Author: Nan Zhi, Odaily Star Daily

Before the popularity of Pump.fun, for security reasons, most Solana Meme investors were "10u war gods" to guard against DEV's removal of liquidity and other Rug operations. In March, influenced by BOME and SLERF, large pool Meme tokens became popular on Solana, but due to the overall market downturn and increasing exit scams, they gradually fell out of favor.

Subsequently, Pump took over—its convenient opening method and secure token endorsement once again made Meme tokens popular on Solana. In response to the attack, Pump.fun launched a 7-day zero transaction fee activity, leading to a historic high in the number of new tokens on Solana, with daily new tokens surpassing 20,000.

However, the appearance of Pump changed the characteristics and gameplay of Meme tokens, and malicious DEV harvesting methods continued to evolve. In this article, Odaily Star Daily will analyze the market characteristics and some tactics.

Token Market Characteristics

Tokens born in Pump have some significant features, which we summarize as follows.

Riding the Heat

Pump.fun's extremely convenient token issuance method has led to a rapid increase in the number of DEVs specializing in riding the heat projects. Similar to how Musk's tweets were dissected into countless Ethereum dog coins, Pump is mostly aimed at some Solana ecosystem influencers, including Ansem, Yelo, and others. By following these influencers, one can hope to gain early chips. However, it often happens that five or six tokens with the same keyword appear within one or two minutes. In such cases, the first token is not the main advantage, and more emphasis should be placed on chip distribution and buying speed.

Immediate Death of Internal Pool

Pump.fun is divided into internal and external pools, with the internal pool requiring the purchase of 85 SOL to end, after which LP will be added and destroyed. However, due to the significant cost difference between early and late participants in the internal pool, often at least five to six times difference, many DEVs tend to take profits directly when the internal pool reaches 80%-90%. How to deal with this? The most straightforward method is to keep an eye on the pump interface's chip list and exit at the first sign of DEV departure. In addition, users can try PlonkBot, which has the function of running away from DEV, but with limited success rate.

Obvious Market Cap Limit

The large number of tokens has dispersed funds and also made the creation of Meme consensus fragmented. Even if successfully exiting the internal pool, only a very small number of tokens can break through the 300,000 market cap. According to some users who have participated in Pump projects in large numbers, there is an obvious step-like limit to market cap existence. When breaking through one limit, it is easy to rise to the next limit, and users can summarize and generalize on their own.

Game

Website and Community

Generally speaking, having a well-made website can greatly promote the early rise of Pump tokens, at which point having a community is not crucial. However, the community and cultural consensus are key to breaking through the usual limits. For example, recent tokens like DJCAT and NAMI, the former rose due to a Community Take Over, and the latter consolidated consensus through continuous thematic image creation by the project team.

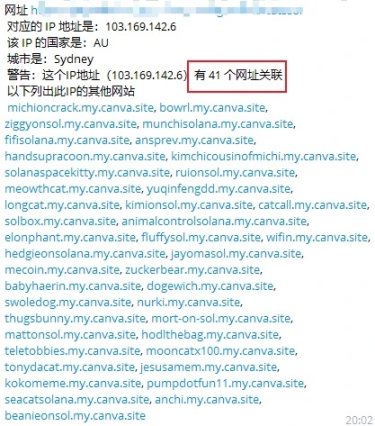

However, it should be noted that some DEVs promote by buying high-follower X accounts or mass-producing websites for promotion, and then selling at the high point of the internal pool. As a reference, the "Ethereum Dog Website Plagiarism" TG tool can be used to check the website, which can query how many websites are deployed on the same IP. However, if the website developer uses some third-party services (such as CDN), there may be cases where the same IP has produced hundreds of websites, and users need to discern on their own.

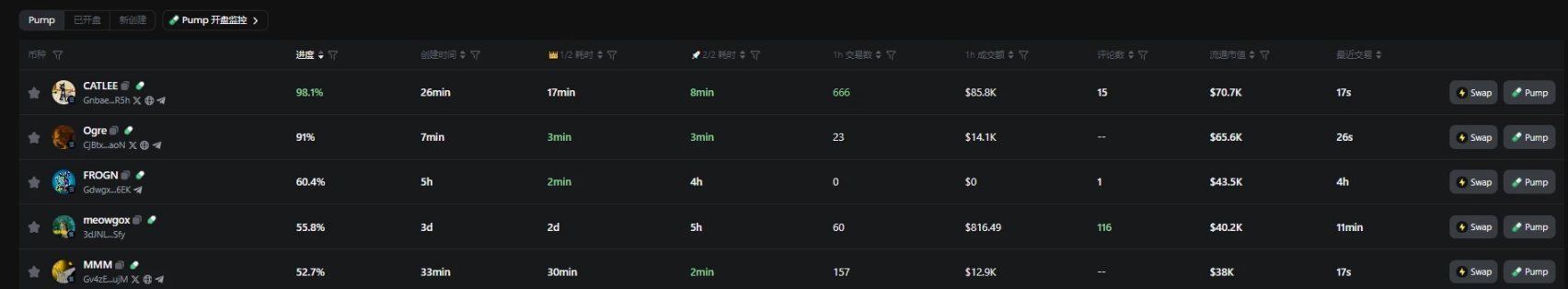

GMGN Indicator

Currently, there are many tools for Pump, and GMGN is one of the more comprehensive data websites. The website provides multidimensional data such as progress, genesis time, fund inflow speed, transaction volume, and number of comments, enabling comprehensive investment evaluation.

However, DEVs are also evolving, and there are currently many cases of DEVs developing their own bots to manipulate trading volume indicators. There are also cases of DEVs buying with multiple wallets, artificially inflating the number of comments on the Pump interface, creating a false sense of prosperity, and then selling at the high point of the internal pool.

Caution in Copy Trading

Copy trading is a common practice for discovering early projects with smart wallets, but it is not suitable in the current Pump trend because almost all LP pools for tokens are extremely small. Buying in with a smart wallet can even push the price up several times. Both domestic and foreign influencers have been exposed for exploiting copy trading mechanisms. To address this issue, it is more appropriate to choose addresses with low win rate and high profit-loss ratio for copy trading, rather than accounts with high win rate and low profit-loss ratio.

Conclusion

The methods of malicious harvesters are constantly evolving. This article can serve as a reference for combating them, but when everyone uses the same or similar strategies, the strategies will become ineffective. Only by constantly evolving can one survive in the market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。