Original Title: Why are all these low float / high FDV coins down bad?

Author: Haseeb, Partner at cryptocurrency risk fund Dragonfly

Translation: Elvin, ChainCatcher

Has the market structure been broken? Are VCs too greedy? Is this a manipulated game in the secondary market?

Almost all the theories I have seen about this issue seem to be wrong. But I will let the data speak.

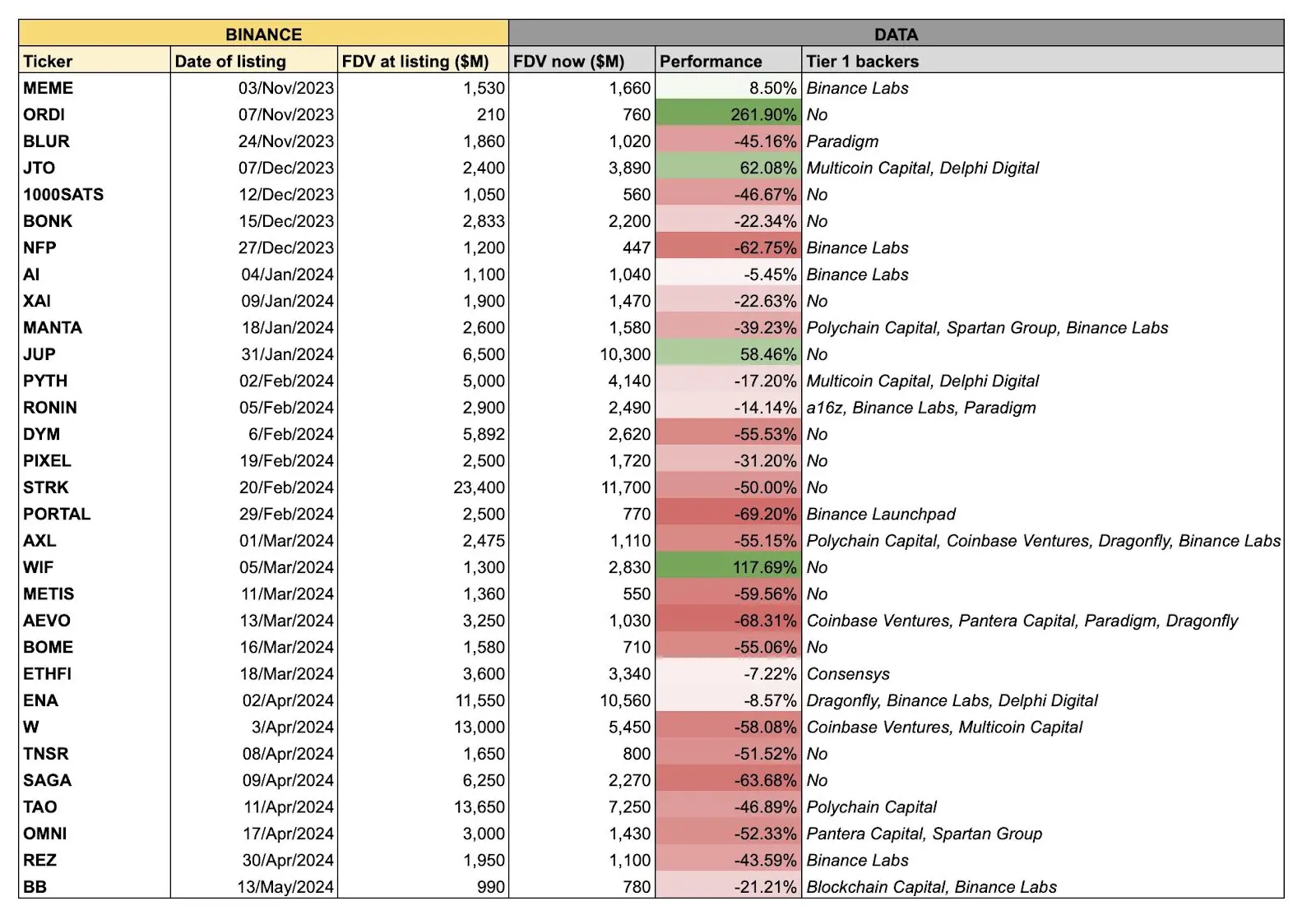

This is a notorious table that has been circulating, from @tradetheflow, showing a batch of tokens recently listed on Binance are all falling. Most of them are mocked as "high FDV (fully diluted valuation), low float" tokens, meaning they have a relatively high FDV valuation but a small initial circulating supply.

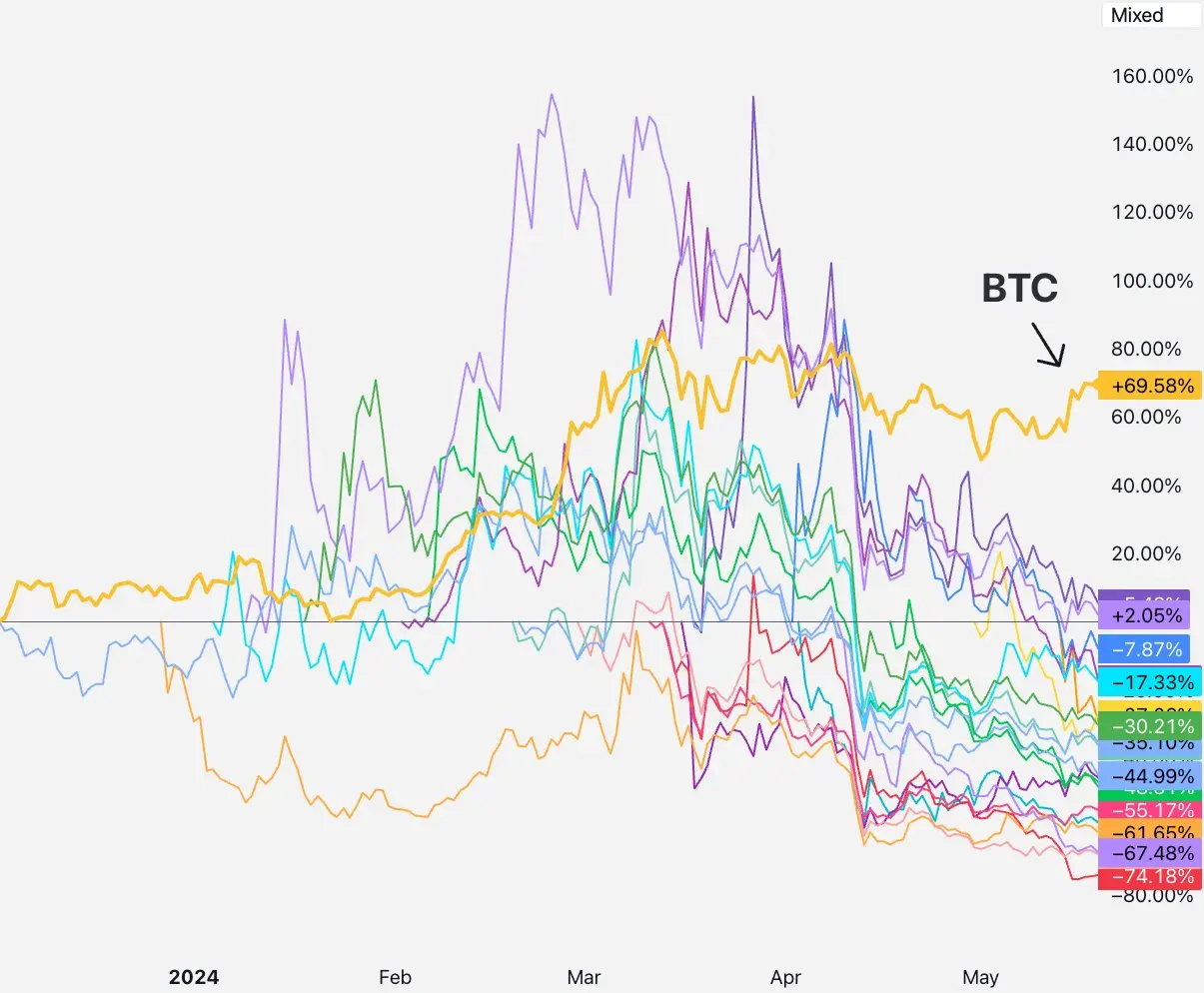

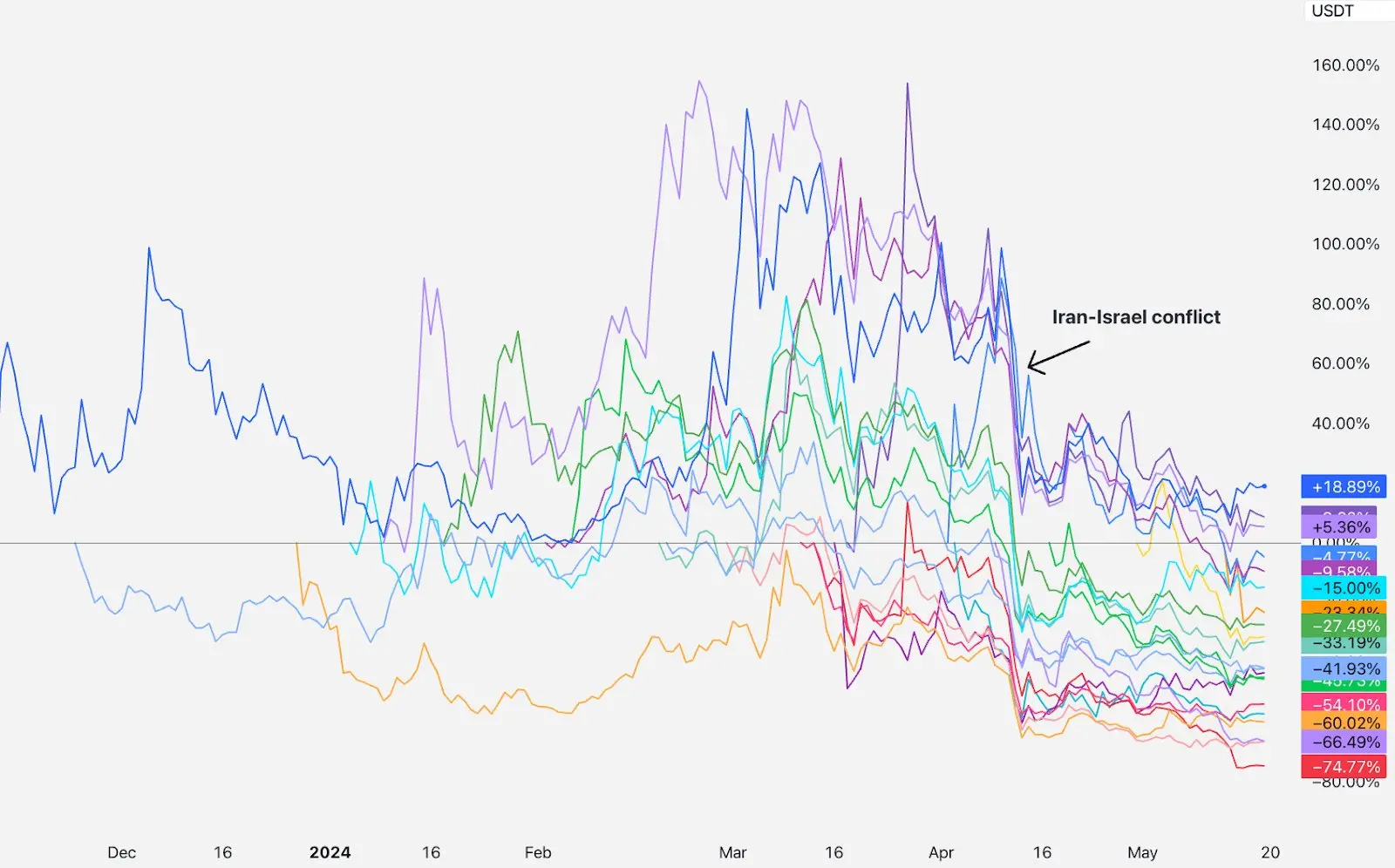

I have plotted all of these into a chart and removed the labels. Excluding any related MEME coins and tokens TGE'd before Binance, such as RON and AXL. The appearance is as follows, with BTC (beta) in yellow:

I have plotted all of these into a chart and removed the labels. Excluding any related MEME coins and tokens TGE'd before Binance, such as RON and AXL. The appearance is as follows, with BTC (beta) in yellow:

Almost all of these "low float, high FDV" Binance-listed projects are falling. Is there an explanation for this? Everyone has their own favorite theory for the disruption of the market structure. The three most popular theories at the moment are:

1) VCs/KOLs are dumping on the secondary market

2) The secondary market is angrily abandoning these tokens and only buying meme coins

3) There is too little supply to have meaningful price discovery

All have some merit! Let's see if they hold true. But to maintain scientific rigor, we need a null hypothesis to refute. Our null hypothesis should be: these assets are all repricing, but there are no deeper market structure issues. (Classic "in the end, sellers always outnumber buyers.")

We will discuss each theory one by one.

1) VCs/KOLs are dumping on the secondary market

If there's a story here, what should it look like?

We should see tokens with shorter lockup periods being sold faster than others, and projects with longer lockups or no KOLs should perform well. (High liquidity perpetual contracts may also be another vehicle for this dump.)

So what do we see in the data?

From the data in the above chart, we can see that from listing to early April, tokens actually performed well—some above listing price, some below, but mostly concentrated around the zero axis. Before that, it seems no VC or KOL has sold.

Then in mid-April, everything started to decline. Despite these projects listing on many different dates and having many different VCs and KOLs, did all of these projects unlock and start dumping on the secondary in mid-April?

Let me share my perspective here. I am a VC. There are definitely VCs dumping in the secondary—there are also VCs not locking up, hedging OTC, or even breaking lockups, but these are low-tier VC firms, most teams working with top-tier VC firms do not sell on primary exchanges. Every top-tier VC firm you can think of has at least a one-year cliff and multiple years of vesting before they get tokens. In fact, according to 144a rules, for anyone regulated by the SEC, a one-year cliff is mandatory. Additionally, for large VC firms like us, our positions are too large to hedge outside of exchanges, and contractually, we usually have an obligation to unlock early.

So this is why this story doesn't make sense: every token in this batch is less than a year from TGE, meaning VCs with 1-year cliffs are still locked up!

Perhaps some low-tier VC projects have sold tokens early, but all projects are falling, even those still locked up with top-tier VC investments.

So, for some tokens, the dumping by investors/KOLs may be real—there are always some projects with bad behavior. But if all tokens are falling at the same time, this theory cannot explain it.

On to the next theory.

2) The secondary market is angrily abandoning these tokens and only buying meme coins

If this is true, what we should see is: the prices of these new tokens are falling, and the secondary market is turning to meme coins.

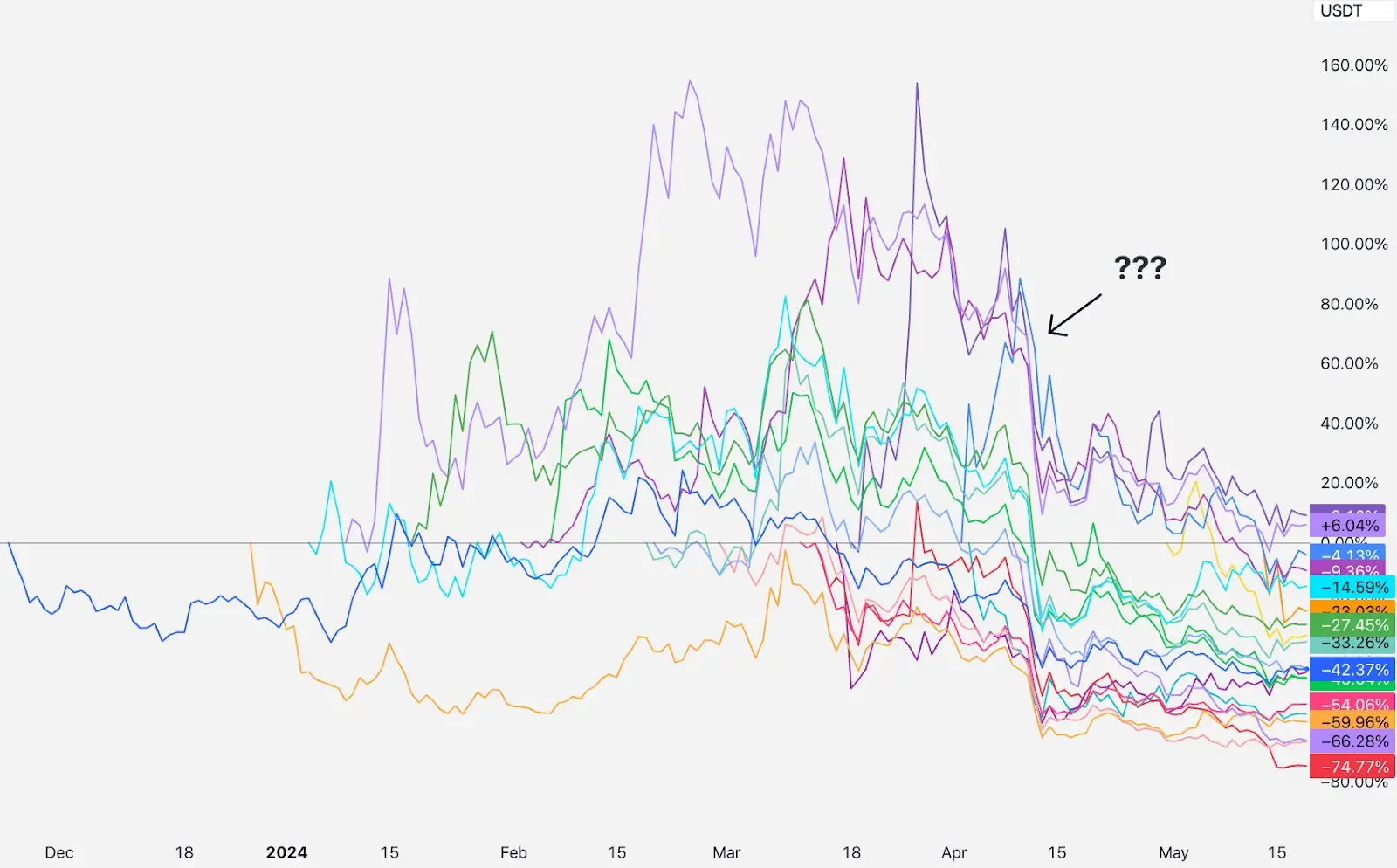

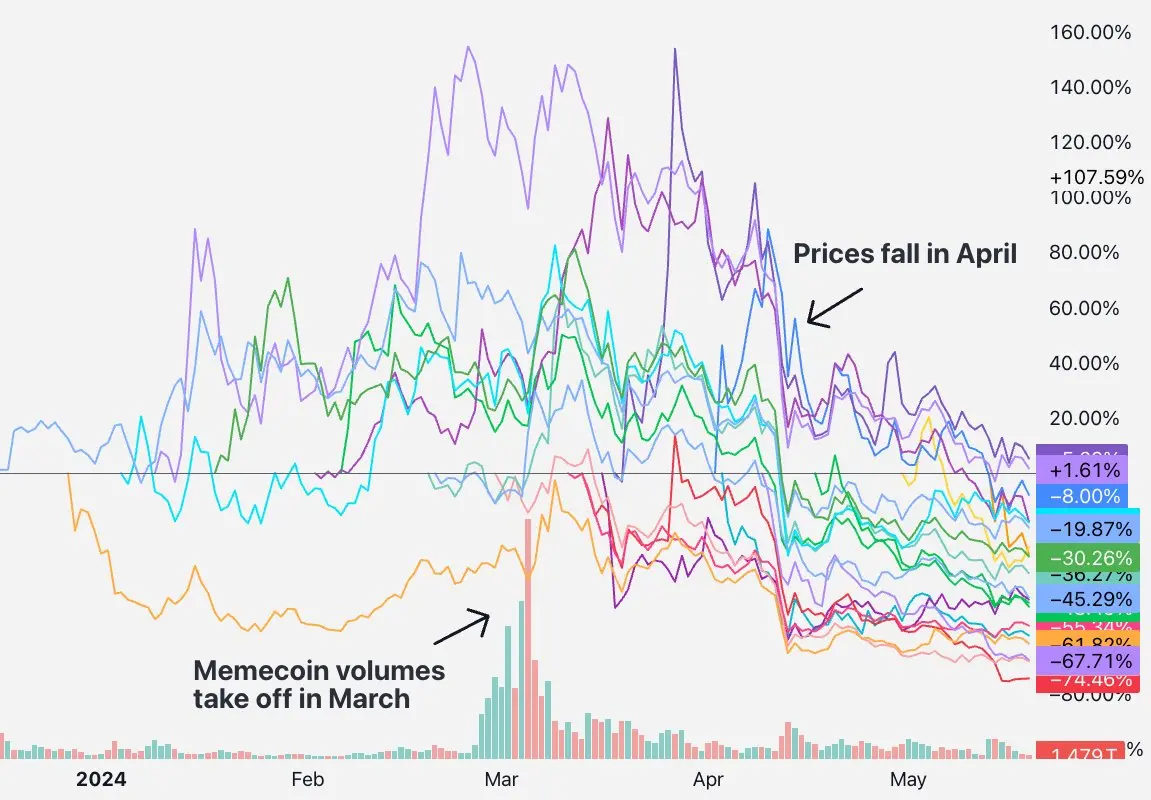

Instead, what we see is this:

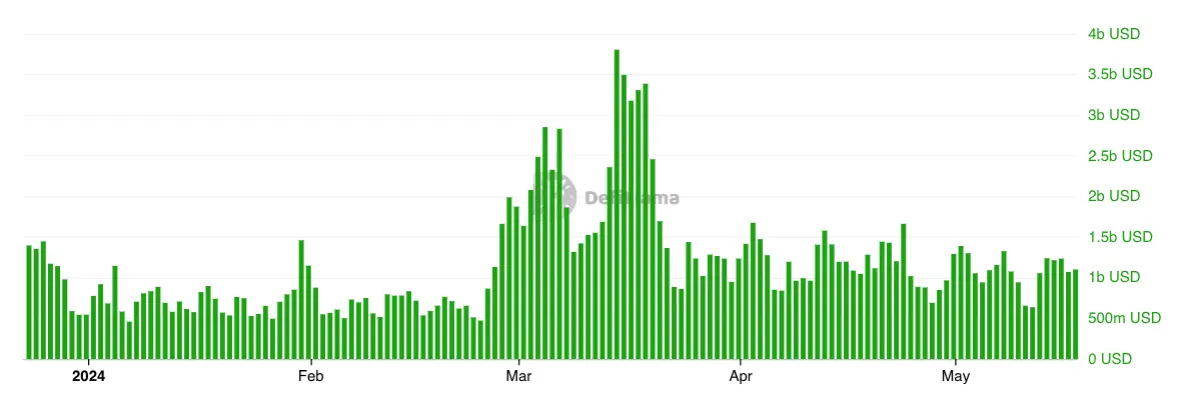

I have plotted the SHIB trading volume chart based on this basket of tokens. But the timing doesn't match up, by March, the meme coin frenzy had already reached a fever pitch, but a month and a half later in April, the entire basket was being sold off.

This is the Solana DEX trading volume, telling the same story—meme coins were booming before mid-April.

So this also doesn't align with the data. After the devaluation of this basket of tokens, there was no massive shift to meme coin trading. People are trading meme coins, they are also trading new coins, and the trading volume does not indicate any clear change.

The issue is not with the trading volume, but with asset prices.

In other words, many people are trying to sell this story: the secondary market's fantasy of real projects has been shattered, and now it's mainly interested in meme coins. I visited Binance's Coingecko page and checked the top 50 trading volume tokens, about 14.3% of Binance's trading volume today is in meme coin pairs. Meme coin trading is only a small part of the cryptocurrency space. Financial nihilism is indeed a phenomenon, and it is very prominent in the crypto market, but most people in the world are still buying tokens because they believe in certain technical stories, whether they are right or wrong.

So, well, maybe retail is not literally shifting from VC tokens to meme coins, but there is a sub-theory here: VCs have too many of these project tokens, which is why retail is angrily exiting. They realize (suddenly in mid-April?) that these are all scams, VC tokens, teams + VCs own about 30-50% of the token supply of these projects. This must be the last straw that broke the camel's back. This seems like a satisfying story.

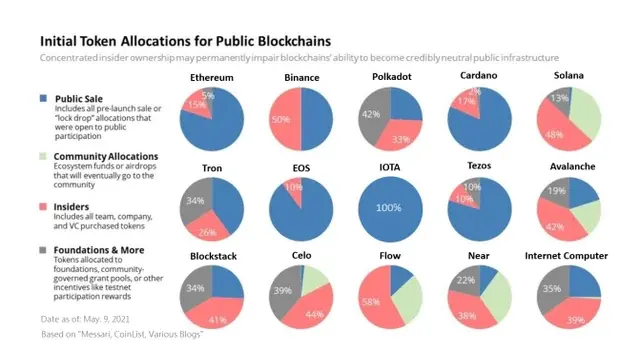

But I've been investing in cryptocurrency for a while. Here's a snapshot of token distribution from 2017-2020:

Look at the red shaded part—this is the share of insiders (team + investors). SOL 48%, AVAX 42%, BNB 50%, STX 41%, NEAR 38%, and so on. The situation today is very similar. So if the theory is "these tokens used to not be VC coins, but now they are," then this also doesn't align with the data. No matter the cycle, capital-intensive projects always face the uncertainty of team and investor vesting at launch. Even after tokens are fully unlocked, these "venture capital coins" still succeed.

Generally, if the thing you're referring to also happened in the previous cycle, then it can't explain the unique phenomenon happening now.

So, this story of "the secondary market angrily refusing to buy in and turning to trade meme coins" sounds very real and is a good irony, but it doesn't explain the data well.

Moving on to the next theory.

3) Too little supply for price discovery

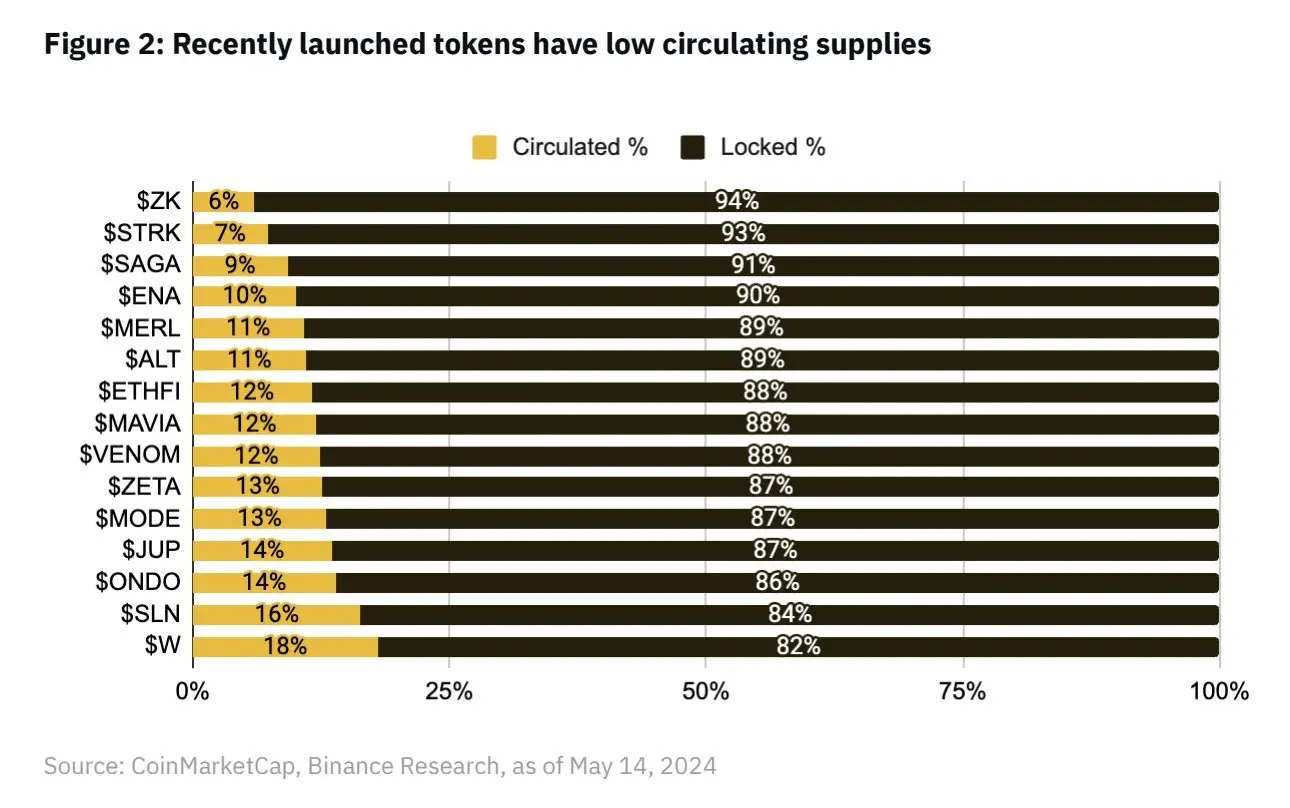

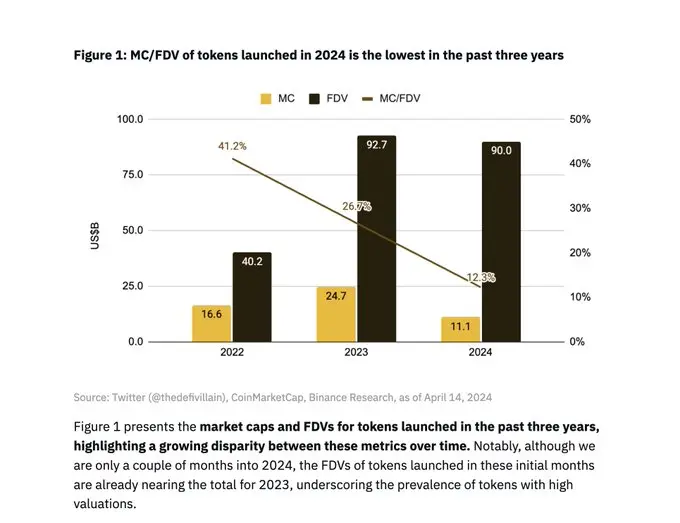

This is the most common approach I've seen. Sounds good, right? It's not as sensational, which is its advantage. Binance Research even released a good report to illustrate this issue:

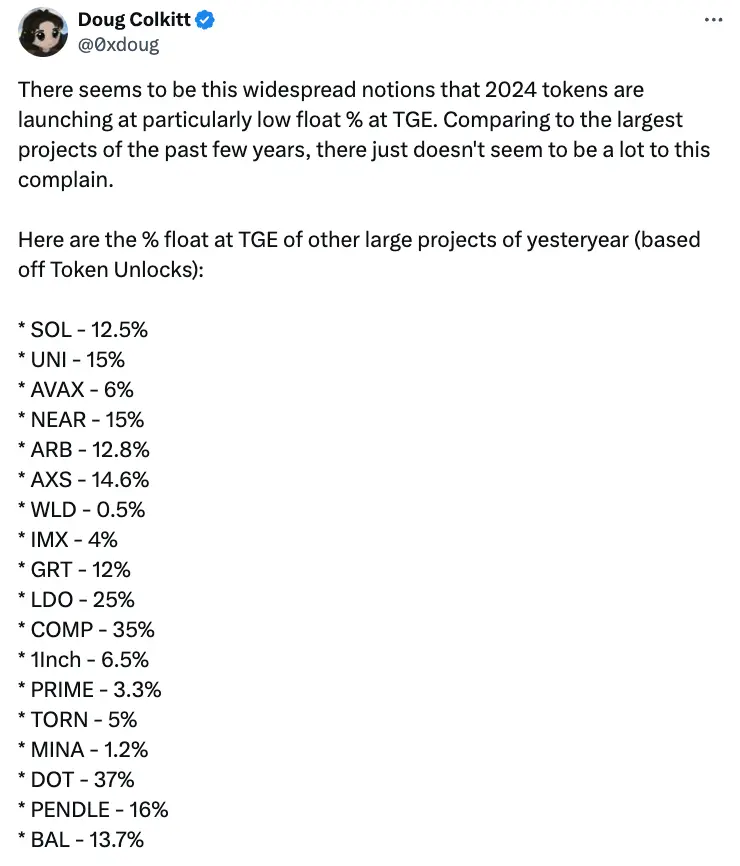

The average looks to be around 13%. That's super low, significantly lower than the past tokens, right?

Is this the correct number?

Thanks to @0xdoug for extracting this data. You guessed it, the average circulating supply of these tokens at TGE in the previous cycle was 13%.

P.S.: In the same article from Binance Research, there's another image that has also been widely circulated, claiming that the average circulating supply of tokens launched in 2022 was 41% at launch.

I'm sorry—WHAT? In 2022, around the time of the project's launch, the circulating supply was already at 41%.

I extracted the Binance 2022 listings: OSMO, MAGIC, APT, GMX, STG, OP, LDO, MOB, NEXO, GAL, BSW, APE, KDA, GMT, ASTR, ALPINE, WOO, ANC, ACA, API3, LOKA, GLMR, ACH, IMX.

I spot-checked some of them because they don't all have TokenUnlocks data: IMX, OP, and APE are similar to the latest batch of tokens we're comparing, with IMX having a first-day circulation rate of 10%, APE having a first-day circulation of 27% (but 10% of that is APE treasury, so I rounded it down to 17% circulation), OP having a first-day circulation of 5%.

On the other hand, you have LDO (55% unlocked) and OSMO (46% unlocked), but they were already launched over a year before listing on Binance, so comparing these listings with the latest first-day listings is foolish. If I had to guess, these non-first-day listed tokens plus random corporate tokens like NEXO or ALPINE are the reason they got such high numbers. I don't think they're describing the true trend of TGE—instead, they're describing the trend of tokens listed on Binance every year.

Well, maybe you'll admit that a 13% circulating supply is similar to the past cycle. But this is still too little for price discovery, right? And the stock market doesn't have this problem.

After all, just look at the median first-day circulation for 2023 IPOs.

But seriously, too little circulating supply is definitely a problem. WLD is a particularly shocking example, with a circulating supply of only 2%. FIL and ICP also had extremely low circulating supplies at launch, leading to very ugly price charts. But most tokens in the Binance group have first-day floats within historical normal ranges.

Additionally, if this theory is correct, you should see the coins with the lowest circulation being punished, and the coins with higher circulation should perform well. But we haven't seen a strong correlation. They all fell.

So, this story of a lack of price discovery sounds intriguing, but after looking at the data, I don't believe it.

Solutions, solutions

While everyone is complaining, a few have proposed actual solutions. Before discussing the null hypothesis, let's review them.

Many suggest restoring ICOs. Sorry—have we forgotten the plight of ICOs being dumped after listing and in the secondary market collapse? And ICOs are almost illegal everywhere, so I don't think this is a serious suggestion.

@KyleSamani believes investors and teams should unlock 100% immediately—according to 144a rules, this is impossible for U.S. investors (and would fuel the "VC dump" event). Also, I think we realized in 2017 why team vesting is a good idea.

@arca suggests tokens should have a bookrunner like traditional IPOs. I mean, maybe it would work? Token issuance is more similar to direct listings, just listing on exchanges with some market makers. I think it's good, but I lean towards simpler market structures and fewer intermediaries.

@reganbozman suggests projects should list their tokens at a lower price to allow retail to buy in earlier and win some upside. I'm inspired, but I don't think it works. Artificially lowering your price below market-clearing price means anyone trading in the first minute on Binance will capture a mispriced undervaluation. We've seen this multiple times in NFT mints and IDOs. Artificially lowering your listing price only benefits the few traders who front-run the orders in the first 10 minutes. If the market thinks your value is X, then in a free market, your value will be X by the end of the day.

Some suggest we go back to fair launches. Fair launches sound good in theory, but they don't work well in practice because teams will just adjust quickly. Trust me, everyone tried this during DeFi summer. There aren't many successful stories here—besides Yearn, what non-meme coin fair launches have been successful in the past few years?

Many suggest teams do larger-scale airdrops. I think this makes sense! We usually encourage teams to try to get more supply on the first day to improve decentralization and price discovery. That being said, I don't think doing a ridiculous large-scale airdrop just for the float is a wise move—protocols need to do a lot of things to handle their tokens after the first day, and hyping up for massive float gains on listing day is not wise, because then you have to compete with token earnings next. You don't want to be one of those tokens that have to re-increase their token supply a few years later because your treasury is empty.

So as a VC, what do we want to see happen here? Believe it or not, the first-year token price reflects reality. We don't make returns through price profits (paper gains), we make returns through DPI, which means we eventually have to convert the tokens into cash. We can't eat paper markups, and we won't mark unvested tokens to market (anyone who does that in my view is insane). For VC funds, it's actually a bad scenario for valuations to reach astronomical numbers and then struggle after we unlock. This makes LPs think this asset class is fake—looks good on paper, but actually terrible. We don't want that. We want asset prices to gradually and steadily rise over time, as most people do.

So, are these high FDVs sustainable? I don't know. These numbers are clearly staggering compared to the initial launches of projects like ETH, SOL, NEAR, and AVAX. But the cryptocurrency market is indeed larger now, and the market potential for successful crypto protocols is clearly larger than in the past.

@0xdoug mentioned an important point that if you standardize last year's meme coin FDVs against today's ETH price, you get numbers very close to the FDVs we're seeing today. @Cobie echoed this in a recent post. We won't go back to L1 FDVs of $40 million, because everyone sees how big the market is now. But at the time of SOL and AVAX's launch, the prices paid by the secondary market were quite similar when adjusted based on the price of ETH.

This feeling of defeat can largely be attributed to the significant rise of cryptocurrencies in the past 5 years. Startups are priced based on comparable companies, so the numbers will be larger. That's just how it is.

So, I'm quick to criticize others' solutions. But what's my clever solution?

The honest answer?

Nothing. Leave it all to the market.

The free market will solve this problem on its own. If tokens drop, other tokens will reprice lower, exchanges will push for lower FDV for the teams launching new projects, the traders hurt in this cycle will only buy at lower prices, VCs will pass this information to new founders. B-round pricing will be lower due to public market comparison, punishing A-round investors, ultimately affecting seed investors. Price signals will eventually always be transmitted this way.

When a real market failure occurs, you might need some clever market intervention. But the free market knows how to correct pricing errors—just change the price. Those losing money, whether VCs or retail, don't need people like me to pontificate or debate on Twitter. They've internalized the lesson and are only willing to pay less for these tokens. That's why all these tokens are trading at lower FDVs, and future token trades will also be priced accordingly.

Similar situations have happened many times before. Market adaptation may only take a minute.

4) Null Hypothesis

Now let's unveil the mystery of Scooby Doo. What exactly happened to cause all tokens to drop in April?

The culprit: the Middle East.

In the initial months, trading for these tokens mostly remained flat since listing, until mid-April. Iran and Israel suddenly started threatening a third world war, and the market crashed. Bitcoin price bounced back, but these tokens didn't.

So, what's the best explanation for why these tokens continued to drop? My explanation is: These new projects were all mentally categorized as "high-risk new coins." Interest in the "high-risk new coin basket" declined in April and didn't recover. The market doesn't want to buy them back now.

Why?

I don't know. The market is sometimes fickle. But if this basket of "high-risk new coins" had risen 50% during this period instead of dropping 50%, would you still argue about how the token market structure was broken? It would still be a mispricing, just in the opposite direction.

Mispricing is mispricing, and the market will eventually correct it. If you want to help—sell things at crazy prices and buy things at more favorable prices. If the market is wrong, it will correct itself. No need to do anything else.

What to do?

When people lose money, everyone wants to know who to blame. Is it the founders? VCs? KOLs? Traders? Market makers? Traders?

I think the best answer is no one or everyone. But thinking about market mispricing from a blame perspective is not a productive framework. So, I'll outline how people can do better in this new market structure.

VCs: Listen to the market, slow down. Show pricing discipline. Encourage founders to have a realistic view of valuations. Don't anchor your locked tokens to the market (as far as I know, almost all top VC firms hold locked tokens at a significant discount to market prices). If you find yourself thinking "I can't lose money on this trade," you might regret that trade.

Exchanges: List new coins at lower prices. But you already knew that. Consider using public auctions for pricing first-day tokens instead of pricing based on the last round of VC valuations. Don't list new coins unless all investors/teams have contractual obligations not to hedge, unless everyone (including KOLs) has market-standard lockups.

Teams: Try to have more tokens circulating on the first day! Less than 10% circulating supply is too low.

Of course, have healthy airdrops, don't be too afraid of low FDV on the first day of listing. The best price chart for building a healthy community is a gradual upward trend.

If your team's token has dropped, don't worry. You have good precedents to refer to. Remember:

AVAX dropped about 24% 2 months after listing;

SOL dropped about 35% 2 months after listing;

NEAR dropped about 47% 2 months after listing.

You'll be okay. Focus on building content to be proud of and keep delivering. The market will eventually figure it out.

For you, please note that single-cause explanations are often not very accurate. The market is complex and sometimes drops. Doubt anyone who claims to confidently know the reasons. Do your own research and don't invest anything you're not willing to lose.

Final note:

Thanks to @EvgenyGaevoy for reviewing this draft.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。