April will be an important month for cryptocurrencies.

Written by: The DeFi Investor

Translated by: TechFlow

The content of today's article is as follows:

Major cryptocurrency driving factors in April

On-chain Alpha this week

Latest developments in DeFi

Major Cryptocurrency Driving Factors in April

April will be an important month for cryptocurrencies.

The highly anticipated Bitcoin halving is about to happen.

Not only that, several well-known projects are set to release their tokens or undergo major upgrades.

Here are four important cryptocurrency events to watch for next month:

1. Bitcoin Halving

The next Bitcoin halving is expected to occur in about 22 days.

Once implemented, it will reduce the circulating supply of new bitcoins by 50%.

However, it is worth noting that the current inflation rate of Bitcoin is already very low (less than 2% per year).

Therefore, from a fundamental perspective, I don't think the halving is a big deal. But from a psychological perspective, it may be different.

Many people know that historically, Bitcoin has performed very well in the months following each halving event. Therefore, they are likely to quickly buy cryptocurrencies again, hoping that history will repeat itself.

In addition, the Hong Kong Securities and Futures Commission is expected to approve the first spot Bitcoin ETF in Hong Kong in the second quarter.

All events are paving the way for Bitcoin.

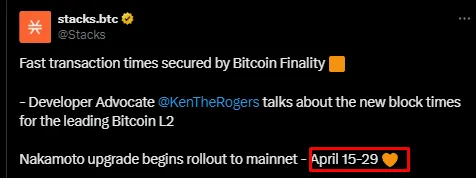

2. Stacks Nakamoto Upgrade

Stacks is a Bitcoin layer 2 solution that makes smart contracts and dApps more powerful.

The Nakamoto upgrade for Stacks has been in development for a long time and seems to be finally launching on the mainnet next month.

The Nakamoto upgrade will:

Allow the use of sBTC (an asset pegged to BTC) in DeFi on Stacks

Reduce network block time from 10 minutes to seconds

Increase the scalability of the Stack L2

This upgrade may trigger a new wave of Bitcoin L2 enthusiasm.

The Stacks token $STX can also be seen as a beta version of Bitcoin.

Stacks is the most popular project built on top of Bitcoin to date.

3. Solana Airdrop Season

Last year, Jito's announcement of a large-scale airdrop revived the Solana ecosystem. In April, several other well-known Solana dApps will launch tokens:

All of these protocols will conduct airdrops.

This list only includes officially confirmed airdrops, so there may actually be some unannounced ones.

Large-scale airdrops can have a huge positive impact on the ecosystem as they inject more liquidity into it. For example, here is what happened to $SOL after the launch of $JTO in November 2023:

Considering that the market value of SOL has now exceeded 80 billion US dollars, I think it is unrealistic to expect SOL to double or triple in the short term.

However, Solana is likely to benefit greatly from these ecosystem airdrops, just as it has in the past.

4. Eigenlayer Mainnet Launch + Potential Token Listing

The Eigenlayer token is likely to be listed in late April or early May.

There are several reasons for this:

The Eigenlayer mainnet is confirmed to launch in the coming weeks (this may be the best time for Eigenlayer to also launch its token)

Many early investors have indicated that the token will be released in late April or early May

Additionally, April may also be the month when the first Eigenlayer Active Verification Service (AVS) goes live. Altlayer is a popular example of an AVS, which is a decentralized protocol for Rollup.

The protocol for borrowing security from Ethereum through Eigenlayer is called AVS (which can be an oracle, sidechain, L2, etc.)

Many AVS projects may conduct airdrops for Eigenlayer users, just as Altlayer did when it launched its token a few months ago.

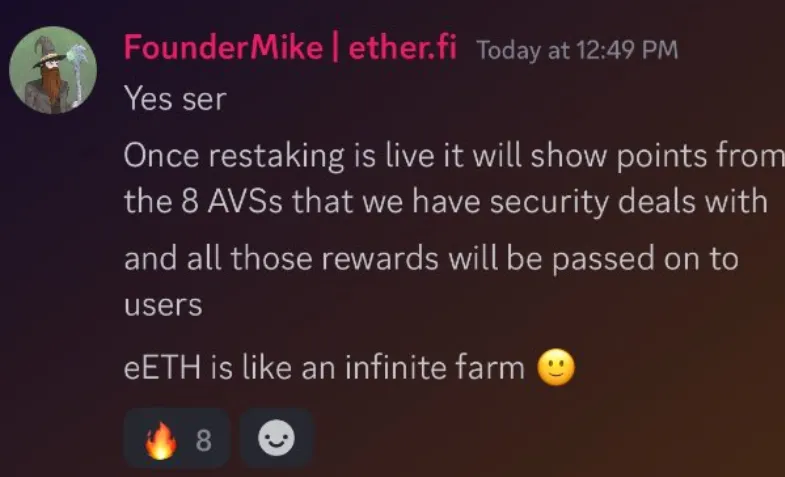

According to the Etherfi team, 8 AVS will soon start distributing points or token rewards to EtherFi's eETH liquidity re-staking token holders.

On-chain Alpha

In the past 6 months, 86 billion US dollars of institutional funds have flowed into Bitcoin.

As shown in the above figure, since the launch of the spot Bitcoin ETF, the inflow of institutional funds into Bitcoin has sharply increased.

This makes me wonder what would happen to Ethereum's institutional adoption later this year if a spot Ethereum ETF is also approved.

It is becoming increasingly clear that institutions are beginning to realize the importance of cryptocurrencies.

Latest Developments in DeFi

CTFC has once again confirmed ETH as a commodity, increasing the likelihood of approving a spot Ethereum ETF

Ethena has announced that the $ENA token will be launched on April 2nd, with 5% of the $ENA supply being airdropped to early adopters

Optimism has allocated $3 billion in grants in Optimism Collective & Superchain, as reported by Cointelegraph

NEAR Protocol has launched Chain Signatures, allowing NEAR accounts to sign transactions for any blockchain, aiming to improve cross-chain user experience

Circle has released its cross-chain transfer protocol on Solana. Now, USDC holders can transfer USDC on 8 chains with 1:1 capital efficiency

Zero1 has launched Keymaker, a market related to decentralized artificial intelligence. Keymaker aims to become the largest decentralized AI ecosystem

Ankr has launched Neura, a blockchain built for artificial intelligence. Neura will utilize Bitcoin's security through Babylon to protect its network

Polygon has launched a dApp Launchpad, a gateway for developers to enter the Polygon ecosystem. The goal of dApp Launchpad is to improve the developer experience on Polygon

Angle Protocol has launched USDA, a yield-bearing and RWA-backed stablecoin. USDA will have several anti-decoupling mechanisms and the same liquidity as USDC

PancakeSwap has announced the launch of MancakeSwap, the first affiliated DEX on PancakeSwap's Mantle network. Mancake will pay 60% of its revenue to Pancakeswap

Liquity has showcased the key features of Liquity V2, including user-set interest rates, aimed at creating an efficient market between borrowers and stablecoin holders

EtherFi has released Points Season 2. The second quarter allocation is 5% of the total ETHFI supply and will end on June 30th

Munchables, a popular protocol on Blast L2, has experienced a $63 million hack, as reported by The Defiant. Fortunately, the hacker has returned the funds

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。