Experienced the events in Mentougou, 94, 312, 519, and the LUNA/FTX crisis, they are definitely old leeks in the currency circle.

Soon it will be May 19th again. Today, let's review the historical currency circle disasters and remind everyone that investment carries risks, so be cautious when entering the circle.

Let's organize the events in chronological order.

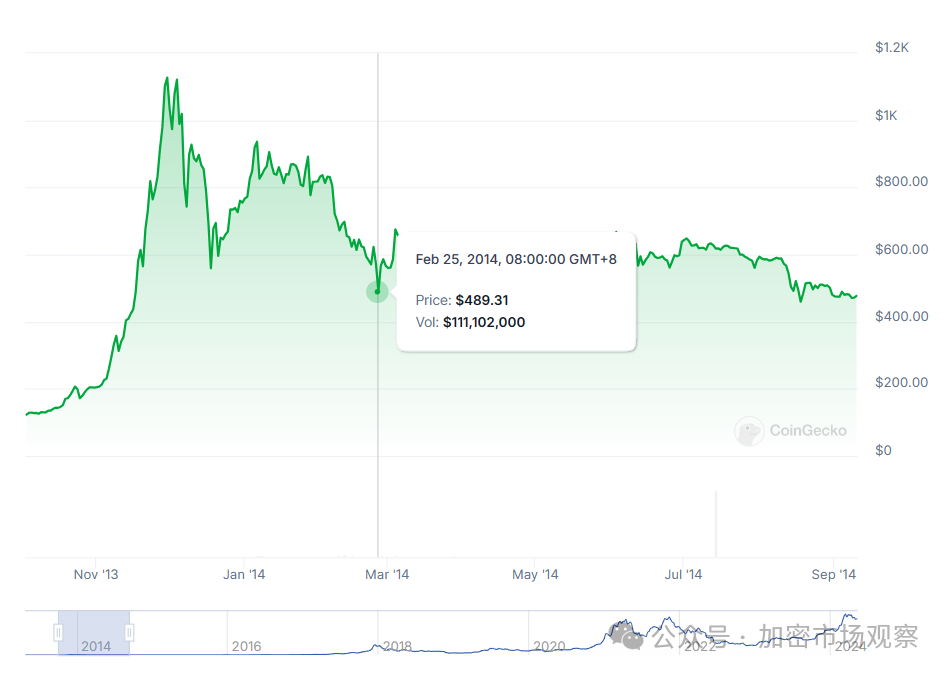

01. Mentougou Incident

The Mentougou incident in February 2014 is considered one of the most serious events in the history of the currency circle. At that time, Mt.Gox, the world's largest Bitcoin exchange, suffered a hacker attack and lost nearly 850,000 bitcoins, accounting for about 7% of the global total. This event not only caused an 80% plunge in the price of Bitcoin but also triggered a crisis of trust in the cryptocurrency market.

If this had happened in another industry ten years ago, the money would definitely not have been recovered after so many assets were stolen.

However, due to the rapid rise of Bitcoin over the past decade and the compensation by the judicial department being based on fiat currency as the judgment unit, some of the remaining bitcoins after the liquidation of Mt.Gox can actually compensate for all the initial creditors' losses. Therefore, there is recent news that Mt.Gox is preparing to distribute about 142,000 bitcoins (BTC) and 143,000 bitcoin cash (BCH) to creditors, with a total value exceeding $9 billion.

02. 94 Incident

The 94 incident occurred in 2017 and was triggered by regulatory actions in mainland China.

That year, various myths of getting rich quick emerged in the currency circle. Millions of people eager for financial freedom were eager for opportunities that were right in front of them and could not be easily let go. As a result, a large number of ICO projects spread like a virus, and even the square dancing aunties stopped dancing and started researching ICOs. For a time, many junk projects and coins sprouted up like mushrooms after a rain.

With such chaos and excitement, how could the regulatory authorities turn a blind eye?

On August 21, the central bank headquarters received an urgent report clearly stating that ICOs were a form of illegal fundraising. After studying a large number of ICO white papers, officials from the central bank concluded that "90% of ICO projects are suspected of illegal fundraising and intentional fraud. In fact, less than 1% of ICOs actually raise funds for project investment."

A blockchain summit scheduled for September 2 was called off by the relevant authorities (Beijing Financial Bureau). The reason behind the cancellation was that the regulators had already made a judgment on ICOs, and relevant regulatory documents would be issued in the near future.

On September 4, 2017, the bombshell finally dropped. Seven ministries jointly issued the "Announcement on Preventing the Risks of Fundraising through Token Offerings," defining ICOs as unauthorized illegal public fundraising. The announcement stated that ICOs were suspected of illegal issuance of token vouchers, illegal issuance of securities, illegal fundraising, financial fraud, pyramid schemes, and other illegal and criminal activities, seriously disrupting the economic and financial order.

With this announcement, Bitcoin plummeted by 32%, and Litecoin plummeted by 57.3%. This drop also reflects the influence of mainland China on Bitcoin at that time.

Faced with the regulatory scythe, many exchanges were forced to move overseas, and the trend of project teams returning funds became prevalent. The currency circle experienced a sharp decline, and panic spread continuously.

However, after the brief impact of the 94 incident, Bitcoin still experienced a super bull market. By the end of 2017, Bitcoin surged to a historical high of $20,000, a sixfold increase in three months.

Exchanges found that they could continue trading by using both coin-to-coin and over-the-counter fiat trading methods, and Binance took advantage of this opportunity to achieve a remarkable comeback, rising to the top of the exchange, where it remains today.

Perhaps without the 94 incident, there would be no Binance today?

03. 312 Incident

Time flies, and we arrive in 2020.

On March 12, 2020, according to Binance data, Bitcoin plummeted from a high of $7,966.17 to a low of $4,410, and on March 13, it hit a low of $3,782.13, with a maximum drop of over 50%. Just a few weeks earlier, Bitcoin had just returned to $10,000.

At that time, due to the impact of the epidemic, the global economy was in recession, and the US stock market had already begun to plummet. Many cryptocurrency investors saw Bitcoin as a safe-haven asset, but whether an asset is a safe haven depends on the consensus of more investors.

From the occurrence of the 312 incident to the present, it has only been a short four years, and the Bitcoin obtained at that time has increased by more than twenty times this year!

04. 519 Incident

The 519 incident occurred in 2021. From 312 to 519, it has only been a little over a year. Before this, Bitcoin had already surged to over $60,000, and those who bought the dip on 312 realized returns of over ten times in just one year.

On May 18, 2021, the central bank took action and issued a document, and the three major financial industry associations spoke out: providing virtual currency trading services is suspected of engaging in illegal financial activities!

The market was relatively stable that day, with a slight increase. However, on May 19, many people still believed that such incidents had occurred before, and a slight drop was normal. By the evening, Bitcoin plummeted from $44,000 to $29,000, a 34% drop!

During this period, mining farms were shut down, mining machines were shipped overseas, and financial platforms were taken offline. For a while, the currency circle was filled with rumors and fears, and leeks felt that the bull market had ended. This is the impact brought by 519 to the currency circle, and the aftershocks are still being felt. Leeks cannot forget the fear of being dominated by 519.

After 519, many bears who survived the bull market thought they had found an opportunity and opened short positions one after another, thinking they could make a fortune by shorting for a few years. However, they did not expect Bitcoin to suddenly turn the tables, breaking through to a new high of $67,000. With this back and forth, it basically wiped out the contract players, and the market truly followed the script, leaving only a few remaining bears to be washed out by this wave.

05. LUNA/FTX Crisis Event

Time has come to 2022, and this year has seen the successive crises of Luna and FTX, triggering a crisis of trust in the entire cryptocurrency market, leading to a deep bear market.

Around 2018, a Korean computer science graduate from Stanford University, Do Kwon, established an ecosystem around stablecoins called Terra. This ecosystem is mainly driven by two coins:

- Luna, a token in the Terra ecosystem

- UST, a stablecoin existing on the Terra blockchain

The interaction between these two coins is as follows:

One UST equals 1 US dollar worth of Luna. This means that if the price of Luna is $1, you can exchange it for one UST. If the price of Luna rises to $100, you can exchange it for 100 UST.

- UST and Luna have a "two-way destruction and minting" relationship. This means that when you exchange Luna for UST, the market has one less dollar's worth of Luna and one more UST, and when you exchange UST for Luna, the market has one less UST.

This model was the algorithmic stablecoin that was once popular, and the market value of LUNA once reached $40 billion.

This type of stablecoin has a fatal flaw: Luna must have value, no matter how low the price, but it cannot be too close to zero. Otherwise, no matter how many Lunas are issued, it will not affect the price fluctuations of UST.

In May 2022, many large holders started selling UST, causing the price of Luna to plummet by over 90% to $10, and UST completely decoupled, dropping to $0.6. However, at the same time, many people started buying the dip in Luna.

On May 11, Do Kwon announced that he could not save the market and could only rely on arbitrage mechanisms to help UST recover its price. Luna plummeted by over 90% again, dropping below $1, and UST briefly plummeted to $0.3.

On May 12, Luna continued to plummet by 99%, almost to zero, and the price of UST dropped below $0.2.

On May 13, many exchanges delisted Luna and suspended trading, and the Terra blockchain went offline.

If the LUNA incident can be said to have proven the business model of algorithmic stablecoins, it was the FTX incident at the end of 2022 that truly shocked many cryptocurrency users.

FTX, as the second-ranked exchange in the cryptocurrency market at the time, had received investments from a number of reputable large funds such as Sequoia, Temasek, and BlackRock, and reportedly conducted several months of due diligence, resulting in a primary market valuation of $32 billion.

This seemingly promising project collapsed at the end of November 2022, with internal mismanagement and arbitrary use of client funds.

With the FTX crisis, Binance further solidified its position as the top exchange.

Influenced by the collapse of Luna and FTX, the price of Bitcoin also plummeted from over $60,000 at the beginning of 2022 to a low of $15,000 at the end of the year, a 75% drop.

06. Is it a Good Opportunity to Buy the Dip After a Crisis?

After all these discussions, have you noticed?

After each disaster, there is always a sought-after opportunity to buy the dip!

Let's review the five crisis events we discussed today:

Only two of them are truly related to cryptocurrency technology: the theft of Mt. Gox in 2014 and the Luna/FTX crisis in 2022.

When the Mt. Gox incident occurred in 2014, it took a year and a half for Bitcoin to recover and start rising again. During this period, many cryptocurrency investors developed a deep sense of distrust in cryptocurrencies, but those who persevered are now considered OGs.

After the Luna/FTX crisis in 2022, both institutional and retail investors developed a deep sense of distrust in cryptocurrencies. It also took a year and a half for Bitcoin to recover.

Additionally, two crises were influenced by the policies of the Chinese government, showing the deep influence of the Chinese on the cryptocurrency industry.

After the 94 incident in 2017, the price recovered in just two months, and there was even a surge at the end of the year.

The 519 incident in 2021 saw a new high for Bitcoin just four months later.

The 312 incident was more influenced by the pandemic, which can be considered a natural disaster, and the price of Bitcoin recovered in just two months.

In summary, Bitcoin is not afraid of policy regulation or natural disasters. The downturn caused by these factors often presents a good opportunity to buy the dip.

When buying the dip, it is important to note that crises caused by policy or natural disasters tend to have a relatively short recovery time. However, when investors lose trust in the industry due to cryptocurrency-related reasons, it may take more than a year to recover.

Many experts believe that this year is the eve of the outbreak of cryptocurrency application scenarios, so everyone should pay close attention!

If there is indeed a large-scale application scenario, then we can continue to enjoy the bull market.

Cryptocurrencies are not afraid of policy regulation or natural disasters, but they are afraid of us in the cryptocurrency community messing things up and losing the trust of the majority of investors. That would truly be the end.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。