Title: ROUTE 2 FI

Author: Luffy, Foresight News

We will explore the current issuance of altcoins and their impact on the market. There is a trend in this cycle where a large number of new tokens are launched with high FDV and airdrop models, followed by a large number of tokens being unlocked in the hands of VCs.

Cryptocurrencies have reflexivity, so what will happen in the market under this trend?

Reflexivity: The Great Idea of Feedback Loop

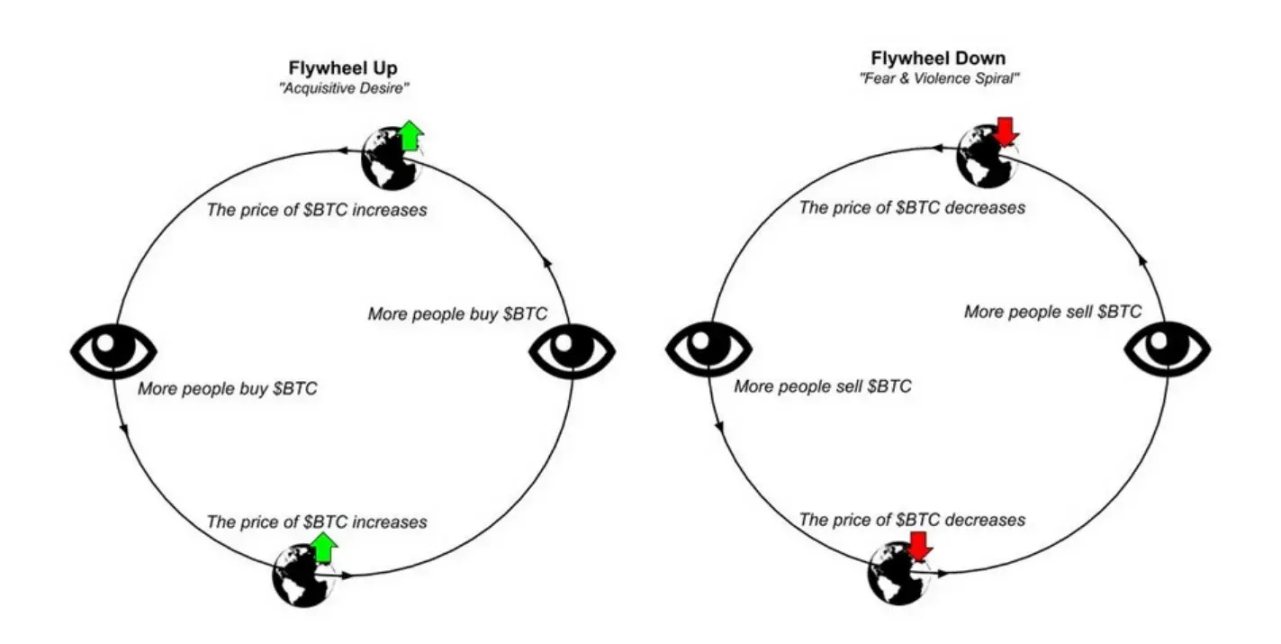

Reflexivity was initially proposed by George Soros as a theory, in which he believed that the positive feedback loop between expectations and economic fundamentals could lead to significant and sustained deviations in price trends from equilibrium prices. Bitcoin has always been characterized by strong reflexivity. The positive cycle of Bitcoin may last for a long time, however, the negative cycle of Bitcoin is notorious for its length and depth.

Cryptonary believes that when analyzing market trends and operations, it is important to remember that the concept of market reflexivity contradicts traditional wisdom. In theory, the market is always seeking balance, and all participants are rational individuals who make decisions based on facts. Examples of abnormal market fluctuations such as bubbles, surrender events, and boom and bust cycles show that prices will eventually return to equilibrium. Prices have nothing to do with establishing this balance.

On the other hand, in market reflexivity, everyone makes judgments based on their own understanding of reality, and prices do affect the market fundamentals. You can see this situation: if pricing affects the fundamentals, then price changes must also affect the fundamentals, which in turn affect investor expectations, and investors take action based on these adjusted expectations, which in turn affect prices. The boom and bust cycle is caused by the positive feedback of market reflexivity, as herding behavior reinforces price changes, causing prices to deviate further and further from reality, eventually becoming the new reality.

Prices should tend towards equilibrium, but due to the reflexivity of the market, prices often exceed or fall below the equilibrium level for a long period of time. Only when market participants realize that their views of the market are no longer based on reality will prices start to turn; this usually happens after prices have been above or below reasonable levels for a long time.

As you can see, reflexivity is two-way, and the ball thrown into the air will eventually fall back to the ground.

If Bitcoin rises sharply in a short period of time, then its price will continue to rise for some time after the initial fluctuation, almost certainly. From another perspective, this also holds true. The cryptocurrency market is still in its early stages, so it is "easier" to experience large price fluctuations.

The above image perfectly describes reflexivity. I think you now have a good understanding of this concept.

Now, let's take a closer look at altcoins and what changes the entire market will undergo with the influx of a large number of new tokens.

The Launch of New High-Quality Tokens is Beneficial

I have previously written about the supply and demand issues of cryptocurrencies, but I will briefly repeat it here.

- Market Cap: Circulating supply x Price

- Fully Diluted Valuation (FDV): All tokens (including unreleased tokens) x Price

This is very important for understanding VC/angel games.

Most cryptocurrency companies raise funds from investors through SAFT (Simple Agreement for Future Tokens). In the stock market, SAFT can be likened to a Simple Agreement for Future Equity (SAFE), which allows early-stage company investors to convert their cash investments into equity at a future point in time under specific conditions.

To illustrate what a typical SAFT transaction looks like, let's take a simple example.

- Token Name: Yolo Coin

- FDV: 100 million

- Vesting Conditions: TGE 10%, then 1-year lockup, followed by linear vesting over 3 years

- Circulating supply at TGE: 12% (partly through airdrop)

After a lot of hype, Yolo Coin is officially launched, and the FDV has now reached 1 billion (a 10x return for seed investors). Investors are happy because they can sell at breakeven prices, and they still have 90% of the allocated tokens, which will gradually unlock over 36 months (after a 1-year lockup period).

But wait? Why is the VC lockup period so long? In short, this is to ensure long-term alignment so that it is not shifted to the TGE.

Let's see why this is a problem:

Because the investors' tokens are locked up for a long time, this means that when they finally start to unlock, the market will face sustained selling pressure. Please refer to the following image.

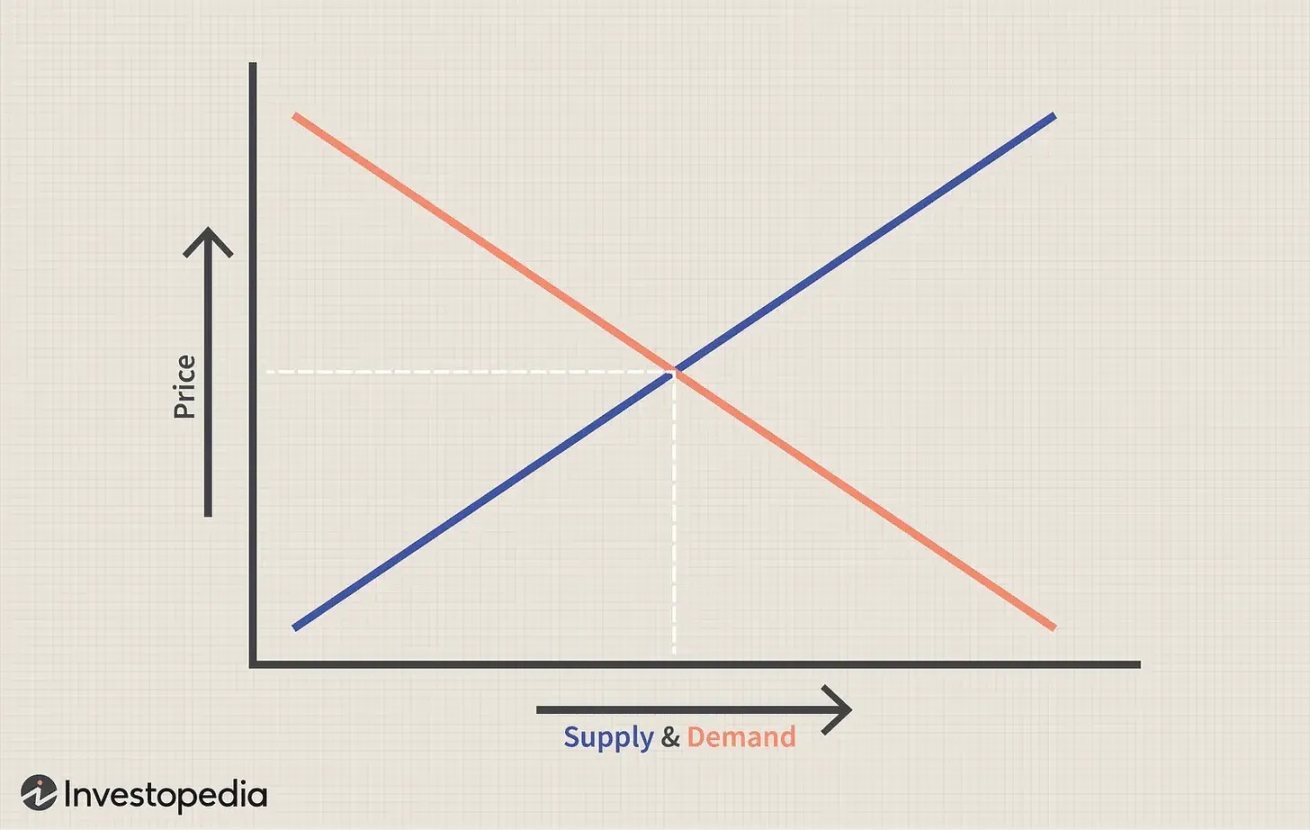

Assuming Yolo Coin's initial price is $1 (investor price = $0.10). At the time of issuance, the supply on the market is 12%, but we know that as tokens gradually unlock, more and more supply will enter the market. This leads to an increase in supply.

But the question is: where is the demand? Who will buy the tokens sold by VCs?

You might argue that due to narratives X, Y, and Z, the price will rise, TVL in DeFi protocols will increase, bullish events, etc., this may continue for some time. But at some point, supply will exceed demand, and we will start to face a spiral decline due to massive inflation.

Early buyers will be in trouble, leading to bearish sentiment in the community, a decrease in TVL in the protocol, developers (if any) leaving to find better fields, team members leaving, etc.

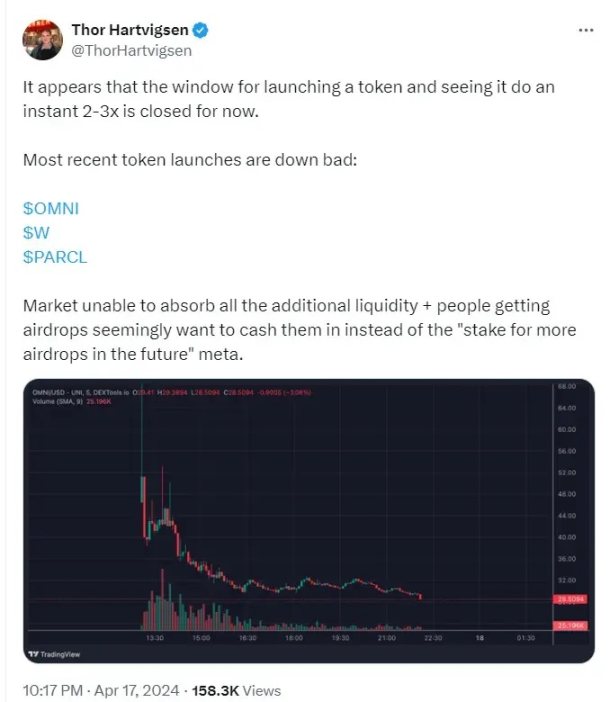

Thor Hartvigsen summed it up well: "The market will not be able to absorb all the additional liquidity, and to get what airdrop recipients want to cash out, rather than 'staking for more future airdrops'."

So far, the biggest change in this cycle is the dispersion of funds. We are used to thinking that altcoins will rise together. There may now be 300 decent projects, but there is not enough liquidity to make them all rise.

We often hear about the frenzy of altcoins, but this time I think the situation will be different. We are used to hearing statements like: as soon as the time comes, all tokens will rise. But is this true?

Please remember that there are many more "utility" tokens in the market now than in 2021. Now, 3-5 "high-quality" tokens enter the market every week. The total market value is rising, and everyone seems to be happy. But ask yourself, who will buy all these tokens? Unless institutions or retail investors flood in, this will be just a PvP game.

An example from two weeks ago is the Wormhole airdrop, which had an FDV of over $10 billion when it was first launched. Now ask yourself why you should own it. Apart from purely speculative reasons, I don't see any other reason. Since its launch, the W token price has fallen by 40%, and the FDV is $6 billion.

As Cobie said:

"Market cap is a measure of demand, and FDV is a measure of supply."

This means that market cap is the total value of public demand, which will rise and fall with price trends. If the price rises, both market cap and FDV increase, but when tokens unlock, market cap will also increase.

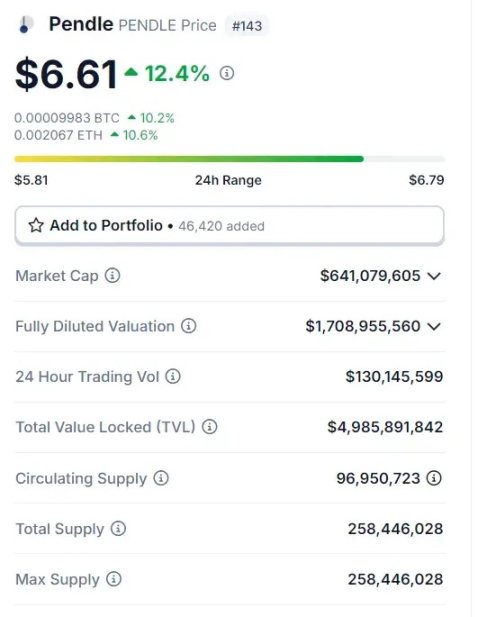

Let's take a look at Pendle. Everyone loves Pendle now, and its TVL has increased significantly due to yield farming and the EigenLayer narrative.

Pendle Market Cap: $640 million, FDV: $1.7 billion

Additionally, please note that out of a total of 258 million Pendle tokens, 95 million are currently in circulation (37%). As the token price rises, the market cap will also increase. However, an increase in market cap does not necessarily mean an increase in demand for these locked tokens. To explain the reason, consider it from the investors' perspective. I know people who bought Pendle for less than 10 cents. Now the price is over 6 dollars. Do you really think investors with unlocked tokens care whether the price is 6 dollars or 7 dollars? No, so they sell. The result is: supply increases, but demand remains the same. (I did not check Pendle's unlocking schedule, nor do I know the FDV when people invested, I just made some assumptions to explain supply and demand).

Are high FDV tokens scary? Not always, a good example is TIA launched in November 2023. TIA currently has an FDV of up to 12 billion dollars, but because the locked tokens will not be listed until the fall of 2024, the situation does not look so bad, but some traders may be scared by the high FDV.

For more information on this, please refer to Cobie's article: On the Meme of Market Caps and Unlocks

Okay, but back to the previous question: where is the demand, in other words, where are the buyers?

Now, new "high-quality" projects are launched every week, and their FDVs are high. This means that countless supplies are pouring into the market, and these tokens will inevitably decline (at least in the long term) unless new buyers come in.

Retail investors have already come in, holding meme coins and altcoins on Solana. They are not buying fancy VC tech tokens. They have learned from the experience of 2021. In the long run, unlicensed token listings and greedy VCs are very detrimental to individual token holders. Hundreds of new tokens are launched every year, and existing tokens are constantly diluted.

It is now April 2024, and the funds flowing into altcoins seem to be more selective, not enough to offset the massive token unlocks.

Is there a solution?

We already know that the low float token model is not friendly. But can we solve this problem?

Clearly, a large part of the problem lies in the number of projects being launched. Not everyone can buy all these projects. But more linear unlocking schedules and retroactive airdrops may be wise (unlike Arbitrum): think about Ethena and EtherFi, which are undergoing two rounds of airdrops. Perhaps a return to ICOs would help, creating more loyal fans.

Returning from here:

I believe that when BTC.D trends lower and altcoins can freely circulate, a few altcoins will rise significantly. There are more participants in the cryptocurrency field now than in the previous cycle, but people are smarter now. We will experience rotations as we have in the past 6 months, and blindly bullish tokens may be a failed game.

According to Thiccy's data, altcoins worth $250 million enter the market every day from new tokens and unlocked old tokens. Due to upward reflexivity (positive feedback loop), most of these tokens are not immediately sold because the market is rising (scarcity mentality). This is why we saw a lot of selling in April, the market just needed a reason (war).

By 2024, token unlocks, new token entries, and staking rewards for existing tokens have led to a daily supply increase of $250 million in altcoins. Due to the issuance of new tokens, the growth rate of FDV has exceeded the circulation, increasing by about 70% since the beginning of the year. The price difference between FDV and circulating supply (representing how much supply will enter the market in the future) has increased by over $150 billion since the beginning of the year. As the flow of funds into mainstream tokens slows down, the weight of daily altcoin supply becomes more and more apparent.

In any case, due to the continuous launch of new tokens and the influx of new supplies into the market, the total market value of altcoins is steadily increasing.

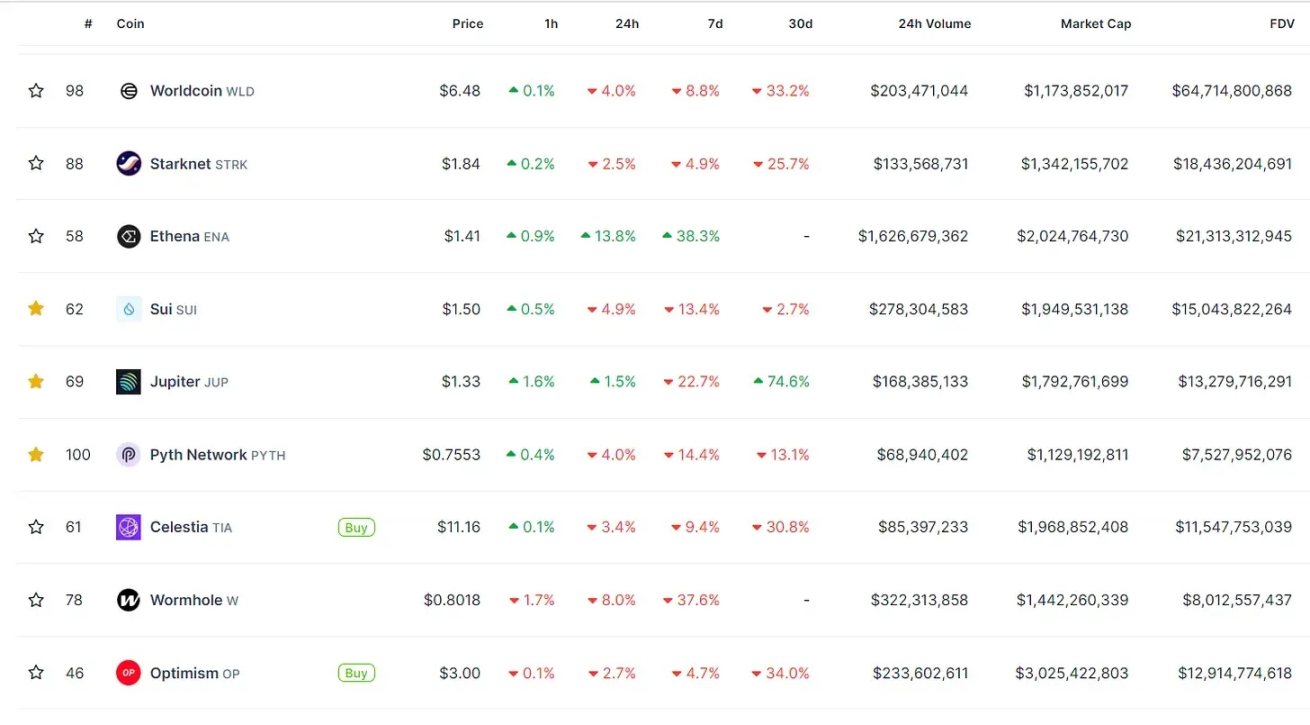

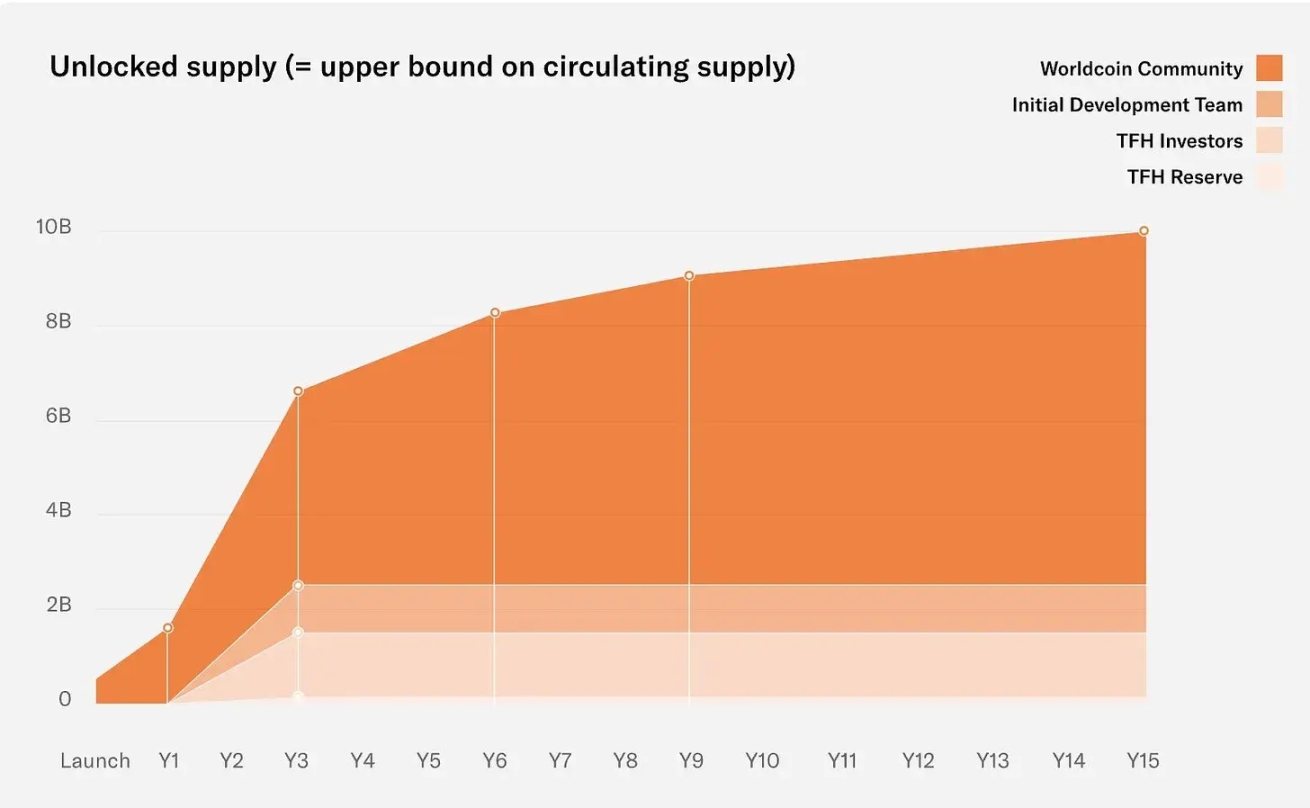

The above examples are some high market cap/FDV tokens. Look at Worldcoin: market cap of $1 billion, but FDV reaches $64 billion. What does this mean?

This means that Worldcoin will have a stable market supply in the future. In July 2024, they will start crazy selling, with 6 million WLD tokens entering the market every day. For reference, there are currently 181 million $WLD tokens in the market…

It is obvious that this is extremely dangerous.

From the basic supply and demand curve, it is easy to see that when these supplies pour into the market, it is difficult for WLD prices to rise.

Who will buy 6 million WLD tokens every day?

What does this mean for the bull market?

If BTC and ETH continue to rise, the situation may not be too bad. But in bearish conditions, we will see terrible situations.

However, I like Anteater's approach of going long on strong currencies and short on weak currencies. This is a hedging strategy, unlike Ethena's delta-neutral hedging. It sounds strange to hedge in a bull market, but there will be several downtrends on the way up. It is not a straight line to the peak.

In addition, several recent posts on CT say that this cycle is already 70% over. Who knows, so please decide the size of the risk based on your own tolerance.

I believe that most new VC coins (high FDV coins) will eventually see a significant decline. You can take advantage of this in pair trading or hedging strategies.

Examples of weak tokens may be STRK, APE, BOME, ADA, CRV, and XRP. Or, if altcoins perform well overall, combine these weak altcoins with strong altcoins. Currently, strong altcoins include ENA, TON, FTM, PENDLE. However, due to the changing market momentum, it is not recommended to go long/short on these tokens.

The advantage of meme coins is that they are actually one of the few honest tokens. WIF, PEPE, $DOGE, POPCAT, have the same circulating and total supply. No one will dump on you according to a crazy unlocking schedule, it's just a competition between players.

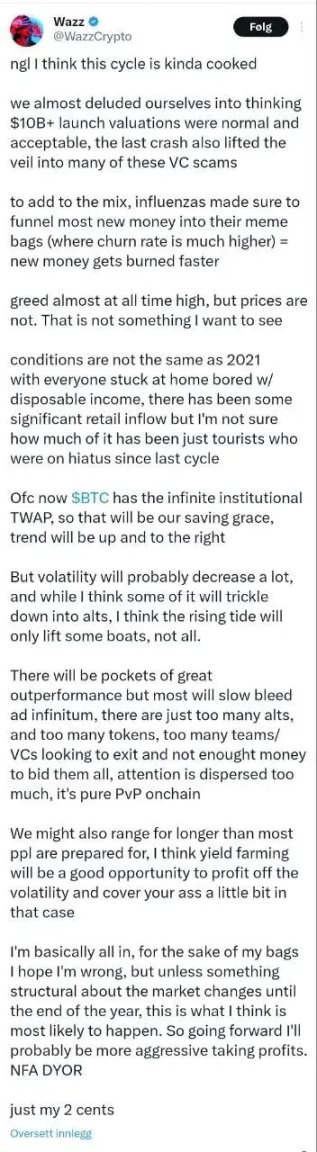

Finally, here are some words from cryptocurrency trader Wazz:

I think his argument makes sense. Too many altcoins, too many projects, and too many unlocked tokens will impact the market in the future.

If the price of Bitcoin rises sharply in a short period of time, then the price will almost certainly continue to rise for some time after the initial rise. Conversely, the cryptocurrency market's low liquidity means that prices are "easier" to rise and fall.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。