Article | Lingyun, Miss Cat

Editor | Ashley

Cover Source | Midjourney

Value investment is a void, and memes shine overnight. Today, AU Research will interpret the economic principles behind the meme craze and how to select reliable targets for you.

01 What is a Meme

The term "meme" was first proposed by British scholar Dawkins in his work "The Selfish Gene." He believed that just like genes in biology, culture also has a basic unit that carries information for cultural transmission.

The term "meme" was first proposed by British scholar Dawkins in his work "The Selfish Gene." He believed that just like genes in biology, culture also has a basic unit that carries information for cultural transmission.

The term "meme" has also been translated as "mimeme" or "mimicry," originating from the Greek word "mimema," meaning "something imitated." Biologist Richard Dawkins first mentioned it in his 1976 work "The Selfish Gene" and simplified it into the word "meme," similar to the rhythm of genes. He applied the theory of "evolution" to the study of "cultural change" and formally defined a meme as a small cultural unit that is constantly replicated and imitated between people, similar to genes. Chinese scholars He Ziran and He Xuelin translated "memes" as "模因" (móyīn).

Richard Dawkins used the rules of biological evolution to analogize the process of cultural inheritance. Memes encompass a wide range, including religion, rumors, news, knowledge, ideas, habits, customs, slogans, proverbs, language, and jokes.

The replication of memes is not as precise as the replication of genes in nature. It is not just a process of imitation but also a process of autonomous recreation, following the principle of natural selection.

Just as genes jump from one person to another in the gene pool, memes jump from one person's mind to another's through imitation in the meme pool, thus completing their reproduction. When a meme occupies a person's mind, it is like a virus infecting a cell, turning the mind into a tool for carrying the meme. Just as not all genes can successfully reproduce, some memes have had a widespread impact, while others have quickly disappeared.

02 How Do Memes Spread

Dawkins summarized three key factors that affect the survival of memes: longevity, fecundity, and fidelity of replication.

Compared to the other two factors, longevity is less important because the survival of a meme largely depends on the longevity of its carrier. When the host of the meme dies or the medium carrying the information is destroyed, the meme also disappears.

Fecundity is relatively more important. If a meme is a scientific discovery, its survival largely depends on how many people can understand this discovery. This can be roughly estimated by calculating the number of times it is cited in reputable academic journals and the journal's circulation. The stronger the fecundity of a meme, the more widely it can be spread, and the greater its chances of survival.

Fidelity of replication refers to whether a meme can be faithfully replicated and accepted when it is copied and spread. Differences may arise between the replicated and accepted memes due to differences in the educational background, interests, age, and gender of the replicator and recipient. In some cases, the replicator may consciously make changes when spreading the meme. A typical example is in academic papers, where to fit the author's intended point, only a certain aspect of a meme is selected for explanation, or it is analyzed from a new perspective, or combined with other memes to form a new one. Memes with high replication fidelity can be preserved intact.

03 What Makes Memes Go Viral?

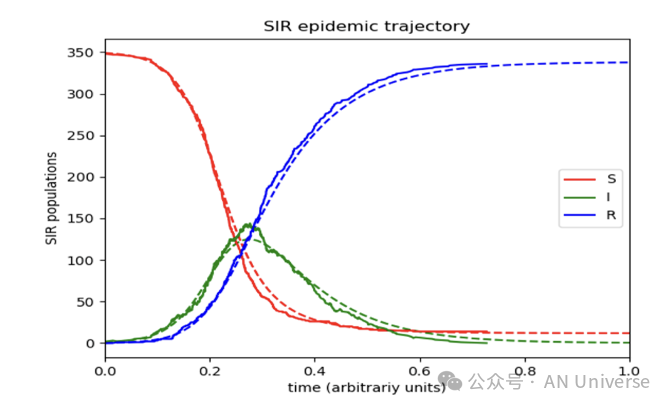

In simple terms, memes go viral by "complying with the laws of communication," enabling rapid dissemination. Therefore, to study memes, one must first study the laws of communication, understand market sentiment, and comprehend "how to evoke people's emotions." This inevitably brings up the SIR transmission model.

This was originally an epidemiological transmission model, but it is also applicable to information dissemination. The red line represents people who are easily infected, the green line represents those infected, the blue represents those recovered, and the horizontal axis represents time.

The core of information dissemination is to ensure that the rate of infection exceeds the rate of recovery, causing the number of infected individuals to continuously expand. Combining psychology and communication studies, the more new people are exposed to this information, the more opportunities there are to infect others.

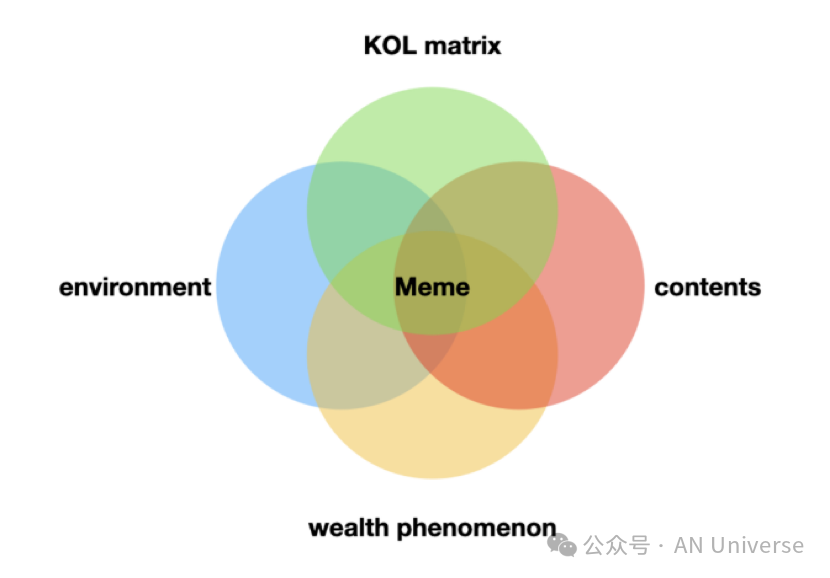

Next, by combining psychology and communication studies to find the rules of meme issuance, we will analyze from these four core elements: MEME content, environmental atmosphere, KOL promotion, and wealth effect.

**Content: **Memes essentially tell stories with images and convey emotions through pictures. For example, $Doge appeals to dog lovers and has a strong long-tail effect, attracting many people with its cute and interesting dogs. $PEPE, the sad little frog, was a beloved emoji before becoming a meme. Sloths are also very popular in the movie "Zootopia."

In terms of emotional transmission, the simpler and more straightforward, the better. There is a saying about "The Three-Body Problem": for every additional formula, ten thousand viewers are lost. In this way, the more down-to-earth and easy to spread, the more likely it is to go viral. Overly professional content only attracts peers.

In summary, what easily goes viral are things that are cute, traditionally popular, and straightforward.

**Environmental Factors: **This environment includes macro-environment and economic cycles. This bull market has brought in a large number of outsiders, who are initially unable to understand complex technical terms, predictions, staking for security, smart contracts, etc. Memes are something they can understand, and the pricing is very cheap. For 10U, they can buy thousands of them, and if it adds a zero, that's a tenfold increase, something that many newcomers can easily grasp.

The meme craze in this bull market is also influenced by the traditional economic downturn. In simple terms, it's a downgrade in the crypto market. Apart from beautiful countries, most countries have experienced economic weakness in the past two years. In this situation, the public's desire to explore new technology will decrease, living in a low-energy, easily absorbable manner, similar to animals hibernating. In this scenario, the meme market becomes even more popular.

**KOL Promotion: **The creation, issuance, pool building, and KOL promotion of a meme are essential. Regardless of the KOL's level, you will find that what they write or say is very persuasive, making people very willing to believe. Many cryptocurrency prices are based on bubbles, and bubbles come from consensus, so meme marketing will inevitably involve KOL promotion and community dissemination.

At this point, here are some risk warnings: You may see several community leaders shouting to buy XX coin, and you will be bombarded by public accounts, making you feel that a certain meme is particularly valuable. After rushing in, you may find that you have been harvested by trading bots, or you are left holding the bag, or the value has dropped to zero in ten minutes.

Paying attention to KOLs in the English-speaking and different countries' communities will help you judge the cultural value behind the meme, as cross-cultural consensus is the real consensus.

**Wealth Effect: **The reason memes have become a mainstream track is their effortless creation of wealth myths and the FOMO (fear of missing out) panic. On one hand, they promote the rise to attract people, and on the other hand, they publicize the myth of wealth creation, such as someone making $30 million in two hours. They also spread FOMO panic within the community, which is a common marketing tactic for memes and also complies with the laws of communication.

04 What is a Meme Coin

Article | Memecoins: Mapping the Culture of Memes in the Cryptocurrency Field

The mapping of meme culture in the cryptocurrency field undoubtedly includes various memecoins and meme NFTs. Memecoins, as a subclass of cryptocurrency, focus on popular internet memes, references to popular culture, and viral internet trends. Famous examples of such memes include different versions of the Japanese Shiba Inu Kabosu and the Pepe frog cartoon, and even extend to celebrities like Elon Musk.

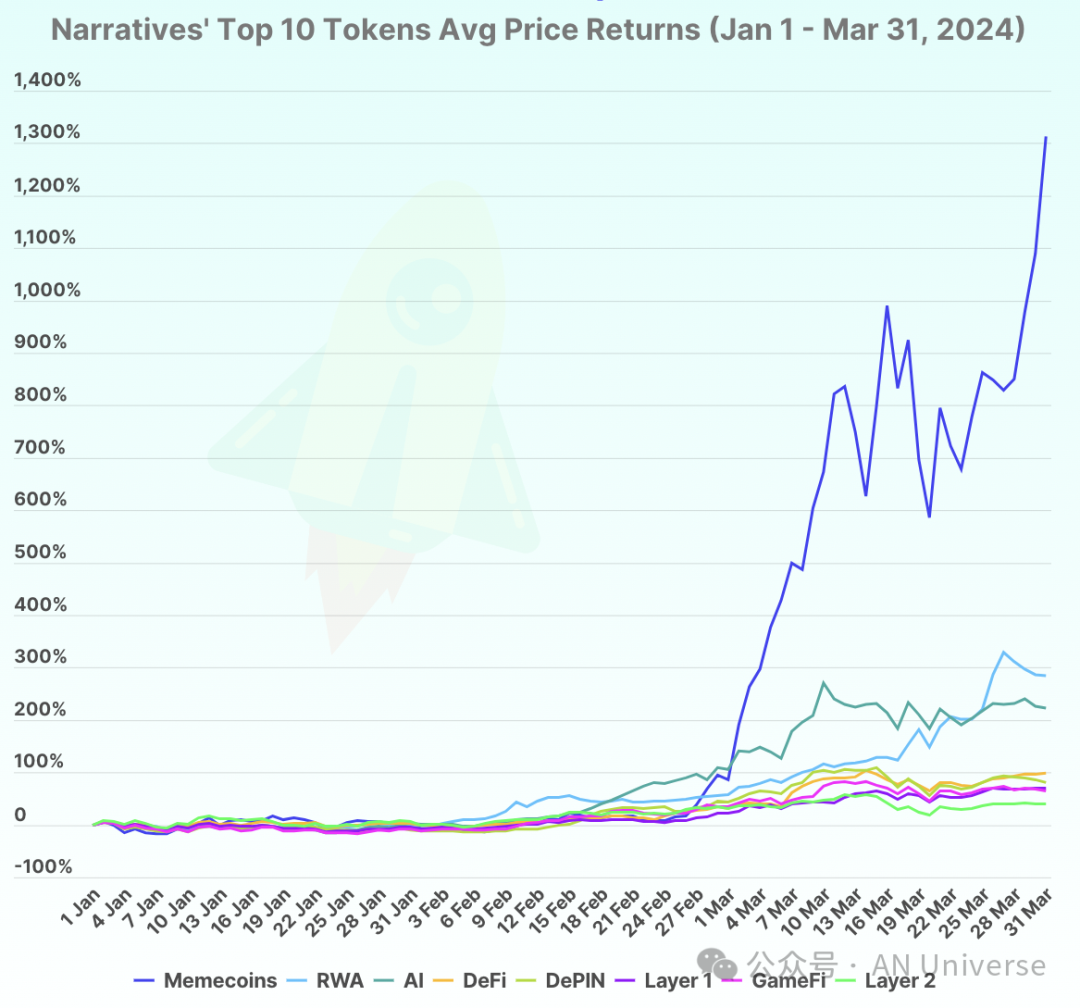

According to a recent report from CoinGecko, the memecoin industry has become the most profitable area so far this year.

The report shows that among the tokens with the highest market value, memecoins have the highest average return rate, at 1,312.6%. By the end of this quarter, memecoins launched in March have entered the top 10 in terms of market value, including Book of Meme (BOME), Brett, and Cat in a Dogs World (MEW), far surpassing the RWA and AI tracks.

The creators of memecoins use various themes to attract the attention and trading volume of speculative investors in the cryptocurrency market. In many cases, well-known KOLs and forums like Reddit have also joined the memecoin craze. Unlike other cryptocurrencies such as Bitcoin (BTC) or Ethereum (ETH) that primarily function as digital currencies, developers usually create memecoins as a lighthearted social experiment, with limited technical value.

Many people believe that memecoins are refreshingly different from traditional cryptocurrencies in terms of their seriousness. Memecoins invite a new generation of users to engage with blockchain technology in an approachable, non-traditional manner. However, some people also consider memecoins to be highly risky assets that could undermine the legitimacy of ambitious blockchain projects. Whether or not you dare to invest in memes, it is still important to understand how memecoins operate, where they are most commonly used, and the risks you should be aware of before entering this field. Today, let's discuss the analysis of memes and cryptocurrencies.

05 History of Memecoins

The concept of memecoins can be traced back to the early stages of cryptocurrency, but it did not attract much attention in the market until the appearance of the first representative memecoin, Dogecoin (DOGE), in 2013. Dogecoin was created as a joke by software engineer Billy Markus and Jackson Palmer. Its logo featured the popular Shiba Inu "Doge" at the time. Despite its origins as a humorous experiment, Dogecoin's low unit price and fast block generation speed quickly made it popular in the cryptocurrency community.

Essentially, Bitcoin is the biggest memecoin. The value of Bitcoin comes from consensus, which is based on decentralized belief and relies on cryptographic technology to achieve it. Currently, we usually refer to cryptocurrencies that rely solely on consensus, jokes, and have rapid dissemination effects but lack technical innovation as memecoins.

From being commonly used for online tipping in European and American communities like Reddit.com to charitable donations to international non-profit organizations, Dogecoin has become a widely used medium of exchange, not just a joke. Following the success of Dogecoin, a series of memecoins inspired by internet trends and jokes emerged: tokens like Pepe (PEPE) (inspired by the sad frog) and Shiba Inu (SHIB) gained attention for their own advantages and became popular in the cryptocurrency community.

In the subsequent development, the rise of DeFi (decentralized finance) and the NFT (non-fungible token) craze provided fertile ground for more memecoin experiments.

06 Memecoins and NFTs

Memecoins also leverage the NFT craze, transforming viral internet characters into unique digital assets that users can own and trade. For example, a memecoin project might create limited edition NFTs containing popular elements related to their tokens. Users can buy, sell, or trade these NFTs on various NFT markets. This allows meme enthusiasts to not only retain a fragment of internet history but also support their favorite meme projects. Rare Pepes and the subsequent Fake Rares series are examples of some of the earliest NFT projects developed from viral internet memes.

Shiba Inu Coin (SHIB), one of the most popular meme projects in the cryptocurrency field today, has also launched its "Shiboshis" NFT. This series includes 10,000 cartoon characters inspired by Shiba Inu, and holders can use them to battle in Shiba Eternity, a popular gold-making game in the SHIB project (earning coins by playing games).

Like many other popular NFTs, meme NFT holders have established private communities for their collections, and some communities allow holders to participate in exclusive offline events and have the opportunity to receive related merchandise.

07 Memecoins and DeFi

DeFi refers to a series of blockchain-based financial applications that reconstruct traditional financial services in a decentralized manner. Memecoins use DeFi protocols to create innovative ways for users to participate in the use of their tokens, not limited to simple speculative trading, but also participating in staking, mining, and providing liquidity.

Staking: Memecoin holders can stake their tokens on DeFi platforms to earn rewards. These rewards can be additional memecoins or other forms of tokens, providing users with the incentive to hold and actively participate in the memecoin ecosystem.

The SHIB token holders can use the ShibaSwap platform to exchange ERC-20 tokens and perform various tasks to earn SHIB and two other native tokens, BONE and LEASH. DoggyDAO, as a decentralized autonomous organization (DAO), provides additional income to token holders by granting them voting rights on key protocol decisions.

Mining: Mining mainly involves using smart contracts to lend your memecoins to others in exchange for interest. DeFi platforms for memecoins use these loans to facilitate various activities, including trading or providing liquidity, and users earn compensation for mining memecoins due to their contributions.

Providing Liquidity: Memecoins can also create liquidity pools, where users provide their own memecoins for trading on decentralized exchanges. This process allows users to earn a portion of the trading fees and contribute to the liquidity and efficiency of the memecoin market, also earning corresponding compensation.

08 Risks of Memecoin Investment

Due to the viral nature of memecoins, many projects have experienced significant increases in value in the past, but some have also suffered sudden collapses.

1. Extreme Volatility: The value of a memecoin may skyrocket in one moment and plummet in the next, making investors vulnerable to significant financial losses. It has a strong speculative nature, making it particularly susceptible to sudden market changes influenced by a key figure (such as Musk), news, or internet trends.

2. Overreliance on Emotions: Many new memecoins often lack fundamental technology or practical use cases, which may cause their value to depend entirely on market sentiment. While some memecoins have found creative ways to integrate NFTs, DeFi, or community-driven initiatives, many projects primarily focus on the emotional value of humor and satire. This lack of fundamental technical value makes memecoins susceptible to being a house of cards.

3. Market Manipulation: The concept-driven nature of memecoins may attract bad actors who want to profit from speculation. Sometimes, they deliberately create false market news and divide the community to drive up the coin price, and then sell off their holdings at the peak, often leading to significant losses for unsuspecting investors. These schemes exploit the speculative and emotional nature of memecoin trading, so investors need to carefully research when heavily investing in memecoins.

4. Many Scams: Many memecoin projects are launched by anonymous or pseudonymous developers, making it difficult to assess the credibility and intentions behind the tokens. Many pre-sale memecoins have emerged, where the development team runs away after receiving a certain amount of funds. There are also cases of using official accounts to change the pre-sale payment address, which brings significant risks.

09 Conclusion

Overall, memecoins represent an interesting fusion of digital currency, internet culture, and humor. As memecoins continue to attract attention and evolve, how they will shape the broader cryptocurrency landscape, how they will find astonishing applications beyond their humorous origins, and how to discover early value and balance risks and returns when entering the field will be further explored by the AU Research team.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。