Author: Compliance Researcher

The Hong Kong virtual asset trading platform's withdrawal policy officially took effect on May 31st, and non-compliant exchanges will cease operations. As the deadline approaches, nearly half of the VATP applicants, including OKX and Kucoin, have already exited, sparking market discussions. Among them, there are voices spreading FUD about Hong Kong: "Hong Kong is already a financial center ruin" and "Hong Kong's Web3 has ended before it even began." But is it really the case? How should regulators embrace Web3?

The conclusion is placed at the forefront: Hong Kong, as the Eastern gateway to Web3, has just begun its game with the West.

Web3's Next Decade: Comprehensive Compliance

When comparing 2022 with the present, Hong Kong's attitude seems to have shifted from "embracing" to "relatively cautious." But from a historical perspective, what stage is Hong Kong currently in? We can take a global view and compare the major Web3 financial markets around the world.

Japan was the earliest pioneer in Web3 regulation. After the famous Mt. Gox Bitcoin exchange collapse in 2014, Japan gradually initiated regulation and introduced a digital currency exchange licensing system in 2017, approved by the Japanese Financial Services Agency. Over the past 10 years, Japan has approved 23 digital currency exchanges to operate, including Binance, but most are domestic enterprises.

Operating an exchange in Japan and in Hong Kong have some similarities. For example, compliance with regulations regarding asset segregation and cold wallet requirements, and undergoing regular audits. It is also due to relatively strict regulations that Japanese exchanges were not implicated when FTX collapsed, as a significant portion of users' funds were stored in cold wallets. In addition, Japan's regulatory frameworks for ICOs, IEOs, STOs, CBDCs, and others have progressed to a relatively mature stage.

Singapore and the United States initiated strong regulation in 2022 following the collapses of Three Arrows and FTX exchanges.

Although the United States does not have "legitimate" compliant exchanges, publicly listed companies like Coinbase appear "seemingly" more compliant than other exchanges and have achieved significant business growth this year. After the FTX incident in 2022, offshore exchanges such as Binance and Kucoin have gradually faced regulatory challenges in the United States.

It is evident that regulation is gradually delving into specific areas, becoming a "fine art."

During this period, Japan and Singapore also faced criticisms of being "too strict" and "pessimistic," but as regulatory regulations continue to improve, the Web3 ecosystems in these two regions are becoming increasingly active.

The once "heavy-handed" U.S. regulation has shifted from a strong suppression stance. Recently, the United States has released the latest FIT21 (21st Century Financial Innovation and Technology Act) regulatory framework, which outlines how to define digital assets (including DeFi and NFTs) and delineate the boundaries between commodities and securities. This may also become one of the most far-reaching laws affecting the crypto industry in the future.

Following the United States, regions in Southeast Asia, Dubai, India, Iran, and others have planned to introduce Web3 regulatory policies within a few years. Even countries like Europe and Nigeria, which were not previously active in the cryptocurrency industry and did not have a clear regulatory stance, have also joined this round of cleaning and rectification.

Regulatory agencies around the world do not want to miss out on Web3. The trend towards compliance has taken shape, and regardless of whether it starts with embracing or collapsing, each jurisdiction will gradually move towards precise regulation.

In terms of the number of licensed exchanges, offshore exchanges account for almost no more than 30% of the total licenses, and regulators are more inclined towards local enterprises.

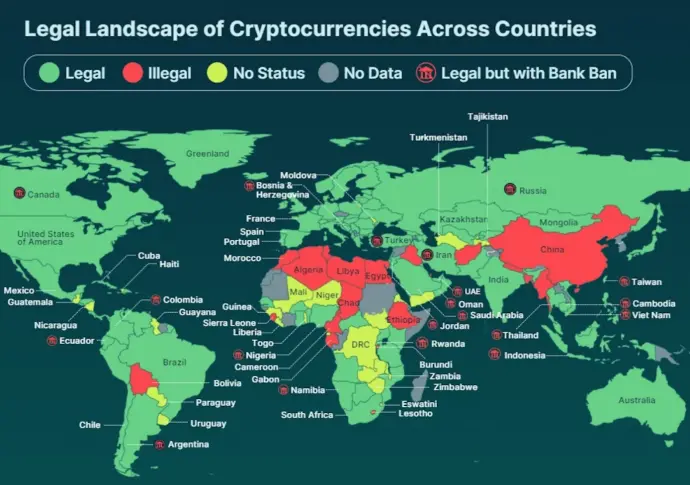

Legal cryptocurrency landscape from 2023 to 2024 (CoinGecko)

This is not a regulatory challenge, but a challenge for offshore exchanges. Looking back at the wild era, offshore exchanges were able to serve nearly 200 million users in a relaxed regulatory environment. But this has become a thing of the past. Apart from the well-known compliant Binance, among the exchanges that withdrew their applications, OKX has gradually expanded its presence and obtained licenses in Singapore, Dubai, and other places over the years, but Gate and Kucoin have relatively fewer licenses.

To use an inappropriate analogy, "it is difficult to go from luxury to frugality." For offshore exchanges seeking to "go ashore" and enter major financial regulatory jurisdictions, it seems quite challenging.

The era of regulatory arbitrage in the crypto market's wilderness has gone and will not return.

Taking another look at Hong Kong after this round of changes. Compared to the "expansion-style regulation" in the United States, where they first operate and then face penalties, Hong Kong has adopted a "native-style regulation" of obtaining a license first and then operating. It has directly skipped the phase of unbridled growth.

Since Hong Kong introduced Web3 regulatory policies in 2022, it has already sounded the horn for the comprehensive compliance of the Web3 industry. By June 1, 2024, the AMLO license was officially implemented, and non-regular exchanges have completed their withdrawal, with more than half of the applicants still in the process. Exchanges that have already operated, such as HashKey Exchange, have achieved a trading volume exceeding 440 billion Hong Kong dollars, demonstrating a positive development trend.

Therefore, it seems that the exit of some exchanges is not worth being overly pessimistic about. From a historical perspective, this is just an inevitable phase that Hong Kong, like other regulatory jurisdictions, is experiencing in its process of thorough review and tracing back to the source.

More importantly, the 531 policy also signifies that Hong Kong has already tackled the most concentrated and complex "tough nut" in the industry, completing comprehensive regulation.

Hong Kong, the United States: The Gateway for East-West Competition

Regulation is in place, what's next? The period of momentum has passed, and the period of competition has just begun.

Four years ago, the founder of PayPal predicted that the major political conflict in the future would be between the artificial intelligence of communism and the cryptographic technology of liberalism.

Now that both AI and Web3 have gained momentum, the United States and Hong Kong are seen as gateways for the East and West in the Web3 industry. The competition between the regulatory attitudes in these two regions will lead the global development direction of Web3.

Why the need for competition? Unlike AI, in Web3, monopolistic regulation is no longer feasible. The Web3 era has built more businesses based on the network economy, which can easily provide services to customers across physical borders.

The Web3 Bible "Sovereign Individual," which inspired Satoshi Nakamoto to invent Bitcoin, depicted this scenario: "Due to the development of information technology, you will soon be able to create wealth in cyberspace without being plundered by nation-states. This will create a de facto constitutional demand, that is, the government must provide satisfactory services before asking you to pay the bill."

In the future, political leadership may become increasingly similar to entrepreneurial spirit, as only being friendly enough can attract funds and talent. It is not that Web3 needs to be regulated, but rather that regulators need Web3.

The recent attitude of the United States is already quite clear. This year, the topic of cryptocurrencies was placed at the center stage of American politics for the first time. According to CoinDesk, about one-third of American voters consider a political candidate's stance on cryptocurrencies before making voting decisions. 77% of voters believe that U.S. presidential candidates should at least understand cryptocurrencies. 44% of voters to some extent believe that "cryptocurrencies and blockchain technology are the future of finance." Even Trump exclaimed, "Ensure the future of cryptocurrencies happens in the United States!"

The East-West game has taken shape, and a prominent battleground is the ETF. The sudden change in the U.S. attitude towards approving ETH ETFs may be due to local factors, as well as the fact that Hong Kong relatively pioneered the launch of ETH ETFs in April.

Although currently there is a significant difference in scale between Hong Kong and U.S. ETFs, as one of the world's largest offshore financial centers, Hong Kong is expected to attract more institutional participation in the future as the ecosystem matures, leading to an institutional bull run.

Next, the development of ETH ETFs as interest-bearing assets is expected to become the next focus of the game.

After Ethereum transitioned from POS to POW, staking generates passive income similar to interest, with the current market annual interest rate at around 4.5%. If Hong Kong is the first to launch a Staking Ethereum spot ETF, after receiving staking rewards, subscribing to the ETF will no longer be a fee-paying activity but a profitable one. It could also become a "digital treasury bond," with its attractiveness potentially surpassing that of Bitcoin ETFs to some extent.

The development of the Web3 industry is also related to its local cultural heritage. Although compared to the relatively outgoing and diverse West, Easterners may seem more reserved and cautious, it does not mean they are falling behind.

Hong Kong has already issued several regulatory documents, including the "Guideline on Anti-Money Laundering and Counter-Terrorist Financing for Licensed Corporations and Registered Institutions engaged in Virtual Asset Services" and the "Guideline on Anti-Money Laundering and Counter-Terrorist Financing for Associated Entities of Licensed Corporations and Registered Institutions engaged in Virtual Asset Services." The regulatory policy, compared to the U.S.'s previously used "Commodity Futures Ordinance," appears clearer and more mature, without the need for extensive debate on whether cryptocurrencies are "securities" or "commodities."

As the bull market gradually reaches its peak, the industry's wealth effect will become apparent, and a new group of wealthy individuals is about to emerge. Hong Kong, a region naturally endowed with "Eastern mystical power," will also see an influx of more mainland and overseas Web3 forces and their capital as the market develops.

In the next cycle, there will be a multidimensional integration of Web3 and traditional finance, revitalizing the Hong Kong financial market. The Securities and Futures Commission of Hong Kong has indicated the possibility of opening up STO and RWA investments to retail investors, further expanding the virtual asset market. In addition, the regulatory framework for Hong Kong's stablecoin and over-the-counter virtual asset shops (OTC) is also in progress. Once the entire chain is connected, Web3 will inject new vitality into the entire Hong Kong market.

As the historical tide continues to advance, which enterprises will remain at the table? Exchanges are the most important cornerstone of the Hong Kong Web3 ecosystem.

In the foreseeable future, licensed exchanges like Hashkey Exchange will not only operate their own trading businesses but also play a crucial role in connecting various financial industries in Hong Kong's Web3. For example, in this ETF issuance, Hashkey Exchange also acted as the custodian, providing underlying infrastructure support to the issuer. In the future, in businesses such as RWA, STO, and OTC, it will play an indispensable role.

It is precisely because of this that some offshore exchanges have been driven off the Hong Kong table. This is also called "what goes around, comes around."

HashKey has actually made a smart move. For offshore exchanges, it is difficult to transition to compliance, but for native compliant exchanges, operating from a jurisdiction to offshore exchanges, "compliance" may even become a shortcut. HashKey has also obtained a license from the offshore center Bermuda and launched the international platform HashKey Global, targeting overseas users. In the future, it is expected that strong exchanges like HashKey will break through physical borders more and provide more secure and convenient Web3 business support for individuals.

Development has its ups and downs, and perhaps we should take a rational and comprehensive view of the historical context during Hong Kong's withdrawal period.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。