Original Title: Ethereum and Its "Killers"

Original Author: Lorraine

TL;DR

After a round of bear market cleansing, the spirits of the "Ethereum killers" are not as good as before, but the retained potential varies.

Solana, as the only public chain in the time comparison group whose market value has not decreased but increased, has accumulated and developed in the trough, completing a "rebirth by fire."

Star public chains may not aim to become the second Ethereum; they just want to be the first in their own race.

Contents:

The Birth of Ethereum (ETH)

Attracting "Killers," What's Wrong with Ethereum?

"Ethereum Killers" widely favored in 2021

In the bear market, Solana's "killer move" is what?

Brief review of the rise and fall of other "Ethereum killers"

Conclusion

From the bear market of 2022 to the beginning of the bull market in 2024, the crypto world has seen several waves of upward trends, large and small.

In addition to the most prominent figure, "Bitcoin," breaking to a new high of $73,750, the native token "SOL" of Solana, which was once called the "Ethereum killer" in the last round, quietly surged from $9 at the bottom to $208 in a year and three months, becoming the fastest rising star in market value.

The boomerang of the "Ethereum killer" once again hit the head of the crypto world.

This also makes me wonder, what has become of the many chains that used to claim to overthrow Ethereum?

1. The Birth of Ethereum (ETH)

Let's start with the central target of the sniper.

The concept of the Ethereum network can be traced back to the end of 2013.

Founder Vitalik Buterin proposed in the white paper a "decentralized platform based on blockchain technology that allows developers to create and deploy smart contracts and decentralized applications (DApps)."

In July 2014, V God and his team began the pre-sale of the native cryptocurrency of the Ethereum network—Ethereum (ETH), which lasted for 42 days and raised about $18 million for the development and maintenance of the network.

In August 2015, the Ethereum mainnet was launched, mainly for developers to develop and test smart contracts. The opening price of ETH that year was about $0.3, and shortly after, it gradually climbed to the second position in market value and has remained stable to this day.

By 2017, Initial Coin Offering (ICO) had become a popular way for many blockchain projects and startups to raise funds.

Many projects chose to conduct ICOs on the Ethereum platform, and Ethereum's market value reached new highs.

The choice of the Ethereum network as an ICO platform can mainly be attributed to several differentiated features:

1. Smart contract functionality & ERC-20 standard:

a. One of the core features of the Ethereum network is its support for smart contracts. Smart contracts are automatically executed protocols based on preset conditions, allowing developers to create complex applications on Ethereum with fast transaction confirmation times and lower transaction fees (compared to Bitcoin), such as on-chain financial trading (DeFi) platforms, on-chain games (GameFi), voting, and more.

b. Among them, the innovative "ERC-20" is a smart contract standard that provides unified rules for token creation and issuance.

Tokens following the ERC-20 standard can be integrated with Ethereum wallets and exchanges without additional development, making it easy for project parties to issue their own tokens on Ethereum and providing important convenience for fundraising in ICOs.

2. Mature ecosystem & active community:

a. The Ethereum network at that time had developed a relatively mature ecosystem to bridge more developers, such as the Solidity smart contract programming language and the Metamask wallet that provides convenient access. These have provided the necessary infrastructure and services for the deployment and issuance of new project tokens, greatly reducing the entry barriers for project parties.

b. Ethereum also has an active community, especially developers and technical experts, who spontaneously solve technical problems for many projects and provide innovative ideas, driving project development.

Having the support of a high-quality community and practical developer technical support is crucial for the success of new projects.

3. Market recognition & liquidity:

a. As the second highest market value cryptocurrency at the time, Ethereum had gained market recognition, making it easier for projects conducting ICOs on Ethereum to attract investors' attention and trust.

b. As the native token of the Ethereum network, ETH had a high demand for both project developers' deployment and user transactions. High liquidity allows investors to easily enter and exit the market, providing good liquidity for ICO projects.

In summary, the frenzy of conducting ICOs on the Ethereum platform also brought a large demand for ETH itself from project parties and investors, driving the price of ETH to new highs by the end of 2017, reaching $1400.

2. Attracting "Killers," What's Wrong with Ethereum?

All the way, it seems that Ethereum has been the chosen one in the crypto world since its birth.

It continuously innovates and improves the blockchain world, and the introduction of smart contract protocols has opened up an imagination without a ceiling for the cryptocurrency industry. It has also nurtured the popularity and prosperity of benchmark events that followed, such as the "DeFi Summer" in 2020 and the "NFT boom" in 2021, driving the practical application and development of blockchain technology and attracting more and more investors and developers from around the world to the crypto world.

"A tree that stands out in the forest will be blown down by the wind."

When something is projected with too much expectation and praise, there will inevitably be opposing voices.

And Ethereum does indeed have some major issues that are criticized by users.

For ease of understanding, we can use "obstacles that may be encountered while swimming in a pool" as an analogy for "problems that may be encountered when trading on the Ethereum network":

For example, the capacity of a swimming pool is limited, and an increasing number of people entering will cause the pool to become overcrowded, making it impossible for people to swim smoothly and quickly.

1. Scalability issues:

With the increasing number of users and applications, the network becomes congested, leading to longer block times and slower transaction speeds. When the high demand for transactions cannot be met, it will have a negative impact on many projects, especially in areas that require timeliness, such as games (GameFi), on-chain financial trading (DeFi), and NFT trading.

(Image source: Nervos column article)

When the summer peak season arrives, this swimming pool has to accommodate a larger number of users than before. To swim out of your own lane in this "dumpling-making" situation, you need to use "cash power" to summon staff, allocate some users who entered at a "early bird price" or with "discount coupons" to wait in line, and wait for the "cash players" in front to finish swimming and return to the pool at a slow pace.

2. Network congestion and high Gas fees:

During certain periods (such as rushing to mint NFTs or quickly trading airdropped tokens), it can cause severe congestion on the Ethereum network, leading to delayed or unsuccessful transactions, greatly affecting the user experience.

To quickly resolve network congestion, users need to pay higher transaction fees (Gas fees).

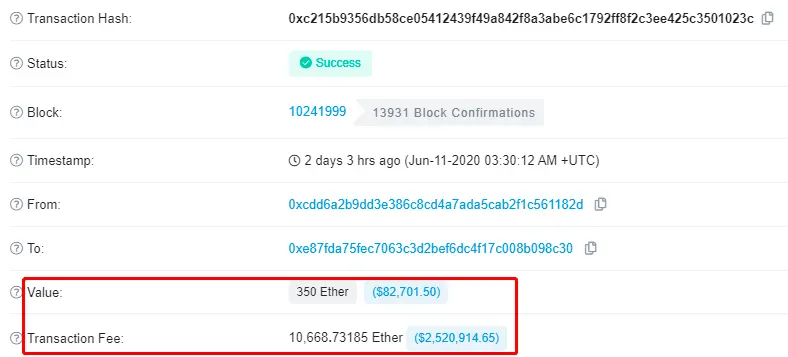

(In 2019, a transaction with a sky-high miner fee: a fee of 10,668.73185 ETH, while the transfer amount was only 350 ETH, making the fee 3% of the amount.)

The swimming pool has lockers for storing personal items. Although most of the time it's fine to open and take items, there may be a stroke of bad luck when you find that your valuable items in the locker have been stolen.

Or perhaps you have carefully placed your items on the shore within your sight, only to find upon returning that the clothes are still there, but the valuable items have been replaced with worthless ones.

You ask the swimming pool for help to check the surveillance footage, only to see the thief leaving with the stolen goods, opening Doraemon's "Anywhere Door," and heading to an untraceable parallel world.

You have no recourse to complain to the swimming pool because you signed a contract upon entry, holding yourself fully responsible for your belongings.

3. Security issues:

Security can be said to be a red line in the blockchain world. With the development of blockchain technology, a variety of unpredictable hacking techniques have emerged, and the Ethereum network has also experienced several significant security attacks in its history.

For example, in 2016, The DAO crowdfunding project was attacked, and the attacker exploited a recursive call vulnerability in the smart contract to steal about 3.5 million ETH (valued at about $60 million at the time) from the fund pool. This attack directly led to a split in the Ethereum community and ultimately resulted in a hard fork of Ethereum (splitting into ETH and ETC). This exposed potential security risks in smart contracts and the entire network, as well as hidden unknown security vulnerabilities.

Of course, the probability of encountering the problems mentioned while swimming in a pool is extremely low; however, the occurrence of the above transaction issues on the Ethereum network is indeed more frequent.

In summary, small transactions on the Ethereum network have become uneconomical, hindering widespread adoption of Ethereum, especially for applications that require frequent operations and real-time transactions.

It is for this reason that many project parties have found new opportunities in these poor user experiences, seizing the opportunity to develop their targeted solutions and alternative options, and launching their own public chains to capture the traffic that Ethereum cannot reach.

3. "Ethereum killers" widely favored in 2021

In order to make a splash in the attention-costly cryptocurrency world, many media outlets use the gimmick of "Ethereum killers" to attract attention when writing promotional articles for many star public chains.

I came across an article on "forkast" at the end of 2021, titled "The top 5 'Ethereum killers' of 2021," which listed the following 5 "Ethereum killers":

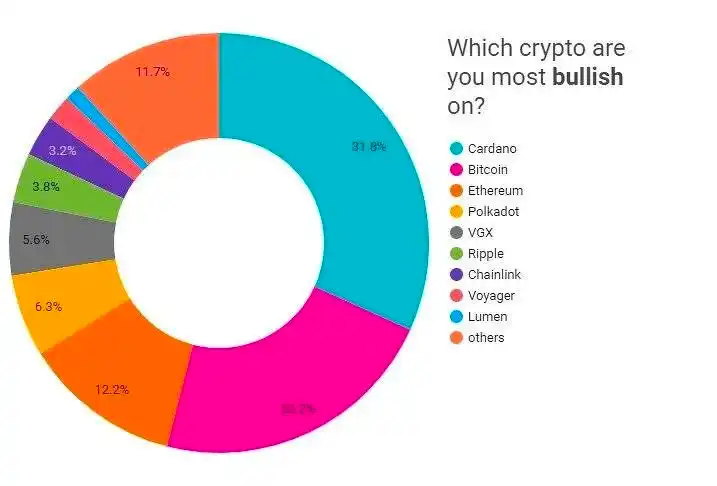

Cardano (ADA), Avalanche (AVAX), BNB Chain (BNB), Solana (SOL), Polkadot (DOT).

The author is LACHLAN KELLER, an Australian journalist who follows the crypto industry. Although one person's opinion is not enough to represent everyone's views, it can indirectly reflect the potential targets outside of ETH that were widely favored at the end of 2021.

By observing the five phenomenon-level "Ethereum killer" public chains mentioned in this article, we can see their changes over the past two years. (The following rankings are not in any particular order)

Price trends are the best portrayal of a target's fundamentals

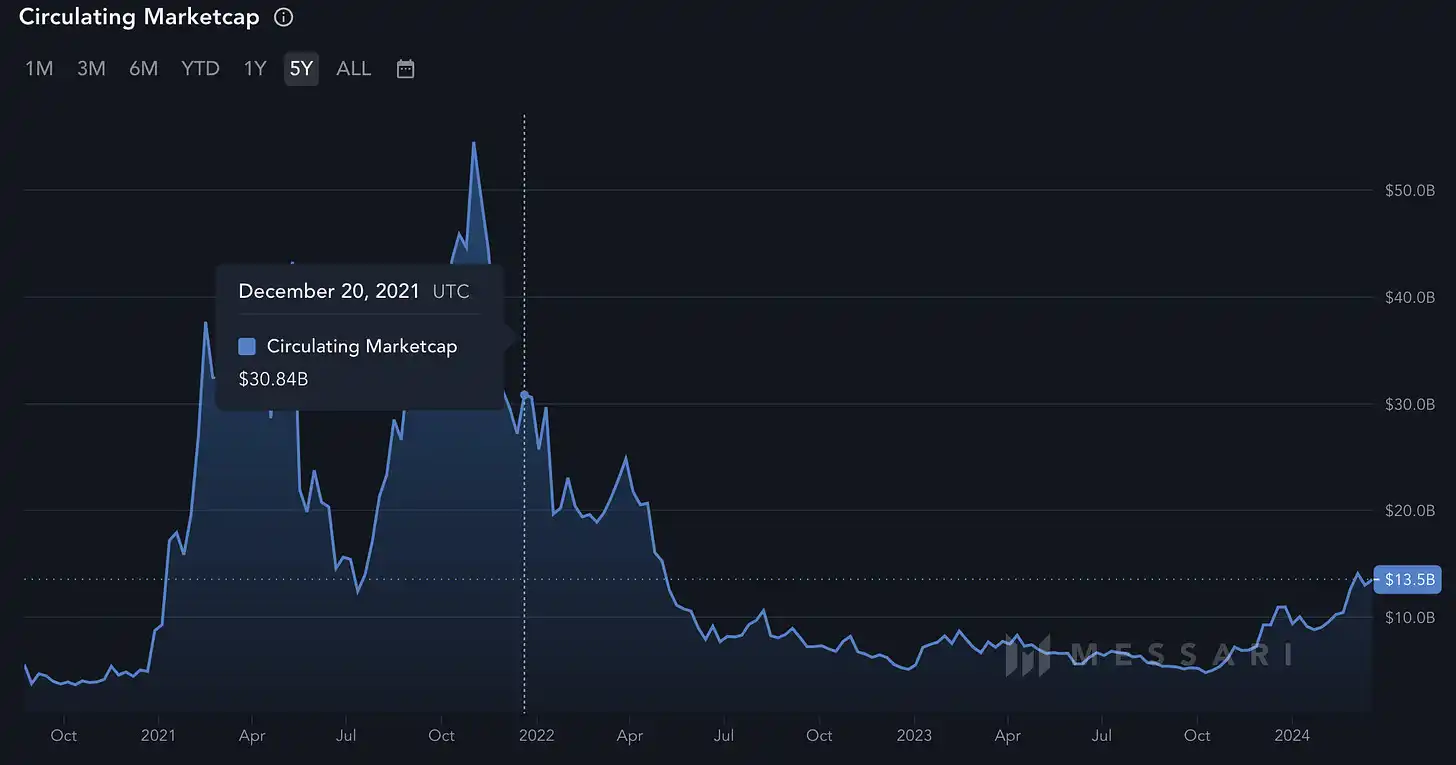

*Data source: Messari, recording dates are December 20, 2021, and March 24, 2024

From the table, it can be seen that after a round of bear market, the prices of all tokens have declined.

Among them, BNB has the smallest decline, and after a recent bull market correction, it has basically remained at the same price as before, gradually shortening the gap from the all-time high (ATH) of $690 in 2021.

Next is SOL.

Although the current recorded token price has slightly declined from before, in mid-March, Solana's on-chain witnessed a frenzy of meme coin pre-sales, pushing the token price to a high of $208, a slight increase from the recorded data at the end of 2021.

More notably, SOL is the only token among these five "Ethereum killers" that has increased in market value, with an increase of +31.85%. At one point, its market value even surpassed BNB, ranking fourth.

The other three tokens (ADA, AVAX, DOT) have all experienced declines of over 50%, with Polkadot's native token DOT experiencing a decline of over 71%.

When Lachlan wrote the article in 2021, it was a year of great prosperity in the cryptocurrency market, with Bitcoin reaching a new high of $69,000, Coinbase listing on Nasdaq, the U.S. Securities and Exchange Commission (SEC) approving the first Bitcoin futures ETF, and the rapid popularity of NFTs and the concept of the metaverse bringing unlimited increments…

But with the cyclical fluctuations in the industry and the impact of the global pandemic, U.S. interest rate hikes, and the Luna black swan event, a large amount of funds accelerated their exit from the crypto industry, and the crypto world entered a bear market, with the targets that were widely favored at the time experiencing comprehensive and deep retracements.

In such a market full of randomness and volatility, fluctuations are normal.

But how can one navigate the ups and downs of the market and still elegantly reach the shore and rush to the next sea area, rather than being washed away by the sea, with little left of oneself?

Perhaps we can glean some insights from the performance of these "killers."

4. In the bear market, Solana's "killer move" is what?

Let's start by briefly introducing various information about Solana:

Founder's background: Founder Anatoly Yakovenko previously served as a core engineer at Qualcomm in the United States, with extensive experience in performance optimization.

Project background: Initially intended to create an order book trading platform on the blockchain, but found that Ethereum could not handle large-scale on-chain transactions. In early 2018, Anatoly decided to build a smart contract platform with Raj Gokal.

Fundraising and project partners: According to Crunchbase statistics, Solana has completed 13 rounds of fundraising, raising approximately $320 million. The largest single fundraising was led by Andreessen Horowitz (a16z), raising $314 million in June 2021. Other rounds of fundraising received significant support from Multicoin Capital, Jump Crypto, and Alameda Research.

Differentiating features: A public chain's proudest performance label is often prominently displayed on the official website. The homepage features a statement: "Powerful for developers. Fast for everyone."

It is clear from this official slogan that Solana is very confident in its underlying technology and has a relatively simple and pure vision. It primarily targets two groups: developers who can innovate on the chain, and users who experience fast on-chain transactions.

Keyword 1: Communities of Millions

- Over 20 million active addresses

- Over 200 million NFTs minted on-chain

- 20,000 participants in Solana Hacker House

- 48,000 developers participated in project creation during hackathons

Keyword 2: Mass Adoption

- "Economic" average transaction cost of 0.00064 (in contrast to Ethereum's gas fees, which can be as high as tens or hundreds of dollars)

- "Fast" block time of 4 seconds, processing approximately 3,170 transactions per second (compared to Ethereum's block time of approximately 15 seconds, processing 25 transactions per second)

- "Decentralized" validated by 1,717 independent nodes to ensure data security and resistance to censorship (compared to Ethereum's current 8,188 nodes)

- "Energy-efficient" pioneering a combination of PoS (Proof of Stake) and PoH (Proof of History) to improve transaction speed and significantly save energy (Ethereum currently implements a single PoS consensus mechanism)

Keyword 3: Growth in All Aspects

- "Payments" Solana Pay protocol integrated with Visa and Shopify, allowing users to make real-time payments using SOL or any other Solana-supported tokens with extremely low fees and without involving banks or payment processors.

- "Gaming" providing support for on-chain multiplayer online games with fast response and low latency, such as Star Atlas and Aurory.

- "NFT" using state compression technology to reduce the cost of minting NFTs to $0.00011, enabling projects to issue collections on-chain at a large scale at a low cost.

- "DeFi" with a total locked value (TVL) on Solana's chain exceeding $11 billion and an average 24-hour trading volume of over 400 million transactions, making it capable of handling various DeFi applications with super-fast, simple, and cost-effective operations.

In summary: As the top "Ethereum killer" in the reserve team, Solana's killer move is "I have what you have, and I have what you don't have." Similar to Ethereum, Solana understands that robust infrastructure technology is the cornerstone of a public chain's prosperity. Therefore, it focuses on creating a positive and active developer ecosystem, hosting hackathons to attract talented developers, and actively attracting investors to support various high-quality young entrepreneurial teams on its chain.

To maximize performance, it has pioneered a consensus mechanism combining PoS and PoH to improve scalability, handle high throughput, reduce transaction latency, and lower transaction costs, thereby optimizing the user experience.

Of course, everything has its two sides. Solana has experienced multiple large-scale outages and security incidents. Especially in 2022, the bankruptcy of FTX tarnished the reputation of founder SBF (an early supporter and active investor in Solana), leading to a sharp decline in Solana's token price to single digits. FTX/Alameda Research still holds a large number of SOL tokens awaiting unlocking, and the gradual liquidation of these assets may have an impact on the market.

However, it is worth noting that despite losing the aura of various big bosses, Solana in the trough of the bear market has not been disheartened or forgotten, but has firmly charted its own path.

Solana Foundation Chairman Lily Liu has actively expanded the development map to other countries, and developers have not given up on continuing to research and develop the ecosystem, but have become more active in innovation.

(In 2023, Solana's developer retention rate significantly increased)

During this period, the following positive developments were launched: state compression technology for NFT project issuance, the release of SAGA hardware phones, the expansion of Solana Pay payment scenarios to Visa and physical merchants, continuous optimization of Wormhole and other chain cross-chain bridge performance, as the preferred chain in the DePIN field, more DePin projects (such as Helium Mobile's token MOBILE, which saw a tenfold increase in a week) were pushed to users, and various meme crazes erupted on the chain…

It is these continuous "presence" proofs that have allowed investors to see the infinite opportunities still present on Solana's chain, with token prices in the single and double digits representing undervalued assets. The widespread optimism has also allowed Solana to rise impressively, rightfully completing a "rebirth through fire" and returning to the battlefield in 2024.

As Solana, an outstanding player, returns to the user's field of vision, what about the other players in the "Ethereum killer" pool? How are they doing now?

5. Brief review of the rise and fall of other "Ethereum killers"

BNB Chain (BNB, initial total supply of 200 million, with multiple burns to come)

Pros

As the first of its kind, its rapid growth in transaction volume and user base has given investors hope. Binance also launched the Binance Smart Chain (BSC), which is compatible with Ethereum smart contracts, providing a low-cost, efficient decentralized application development environment, attracting a large number of projects and developers.

Unlike Ethereum's unlimited issuance, Binance uses a unique token burn mechanism, repurchasing and burning BNB with a portion of its profits each quarter, reducing the circulating supply and increasing the value of BNB.

BNB is not just a medium of exchange; it can also be used for liquidity mining and IEO (Initial Exchange Offering), earning it the nickname "golden shovel" from many users. For example, PancakeSwap on the BSC chain introduced Initial Farm Offerings (IFO), allowing users to stake BNB to obtain CAKE tokens and participate in the issuance of new tokens.

Cons

In October 2022, BNB Chain was hacked, involving a total amount at the time of over $566 million, making it one of the largest security incidents in the cryptocurrency field to date.

In November 2022, the bankruptcy of FTX exchange had a huge impact on the entire cryptocurrency market, causing market panic and a crisis of trust. Although Binance and FTX are separate entities, the market panic spread to other exchanges and their tokens.

The exchange market competition is intensifying, with OKX taking the lead last year by launching a Web3 wallet and attracting a wave of users and funds, indirectly affecting Binance's market share and the performance of BNB.

As the world's largest cryptocurrency exchange and with a Chinese gene, Binance faced increased regulatory pressure during the last bear market. Faced with criminal charges from the SEC, it ultimately paid a $4.3 billion fine and its founder CZ stepped down as CEO.

Cardano (ADA, maximum total supply of 45 billion)

Pros

Cardano uses a new algorithm called Ouroboros, essentially a proof-of-stake (PoS) mechanism, designed to provide high energy efficiency, security, and scalability. It uses a two-layer system: the settlement layer (CSL) for processing transactions, balances, and smart contracts, and the computation layer (CCL) for handling data storage for future applications. Each layer can be independently upgraded without slowing down transactions on the other layer, providing higher transaction processing speed (TPS) and lower transaction fees.

Cardano/ADA solves interoperability and forking issues through side chains and smart contract technology, allowing different mainnet coins to be safely converted and avoiding fork events, providing an example for industry development.

It raised a large amount of funds in its ICO in 2017, making it one of the largest ICOs at the time, accumulating the loyal recognition of many early users. Cardano is driven by three teams with clear division of labor:

- IOHK (Input Output Hong Kong): A Hong Kong company led by founder Charles Hoskinson and composed of a hundred elites, responsible for technical development.

- EMURGO: A Japanese company responsible for Cardano's project ecosystem layout, supporting and incubating other project teams in the ecosystem, and solving funding issues (early funding mostly came from Japanese public investors, hence Cardano is also jokingly referred to as "Japanese Ethereum").

- Foundation: Responsible for fund supervision, ecosystem regulations and standards, community building, popularizing and promoting the Cardano protocol, and communicating with the government.

(In 2021, public investment interest in Cardano was greater than Bitcoin. Source: 2021 Voyager Digital investor sentiment survey report)

Cons

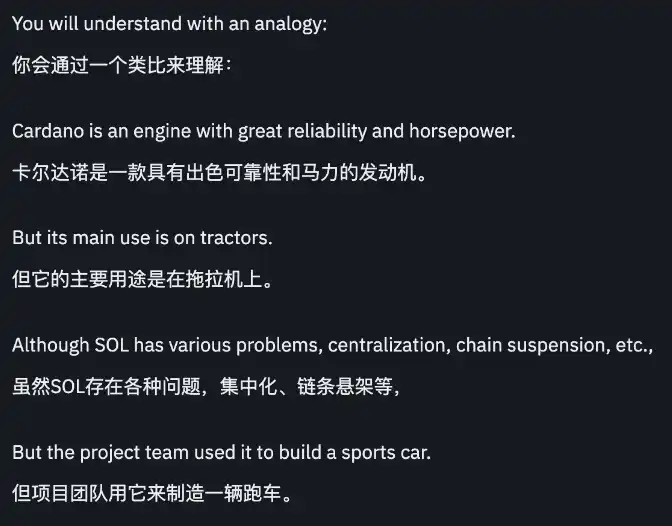

Slow development progress, with no "killer-level applications" for several years, and the operational team's promotional language is not down-to-earth, making it difficult for users to understand.

Cardano's foundation is built on the Haskell language, and its smart contract programming languages are Plutus, Marlowe, and Aiken. Compared to the Solidity/Rust/Move languages used in other projects, they are relatively niche and require higher-level software engineers, resulting in a high development entry barrier.

(Source: Binance Square, Cardano user blog content)

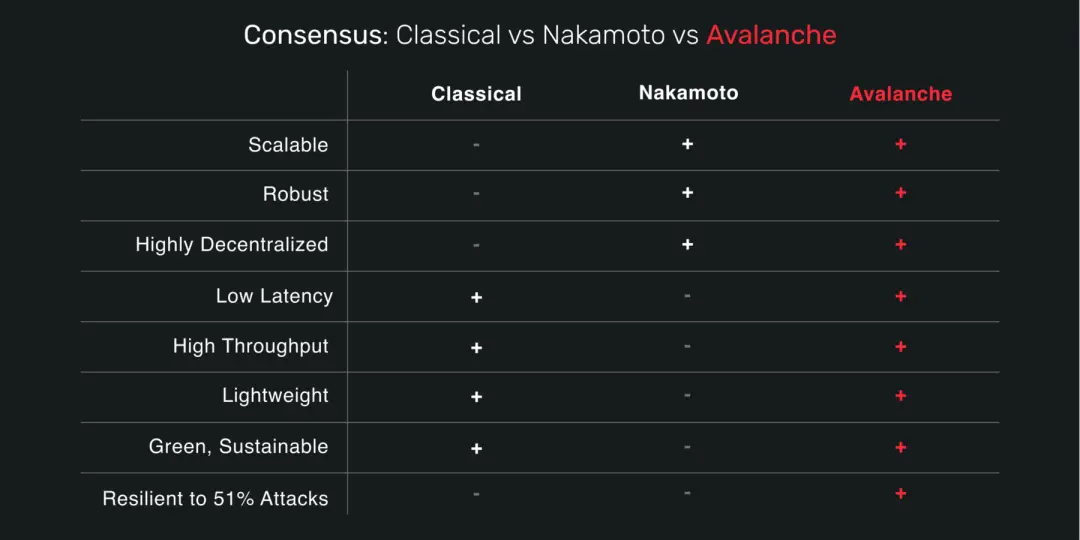

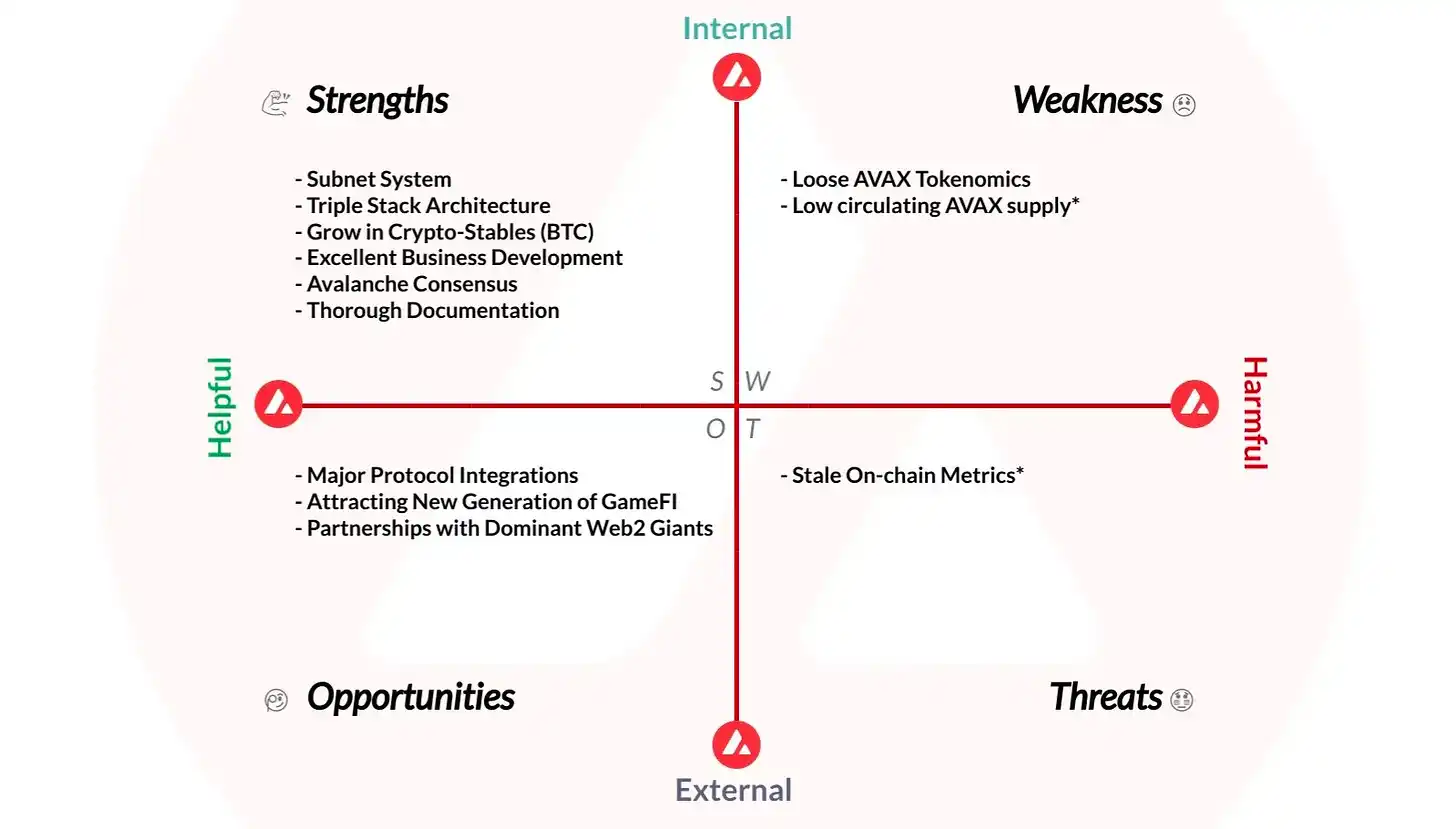

Avalanche (AVAX, maximum supply of 720 million)

- Avalanche is a blockchain built on Layer 0, and its consensus mechanism is a new type of consensus algorithm that combines the advantages of classic Byzantine Fault Tolerance (CBC) and Nakamoto Consensus (PoW), achieved through random subsampling. It offers scalability, security, and high speed. (For a detailed explanation, refer to this article by Luodong: https://www.theblockbeats.info/news/28137)

Avalanche consists of 3 subnets: X-Chain for transactions, C-Chain for contracts, and P-Chain for the platform. This new mechanism improves the overall transaction speed on the chain, with each subnet claiming a throughput of up to 4500 TPS, as per official claims.

The foundation has launched the Avalanche Rush liquidity mining reward program with a budget of $180 million, aiming to attract more DeFi projects and users to join the ecosystem. This program significantly boosted DeFi activities on Avalanche and increased the Total Value Locked (TVL) on the chain.

It not only supports sub-second confirmations but also supports integration with various virtual machines such as EVM and WASM, making it an Ethereum-compatible blockchain. Through cross-chain bridges, assets can easily be transferred to Avalanche for trading, providing more options for DeFi users.

In the gaming sector, the subnet technology allows each game to build a customized chain according to its specific requirements, giving game developers great flexibility to optimize the blockchain's performance parameters. Game developers can even offer gas-free transactions, lowering the barrier for players to participate in games.

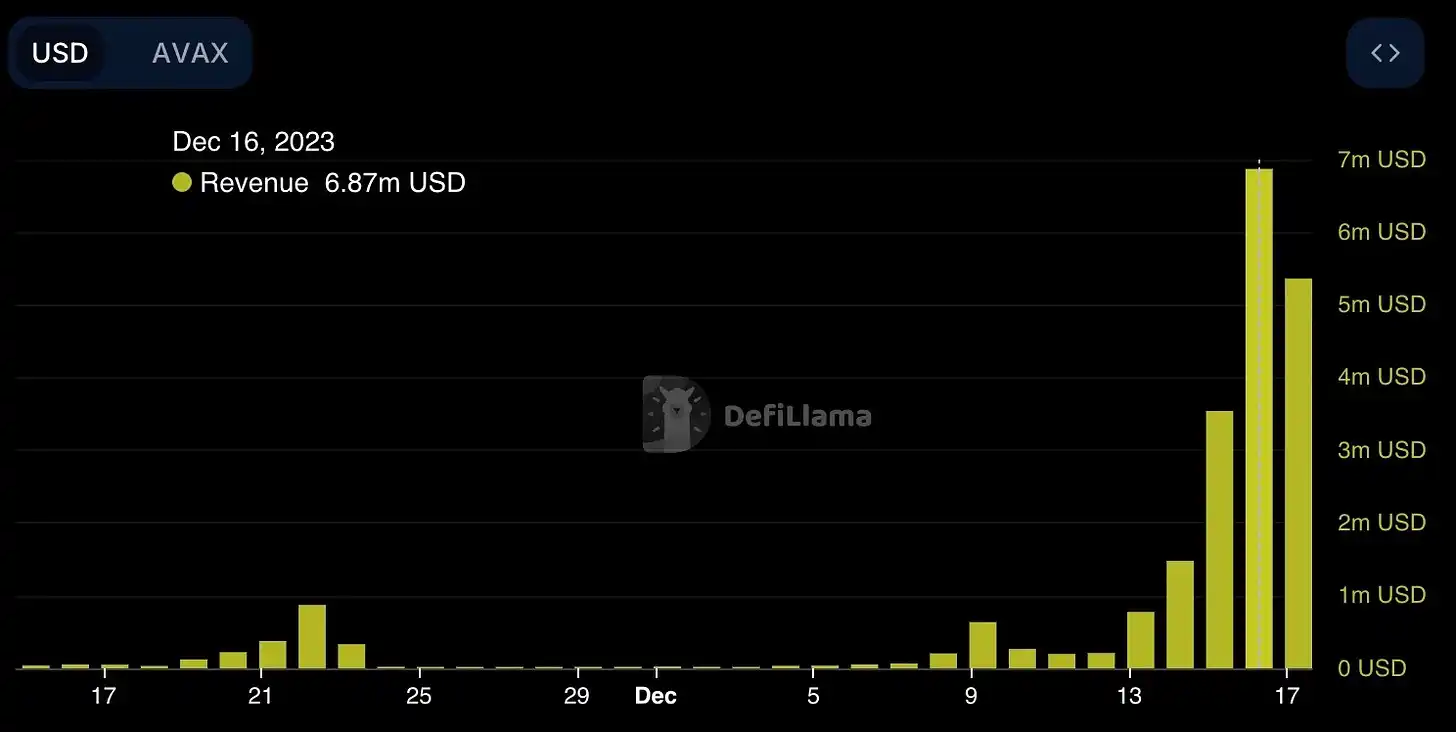

Actively seeking other growth opportunities, such as the launch of the "Avalanche Vista" program to support the tokenization of off-chain assets; achieving interoperability between Uniswap and Avalanche through LayerZero; collaborating with Morgan Stanley and Evergreen Subnets to demonstrate the potential of blockchain technology, smart contracts, and tokenization in automated portfolio management; partnering with AvaCloud and Citibank to test the feasibility of using blockchain infrastructure for forex trading; and providing computing power and storage for Amazon, among others.

Embracing the Metaverse trend at the end of last year, Avalanche saw a trading volume of over $10 million for Metaverse minting and transactions within a week on the chain.

Cons

AVAX has a relatively low circulating supply (~48%), which may lead to potential price suppression and excessive volatility.

The Avalanche ecosystem and its tokens are not closely linked, and the current token economic model does not require subnets to pay for their activities in AVAX.

Polkadot (DOT, inflationary token)

Pros

Polkadot is a project built on Layer 0 by the Web3 Foundation, founded by one of Ethereum's co-founders, Gavin Wood.

Polkadot uses Nominated Proof of Stake (NPoS) for electing validators and the GRANDPA mechanism for finalizing block consensus, ensuring decentralized network decision-making and strong security through a dual governance model.

Known as a "multi-chain network," Polkadot aims to seamlessly integrate various blockchains, allowing communication and data transfer between chains. Parachains are a unique structure in the Polkadot network, connected to the Polkadot Relay Chain, aiming to achieve parallel interoperability and scalability between multiple blockchains while maintaining their independence and security, and increasing the network's throughput.

Invented the Parachain Auction narrative, where parachains need to win a slot through auction to connect to the Relay Chain. The decentralized auction process involves bidding for slots by locking DOT tokens.

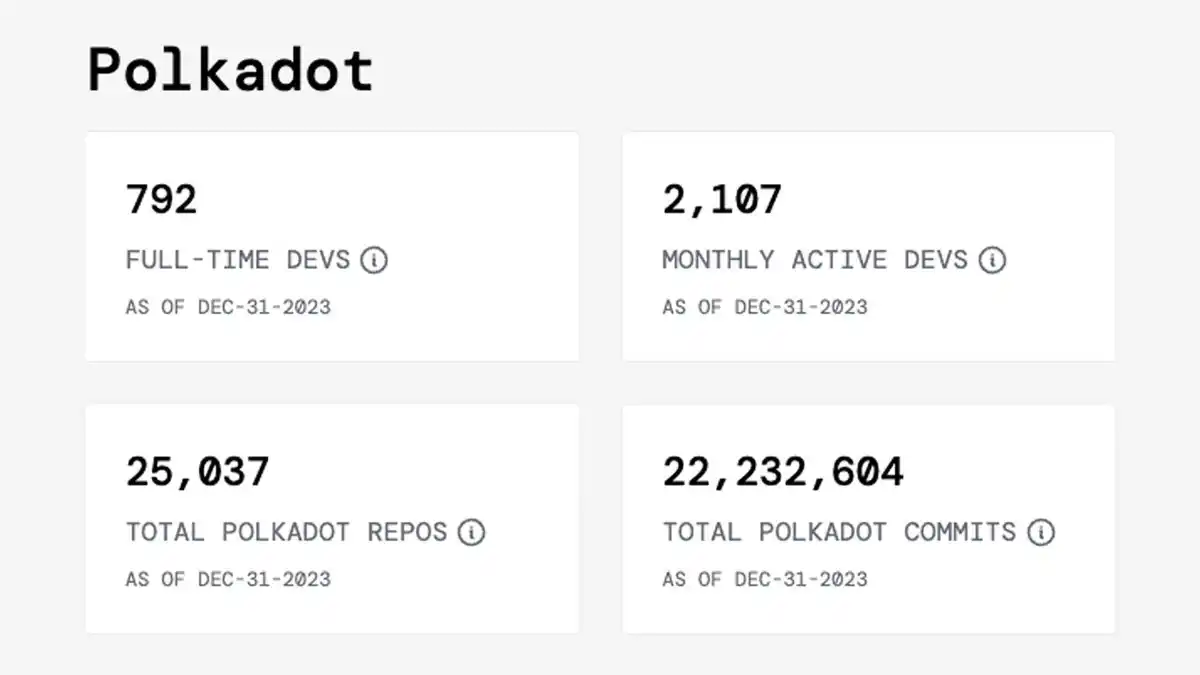

Active developer ecosystem. According to the 2023 Developer Report by Electric Capital, developers on the Polkadot network submitted a total of 22,232,604 lines of original code throughout 2023, accounting for 10.5% of all code submissions in the Web3 field, and having the second-highest number of full-time developers, second only to Ethereum, reaching 792.

Cons

The Polkadot ecosystem is complex, and the working principles and technical details are difficult for ordinary users to understand, increasing the learning curve and entry barriers.

Although the decentralized governance model OpenGov has been introduced, very few voters actively participate in voting and proposals, leading to a centralized decision-making process with a lack of community involvement.

Activity waned after the first round of parachain auctions, requiring new narratives to re-engage users. The number of parallel chains that can be supported is limited, and the auction system is not friendly to small-scale startups and small innovators with limited funds.

There is a disconnect in information dissemination and feedback between the Polkadot official team and users, failing to promptly synchronize the latest developments with the community and convey messaging that is not easily understandable.

In terms of the economic model, the high inflation rate and relatively limited use cases for DOT tokens have raised doubts among some users and investors about the token's actual utility and long-term value.

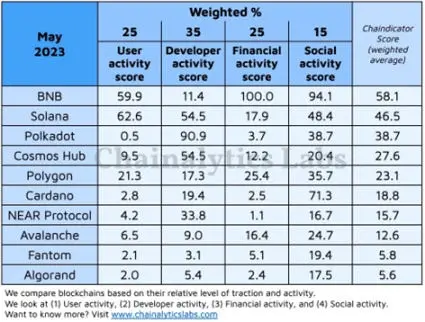

According to Chainalytics Labs' May 2023 statistics on the activity levels of mainstream public chains, looking at "user activity," "developer activity," "financial situation," and "social activity," Polkadot ranks third, with a significant difference in scores compared to BNB and Solana, and even the lowest ranking in user activity, despite leading in developer participation.

(Source: Chainalytics Lab)

Conclusion:

Looking back at the timeline and the stories of these well-known public chains, it feels somewhat surreal.

The cryptocurrency boom in 2021 made these star public chains shine, but over two years later, they are still recovering from the last bear market. The journalist who wrote this article for Forkast has long stopped writing, and the X account homepage no longer follows or updates any content related to the cryptocurrency industry.

The stories of high-performance public chains are numerous, from initially impressing everyone to the disappointing actual delivery results, making people hesitant to easily buy into such narratives.

5-1

Almost every chain enters the scene with "high throughput" and "low transaction fees" as their "killer moves," but each also has its own unique highlights—

BNB Chain (BNB): As the first in the universe, its inherent CEX properties naturally attract a large number of users to the token. BNB also has leverage to participate in liquidity mining and IEO, making the token a lever to unlock more benefits. It is natural that investors and users have a long-term demand for it.

Cardano (ADA): The unique and detailed team division early on garnered a large amount of audience support and investor attention. However, slow development progress in the subsequent years without any "killer applications," and a distant relationship with the community, led to some users quietly leaving during this period.

Avalanche (AVAX): Its pioneering consensus mechanism and the distinct roles of its three subnets have greatly optimized its transaction speed. Low latency and low fees have made Avalanche stand out in the gaming field, collaborating with games like "MapleStory" in South Korea and launching a Web3 version called "MapleStory Universe." It actively seeks various marketing strategies, embraces hot narratives such as Metaverse and collaboration with Web2 enterprises, and strives to become the preferred platform for traditional enterprises to issue encrypted assets on the chain.

Polkadot (DOT): Its multi-chain structure and highly active developer ecosystem are its strongest assets. However, possibly due to a one-sided focus on technological development, it neglected internal community education and external marketing. When the token value was halved in the bear market, Polkadot struggled to retain users who lacked understanding of the technology and faith in it.

5-2

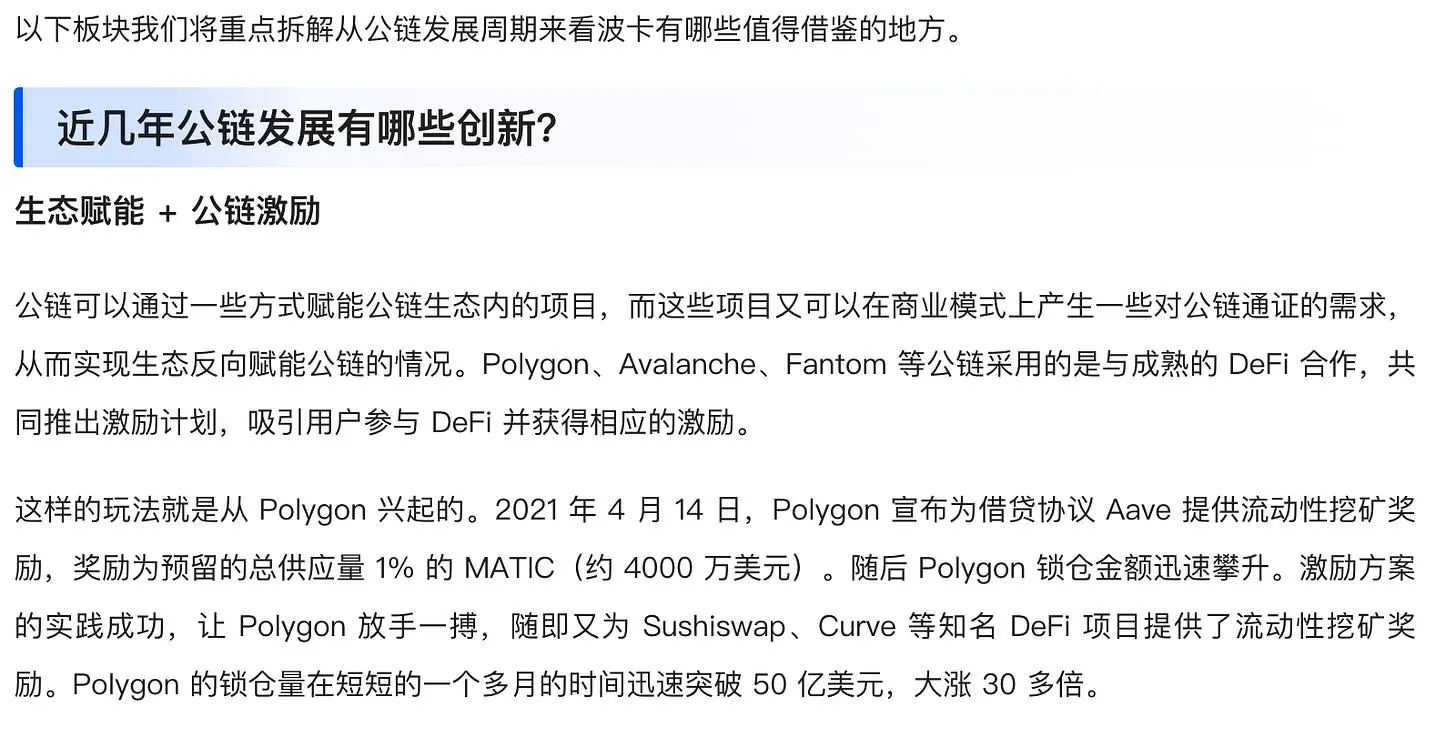

During the data collection process, what impressed me the most was a 30,000-word article from the "Polkadot Ecological Research Institute" on Polkadot: "A 30,000-word Strategic Report: How can Polkadot break free from its growth dilemma, and where is the future path?" (I highly recommend everyone to read it, as it is truly moving with its sincerity and dedication.)

This organization has been focusing on researching Polkadot and the development opportunities and prospects within the Polkadot ecosystem for five years, receiving support from the Polkadot Treasury six times in a row, making it an OG team within the community.

In the article, the research team not only sincerely acknowledged the widespread negative sentiment within the community but also analyzed in detail the current state of the Polkadot chain, its technological achievements, issues with social media account operations, and the clear advantages and disadvantages of the public chain.

In addition, the team also shared some derivative thoughts, such as "What innovations have there been in public chain development in recent years?" and "What is the growth logic of public chains?"

Apart from focusing on the Polkadot chain itself, the researchers also found bright spots and areas for improvement on other public chains that performed well or poorly in the market, using these points to consider how Polkadot can break through.

5-3

Combining the viewpoints in the report and my own feelings after navigating through the information, the following viewpoints can be presented:

5-3-1

One of the most unavoidable words in the crypto world: "Go with the flow."

In a bear market with generally low development, funds become conservative and withdraw, and user participation wanes.

Unstable price trends or even a continuous decline, slow progress in team development, or unmet expectations in practical applications all bring uncertainty to investors, developers, and users.

If at this time, the project cannot come up with an innovative narrative to capture attention or launch a phenomenal application, allocating the majority of the budget to a single financial incentive is not very effective. Users tend to lean towards selling off in a precarious environment, making it more evident than in a bull market that "less effort yields half the results."

When the positive feedback mechanism fails to operate, it directly leads to a decrease in activity, a sluggish ecosystem development, and a more hesitant entry of external investors, causing the project to spiral into a state of decline.

Most likely, many project teams will feel that they are facing a bear market at a stage when they should be vigorously developing.

This industry is famous for its definite "cyclicality," and it is precisely because of these cycles that it leaves room for you to "arbitrage."

"Arbitrage" for ordinary users may be buying low and selling high, but for project teams, it is using the less valuable time in a bear market to build a ladder that can effortlessly transition to a bull market.

With cycles come ups and downs, and with fluctuations come rhythms.

If the focus is clearly on doing things that adapt to the trend at the right time, and even preparing plans for the next cycle, perhaps the road ahead will have continuous stumbling blocks, but it will not be so difficult to move forward.

5-3-2

In a market with limited resources, the rise or fall of a public chain is closely related to the development of DeFi on it.

When DeFi flourishes, the tokens on that chain are often used as native token assets.

As the variety of DeFi applications increases, it also means that the scenarios in which token assets can be used become more diverse. This playability and positive feedback mechanism make users more willing to hold tokens for the long term, thereby attracting more people to join.

Often, the number of tokens locked in a DeFi application reflects the liquidity, activity, and user participation in the ecosystem of that chain.

As mentioned by the Polkadot researchers above, it was precisely because of the slow technological development of the Polkadot chain and the late introduction of DeFi applications that the value evaporated by half at the end of the bull market in the bear market.

"DeFi can empower other projects on the chain in the same way traditional finance empowers entities, not only bringing more composability and higher asset utilization to the assets of other projects but also leveraging more funds for the entire public chain.

DeFi for public chains is like banks and other financial institutions for cities, serving as important financial infrastructure. Therefore, with limited resources and time, prioritizing the development of DeFi is the primary goal of public chains."

5-3-3

Investors are most supportive of project teams with the strongest ability to manage "people."

It must be acknowledged that every boom is inevitably accompanied by bubbles.

When a cyclical retracement occurs, the first to burst and dissipate will be these bubbles.

Only real user retention and continuous recruitment of new people can keep a beer glass full of attractive bubbles, attracting investor attention.

When the focus in a bear market is more on "people,"

it makes project teams cherish existing developers and users more, share every step of the plan, and make the collective more participatory;

it forces project teams to innovate more, come up with new narratives that can attract more people;

it makes project teams more sensitive to the "people-oriented scenarios," where if Web3 is empty, they go to Web2 to find incremental opportunities.

…

You could say that "focusing on the new, not the old" is a golden rule in crypto.

But "old" projects like Solana, relying on its silent cultivation and strong marketing capabilities, continue to create new features to retain people, and even create many new entry points, such as DePIN, RWA, AI + Crypto, actively building a payment track for merchants in the Web2 world, and more.

It is like a well-rounded student, not only with a proper attitude but also a bit of a trick in every aspect;

It is also like a Doraemon with a pocketful of treasures, always curious and anticipated, and always ready to surprise.

6. Conclusion:

Undoubtedly, even with the emergence of many strong competitors, this round of bull market is showing signs of fatigue. Ethereum still holds some unique and irreplaceable advantages.

It was the first blockchain platform to implement Turing-complete smart contracts;

It has one of the most mature blockchain ecosystems in the crypto world, the most active developer community, and continuous technological development and iteration capabilities, all under the strong management of the Ethereum Foundation;

It hosts thousands of decentralized applications (DApps) and has opened the Pandora's box of explosive growth in the crypto world, such as DeFi Summer and the NFT craze.

This vast ecosystem has provided developers with rich tools and resources over the past few years, attracting a large number of users and developer communities.

With the expected landing of the Ethereum ETF application, continuous technological upgrades, and the increasingly powerful Layer 2 capabilities, it will bring more unforeseen benefits to the market, often requiring observation and conclusions over several years.

And I increasingly feel that the public perception of some star public chains coveting Ethereum is just a fanciful gimmick.

Perhaps from the beginning, these project teams did not see Ethereum as an insurmountable mountain.

I remember a quote from Zhang Xiaoyu,

"Be careful in choosing your competitors, because in the end, you may end up being very similar."

These so-called "Ethereum killers," each have their own winning strategies and unique narratives. They have discovered the limitations and chronic illnesses of Ethereum. They have their own remedies, and they can also learn from the strengths and advantages of Ethereum, without thinking that they will be Ethereum 2.0.

Disdaining to be a certain "killer," they ultimately want to open up a new track and completely pave their own path.

I still look forward to them and other high-quality public chains in this bull market, all being able to climb higher in their own way during the upward cycle, bringing more surprises to the entire crypto market.

When the original intention of all project teams is to better utilize blockchain technology to achieve decentralization and safeguard the ultimate financial sovereignty, then no matter how rugged the different paths may be, they will eventually converge to rebuild the consensus tower in everyone's hearts.

I still believe.

Reference links:

CoinBureau - Ethereum Killers Analysis

Forkast News - Top Five Ethereum Killers

Systango - All You Must Know About Solana Blockchain Platform

The Block Beats - Solana调研分析报告

ChainCatcher - Solana生态系统2023年状态

EMURGO - Cardano: What to Look Forward to in 2024

Foresight News - Avalanche SWOT Analysis

Foresight News - Polkadot调研分析报告

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。