As we all know, the Ethereum ERC20 protocol is the largest coin issuance protocol in the cryptocurrency circle, and it has achieved the following merits:

First, it has achieved the Ethereum public chain, making Ethereum's EVM smart contract platform the most mainstream development protocol in the entire cryptocurrency circle.

Second, it has achieved DeFi. The emergence of ERC20 tokens allows project parties to use decentralized tokens to carry out decentralized financial business.

Third, it has achieved decentralized financing and entrepreneurship, in simple terms, it has achieved ICO, allowing investors and entrepreneurs to invest and finance more directly and efficiently.

Looking at the narratives of all new public chains at present, they are basically replicating Ethereum's successful path in order to support their own ERC20. So, how can one create their own platform's ERC20? There are two points:

The market value of the new public chain must be large enough, so Solana has been aggressively promoted, even surpassing the market value of ETH by 20% at one point, in order to solidify its foundation.

The issuance protocol must be innovative and not simply a copy of ERC20. It needs to gain recognition from cryptocurrency users and communities.

Comparing the path of ERC20 achievements and the breakthrough path of new issuance protocols, the most likely protocol to surpass ERC20 issuance protocol at present is Runes. The reasons are as follows:

BTC's market value accounts for 50% of the cryptocurrency market value, making its foundation the most solid, even surpassing Ethereum's foundation by far.

When BRC20 was launched, the logic of fair launch was innovative enough to gain recognition from the community users.

The Runes protocol is derived from the fair launch of BRC20, compatible with the advantages of BRC20 and ERC20, and is also an asset issuance protocol on the BTC mainnet.

Basic Features of Runes

Utilize the op_return carried by UTXO to describe the basic operations of tokens such as deployment, minting, and transfer, as well as the token information carried by them.

Token issuers can customize a fair launch similar to BRC20, or customize a team-institution fundraising process similar to ERC20. It also supports a combination of both, with a portion used for fair launch and another portion reserved for the team.

Runes VS BRC20

More flexible: BRC20 can only have a fair launch, which is not conducive to team fundraising and financing, while Runes can.

More convenient: When transferring BRC20, it is necessary to first inscribe and send a transaction, and then transfer, requiring a heavy external retriever to trace the history. In contrast, Runes, based on UTXO op_return, carries operation codes and information in each UTXO, eliminating the need for additional inscribed transactions. It only requires a lightweight retriever, which does not cause a large-scale dust attack of small UTXOs on the BTC network, and also saves users transaction fee costs.

Can be concurrent: For example, a transaction can carry an op_return plus M (M is an integer, such as 1000) addresses, allowing a single transaction to be evenly sent to M users. This is somewhat similar to the basic function of sending red envelopes on WeChat.

Runes VS ERC20

ERC20's foundation is ETH, while Runes' foundation is BTC, making Runes' foundation more solid.

Since 2016, ERC20 has already formed many closed-loop businesses and a large ecosystem, while Runes has not officially started yet. ERC20 has the advantage of being first and economies of scale.

Runes is more innovative. There is a saying in the cryptocurrency circle that "don't speculate on old, speculate on new," and Runes is more fashionable, with greater room for growth.

Runes is compatible with the fair launch of BRC20, which is the most important asset narrative in this round of the cryptocurrency cycle.

ERC20 has the Turing-complete EVM mainnet to support its business closed-loop, but Runes can use BTC Layer2 to complete the business logic brought by Ethereum's Turing completeness. It is understood that the leading BTC L2 project, BEVM, announced early on that it would integrate the Runes protocol at the first opportunity, allowing users to cross Runes protocol assets to the second layer network for commercial applications.

Some Details of the Runes Issuance Protocol

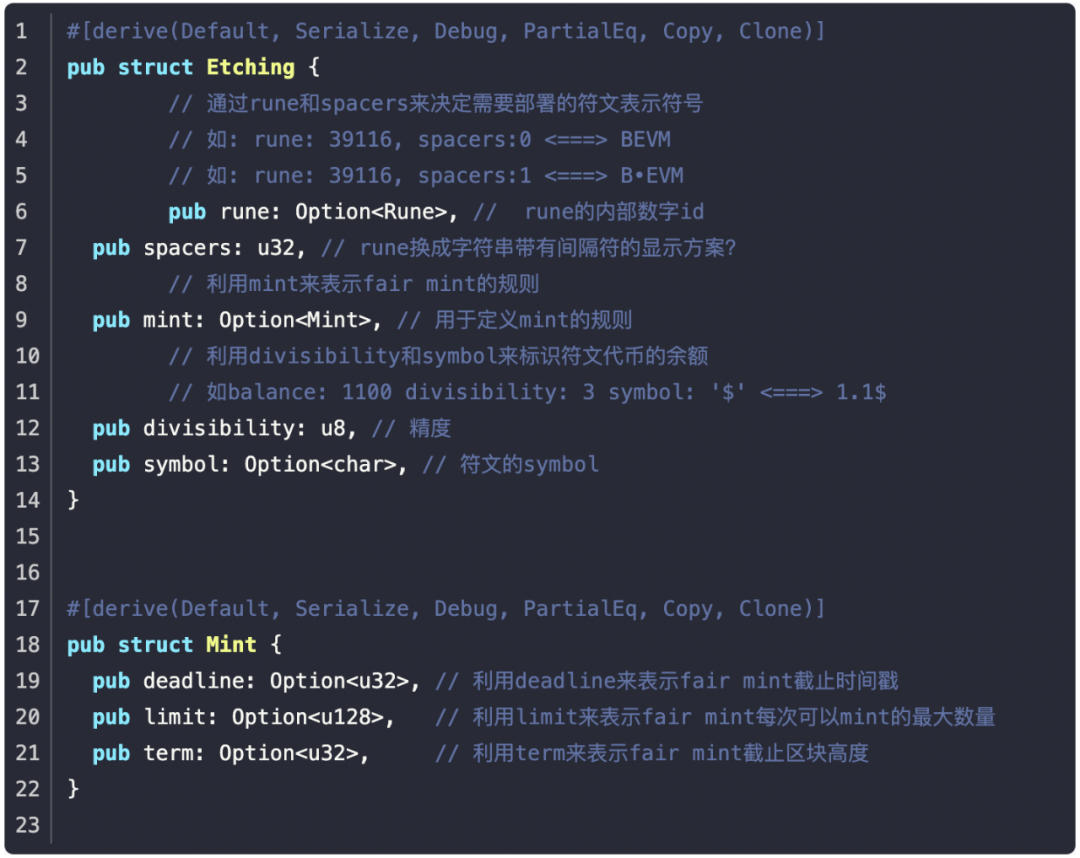

Deploy: Achieve the deployment of runes by constructing a transaction with op_return containing the following information.

In the Deploy transaction, the following information can be simultaneously carried in op_return to achieve deployment while the project party reserves tokens.

There are 3 ways to start the deployment of runes:

When term is set to 0 and Edict is included, it represents that all the deployed runes are in the hands of the project party.

When term is not 0 and Edict is not included, it represents that the project party does not reserve runes, and fair minting can be done when both the deadline and term constraints are met.

When term is not 0 and Edict is included, it represents that the project party reserves runes, and fair minting can be done when both the deadline and term constraints are met.

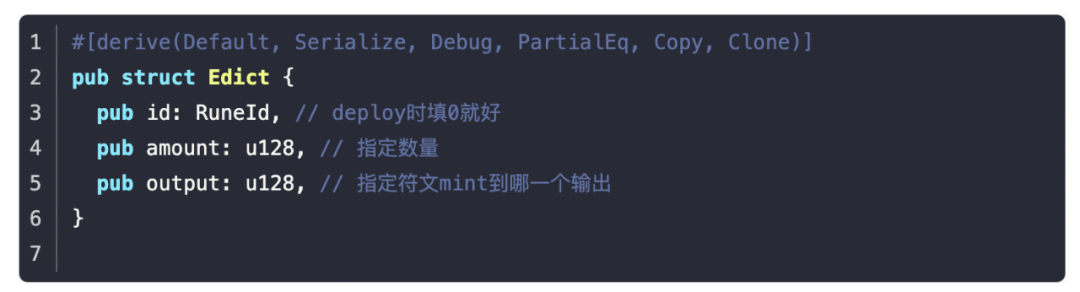

Mint: To achieve minting, only the following information needs to be carried in op_return, and the quantity of minting has already been limited during deployment.

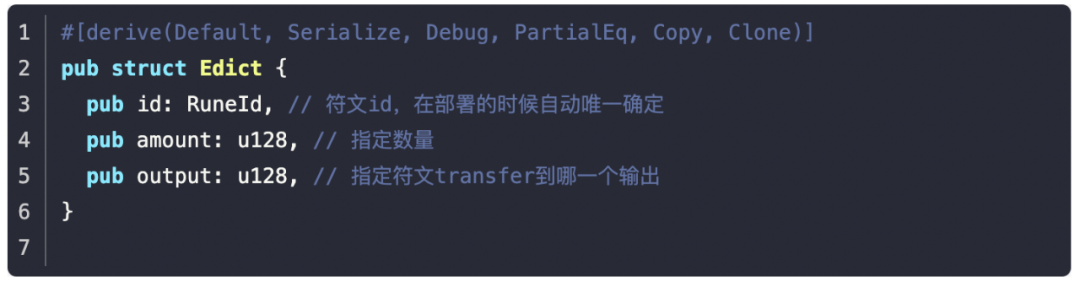

Transfer: Utilize UTXO with runes and then use op_return to carry Edict information to specify the transfer to which UTXO.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。