Author: Nick Pai, Archetype

Translation: DeepTechFlow

This article is divided into two parts. First, I elaborated on the importance of chain abstraction infrastructure for the adoption of cryptocurrencies by consumers, and why an intent-based architecture is the best way to design it. Second, I described the main obstacle to the widespread adoption of intent: the activity of solution networks.

In the end of the article, I proposed a solution and introduced the standard formulated by Across and Uniswap, based on the feedback of the CAKE working group. This standard aims to optimize the user experience of the solution, reduce the barriers to entry into the general solution network, route most intents to this network, and ultimately enable larger and more competitive solution networks to thrive.

Agenda

Issues:

Defining the final state: What makes a cryptographic application "usable"?

Why is "chain abstraction" the solution to the user experience problems generated by the modular blockchain basic topology?

Why must usable cryptographic applications be built on the foundation of chain abstraction infrastructure?

Solution Space:

How does an intent-based architecture generate chain abstraction?

Understanding the optimal performance of the intent market when the solution network is large and competitive

Launching an intent solution network requires introducing more applications that will generate intent

Proposal:

- Why do we need a cross-chain intent standard that prioritizes "solution user experience" in order to expand the solution and intent market to a large enough scale to achieve network effects?

Without chain abstraction, usable cryptographic applications cannot be built

Are our best and brightest people building redundant infrastructure?

Many people complain that the best cryptographic engineers are overly focused on providing more block space to end users. This criticism is valid; there are too many L2 solutions provided to end users relative to demand.

However, I refuse to accept the view that there are no useful cryptographic applications.

Decentralized finance provides individuals with the ability to self-custody digital assets, allowing them to bypass strict service providers and use their digital assets to purchase valuable items in the real world. The promise of self-custody data also provides a utopian alternative for individuals increasingly concerned about the FAANG (the five most popular and best-performing technology stocks in the U.S. market) monopoly to keep their data secure.

I believe that the real problem is not the lack of useful cryptographic applications, but the friction that end users encounter when trying to access these applications. End users should be able to experience the following when interacting with cryptographic applications:

Speed: Applications should feel as fast as web2 applications

Cost: Unlike web2, all web3 interactions must incur some cost, but the cost of "each click" should be negligible

Censorship resistance ("permissionless"): Anyone with a wallet should be able to interact with the application as long as they can afford the cost

Security: Clicks should complete the expected operations and should not be revoked; all web3 updates should be permanent

These are the attributes of "usable" cryptographic applications.

We have been trying to build usable cryptography for a long time

Today's modular blockchain solutions provide all of these attributes to consumers, but they are not all provided in the same place.

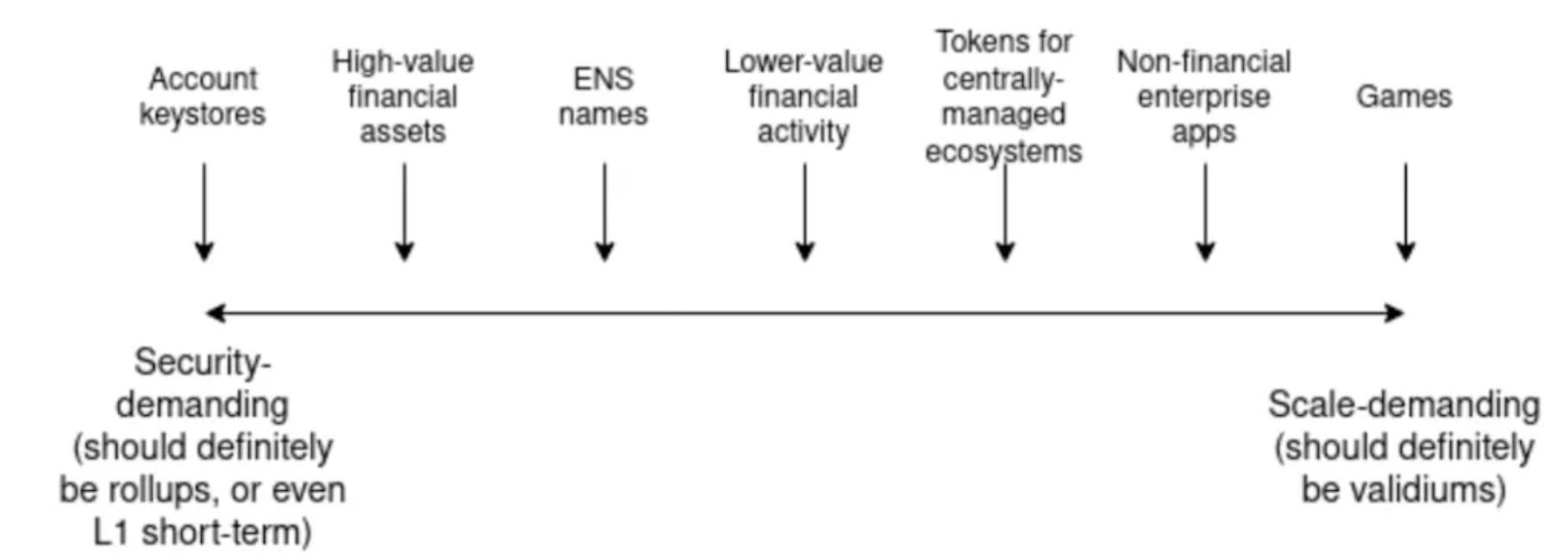

In 2020, blockchains were monolithic, providing two of the three attributes to end users: speed, cost, or security. Then we envisioned a rollup-centric or modular future, which could unlock all three attributes simultaneously.

Today, we have laid the foundation for this rollup-centric infrastructure. L2 provides cheap and fast block space, and most L2s provide permissionless block space. In contrast, L1 provides secure block space against WW3 (you can read more about the security and user experience trade-offs between L1 and L2 in my article). These L2s are securely connected to L1 through standardized message paths, laying the foundation for a modular and interoperable network. Over the past four years, we have built fiber between blockchains that support useful cryptographic applications. But why is modular blockchain so unusable?

The inevitability of a modular blockchain network is that capital assets will aggregate on the most secure layer, while user clicks will aggregate on the faster and cheaper layer.

The modular blockchain topology encourages the provision of secure block space on a different layer than the cheap and fast block space. Users naturally tend to store their value on the most secure network, but they will demand frequent interaction with the cheaper and faster network. By design, the standardized path between L2 and L1 is slow and/or expensive. These phenomena explain why users must traverse these standardized paths and pay fees for L2 interactions using L1 assets. This leads to a "non-usable" cryptographic user experience.

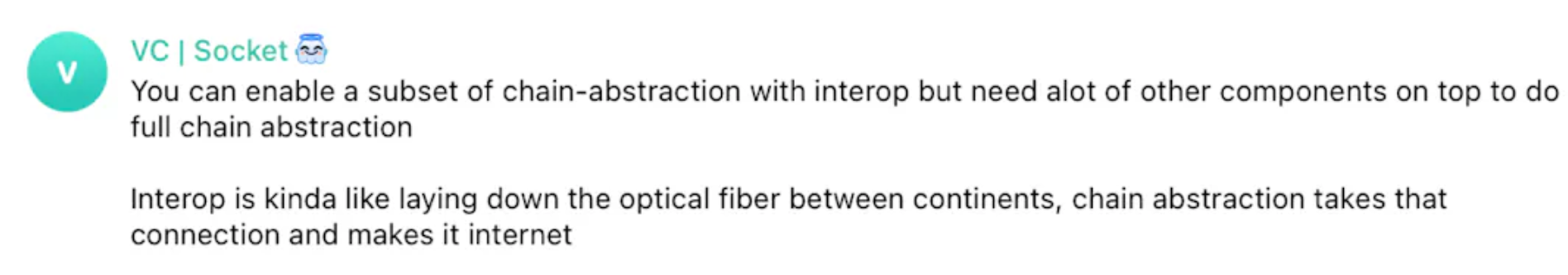

The goal of chain abstraction is to reduce the friction for users to send value across these protocol paths. Chain abstractors assume that users are more inclined to specify their desired final state to the dapp as "intent," and the dapp is responsible for implementing their intent. Users should not compromise the custody of secure assets for access to low-cost and low-latency.

Therefore, chain abstraction is about users being able to securely, inexpensively, and quickly transfer value across networks. A common user flow today is for a user with a USDC balance on a "secure" chain (such as Ethereum) to mint an NFT or exchange new tokens on a new chain (such as Blast or Base). The most efficient way to perform this operation with as few steps as possible is to sequentially execute bridging → exchanging → minting a series of transactions (or exchanging → bridging → minting).

In this example, the user's intent is to use their USDC on the secure chain to mint an NFT on another chain. As long as they receive the NFT and their USDC balance is deducted in their chosen custody location, the user will be satisfied.

An intent-based architecture is the only way to build chain abstraction

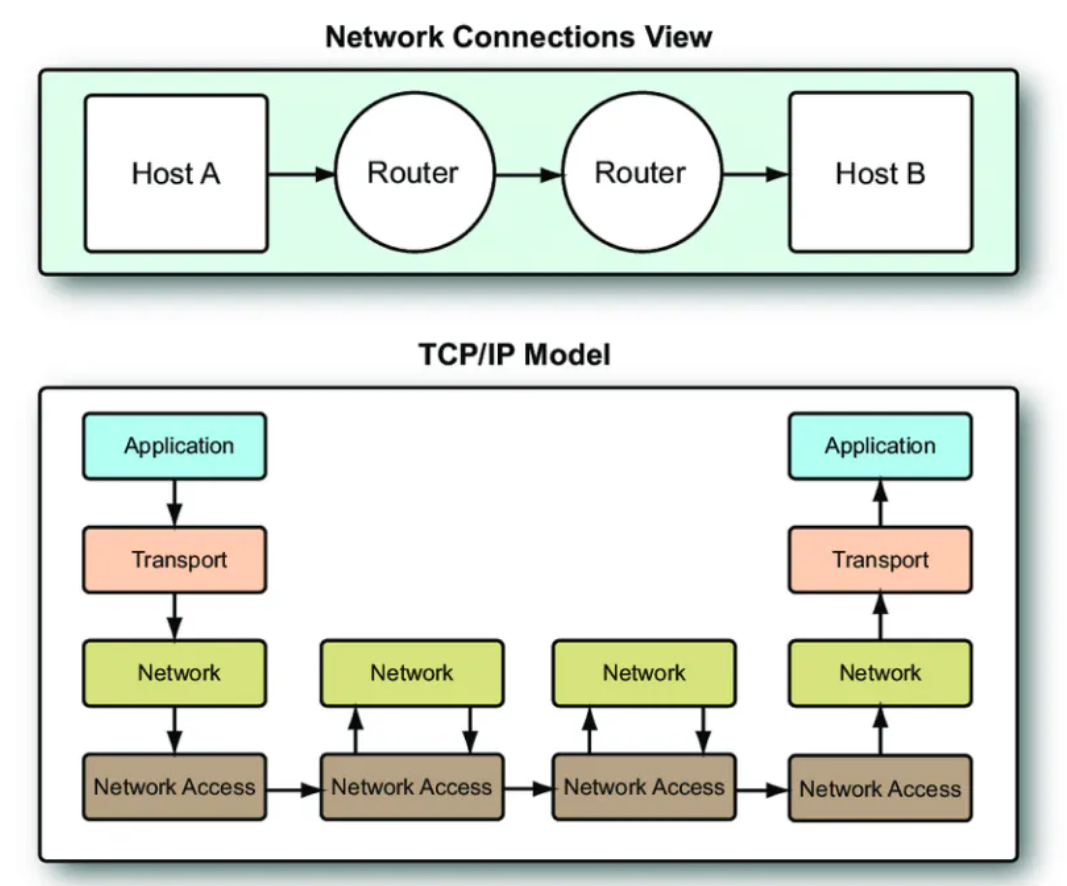

Chain abstraction relies on cross-chain value transfer, but sending value through standardized message paths is either expensive or slow. "Fast bridges" provide users with a cheap and fast alternative for sending value across networks, but they introduce new trust assumptions. Message passing is the most intuitive way to build fast bridging because it is modeled on the TCP/IP architecture; it relies on a bridging protocol as TCP routers connect two chains.

TCP/IP chart from ResearchGate

Translating…

If the user's intent includes a Permit2 or EIP 3074 signature, the user does not need to submit their intent on-chain. This is true for both message-passing and intent-based bridging. Both architectures can utilize the Permit2 pattern, allowing users to offline sign the amount of tokens they are willing to spend on their original chain wallet.

Intent-based markets are best suited to support chain abstraction, as they provide cheap and fast cross-chain value transfer. Imagine a user requesting a solver to provide a quote for using their USDC on Optimism to enter a WETH collateral position on Arbitrum. The user can send this intent to an RFQ auction, where solvers can bid on it. The winner of the auction can then receive the user's signed intent, which includes permission to spend their USDC on Optimism, the amount of WETH received on Arbitrum, and the calldata for depositing this WETH into the Arbitrum collateral position. The solver can then submit this transaction on Optimism (on behalf of the user) to initiate the cross-chain intent and extract the USDC from the user's Optimism wallet. Finally, the solver can fulfill the user's intent by sending WETH to the user and forwarding the calldata to the user's on-chain collateral position.

Building the infrastructure for chain abstraction means making the user experience feel instant and cheap without requiring them to submit on-chain transactions. Let's conclude this article by discussing the barriers to wider adoption of intent.

To achieve the best user experience from intent-based chain abstraction, we need a competitive solver network.

The key to achieving the best user experience with intent-based chain abstraction is to establish a competitive network of solvers. The success of bridging architectures connected to intent depends on the network effect of solvers, to outperform variants of message passing. This is the core trade-off between intent and message-passing architectures. The reality is that not all apps generating intent need access to a fully competitive set of solvers, and some may prefer to route their intent to an oligopoly of solvers. However, the current state of the solver network is not mature enough to meet the activity assumptions of the intent market.

We do not want every DApp to route intent to isolated solver networks. The best-case scenario for user experience is for many DApps to communicate with the same solver pool, and all DApps have the freedom to change the solver pool they send their intent to.

How to guide the solver network?

We must prioritize the solver user experience.

Running intent solvers is complex, requiring expertise in building high-performance software and managing cross-chain inventory risk. Naturally, there will be few parties interested in paying the startup costs to run this code. Ideally, a solver written for one DApp, such as the UniswapX solver, can be reused to solve intents generated by other DApps, such as Across and CowSwap.

We really need to increase the overall capital efficiency of all intent-based DApp solver networks. This will require addressing the barriers to running solvers.

To do this, we need to make the intents generated by DApps visible to any solver and ensure that all solvers have access to multiple differentiated and competitive intent settlement networks. This will give solvers confidence that they can choose to route their intent fulfillment to settlement networks they trust. Competition between settlement networks will also lower the cost for solvers.

The value proposition of the intent settlement network is to provide solvers with security and other features that may affect their ability to fulfill intents.

The choice of settlement network by solvers will affect their ability to provide fee and execution time guarantees to users. Some settlement networks may offer solvers an exclusive period, which will support the development of off-chain auctions where solvers and users can negotiate and commit to relay fees. (In addition, these intent auctions may also provide economically guaranteed pre-confirmation, further enhancing the user experience. To understand the user process of intent discovery through auctions and pre-confirmation, I recommend referring to Karthik's talk at Sorella.)

Some settlement networks may offer intent expiry (i.e., sending back the value to the user after a certain fulfillment deadline), intent support (i.e., using their own balance sheet to fulfill the user's intent if no solver does), or flexible repayment chains (i.e., allowing solvers to choose the chain for repayment).

Ultimately, settlement networks will fiercely compete to fulfill solvers quickly, cheaply, and securely, without compromising on security. In turn, solvers will send their order flow to settlement networks that allow them to offer the cheapest fees to users, in order to win the order flow of DApps. Competition between settlement and solver networks depends on all parties in the intent supply chain coordinating using the same language, and competition will lead to the best user experience for cross-chain value transfer.

Clearly, we need a cross-chain intent standard.

If solvers can assume that intents will share common elements, they can reuse their code to solve intents initiated by different DApps, reducing their setup costs. If different DApps create intents that comply with the same standard, they can route their intents to the same solver pool. This will help provide access for the next generation of DApps by allowing them to directly insert their cross-chain intents into existing mature solver pools, without the need for individual access to solvers, and will provide cheap, fast, secure, and permissionless value transfer.

If compliant with the standard, third-party tracking software will also find it easier to track the intent status of any new DApp.

This intent standard should allow the intent subject or solver to specify which settlement network they want to settle their intent on.

I envision competitive settlement protocols (such as SUAVE, Across, Anoma, and Khalani) providing different features for solvers. Depending on which settlement network is fulfilling solvers, solvers can offer different price and time guarantees to intent owners. DApps and solvers can agree to route the user's intent to settlement networks they trust to avoid scrutiny, maintain data privacy, and be secure enough for solvers to trust their repayment.

By writing the choice of settlement network into the intent order itself, solvers can incorporate this determinism into the quotes they present to users. Solvers and users can eliminate the upfront uncertainty of bridge pricing before submitting the intent on-chain.

Working with Uniswap and based on feedback from the CAKE working group, Across and I have proposed the following cross-chain intent standard, prioritizing the solver user experience.

The standard aims to simplify the work of solvers. One deliberate choice it makes is to natively support Permit2/EIP3074 with nonce and initiateDeadline, and provide some guarantees for fillers, such as the refund amount they will receive from the settlement network and the user intent format they can track. Additionally, the standard defines an initiation function that allows fillers (those who bring orders onto the chain) to specify additional "filler data" on-chain, which the user does not know when signing the CrossChainOrder. This allows fillers to ensure they receive rewards from the settlement contract for submitting the user's meta-transaction and to set specific repayment information such as the repayment chain.

The standard also aims to make it easier for DApps to track the completion status of intents. Any settlement contract implementing this standard should create a custom subtype ResolvedCrossChainOrder, which can be parsed from the orderData field. This may include tokens involved in the exchange, the target chain, and other fulfillment constraints. The standard includes a resolve function that allows DApps to understand how to display intent status to users and lets solvers know the exact intent order structure they are dealing with.

The design goal of this standard is to enhance the solver user experience, making it easier for them to support multiple settlement networks and calculate their rewards deterministically. I believe this will enable them to provide more accurate and concise quotes to users. You can read more details about this standard, named ERC7683, in this post and the Ethereum Magicians forum.

Conclusion

"Intents" are confusing because they are not defined, and this lack of definition is causing real user experience issues.

Everyone wants others to use their standard definition of intent, so I fully acknowledge that it is impossible to establish a standard in practice. I believe the correct approach is to first define the intent settlement system and then attempt to attract order flow.

In my view, a more feasible approach is for DApps that already have a large user base and generate many user intents to agree to comply with some minimum standards, which will be adopted by their existing solvers. This will form a new, larger pool of solvers. By acquiring combined order flow from prominent venues, this new pool of solvers will earn more profits and be able to offer better prices to end users. Ultimately, new DApps will also be required to route their intents to this solver pool and support its intent standard.

To kickstart this process, Across and Uniswap have jointly proposed a standard for all participants in the intent supply chain when processing user orders to send X tokens from chain A and receive Y tokens on chain B. The order flow operated by UniswapX (with advantages in auction design and intent initiation) and Across (with advantages in settling intent fulfillment) can be combined to foster a larger, more competitive solver network.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。