Author: Pentoshi, Cryptocurrency Analyst

Translation: Felix, PANews

How will the future of this round of the cryptocurrency bull market evolve? Cryptocurrency analyst Pentoshi has analyzed the current market and believes that there are still good opportunities, but more realistic expectations should be set.

Some thoughts and expectations. This cycle should be the one with the greatest diminishing returns among all cycles. There are several reasons for this. The bottom price of the entire market has been set relatively high. In terms of market value, the bottom of each cycle is about 10 times the low point of the previous cycle. It is important to note that in the past cycles, Total 3 (see the candlestick chart below, excluding the market value of Bitcoin and Ethereum) only included 125 cryptocurrencies, not all of them.

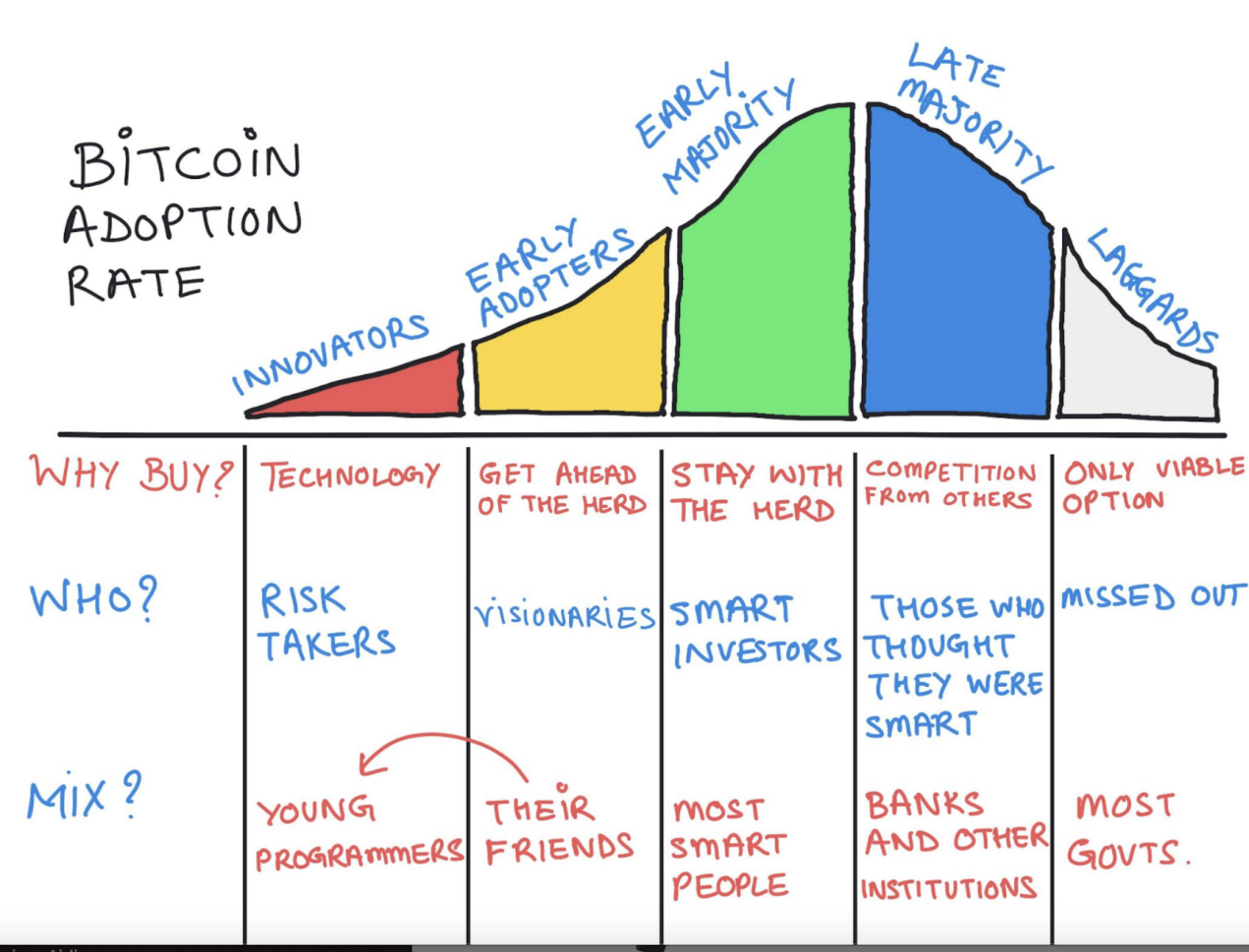

When the author entered the cryptocurrency industry in 2017, the market value of altcoins was about 12-15 billion US dollars, eventually exceeding 1 trillion US dollars. This growth is not replicable, as there are more altcoins today and more dilution. Prices only rose back then because the market was still in its early stages. At that time, only about 2% of Americans owned cryptocurrencies, whereas now it's over 25% (data from Coinbase).

This is important because the early entrants into the market are the wealthy ones. The adoption in countries like Bangladesh (meaning underdeveloped countries) is not significant, and the increase in the number of people cannot be equated with an increase in capital. More capital is needed to drive market development, and there will continue to be more altcoins in the future, expanding the market further. Therefore, it will be much more difficult to achieve excess returns.

A few weeks ago, the peak daily unlock of tokens (not necessarily sold) was $250 million. Assuming they were all sold, this would be the inflow of funds needed to maintain price stability for 24 hours. One day, these tokens will be sold, but not today, as most holdings are temporary. The author's speculation is that the Total 3 for this cycle (excluding the market value of Bitcoin and Ethereum) will not exceed twice the new high of the 21-year bull market, with a maximum value of about 2.2 trillion US dollars. But this does not mean that there are no opportunities now, it just means that the market is no longer in its early stages, but in its later stages. People's expectations should be lowered a bit, and this cycle should not be compared to past cycles, as adoption and overall growth in this field are much higher.

Most people have never truly learned their lesson. If you cannot control greed and overcome it, you are destined to lose your gains time and time again. You will always be chasing your goals or trying to recoup some profits.

If you believe that this cycle is already 50% over, you should take out your principal while accumulating some cash to buy other lower-risk assets. This strategy applies to most people, but not everyone. Going all in at the final stage is not wise; your goal should be to capture 80% of the entire bull market. Not everyone can "survive," statistically speaking, only 1% of people can laugh in the end, and most people will not profit from exiting. Your gains are usually temporary, and this system is designed for you to lose. If you have gained life-changing profits or have already profited, make sure to protect those gains. When you reach certain goals, protect yourself, and then start over with as little money as possible.

There are some things worth considering, such as where the market is currently positioned, how much growth has been achieved, and what this means for future growth and returns. In the author's view, the best time to easily achieve comprehensive excess returns has passed, but the future still looks bright. There are still good opportunities now, but more realistic expectations should be set so as not to be caught off guard.

Many people will sell you their dreams because selling your own dreams to others is easy.

Related reading: Grayscale April Market Report: Macro storms are coming, but the cryptocurrency market is surprisingly bullish?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。