SOL has peaked during this period, and taking a long position in ETH / short position in SOL will be very attractive.

Author: 0XKYLE

Translation: DeepTechFlow

Introduction

In this article, the author analyzes the launch of the Ethereum ETF and its potential impact on the market, and proposes specific trading strategies. Despite changes in the market during the writing process, the author believes there is still profit potential. This article not only explores the performance of Ethereum and its related assets, but also involves opportunities in the Real World Assets (RWA) industry in the new regulatory environment.

Main Content

I started writing this article on May 24, 2024, when the price of ETH was $3632.22 and ONDO was $1.08. Although the prices of certain assets have changed during the writing process, the author believes that there is still potential for an upward trend, despite the reduced risk/reward ratio of the trade.

Dear cryptocurrency enthusiasts, congratulations. In a surprising move, the U.S. Securities and Exchange Commission (SEC) approved a rule change to allow the creation of Ethereum ETFs, despite Gary Gensler's strong stance on ETH in public.

I won't delve into the reasons behind this decision - that's left for the political commentators on Twitter to discuss. What we care about is that this decision has happened and marks a significant shift in the U.S. government's attitude towards cryptocurrencies.

This is also thanks to the approval of FIT21 ("FIT21 provides the regulatory clarity and strong consumer protection needed for the digital asset ecosystem to thrive in the United States") - a new era of regulatory compliance for businesses is on the horizon.

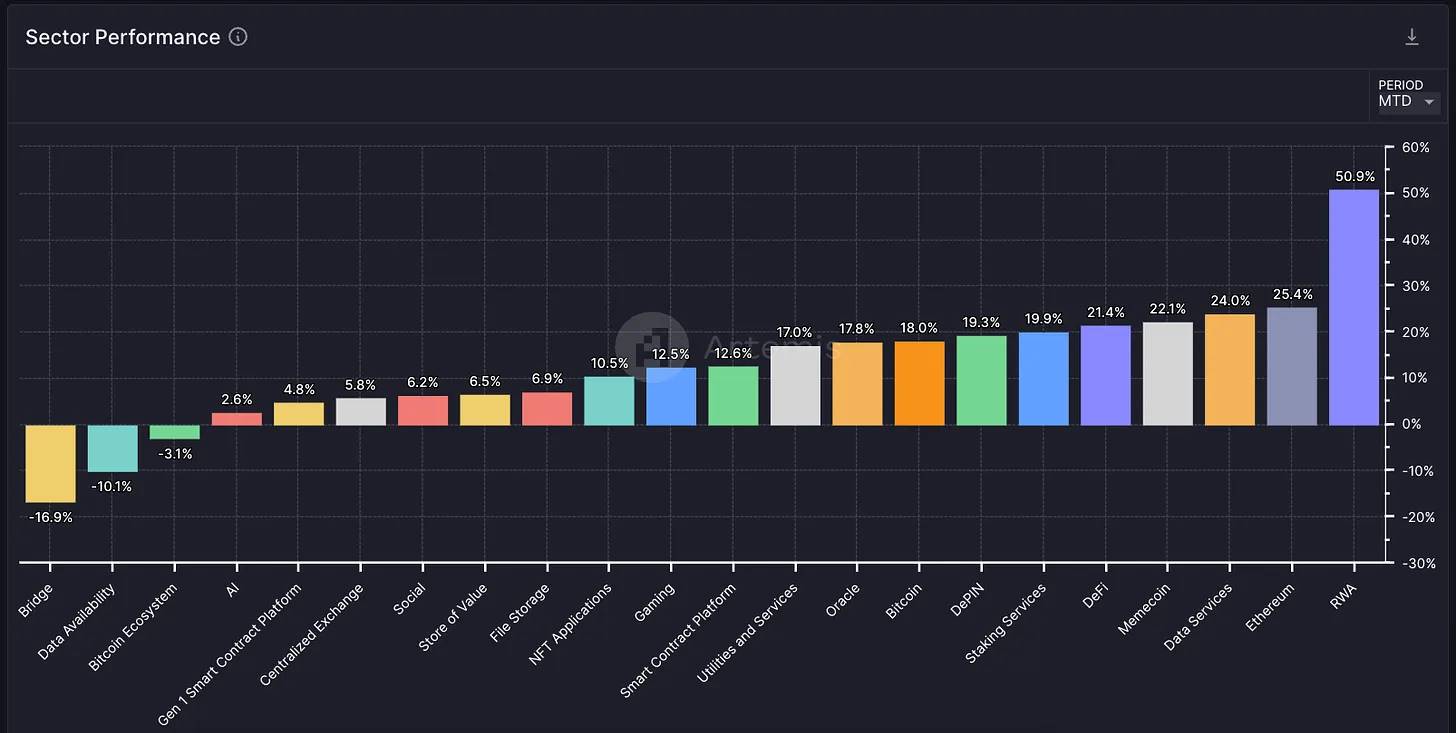

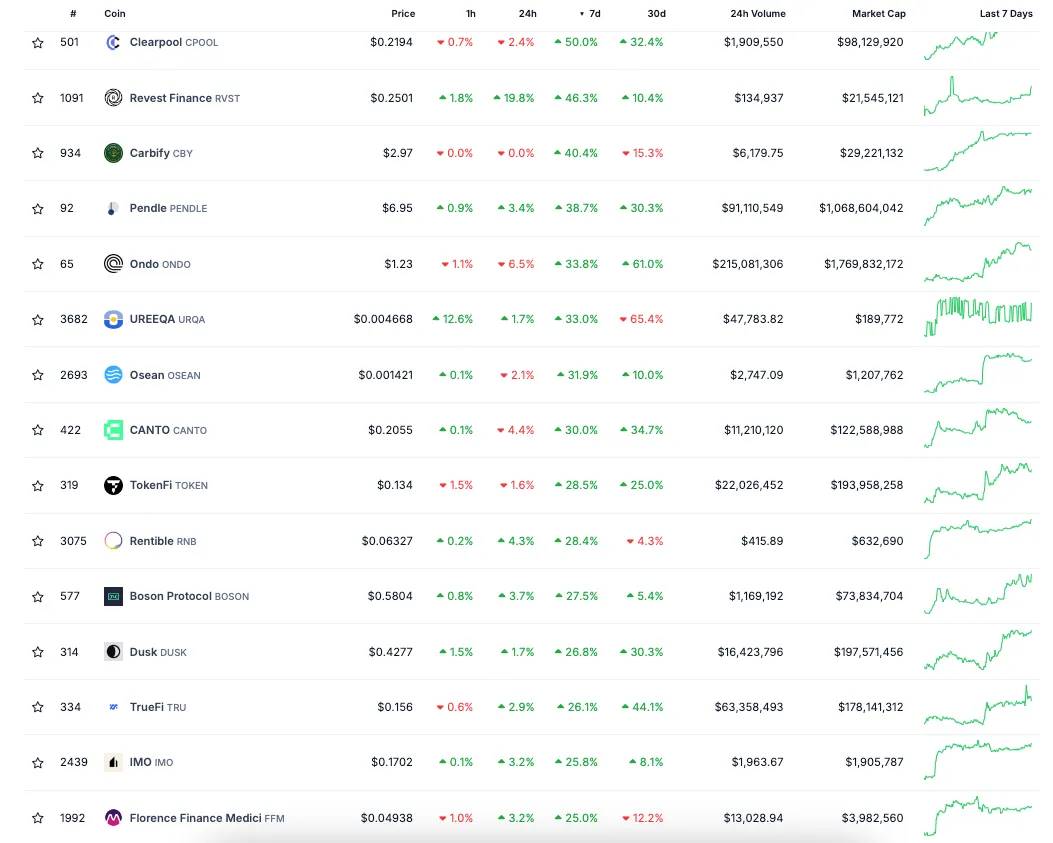

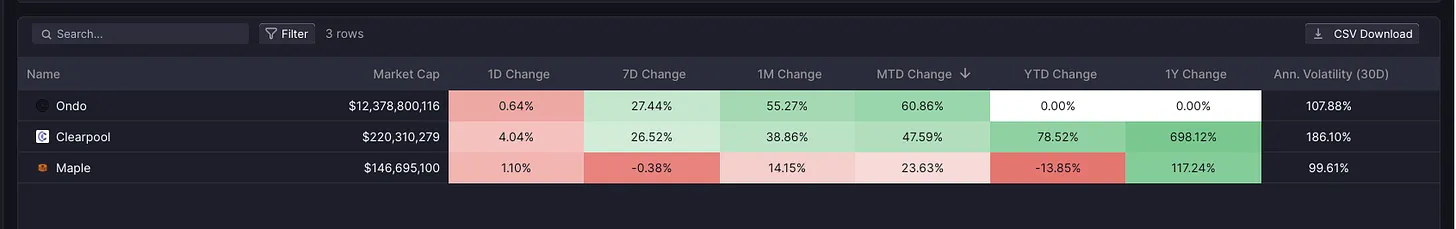

The new dovish stance of the U.S. government towards cryptocurrencies is very bullish, and you can see how the market is digesting this information - RWA and the Ethereum sector have been outstanding performers so far this month (MTD).

I believe that with the ETH ETF and the recent dovish stance on cryptocurrencies, these two sectors are likely to continue to outperform the broader market in the coming weeks and months.

Introduction

Overview

This argument can be divided into two parts. First, the outstanding performance of Ethereum as an asset class and its related alternatives, and then the outstanding performance of the RWA industry as a beta for the overall "bullish government stance on cryptocurrencies."

These two sectors are closely linked because:

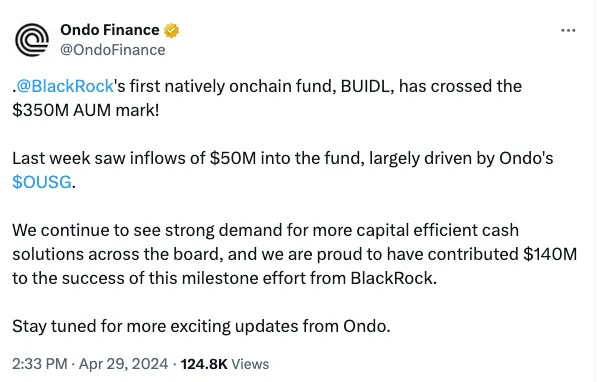

With the approval of the ETH ETF by the SEC, it signifies a more dovish stance on cryptocurrencies, which means that institutionally-driven RWA assets will also see more capital inflows (as we have already seen in the relationship between ONDO and BlackRock).

The institutional "ETH thesis" has always been about tokenization, stablecoins, real-world settlements - major institutions will talk about RWA assets on Ethereum everywhere; after all, this has always been the main narrative of ETH.

Therefore:

Long ETH and its best beta

Long RWA - ONDO is my favorite

Other RWAs can also be considered for long positions, but the reason I don't do this is because ONDO itself is a fork of ETH, and going down the risk curve only means that you are more susceptible to market impact in a downturn.

Comprehensive analysis of the ETH ETF

Now let's break down the ETH ETF trade. I find this very interesting because unlike the BTC ETF, which we had plenty of time to "prepare" for, the approval of the ETH ETF caught many market participants off guard. That's why we saw a 25% increase in ETH on the day the probability of the ETH ETF approval changed dramatically.

The issue is, the market rarely allows you to make the same trade twice - the argument for this trade depends on the idea that "ETH ETF is not yet priced." To gauge this, we must first look at the performance of the BTC ETF:

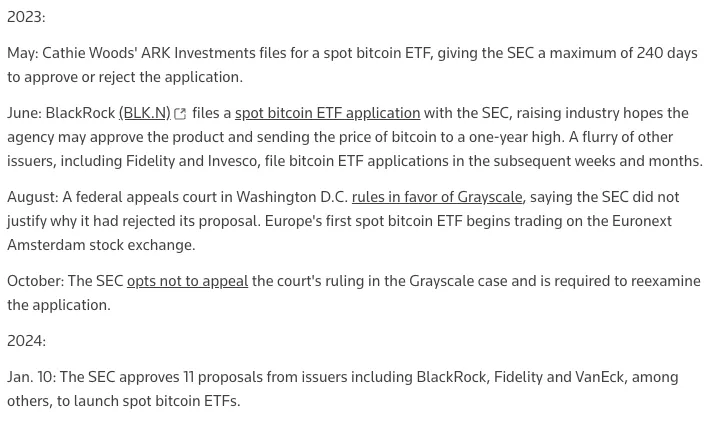

Key dates for the BTC ETF

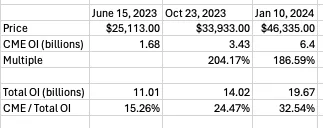

June 15, 2023: A crucial week for BTC, BlackRock showed their hand and submitted a spot Bitcoin ETF

October 23, 2023: Perhaps the real consolidation of the BTC ETF possibility is that the SEC did not appeal the court ruling on Grayscale, which means they are seriously considering it → confirmed by the market

January 10, 2024: Bitcoin ETF officially launched

Some points to note

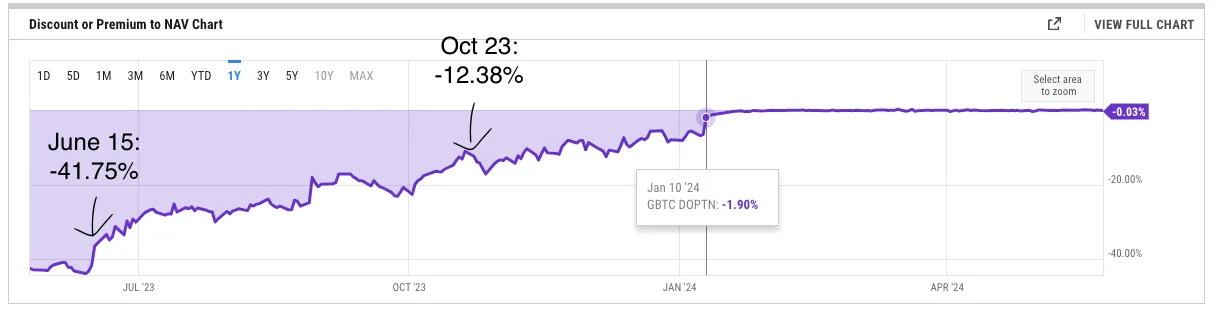

BlackRock's ETF announcement essentially marked the end of the discount trading

The discount only ends when the ETF is launched (this may seem obvious, but think about it carefully, it's like "free money," since we have already "proved" that the ETF can/will be launched, the discount may even end before the ETF is launched)

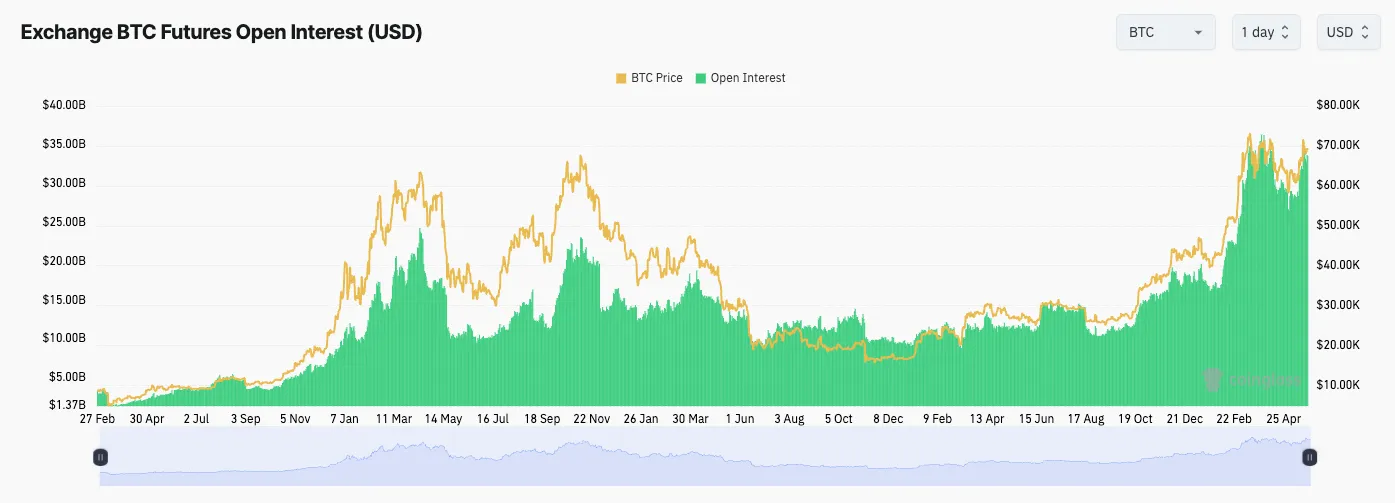

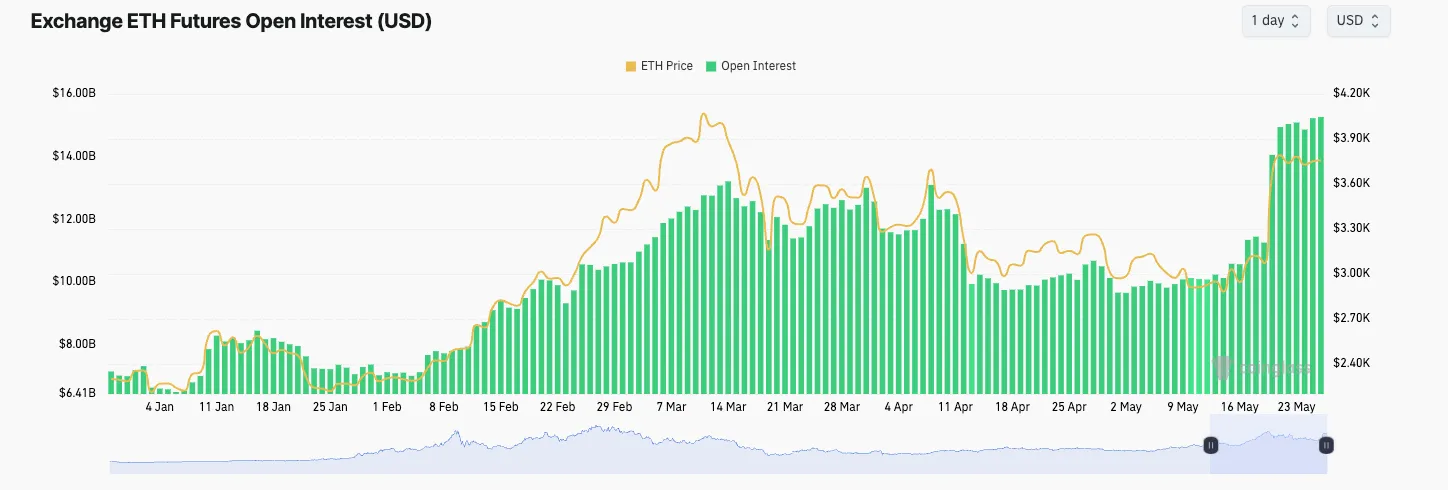

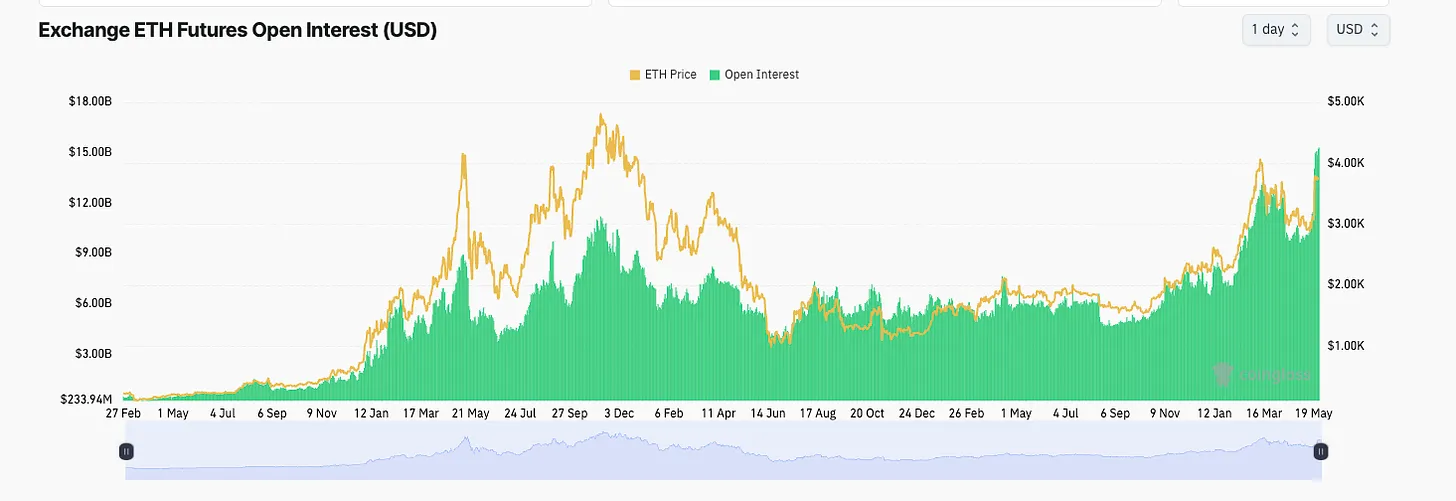

OI surged after June 15, fell in August, but started to rise in October, and peaked in February

I'm watching the Chicago Mercantile Exchange (CME) OI, as it is the best tool to understand institutional positioning

Key dates for the ETH ETF

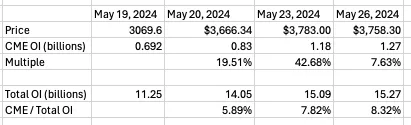

May 20, 2024: Bloomberg analysts raised the probability of ETH ETF approval from 25% to 75%

May 23, 2024: The U.S. Securities and Exchange Commission approved the application for the listing of spot Ethereum ETFs

Here are some interesting things to note:

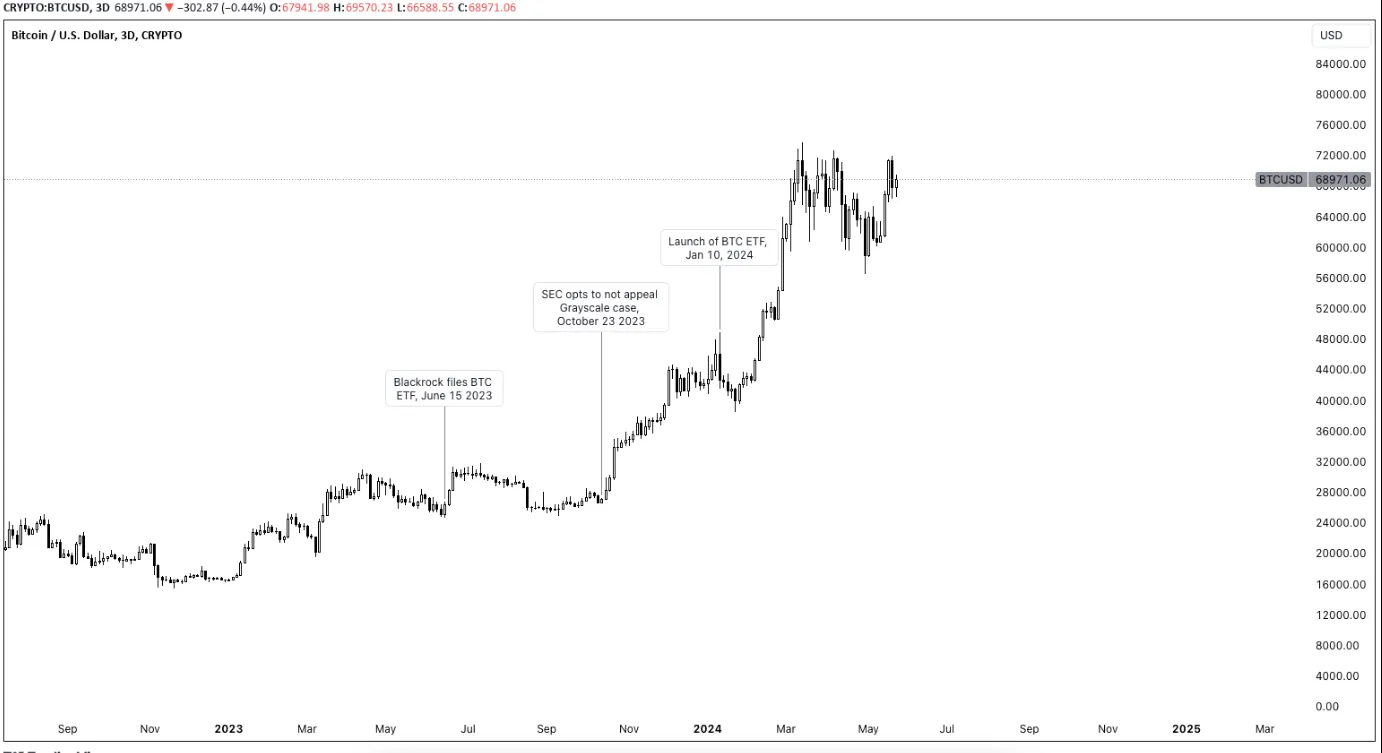

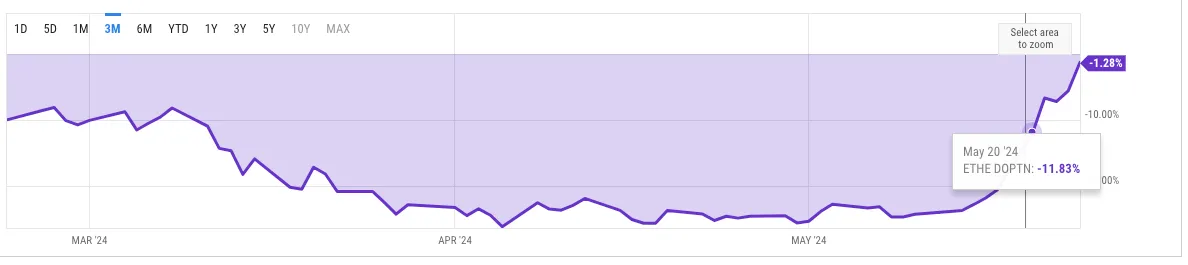

- Grayscale Ethereum Trust (ETHE) discount closed from -24% to -1.28% in 2 days, while GBTC took months to close

- The growth of CME OI is not as strong as that of BTC ETF

- The price movement of ETH mostly reflected the probability of ETF approval being raised by the market, rather than the actual event of ETF approval. This means that the market acted in anticipation of the ETF before the actual announcement, reflecting changes in expectations for the ETF. In contrast, each announcement of a Bitcoin ETF led to a significant price increase, showing that the market does not react the same way to the same trading opportunity twice.

Arguments and Risks

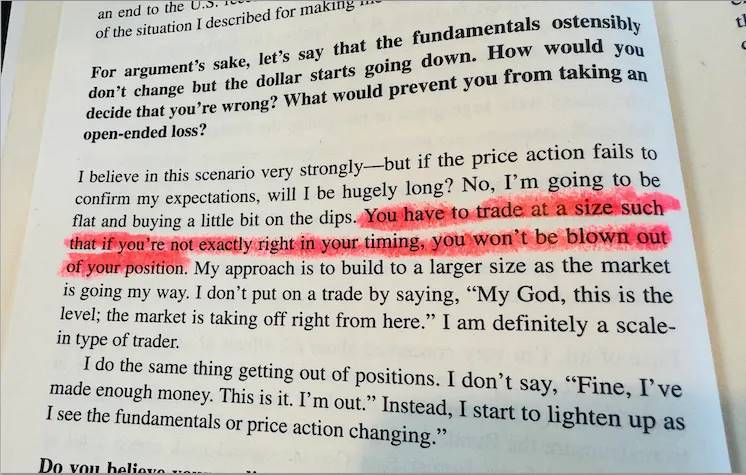

I want to start with the risks of the trade, as I believe that measuring the downside risk of a trade is more important than the upside risk - manage your downside risk, and the upside risk will naturally be managed.

Risks:

Primary Risk: Market has peaked/nearing the top of ETH/time-based surrender

The argument here is the speed at which the discount closed and the price performance of ETH before and after the announcement. You could think that these people know how the trade is going - it's basically a trade that only goes up, but CME OI and total OI are basically stagnant.

If the ETH OI is only $4 billion less than the BTC OI on January 10, this may indicate "all longs are long, who else will continue to buy?"

Honestly, I think this argument is quite strong. I believe the market is front-running this trade - despite the ETF just launching, the expansion of OI has already exceeded historical highs, which is different from BTC trading, where the market only sees such high OI when the ETF is launched.

The market equates "approval of the ETF" with "launch of the ETH ETF," which are two completely different things. This viewpoint is reasonable when you look at the price reaction at the approval announcement and the speed at which the discount closed.

I actually agree with this view, which is why I said at the beginning of the article, "these two sectors are likely to continue to outperform the broader market in the coming weeks and months."

I believe that there may be a price drop when market participants realize that the impact of the Ethereum ETF will not be immediate (i.e., "time-based surrender"). This would be an appropriate buying opportunity. I have set buy orders at different price levels and plan to gradually and prudently execute these buy orders. Here is a paragraph to explain how I trade:

Special Regulatory Risks

Because I don't know how registration risk works, I'm not in a position to comment on this. However, from what I've seen on TWITTER (DOT) COM, people are talking about why only 19b-4s were approved, and not S-1s.

Essentially, this means "challenges can be made to it within the next 10 days." I don't know if this is true. But if it is, if the whole thing is a scam, it would undoubtedly pose a huge risk to the trade.

Perhaps there are other "hidden in the fine print" risks to this approval, and that is definitely something to keep in mind.

I like this trade. What should you long next?

I know this article is already long, but we're getting to the exciting part. The story so far is: ETH is good, but the market may have run too far ahead. But in the long run, it is still a bullish catalyst. So, what should you buy next?

Many participants are in a dilemma when choosing the beta of ETH - after all, you have liquidity mining derivatives (LSDs), L2s, ZK-Rollups and De-Fi protocols, Meme, and so on to choose from.

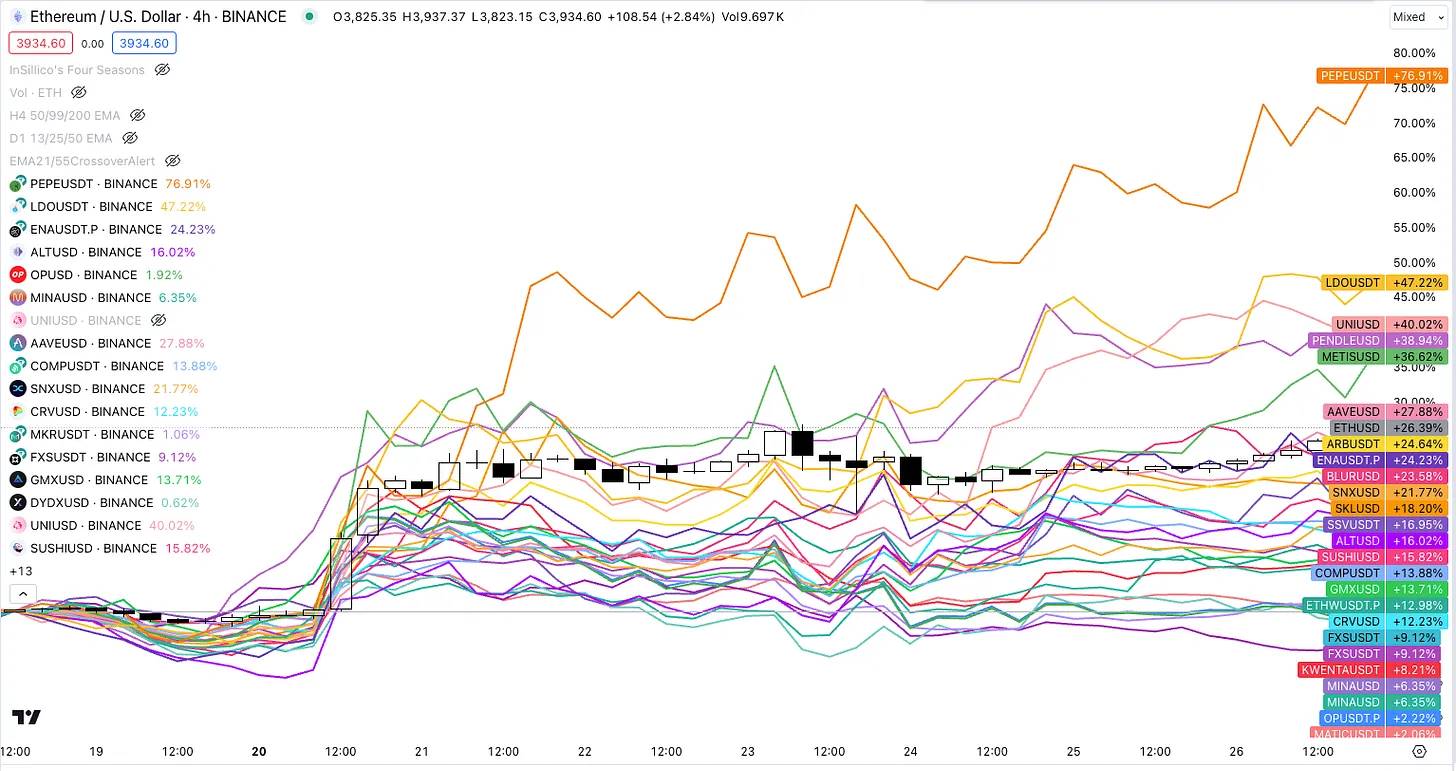

Therefore, in plotting the performance of all these coins, we can see that the top-performing coins (ranked by performance from high to low) are:

PEPE, LDO, UNI, PENDLE, METIS, AAVE

This is within a 1-week review period (i.e., from May 18 to May 26). This is a rough way to measure performance - a more scientific approach would be to actually calculate the beta of these coins over a more "appropriate" review period, but for me, this method is effective.

Personally, I choose to long PEPE and PENDLE among all the coins, as they have been the darlings of the market all year. These coins not only perform well in specific situations - they are among the best-performing coins so far this year.

Therefore, I believe that PEPE + PENDLE offer the most upside potential. They also have the added effect of being highly attention-grabbing coins; I wouldn't overlook the power of the PEPE-NDLE combination.

Timing of RWA trades

I spent too much time discussing ETH ETF trades, and now I don't have the energy to write about RWA trades. The argument here is simple: RWA has always been the driving force behind institutional entry into cryptocurrencies, and ETH has always been the main chain - ONDO has a partnership with BlackRock on ETH.

So, this is a beta play for the overall ETH narrative. For asset selection, my primary choice is ONDO, and some people I know are also promoting CANTO / DUSK. Personally, I keep it simple on this issue - 1 ONDO = 1 CONDO.

Other

As an aside, I believe a good hedge trade is ETH/SOL. Overall, I feel that SOL has peaked during this period, and taking a long position in ETH / short position in SOL will be very attractive.

Conclusion

Phew! If you've made it this far, you deserve a cookie! I hope you enjoy this trading idea. I'm getting back into the swing of things, so I hope to continue to roll out new trading ideas! Also, for those in the U.S., have a very happy Memorial Day. I'm in New York City, so if you want to grab a coffee, feel free to reach out.

Additionally, here is a screenshot that I wanted to include, just to show that people may have overestimated the entire "spot ETF approval" and positioned too early.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。