In the past 15 days, the Meme coin DOG•GO•TO•THE•MOON ($DOG) has risen by over 230%, breaking through its previous high and reaching a peak of $0.0062. Meanwhile, many mainstream Layer 2 protocol tokens in the Bitcoin ecosystem have experienced a decline of over 50%. These are what we call "value coins".

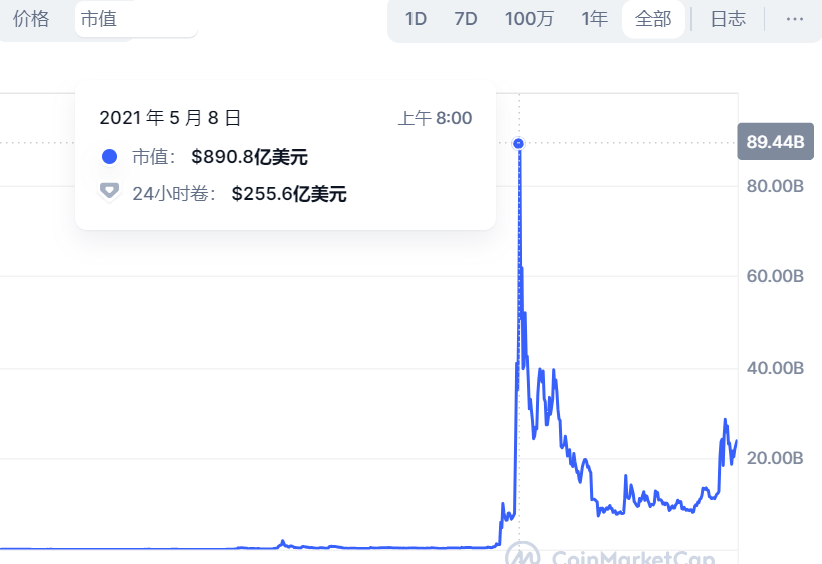

Although short-term fluctuations may not indicate much, looking back at previous bull markets, leading MemeCoins have shown remarkable performance. During the last bull market, $DOGE's price increased by over 150 times, reaching a market value close to $90 billion. Other MemeCoins such as $Shib, $People, $ELON, and $AKITA have also performed well.

MemeCoins originally originated from a spoof of cryptocurrencies by two software engineers, Billy Markus and Jackson Palmer, in 2013, which led to the creation of Dogecoin ($DOGE). However, with the development of cryptocurrencies, MemeCoins have become an essential narrative in each cycle and are increasingly sought after by the broader crypto community. There is even a trend of "rejecting VC coins and only loving MemeCoins".

On one hand, from the perspective of VC coins, many so-called value coins often have high market values, and investors are wary of being left holding the bag. On the other hand, it is necessary for us to consider whether MemeCoins truly embody some kind of "special value". This special value, due to differences in awareness among different groups, may be an explicit value or an implicit value that has been consciously or unconsciously accepted by the broader crypto community and has developed into a common consensus.

Such changes are enough to arouse people's attention and prompt a reexamination of the concept of "value coins" that we are accustomed to. The question arises: how should we redefine it?

Let's first talk about the so-called value coins. In the existing cognitive structure, value coins are supported by value, which basically includes:

- Technological innovation: such as block expansion, smart contracts, AMM, oracles, multi-signature, various privacy/encryption technologies, etc.

- Application innovation: such as DEX, collateral, lending, derivatives, stablecoins, liquidity pools, interest rate swaps, aggregated yield, etc.

- Value capture: for example, $BTC as digital gold, $ETH as the platform token for smart contracts and DApps, $UNI as a DEX and infrastructure for various DeFi protocols, etc.

- Economic model: a good value coin often has a strict (at least serious) token economic model that reflects the careful design of the protocol token in various aspects such as mathematical models, resource integration, token distribution, value capture, and value flywheels.

- Ecological development: forming upstream, midstream, and downstream ecosystems around the encryption protocol, the development of the ecosystem can expand and capture the value of the protocol token, enabling it to grow and develop sustainably. For example, the thriving Ethereum and Solana ecosystems.

- Mainstream recognition: for a considerable period of time, a cryptographic protocol that has received recognition and investment from VCs demonstrates its value, and its protocol token becomes the object of pursuit for many.

And so on…

It is clear that value coins do not exist in the form of a single coin. They are a comprehensive presentation of encryption technology, encryption protocols, product applications, and ecological development. However, MemeCoins seem to be going against the grain. In a serious atmosphere in the crypto world, they even appear to be a joke. What are the characteristics of MemeCoins?

From the perspective of the coin itself:

- Low unit price

- Huge supply

- No practical use

- Large price fluctuations

- No serious economic model

- Does not emphasize technology, fundamentals, and ecology

- Appears to be just a single coin

- Mostly have a short lifecycle

- And so on…

But from the perspective of participants, MemeCoins often have the following characteristics:

- Interesting: not serious, fun and interesting, such as $Lowb, although unsuccessful, it is considered interesting

- Easy to empathize: represented by something widely known, it can empathize on a large scale, such as Dogecoin, $PEPE

- Community-driven: not driven from the top down by the project party and VCs, but rather by the community's consensus and spontaneous participation, with participants paying for their own approval

- Emotion-driven: the community tends to band together, often generating strong FOMO emotions under the influence of celebrities or the community, leading to FOMO buying and selling

- Cultural attributes: good MemeCoins gradually precipitate some cultural attributes, which in a sense can reflect or demonstrate certain intrinsic connotations and demands of different social groups, and also make the MemeCoin exhibit more lasting vitality

- And so on…

It is evident that MemeCoins lack the rational elements of technology, applications, and economic models, but possess human and social attributes, satisfying the emotional needs of individuals, communities, and even social organizations.

From the current development trend of MemeCoins, whether it is the MemeCoins issued in previous cycles, such as $DOGE, $PEOPLE, $SHIB, or the new ones in this cycle, such as $PEPE, $DOG, $ORDI, $BOME, they are showing strong empathetic narratives, competing for liquidity with so-called value coins.

Looking at the lifecycle of MemeCoins, after several rounds of bull and bear markets, some leading tokens still have a large number of supporters. Like holders of value coins, they buy, sell, or hold leading MemeCoins for the long term, making their market value and price strong, with active trading and sufficient liquidity, showing active vitality.

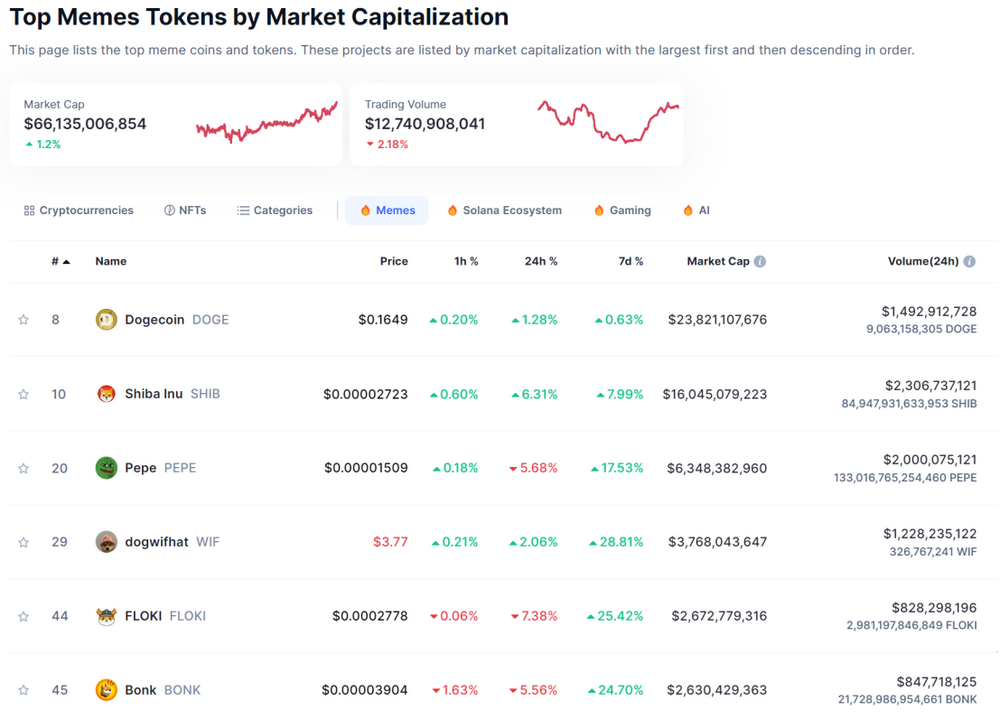

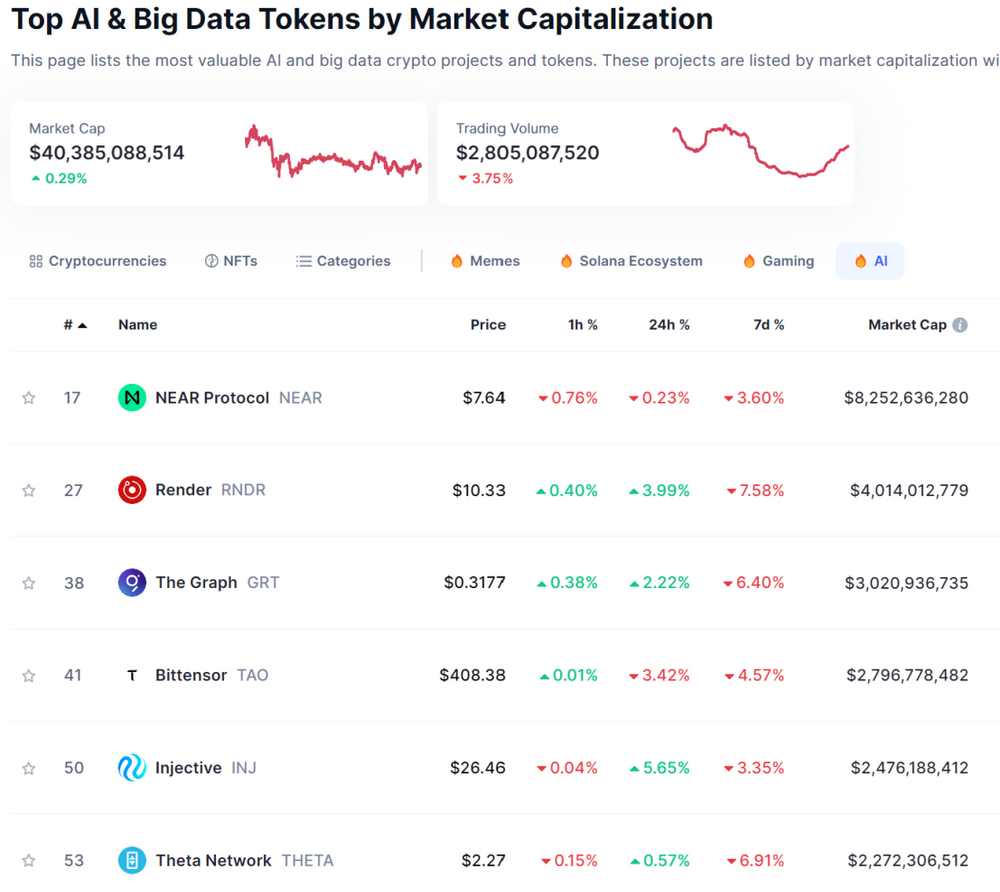

In terms of overall market value, the entire MemeCoin holds an important position in the cryptocurrency market, with a total market value exceeding $66 billion, surpassing the mainstream AI narrative of $40 billion.

At this point, MemeCoins cannot be underestimated, nor can they be overlooked. They have already made their mark. What exactly has happened behind this?

Through the analysis of traditional "value coins" and "MemeCoins", we can summarize the two development trends that the crypto world is presenting:

- From real to virtual, coexistence of the real and virtual

Real and virtual are relative. Cryptocurrencies are originally virtual assets, but cryptocurrencies with technological, application, economic model, and value capture can be considered "real", while those without these supports, relying on emotions, culture, and emotional attributes, can be considered "virtual".

Starting from BTC, aiming to be a "peer-to-peer electronic cash system", to ETH's "a smart contract and decentralized application platform", Uniswap's decentralized exchange (DEX)… Whether it's public chain tokens or smart contract protocol tokens, they have precise positioning and scenarios, providing so-called value support for the tokens. This is a rational expression.

On the other hand, MemeCoins seem more like a group "playing around", expressing preferences (such as Dogecoin), emotions (such as $PEOPLE), love or aspirations (Dogecoin Elon Mars $ELON)… and hobbies, emotions, empathy, love, and emotions are all emotional expressions, which are relatively virtual things. MemeCoins become their carrier, tokenizing them, and realizing value measurement.

At this point, we roughly understand that traditional so-called value coins have value because they are "practically usable", which is the usual cognition, while MemeCoins have captured the value of emotions and emotions, and have real value, which is a new cognition that should be established.

The relationship between the two is that the former expresses the "real," while the latter expresses the "virtual," but "virtual" does not mean it lacks value. As the saying goes, "the great Dao leaves no trace," and within the "virtual" lies enormous value. In the world of cryptocurrencies, the combination of the real and the virtual, rationality and emotion, may complement each other more effectively.

In my opinion, MemeCoins do not need the practical aspects to support them; being virtual is enough, boundless virtuality, TO DA MOON. However, for the practical faction, the virtual elements are very much needed, being meticulous and precise, lacking much fun, lacking the illusion of imagination, and also lacking the colorful dreams.

Therefore, I believe that the concept of "value coins," as traditionally defined, needs to be expanded, and its connotation needs to be re-cognized.

Secondly, it is the transition from centralization to decentralization, and the coexistence of the two in the long term.

The crypto world started with decentralization, then experienced a trend towards centralization, and is now moving back towards decentralization, and the two states may coexist for a long time.

In simple terms, the Bitcoin network is completely decentralized, while the emergence of Ethereum seems to have pushed towards centralization, with a typical manifestation being the presence of project parties and VC coins, which essentially control the distribution of benefits, making it very centralized, such as airdrops, governance, VC-led market value, and coin price. This has left many retail investors dissatisfied, voting with their feet - can I not participate?

The emergence of MemeCoins, not led by the elite, driven by the community, and the masses joining in the fun, gathering strength from the margins, even foolish consensus is still consensus. I like it, I participate, this is a redefinition of value. No technology, no applications, no ecosystem… but marginal emotions and feelings are consolidated, value is expressed and quantified. MemeCoins have turned the tide in promoting decentralization, becoming the "megaphone" for the vast retail investors, and MemeCoins have become their spokesperson and value carrier.

In the analysis of "real and virtual" and "centralization and decentralization," both of these development trends are clearly evident, each showing its unique value. The conclusion I want to draw here is that we have gradually realized that the emergence of MemeCoins is the product of the integration of these two trends. It comprehensively reflects "virtualized value" and "decentralized power." MemeCoin is another form of existence of value coins, and its value can be quantified and transmitted.

Finally, I want to emphasize that this article is based on personal contemplation and is intended to stimulate discussion. If we can recognize the characteristic attributes and value of MemeCoins, in the current trend where "asset issuance is an important innovation and narrative," if we can innovate MemeCoins that resonate with people and gods, or imbue so-called value coins with Meme attributes, this is indeed very meaningful. Of course, if we can theoretically establish a systematic framework and guide the continuous release of the enormous potential value of MemeCoins through practice, that would be even better.

For timely updates, please follow X (Twitter): @web3thinking

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。