Polymarket is a blockchain-based decentralized prediction market platform that allows users to bet on the future outcomes of various topics using cryptocurrencies.

By: Chain Teahouse

1. Project Introduction

Polymarket is a blockchain-based decentralized prediction market platform that allows users to bet on the future outcomes of various topics using cryptocurrencies.

The platform operates on the Polygon blockchain using smart contracts, which reduces costs and speeds up transaction settlement. On Polymarket, users do not directly store funds, but instead participate in the market by providing liquidity through Automated Market Makers (AMMs) or order book systems. This model allows users to bet on the outcome of events ("yes" or "no") and win the corresponding wager if their prediction is correct.

The platform allows users to trade and exchange outcome shares by investing in real-money markets related to currently debated events. Users need to deposit USDC stablecoins into the Polymarket wallet and purchase outcome shares to participate in the market. The price of these shares reflects the market's expected probability of event outcomes. Polymarket uses an automated and transparent process, charges no transaction fees, and closes markets once event results are clear. If users predict correctly, their shares can be redeemed for $1 each; if they predict incorrectly, the shares become worthless.

Polymarket's feature is that it provides a trading environment unrestricted by traditional financial institutions, making it an innovative platform in the DeFi field. Its goal is to aggregate collective knowledge through the power of free markets and provide an unbiased source of truth for the public about the likelihood of future significant events.

It is worth noting that on May 14th, Polymarket completed a $45 million Series B financing round, led by Founders Fund. Additionally, General Catalyst had earlier helped the project raise $25 million in Series A financing. Polymarket raised a total of $70 million in two rounds of financing, with supporters including Ethereum co-founder Vitalik Buterin.

2. Smart Contracts

The core operation of Polymarket relies on smart contracts, which automatically execute complex transaction and decision logic on the Ethereum blockchain. The use of smart contracts is at the heart of Polymarket's technological innovation, enabling the platform to achieve decentralized, automated, and transparent market operations.

Here is a detailed introduction to Polymarket's smart contracts:

2.1 Functionality and Structure

Market Creation: Smart contracts allow users to create new prediction markets, set market-related questions, and possible outcomes (usually binary, i.e., "yes" or "no").

Trade Execution: Users can buy and sell shares in the market through smart contracts. The prices of these shares dynamically adjust based on the collective market prediction of event outcomes.

Result Determination and Fund Settlement: After the event occurs, smart contracts determine the results based on preset rules or through external information sources (such as oracles) and automatically execute the fund settlement process.

2.2 Non-Custodial Fund Management

- On Polymarket, smart contracts ensure that all user fund handling is transparently conducted on-chain without the need for third-party custody. This reduces trust requirements and enhances security.

2.3 Automated Market Makers (AMMs)

- AMM contracts provide market liquidity, allowing users to trade even in the absence of direct counterparties. This is achieved by creating a pool that automatically prices and executes trades based on current buying and selling pressures.

2.4 Order Book

- As Polymarket plans to transition from AMMs to an order book system, smart contracts will also adapt to this change. The order book system will allow users to set specific buying and selling prices, increasing market flexibility and depth.

2.5 Integration with Polygon

- By integrating Polygon as a layer-2 solution, Polymarket's smart contracts can ensure security while significantly reducing transaction costs and speeding up transaction speeds, which is crucial for frequently traded prediction markets.

2.6 Use of Oracles

- To obtain reliable event result data from off-chain sources, Polymarket's smart contracts may integrate oracle services. Oracles allow smart contracts to access external data sources, ensuring the accuracy and fairness of market results.

2.7 Market Integrity and Arbitration

- In cases of disputes, specific smart contract mechanisms can be initiated, such as the involvement of a Market Integrity Committee, a group of community-elected members responsible for resolving market result disputes and confirmations.

Polymarket's smart contract architecture makes it a highly automated and transparent prediction market platform, effectively reducing the possibility of intermediary costs and manipulation, while providing a reliable and user-friendly environment for global users. The design and implementation of these contracts are key factors in the success of Polymarket as an advanced financial technology product.

3. Business Model

1. Decentralization and Non-Custodial

Polymarket operates on the Ethereum blockchain and Polygon Layer-2 solution, providing decentralized and non-custodial services. Users interact directly with smart contracts through their digital wallets, bypassing traditional centralized platforms, thereby increasing security and transparency.

2. Transaction Fees and Liquidity Provision

Although Polymarket itself does not charge traditional transaction fees, it generates revenue through market liquidity extracted from trading activities. Through automated market makers (AMMs) and order book systems, Polymarket can provide sufficient liquidity, making the market more efficient.

3. Data and Insights Provision

Polymarket utilizes its platform's trading data to provide real-time market insights and data analysis services. This data can help users make wiser decisions and is also a valuable resource for media and research institutions to understand public opinion and market trends.

4. Promotion and Partnerships

Polymarket engages in various marketing activities and collaborates with other blockchain projects to increase its user base and market visibility. This includes providing cryptocurrency rewards and other incentives to attract and retain users.

5. Compliance and Adaptability

Facing regulatory challenges, Polymarket has taken measures to negotiate with regulatory bodies such as the U.S. Commodity Futures Trading Commission (CFTC) to ensure the compliance of its operations, which helps solidify its business foundation and protect user interests.

4. User Guide

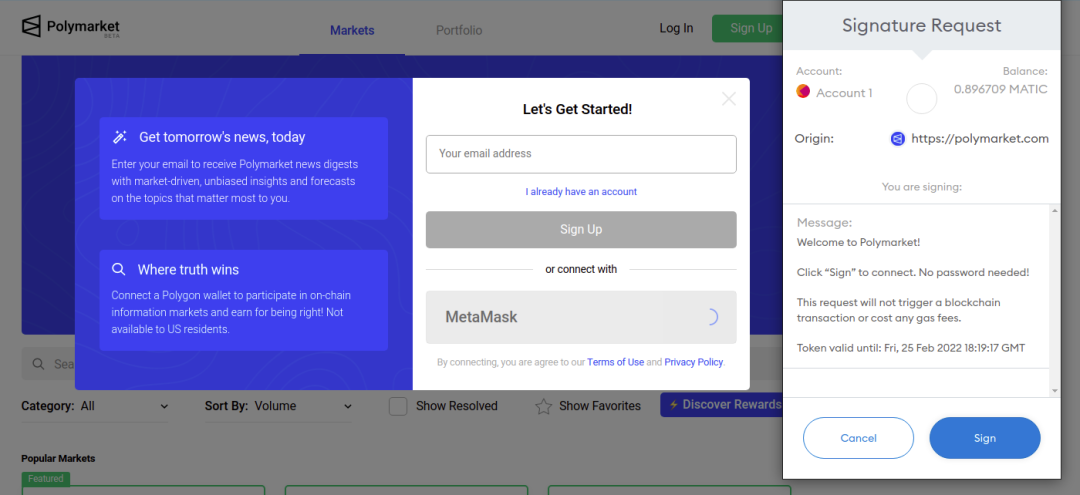

Step 1: Create an Account

Visit the official website of Polymarket and register an account. You will need to provide an email address and set a secure password.

After creating an account, you will be guided to create or connect an Ethereum wallet. Polymarket is non-custodial, meaning all funds are controlled by the users themselves.

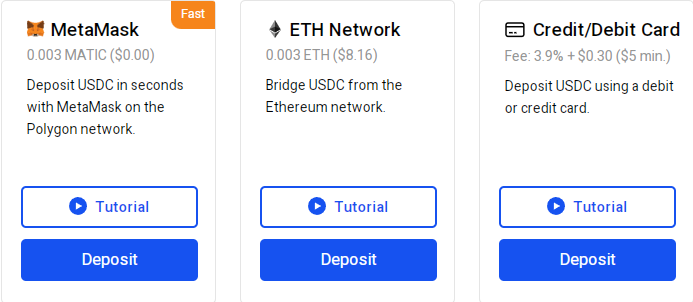

Step 2: Fund Deposit

Trading on Polymarket requires the use of USDC (a stablecoin pegged to the US dollar). You need to prepare some USDC in your Ethereum wallet.

Transfer USDC from your wallet to the Polymarket platform, usually done through the wallet's built-in transfer function.

Step 3: Browse Markets

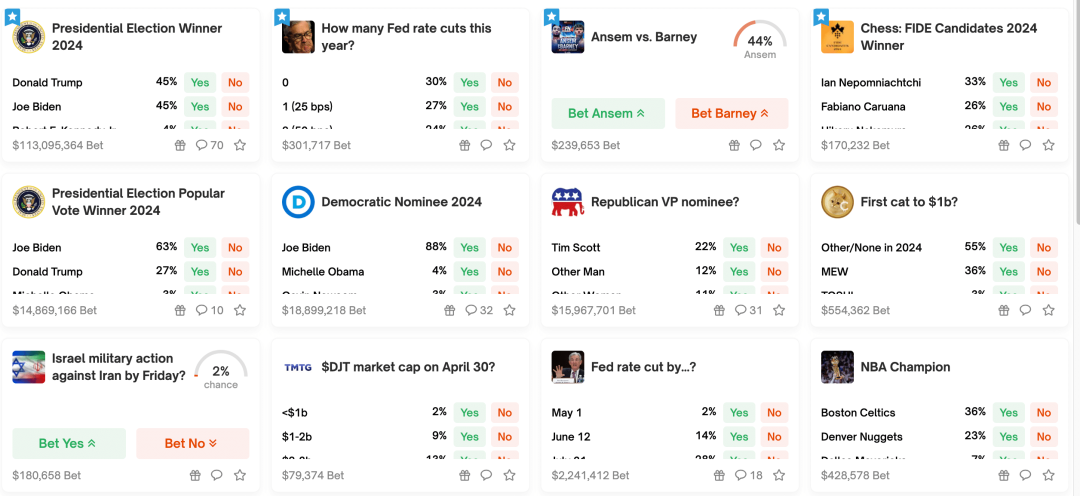

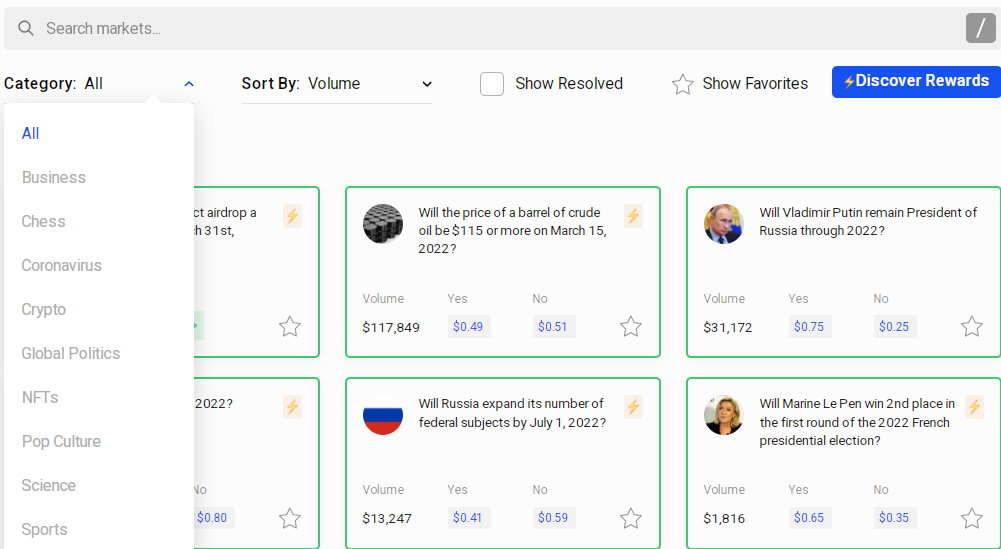

Log in to your Polymarket account and browse the various available prediction markets. These markets cover events in multiple fields such as politics, economics, technology, and sports.

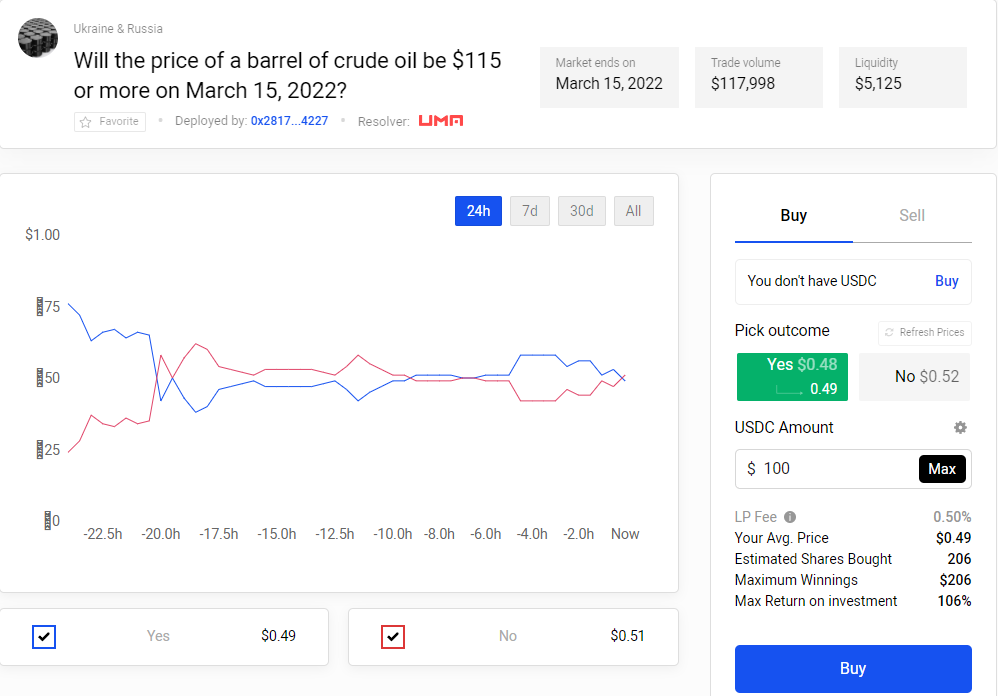

Each market displays current odds and possible outcomes, allowing you to decide which market you want to bet on based on this information.

Step 4: Purchase and Sell Shares

After selecting a market, you can purchase shares corresponding to your prediction of the event outcome. If you believe an event will occur, you can buy "yes" shares; otherwise, you can buy "no" shares.

The price of shares will change dynamically, and you can decide to hold or sell your shares at any time.

Step 5: Market Results and Settlement

After the event concludes, the market will be resolved based on the actual outcome. If you hold the correct shares, you can redeem each share for a $1 payout; if you hold the wrong shares, they become worthless.

Payouts will be automatically transferred to your Polymarket wallet, and you can choose to reinvest or withdraw to your Ethereum wallet.

Step 6: Withdrawal

You can withdraw your winnings from Polymarket at any time, usually by transferring the funds back to your Ethereum wallet.

Depending on network conditions and transaction fees, this process may take some time to complete.

5. Team

Polymarket was founded by Shayne Coplan, who also serves as the company's CEO. Shayne Coplan is a graduate of New York University with a rich background in blockchain and technology entrepreneurship. He has played key roles in multiple cryptocurrency and technology innovation projects and successfully led Polymarket to become a leading decentralized information market platform.

Another important member of the team is Rich Jaycobs, who currently serves as the Head of Market Development at Polymarket. Rich Jaycobs was the President of Cantor Futures Exchange and has extensive experience in the registration and operation of financial derivatives exchanges and clearinghouses. His deep background in financial markets and derivatives is crucial for the strategic development and market expansion of Polymarket.

The team at Polymarket consists of professionals with backgrounds in finance, technology, and the blockchain industry, all dedicated to revolutionizing information exchange and decision-making processes through innovative decentralized prediction markets. The team's diverse backgrounds and extensive expertise provide Polymarket with strong technical support and market insights, allowing it to maintain a leading position in a competitive market.

6. Project Evaluation

6.1 Track Analysis

The Polymarket project belongs to the field of decentralized prediction markets, which is an application of blockchain and cryptocurrency technology in the financial and information services industry. This platform uses blockchain technology to allow users to bet on and trade the outcomes of various real-world events, providing a decentralized, transparent, and trustless market environment.

- Decentralized Prediction Markets:

This field includes platforms that use blockchain technology to create prediction markets, where market participants can bet on the outcomes of events such as political elections, economic indicators, and sports events. These platforms provide a trading environment without intermediaries through automated trading and result verification via smart contracts.

- Fintech:

Although primarily focused on prediction markets, Polymarket is also part of the fintech field, as it involves financial activities such as fund trading, investment returns, and market analysis.

- Decentralized Finance (DeFi):

Polymarket can be considered part of decentralized finance (DeFi) as it provides an alternative way to bet and trade funds and assets without traditional financial institutions.

Similar projects to Polymarket include:

- Augur (REP):

Augur is one of the oldest blockchain-based prediction markets. This Ethereum-based platform was founded in 2014 and fully launched in 2018. In addition to betting on event outcomes, users can create their own markets. The platform has its native token REP, used for rewards, creating new markets, and disputing results.

Augur has a dedicated "Sports Betting" platform for sports betting. Additionally, it supports many categories, including crypto. Like Polymarket, Augur supports binary, categorical, and scalar markets. Recently, Augur launched a "Turbo" version using Polygon.

- Gnosis (GNO):

Gnosis is another Ethereum-based prediction market. It was founded in 2015 and has added other functionalities besides betting, including decentralized trading, wallet services, and infrastructure tools.

Gnosis has a more complex architecture and has a wider range of use cases beyond prediction. Its native token GNO is used for governance and staking.

Gnosis even built its own Layer-2 chain with smart contract capabilities, Gnosis Chain.

6.2 Project Advantages

- Decentralization and Non-Custodial:

Polymarket is fully decentralized and does not custody user funds. User funds are always stored in their own blockchain wallets and transactions are conducted through smart contracts, greatly reducing the risk of fraud and fund loss.

- Real-time Market Data and Transparency:

All trades and market dynamics are recorded on the blockchain, ensuring complete transparency and traceability. This not only helps users make well-informed decisions but also allows external analysts to access unaltered data.

- Low Cost and High Efficiency:

By using Polygon as a second-layer solution, Polymarket is able to provide fast and cost-effective transactions. This is particularly attractive for users who engage in frequent small-value transactions.

- Wide Market Coverage:

Polymarket offers event predictions covering multiple fields such as politics, economics, sports, and entertainment, providing users with a diverse range of betting options.

- Compliance Efforts:

In the face of regulatory challenges, Polymarket has taken measures to negotiate with regulatory authorities, striving to ensure the compliance of its operations. This helps to strengthen its business foundation and protect user interests.

6.3 Shortcomings

Regulatory Uncertainty: As an emerging financial technology, decentralized prediction markets face legal and regulatory uncertainty. Although Polymarket has been striving for compliance, it may still face the risk of legal challenges and regulatory changes in the future.

Market Liquidity Issues: While automated market maker (AMM) and order book systems can provide some market liquidity, new markets or less popular events may face liquidity shortages, which could affect user trading experience and potential returns.

Market Manipulation Risk: Despite the transparency provided by blockchain, prediction markets may still be susceptible to market manipulation, especially in smaller, less liquid markets.

Dependency on Smart Contracts: Polymarket's operation heavily relies on smart contracts, and any vulnerabilities or errors in smart contracts could lead to fund losses or other security issues.

7. Conclusion

In conclusion, Polymarket, as a blockchain-based decentralized prediction market, provides a unique platform for users to bet and predict on major global events. By leveraging the transparency and security of blockchain technology, Polymarket allows users to freely trade in a non-custodial environment while ensuring open and fair operations. Despite facing challenges such as regulation, technological dependency, and market liquidity, Polymarket strives to provide a more user-friendly experience through continuous innovation and improvement, while actively addressing various challenges and risks.

In the future, with the further maturity of blockchain technology and clarification of the regulatory environment, Polymarket is expected to play a more significant role in the decentralized financial services field. For users seeking to engage in market predictions in an open and transparent environment, Polymarket offers an attractive choice, allowing them to participate in the prediction of global events and experience the innovation and transformation brought by blockchain. With technological optimization and an expanding user base, the future of Polymarket is full of possibilities.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。