Author: Mary Liu, BitpushNews

On Thursday, the cryptocurrency market rebounded slightly. Bitcoin climbed from an intraday low of $68,855 in the early morning, reaching a high of $71,635 in the afternoon before stabilizing around $70,000 before the major options expiration on Friday.

As for altcoins, Dogecoin (DOGE) surged nearly 20%, currently trading above $0.22 for the first time since December 14, 2021. Bitcoin Cash (BCH) rose by 13% ahead of the expected halving event on April 4.

In the stock market, the S&P 500 index rose at the close, with investors focusing on tomorrow's Personal Consumption Expenditures (PCE) report. Although inflation is expected to rise slightly, the impact on the stock market will be delayed due to the closure of the U.S. market for Good Friday. At the close, the S&P index and Dow Jones index rose by 0.11% and 0.12% respectively, while the Nasdaq fell by 0.12%.

$15 Billion Options Expiration Imminent

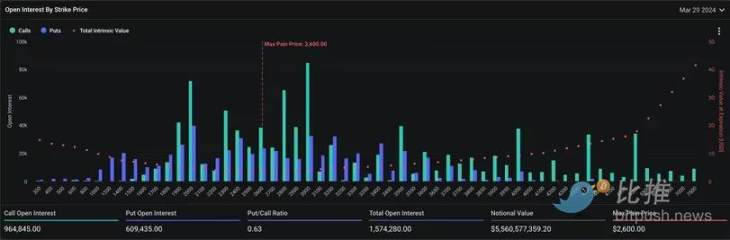

At 08:00 UTC on Friday, cryptocurrency options exchange Deribit will see the expiration and settlement of quarterly contracts worth $15.2 billion, with $9.5 billion in Bitcoin options, accounting for 62% of the total open interest, and the rest in Ethereum options.

Deribit data shows that this $15 billion expiration is the largest in the exchange's history, and it will eliminate 40% and 43% of the total open interest for Bitcoin and Ethereum options, respectively.

Open interest refers to the dollar value of active contracts at a given time. On Deribit, one options contract represents 1 BTC and 1 ETH. The exchange holds over 85% of the global cryptocurrency options market share. A call option is a financial contract that gives the buyer the right, but not the obligation, to buy the underlying asset at a predetermined price in the future. A put option gives the right to sell.

Market May Experience Volatility

Luuk Strijers, Chief Commercial Officer of Deribit, stated that a large number of options will expire in-the-money (ITM), which may bring upward pressure or volatility to the market.

In-the-money call options have an exercise price lower than the current market rate of the underlying asset. At expiration, ITM call options give the buyer the right to buy 1 BTC at the exercise price (lower than the spot market price), resulting in profit. At expiration, in-the-money put options have an exercise price higher than the current market rate of the underlying asset.

Based on a market price of around $70,000, approximately $3.9 billion worth of Bitcoin options will expire in-the-money, accounting for 41% of the $9.5 billion total open interest for the quarter. Similarly, 15% of the $5.7 billion total open interest for ETH will expire in-the-money.

Strijers explained, "These levels are higher than usual, which can also be seen from the lower maximum pain levels, of course due to the recent price increase. Higher levels of ITM expiration may lead to potential upward pressure or volatility."

The maximum pain points for BTC and ETH quarterly expirations are $50,000 and $2,600, respectively. Maximum pain is where option buyers lose the most money. The theory suggests that option sellers, typically well-capitalized institutions or traders, aim to keep the price near the maximum pain point to inflict the most loss on option buyers.

During the last bull market, Bitcoin and Ethereum consistently pulled back towards their respective maximum pain points, only to resume their upward trend after expiration.

Strijers suggested that similar dynamics may be at play, stating, "With the expiration eliminating lower maximum pain points, the market may face upward pressure."

Increased Hedging by Traders or Market Makers

David Brickell, Head of International Distribution at Toronto-based cryptocurrency platform FRNT Financial, stated that hedging activities by traders or market makers could exacerbate volatility.

Brickell mentioned in a report, "However, the biggest impact comes from market makers' gamma positions. Market makers are short about $50 million of gamma, with most concentrated around a strike price of around $70,000. As the expiration date approaches, the gamma position will become larger, and forced hedging will intensify volatility around $70,000, causing some sharp movements on both sides at that level."

Gamma measures the change in Delta, which represents the sensitivity of options to changes in the price of the underlying asset. In other words, Gamma shows the amount of Delta hedging market makers need to maintain a neutral position in response to price changes. Market makers must maintain a neutral position in the market while providing liquidity in the order book and profiting from the bid-ask spread.

When market makers are short Gamma or hold short option positions, they buy high and sell low to hedge their books, causing market fluctuations.

Key Support at $69,000

Some traders warned that if Bitcoin falls below the $69,000 level in the coming days, the entire market will experience further pullback.

Alex Kuptsikevich, Senior Market Analyst at FxPro, stated in a report, "Traders' short-term focus will be on whether Bitcoin can retest the intraday low near $69,500 on Tuesday. Breaking this level may indicate a more sustained correction."

Cryptocurrency analyst Bruce Powers believes that over the past four days, Bitcoin has been facing resistance near the 78.6% Fibonacci retracement level, with resistance at 71,790 points. The past few days of trading have remained above the 20-day moving average. The uptrend remains intact, but the bearish divergence in the RSI suggests that the pullback may continue. A decisive rebound above this week's high of 71,290 points will trigger a bullish continuation of the uptrend, with an initial target around 77,660 points, determined by two Fibonacci levels.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。