Author: Howe

Editor: Faust, Geek Web3

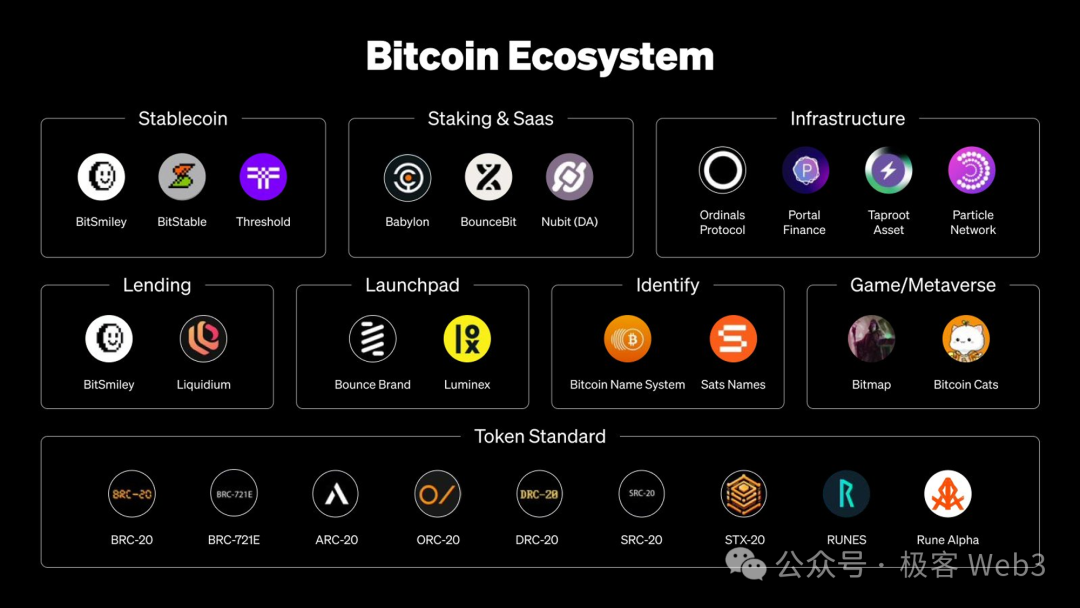

From a technical perspective, the asset issuance schemes in the current BTC ecosystem can be divided into two major factions: UTXO-bound and non-UTXO-bound. The main difference lies in whether the data of the tokenized assets is directly associated with the UTXO on the Bitcoin chain. According to this classification, BRC-20 belongs to the non-UTXO-bound assets, while ARC-20 under the jurisdiction of the Atomicals protocol has pioneered the UTXO-bound assets.

This article will mainly analyze the history, current status, and future development of the Atomicals protocol objectively from two aspects: the emerging concepts and technologies brought by the Atomicals protocol and the development direction of the entire Atomicals ecosystem. Through this article, readers will find it easier to understand why we call the Atomicals protocol "a revolutionary faction in the BTC ecosystem."

Image Source: https://twitter.com/okxweb3/status/1765967704282816873

Text: The birth of the Atomicals protocol was quite dramatic. The founder, Arthur, initially intended to develop a DID project on top of the Ordinals protocol when it was first released. However, during the development process, he found that the Ordinals protocol had many limitations that were not conducive to supporting some of the features he wanted to implement.

Therefore, on May 29, 2023, Arthur posted the first tweet about the concept of the Atomicals protocol on Twitter, and after several months of development, the Atomicals protocol went live on September 17, 2023.

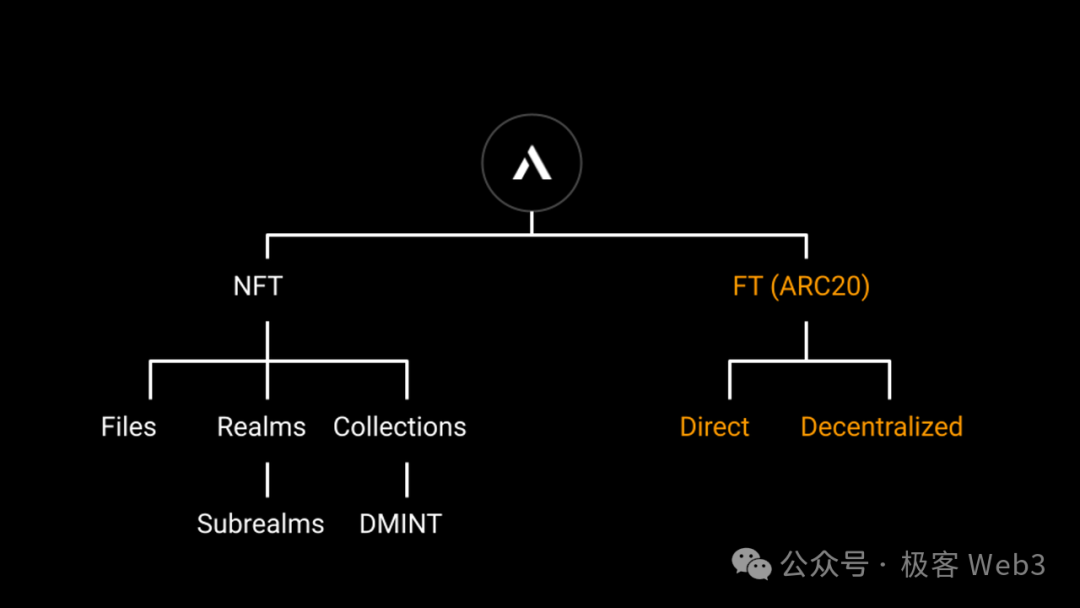

Later, the Atomicals protocol gave rise to four major concepts: Dmint, Bitwork, ARC-20, and RNS, and will also introduce AVM and a splitting plan in the future. In the following sections, we will provide an in-depth interpretation of these typical product innovations to help everyone better understand the innovation of Atomicals.

Image Source: https://twitter.com/atomicalsxyz/status/1761738325176553535

Bitwork: Non-exclusive PoW

The Atomicals protocol incorporates PoW into the token minting process, which is referred to as Bitwork, similar to Bitcoin mining, to limit flow and prevent witching.

Let's first look at the principle of Bitcoin mining: Miners continuously provide different input values to a given algorithm locally, attempting to make the output value meet the requirements of the Bitcoin protocol. A miner may, by stroke of luck, obtain a result that meets the conditions. The corresponding output and input values are then written into a block as a "proof of work" and serve as the chip for obtaining mining rewards. As long as this new block is recognized by the vast majority of nodes in the network, the miner can obtain BTC rewards.

In the Atomicals protocol, you need to go through a similar process to obtain input-output parameters that meet the specified conditions in order to qualify for token minting. Similar to Bitcoin, Atomicals can also dynamically adjust the mining difficulty. For example, the protocol can stipulate in advance:

Miners who want to receive rewards must find a set of parameters. When these parameters are input into the given algorithm, the output value must meet the following condition: the first 4 digits are all 6, and the fifth digit is greater than 10 (in hexadecimal). At this point, the restriction is relatively loose. However, the Atomicals protocol can periodically change the restriction, such as requiring the first 5 digits of the output value to be all 6, which tightens the restriction and increases the mining difficulty for miners.

There is a fundamental difference between Bitwork and Bitcoin mining: Bitcoin mining is exclusive, while Bitwork mining is non-exclusive. For example, if the 99th and 100th blocks appear in the Bitcoin network, different mining pools compete for the right to record the 101st block. Only the 101st block submitted by one mining pool will be recognized by the Bitcoin network, and the blocks submitted by other mining pools will be "invalidated," which is the exclusivity of Bitcoin mining.

Clearly, the harsh exclusivity competition is not conducive to the survival of individual miners. Many small miners will eventually contribute their mining machines to large mining pools, which act as a "whole" that aggregates a large amount of computing power and competes with other mining pools. Undoubtedly, this will lead to a high degree of centralization of computing power within the Bitcoin network, a point that is even explicitly mentioned in the Ethereum whitepaper.

In stark contrast to Bitcoin mining, mining under the Bitwork protocol for ARC-20 is non-exclusive, meaning that there is no strict competition between different miners. As long as the total amount of Atomicals assets to be minted has not exceeded the specified limit, the mining results (token minting declarations) provided by miners through the Bitwork mechanism will all be included in the protocol's historical records.

Let's imagine the following scenario: Suppose a type of ARC-20 asset following the Bitwork protocol for asset issuance begins to be minted, and someone submits a minting request with low gas fees, but many people participate in the asset minting. Gas fees immediately surge, causing the previously submitted low-gas minting request to be stuck and unable to be added to the chain. However, as long as this ARC-20 asset has not been fully minted, when the gas fees drop, this minting request will still be recognized and trigger the minting process.

In summary, Bitwork only considers the remaining mintable amount of the asset and does not consider the order of minting requests, while under the Bitcoin mining protocol, miners who submit blocks late are most likely to be eliminated by other miners.

Undoubtedly, Atomicals lowers the participation threshold for miners/asset minters. Traditional PoW public chains are constrained by the enormous mining difficulty, and the right to mine blocks is basically monopolized by a few major mining pools, with individual miners having a very low probability of successfully mining. The improvement measures of Bitwork greatly weaken the position of centralized mining pools, making it more conducive for individual miners to participate, and the distribution of assets is more fair.

Considering that PoW itself is a fairer asset distribution scheme than PoS and ID0, the Atomicals protocol further enhances the fairness of asset distribution, injecting the value of physical resources and introducing a random luck factor (mining is a stroke of luck). This further promotes the development of the "Fair Launch" concept.

ARC-20: More Like Colored Coins Than Inscriptions

In fact, many people have misconceptions about the ARC-20 concept included in the Atomicals protocol, thinking that it is also a form of inscription protocol. However, in reality, ARC-20 is closer to colored coins. It takes the smallest divisible unit of Bitcoin, sat, as the basic "atom," and the amount of ARC-20 assets bound to each Bitcoin UTXO corresponds to the number of sats, where 1 sat = 1 Token.

Here we will use an ARC-20 called "TEST" as a case study to explain its operation.

First, the token issuer of TEST needs to determine which block of Bitcoin will serve as the "genesis block" for TEST and record initialization information in the transaction script of a Bitcoin UTXO in the genesis block. This initialization information includes the token symbol, total supply, and other details. This process is essentially like coloring, where existing Bitcoin UTXOs' sats are colored to be bound to ARC-20. The balance of sats in a Bitcoin UTXO represents the amount of ARC-20 assets.

The issuer of the TEST token can use the functionality of Taproot locking scripts to set certain conditions. Only those who meet the conditions can transfer a portion of the sats controlled by the locking script of the issuer, which are all colored. By taking a portion of the sats locked by the issuer, it is equivalent to obtaining an equal amount of TEST tokens.

After successfully obtaining TEST tokens, the asset minter can directly transfer these ARC-20 tokens to others. This process is almost indistinguishable from a normal transfer on the Bitcoin chain. It involves splitting the Bitcoin UTXO, transferring a portion or multiple portions to others, where each split Bitcoin UTXO corresponds to a certain amount of sats balance, which in turn corresponds to a certain amount of ARC-20 tokens.

Based on this feature, ARC-20 token transfers do not require inscription-related data for the Transfer instruction, as in the case of BRC-20. This saves on transfer costs and reduces the additional data size generated on the BTC network.

In summary, ARC-20 assets mainly involve three operations: deployment, minting, and transfer:

- When deploying ARC-20, the asset issuer needs to set the token name, total supply, difficulty settings, genesis block, and configure the corresponding Taproot locking script.

- When minting ARC-20, users write the Claim information (data required for minting tokens) into the locking script of the aforementioned UTXO, and then take out the corresponding ARC-20 assets (colored sats).

- When transferring ARC-20, users do not need to deposit any data into BTC, they only need to transfer the aforementioned UTXO to others. The recipient can confirm its association with ARC-20 assets by tracing the Bitcoin UTXO.

Compared to the "one-time seal" emphasized by the RGB protocol, the security of ARC-20 transactions is entirely guaranteed by the BTC mainnet. When tracking historical transaction records and calculating current ARC-20 asset balances, no additional data needs to be read from off-chain storage modules. It only requires verification of the Bitcoin UTXOs associated with ARC-20, which is the biggest difference from the BRC-20 protocol, which often has a strong reliance on off-chain indexers and storage layers.

As for ARC-20, we only need a lightweight indexer (or wallet client) to help us identify which ARC-20 assets have been minted and transferred on the Bitcoin chain.

Of course, the design of one coin per sat has significant drawbacks. Due to a restriction on the Bitcoin mainnet to prevent "dust attacks," a single transfer must transfer at least 546 sats at once, which may be unacceptable for most people. Additionally, since each ARC-20 token must be bound to a sat, the minimum split precision of ARC-20 asset balances is 1 and cannot be subdivided further.

At the same time, it is noted that many people still have a vague understanding of the differences between ARC-20 indexers and BRC-20 indexers. Here is a detailed explanation:

- ARC-20 indexers are more concise and lightweight than BRC-20 indexers. BRC-20 can be likened to a paper check, while ARC-20 can be likened to a hard coin. The BRC-20 standard allows users to fill in any amount of BRC-20 assets on the check, which is why the BRC-20 protocol uses three different index transactions to ensure the accuracy and security of BRC-20 assets. Regardless of how ARC-20 is traded, it is like directly transferring a ready-made coin. Calculating ARC-20 asset balances is much easier than calculating BRC-20 asset balances, and the workload of the ARC-20 indexer is much less than that of the BRC-20 indexer.

- ARC-20 transaction indexing is more convenient for asset consolidation than BRC-20 transaction indexing. BRC-20 asset consolidation involves replacing three $1000-value checks with a new $3000-value check, theoretically destroying the original three checks, but because they have been recorded on the chain, they cannot be directly erased, leading to data pollution. Many times, when withdrawing from an exchange, there are inexplicable inscriptions. On the other hand, ARC-20 asset consolidation involves packaging three coins into one transaction, and often there are inexplicable inscriptions when withdrawing from an exchange, but the ARC-20 transaction indexer does not pollute the data of sats because its workflow is different.

Moving on to Dmint: In the Atomicals protocol, NFT collections are referred to as "containers" and are issued in a decentralized manner using a method called "Dmint." NFT issuance following the Dmint protocol involves four steps: NFT data preparation, container configuration, NFT project verification, and NFT minting.

For NFT project owners, the focus can be on the preparation work before NFT issuance, which involves consolidating all NFT data, configuring Dmint data, and more. Additionally, NFT issuers following the Dmint protocol will aggregate all NFT data to build a Merkle Tree, and the Merkle root of this tree will be published on the chain, while the complete NFT metadata will be stored off-chain.

When a NFT minter selects the NFT to be minted, they will be informed of their off-chain metadata. The minter then presents a Merkle Proof to prove that the off-chain metadata they are aware of is indeed related to the Merkle Tree initially constructed by the issuer, and is part of the NFT data set declared by the issuer.

During the minting of NFTs, the Atomicals protocol provides advanced options for the project's founding team, such as setting mint payment rules and allowing NFT minters to mint limited edition NFTs. This not only requires minting through the Bitwork method mentioned earlier, but also requires the payment of tokens to a specified address to take effect.

Sure, here is the translated text:

It can be said that after the integration of Bitwork, Dmint has introduced a decentralized minting mechanism for NFTs on the Bitcoin chain. At this point, all minters need to continuously participate in the NFT minting process through a "mining" method, similar to a lottery, and it is difficult for script scientists to conduct flood transactions through automated code.

With the combination of Bitwork and the Dmint protocol, both homogeneous tokens and non-homogeneous tokens within the Bitcoin ecosystem now have the foundation for Fair Launch.

Through Dmint, the Atomicals protocol strengthens the security and uniqueness of NFTs, providing flexible management options. Project owners can freely control their NFT collections on the Bitcoin blockchain. This not only opens up customization options for creators to meet diverse creative needs but also provides a convenient on-chain operational solution for the minting, transfer, and updating of digital assets, greatly enhancing the flexibility of static and dynamic digital assets.

In addition, the Bitwork mining mechanism introduced by Dmint provides an equal one-time minting opportunity for everyone, fundamentally eliminating the possibility of script automation minting and market competition related to gas fees.

RNS: Infinite Expansion of Domains

As mentioned earlier, Arthur initially wanted to work on a DID project in the Ordinals ecosystem, which is the RNS - Realm Name System, also known as Realm.

Realm names start with a plus sign (+) and have at least one letter character, for example, +alice and +agent007, both of which are valid DID identifiers. Compared to traditional domain names and ENS, Realm has higher scalability and flexibility while retaining decentralization.

Current domain name services or DID projects have significant limitations, as the provided domain names are mostly used to refer to a single object (such as a website/wallet address), and users cannot expand them further. For example, Alice owns the domain name Alice.com, and the domain's function is limited to representing different websites or personal information by adding different prefixes such as blog.Alice.com. It cannot be continuously expanded to forms such as Alice.com.blog.text, which have more diverse scenarios.

Here, we compare the two different forms of domain names, Alice.com/blog/text and Alice.com.blog.text, in more depth. For example, Alice.com/blog/text1 and Alice.com/blog/text2 refer to opening the first/second page of the blog diary in Alice's room; whereas Alice.com.blog.text1 and Alice.com.blog.text2 can correspond to two different interpretations:

- Opening two different blog notes in two different rooms

- Opening different two pages of the blog diary in Alice's room

We can see that the traditional "/" mode initially limits the operational space very narrowly, while the sub-domain model used by Realm domain names does not have this restriction.

The Realm domain name protocol allows any user to issue sub-domains (SubRealm) under any Realm domain name, managing the domain name ecosystem in a hierarchical manner and tokenizing it. The specific rules are as follows:

- Any Realm or SubRealm can issue SubRealm

- All SubRealms can inherit the same characteristics and issue their SubRealms based on SubRealm

- Everyone is the registrant of the Realm they own, and there is no centralized domain name management organization

In theory, there is no limit to the number of times SubRealm can be expanded, which expands the imaginative space of the Realm domain name system. For example, we can consider the top-level Realm domain name as a community forum, the first-level SubRealm can be various types of posts, and the subsequent second-level SubRealm corresponds to replies to the posts. In this way, the Realm domain name system may bring about a revolution in domain name applications, empowering domain name applications and bringing higher scalability.

AVM: Potential Dark Horse

Since its inception, the Atomicals protocol's ambition has extended beyond asset issuance. After about half a year of development, more and more assets compliant with the Atomicals protocol have emerged, leading to new questions - how to provide richer use cases for assets to enhance their liquidity and expand their functionality.

It is well known that Bitcoin does not support a Turing-complete programming language, making it difficult to build complex DApps on it. Inspired by the BitVM concept and concerns about the development of the Atomicals protocol, Arthur proposed the idea of AVM. Although the specific details of AVM have not been disclosed, the market has high expectations for it.

According to Arthur, AVM is mainly designed to support the implementation of complex logic in the Bitcoin network, such as solving the problem of the inability to split ARC-20 "one coin per sat." In addition, most of the current Bitcoin scaling solutions on the market have various problems. We look forward to the release of AVM bringing more vitality to the BTC ecosystem.

According to Arthur, in an optimistic scenario, the first beta version of AVM could be released before the Bitcoin halving, and we will further analyze it at that time.

Summary of the Atomicals Protocol Ecosystem: Opportunities Are Emerging

Whether it is the inscription protocols such as BRC-20 or the Atomicals ecosystem, after experiencing several waves of highs, they have entered a period of calm. However, we have found that asset issuance on BTC is very different from asset issuance on Ethereum. These two ecosystems are more about the difference between centralization and decentralization.

The existing assets on BTC have popularized the concept of "Fair Launch." Through Bitwork, Dmint, no pre-mining, and no allocation, the Atomicals protocol has increased market users' trust in project assets and reduced direct manipulation of assets by project owners. To some extent, this is the love-hate relationship between centralization and decentralization.

Centralized projects are more efficient in the early stages of development, with more responsive reactions, and if managed properly, they can easily succeed. On the other hand, decentralized projects, in pursuit of higher fairness and decentralization, require more spontaneous action from the community in project promotion and marketing, and may face significant resistance in the early stages of development. However, once they overcome the difficult period, they quickly leave centralized projects behind.

The Atomicals ecosystem is no exception. The following image shows the current Atomicals ecosystem projects that are already online or under development. Even though the entire BTC asset market is relatively quiet at the moment, the development of the Atomicals protocol is still in its early stages, and many projects are actively choosing to integrate into the Atomicals ecosystem. This is due to the strong confidence of community members in the Atomicals ecosystem.

The source of this strong confidence comes from the "Fair Launch" trend brought about by the Ordinals protocol and the BRC-20 protocol, as well as the beautiful vision brought about by this wild decentralized experiment.

We believe that with the release of AVM in the future, the Atomicals protocol will be able to achieve programmability on the Bitcoin Layer1, develop more applications based on AVM, and write a new chapter for the entire Bitcoin ecosystem.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。