Author: ZAN Team

What is the duality of graph coins?

Coins generally refer to native tokens of chains or homogeneous tokens similar to the ERC20 protocol, such as BTC, ETH, USDT, etc.

Graph refers to non-fungible tokens (NFT) that comply with the ERC721 protocol, such as CryptoPunks, Bored Ape Yacht Club, Meebits, etc. 3D model assets issued by domestic digital collectible platforms (such as Whalesnatch) are also considered as graph.

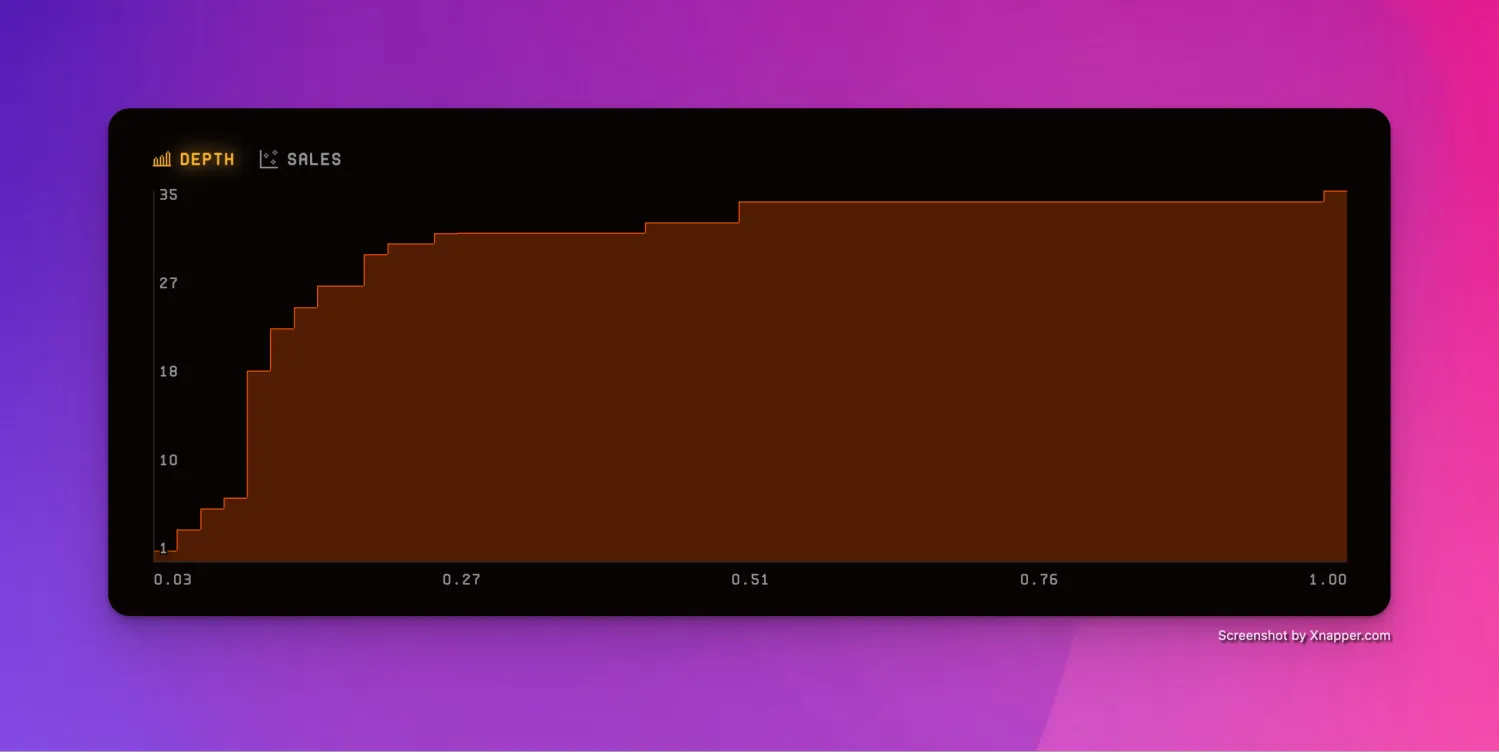

Both tokens and NFTs have their own limitations. For example, tokens have strong liquidity but no speculative value, while NFTs have rarity and uniqueness but often have poor liquidity and mostly focus on floor prices.

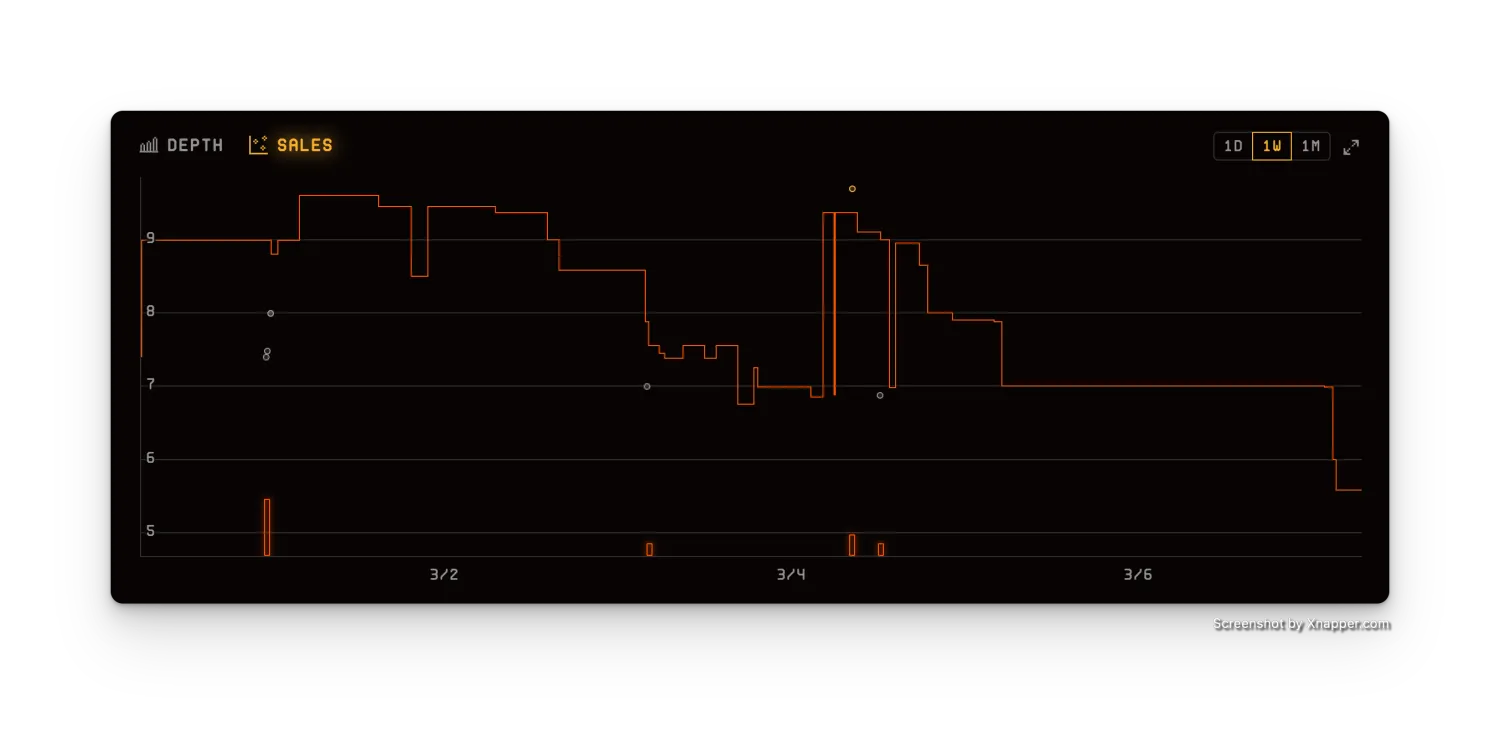

Liquidity depth chart of a certain NFT project

The duality of graph coins refers to a specification that combines tokens and NFTs in some way.

Taking Ethereum as an example, for a project that supports the duality of graph coins, it should be both homogeneous and non-fungible. It should be able to enjoy the high liquidity brought by tokens and achieve rarity, uniqueness, and speculative value.

But does such a thing really exist? The price of NFT is linked to its rarity, so how can it achieve homogeneity?

80 Order Price 18.3E #7520 Order Price 281.4E

ERC404 opens the Pandora's Box

During the 2024 Spring Festival, an experimental protocol named ERC404 and its first project Pandora quickly gained popularity.

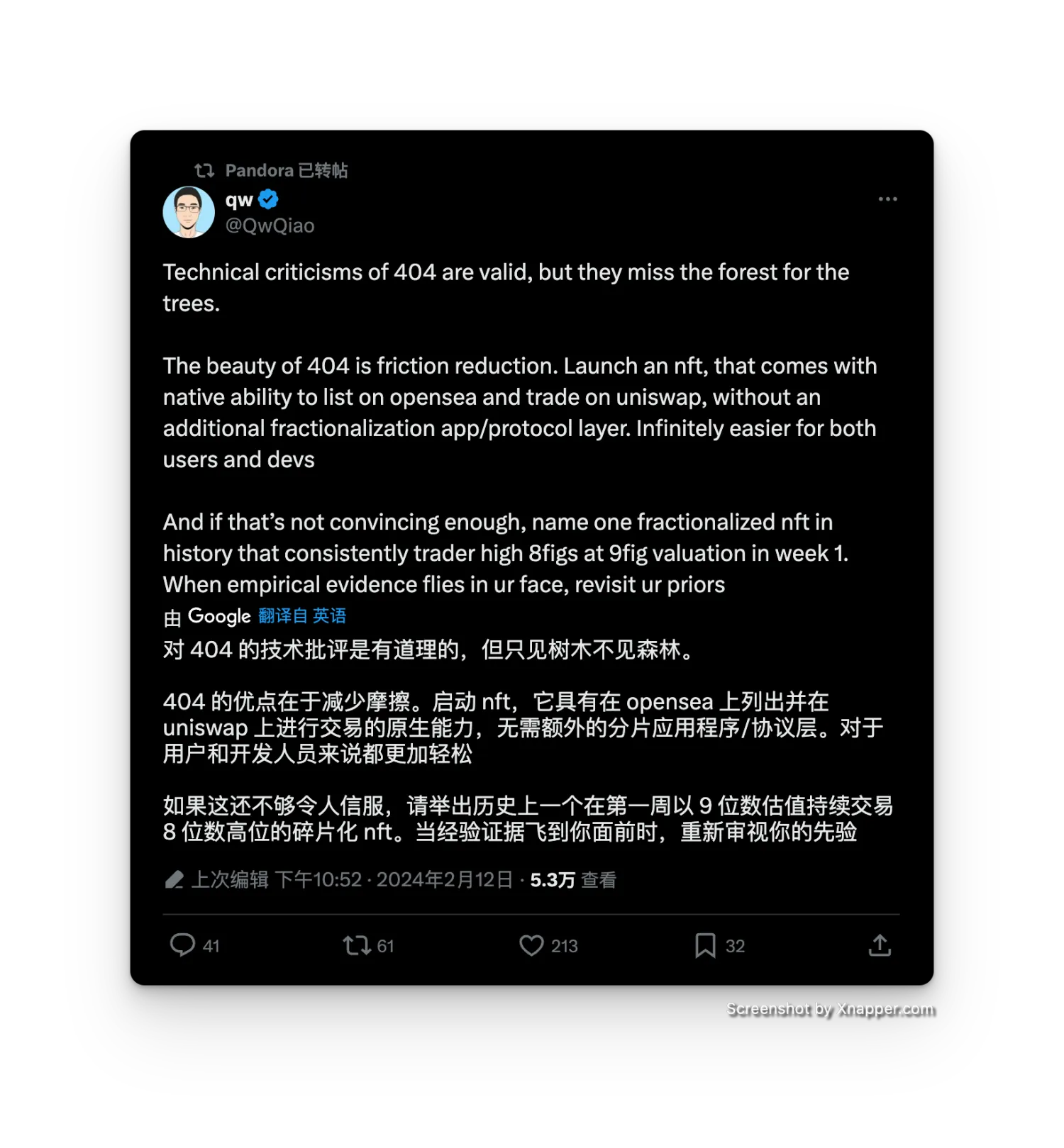

Criticism Praise

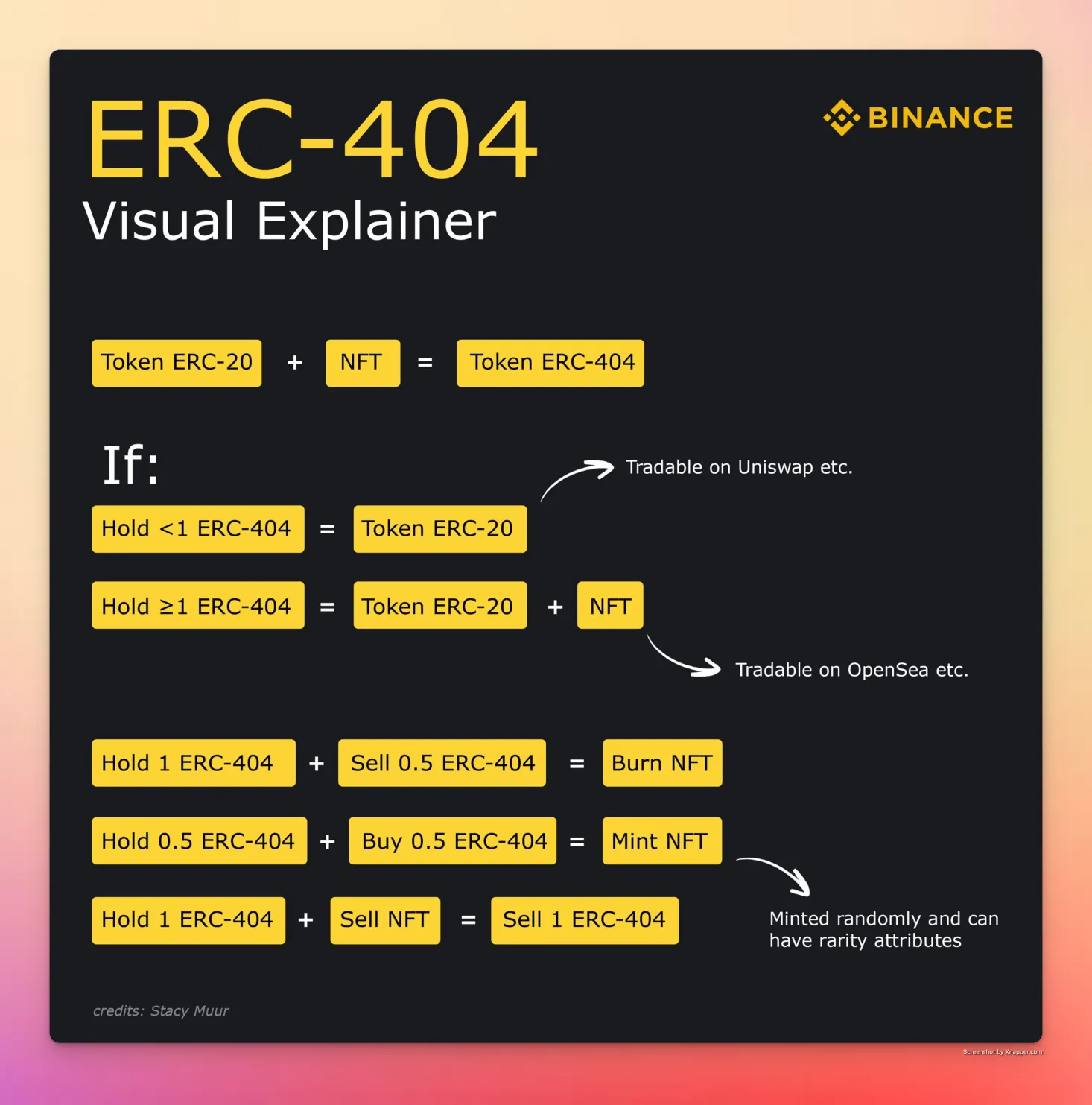

ERC404 has created a unique way of combining tokens and NFTs, simply put:

- Buying 1 Pandora Token will automatically give you 1 Pandora NFT

- If your balance is insufficient for 1 Pandora Token, your NFT will be automatically destroyed

- Buying 1 Pandora NFT will automatically increase your token balance, and vice versa for selling

The current mixed logic of ERC404 is expressed in a chart:

ERC404 game rules

Below are the 5 different Pandora's Boxes, each with different rarity. According to the contract implementation, we can calculate the probabilities:

39.5%

23.4%

19.5%

11.7%

5.9%

Implementing an ERC404

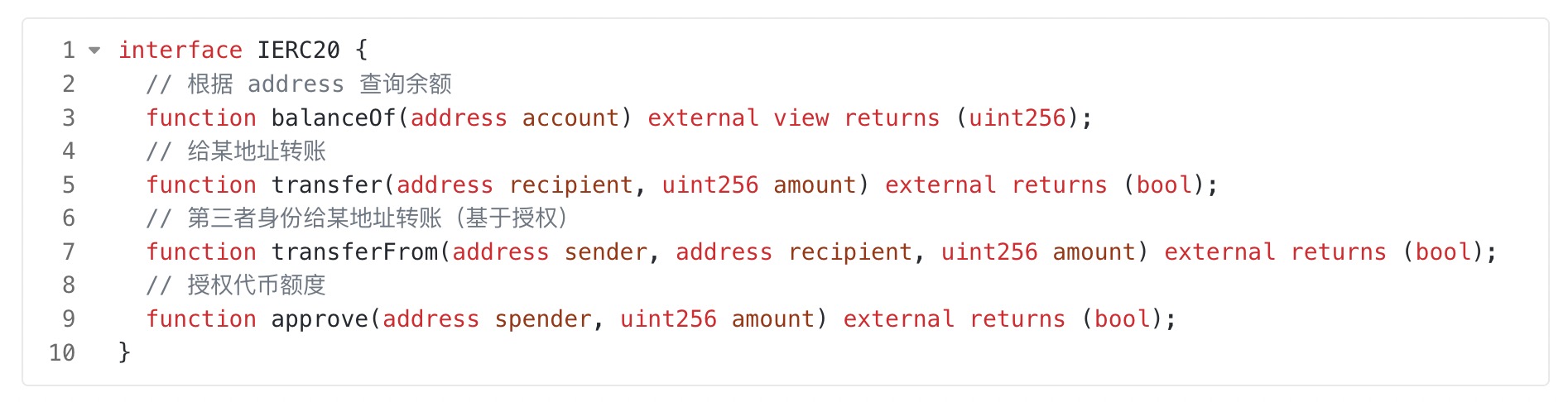

The first version of the ERC404 code is not well written, or rather, it is very mediocre. However, it solves the most important problem—how to simultaneously implement the interfaces of ERC20 and ERC721 in one contract.

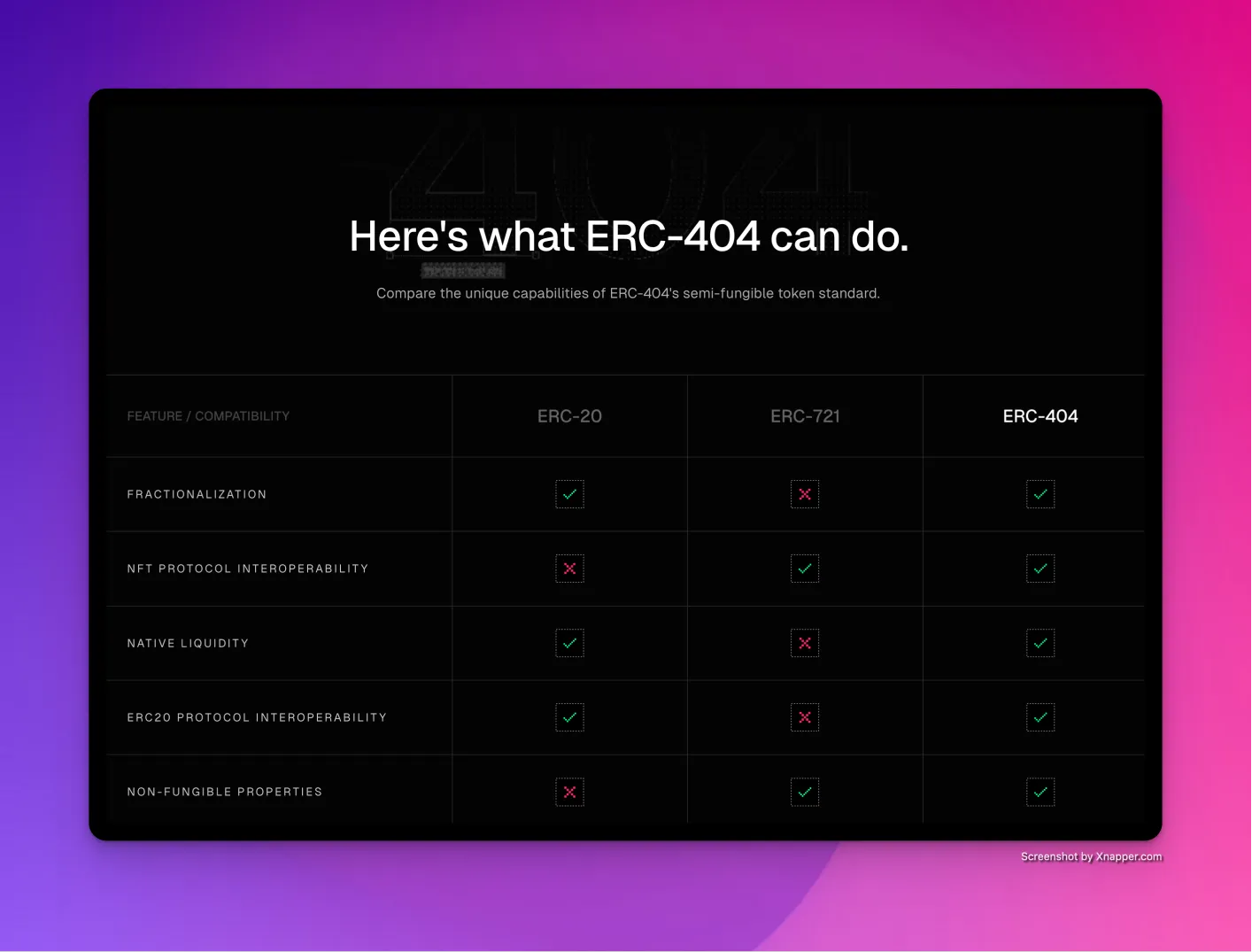

Comparison of three protocols

We shield the unrelated parts of the two interface definitions and compare which interfaces intersect or conflict:

You can see that the four conflicting interfaces are all related to transfers. In ERC20, the semantic of the last parameter is "amount," which represents the token amount, while in ERC721, the parameter's semantic is "tokenId," representing the NFT's number.

In the contract implementation of ERC404, the semantic of this parameter is modified to "amountOrId," and the method to distinguish when it is "amount" and when it is "tokenId" is very simple: based on the value's magnitude.

Similar to 1 BTC = 10^9 Sats, in the world of ERC404, when we say 1 Token, it actually corresponds to a value of 10^18, while the tokenId of an NFT is generally an incrementing integer starting from 1. So, although both "amount" and "tokenId" are integers, the actual magnitudes are very different.

For example, the Pandora contract records how many NFTs have been minted (currently 68180). When the value of amountOrId is less than or equal to this number, it is considered a tokenId; otherwise, it is considered an amount.

Is this logic useful? Yes, it is. Is it reasonable? Apart from this, when Transfer is greater than or equal to 1 Token, the logic for NFT is not a transfer, but rather the original account is destroyed, and a new account is minted. This operation matches liquidity and is simple to implement (considering the case of transferring less than 1 token), but it results in exaggerated gas consumption.

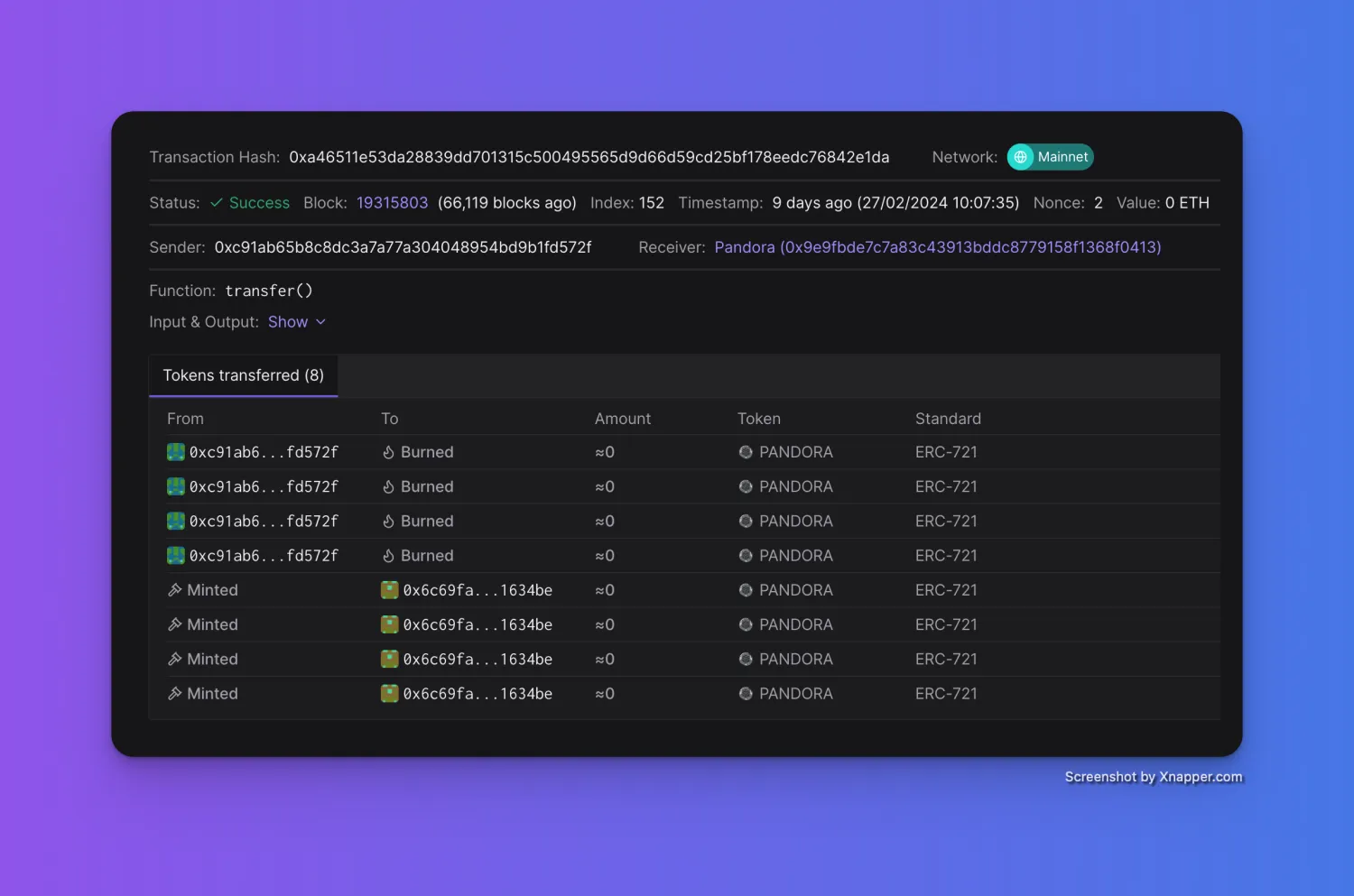

Referencing this transaction, transferring 4 Tokens resulted in the destruction of 4 NFTs and the minting of 4 new NFTs:

The transaction consumed $64 worth of gas.

New Narrative and New Opportunities

The gameplay of ERC404 brings several implicit rules:

- The price of Tokens on DEX will not differ much from the price of NFTs on the Marketplace.

- NFTs are only minted in one scenario: when 1 Token is charged. In other words, the only way to exchange low-rarity NFTs for high-rarity ones is through continuous token trading.

- The total supply of Pandora Tokens is 10,000, representing a maximum of 10,000 NFTs, which will decrease as the number of holders increases (the more holders, the more common the situation of less than 1 Token).

If I have the magic to stably mint "Red Pandora's Boxes," buy Tokens on the exchange, and then sell them at a high price in the NFT market, can I engage in unlimited arbitrage?

First, let's look at the price of Pandora. This data provides the theoretical basis for arbitrage:

Buying Tokens at 4.7E, the floor price of NFTs in the past week has been greater than 5E.

The above data does not consider the rarity of NFTs. In this scenario, the profit after deducting wear and tear is around 0.2E. Considering the implicit rules mentioned earlier, if we can ensure that all minted NFTs are always high-rarity red Pandoras, wouldn't the profit margin be even greater?

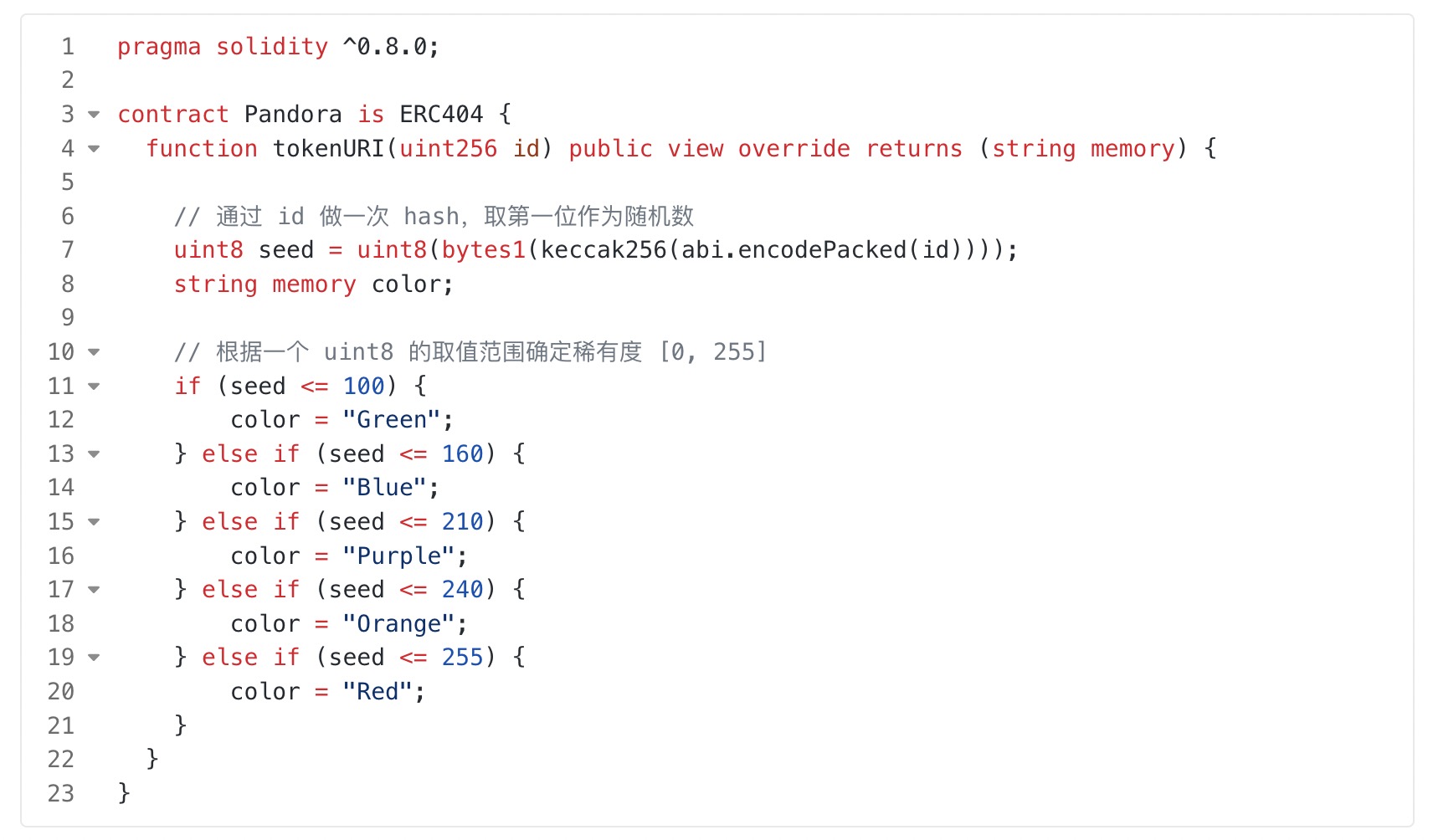

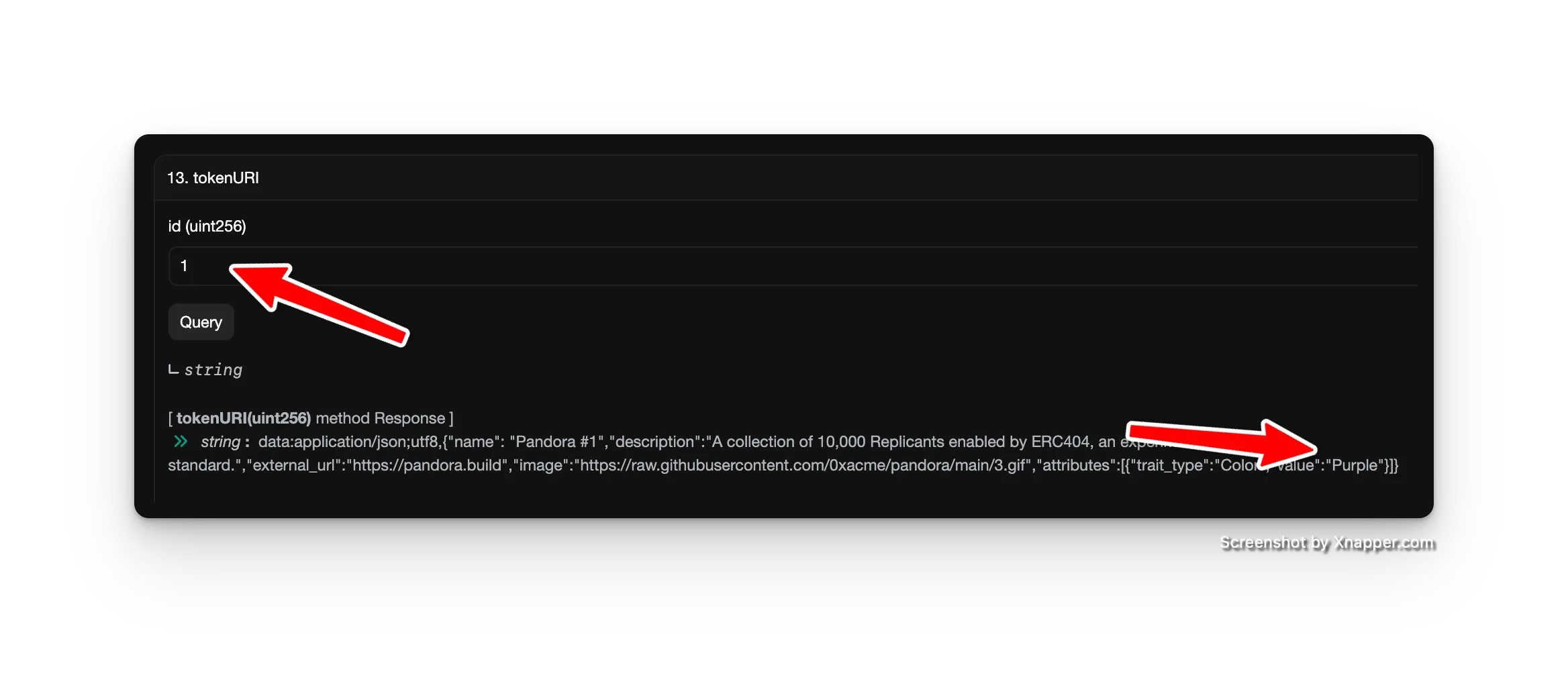

Let's take a look at the Pandora contract to see how the "random generation" described by many KOLs is actually implemented:

By reading the contract implementation, we can see that the rarity of Pandora Boxes is pseudo-random, similar to the CryptoFish project we implemented earlier. The tokenId is incrementing, so the rarity of the next minted NFT is completely predictable.

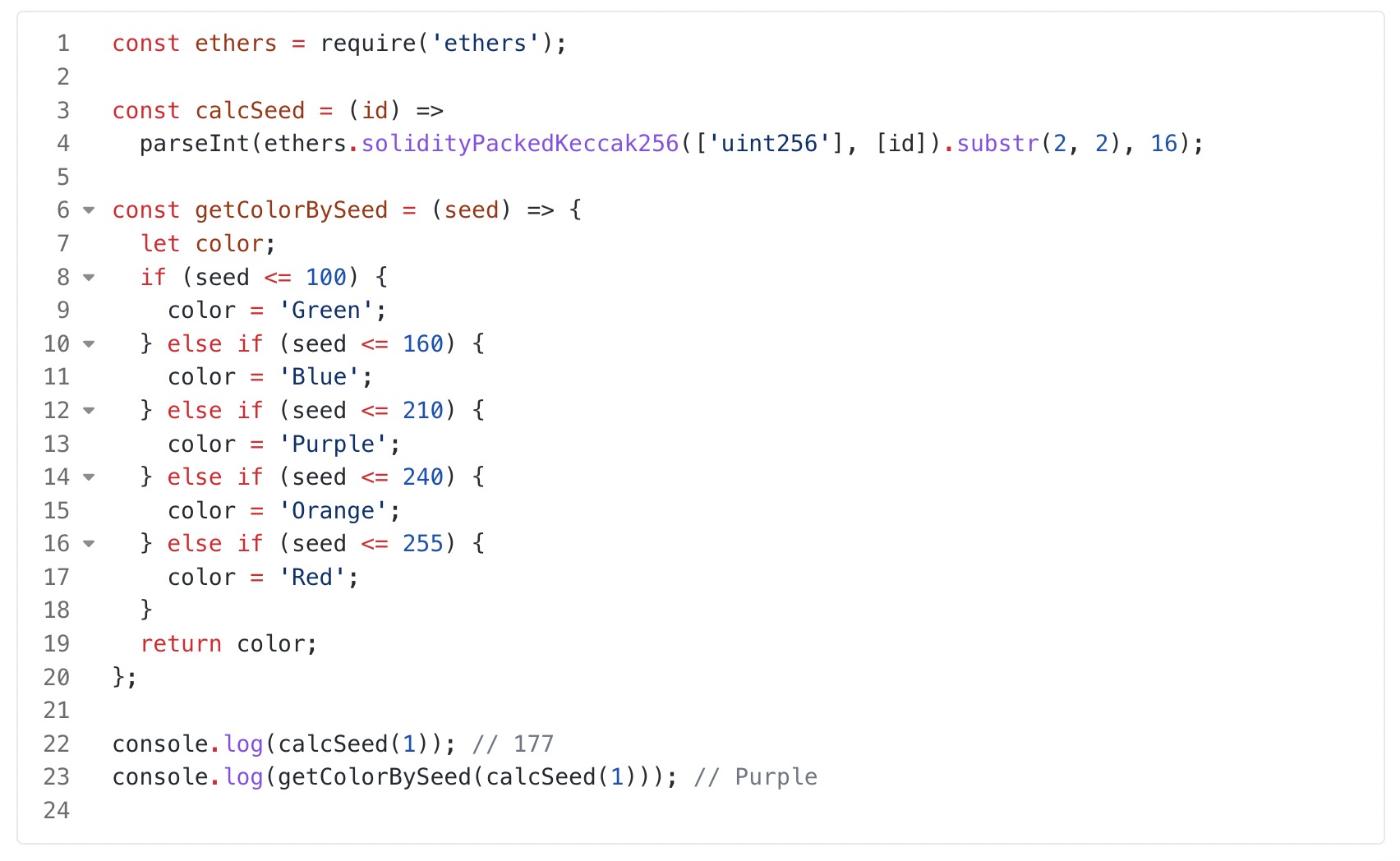

We can purely speculate this logic locally through a JavaScript script, and upon verification, this logic is entirely correct:

The current minted value for Pandora is 68180, so we can predict that the IDs for the next 100 NFTs with high rarity will be:

68186/68201/68213/68227/68228/68257/68259/68262

If we don't consider the reduced liquidity of the current Pandora project, this would be a very popular financial activity.

Conclusion

ERC404 and Pandora are not the first protocol projects to explore NFT liquidity. Discussions about fractionalizing NFTs have been around for a long time, and ERC1155 is also an innovation for NFTs.

But why is everyone so excited about ERC404 this time? I think it's because of the name.

Unfortunately, the implementation of the first version of the ERC404 contract is very poor, so the official team is actively promoting the V2 version, and the community has third-party implementations like DN404. There are even new protocols called ERC911, fully utilizing the naming attribute.

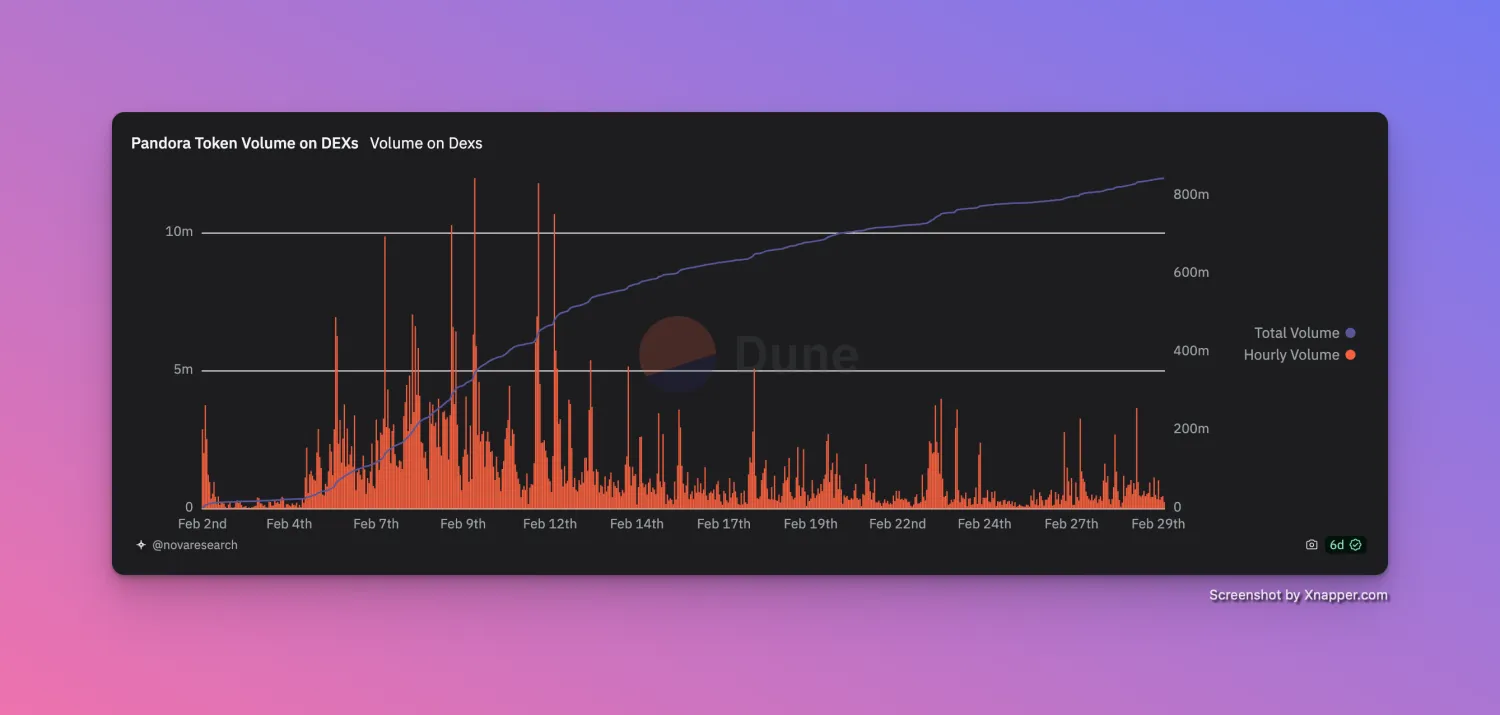

Liquidity peaked during the Spring Festival and has since declined significantly.

Liquidity peaked during the Spring Festival and has since declined significantly.

The story of Pandora V1 may soon come to an end, as the current version has countless flaws that are enough to bring it down, and liquidity and holders have also declined significantly. However, more and more projects are attempting the ERC404 model, with 25 projects that can be counted on CoinMarketCap.

I believe there will be more solutions to the liquidity issues of NFTs in the future, and ERC404 can truly bring about the next NFT summer.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。