Author: Grayscale Research

Translator: Felix, PANews

TLDR:

- Bitcoin has fully recovered from the decline of 2021-2022 and reached a historic high in March 2024. Grayscale Research believes that the eagerness of central banks to cut interest rates may be a factor driving the increased demand for value storage assets such as physical gold and Bitcoin.

- Ethereum successfully implemented a major network upgrade, but Ether's performance this month is inferior to Bitcoin, possibly due to the market's perception of a low likelihood of the U.S. approving a spot ETF.

- Bitcoin is about to halve (scheduled for April 19), at which point the issuance will be reduced by half. The predictable monetary policy of Bitcoin's network contrasts with the uncertain prospects of fiat currency.

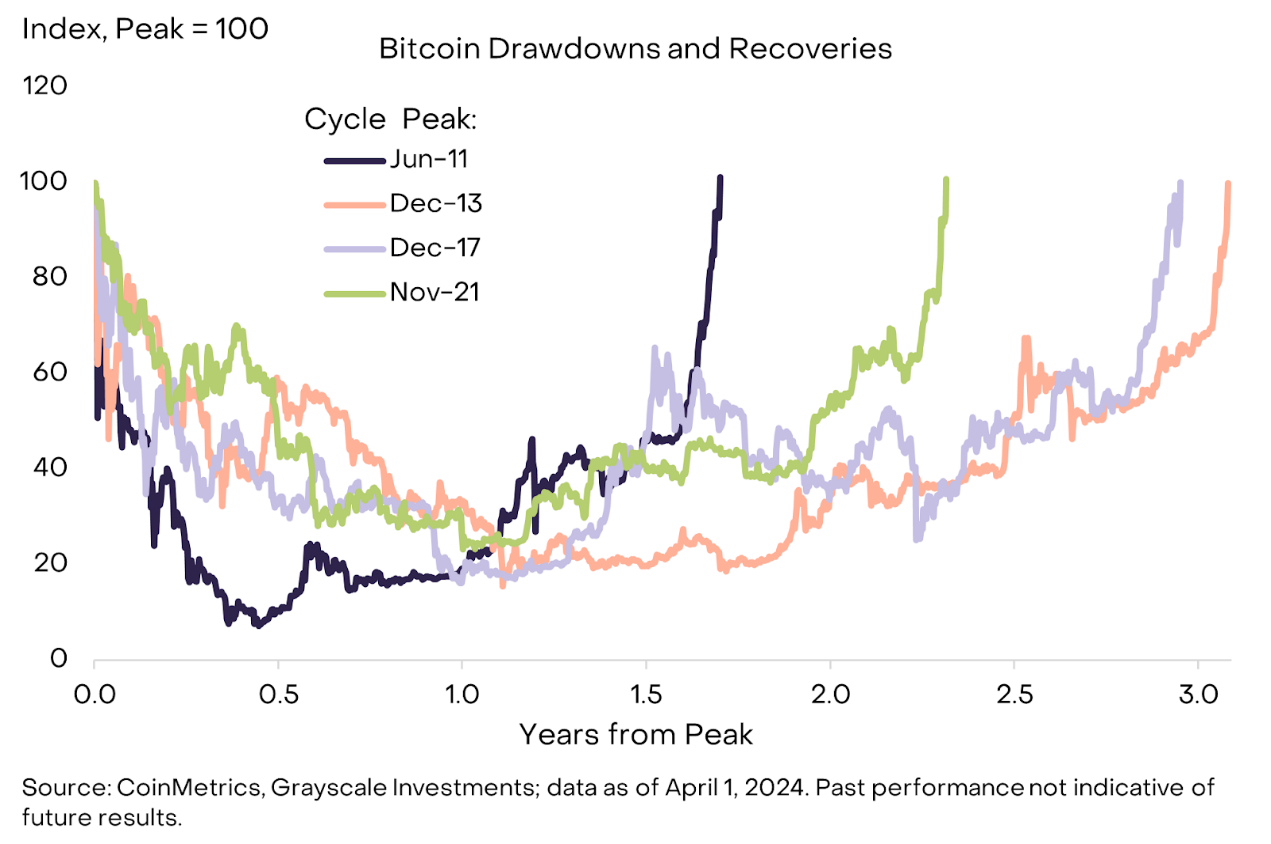

Bitcoin has rebounded strongly after a significant decline. In the last crypto cycle, Bitcoin peaked at $69,000 in November 2021. It then fell by about 75% over the following year, hitting a low of around $16,000 in November 2022, and then began to recover.

Overall, compared to the previous two cycles, Bitcoin's recovery speed is faster. Bitcoin returned to its previous peak in just over two years (Chart 1). In contrast, it took about three years for Bitcoin to recover from the previous two declines, and about a year and a half to recover from the first major decline. Grayscale Research believes that we are currently in the "mid-term" of another Bitcoin bull market, and prices may continue to rise.

Chart 1: Bitcoin's recovery speed is faster compared to the previous two cycles

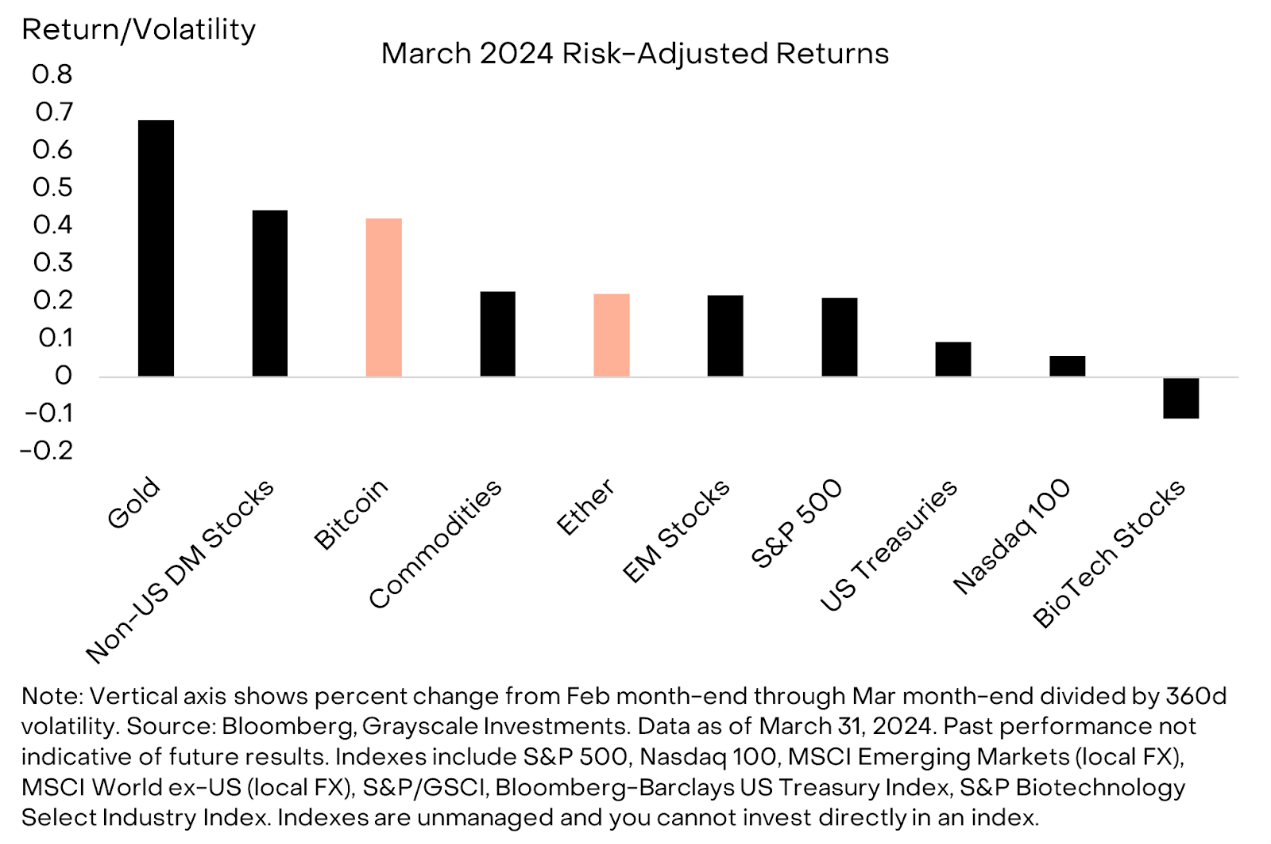

Many traditional assets also achieved positive returns in March 2024. On a risk-adjusted basis (considering the volatility of each asset), Bitcoin's performance is at the high end of the range, while Ether's return is close to the middle level (Chart 2). The best-performing sectors in the traditional asset market last month included physical gold, non-U.S. developed market stocks, and energy-related stocks. Some stocks related to emerging technologies such as biotechnology performed worse than the broader market.

Chart 2: Bitcoin is one of the best-performing assets in March 2024

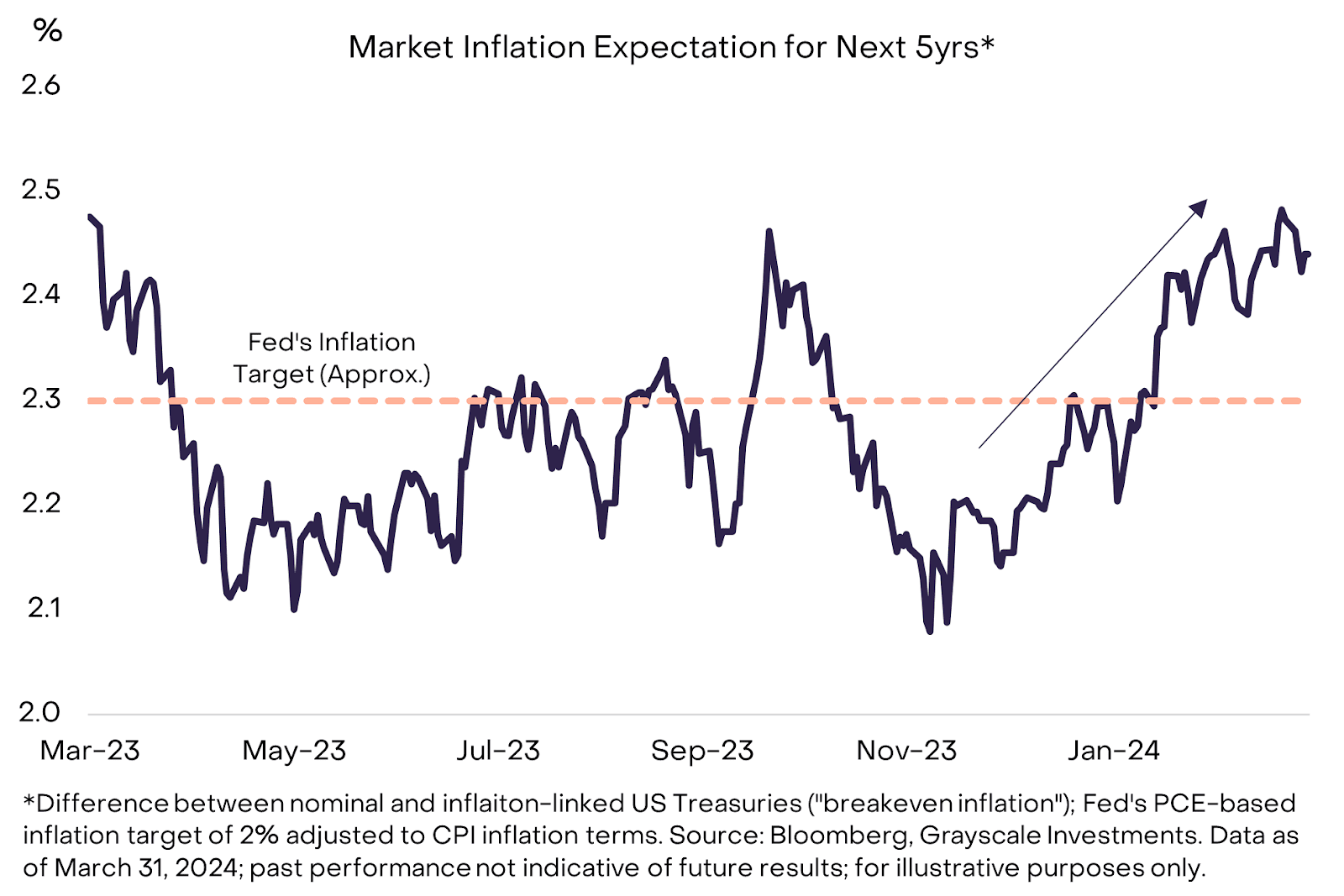

One of the reasons for the strong performance of major markets last month may be the signals of interest rate cuts from central banks around the world. According to a Bloomberg survey, all G10 central banks except the Bank of Japan are expected to cut interest rates in the next year. Developments last month strengthened this outlook. For example, at the meeting on March 19-20, Federal Reserve officials indicated that despite expectations of strong GDP growth and rising inflation, they still plan to cut interest rates three times this year. Similarly, the Bank of England, for the first time since September 2021, had no officials supporting a rate hike, and the Swiss National Bank unexpectedly cut interest rates on March 21.

Against the backdrop of strong economic growth, central banks of major countries are eager to cut interest rates, which may lead to an increase in market inflation expectations. For example, the yield spread between nominal bonds and inflation-linked bonds—known as "breakeven inflation"—has increased across all maturities this year (Chart 3). The risk of rising inflation may in turn stimulate demand for other value storage means such as physical gold and Bitcoin.

Chart 3: Market inflation expectations are rising

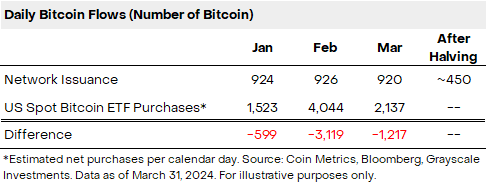

Despite Bitcoin reaching a new high, it experienced a mid-month drop of about 13% as traders reduced leverage and the inflow of funds into spot Bitcoin ETFs slowed down. Looking at the entire month of March, the net inflow total of U.S.-listed spot Bitcoin ETFs was $4.6 billion, lower than February's $6 billion.

Although the net inflow volume has decreased from the previous month, it still far exceeds the network issuance. It is estimated that U.S. ETFs purchased about 2,100 bitcoins per trading day in March, while the network issued about 900 bitcoins per day (Chart 4). After the halving event in April, the network issuance will decrease to about 450 bitcoins per day.

Chart 4: ETF inflow continues to exceed network issuance

Meanwhile, on March 13, the Ethereum network underwent a major upgrade aimed at reducing L2 costs and promoting Ethereum's transition to a modular architecture. The impact of the upgrade can be observed on-chain: the transaction costs of L2s such as Arbitrum and Optimism dropped from around $0.21 and $0.23 in February to less than $0.01 after the upgrade, making transaction costs within the Ethereum ecosystem cheaper for end users.

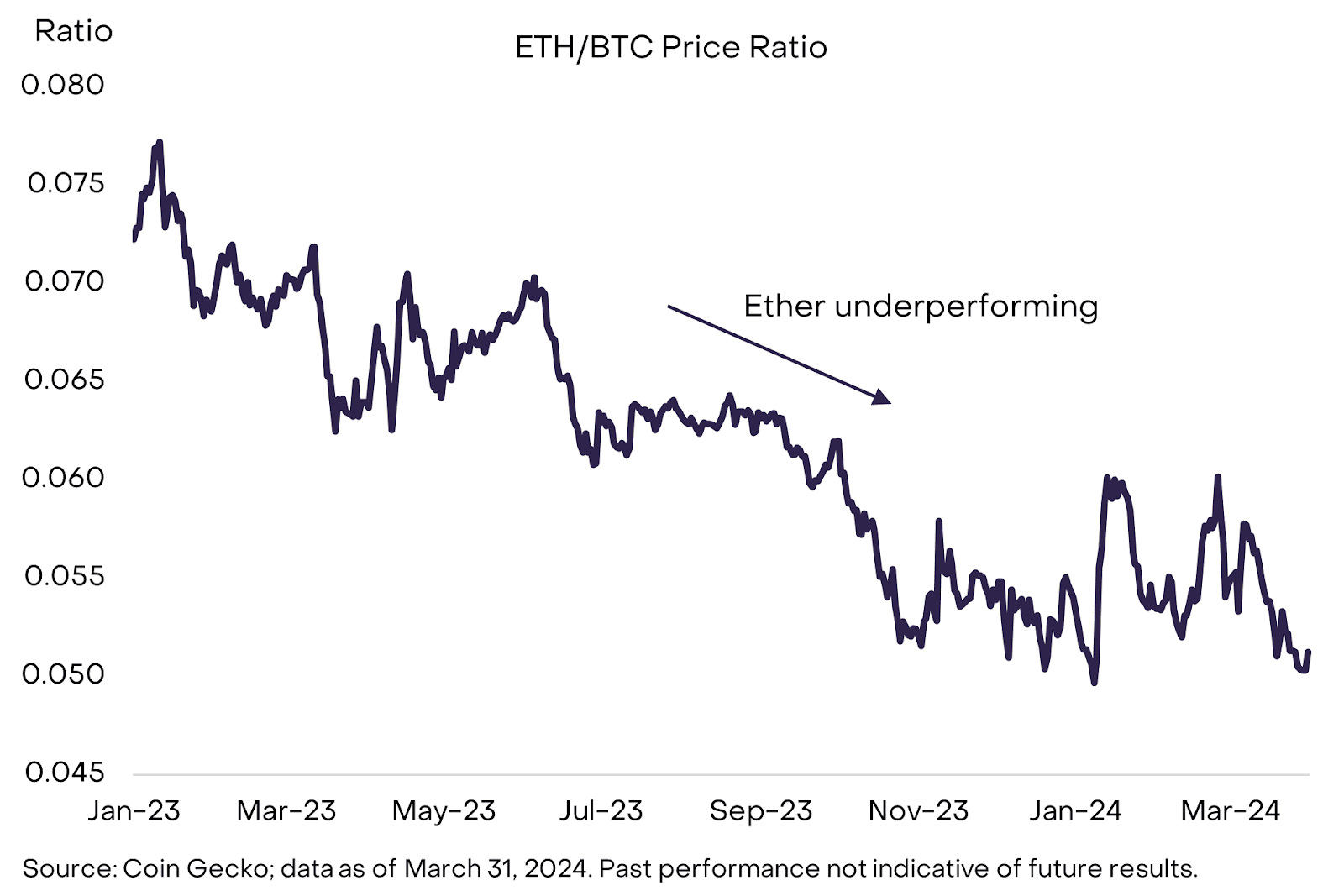

Although the upgrade reduced transaction costs, Ether's performance this month lags behind Bitcoin, with the ETH/BTC price ratio dropping to its lowest level since early January (Chart 5). Ether's valuation may be suppressed by the market's reduced expectations of the approval of a spot Ethereum ETF. According to data from the decentralized prediction platform Polymarket, the consensus expectation for the U.S. SEC to approve a spot Ethereum ETF by the end of May has dropped from around 80% in January to 21%. Whether a spot Ethereum ETF can be approved in the current wave of applications is expected to be a significant factor affecting the valuation of tokens in the next two months.

Chart 5: Despite a major network upgrade, Ether's performance lags behind Bitcoin

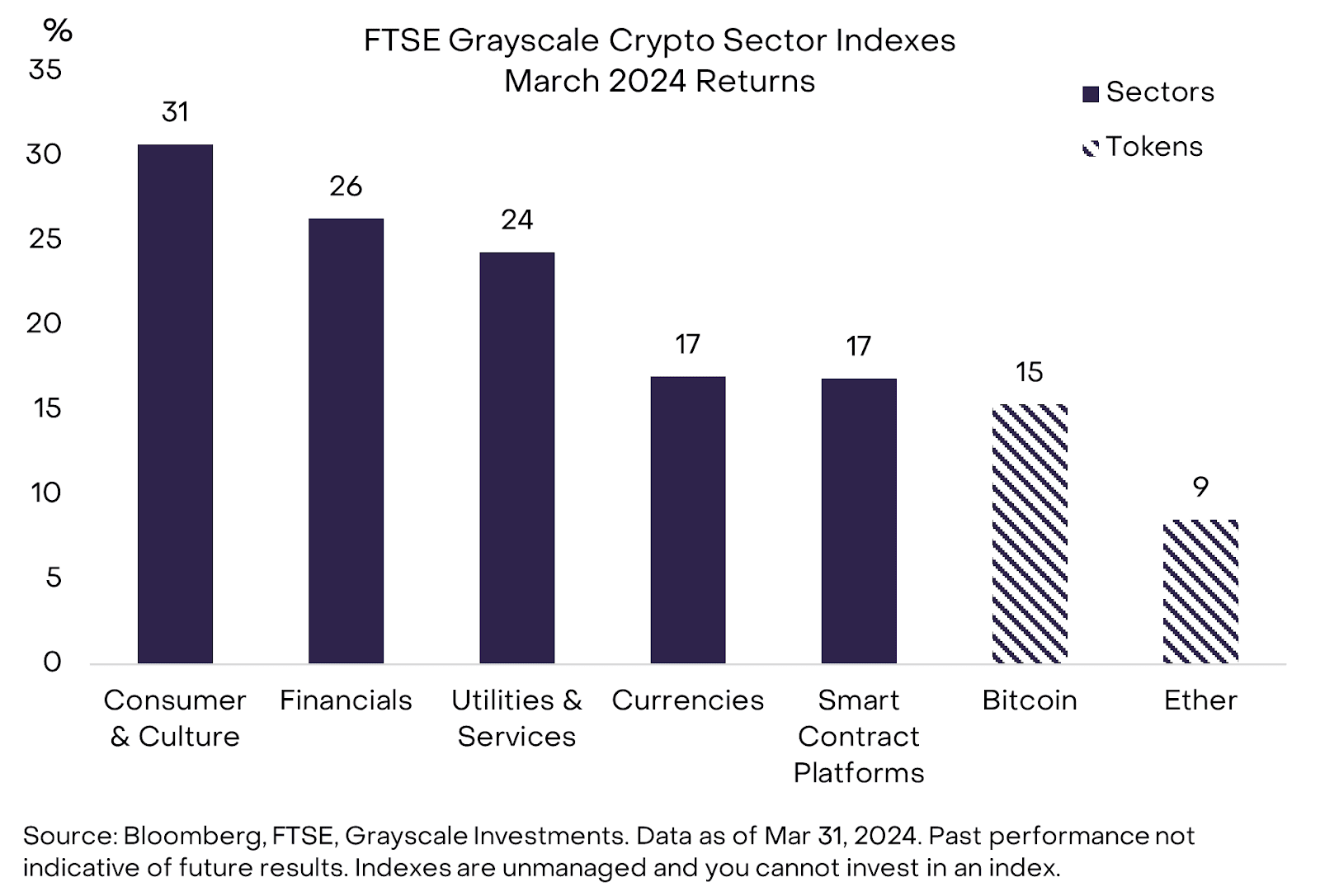

According to Grayscale's segmentation of the crypto market, the best-performing segment in March was consumer and culture, attributed to the high returns of "Memecoins" (Chart 6). Memecoins are a manifestation of internet culture, and in the crypto space, tokens related to Memecoins are primarily used for entertainment value; these projects have historically not generated revenue or had practical use cases (e.g., for payments), and should therefore be considered highly risky investments. In other words, the developers behind Shiba Inu (the second-largest Memecoin in the consumer and culture segment by market value) are attempting to expand the project's scope by launching an Ethereum L2.

Chart 6: Consumer and culture segment grew by over 30%

Various tokens in the financial sector also generated stable returns this month, with the best performers being Binance Coin (BNB), MakerDao governance token (MKR), THORchain (RUNE), 0x (ZRX), and Ribbon Finance (RBN). In recent months, Binance's share of spot market trading volume has begun to recover (currently at 46%), but is still below the peak reached in February 2023.

Like all other asset markets, the valuation of cryptocurrencies is influenced by fundamental and technical factors. From a technical perspective, the net inflow/outflow of U.S.-listed spot Bitcoin ETFs may still be an important factor affecting the short-term price of Bitcoin. These products currently account for about 4% of Bitcoin's circulation, so any changes in their demand can have a certain impact on Bitcoin.

However, Grayscale Research believes that the demand for Bitcoin ultimately stems in part from investors' interest in its role as a "value store" asset. Bitcoin is an alternative monetary system with a unique and highly predictable monetary policy. The supply of the U.S. dollar is determined by personnel from the U.S. Department of the Treasury and the Federal Reserve, while the supply of Bitcoin is determined by pre-existing code: the daily issuance decreases by half every four years until the limit of 21 million coins is reached.

In the view of Grayscale Research, when investors are uncertain about the medium-term prospects of fiat currency, they seek assets with this verifiable scarcity. Currently, this uncertainty seems to be increasing: even though inflation remains above target, the Federal Reserve is still prepared to cut interest rates; and the U.S. election in November may stimulate changes in macroeconomic policies, which over time could put pressure on the value of the U.S. dollar. The upcoming Bitcoin halving event next month should remind investors that Bitcoin's fundamental attribute is as a scarce digital asset, an alternative to fiat currency with uncertain future supply.

Related reading: Opinion: The four-year bull and bear cycle of Bitcoin may have come to an end

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。