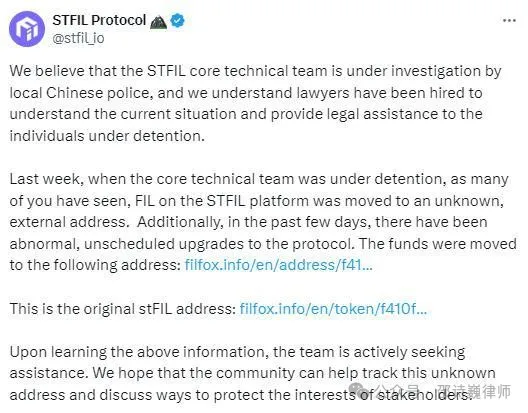

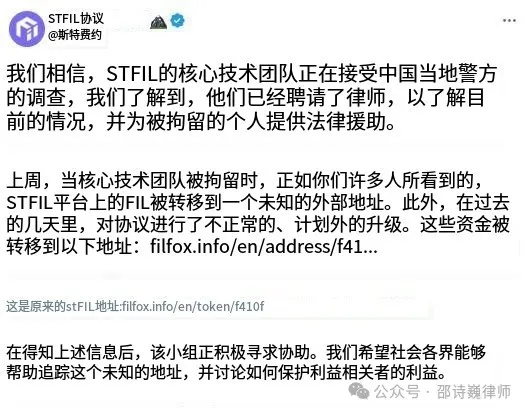

According to the official announcement from STFIL Protocol, on April 9, 2024, its core technical team is being detained by the Chinese police.

This incident occurred after the previous investigation of Filecoin miners, marking another instance of a Filecoin project being investigated by domestic authorities.

According to the STFIL Protocol official website, as a promoter of the Filecoin DeFi ecosystem, the STFIL Protocol is the first Filecoin liquidity staking protocol launched on the FVM. It allows $FIL token holders to receive stable returns without a lock-up period and provides collateral for storage providers to engage in leveraged mining.

As one of the applications in the DeFi field, what are the legal risks of liquidity staking projects in China?

01. What is Liquidity Staking Mining?

The core of Liquidity Staking Mining is to inject cryptocurrency funds into liquidity pools to support the normal operation of decentralized exchanges (DEX) or other blockchain protocols. In return, participants receive rewards in corresponding tokens. This mechanism injects necessary liquidity into the blockchain ecosystem and facilitates the trading of digital assets for users. Liquidity staking, as an innovative form of staking, allows users to maintain liquidity while staking assets. Users are not subject to any lock-up period. In short, liquidity staking tokenizes staked assets, allowing users to deposit funds into a DeFi custody account while maintaining access to the funds, resulting in a highly liquid protocol.

02. Legal Analysis of Liquidity Staking Mining

1. Can Staking Mining Contracts be Subject to Civil Rights Protection?

Although many people are aware that domestic virtual currency trading is not protected by law, the temptation of high returns is difficult to resist. In practice, there are many disputes related to virtual currency entrusted wealth management. For example, party A tells party B that they can transfer the virtual currency in their wallet to a contract mining pool for mining, which can generate high returns through interest-bearing assets. Party A then signs an entrusted wealth management contract with party B and transfers the virtual currency to the other party as requested. However, later, party B informs party A that due to market fluctuations, not only did they not profit, but party A's principal was also lost. In this case, can party A sue party B to reclaim the "principal"?

To put it bluntly, the court is likely to reject party A's claim. There are two main reasons: first, the contract is invalidated due to the nature of virtual currency trading itself; second, staking mining projects such as liquidity staking are not considered pledged property as defined in China's Civil Code. Virtual currency does not fall under the category of "rights pledge" (such as checks, bonds, equities, etc.) or "movable property pledge."

Therefore, losses incurred from signing such staking agreements lack the basis for a claim and are unlikely to receive support from the court.

2. Liquidity Staking Projects May Involve Pyramid Scheme Risks

In liquidity staking, users earn rewards by staking their own tokens on the platform to earn staking rewards. This is unrelated to pyramid schemes, but the platform's potential involvement in pyramid schemes often arises from its promotional model. To attract more users during the initial launch, platforms often set up reward mechanisms to encourage existing users to refer new users.

The "Regulations on Prohibiting Pyramid Selling" stipulate three types of pyramid selling behaviors: recruiting members, charging entry fees, and team rewards. The Criminal Law Amendment (VII) only includes "recruiting members" and "charging entry fees" as forms of pyramid selling in the crime of organizing and leading pyramid selling activities. In other words, team reward-based pyramid selling (selling goods) is only an administrative violation, and the crime of pyramid selling only includes "recruiting members" and "charging entry fees."

Firstly, from a formal perspective, token staking in mining projects may be deemed "entry fees" by judicial authorities. Secondly, if in a staking mining project, users' profits are solely from interest-bearing assets, the platform is not involved in pyramid schemes. However, if users also receive token rewards for developing new users, the project's potential involvement in pyramid schemes should be evaluated based on the profit model, hierarchical structure, and scale of personnel.

3. Liquidity Staking Projects May Involve Illegal Fundraising Risks

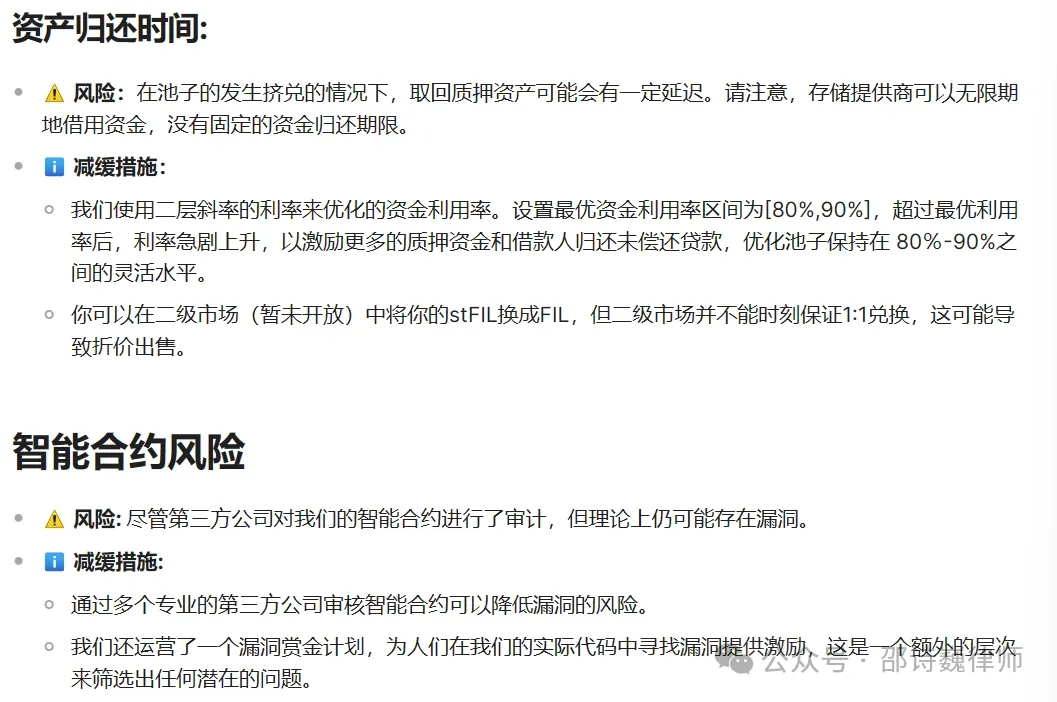

What risks might liquidity staking projects pose to users, leading to potential losses? Referring to the STFIL Protocol official website, it highlights two risks for stakers: first, there may be a delay in reclaiming staked assets in the event of a run on the pool; second, smart contracts may have vulnerabilities.

Therefore, theoretically, if there are unpredictable risks in DeFi staking projects, users' assets may be completely lost.

According to China's Notice 924 and other policies, virtual currency-related businesses are classified as illegal financial activities. Therefore, even if the project has fulfilled its related obligations in the eyes of industry insiders due to risks beyond its control, it is still at risk if domestic users report their financial losses. From the perspective of judicial authorities: virtual currency-related investment and trading activities are prohibited domestically, yet the project continues to operate; users suffer significant financial losses; therefore, the project is suspected of illegally absorbing public deposits and engaging in illegal financial activities.

03. Conclusion

From the platform's perspective, under China's criminal jurisdiction, even if the project is based overseas, if the victims are in China or the perpetrators are Chinese nationals, Chinese judicial authorities have jurisdiction. Under the premise of virtual currency-related projects being classified as illegal financial activities, there are indeed significant legal risks in China for domestic employees engaged in DeFi-related entrepreneurial projects.

From the user's perspective, since virtual currency trading is not protected by law, there are legal consequences that make it difficult to seek redress in the event of investment losses. Therefore, users should also carefully consider and guard against being deceived when investing in such staking mining projects.

[1]https://docs.stfil.io/v/cn/liquid-staking/risks

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。