作者:Bradley Peak

编译:Felix, PANews

要点:

- 大约 61% 的 ETH 仅由 10 个地址持有,但其中大多数属于质押合约、交易所或基金,而非个人巨鲸。

- 近一半的 ETH 都存放在一个智能合约中:Beacon 存款合约,其为以太坊的权益证明系统提供动力。

- 像贝莱德、富达这样的大型机构以及上市公司如今持有数百万枚 ETH,ETH 成为一种重要的储备资产。

- ETH 的所有权已从早期采用者转移。如今,一切都取决于构建在其上的平台和服务。

截至 2025 年 8 月,链上数据显示,排名前 10 的 ETH 持有者控制着约 61% 的总流通供应量。

这不禁令人思考:究竟是谁持有大部分 ETH?答案指向协议级智能合约、大型交易所、交易所交易基金 (ETF) 信托,甚至上市公司。

本文探讨了 2025 年 ETH 富豪榜,从 Beacon 质押合约和 Coinbase 的热钱包,到贝莱德的 ETHA 信托,再到 Vitalik 的持仓。

按余额排名的 ETH 地址

截至 2025 年年中,ETH 的流通供应量约为 1.2071 亿枚。在 5 月的 Pectra 升级之后,发行量已稳定在接近零的水平。

正如上文简要探讨的那样,截至 2025 年 9 月 2 日,排名前十的 ETH 地址持有 7180 万枚以太币(约占总供应量的 60%)。

从更广泛的范围来看,排名前 200 的钱包占据了超过 52% 的份额,持有超过 6276 万枚 ETH(其中大部分持有量与质押合约、交易所流动性、代币桥接或托管基金相关)。与不活跃的 BTC 巨鲸地址不同,这些 ETH 巨鲸地址在以太坊网络十分活跃,这反映了 ETH 能够充分支持质押、DeFi 和机构运营的能力。

2025 年,谁拥有最多的 ETH?

截至 2025 年 9 月 2 日,Beacon 存款合约持有约 6800 万枚 ETH,约占 1.2071 亿枚 ETH 总流通供应量的 56%。

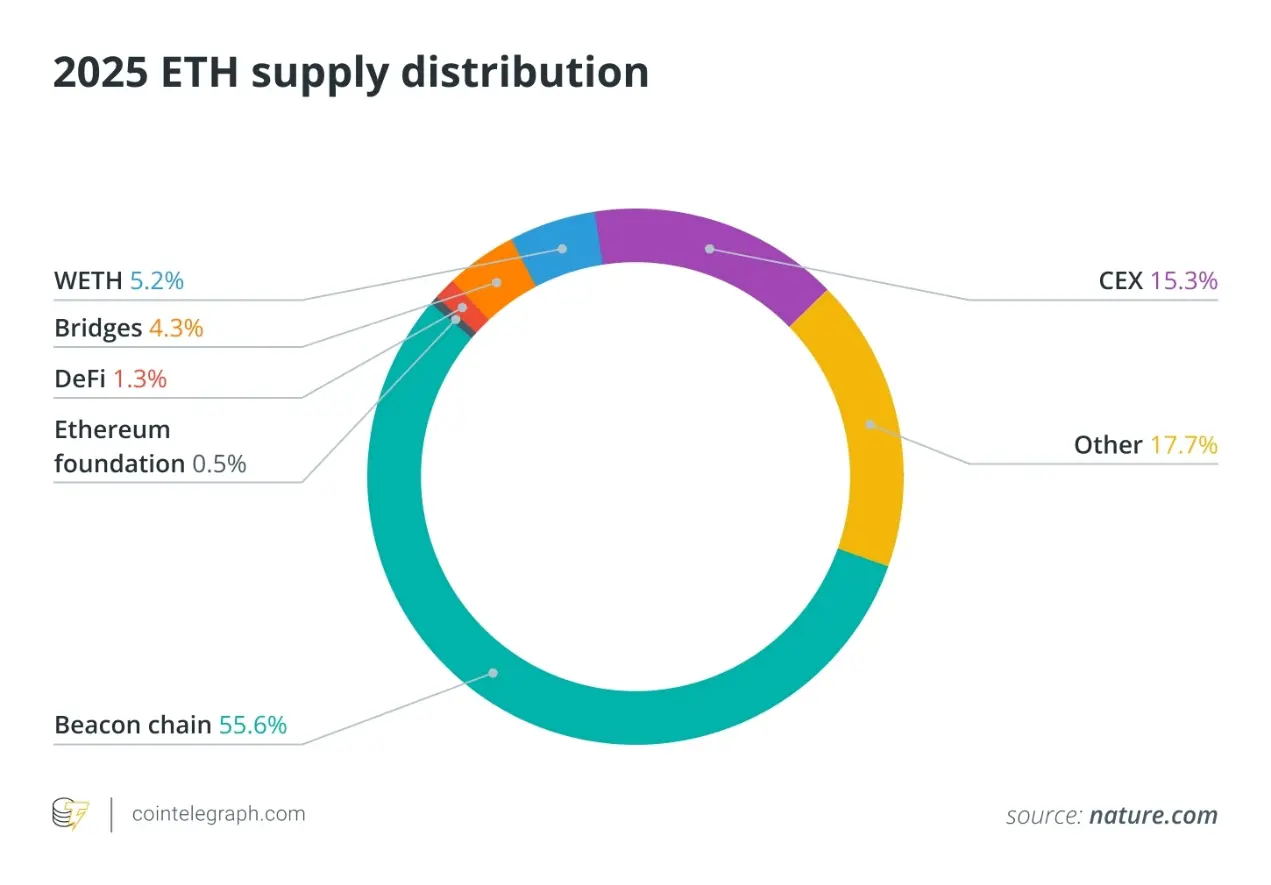

这些数据与 2025 年 3 月的报告大致一致,报告估计该份额约为 55.6%(见下图)。

此智能合约是以太坊验证者的入口,每位验证者都必须至少存入 32 枚 ETH 才能参与网络的安全保障。

即使在 2023 年启用提款功能之后,资金也不会立即变为流动资金。验证者必须退出活跃集,等待大约 27 个小时的解绑期,然后依靠协议控制的清理操作来释放 ETH。

这使得 Beacon 合约成为最大的 ETH 持有者——不是个人,而是网络本身。

通过严厉的惩罚措施和有组织的退出机制,其确保了验证者的责任。尽管如此,一些批评人士认为,将一半的供应量集中在一个合约中,如果发生协同退出或协议级错误,可能会带来系统性风险。

Wrapped Ether (WETH) 智能合约也是最大的 ETH 持有者之一,目前持有超 226 万枚 ETH(约占流通供应量的 1.87%)。

第二大 ETH 钱包

截至 9 月 2 日,以下的交易所和托管机构是第二大 ETH持有者:

- Coinbase:516 万 ETH(约占总供应量的 4.2%)

- Binance:406 万 ETH(约占 3.3%)

- Robinhood:137 万 ETH(约占 1.1%)

- Upbit:135 万 ETH(约占 1.1%)。

这些地址代表了活跃的基础设施层,其中 ETH 用于支持交易所流动性、质押 cbETH 等衍生品以及跨链资产桥接。

2025 年最大的 ETH 钱包

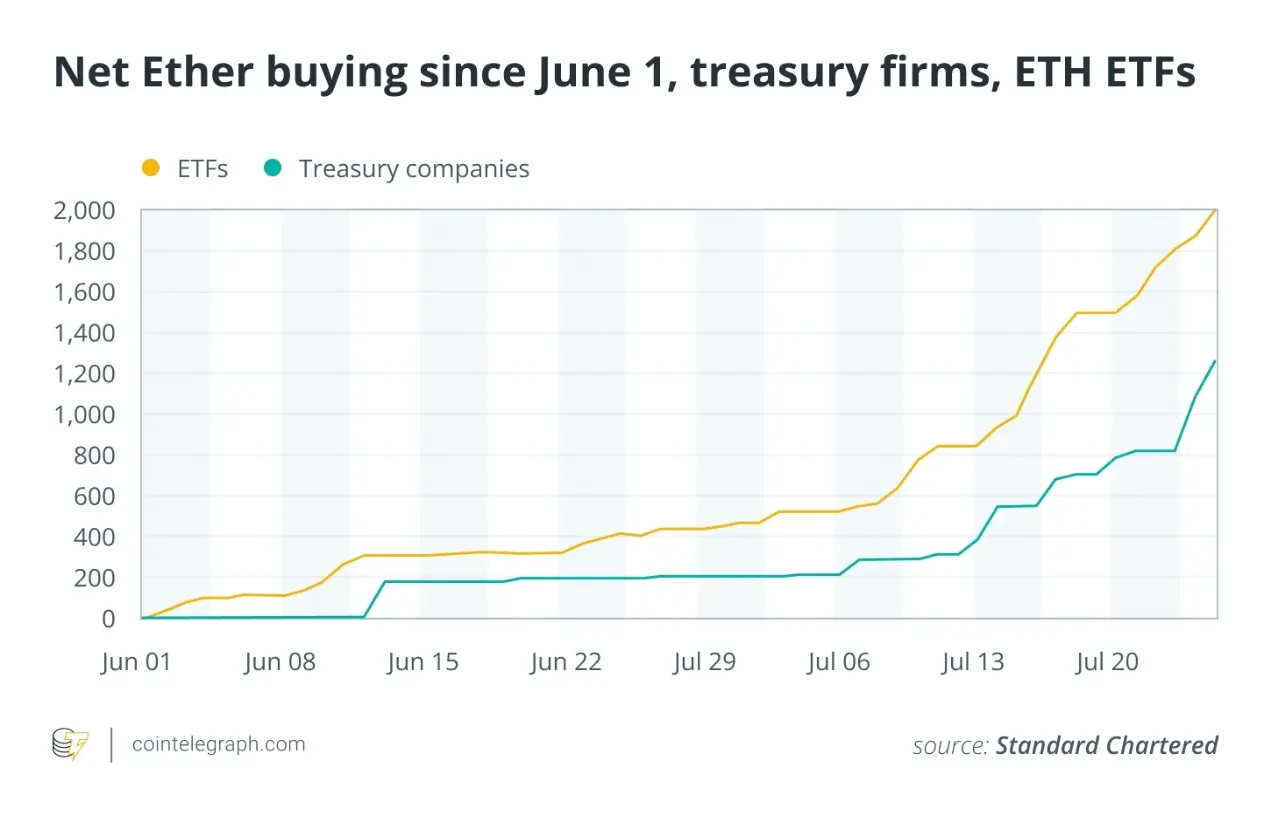

截至 2025 年 7 月下旬,贝莱德的 iShares 以太坊信托 (ETHA) 推动了机构 ETH 所有权的重大转变。 ETHA 的净流入量达 97.4 亿美元,目前(截至 2025 年 8 月)持有超过 300 万 ETH(约占总供应量的 2.5%),使其成为 2025 年最大的 ETH 钱包之一。

灰度旗下的 ETHE 仍是市场的重要参与者,管理着 113 万枚 ETH。富达于 2024 年推出的以太坊基金 (FETH) 的流入量已达 14 亿美元,而 Bitwise 则正在从仅投资 BTC 转向基于 ETH 的委托投资,并提供质押功能。

这些机构目前共控制着超 500 万枚 ETH(占总供应量的 4.4%),改变了 ETH 的持有格局。其代表着一类新的 DeFi 百万富翁,他们受到监管,持有 ETF 资产,并注重质押。

企业以太坊鲸鱼地址

越来越多的上市公司正在效仿 Strategy 的比特币财库计划(但加入了质押),将 ETH 视为一种资产。例如(但不限于):

- Bitmine Immersion Technologies(纽交所代码:BMNR)持有超 180 万枚 ETH(约合 78 亿美元)。

- SharpLink Gaming(纳斯达克代码:SBET)自 6 月以来已购入约 797,700 枚 ETH(约合 35 亿美元)。

- Bit Digital(纳斯达克代码:BTBT)持有约 120,300 枚 ETH,该公司在股权融资后已从 BTC 转为 ETH。

- BTCS(纳斯达克代码:BTCS)报告称其持有约 70,028 ETH(约合 3.07 亿美元),资金来自可转换债券。

这些 ETH 中的大部分都处于活跃质押状态,年化收益率约为 3% 至 5%。这些公司认为,以太坊的可编程性、稳定币生态系统以及监管清晰度(如《GENIUS 法案》)是其 ETH 财库战略的基础。

这份新的 ETH 亿万富翁榜单不仅涵盖个人,还包括押注 ETH 长期价值的企业人员。

ETH 亿万富翁榜单

虽然智能合约和机构在 2025 年以太坊富豪榜上占据主导地位,但仍有少数个人是 ETH 的主要持有者。

以太坊联合创始人 Vitalik Buterin 据称持有约 25 万至 28 万枚 ETH(约合 9.5 亿美元),这些 ETH 主要存放在少数几个非托管钱包中,其中包括知名的 VB3 地址。

LHV 银行联合创始人 Rain Lõhmus 在 2014 年首次代币发行 (ICO) 期间购买了 25 万枚 ETH,但后来失去了私钥。其代币至今仍未动用,目前价值近 9 亿美元。

Gemini 的早期投资者和创始人 Cameron Winklevoss 和 Tyler Winklevoss 兄弟控制着 15 万至 20 万枚 ETH,这还不包括 Gemini 交易所储备的超过 36 万枚 ETH。

以太坊联合创始人兼 ConsenSys 负责人 Joseph Lubin 持有约 50 万枚 ETH(约合 12 亿美元),但这一数字从未得到官方证实。

另一位以太坊联合创始人 Anthony Di Iorio 据称持有 5 万至 10 万枚 ETH。

截至 2025 年初,Etherscan 数据显示,以太坊上有超过 1.3 亿个独立地址,但持有至少 1 枚 ETH 的地址不到 130 万个,仅占总数的不到 1%。

如何追踪 ETH 所有权分布

识别 2025 年最大的 ETH 持有者依赖于 Nansen 的 Token God Mode、Dune Analytics 和 Etherscan 等工具。这些平台根据行为对钱包进行分类,并将其与交易所、基金、智能合约或个人关联起来。

- Token God Mode 将钱包集群映射到已知实体,追踪资金流入/流出,并对 2025 年最大的 ETH 钱包进行排名。

- Dune Analytics 使用“labels.addresses”之类的模式表将外部拥有账户 (EOA) 与智能合约和交易所区分开来,从而生成有关公共以太坊地址和 ETH 持有模式的洞察。

- Etherscan 根据交易历史、归属或用户提交的证据对钱包进行标记,从而提高加密钱包的透明度。这些来源共同勾勒出 ETH 所有权分布情况。

然而,局限性仍然存在。重复使用的存款地址可能会夸大数字,冷钱包可能会逃避集群管理,隐私技术会掩盖真正的控制权。即使是余额排名前 200 的以太坊地址,也可能包含碎片化或标签错误的实体。ETH 地址排名反映的是确定性和统计推断的结合,而非完全可见性。

相关阅读:Tom Lee:比特币年底或达 25 万美元,以太坊潜在价值超过 6 万美元

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。