Author: Marlon

Translation: Yangz, Techub News

As the Bitcoin "halving" approaches, speculators are eagerly anticipating the launch of Runes. While attracting a lot of attention on CT, there has been much confusion and misinformation surrounding this new token standard. Furthermore, unrelated protocols have used "Rune" in their names and tokens, exacerbating the confusion.

To avoid confusion, we have made a simple summary.

What are Runes?

As the developer of the Ordinal Theory, Casey Rodarmor is building a homogenized token standard for Bitcoin, known as the Runes protocol. As a meta-protocol, the Runes protocol itself is not a token. As Casey mentioned in a podcast, it is "where people create shitcoins on Bitcoin."

Tokens created using this standard are called Runes. Unlike BRC-20, Runes is a homogenized token standard, meaning each Rune is interchangeable. The Runes token standard is similar to the ERC-20 tokens on Ethereum, but simpler.

Overview

The Rune protocol will launch on the halving block on April 19th.

Rune balances are stored in Bitcoin UTXOs.

The Runes protocol adopts Bitcoin's security framework, extending UTXOs to store Bitcoin and Rune balances. Therefore, users can create and trade Runes through regular Bitcoin transactions.

- Runes 0-9 are hard-coded to ensure fair issuance.

This is an important distinction. Many protocols are rushing to launch their own Rune tokens, some through creative gamified models, and others through enticing airdrop promises. For those claiming to be the first Runecoin project in false marketing, caution is advised; at best, they can only ensure and engrave the 11th Rune.

The Genesis Rune, Rune 0, will open coinage from this halving until the end of the next halving in about 4 years. Each coinage receives a Genesis Rune, with zero divisibility.

- Initially, only 13 or more characters can be used as Rune names.

Approximately every 4 months, the Rune names will decrease by one character. The maximum length of a name is 28 characters. Additionally, to prevent "front-running," the protocol adopts a "submit first, disclose later" approach. The token name unlocking schedule can be found here. In short, be prepared for crazy token names:

- Use the OP_Return field to create Runes.

This makes each Rune name unique. Additionally, each token will have a single Unicode code point as a currency symbol.

Can Runes replace BRC-20?

The total market value of BRC-20 tokens is 26.5 billion US dollars, making it a significant market size in the Bitcoin market. The narrative surrounding Runes is mainly driven by speculators who believe that Runes will replace BRC-20 and become a widely used token standard on Bitcoin.

Is Runes a superior token standard?

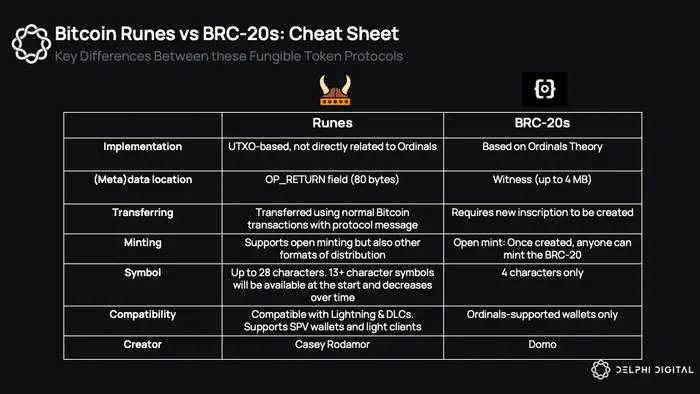

As emphasized in our in-depth discussion of Ordinals and Runes, the differences between the two are very clear:

Runes does not use witness data but simplifies the process of creating tokens using the OP_RETURN field. Users can deploy, mint, and transfer Runes using Rune stones, making regular Bitcoin transactions possible.

Rune stones are Rune protocol information stored in unspent transaction outputs (UTXOs) of Bitcoin. These transfer instructions determine how Runes are transferred in the output, such as the destination address and transfer amount. By default, the Rune balance on the input UTXO is destroyed when transferred to a new UTXO.

In comparison to the BRC-20 standard, this method is more network-friendly, as the BRC-20 standard currently generates a large number of unused UTXOs, making the network messy. Another drawback of BRC-20 is that a new inscription must be created for each token transfer.

Furthermore, the creation of Runes is more flexible. They can be minted openly and fairly, and users can choose to mint the entire supply to a single address (similar to ERC-20). BRC-20, on the other hand, is limited to open minting.

Most importantly, BRC-20 inscriptions are more susceptible to "front-running." This is because anyone can see inscription transactions in the mempool and preemptively execute them by paying higher transaction fees, which is inevitably troublesome for those trying to deploy new tokens. In contrast, Runes attempt to prevent front-running by using a "submit first, disclose later" approach. At a higher level, private commitment transactions are also possible. Disclosing details shortly before confirmation can greatly reduce the window for front-running.

Finally, Runes support SPV wallets and are compatible with Bitcoin L2 using the UTXO model. Therefore, theoretically, it is possible to use lightweight wallets and integrate with the Lightning Network to achieve faster and cheaper transactions. The emphasis on "theoretically" is because although interoperability already exists, infrastructure development must come first.

Some FUD

In theory, Runes address many of the issues in user experience and compatibility that BRC-20 faces. However, I am cautious about the view that Runes will unquestionably replace BRC-20.

To implement protocol upgrades and ensure client synchronization, Casey has introduced what he calls the Cenotaph model in the Runes protocol. Cenotaphs are malformed Rune stones created by bad inputs. When included in transactions, Runes associated with Cenotaphs will be destroyed or rendered unusable.

This is a point of controversy because it introduces the risk of inadvertently losing Runes. For example, if you interact with an app that creates Rune transactions and it accidentally generates a Cenotaph, you may lose all the Runes stored in the same UTXO.

How significant is this risk? It's hard to say before the protocol goes live, but users need to keep this in mind. Casey mentioned these issues in this Thread - TLDR: in his view, the risk is negligible. Regardless of its importance, avoiding the use of untested third-party services after the launch of Runes is a good way to minimize risk.

Additionally, there have been rumors on Twitter recently that BRC-20 may soon receive an update (source). It is said that the BRC-20 indexer will be able to calculate EVM smart contract code on token balances. If the rumors are true, many design issues will be resolved, making BRC-20 more competitive than Runes. However, it is important to note that this is just a rumor and should be treated with caution.

Ultimately, the success of Runes depends on user experience. If it can quickly integrate and leverage the widespread compatibility of Runes, then it has the potential to replace BRC-20.

If you are interested in getting a brief introduction to Runes before it goes live, you can check out Haze's insightful analysis of $PUPs on Pionex. For more information about the technology, I highly recommend checking out the official documentation and listening to Casey's podcast about the product release.

Redphone's Overview

Finally, special thanks to Redphone, who was the first to propose the concept of BRC-20, for sharing his views on Runes:

Unless BRC-20 continues to evolve, Runes is likely to become the mainstream token standard for Bitcoin.

Runes are more efficient.

Runes store token balances in UTXOs, transferring trust back to the Bitcoin blockchain from the indexer level. This is a huge win in itself.

Because Runes are in UTXOs, they are easier to integrate with L2, cross-chain bridges, and other DeFi applications.

If Runes can be integrated into the Lightning Network, the Lightning Network will also be revitalized. Can you imagine a stablecoin based on Runes running on the Lightning Network? Coinbase is already working hard to support the Lightning Network. Perhaps one day, we can directly transfer shitcoins on Bitcoin to Lightning wallets.

Runes expand the token issuance mechanism. Unlike BRC-20, it is not limited to fair issuance. This helps drive more adoption because fair issuance makes it difficult for contributors to remain consistent over a period of time.

Casey Rodarmor is definitely a master at gamifying protocol releases. For example, when launching ordinals, he gave each Satoshi represented by a number a corresponding name represented by a letter (learn more about Sats naming). He also created rarity levels for each type of Sat (sparking a craze for "Sat prospectors"). Similarly, he gamified the release of Runes by gradually allowing the use of shorter names. Initially, each token name had to be 13 characters or longer. Approximately every four months, new Rune names can be shortened by 1 character. This is the magical progressive evolution of the Runes protocol, constantly capturing people's attention. All protocol designers in the world can learn from this approach.

Combining the launch of Runes with the Bitcoin halving is another brilliant marketing move/gamification by Rodarmor. Usually, I would look forward to the Bitcoin halving itself. Now, I am almost only looking forward to Runes.

Many BRC-20 tokens will bridge to Runes (perhaps through remote destruction "teleburns"?)

Multiple token standards coexisting is completely fine. What's more important is what you can do with these tokens. Many BRC-20 tokens have already entered centralized exchanges. In my opinion, this has already proven its sustainability.

For native shitcoins, Bitcoin's development is too slow. This means that the Bitcoin L2 battle will be one of the biggest opportunities in the cryptocurrency field. I am excited to see ordinals (and BRC-20) indexers win this battle by launching tokenized L2 networks. In any case, in the coming months or years, we will see a groundbreaking L2 ecosystem, and I believe Runes will be a key part of this story.

Finally, I, along with Redphone, am a fan of both Runes and BRC-20. Both may continue to thrive in the short term, but BRC-20 must continue to evolve to avoid being outdated by the times.

In addition to Runes, I prefer Rodarmor's creativity. From the moment I first encountered ordinals, I have regarded him as an innovator in the crypto community, like the visionary figures who have made history, such as the first Bitcoin contributor Hal Finney, Ethereum co-founder Vitalik Buterin, Uniswap founder Hayden Adams, and others. The successful release of Runes will only add to Rodarmor's achievements. He has already changed the fate of this orange currency, and Runes seems ready to do so again.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。