Author: Darius Devėnas, DappRadar

Translation: Felix, PANews

The blockchain industry is filled with promises of quick and easy money. It is crucial to identify which projects are safe and which are destined to fail after 3 months. This article introduces eight methods to help traders avoid effective scams.

1. Starting from the Basics

To verify the legitimacy of a token, you can start with the most easily accessible methods. For example, Google search and Twitter, including researching the token and its team, checking for any danger or warning signals, and looking for reliable sources of information such as official websites, news articles, and verified social media accounts.

Checking for Danger Signals on Social Media

Verified X (Twitter) accounts can usually help prove the legitimacy of a project. Additionally, participating in discussions about the token can help understand the community's viewpoints and opinions.

Be cautious of projects with a large number of followers on social media but low engagement. Automatic comments from fake accounts should also be a danger signal. If all comments are "This is a great project" and "Moon is coming soon," it should be noted.

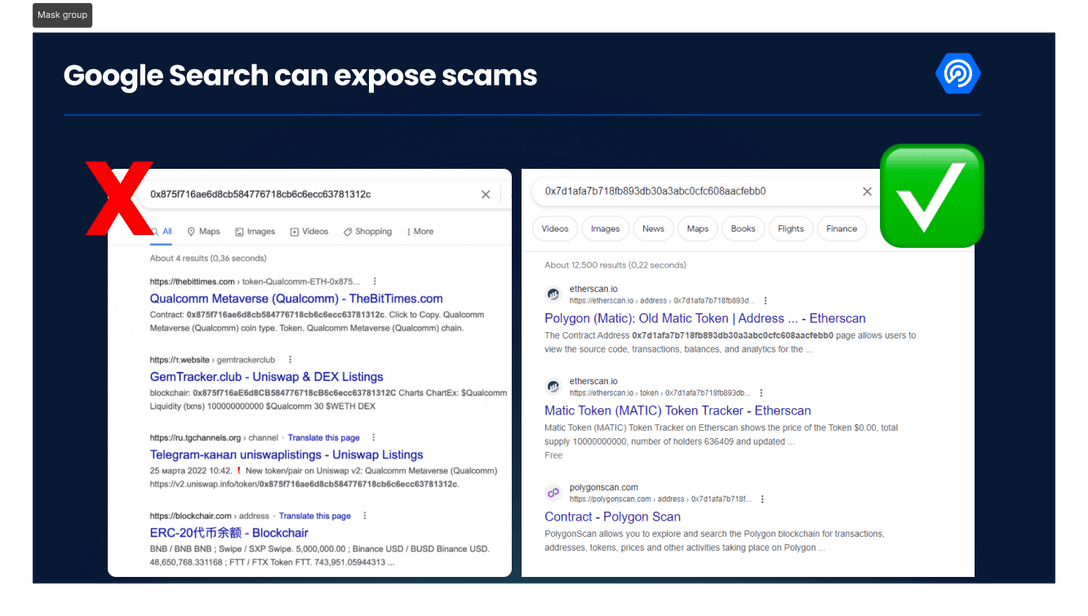

Checking Token Address in Google Search

If a clear homepage, "white paper," or obvious token usage cannot be found on the internet, it is likely a scam. When searching for a token address, it should be easy to find links to block explorers, official websites, and white papers. If not, consider it a danger signal.

Also, note that Google ads are often a free zone for scam websites. Do not click on the top ads in Google search results. Make sure you are visiting the official website and avoid clicking on Wallet Drainers or other hacker software.

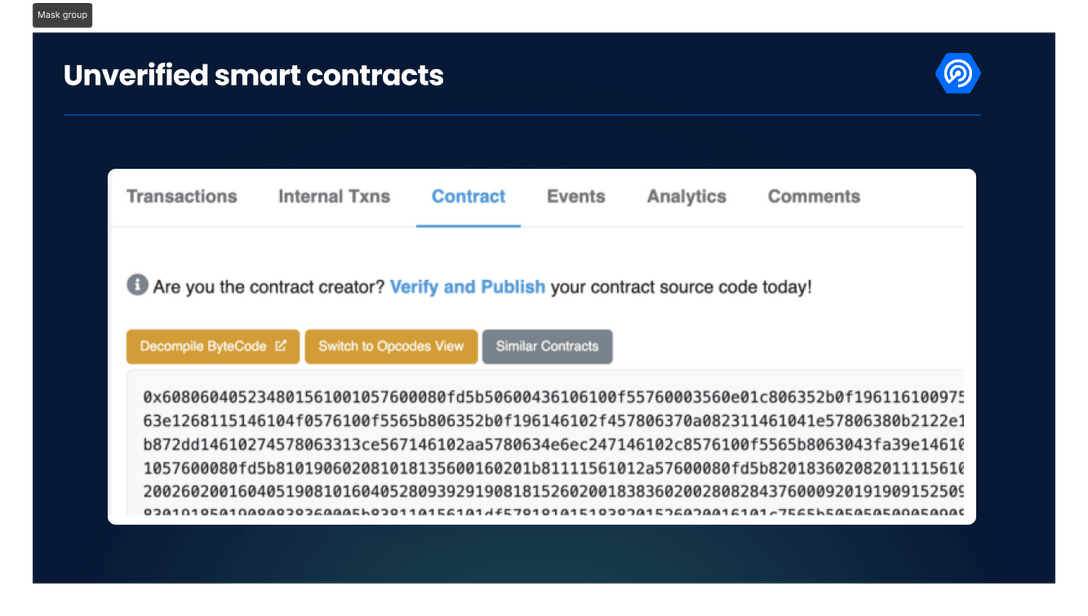

2. Verify Code on Etherscan

Visit the block explorer of the chain you choose and check if the source code has been verified. For example, on the Ethereum block explorer Etherscan, it should look like the image below. If the code is not verified, it should be an obvious warning signal. If the code is not verified, you may have encountered a scam.

Why don't scammers directly verify their code?

Because once the source code of the contract is public, everyone can know the intent behind the contract. It is a way for developers to either have an absurd token system or to steal all your tokens. But does this mean that every unverified contract is a scam? Not necessarily, but it is a very serious danger signal.

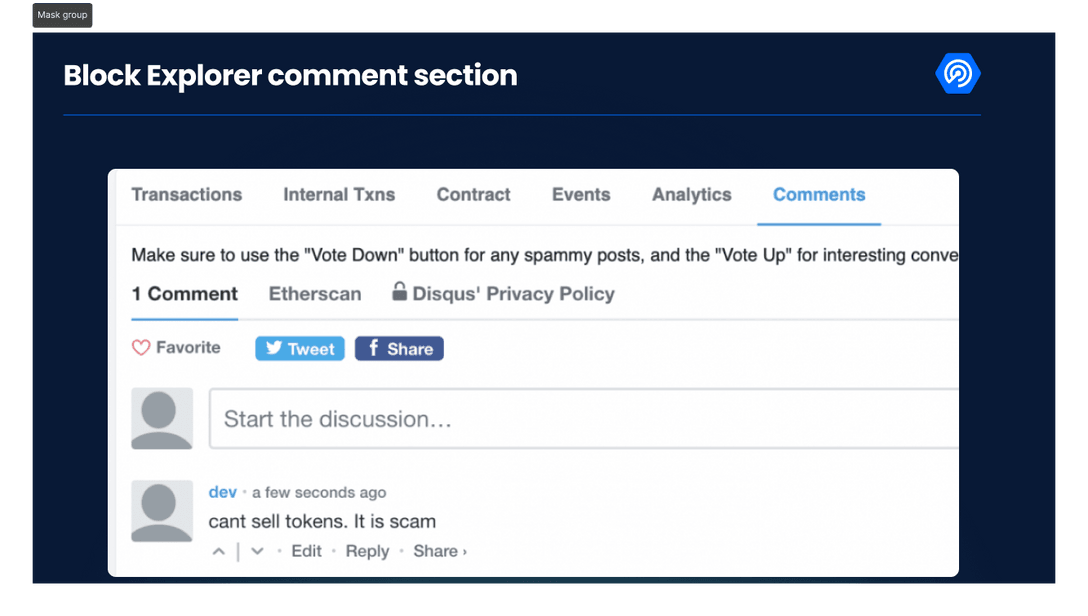

3. Check the Etherscan Comments Section

This part is very simple, as most block explorers usually have a comments section. Most of the time there are no comments, but if a project is a scam, you may find a group of angry people in the comments section. So be sure to click and check. If someone says it's a scam, there's a 99% chance it is. If you are a victim of this project, please leave a comment as well.

4. Check DappRadar's Blacklist

You can compare the token address with the token blacklist compiled by DappRadar on Github. If the token address appears on the list, it is a scam.

5. Check Token Details in Token Index

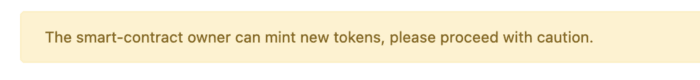

If you cannot find the token on CoinGecko or DappRadar's token index (or similar token price trackers), the token is likely a scam. If you see a warning like the image below, proceed with caution:

All legitimate tokens will share their information with token index websites for verification. However, platforms like CoinMarketCap and Coingecko have specific conditions to be met. Therefore, not all tokens (whether legitimate or not) will automatically be listed on these token index platforms.

6. Check How Many Exchanges Have Listed the Token

If the token is only traded on a few decentralized exchanges (DEX), it may be a scam. Listing on centralized exchanges requires KYC and additional trust, and the larger the exchange, the better the reputation of the listed tokens.

However, tokens listed only on DEX are not necessarily scams. Some projects do not require high trading volume, and some projects only cater to Web3 users rather than token traders.

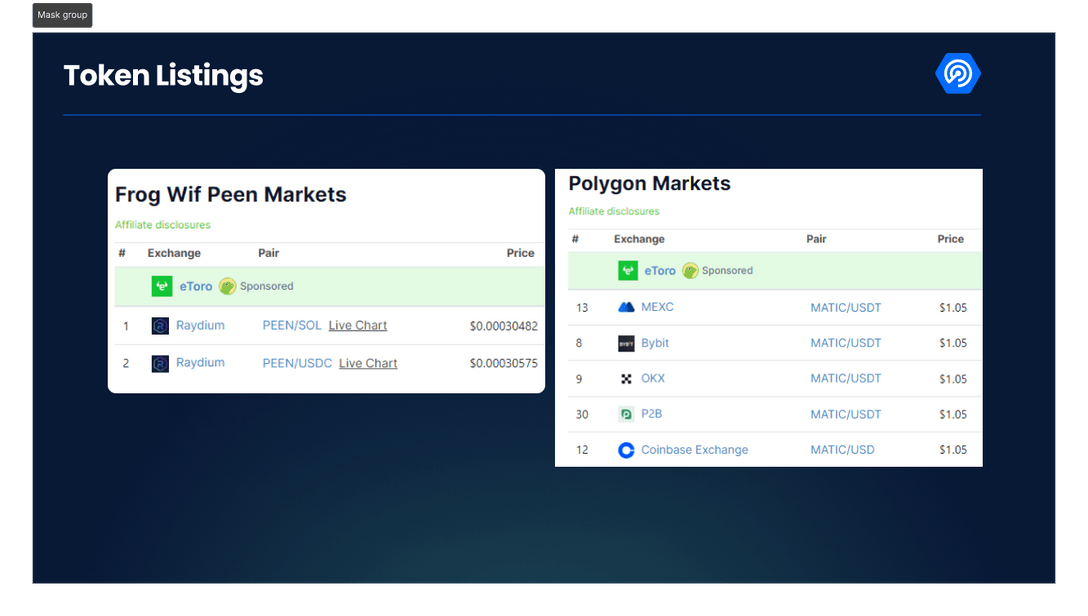

Nevertheless, tokens listed only on DEX are a higher-risk investment, and you are more likely to encounter a scam. The image on the left below shows a token used only on DEX, while the image on the right shows a token that can be used on multiple CEX.

7. Check the Liquidity in the Token's Pool

Before investing in a token, it may be necessary to check the availability of overall demand and liquidity. Checking the liquidity of a token on platforms such as Uniswap V2 or other DEX is very easy.

Liquidity refers to the amount of cryptocurrency or tokens locked in a smart contract, allowing users to buy and sell assets through (decentralized) exchanges. If the liquidity is less than $100,000 or rapidly declining, you may have encountered a scam.

When using DEX, be sure to check basic other on-chain activities, including:

- Trading volume

- Number of transactions

- Number of active wallets interacting with the smart contract—number of users connecting to DEX using Web3 wallets.

If any of these looks unusual, do some more investigation.

8. Use Third-Party Analysis Tools

Here are some token analysis tools:

Smell Test: Automatically audit tokens. The lower the score out of 100, the more likely it is a scam.

Honeypot: Honeypot is a smart contract intentionally inserted with obvious programming flaws. When attackers exploit the flaw, another hidden code is activated to counter-attack the attacker. Whether intending to be a crypto hacker or not, Honeypot should be avoided.

DEXtools: Records real-time token prices and helps you assess the token's real value in real-time.

Scammers always exist, whether in the blockchain or the real world. Following these suggestions should help avoid fake tokens designed to scam funds.

Related reading: Web3 Security Alert: Industrialization of Phishing, Twitter Surfing Has Risks

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。