In the just concluded first quarter, as the prices of cryptocurrencies rose, the primary market also gradually warmed up. According to PitchBook statistics, a total of $25.2 billion was raised in the cryptocurrency and blockchain field in the first quarter of 2024, a 25% increase compared to the previous quarter. The investments mainly involved L1/L2, DeFi, AI, DePIN, and Web3 games. However, the 2024 first-quarter blockchain game report jointly released by DappRadar and BGA showed that investments in the Web3 game vertical were actually declining. This trend is a correction after the investment frenzy in the metaverse and gaming during the epidemic, and it is not only applicable to Web3 games but also to the traditional gaming industry.

Early Bull Market in the Primary Market: Cautious and Optimistic

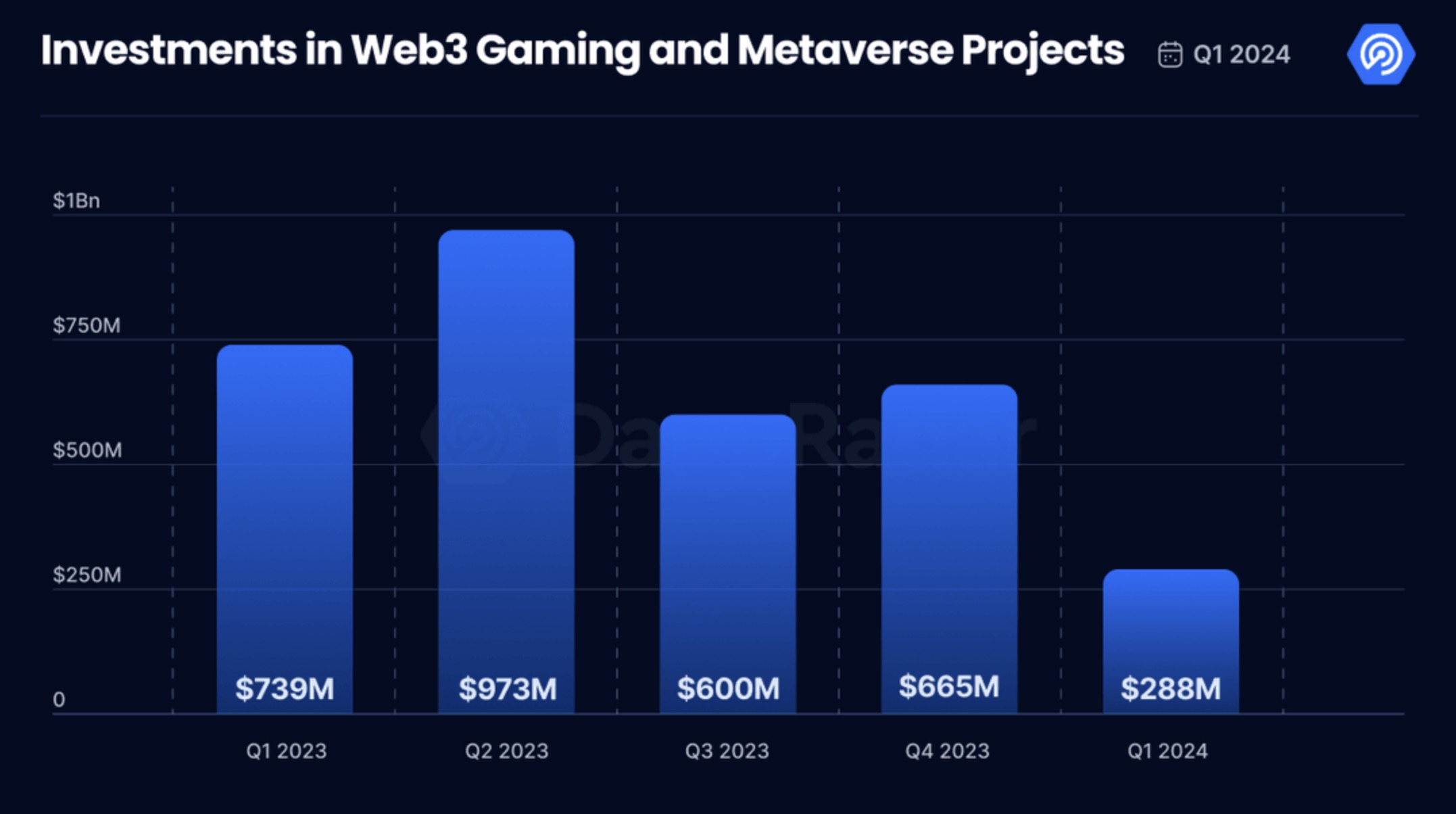

The first-quarter blockchain game report pointed out that the investment prospects in the Web3 and blockchain game fields are cautious yet optimistic. The blockchain game industry received $288 million in financing in the first quarter, a significant decline from the previous few quarters. The analysis stated that this cautious attitude can be attributed to the challenging past year, during which many companies were waiting for the results of early investments. In addition, the focus of these investments is mainly on Web3 games and infrastructure, indicating that the industry is in a period of infrastructure construction aimed at enriching the Web3 game ecosystem.

Considering that Bitkraft Ventures announced the launch of a $275 million game fund in early April, and according to the "Financing Weekly" column by PANews, the first week of this month saw nearly $40 million raised in the blockchain game track. Overall, the performance of the Web3 game industry in the primary market since the beginning of the year has remained at a similar level to the second half of last year, and has shown an explosive trend in the past month.

In March, the large-scale financing of NFT card game Parallel and AAA game developer Gunzilla Games was impressive. Parallel completed a new round of financing of $35 million at the end of the month, with participation from Solana Ventures, Amber Group, and others. In the previous round, Parallel raised $50 million from Paradigm at a valuation of $500 million in October 2021. The studio's current strategy is focused on expanding the player base, including implementing the Parallel Ambassador Program and leveraging influential partnerships. It is worth mentioning that the recent endorsement of Parallel by several well-known "Hearthstone" game anchors, represented by Thijs, has sparked conflicts within the community. The crypto media Decrypt commented, "Much of the hatred from the traditional gaming community seems to stem from the fact that crypto games are trying to compete with their favorite 'Web2' games, and the suspicion that comes with it."

Gunzilla Games also raised $30 million in a round of financing led by Avalanche Blizzard Fund and CoinFund at the end of the month. The studio had previously raised $46 million in August 2022, with Republic Capital as the lead investor and participation from Griffin Gaming Partners, Animoca Brands, Jump Crypto, CoinFund, Shima Capital, and others. In addition, Gunzilla had raised $25 million when it was founded in 2020, bringing the total amount of financing for the studio to over $100 million. Gunzilla Games is about to launch the battle royale game "Off the Grid," a free third-person shooter game that will be released on Sony PlayStation, Microsoft Xbox, and PC platforms.

These investments emphasize the strategic shift in the blockchain game world towards creating immersive, player-centric experiences. As the industry continues to recover from the challenges, building and enhancing Web3 games and infrastructure remains a top priority, laying the foundation for future growth and innovation.

However, bankruptcy and failure are very common in the gaming industry. According to a survey by game service company SuperScale of over 500 mobile game developers, 83% of mobile game projects will die within three years, with nearly half (47%) dying within 12 months of launch, and 17% of games having a lifespan of less than 6 months. The same is true for the niche market of Web3 games. According to CoinGecko statistics, out of 2,817 Web3 games launched between 2018 and 2023, 2,127 have already failed, accounting for 75.5%.

Investment Correction After the Epidemic, the Gaming Industry's Investment and Financing Market Enters a Downturn

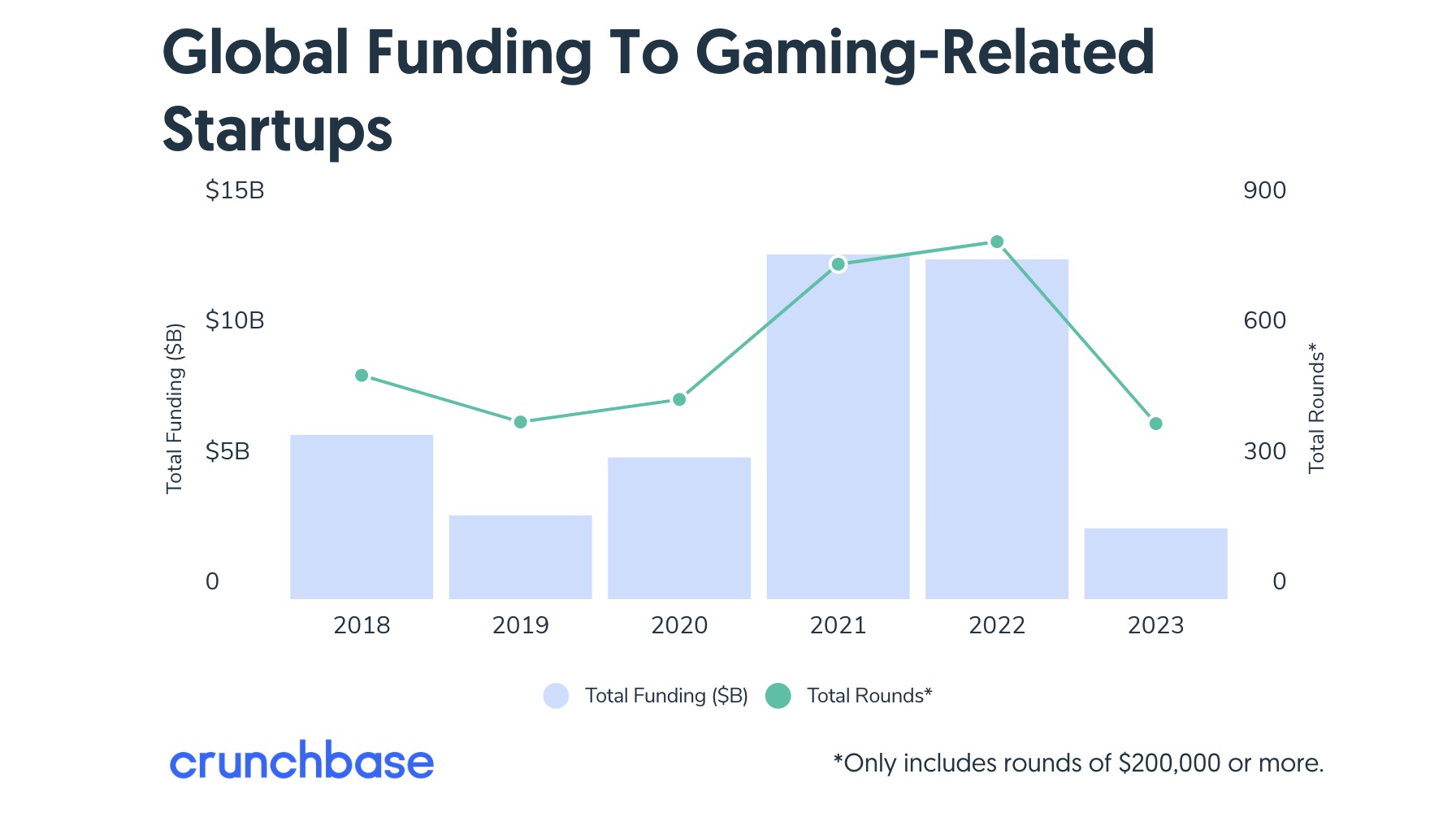

In 2023, the entire gaming industry's investment and financing market was very sluggish. According to Crunchbase data, investments in the market from the seed stage to the growth stage hit multi-year lows. No digital game companies received late-stage venture capital of over $100 million for the entire year, and large-scale pre-IPO financing disappeared, while early-stage financing remained tepid. According to Crunchbase's statistics on global game market investments over the past six years, the total amount of funds raised by the industry in 2023 decreased by 79% compared to the previous year. In terms of countries and regions, the investment decline in the U.S. market was as high as 86%.

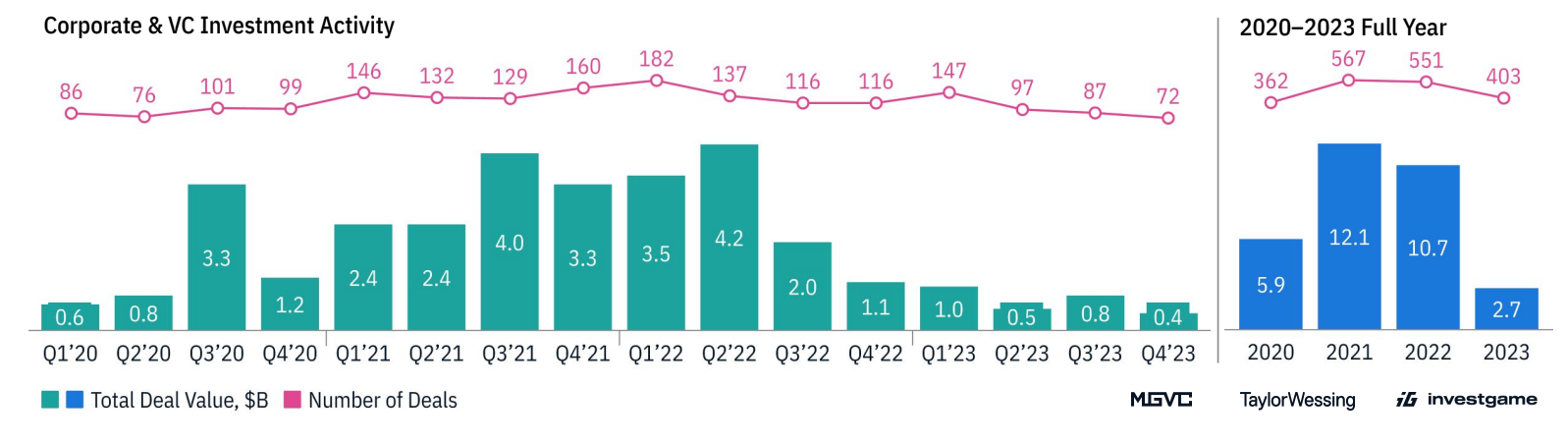

In specific amounts, according to the game investment data analysis company Investgame, the total amount of venture capital and private investment in 2023 was $2.7 billion, involving 403 financing events. This was a significant decrease of 75% from the annual financing total of $10.7 billion in 2022. However, the number of financing events did not decrease by as much, only a "mere" 21% decrease from 551. This resulted in a two-thirds reduction in the average financing size, from $19.4 million in 2022 to $6.7 million in 2023. InvestGame described this sluggish market as a correction to the inflated financing activities during the COVID-19 pandemic. While the number of financing events in the industry remains higher than pre-pandemic levels, the number of late-stage financings is lower, thus unable to increase the total amount of funds.

Joanna Glasner, a columnist for Crunchbase News specializing in business and technology, believes that the quietness in the primary market may be due to changes in consumer habits. During the peak of the global COVID-19 pandemic, homebound consumers spent more time and money on video games, but now consumption is increasingly shifting to activities outside the home. She stated that the decline in adjacent categories such as Web3 and the Metaverse has also affected the gaming industry. Integrating NFT and other plug-in products into games or metaverse games was very popular in 2021 and 2022, but it is no longer as popular now.

Game venture firm Konvoy Ventures co-founder and managing partner Josh Chapman believes that the gaming frenzy sparked by the epidemic has attracted increased activity from investor tourists and predicts that the industry will return to normal growth in 2024. Chapman also stated that the downturn in the Web3 gaming industry in 2023 was also a reason for the overall decrease in transaction volume, "Many of the encryption technologies in Web3 and gaming disappeared last year, and the lack of Web3 gaming companies entering the market led to an overall decrease in transaction volume. This is a sub-industry of the gambling industry, and other industries have maintained a fairly strong momentum."

It is worth mentioning that Konvoy Ventures announced the launch of a new fund of $150 million in July 2022, stating that part of the funds would be invested in blockchain and crypto-related games. Prior to this, Konvoy Ventures had invested in the developer of Axie Infinity, Sky Mavis, NFT sports game Genopets, and NFT pet game Ready Player Me. As Web3 games entered a bear market along with the crypto industry, star projects like Axie Infinity also fell to the bottom, and it seems that Konvoy Ventures did not inject more funds into this area.

Web3 Game Investment and Financing "Back to Pre-Liberation"

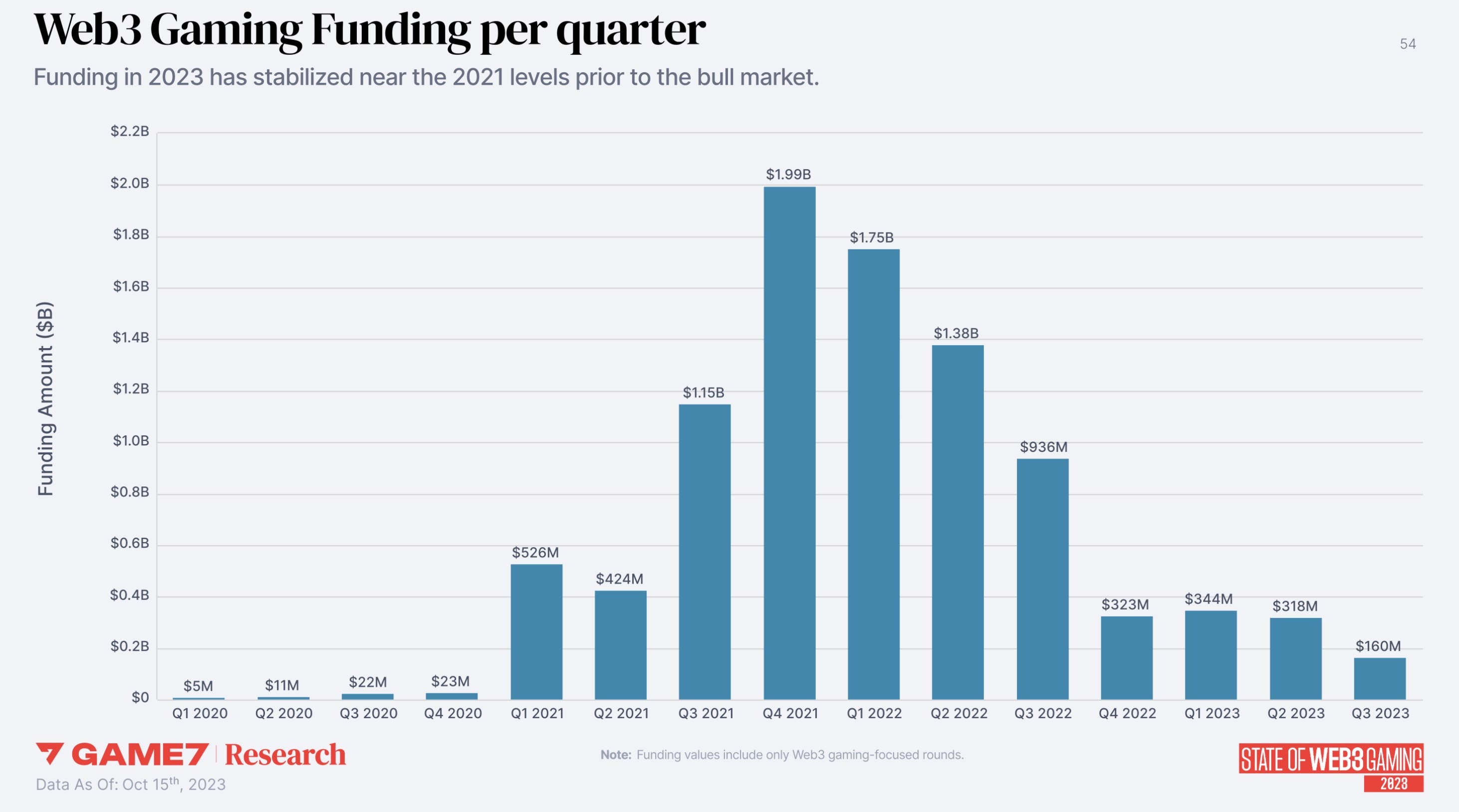

Against the backdrop of a sluggish overall gaming market and a crypto market in a cold winter, the investment and financing in the Web3 gaming field also showed a significant downturn in 2023. According to the decentralized organization game7, which focuses on blockchain games, the Web3 gaming industry continued to decline in the first three quarters of 2023, dropping from $344 million in the first quarter to $160 million in the third quarter, with the single-quarter financing scale halved and stabilizing at a level lower than the eve of the bull market in 2021.

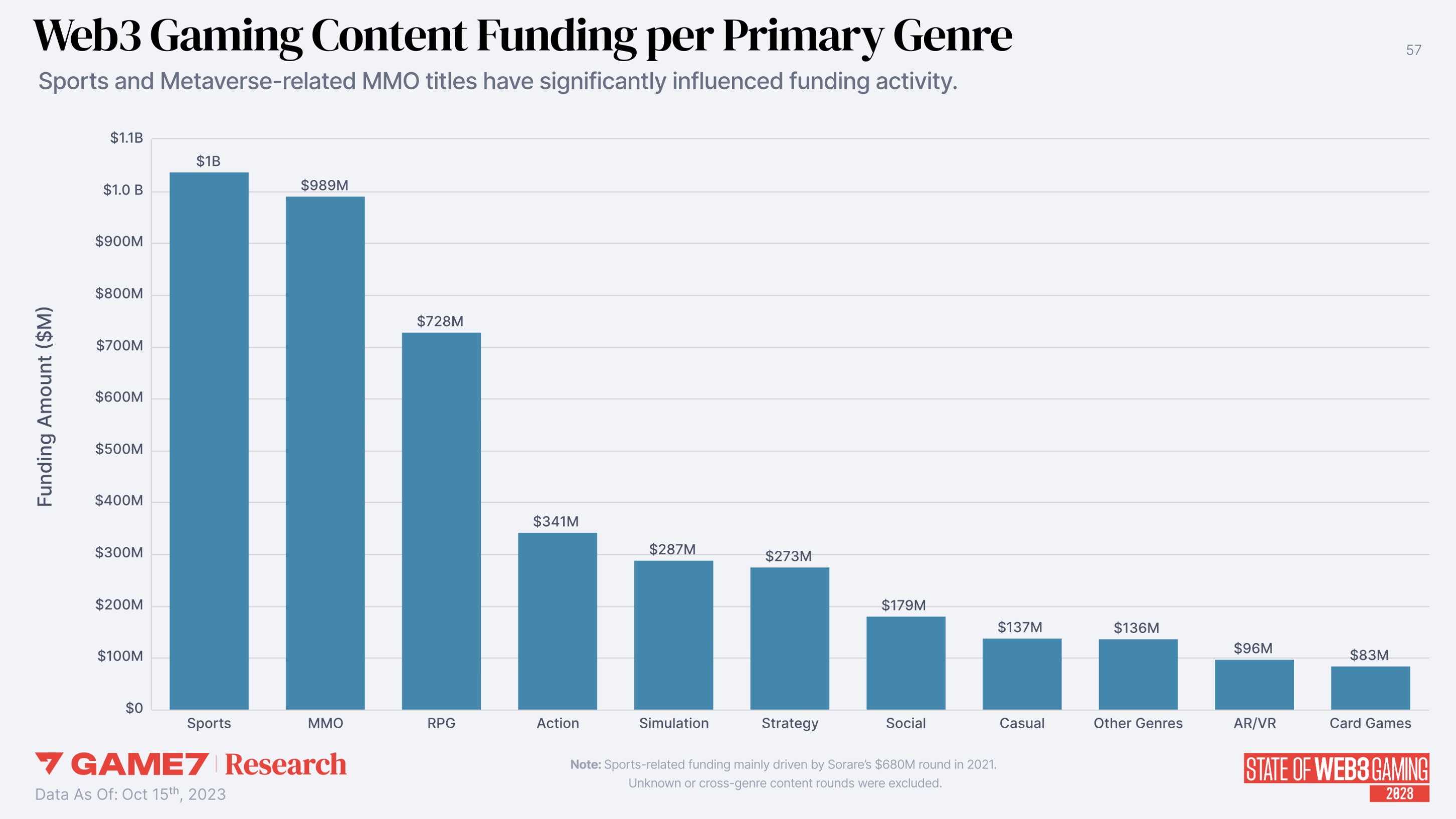

In addition, after classifying game types, game7 found that sports, MMO (Massively Multiplayer Online), and RPG (Role-Playing Game) blockchain game types raised the most funds in recent years, ranking in the top three and significantly ahead of other categories. It is worth noting that the football game Sorare completed a Series B financing of $680 million at a valuation of $4.3 billion in 2021, accounting for nearly 70% of the total funds in the same category. Additionally, action, management, and strategy games also received some market attention.

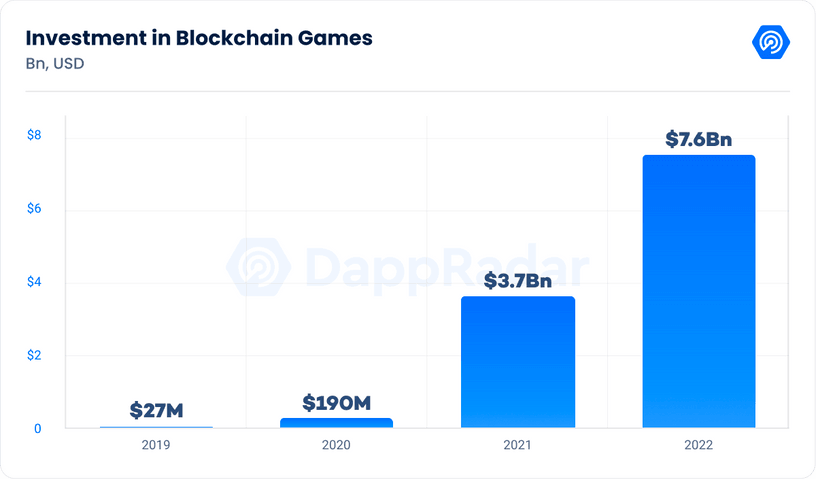

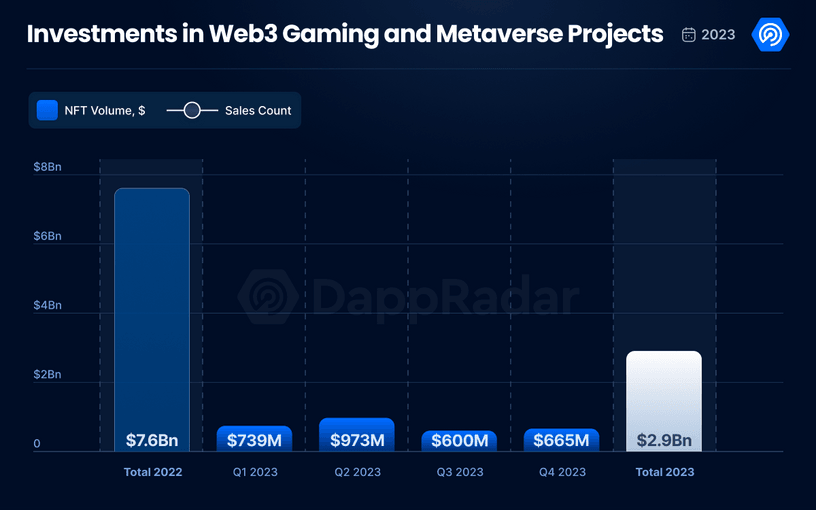

Although there are some discrepancies in the data, a report jointly released by DappRadar and the Blockchain Game Alliance (BGA) also showed a downturn in the primary market in the past year. The report also included funds raised by VCs focusing on the gaming sector and intending to invest in Web3 games. According to their statistics, a total of $2.9 billion flowed into the Web3 gaming and metaverse industry in 2023, a 61% decrease compared to the $7.6 billion invested in 2022, and lower than the $3.7 billion in 2021.

The report pointed out that among the funds flowing into the Web3 gaming and metaverse industry, game infrastructure, games and metaverse, and game investment companies are basically in a three-legged position. This distribution shows a strong focus on the core aspects of blockchain game and metaverse development, especially in game experience and support infrastructure. It interpreted this as a positive signal for the industry and believed that it indicated the industry's focus on providing top-notch games. This quality-over-quantity strategy aims to raise the standards and public awareness of blockchain games to drive broader adoption and long-term market success.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。