In the world of Web3, "renaming leads to price increase" has to some extent become a consensus within the community.

Recently, the blockchain game guild GuildFi announced that it will be renamed to Zentry and plans to create a unified Superlayer to reward all types of game players across multiple blockchains.

In addition to GuildFi, many projects are popular for seeking new opportunities through rebranding during a new round of bull market. PANews previously reported that in the past year, 15 rebranded projects had an average highest increase of nearly 243.5%, including last October when the blockchain game guild Merit Circle announced a brand upgrade to Beam. Currently, the token market value of BEAM is approximately $1.4 billion, ranking at the forefront of various blockchain game guilds.

Apart from GuildFi, what is the current development status of game guilds? Based on data from CoinGecko, PANews took stock of the top 10 game guilds by market value and found that the leading guilds, Merit Circle, YGG, and GuildFi, have all seen considerable increases in token prices and market value this year. However, several projects at the lower end of the market value of game guilds have generally experienced both a decrease in token prices and market value, with the highest price drop reaching 74.55%.

Rebranding and token migration lead to price increase for GuildFi

As part of the rebranding effort, Zentry will launch a new token, ZENT, and existing holders of the GuildFi token GF on Ethereum can exchange ZENT at a ratio of 1:10 through the portal website. Subsequently, influenced by the news, on the evening of April 23, the price of the GuildFi token $GF rose from 0.355306 to 0.431287 US dollars, an increase of 21%.

GuildFi has previously raised $140 million from institutions such as Binance Labs, Coinbase Ventures, Animoca, Pantera Capital, and Hashed. It has integrated a one-stop platform for games, NFTs, and communities, and is creating a new narrative for gameplay economics.

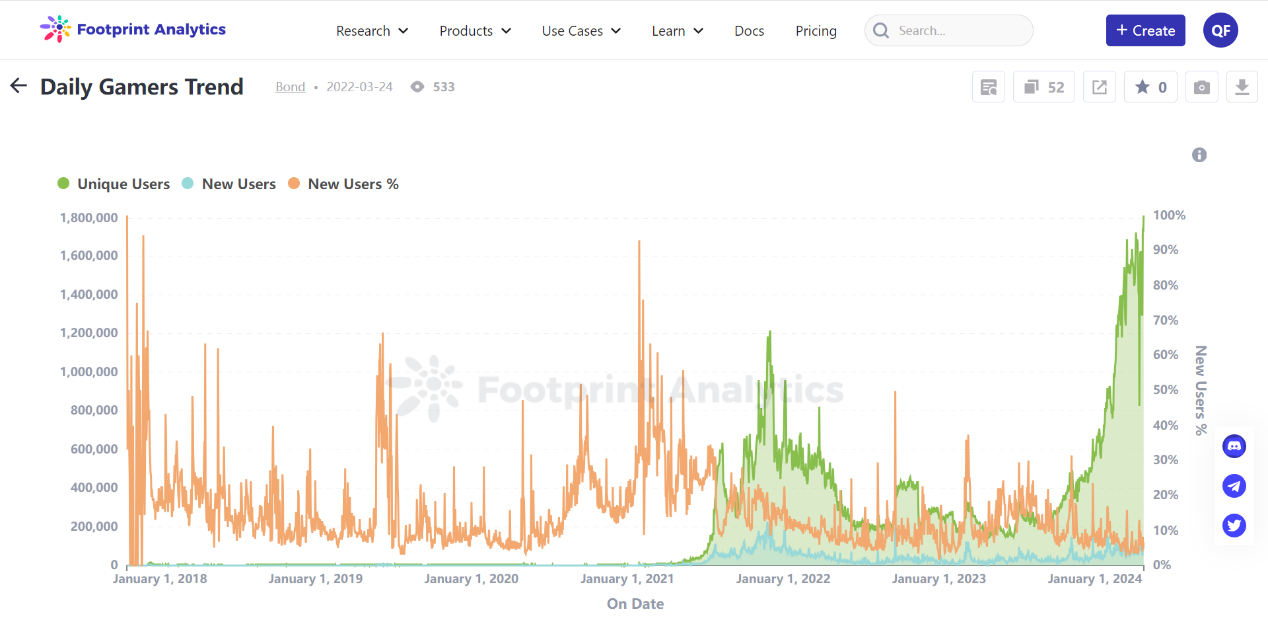

Looking at the overall situation of the GameFi track, after the peak in 2021, the game track has gone through a long period of adjustment and is now at a stage of recovery. According to data from FootPrint Analytics, as of April 24, the latest daily active independent user data for GameFi is 1,813,203, which is 1.53 times the highest value in November 2021, marking another peak. However, the overall market value of GameFi is around $21 billion, maintaining at a relatively low level, compared to $55.38 billion in February 2022.

In 2021, the play-to-earn game Axie Infinity was popular, but for traditional players, the learning curve and initial investment threshold were high. As a result, game guilds emerged, using mechanisms such as scholarships to lower the entry barriers for players and quickly train them. In specific games, the NFT characters owned by the guild can be lent to players, who are also referred to as "scholars." In return, these scholars participate in profit-sharing with the guild while playing these games, sharing the profits within the game.

However, there are also significant limitations to game guilds, such as primarily helping players focused on gold farming, which makes it difficult to sustain the long-term development of blockchain games. They are also heavily regional, with players being confined to individual games and guilds.

Apart from GuildFi, what is the current development status of game guilds?

Based on data from CoinGecko, PANews took stock of the top 10 game guilds by market value and found that the leading guilds, Merit Circle, YGG, and GuildFi, have all seen considerable increases in token prices and market value this year, with price increases of 59.88%, 112.03%, and 89.34% respectively. However, several projects at the lower end of the market value of game guilds have generally experienced both a decrease in token prices and market value, with Unix experiencing the highest price drop of 74.55%.

Merit Circle is a decentralized autonomous organization that provides opportunities for people who want to help build the metaverse to earn money through games. The Merit Circle platform provides scholarship opportunities, educational opportunities, and everything people may need in the process of becoming a money-making game player in the metaverse. Merit Circle announced a brand upgrade to Beam last October. As of April 26, BEAM has a market value of $1.445 billion, with a year-to-date increase of 76.23%, ranking at the forefront of the 10 game guilds. In addition, the project's treasury assets amount to $667 million, with BEAM accounting for $605 million and MC accounting for $24.66 million.

Yield Guild Games is a well-known leading Web3 game guild that pools funds to purchase income-generating NFTs and utilizes players' time and energy to optimize the assets owned by the community. As of April 26, its market value has reached $283 million, with a significant year-to-date increase of 136.75%. The token price on April 26 was $0.8994, with a year-to-date increase of 112%. The current treasury assets amount to $545 million, with YGG accounting for $529 million.

On April 26, the newly rebranded GuildFi token was priced at $0.3973, with a year-to-date increase of 89.34%, and the market value is currently $229 million, with a year-to-date increase of 123.57%. GuildFi's market value currently ranks third. The treasury assets amount to $216 million, with GF accounting for $108 million and ZENT accounting for $96.84 million.

In addition to rebranding, these active guild projects in GameFi are also adopting other transformation strategies, which have made good progress through new catalysts. On March 23, according to Decrypt, Yield Guild Games has begun to explore the next major evolution, transitioning from a blockchain game guild to a blockchain game guild protocol. YGG expressed its hope to become an infrastructure layer that enables all guilds to thrive on-chain and in games, while considering the use of tokenized credentials and tools to manage assets and characters and deeply integrate with blockchain games.

In addition, Yield Guild is an official guild partner of Pixels, and besides integrating Pixels, Yield Guild has recently taken many other initiatives, including strategic investment from LongHash Ventures.

Apart from the top two guilds, the performance of the remaining guilds is not ideal. For example, Good Games Guild has seen a decrease of around 38% in token price and market value this year. Projects with a significant decrease in token price include UniX and BlackPool, with the prices of the tokens UNIX and BPT dropping by 75% and 48% respectively from January 1 to April 26, with prices of 0.0085 US dollars and 0.0838 US dollars on April 26.

However, these projects are also attempting to innovate. In addition to daily game collaborations and partnerships, Unix's parent company, Owned, is venturing into SocialFi and has developed an application called Battle.tech, which integrates SocialFi and gaming on Avalanche. The application went live on February 14.

Currently, it seems that in the early stages, game guilds have prospered by attracting low-cost labor through scholarships for gold farming. However, due to the lack of growth incentives in PVE games and the general concentration of guild models in Southeast Asia, these guild projects are all seeking new paths.

Another direction is the transformation towards fund and functional features, with the profit model shifting to earning money through primary investments. One advantage is that as investors in other projects, these guilds are not bound to the complete lifecycle of game projects and can lock in profits at the right time, while business income directly empowers the tokens. However, analysts point out that the disadvantages of doing so are also evident. For projects that use investment returns to repurchase tokens, the bull market leads to a spiral rise, while the bear market leads to a spiral decline.

Now, in the new round of bull market, can GameFi find new narratives and opportunities? It can be said that against the backdrop of transitioning to protocols and investment, the players in this track of guilds are brewing new growth opportunities.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。