Web3 AI does not exist independently, and understanding the broader industry background is crucial for the competition between decentralized and centralized projects.

Author: Crypto, Distilled

Translation: DeepTechFlow

The Web3 AI field is vast and often misunderstood. Overemphasis on technical details may cause you to miss out on significant opportunities. If you only focus on prices, you may end up with nothing more than a conceptual product without substance.

Fortunately, there is a simple factor driving most results.

Before delving into this key insight, let's clarify some important things.

Many people mistakenly equate complexity with high quality, especially in the Web3 AI field. However, in reality, simplicity often leads to the best outcomes. In the chaotic AI industry, a simple and direct approach is not only practical but also essential.

That's why I adopt the principle of Occam's Razor. This principle holds that among multiple solutions, the simplest one is usually the best.

Think about the elegance of Einstein's equation e=mc^2, which involves only three variables but explains vast cosmic phenomena. This illustrates the power of simplicity in understanding complex systems.

I summarize the key driver of Web3 AI as a crucial consideration: "the flow of attention in the mainstream AI industry." In this sense, Web3 AI simply acts as a general agent for the advancement of AI.

Let's analyze step by step.

In recent years, significant breakthroughs in the AI field have received considerable attention. This has propelled the development of AI-focused crypto projects. Although the combination of AI and cryptocurrency demonstrates enormous potential, many practical challenges still exist, and valuation methods are not clear.

This is why mainstream narratives often overshadow crypto-centric narratives.

How to evaluate the negative externalities of centralized AI?

How important is the "decentralization" of AI?

How to assess great technologies that are not yet suitable for the product market?

A bottom-up approach is very challenging. Instead, a top-down approach is often more direct and effective. This approach first analyzes the flow of attention in the mainstream AI industry. It's more important to focus on "which wave to ride" than choosing which boat.

How influential is the widespread attention to AI?

Can it surpass the strength of the entire market? In some cases, it certainly can.

Despite practical bottlenecks, the performance of many AI tokens has exceeded that of $BTC and $ETH, as well as major AI stocks such as $MSFT and $NVDA, especially in the fourth quarter of 2023.

This performance is mainly attributed to two factors:

Broader performance of the cryptocurrency market

AI headline news

The following chart shows the performance distribution of AI tokens when $BTC is declining.

How to leverage this insight?

First, identify the key factors driving the development of the entire AI industry.

Next, determine the cryptocurrency submarkets that align with this attention.

Finally, identify the most "mispriced" projects in these categories.

(Note that this premise assumes a bull market is underway)

For example, GPU projects like $RNDR surged before the GTC event of $NVDA in March. Similarly, projects like $TAO performed well when open-source AI models became a trend.

During these shifts, the core technology often remains relatively unchanged. The real difference lies in the focus of mainstream attention, which amplifies valuation.

Ultimate example—$WLD

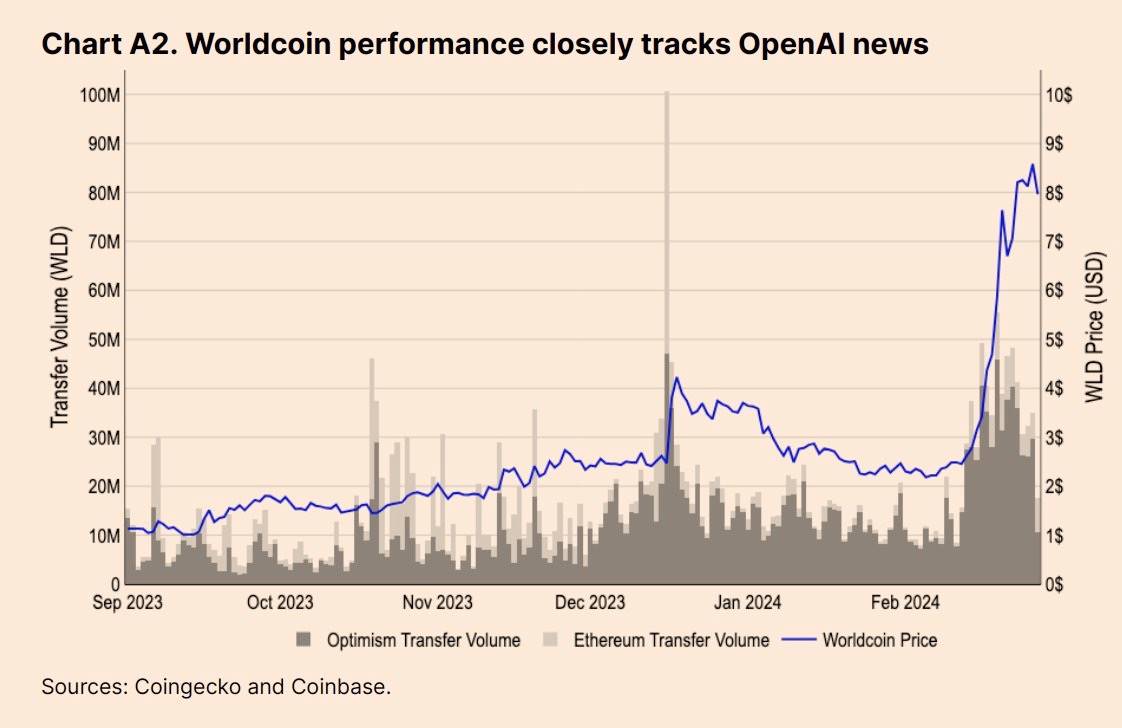

Coinbase recently provided compelling evidence to support this theory. A typical example is $WLD, demonstrating how AI tokens closely track AI headline news.

For instance, after Sam Altman promoted $WLD on December 15, the token surged by 50%. When OpenAI released Sora on February 15, 2024, the price of $WLD tripled, despite no direct announcement on Twitter. At one point, the valuation of $WLD reached $80 billion, which is almost on par with OpenAI's $86 billion valuation in February, highlighting the significant impact of widespread attention to AI on market trends.

Conclusion:

In short, Web3 AI does not exist independently, and understanding the broader industry background is crucial for the competition between decentralized and centralized projects.

Although Web3 AI projects are innovative, they are not as feasible as centralized projects. Therefore, mainstream AI narratives may continue to drive market development. Pay attention to real-life AI narratives and predict trends in the AI and crypto markets.

But please remember, there are high risks involved. Due to many promises but little actual adoption, risk management and prudence are essential.

This article is not financial advice.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。