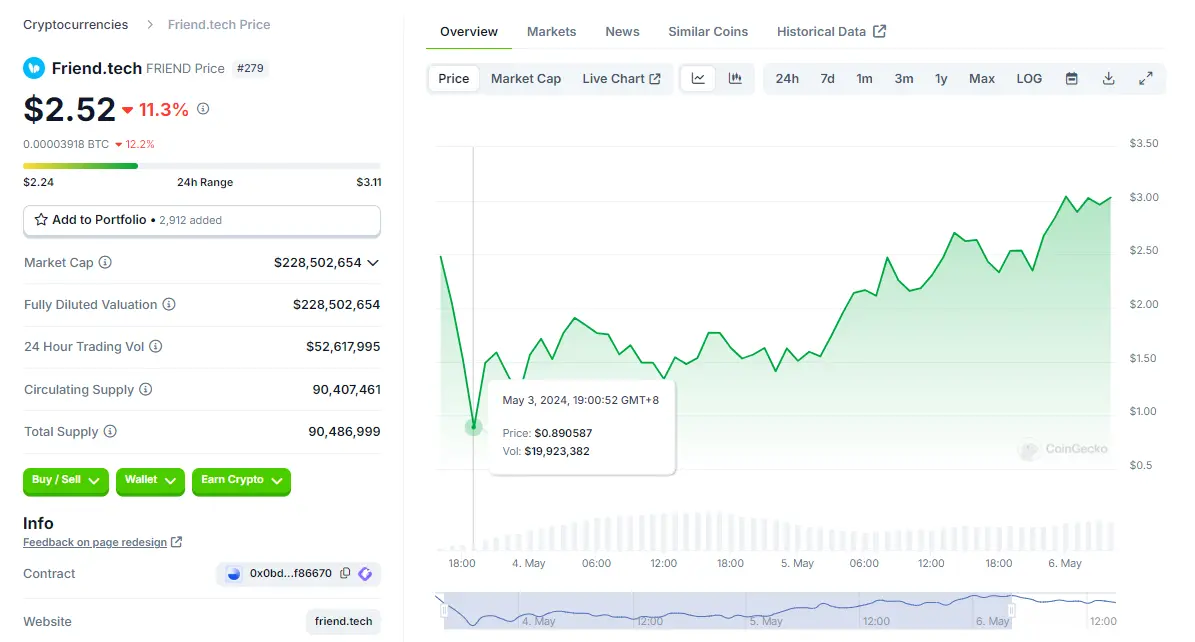

In the dynamic encrypted market, Friend.tech is rapidly attracting attention with its innovative community-driven model. According to CoinGecko's data, the price of the $FRIEND token has surged from $1.54 to $2.65 in the short term, with a 72.6% increase in the past 24 hours, reaching a market value of approximately $227 million and rising to 271st place. In addition, the daily trading volume of $FRIEND has reached $56.22 million.

Recently, Friend.tech announced the release of its platform's V2 version and launched the BunnySwap native DEX to demonstrate its technological progress and market response. These developments not only showcase the platform's technical strength but also highlight its ability to build a sustainable ecosystem.

Next, this article will focus on how Friend.tech stands out in the fierce market competition.

Friend.tech Worth Paying Attention to in Web3 Social: From Unique Social Monetization to Top Capital Support

Friend.tech is a Web3-based social finance (SocialFi) platform that innovatively transforms users' influence on social media into tradable assets. Platform users can purchase and hold other users' KEY, which represents the right to access specific content and interact with content creators. Friend.tech's main features include social interactions related to KEY, such as joining private group chats and the opportunity to interact directly with content creators. In addition, all transactions are conducted on the Ethereum-based Layer2 network—Base Chain, ensuring higher transaction speeds and lower fees.

As the encrypted market enters a persistent bear market and the heat in the gaming and NFT fields gradually recedes, Friend.tech has rapidly risen in the market with its unique social finance (SocialFi) model, attracting widespread attention. Here are several key analyses of the success factors of Friend.tech:

- The expansion potential of social networks in Web3

Social networks have proven their enormous potential on the traditional Internet. Successful platforms such as Facebook, Instagram, and TikTok demonstrate the strong ability of social functions to attract and retain users. Social network experiments in Web3 projects, such as Cyber Connect, Debank, and Lens Protocol, although merely replicating existing successful social network models and adding encryption functions, also demonstrate the enormous development potential of the Web3 social field.

- Friend.tech's unique social monetization model

Friend.tech officially launched in August 2023 and experienced a period of explosive user growth just one week later. The core of the platform lies in monetizing social influence on Twitter into tradable tokens. Users can gain access and interaction rights to content by purchasing other users' KEY, which are similar to paid subscriptions in traditional social networks. ETH serves as the main payment currency within the application for trading these KEY.

- Dynamic pricing mechanism and market response

Another feature of Friend.tech is its dynamic pricing mechanism. Through a parabolic pricing curve, i.e., 𝑦=𝑥216000y=16000x2, where 𝑦y represents the price in ETH and 𝑥x is the current total KEY supply. This design initially keeps the KEY price relatively low, and as purchases increase, the price quickly rises, triggering a buying frenzy in the market. In addition, each transaction incurs a 10% fee, with 5% going to KOLs and the remaining 5% as platform revenue, effectively regulating market speculation.

- Market strategy and support from top capital

Friend.tech not only seized the market dividend at the beginning of the Base Chain launch but also gained support from the top investment fund Paradigm in the cryptocurrency circle, adding extra trust and market expectations to the project. In addition, the project's user invitation mechanism and point system are similar to other successful encrypted projects, such as Blur, designed to incentivize long-term user participation and active trading.

Through these innovative strategies, Friend.tech has established its position in the Web3 social field, demonstrating the enormous potential of social functions in driving user growth and activity.

Friend.tech V1 and V2: Innovation Brings Growth, but High Cost Model Raises Doubts?

Friend.tech V1: Coexistence of Innovation and Challenges

Friend.tech V1 introduced a unique model that aligned the interests of well-known cryptocurrency figures with those of ordinary users, resulting in significant growth in user base, activity, and income during the bear market. This consistency made FT stand out in new projects and became one of the fastest-growing decentralized social applications. However, this model also faces challenges: due to the high 20% transaction fee, ordinary users often find it difficult to profit from normal transactions, especially during periods of low activity and inflow.

During the operation of V1, despite generating approximately $13 million in fees and driving the transaction volume to reach $130 million, nearly $6 million in revenue was distributed to users. However, the high fees ultimately became a barrier to entering the market. Therefore, despite V1 reaching several important milestones, the high costs and the model's difficulty in sustaining profits limited its long-term development.

Friend.tech V2: Gap between Expectations and Reality

The long-awaited Friend.tech V2 was released on March 3, 2024, bringing many updates, including allowing users to claim $FRIEND tokens. However, this update seems to have not met the community's expectations, mainly due to the lack of clear information release and complex token claiming conditions. Users encountered obstacles when claiming airdrops, such as being able to claim only 10% of the tokens and needing to join a club to claim the remaining 90%.

The main new feature introduced in the V2 version is "clubs," which are group spaces owned and managed by key holders. Although the concept of clubs aims to increase social interaction and network building, its specific application and utility are not yet clear, leaving many users guessing. In addition, each club transaction incurs a 1.5% fee, allocated to farmers and FT, increasing transaction costs.

Although V2 has made some interface updates, such as adding new elements like "farms," airdrop claims, and rewards, doubts remain about the practicality and long-term value of the $FRIEND token. The lack of innovative use cases and real expansion of key functions limits the acceptance and market influence of the V2 version.

In summary, Friend.tech V1 and V2 both demonstrate the innovative potential of encrypted social platforms, but also expose significant challenges in user experience, cost structure, and information transparency. While the release of V2 brought some new features, it seems to have not fully addressed the core issues of the community, which may affect its sustained success in the increasingly competitive Web3 social market.

The Future of Friend.tech: Innovation or Short-lived Craze?

In the wave of innovation in Web3 social platforms, Friend.tech has demonstrated its unique business model and technological application. By transforming users' influence on social media into tradable NFTs, the platform has created a new dimension of interaction for KOLs and their fans. Fans can acquire the opportunity to communicate directly with their idols by purchasing KOLs' NFTs, deepening the connection between fans and idols and creating new sources of income for KOLs.

However, despite attracting a large number of users and rapidly increasing the platform's activity and revenue in the initial stage, some key issues have gradually emerged. Especially after the launch of Friend.tech V2, although expectations were high, the actual effect did not meet the community's expectations. The new version attempts to reduce dependence on KOLs through a more community-centric approach, aiming to create a more sustainable ecosystem. However, when the value of a social network highly depends on its users, especially core influencers, this dependence becomes a vulnerability.

Some features of the V2 version, such as clubs and the introduction of the $FRIEND token, were intended to enhance user interaction and participation, but complex airdrop rules and technical issues have greatly discounted the user experience. In addition, for some latecomers, buying at a high position may lead to funds being trapped, increasing the platform's instability.

Combining these factors, although Friend.tech has created significant market heat in the short term, as time goes on, critics' voices are growing, questioning the sustainability of its model. Is the market enthusiasm just due to novelty and initial hype? As the excitement fades, we cannot help but ask: Can this NFT model based on social influence continue to attract users and become the future of social media?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。