while simple value transfers account for 20%. These revenues belong to the financial, banking, and payment (FGP) category. Meanwhile, infrastructure occupies the second largest share, at approximately 19%. Finally, activities related to social media and NFTs are classified under the marketing, advertising, social media, and gaming (MASG) category, contributing 11% of the revenue. Currently, AI plays a very small role in generating revenue for Ethereum.

The revenue generated from the above terminal market activities is attributed to Ethereum's revenue items. These include transaction fees, Layer2 settlements, MEV, and security as a service. Transaction fees are the fees paid by users for participating in applications or transferring value on Ethereum. Layer2 settlements are the revenue from Ethereum Layer2 blockchains paying for "settlement" transaction privileges on Ethereum. MEV is the revenue generated from users paying for the right to order transactions in blocks. In the past year, approximately 72% of Ethereum's revenue came from transactions, MEV accounted for about 19%, L2 settlements accounted for about 9%, and security as a service has not been formally launched yet.

As VanEck believes that Ethereum's strongest value proposition is financial, it is expected that by 2030, 71% of Ethereum's revenue will come from financial businesses (FGP). Due to the benefits of experimentation and open-source finance and data systems on Ethereum, MASG is expected to grow to 17%, slightly replacing infrastructure, which will provide 8% of the revenue. Overall, AI will account for 2% of Ethereum's revenue. However, if decentralized AI software shows its enormous potential, the contribution of AI revenue is expected to increase significantly.

From the perspective of revenue items, it is estimated that individual mainnet transactions account for only 1.5% of revenue. Layer2 settlements bundled with transactions on the mainnet will increase to 76% of revenue. This is because most activity is expected to occur on Ethereum Layer2, but most of the value of these transactions will accrue to Ethereum. Meanwhile, MEV accounts for 18% of revenue, while security as a service will account for 4.5% of Ethereum's revenue.

Figure 5: Ethereum's revenue mainly comes from financial applications

Figure 6:

Bitcoin and Ether: Optimal Investment Portfolio Allocation

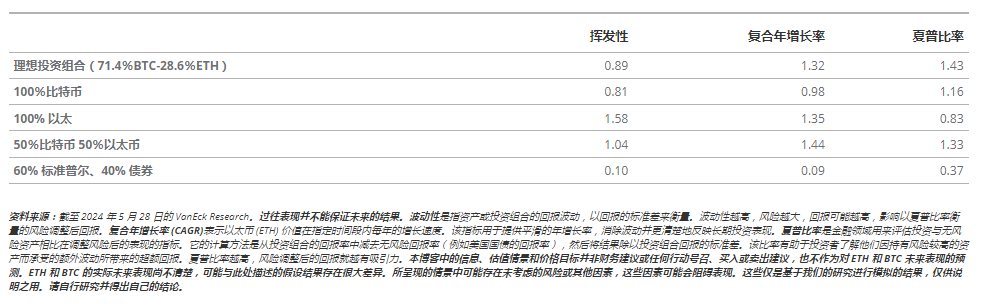

VanEck conducted a study to assess the impact of including BTC and ETH in a traditional 60/40 investment portfolio, covering the period from January 9, 2015, to April 30, 2024. The analysis was conducted through five main sections:

Optimal allocation in a traditional 60/40 investment portfolio: Evaluated the ideal weights of BTC and ETH in a 60% stock and 40% bond portfolio, with the maximum portfolio allocation limited to 6%. This was done using 169 sample investment portfolios, with the addition of cryptocurrency exposure.

Drawdown and Sharpe ratio analysis: VanEck studied the drawdown and Sharpe ratios of 16 representative subsets of investment portfolios. Adding a moderate amount of cryptocurrencies (up to 6%) to a traditional 60/40 investment portfolio can significantly improve the portfolio's Sharpe ratio with relatively minimal impact on drawdowns. For investors with high risk tolerance (annualized volatility of up to about 20%), a continuous improvement in the risk/return of the entire portfolio was achieved with a maximum allocation of up to 20%, with a 70/30 weighting between BTC and ETH considered to provide the best risk-adjusted return.

Optimal allocation of BTC and ETH in a pure cryptocurrency investment portfolio: VanEck analyzed the weights of BTC and ETH in a portfolio consisting only of these two cryptocurrencies, aiming to maximize the Sharpe ratio and derive the ideal BTC/ETH weight.

Efficiency frontier using the optimal cryptocurrency investment portfolio: VanEck studied the optimal weights of the ideal BTC/ETH investment portfolio to maximize returns at various volatility levels, to illustrate a part of the efficient frontier when adding cryptocurrencies to a 60/40 (with reasonable volatility levels).

(PANews note: The efficient frontier refers to the set of optimal portfolios that offer the highest expected return for a given level of risk)

Time dependency of efficiency frontier results: VanEck considered the impact of different starting points on the research results. The study showed that a larger allocation of crypto assets in each time period contributes to the risk-adjusted return of the investment portfolio.

1. Optimal Configuration in Traditional 60/40 Investment Portfolio

The main objective was to determine the optimal configuration of BTC and ETH in a traditional 60/40 investment portfolio, with the cryptocurrency allocation limited to a maximum of 6%. The analysis involved creating 169 model investment portfolios, gradually increasing the exposure to cryptocurrencies (up to 3% for BTC and ETH, respectively).

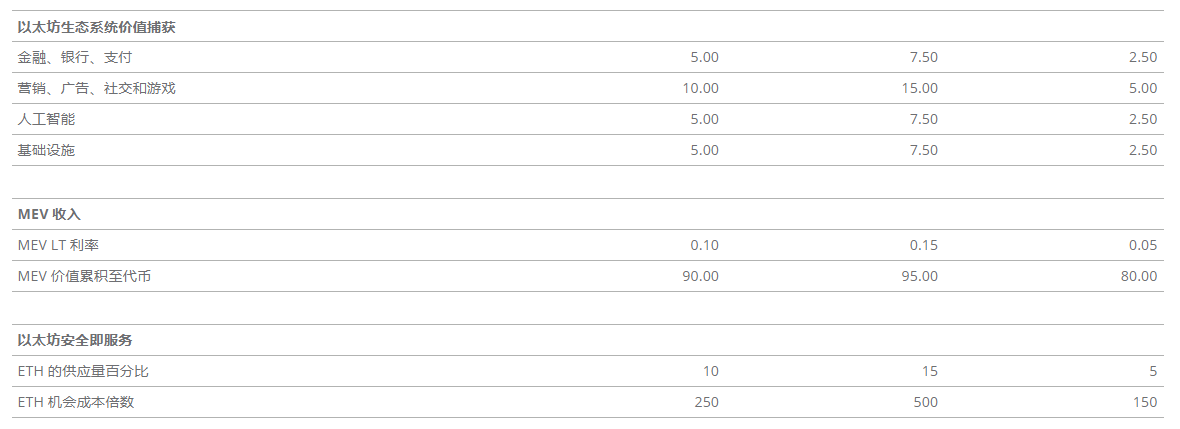

The results showed that a portfolio consisting of 3% Bitcoin and 3% Ether (along with 57% S&P 500 and 37% US bonds) achieved the highest risk-adjusted return (standard deviation). In other words, the maximum allowed allocation for cryptocurrencies achieved the highest risk-adjusted return while maintaining a conservative overall allocation of 6%.

Optimal BTC/ETH Configuration in Traditional 60/40 Investment Portfolio for Risk-Adjusted Return

(September 1, 2015 - April 30, 2024)

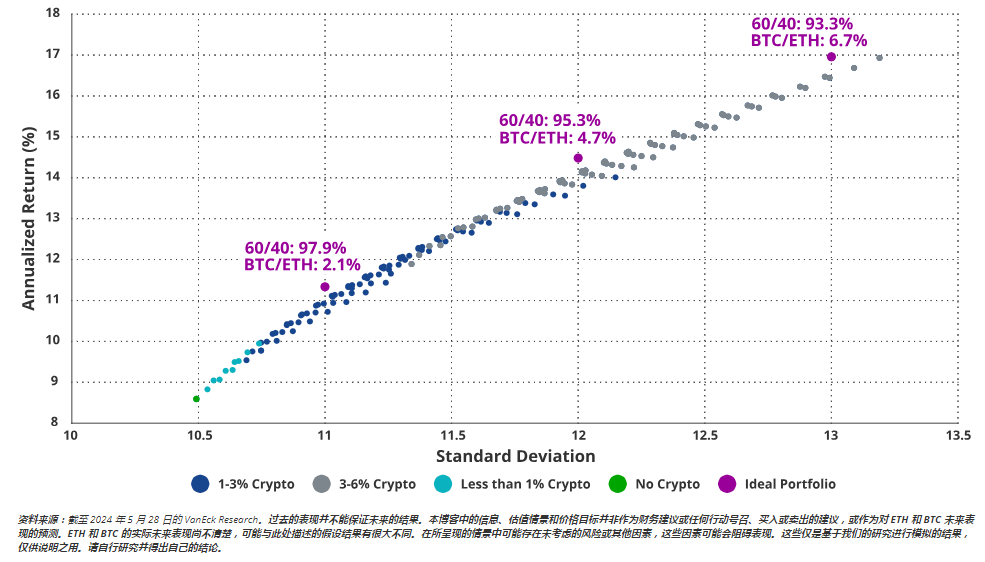

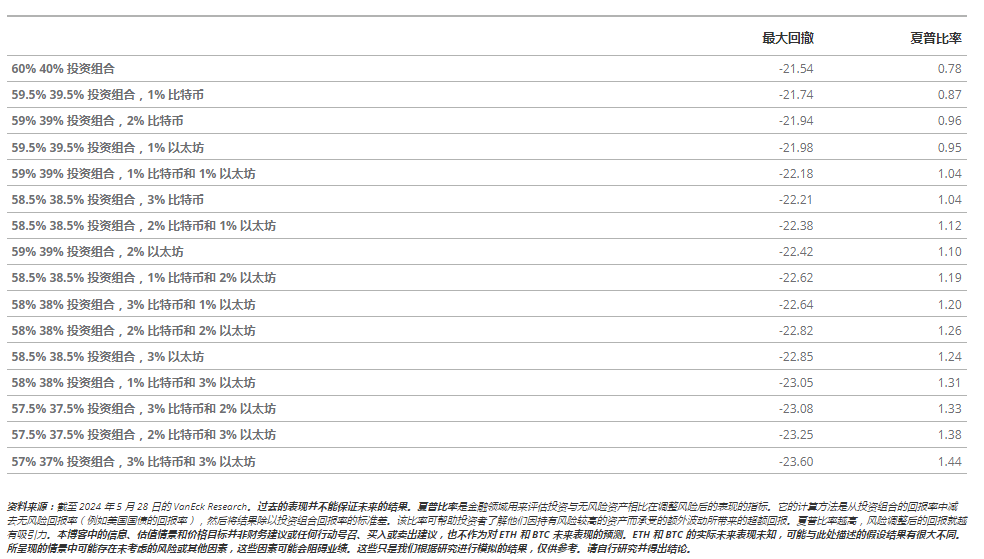

2. Drawdown and Sharpe Ratio Analysis

To assess risk and return, VanEck analyzed 16 representative 60/40 investment portfolios, gradually increasing the cryptocurrency allocation up to a maximum of 6%. The main findings were as follows:

- Improved Sharpe ratio: As the cryptocurrency allocation increased, the portfolio's Sharpe ratio significantly improved.

- Minimal impact on drawdowns: The maximum drawdown only slightly increased, making a higher cryptocurrency allocation attractive to many investors.

The data on maximum drawdown and Sharpe ratio showed that a 6% cryptocurrency allocation resulted in a Sharpe ratio almost twice that of the 60/40 investment portfolio, with only a slight increase in drawdown. This emphasizes the significant benefits of adding BTC and ETH to traditional investment portfolios.

3. Optimal Allocation of BTC and ETH in Pure Cryptocurrency Investment Portfolio

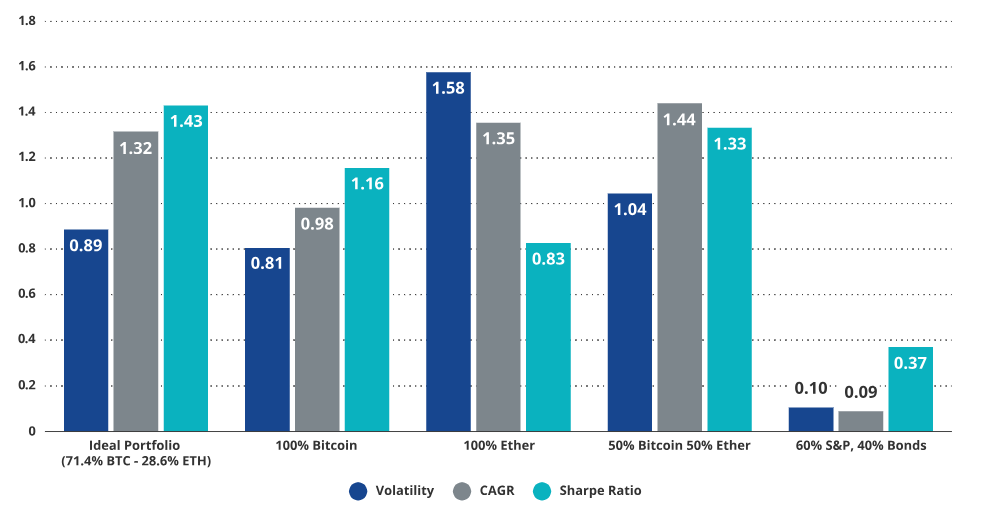

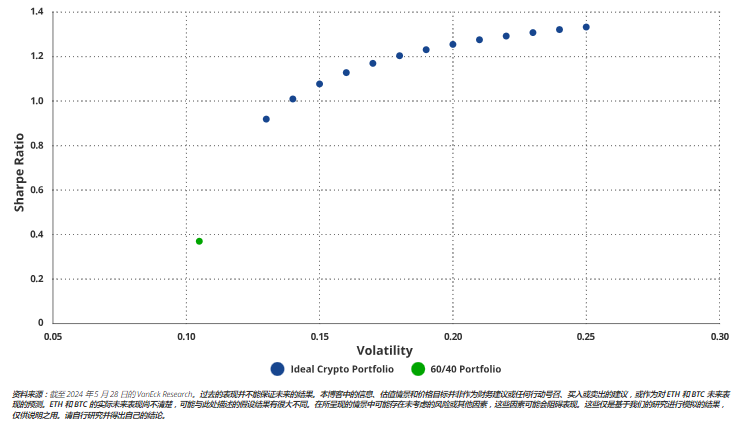

VanEck tested every possible combination of weights to determine the optimal combination that maximizes the Sharpe ratio. The analysis showed that the ideal allocation is 71.4% Bitcoin and 28.6% Ether. This allocation resulted in the highest Sharpe ratio. A 50% BTC and 50% ETH allocation also demonstrated significant advantages.

Comparison of Various BTC-ETH Investment Portfolio Configurations

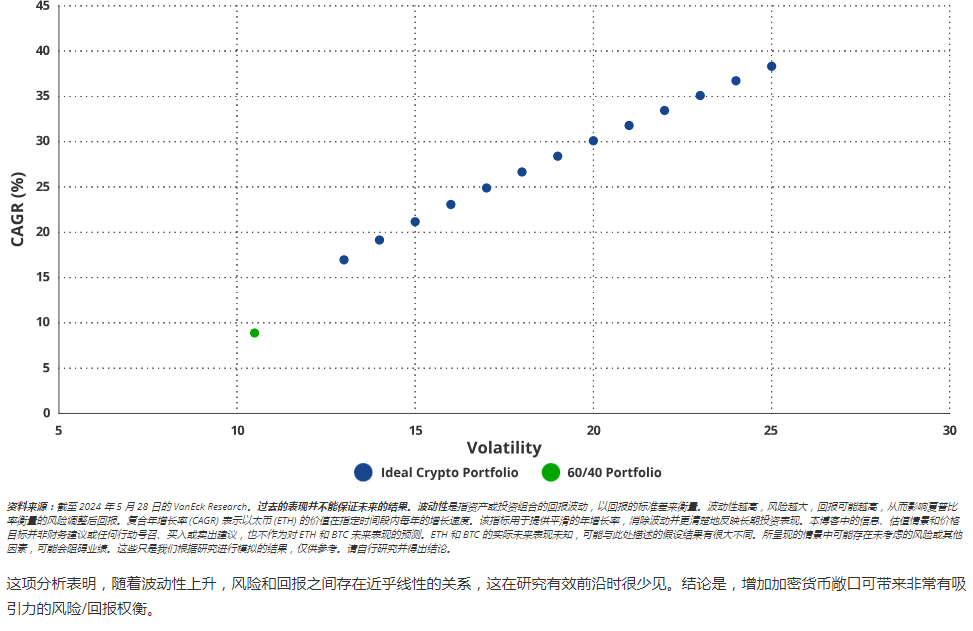

4. Efficiency Frontier with Cryptocurrency Inclusion

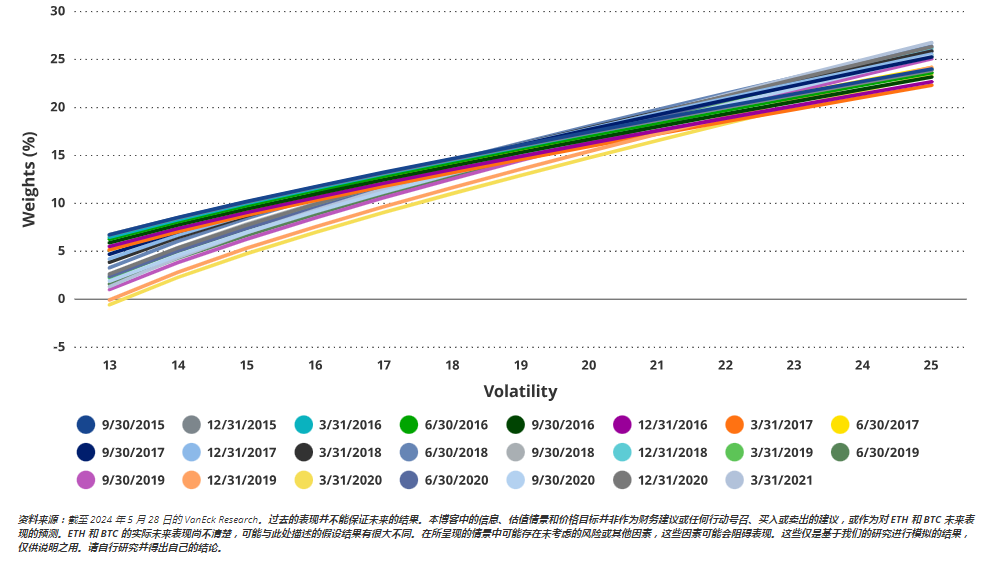

To achieve the optimal allocation of cryptocurrencies without constraints while maintaining reasonable volatility, VanEck studied the optimal weights of the ideal cryptocurrency investment portfolio (28.6% ETH and 71.4% BTC) when added to a traditional 60/40 investment portfolio. The resulting distribution chart showed that including the optimal cryptocurrency investment portfolio in a traditional 60/40 investment portfolio significantly improved returns at different levels of risk.

Additional volatility from digital assets contributes to overall returns

This analysis revealed a near-linear relationship between risk and return as volatility increases. The conclusion is that the increased cryptocurrency risk exposure leads to a very attractive risk-return profile.

5. Time Dependency of Efficiency Frontier Results

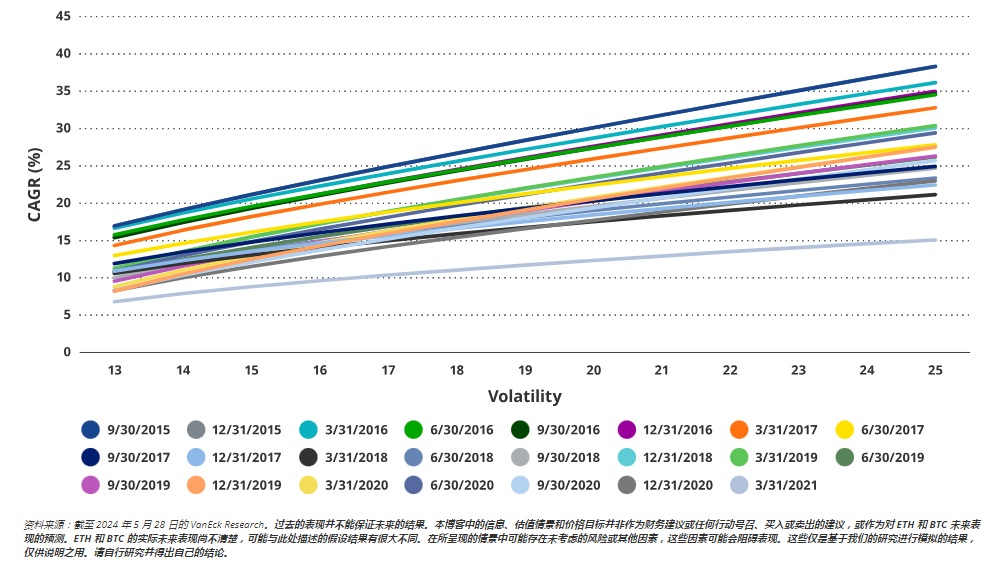

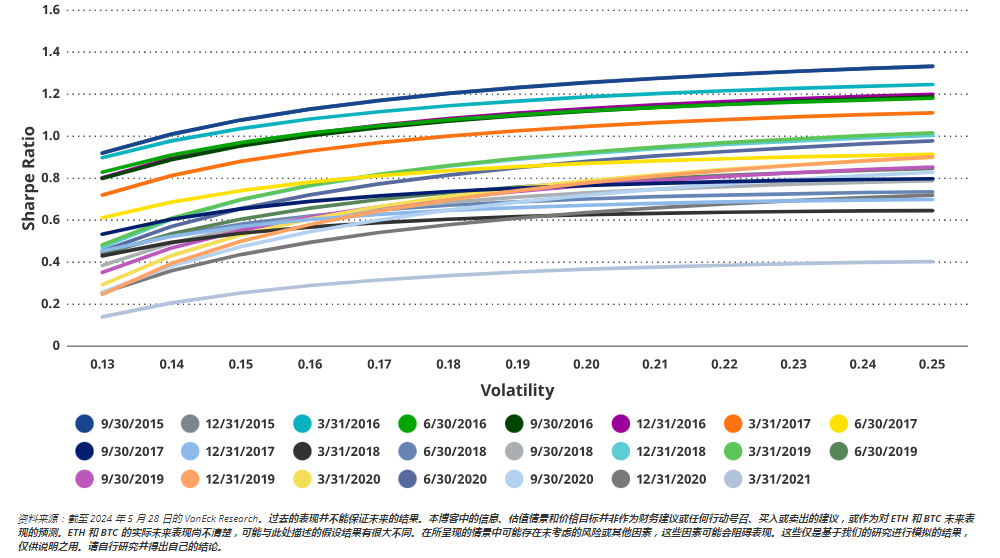

To determine if different time periods would affect the risk-return profile of the ideal cryptocurrency and 60/40 investment portfolio, VanEck repeated the analysis four times, repeatedly shifting the starting point forward by one quarter, generating 23 sets of results. The findings were as follows:

- As risk increased in all time periods, the optimal cryptocurrency investment portfolio's best weights also increased.

- Higher cryptocurrency allocations achieved higher compound annual growth rates in all time periods.

- The Sharpe ratio generally increased with higher volatility and cryptocurrency allocations.

Investment Risks of Ether

While ETH has a market capitalization of over $400 billion and is considered a mature smart contract platform, it is important to note that investing in ETH carries significant risks.

Speculative Dependence

- Currently, Ethereum's ecosystem heavily depends on speculation to generate income. If overall risk appetite decreases, ETH may exhibit a beta significantly lower than the S&P 500 or Nasdaq Composite Index.

Regulatory Risks

- This risk depends on regulation. Many assets within the ETH ecosystem may be classified as securities. This could lead to many Ethereum ecosystem projects having to register with the SEC, or face severe legal consequences.

- Large financial firms have numerous lobbying groups and former employees appointed to top positions in most governments globally. These former employees can build regulatory moats to prevent disruptors like Ethereum.

Interest Rate Risk

- As a high-risk asset, rate hikes or other restrictions on global liquidity risk could have a significant impact on the valuation of ETH compared to other asset classes.

Competition

- Competition in the emerging smart contract platform space is exceptionally fierce. While Ethereum is currently the leader, high-performance blockchains like Solana and Sui have some technical advantages and are focused on business development and user experience. In the long run, they could challenge Ethereum's dominant position.

Development by Financial Companies

- One of the biggest advantages of Ethereum is its ability to reduce the costs of the financial system by eliminating many high costs in the current financial system. If financial companies take cost-saving measures, they can retain their user base.

- Existing financial companies can also create blockchain smart contract platforms to compete with Ethereum, thereby weakening Ethereum's long-term potential.

Geopolitics

- Currency control is one of the most important areas of government power. Geopolitical events, such as major regional wars or escalating geopolitical tensions, may prompt governments around the world to suppress non-sovereign financial systems and forms of currency.

Conclusion

This article clearly demonstrates that adding a moderate amount of cryptocurrency (up to 6%) to a traditional 60/40 investment portfolio can significantly improve the portfolio's Sharpe ratio, with relatively minimal impact on drawdowns. For a pure cryptocurrency investment portfolio, a 70/30 allocation between Bitcoin and Ether provides the best risk-adjusted return.

Investors should consider their individual risk tolerance, but the data shows that balanced inclusion of Bitcoin and ETH can provide significant benefits in enhancing returns relative to the incremental risk introduced. The research results highlight the potential for cryptocurrencies to improve portfolio performance in a controlled and measurable manner.

Related Reading: 10x Research: Why Are We Bearish on ETH and Bullish on BTC?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。