However, in the medium to long term, the physical creation and redemption mechanism of Hong Kong cryptocurrency ETFs also provides a channel for cryptocurrency assets to be converted into traditional financial assets.

Author: Tom Analysis, SoSoValue Researcher

The Hong Kong Securities and Futures Commission officially announced the list of approved virtual asset spot ETFs, including Bitcoin spot ETFs and Ethereum spot ETFs under Huaxia (Hong Kong), Jia Shi International, and Bo Shi International. These 6 spot ETF products were open for subscription from April 25th to 26th and were listed on the Hong Kong Stock Exchange on April 30th.

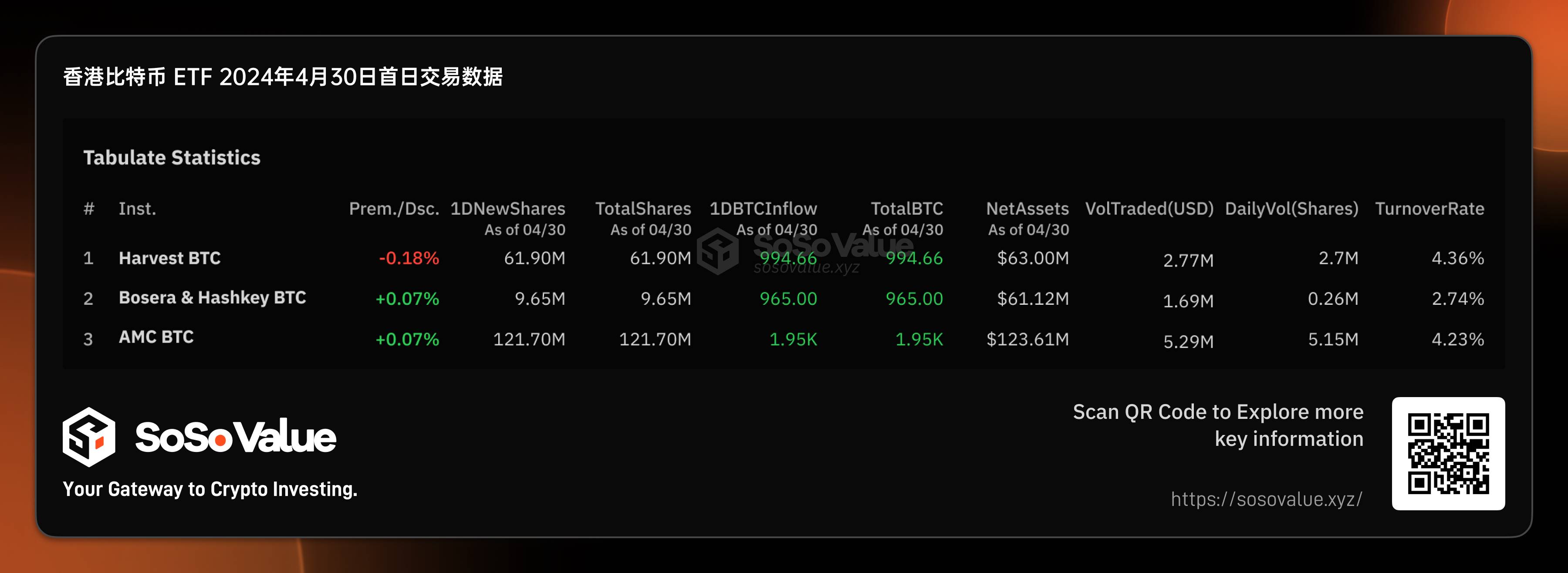

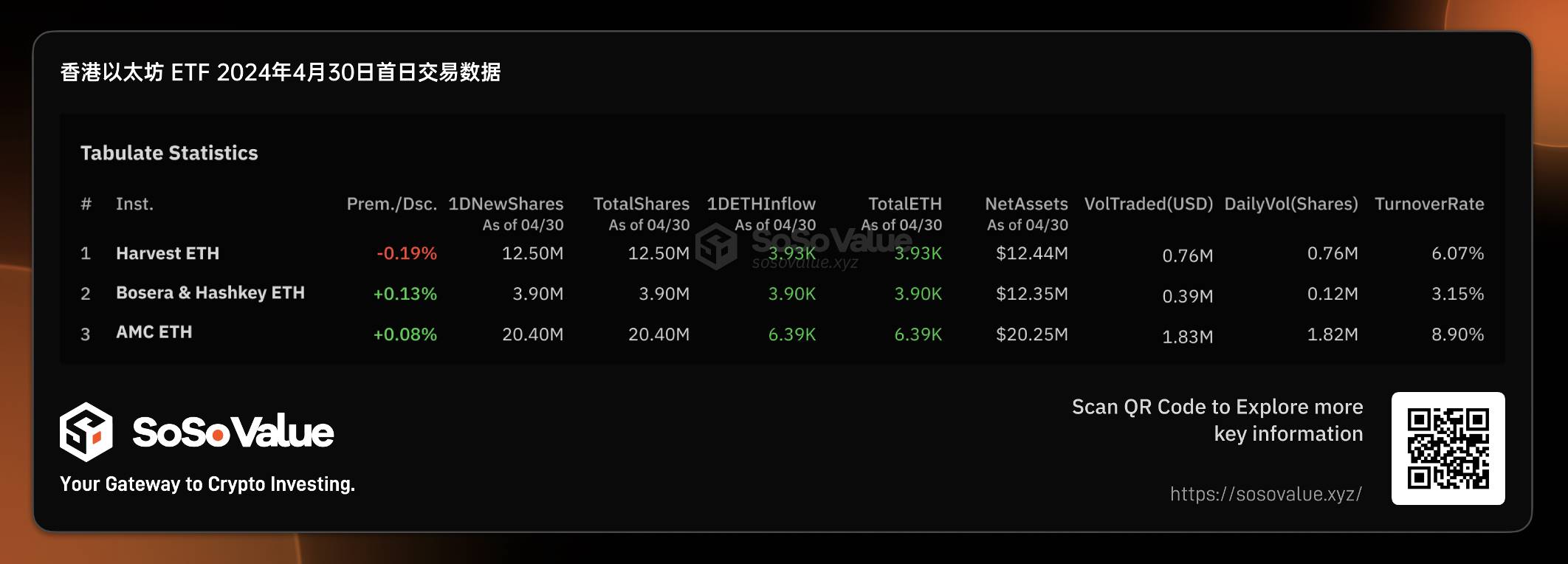

Through the subscription, the 6 Hong Kong spot ETFs obtained a decent initial scale. According to SoSo Value data, the total net value of 3 Bitcoin ETFs is 248 million US dollars, and the total net value of 3 Ethereum ETFs is 45 million US dollars, with a total net value of nearly 300 million US dollars. In contrast, the first-day total net value of the American Bitcoin spot ETF products, excluding Grayscale (GBTC) which was converted from a trust to an ETF, was only 130 million US dollars.

However, in terms of first-day trading volume, the Hong Kong cryptocurrency ETFs were much smaller than their American counterparts. According to SoSo Value data, the first-day trading volume of the 6 Hong Kong cryptocurrency ETFs on April 30th was only 12.7 million US dollars, far lower than the 4.66 billion US dollars trading volume of the American ETFs on their first day of listing.

We observed a significant mismatch between the initial scale and first-day trading volume of the Hong Kong cryptocurrency ETFs. How large can the scale of the Hong Kong cryptocurrency spot ETFs be in the future, what kind of impact can they have on the cryptocurrency market, and how to seize relevant investment opportunities will be analyzed through the supply and demand relationship of the Hong Kong ETF.

Figure 1: Overview of Hong Kong cryptocurrency spot ETF data (Data source: SoSo Value)

Demand side: Chinese mainland investors are not allowed to purchase, limited incremental funds may lead to low trading volume

For this Hong Kong cryptocurrency ETF, there are still strict restrictions on investor qualifications, and mainland Chinese investors cannot participate in trading. Taking Futu Securities as an example, it requires the account holder to be a non-mainland Chinese or American resident in order to trade. It is currently not allowed for mainland funds to trade through the southbound Hong Kong Stock Connect, and it is expected to be difficult to achieve in the foreseeable future.

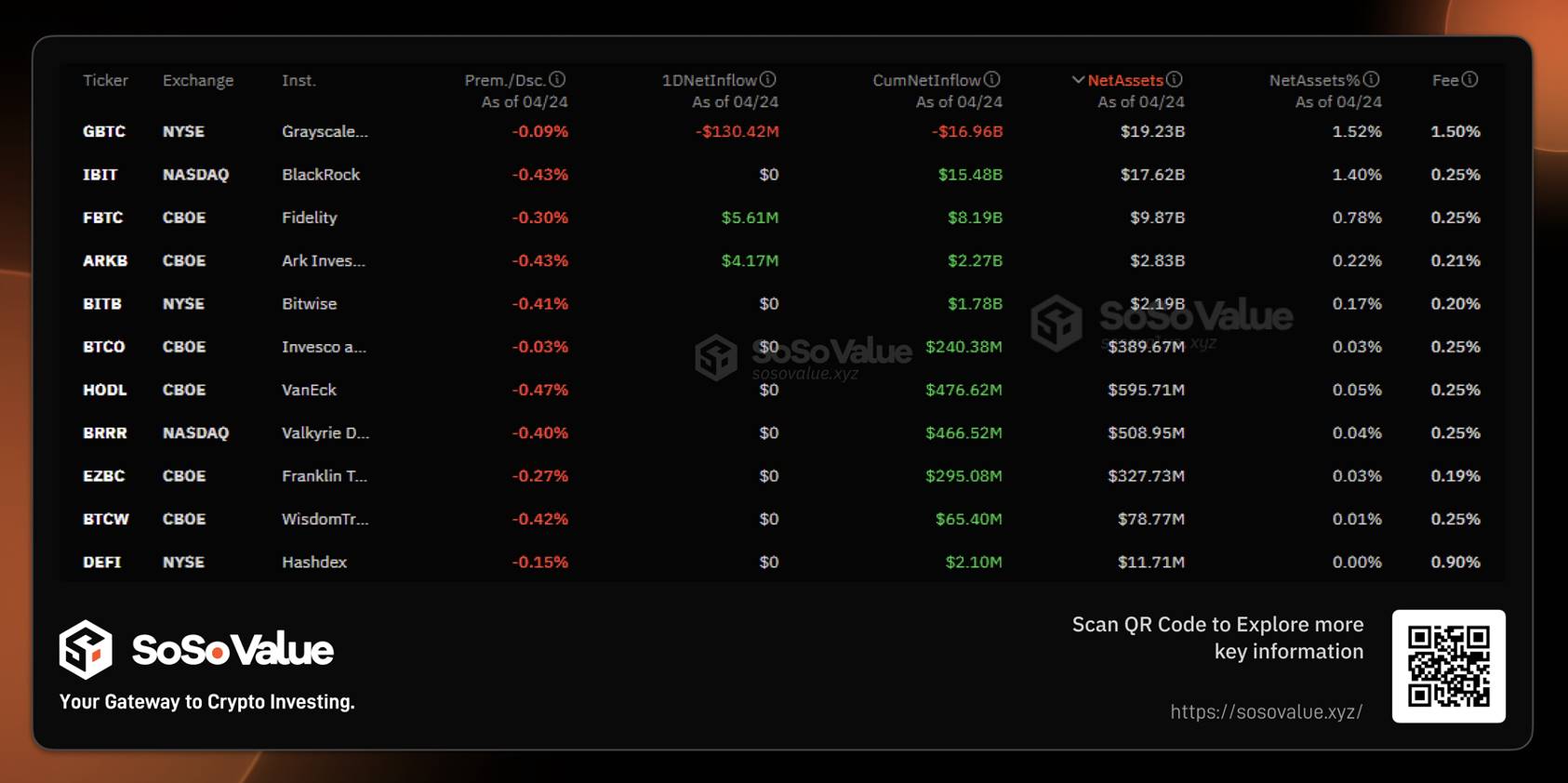

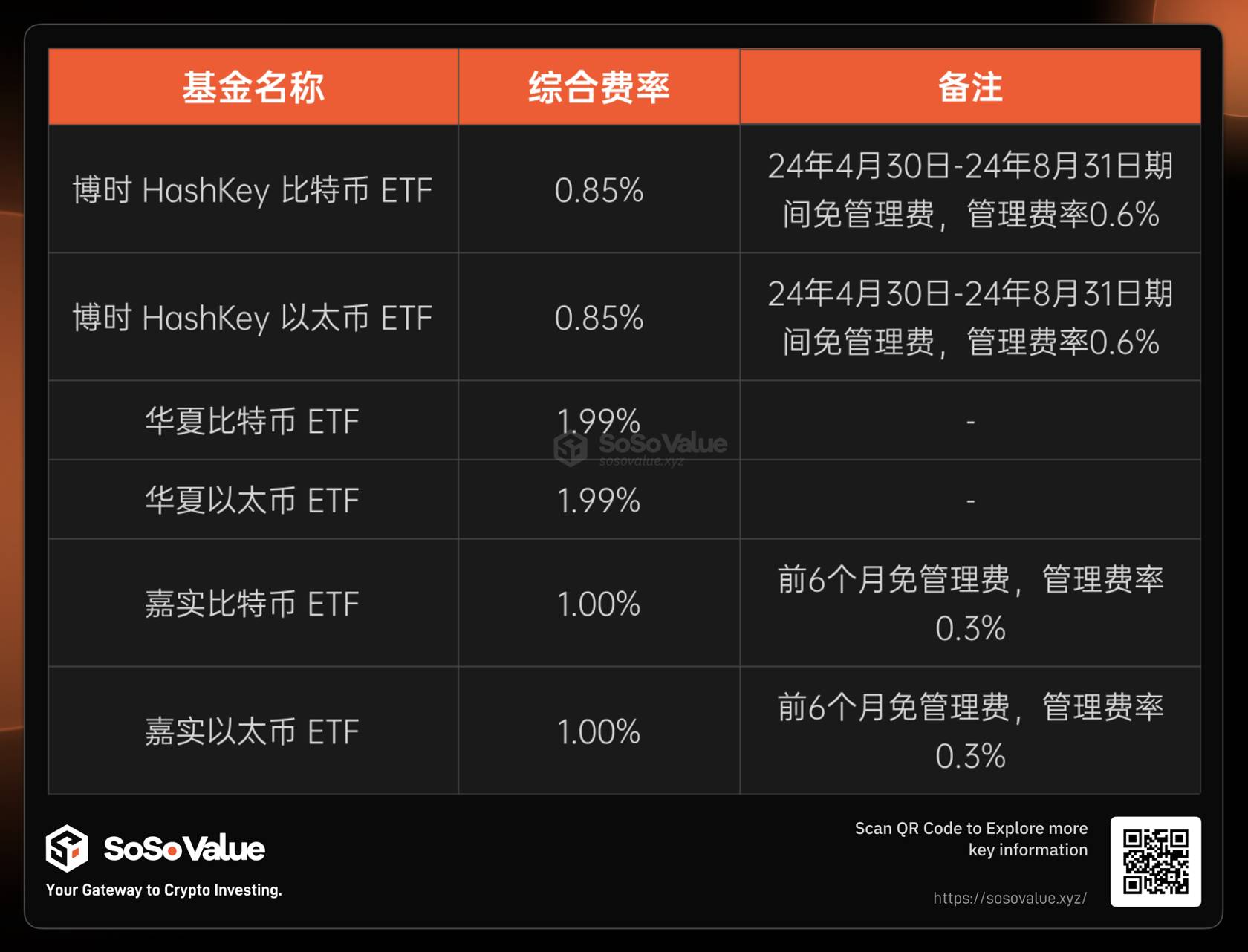

In terms of fees, the Hong Kong cryptocurrency ETF does not have an advantage compared to the American ETF, and it is not very attractive to institutions that wish to hold for the long term. According to SoSo Value data, among the 11 Bitcoin spot ETFs in the United States, except for Grayscale and Hashdex, the largest ones such as IBIT and CBOE have management fees of around 0.25%. In contrast, the comprehensive fees of the 3 Bitcoin ETFs in Hong Kong are relatively high, with Huaxia at 1.99%, Jia Shi at 1.00%, and the lowest Bo Shi at 0.85%. Even with a short-term waiver of management fees, there is still no fee advantage. Due to the difference in fees, the holding cost of the American Bitcoin ETF is lower for institutional investors who are optimistic about the cryptocurrency market and wish to hold for the long term.

Looking ahead, the funds on the demand side may mainly come from two sources: 1) Hong Kong retail investors. For retail investors with a Hong Kong identity card, the threshold for purchasing the Hong Kong cryptocurrency ETF is lower. For example, to purchase the American Bitcoin spot ETF, one needs to have a Professional Investor (PI) qualification, and obtaining a PI qualification requires proof of an investment portfolio of 8 million Hong Kong dollars or total assets of 40 million Hong Kong dollars. This Hong Kong Bitcoin spot ETF allows retail investors to trade, and the trading hours also better suit the Asian time zone, which is an important incremental factor. 2) Traditional investors interested in Ethereum. The Hong Kong Ethereum spot ETF is the first to be launched globally, so for investors who have difficulty holding the asset but are optimistic about the future of Ethereum, it may bring incremental funds to the Ethereum ETF.

Figure 2: Fee situation of American Bitcoin spot ETF (Data source: SoSo Value)

Figure 3: Fee situation of Hong Kong cryptocurrency spot ETF (Data source: SoSo Value compilation)

Supply side: In-kind creation and redemption increase the supply of ETF shares and enhance the initial scale

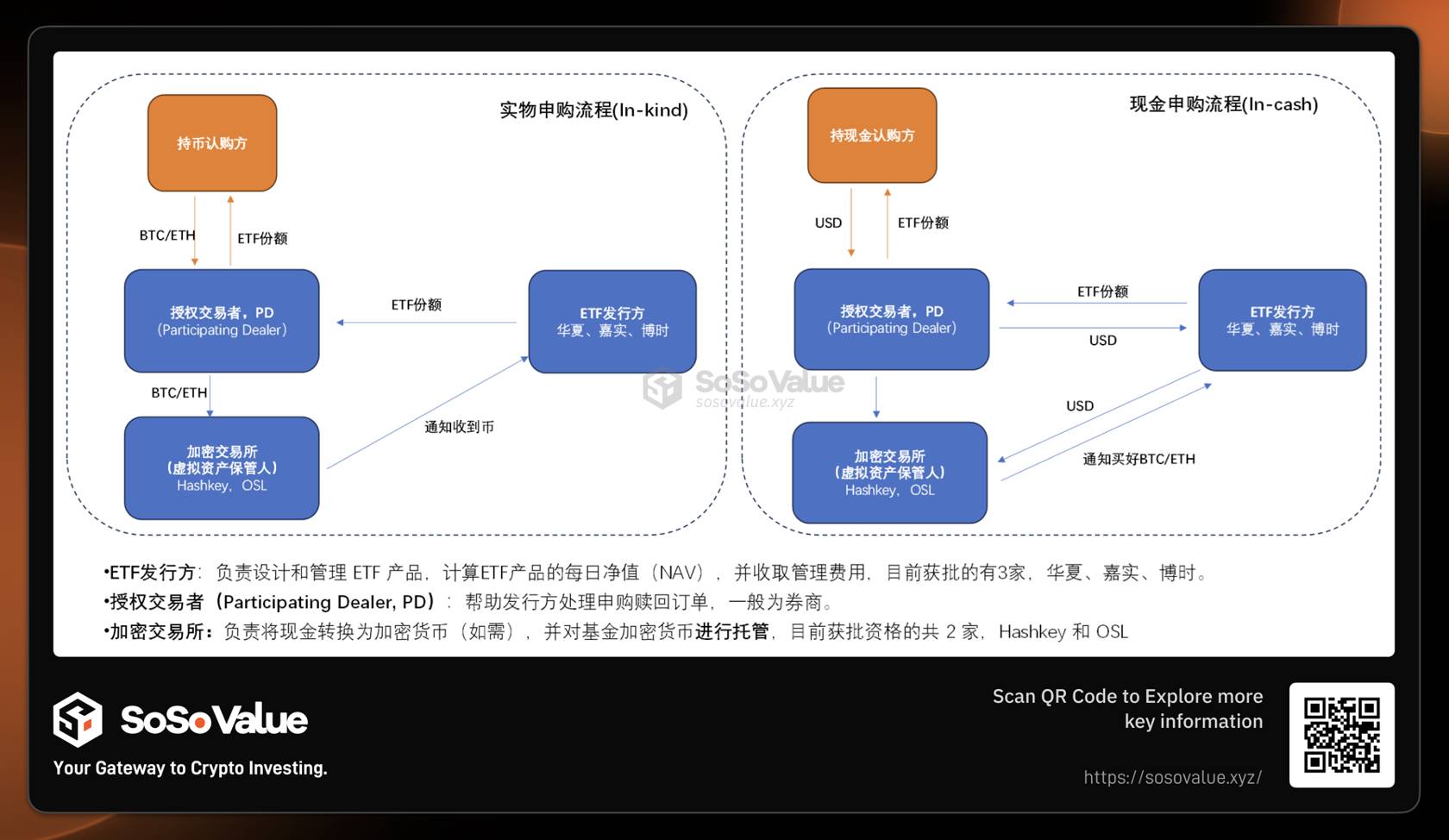

The biggest difference between the Hong Kong cryptocurrency spot ETF and the American Bitcoin spot ETF: In addition to cash creation and redemption, it has added in-kind creation and redemption. This directly determines that the Hong Kong cryptocurrency ETF may have more supply of ETF shares.

In-kind creation and redemption refers to investors using cryptocurrency (Bitcoin or Ethereum) to subscribe (create) or redeem ETF shares, instead of using cash. When subscribing, investors provide a certain amount of cryptocurrency to the ETF in exchange for ETF shares; when redeeming, investors return ETF shares in exchange for the corresponding cryptocurrency.

Referring to the comparison of the Hong Kong cryptocurrency purchase process in Figure 2, it can be seen that in-kind creation brings two major differences compared to cash creation:

1) Holders can directly subscribe with cryptocurrency: For some large holders, such as miners, it is easy for them to convert their own cryptocurrency into ETF shares, and the ETF shares can be used for cash redemption or directly sold for cash on the Hong Kong Stock Exchange, providing a very flexible handling method.

2) For the cryptocurrency market, in-kind creation will not bring incremental funds into the market, but only transfer cryptocurrency between different accounts. Cash creation, on the other hand, will bring actual buying pressure to on-chain cryptocurrency assets.

Therefore, the subscribers of the Hong Kong cryptocurrency ETF shares include both traditional cash subscribers and large holders. Although the specific share of in-kind creation and cash creation has not been disclosed by various institutions, according to OSL's public communication, the proportion of the first batch of in-kind creation ETF shares may exceed 50%. This also explains why the initial fundraising scale of the Hong Kong cryptocurrency ETF can reach nearly 300 million US dollars, and the credit for in-kind creation cannot be ignored. However, on the other hand, these in-kind creation ETF shares may be converted into sell orders in the secondary market.

Figure 4: Comparison of in-kind vs. cash creation process for Hong Kong cryptocurrency spot ETF

Comprehensive supply and demand, focus on the discount/premium rate to seize investment opportunities

According to the comprehensive analysis of supply and demand in the previous text, unlike the American Bitcoin spot ETF, we can track the Total Net Inflow of ETFs on a daily basis (for specific details, please refer to https://sosovalue.xyz/assets/us-btc-spot) to intuitively assess the impact of incremental funds brought to on-chain cryptocurrency assets by the Bitcoin ETF. The supply and demand of the Hong Kong cryptocurrency spot ETF is more complex, and the data published by various fund companies cannot clearly distinguish between the volume of in-kind and cash creation and redemption. In this context, we believe that the premium/discount rate in the open market (Hong Kong Stock Exchange trading) may be a better indicator to observe.

As we analyzed earlier, in the on-exchange trading on the Hong Kong Stock Exchange, the premium/discount is the best reflection of the strength of supply and demand. If the ETF trades at a discount, it indicates a stronger selling intention, an oversupply, and market makers are motivated to purchase ETF shares at a discount on the Hong Kong Stock Exchange and then redeem the shares from the ETF issuer off-exchange to earn the price difference, leading to a reduction in the overall net assets of the ETF, outflow of funds, and a negative impact on the cryptocurrency market as a whole. The entire process can be summarized as follows: ETF trades at a discount --> stronger selling pressure --> potential redemption --> negative impact on the cryptocurrency market. Conversely, if the ETF trades at a premium --> stronger buying pressure --> potential subscription --> positive impact on the cryptocurrency market.

According to SoSo Value data, as of the close on April 30th, except for Jia Shi Bitcoin spot ETF (3439.HK) and Jia Shi Ethereum spot ETF (3179.HK) which had negative premiums of -0.18% and -0.19% respectively, all other products were at a positive premium, and during intraday trading, a maximum positive premium of 0.33% was observed, with restrained selling pressure and relatively strong buying pressure on the first day. Considering the impact of market makers on the first day of listing, this premium/discount data can be continuously observed. If it can sustain a positive premium, it is expected to continue attracting investors for subscription, especially from holders of cryptocurrency, and the scale of the Hong Kong cryptocurrency spot ETF is estimated to exceed 500 million US dollars. However, if it turns into a discount, caution should be exercised against arbitrage trading for redemption of ETF shares, with the ETF issuer selling off cryptocurrency, leading to a downturn in the cryptocurrency market.

Figure 5: Supply and demand impact mechanism of Hong Kong cryptocurrency spot ETF (Data source: SoSo Value compilation)

Hong Kong cryptocurrency ETF also has an important value for investors: it provides a pathway for the conversion of cryptocurrency into tradable financial assets

The rapid approval of the Hong Kong cryptocurrency spot ETF, although its short-term impact on the cryptocurrency market may be smaller than that of the American spot ETF, in the medium to long term, the physical creation and redemption mechanism of the Hong Kong cryptocurrency ETF also provides a channel for cryptocurrency assets to be converted into traditional financial assets. Through physical creation, cryptocurrency can be converted into ETF shares, and because ETF shares have fair value and liquidity based on traditional financial market pricing, holding cryptocurrency ETFs can serve as proof of assets in traditional financial markets, allowing for various leveraged operations such as pledging and borrowing, and the construction of structured products, further bridging the gap between cryptocurrency assets and traditional finance, allowing for a more comprehensive reflection and realization of the value of cryptocurrency assets.

From a more macro and long-term perspective, the approval of Bitcoin and Ethereum spot ETFs in Hong Kong is an important development for the global cryptocurrency market. This policy will have a long-term impact on the financial landscape in the Chinese-speaking region and is also an important step in further legitimizing cryptocurrency within the global financial system.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。