As the cornerstone of the $ETH ecosystem, DeFi 1.0 may be ready for repricing.

Author: Crypto, Distilled

Translation: Deep Tide TechFlow

Recent news about the $ETH ETF has sparked significant market attention on $ETH beta. However, in the context of high demand for high-quality, highly liquid tokens, where are the best opportunities?

Despite being rich in truly valuable projects, DeFi 1.0 may be overshadowed by high-risk speculative projects and popular but lacking substance memes. The following are key points:

- $UNI DEX

L2 trading volume has surged by 650% in the past two years.

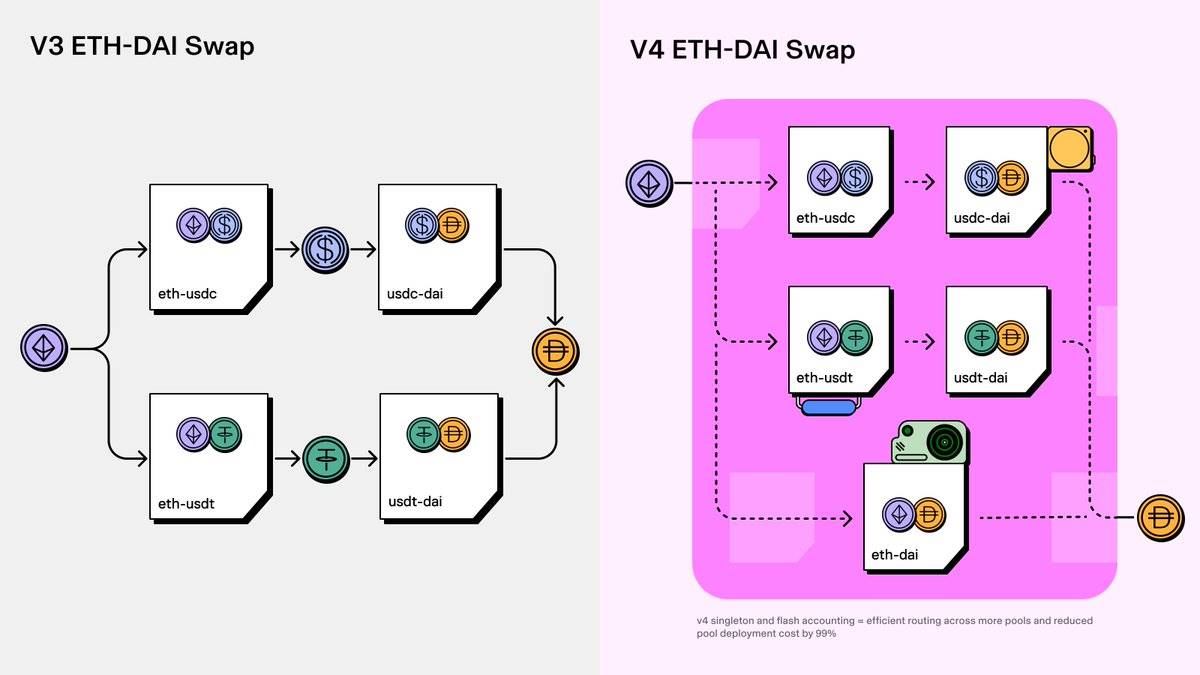

Uniswap V4 is scheduled to be launched in the third quarter.

The DAO proposed to activate a "fee switch" of $3.3 billion in February.

Received a Wells notice in April.

$UNI responded, claiming that 65% of its trading volume includes explicitly non-securities.

- $AAVE - Money Market

The third-largest DeFi protocol, with TVL exceeding $10 billion.

Approved to deploy Aave V3 on Solana in the first quarter.

Released a unified cross-chain liquidity solution Aave V4 on May 1st; prototype design starts from the fourth quarter.

Aave's TVL has almost doubled since the beginning of the year.

- $ENS - Domain Name Service

In February, ENS partnered with GoDaddy to simplify the link between wallets and web pages.

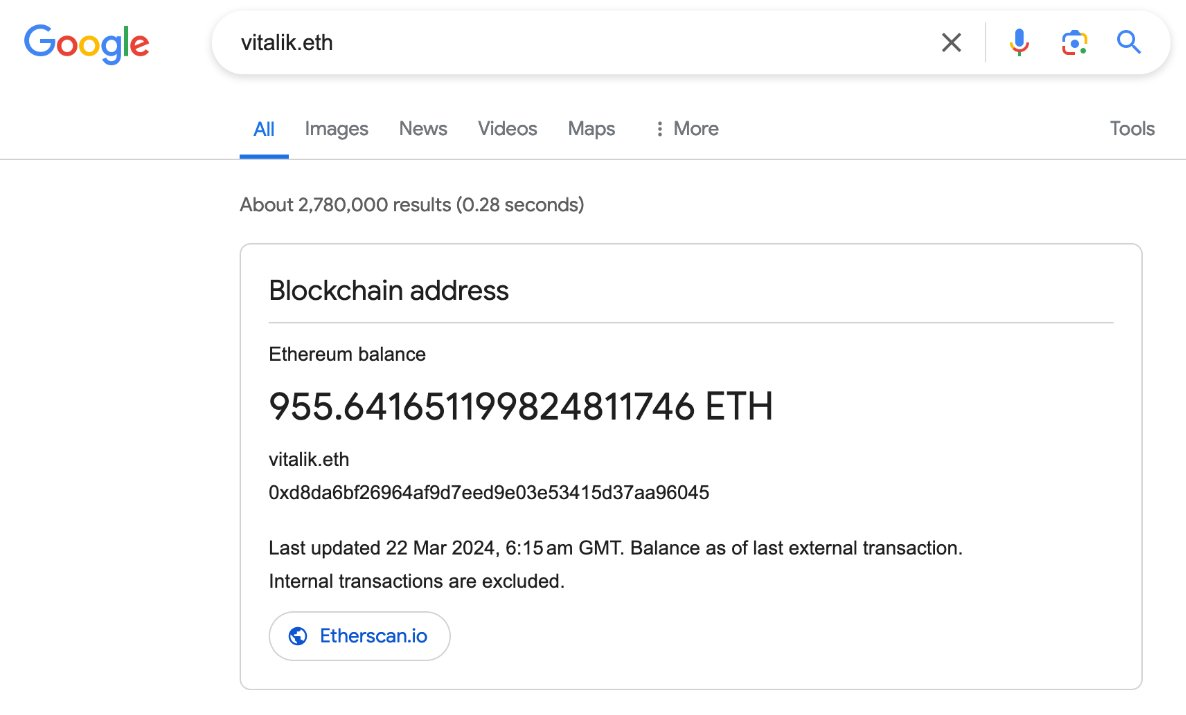

In March, Google integrated wallet balances with $ETH Name Service (ENS) domain names.

- $LINK Oracle

In April, $LINK launched the cross-chain bridge application "Transporter" to enhance token transfer security.

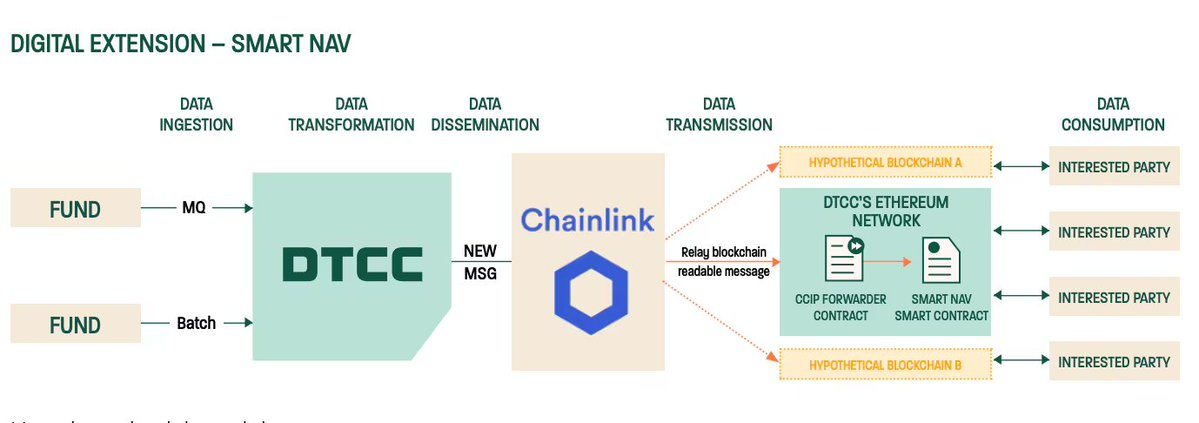

In May, DTCC completed a pilot with $LINK to accelerate the tokenization of funds across multiple blockchains.

Participants include Franklin Templeton, Schroders, JPMorgan, and BNY Mellon.

In May, $MKR announced their "endgame" strategy.

Launched two new stablecoins: NewStable and PureDAI, to surpass $DAI.

NewStable focuses on utility and scalability, supported by RWA.

PureDAI aims for decentralization, supported by assets such as ETH.

- $LDO Dominant Liquidity Staking

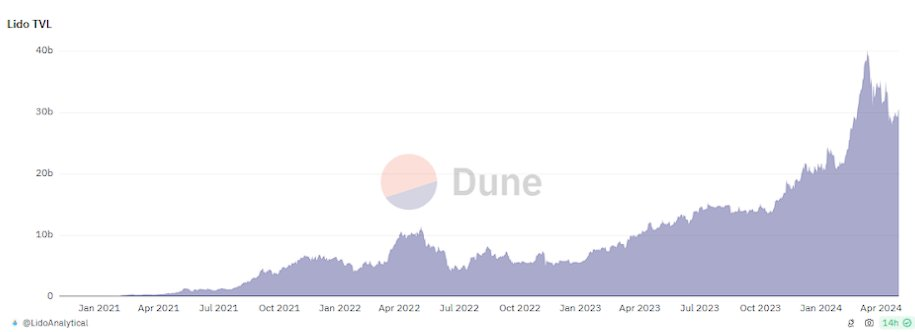

In February, the TVL of $LDO exceeded $30 billion.

By April, $LDO had reached 1M+ validators.

As a leading liquidity staking protocol, $LDO manages over 25% of all staked ETH.

Tailwind: The growth rate of ETH staking is 20 times the issuance speed of $ETH.

Final Thoughts

As the cornerstone of the $ETH ecosystem, DeFi 1.0 may be ready for repricing.

The market landscape is dynamic; exercise caution and prudence as the ETF develops.

As always, this is not financial advice.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。