On April 30th, the first day of trading for 6 virtual asset ETFs in Hong Kong, the total trading volume reached 87.58 million Hong Kong dollars (12 million US dollars). In comparison, on January 10th of this year, the first-day trading volume of the Bitcoin ETF in the United States was 4.6 billion US dollars. Despite the significant difference in numbers, Weng Xiaoqi, Chief Operating Officer of Hasheky Group, stated to media outlets such as PANews today that the mid-term capacity of the Hong Kong ETF market is expected to reach 20% of the US ETF market, with an estimated scale of around 10 billion US dollars.

As a new channel for "old money" to enter the virtual asset industry, ETFs are expected to attract more traditional investors into the virtual asset market. Additionally, due to their support for physical subscription and redemption, Bitcoin and Ethereum spot ETFs are expected to attract more Web3 participants and drive overall market growth.

6 ETFs with a first-day trading volume of 87.58 million Hong Kong dollars

On the first trading day of April 30th, the Bitcoin spot ETFs of Huaxia Fund, Boshi HashKey, and Jia Shi International initially rose by over 3%, but later narrowed to about 1.5%. In the morning, the three Ethereum ETFs traded up by over 1%, but later fell into negative territory in the afternoon. In the first two and a half hours of trading, the six funds in Hong Kong accumulated a total trading volume of nearly 50 million Hong Kong dollars.

In the morning, the trading volume of the Bitcoin ETF approached 35 million Hong Kong dollars (about 4.5 million US dollars), with the ETF of Huaxia Fund having the largest trading volume of about 23 million Hong Kong dollars.

Ultimately, the first-day trading volume of the 6 virtual asset ETFs in Hong Kong reached 87.58 million Hong Kong dollars (12 million US dollars). Among them, the trading volume of Huaxia Bitcoin ETF (3042 HK) was 37.16 million Hong Kong dollars, and the trading volume of Huaxia Ethereum ETF (3046 HK) was 12.66 million Hong Kong dollars.

The trading volume of Boshi HashKey Bitcoin ETF (3008 HK) was 12.44 million Hong Kong dollars, and the trading volume of Boshi HashKey Ethereum ETF (3009 HK) was 2.48 million Hong Kong dollars.

The trading volume of Jia Shi Bitcoin spot ETF (3439 HK) was 17.89 million Hong Kong dollars, and the trading volume of Jia Shi Ethereum spot ETF (3179 HK) was 4.95 million Hong Kong dollars.

For comparison, on January 10th, the first-day trading volume of the Bitcoin ETF in the United States was 46 billion US dollars, which is 383 times the first-day trading volume in Hong Kong.

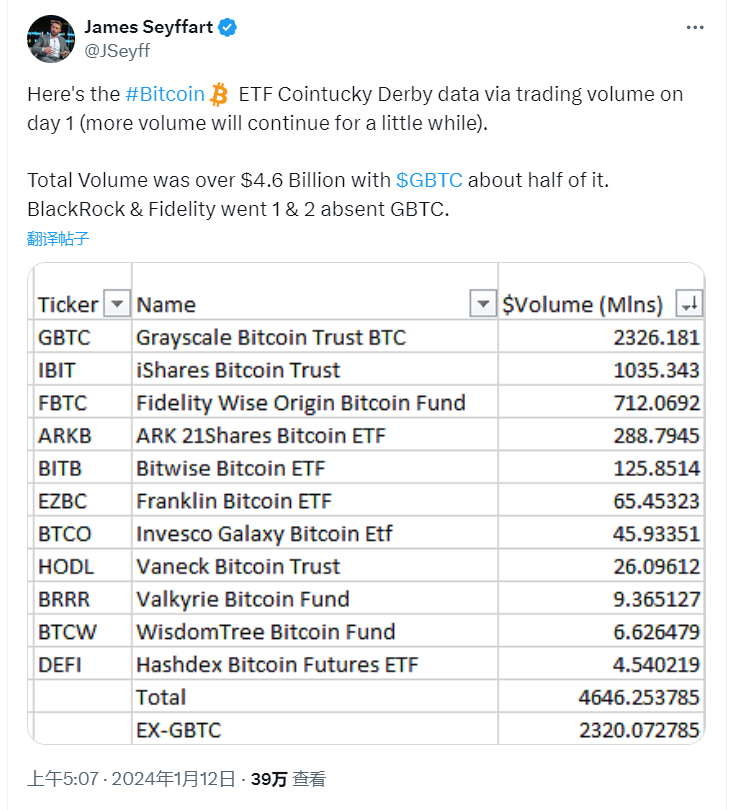

In January of this year, 11 Bitcoin ETFs launched in the United States had a trading volume exceeding 46 billion US dollars on the first day. Among them, Grayscale's GBTC accounted for 23.26 billion US dollars, BlackRock's IBIT accounted for 10.35 billion US dollars, and Fidelity's FBTC accounted for 7.12 billion US dollars, with these three ETFs dominating the trading volume.

"Hong Kong drifters" can make purchases, expected to attract Web3 participants

According to previous reports by PANews, the competition among these three fund companies in Hong Kong in terms of management fees is intense. Jia Shi International's products have a management fee waiver within 6 months, and Boshi International's products have a management fee waiver within 4 months after issuance. The management fees of the three fund companies are 30 basis points (Jia Shi International), 60 basis points (Boshi International), and 99 basis points (Huaxia Fund), respectively.

In addition, on April 30th, according to an official tweet from HashKey, non-Hong Kong residents can subscribe to or purchase Boshi HashKey Bitcoin and Ethereum spot ETF products if they meet local regulatory requirements (such as through customer due diligence).

Currently, just like buying stocks in Hong Kong, anyone eligible to trade stocks in Hong Kong can participate in the trading of these ETFs. For new customers, they only need to meet the requirements of holding a Hong Kong identity card, having a permanent address in Hong Kong, and having a bank account in Hong Kong. This means that more than 1.5 million "Hong Kong drifters" can also participate in the initial trading of the 6 virtual asset spot ETFs.

Another difference from the US cryptocurrency ETFs is that the ETFs in Hong Kong adopt the so-called "in-kind subscription and redemption" mechanism, allowing investors to use relevant cryptocurrency tokens instead of cash to buy and sell ETF shares. This choice should be attractive to investors, as token holders "may consider the benefits of holding tokens through ETFs without first converting them into fiat currency."

Weng Xiaoqi stated that for traditional investors, they can seize the current strong virtual asset bull market represented by BTC and ETH through the fund channel and the asset structure advantages of ETFs to achieve asset appreciation. For Web3 native users, purchasing spot ETFs is essentially a form of "TradFi mining," "mining" the value and potential of traditional markets and assets. For example, users in Hong Kong who already hold BTC and ETH can turn their "alternative assets" into "mainstream assets" through in-kind subscription, which can attract more Web3 native participants to stay in Hong Kong.

Regarding in-kind subscription, PANews learned that HashKey actively promoted ETF products to large investors in the crypto community before the launch. HashKey Exchange also helped Boshi International and HashKey Capital complete the first in-kind subscription of Bitcoin spot ETF and Ethereum spot ETF, respectively.

However, according to a report by Tencent's "Qianwang," there were not many investors who completed in-kind subscription through Victory Securities in the past few days. Some original investors in the crypto circle who opened an account with Victory Securities did not rush to make deposits and place orders. In addition, the in-kind subscription and redemption at Victory Securities is still not convenient enough, as it is currently done through email or phone orders and confirmations. It is expected that all parties will further refine the process and customer engagement in the next stage.

Although the gap in trading volume on the first day compared to the United States was expected, as one person in charge of a Hong Kong institution commented, "The issuance of BTC and ETH spot ETFs in Hong Kong is a challenge to regain the pricing power of crypto assets, with the result being second, but the position being first."

Zhu Haokang, Director of Digital Asset Management at Huaxia Fund (Hong Kong), told PANews the day before trading began that this launch "will enhance Hong Kong's competitiveness as an international financial center." Weng Xiaoqi also believes that the significance of the launch of spot ETFs in Hong Kong is not limited to the ETFs themselves. ETFs are more of a symbol, indicating that traditional financial institutions are fully embracing virtual assets, and the real highlight is the influx of institutional investors. It is expected that more Chinese and foreign fund companies will enter the market to issue ETFs in the future.

"There is a bigger game at play here: the launch of these new ETFs puts Hong Kong ahead of Singapore and Dubai, both of which are also trying to establish themselves as regulatory centers for digital assets," as Antoni Trenchev, co-founder of the cryptocurrency exchange Nexo, expressed to the public.

A new game has begun, with Hong Kong taking the lead. The final outcome remains to be observed.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。