Recently, Clearpool and PAAL AI announced a collaboration to launch the trading robot Clearpool AI Bot, which has attracted widespread attention. It is reported that this robot can provide uninterrupted service 24/7, but its accuracy still needs further optimization as its technology is still in the early stages.

Of course, with this tool, Clearpool has truly made a wave of presence. Below is an introduction to the Clearpool project.

Accumulating $440 million in loans over 2 years, will Clearpool's on-chain capital market ecosystem become stronger?

Clearpool is a decentralized capital market ecosystem where institutional borrowers can obtain unsecured loans directly from the DeFi ecosystem. Clearpool has introduced a dynamic interest model driven by market supply and demand forces.

Liquidity providers on Clearpool can earn attractive returns, and additional LP rewards paid in CPOOL (Clearpool's utility and governance token) increase pool rates. Clearpool LP tokens, called cpTokens, are the cornerstone of a tokenized credit system, providing risk management and hedging capabilities for Clearpool LP.

As more and more institutions realize the benefits that decentralized finance can bring to their organizations, Clearpool will provide a new architecture to facilitate the flow between the $120 trillion traditional capital markets and the emerging DeFi ecosystem.

Since its launch in March 2022, Clearpool has disbursed over $440 million in loans within the crypto and traditional finance sectors, and has successfully attracted numerous well-known institutional users including Wintermute, Jane Street, Fasanara Digital, CoinShares, and others. As a continuously expanding decentralized finance platform, Clearpool has been successfully deployed on the Ethereum mainnet, Polygon PoS, Polygon zkEVM, and Optimism, demonstrating its wide adaptability and innovation in blockchain technology applications.

Introduction to Clearpool's Business Modules: Private Collateralized Loans Prime + Oracle and Staking System + Delegated Staking and LP Reward Mechanism

Clearpool's Permissionless module requires borrowers to undergo global KYC and AML certification to ensure the compliance of lending activities. This module currently supports USDC/USDT funds and initiates fund pools through Clearpool's multi-signature mechanism, ensuring the platform's security and transparency.

Prime business marks an important step for Clearpool in the field of private collateralized loans for physical assets. In this module, all parties involved in the transactions must undergo strict KYC and AML due diligence. Borrowers can customize terms to initiate fund pools, while suppliers can earn returns in a secure and compliant environment without providing collateral. This model not only increases the liquidity of funds but also provides users with more flexibility and choices.

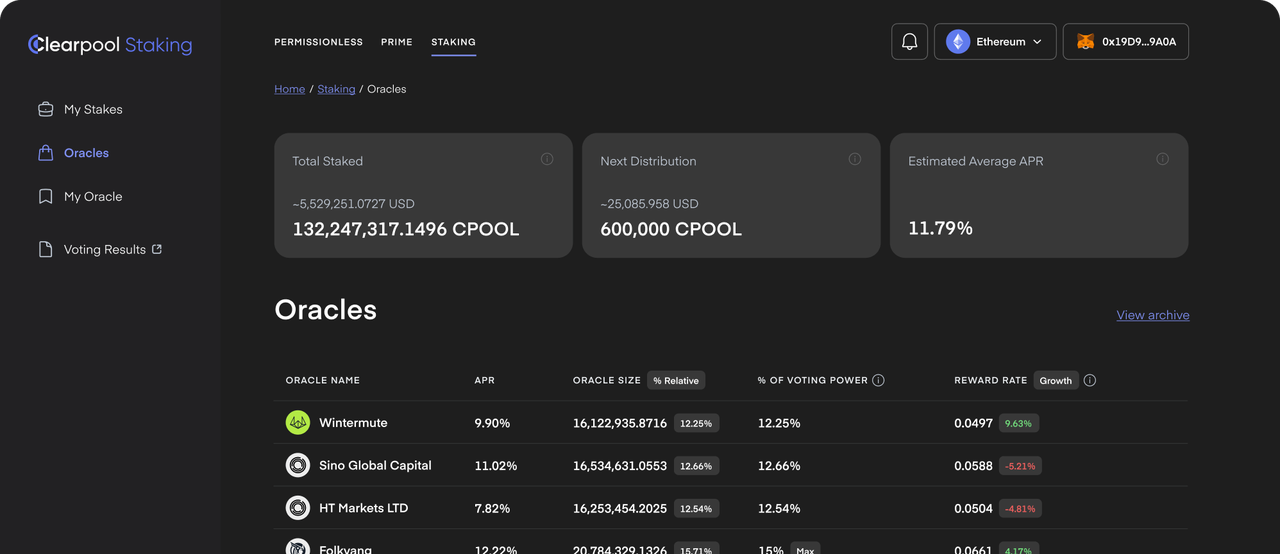

Clearpool has introduced its own oracle network and staking system, where institutions can vote to determine interest rates through the Clearpool Oracle Network. By staking $CPOOL tokens into the Oracle pool, users can not only receive token incentives but also collectively maintain the interest rate pricing mechanism. This mechanism enhances the platform's decentralization and provides users with the opportunity to participate in platform governance.

Clearpool's economic model has designed two major value capture mechanisms: delegated staking and LP rewards. By providing liquidity through supplying funds, users can earn CPOOL mining incentives. In addition, the platform generates revenue through Origination Fee and Protocol Fee, which are not only used to repurchase $CPOOL but also for the reallocation or destruction of reward pools, thereby achieving sustained growth in platform value and maximizing user benefits.

Through this series of innovative financial tools and models, Clearpool not only provides more convenience and choices for participants in the crypto assets and traditional finance sectors but also demonstrates its leadership in driving decentralized finance innovation.

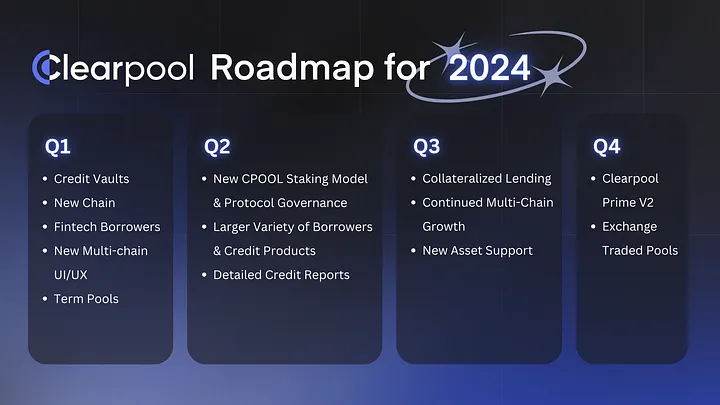

Rapid development and outstanding advantages in various business sectors, will Clearpool shine in the RWA field?

In the unsecured lending protocol field, Clearpool has firmly secured the third position and ranks first on the Optimism platform, showing a monthly average growth rate of 25.12%. Especially since the launch of the Prime business for its token $CPOOL on Optimism, the token price has astonishingly surged by 111.29% monthly. Despite the competitive market for lending protocols, Clearpool's total value locked (TVL) of 55.28M may not seem advantageous, but its introduction of private collateralized loans for physical assets (RWA) demonstrates its unique competitiveness in the market.

The first loan in Clearpool's Prime business was initiated by Portofino Technologies, a crypto-native high-frequency trading (HFT) market-making institution focused on reducing friction in digital asset trading using advanced technology. The borrower, Azure Tide, a digital asset lending institution serving numerous traditional family offices and institutions, signifies an important advancement for Clearpool in the RWA lending field.

Through the Prime business, certified institutions can apply for loans without collateral, and users as fund providers (Supplyers) can not only meet the compliance requirements for institutional digital asset lending but also earn attractive annualized percentage yields (APY) and mining rewards ($CPOOL) by providing funds. In addition, Clearpool has received a grant of 150,000 $OP from the Optimism Foundation to enhance liquidity mining returns on the OP mainnet.

The governance rights of the $CPOOL token not only reflect its importance in oracle voting but are also a key factor in participating in the core competition of Curve War, enhancing the demand and value of the token. This economic model design, including the feedback of governance rights, mining incentives, and token repurchase, provides strong support for Clearpool's future development.

Overall, Clearpool's progress in compliance and application aspects of RWA lending not only serves as an important milestone in bridging the gap between traditional private credit and decentralized finance (DeFi) but also demonstrates its strong competitiveness and innovation in the market through its leading position in permissionless lending protocols, substantial grants from Optimism, and rich liquidity pool incentives.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。